Vol. 40 (Number 4) Year 2019. Page 21

GNEVASHEVA, Vera A. 1

Received: 25/09/2018 • Approved: 14/01/2019 • Published 04/02/2019

ABSTRACT: The article discusses the results of economic reforms in Russia, the terms "corporation", "corporate governance", and the formation of a notion of a management system as one of the ways of effective management and withdrawal of enterprises from crisis. Despite the relatively short duration of the process of redistribution of property in Russia, it is already possible to identify certain stages in the formation of corporate governance structures, to identify the origins of errors and misconceptions, and to suggest ways to overcome them. |

RESUMEN: El artículo analiza los resultados de las reformas económicas en Rusia, los términos "corporación", "gobierno corporativo" y la formación de una noción de sistema de gestión como una de las formas de gestión efectiva y retiro de empresas de la crisis. A pesar de la duración relativamente corta del proceso de redistribución de la propiedad en Rusia, ya es posible identificar ciertas etapas en la formación de estructuras de gobierno corporativo, identificar los orígenes de los errores y conceptos erróneos, y sugerir formas de superarlos. |

First of all, it is necessary to give a definition to the term “corporation”. The most complete definition can be found in the "Large Commercial Dictionary" (A large commercial dictionary, 1996, p. 132): A corporation is a form of business organization that is widespread in countries with developed market economy, providing for shared ownership, legal status and concentration of management functions in the hands of the top echelon of professional managers working for hire.

From this definition it follows that at least a few basic conditions are necessary for the successful functioning of the corporation: the development of the economy, the entrepreneurship mastered by the population, the coexistence of various forms of ownership, and a sufficient number of professional managers. Therefore, without the fulfillment of these conditions, it would be premature to talk about the effective implementation of corporate governance, until the necessary regulatory and economic prerequisites for the successful operation of corporations are created on the scale of the state or in a separate industry (Goncharov, 1998, p. 112).

In this regard, the generalization of the experience accumulated over the years of economic reforms will help to understand the essence of the ongoing processes in the formation of the Russian corporate environment. Despite the relatively short duration of the process of redistribution of property in Russia, it is already possible to identify certain stages in the formation of corporate governance structures, to identify the origins of errors and misconceptions, and to suggest ways to overcome them.

The methodology is a set of methods that are applied in accordance with the types of corporate property objects, while the integrated application of techniques for the entire set of objects of different types is subject to the overall efficiency criterion, according to which management actions are carried out and control actions are generated.

In the course of the research, the financial statements of real enterprises of the Russian Federation were used, which exemplifies the practical application of the methodology. Among such enterprises, I would like to pay special attention to the following: JSC Concern Scientific Center, JSC NIIME and Mikron Plant, and MITS RTI, etc. During the work, testing of various hypotheses was carried out by studying various examples to establish the typicality and applicability of a particular method and the adaptation of theoretical methods to practical conditions.

Schematically, the corporate environment itself is a complexly organized unity of large blocks and smaller structural elements.

Figure 1

To solve the set tasks, economical and mathematical methods are used in the work: mean values, graphs, cluster analysis, the method of chain substitutions.

Management methods, in our opinion, should consider the specifics of the subject of management and can be divided into:

• Administrative;

• Economic;

• Legislative and regulatory legal;

• Organizational.

At the same time, these management methods can be divided into application levels by the subjects of management:

• Corporate;

• Level of business directions of the corporation;

• Individual enterprises and units.

In general, the above classification of types of corporate property and management methods of its objects allows us to proceed to the presentation of specific methods of management of certain types of property, the main ones for the purposes of this monograph, in our opinion, are:

• Subsidiaries of the corporation;

• Blocks of shares owned by the corporation;

• Corporate real estate; et al. [2]

The process of managing all these types of CC, in our opinion, will be built within the overall management cycle, but in accordance with the specifics of the management objects, this cycle can be transformed to improve the efficiency of a particular corporate property object.

During various periods of development of the Russian economy, the prerequisites for creating an effective corporate environment were laid, but at the same time there were certain contradictions in the systems of corporate governance with which one has to deal in practice. Each period personified a new stage of understanding by the country's leadership of economic problems and the development of ways to solve them, so the boundaries of the periods are arbitrary and can be shifted in any direction in accordance with the applicable criteria. In our opinion, the time frame and key problems of each of the periods can be described as follows:

Administrative-command methods of centralized management of the state economy have ceased to meet the requirements of the macroeconomic situation; the removal of middle and low-level workers from real participation in enterprise management prompted many of them to try themselves in the emerging small cooperative business or individual entrepreneurship, and the lack of a clear legislative base and practical knowledge of the economy led many of them to collapse the illusions of rapid enrichment.

Corporateism as a production management system became more and more identified with the clannishness of the party-nomenclature elite and provoked a contradictory attitude of beginning entrepreneurs (Shupiro, 1997, p. 248).

The corporate environment during this period was similar to the system of party-economic assets: all key positions at the enterprises were distributed not in accordance with the professionalism of managers, but on the basis of available connections. The basis for this was three reasons:

1. The absence of domestic highly qualified independent managers in the labor market.

2. Unwillingness to pay highly for the work of emerging qualified managers.

3. The low desire for mutual exchange of accumulated experience between countries with developed market economies and countries of the former socialist camp (Ryazan).

Centrifugal forces confidently led to the disintegration of the monopolized and centralized organization of the economy; the encouraged independence and permitted rent of enterprises prompted the director's corps to gradually subordinate them to groups of employees that shared the position of managers, that is, corporatism acquired a shade of loyalty to the authorities. The participation of collectives in the management of enterprises through the councils of labor collectives stipulated by legislative norms was not developed due to the unpreparedness of the employees for effective participation in management and the reluctance of the leaders to "share power."

During this period, the foundations for the corporateness of the directorate corps and structures close to the party-nomenklatura governing bodies were laid, but there were already sprouts of the emerging corporate environment. In addition to industrial, financial capital has emerged in Russia and began to develop in the banking and insurance sectors of the economy. There were sources and the first tools of capital accumulation.

Active check privatization, during which there was a primary redistribution of property among the directorate and formed financial and banking structures; Participation in privatization was possible, first of all, through open and hidden cooperation with the administration of the regions and the State Property Committee of Russia. Joint-stock companies created during privatization on the basis of large state enterprises could already be referred to corporations, but the undeveloped shareholder right, undervalued corporate property, and the unpreparedness of enterprise personnel reduced corporate governance to traditional methods that, in the performance of unprofessional managers, led to further collapse and bankruptcy enterprises. All this was superimposed on the paralysis of the central government and the collapse of state property, which caused the low transparency of economic and legal transactions within the national economy.

At the same time, a certain corporate style of relationships between certain structures, such as bank capital, oil and gas enterprises, and others, began to take shape, when self-governing companies replace government agencies. Alienation of the majority of the population from active processes of participation in property management, loss of jobs and economic illiteracy have formed a negative attitude to all the processes of economic reform.

But it was during this period that the foundations of the present corporatism among the new entrepreneurial structures created by young (educated, ambitious) entrepreneurs were laid, which had only two ways: either to enter into cooperation with former state structures, or to oppose them to a civilized business based on the experience of foreign corporations. In addition, the decisions taken in corporations have begun to be influenced by quality foreign education already acquired in new areas for the Russian economy: in the financial and stock markets, in the market of obligations, in marketing and management. Active interpenetration of Western and Russian corporations, joint work on the Russian stock market inevitably pushed Russian corporations to understand the features of corporate governance.

Monetary privatization in the context of the adoption of laws on joint stock companies, the securities market, the Civil Code of the Russian Federation, and clarification of legislation on privatization. The market infrastructure is actively formed: investment companies and funds, depositories and registrars, mutual funds, insurance companies, audit and consulting companies, pension funds, etc. Large foreign companies open their branches, representative offices or create joint companies in Russia.

The main burden of attracting investments is shifting from the federal center to the regions. Regional authorities adopt local laws on the formation of insurance funds to attract investment, and land and other real estate objects become the object of purchase and sale in accordance with the adopted regional laws (Vynslav, 1996).

The situation of external and internal default, the general lack of financial resources. The flight of capital from Russia makes it necessary to look for new financial instruments or new mechanisms for using old assets. Tensions in the foreign exchange market, along with the total absence of the corporate securities market, make regional financial instruments almost the only way to protect against inflation and generate income in Russia.

Against this background, Russian managers (especially the top management level) are poorly prepared to choose a development strategy, attract capital and investment, keep and win sales markets, and consider the true motivation of business partners. All this leads to a further redistribution of property, but already against the background of shareholders who understand their rights. Corruption and lawlessness of shadow capital forces top management to choose one of two directions: either to come into contact with shadow structures and gradually lose control, or to build such a system of corporate relations that would preserve both itself and property.

Corporate governance is built on the basis of well-established and effective standards in the areas of finance, securities, management, labor relations, contractual obligations, contractual activities, organizational structures, marketing. In the presence of basic government documents and accumulated experience, it is possible to build a system of corporate relations at the level of a specific corporation, thus setting benchmarks for the entire Russian economy.

In each specific case, the corporation, in the person of its top management (and in Russia, this is mostly the owners themselves), opts for the gradual inclusion of workers in the system of business relations in the field of property, instead of rigid management of hired personnel. This represents the most important trend in the formation and formation of normal corporate relations (Gubin, 1999, p. 248).

Before considering trends in the development of Russian corporate governance in the near future - the beginning of the twenty-first century. - it is necessary to consider the ways of the possible painless entry of corporations into the system of normal corporate governance. To do this, the top management of corporations has to perform a large amount of versatile, multifaceted work based on the requirements of modern management, marketing, business. This work consists of the following main stages:

- Strict definition of the objectives of the corporation and ways to motivate its owners;

- Restructuring of the corporation to the level of self-governing structures under the control of the owners;

- Selection of an organizational structure adequate to the goals: production, marketing, innovation, marketing;

- Development of unified principles of the corporation in the form of a mission, philosophy or other basic document;

- A change in the philosophy of remuneration of staff, especially senior managers.

Moving from the Marxist principle of "fair pay for labor" to pay, considering the real contribution of each employee to both the current profit and the formation of the capitalized profits of the corporation, they face the problem of the personal interest of shareholders. If the shareholding is significant, then the influence of the shareholder is also significant in the decision-making process and the share of profits distributed according to the results of the financial year is significant. If the package of shares is insignificant, then the motivation shifts to the area of receiving high pay for the results of work. Therefore, the real system of labor remuneration in corporations must consider three components:

- Direct pay for the work performed on the basis of the contract;

- Income from the share of shares following the results of the financial year;

- Additional payments and benefits (bonuses), defined in each corporation by internal documents.

Under such a wage scheme, top managers should receive a total high income that stimulates intensive work, an increase in the share of their capitalized profits, and an increase in social payments and guarantees in the corporation. This way will naturally remove the contradictions existing in Russia between the remuneration of labor of top managers of corporations and the results of the work of corporations themselves (Doyle, 1999, p. 560).

The development of corporations today directly depends on a properly organized financial activity and within its framework of credit and investment activities. Since the restructuring of corporations and the creation of self-governing structures lead to the interaction of a large number of legal entities, the top management of the corporation, as a rule, "projects" the principles of financial, including investment and credit, strategies based on the following main objectives:

- Consolidation of structural divisions of the corporation in order to optimize tax payments;

- A unified credit and financial policy;

- Reorganization of production facilities as a result of mergers;

- Penetration through the intermediation of the corporation into the production and marketing of various goods;

- The implementation of a unified policy and the implementation of a unified control over the observance of the common interests of the corporation;

- Acceleration of the diversification process;

- Organization of internal financial flows;

- Centralization of participation in the capital of other enterprises, etc.

In particular, the credit strategy of the corporation can be focused, first of all, on optimizing the mobilized resources by attracting capital, including by issuing securities and working with them, by actively interacting with foreign funds and organizations, by using offshore and free economic zones, accumulation of funds of corporate employees in non-governmental pension funds, insurance companies, bank deposits and financial companies, as well as in capital organizations - participants of the corporation (Basalay, 2001, p. 166).

Thus, the successful financial activity of the corporation is conditioned both by timely and correct decisions of the top management in the current work, and in the issues of strategy, which should be developed not only on the basis of the internal conditions of the corporation, but also considering the influence of the financial system that has developed in Russia at this stage.

The need to improve the system of accounting and reporting of corporate associations naturally follows from the economic essence of the association of business entities. The practical lack of sufficient domestic experience in compiling and maintaining unified financial and economic reporting in integrated structures indicates that these structures face a fundamentally new task. In the world practice this type of reporting is called consolidated (Kovalev, 1997).

Under Russian conditions, when using the concepts of consolidated accounting and reporting, one can proceed from the fact that it is about integrating the performance indicators of economic entities contained in:

- Balance;

- Profit and Loss Statement;

- A report on the movement of funds of funds;

- Other elements of reporting.

The need for consolidated reporting appears when in a real economic life, structures are beginning to be created, for example, corporations whose members are linked by mutual participation in each other's capital or otherwise. Objects for consolidated reporting arise for a variety of reasons. Joint stock companies acquire other companies in order to expand their business and obtain income from investments, eliminate competitors or acquire a large stake in another company in order to establish control over it or establish closer official relations of mutual cooperation.

The presence of the consolidated reporting of the corporation allows to increase financial and socio-economic controllability for it, to have an objective picture of the activity of the association as a whole and of each of its participants in particular, to invest funds in really promising areas of economic development.

The essence of the consolidated reporting of the corporation is that at present it is, as a rule, not the reporting of a legally independent economic entity and has a clearly expressed analytical orientation. The purpose of such reporting is not to identify taxable profits, but to obtain a general idea of the activities of economic entities within the association, the group.

As studies show, financial and economic information on the results of the corporation as a whole is necessary for:

- State bodies - in order to determine the role and place of the corporation in the economic development of the state and the region, in particular, to determine the degree of coincidence of interests of federal, local authorities and corporations in the implementation of economic development programs declared by the corporation at the time of its registration, whether this corporation is an instrument for the development of industrial production in the conditions of structural reorganization of the economy of the state or the direction of its activity is subject to change either correction, for example, through the use of state incentives or through the participation of government representatives on the Board of Directors;

- Internal consumption by the corporation - in order to develop an overall effective corporate development and operational strategy, increase the manageability of its participants, and conduct a unified, coordinated financial, economic and social policy by the participants in the corporation;

- Informing the general public, existing and potential investors about the activities of this corporation, allowing to judge the amounts, time and risks associated with expected revenues, as well as the corporation's economic resources, its liabilities, the composition of funds and sources, and the reasons for their changes.

Thus, the consolidated financial statements contain information characterizing the activities of a set of economic entities operating within the framework of a single economic strategy and participating (in varying degrees) in each other's capital. It is necessary for all who have or are supposed to have interests in this corporation: investors, creditors, suppliers, customers, enterprise personnel, banks, government and local authorities.

For the convenience of forming and subsequent analysis of the financial statements of corporations abroad, the system of accounting standards, the so-called IAS (International Accounting Standards), was developed and compiled, in Russia the term IFRS (International Financial Reporting Standards) is more often used. One of the main objectives of IAS is to structure financial statements that would allow shareholders and potential investors to compare financial and economic performance of various corporations for making investment decisions.

By adapting the IAS requirements for domestic corporations, you can formulate several requirements that define:

- Accounting Periods - financial statements should be prepared periodically, at regular intervals. The corporation may choose the time when its financial period will end (minimum - annual report);

- Completeness of coverage (Matching) - in the financial documents the corporation should include all expenses which realization is necessary for reception of the incomes specified in the reporting;

- Conservatism - in a situation where the uncertainty of the measurement gives rise to equiprobable profits, the corporation should report the smallest figure in the report. In this case, the corporation should strive to foresee all expenses and not report incomes without a thorough justification. Distortion of information is unacceptable;

- Understandability - the information contained in the reports should be stated at a level that the reader can perceive with an average level of understanding of business problems;

- Relevance (Relevance) - reports should contain information that is essential for decision-making and is user-oriented;

- Reliability - the information provided should be complete and reliable;

- Consistency - the corporation should strive to use comparable methods of financial calculations, so that it is possible to compare the reporting data for different time periods (Easterbrook, 1990).

The above list does not include all of the IAS requirements, but only those that primarily relate to external reporting. Any corporation in its financial statements should show:

- The financial position at the end of the period (the Financial Position at Period's End);

- Cash flows for the period (the Cash Flows for the Period);

- Income for the period (the Earnings for the Period);

- The total income for the period (the Comprehensive Income for the Period);

- Contributions of owners and payments to owners for a period (the Investments by and Distributions to Owners for the Period);

- Comments to Documents for Owners (Schneidman, 1998).

Based on the above requirements, you can formulate a list of reporting documents, the preparation of which is necessary for the analysis of the functioning of the corporation:

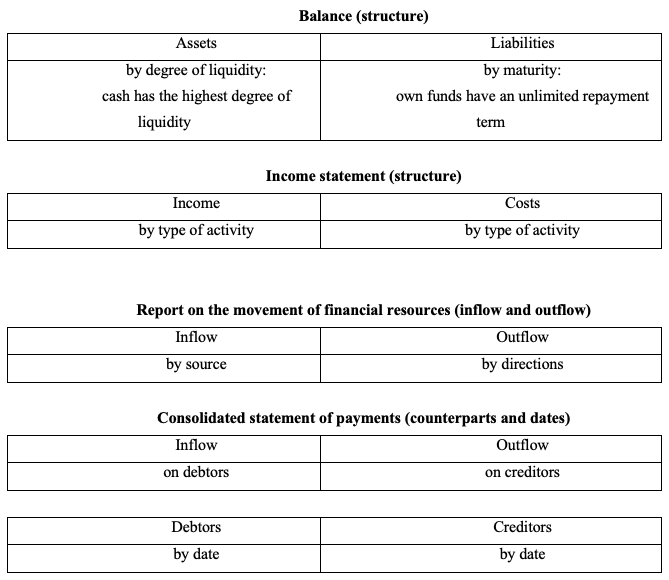

- Balance sheet - a document reflecting the structure of the corporation's assets (asset structure), distributed according to the degree of liquidity, and the structure of sources for the acquisition of assets (liabilities structure), distributed by maturity;

- The report on incomes and expenses of corporation - the document illustrating structure of incomes and structure of expenses (expenses) of corporation;

- A report on the movement of financial resources of the corporation - a document that allows estimating the inflow and outflow of funds;

- Summary statement of payments - a document that distributes debtors and creditors into two groups: by the terms of payments and by the amounts of payments.

Thus, the corporation, having sufficient freedom in the formation of the list of reporting articles, submits to the fiscal bodies a standardized set of financial reporting documents. For the analysis, additional data may be required, which are requested individually from each corporation. Schematically documents are shown in Figure 2.

Figure 2

Documents of the consolidated statements

Also, when preparing consolidated financial statements, the forms of financial reporting recommended by the European Union (EU) can be taken as a basis.

In the article, the question of the results of economic reforms in Russia, the terms "corporation", "corporate governance", their application in the field of mass information and in the literature, as well as the formation of the notion of a management system adopted by corporations as one of the ways of effective management and withdrawal of Russian enterprises from the crisis.

From a legal point of view, property is a relationship between a person and a group or a community of entities on the one hand, and any substance of the material world (object), on the other hand, consisting in the permanent or temporary, partial or complete alienation, disassociation, appropriation of the property.

The subject of ownership is the active side of property relations, which has the possibility and the right to own an object of ownership.

The property object is the passive side of property relations in the form of objects of nature, property, substance, information, spiritual and intellectual values.

Objects of ownership as a commodity can form a property market with its inherent hierarchical control system of its functions, relationships and other characteristics.

The objects of the property market can represent all forms of ownership (private, corporate, municipal and other), and subjects can be citizens, legal entities, Russia, Subjects of the Federation, municipalities, public and religious organizations, foundations (Chuev, 2016, pp. 239-244).

The formation of real schemes for managing the property of industrial corporations should be based on the principles of effective management, using the basic provisions of civil and economic legislation. Practical implementation of these tasks is carried out within the framework of a single closed management process, including identification, accounting, evaluation of the effectiveness of use, planning activities to improve efficiency, assessing the opportunities for corporate support for planned activities and the implementation of activities (Koryakovtseva, 2016, pp. 293-299).

According to the authors, only the application of a set of methods from different sections of the economy can give the necessary economic effect and solve the acute problem of improving the efficiency of corporate property management in Russia. In this connection, the paper considers general principles of effective management and analyzes the possibilities of their application for the purposes of managing corporate property. Corruption and lawlessness of shadow capital forces top management to choose one of two directions: either to come into contact with shadow structures and gradually lose control, or to build such a system of corporate relations that would preserve both itself and property.

Corporate governance is built on the basis of well-established and effective standards in the areas of finance, securities, management, labor relations, contractual obligations, contractual activities, organizational structures, marketing. In the presence of basic government documents and accumulated experience, it is possible to build a system of corporate relations at the level of a specific corporation, thus setting benchmarks for the entire Russian economy.

The result of the work was the issue of providing financial documents in the field of corporate economic management in Russia, which is appropriate from the analysis of Russian corporations in the modern economy.

A large commercial dictionary (1996). M.: Moscow, p. 132.

Basalay, S.I. (1996). Mechanisms of financial resources management of the corporation. Moscow: "TDDS Capital-8", p. 166.

Chuev, I.N., Panchenko, T.M., Novikov, V.S., Konnova, O. A., Iraeva, N.G., Karabulatova, I.S. (2016). Innovation and Integrated Structures of the Innovations in Modern Russia. International Review of management and marketing, 6(1S), 239-244.

Doyle, P. (1990). Management: Strategy and Tactics, St. Petersburg: Peter, p. 560.

Easterbrook, F.H., Fishel, D. (1990). The Corporate Contract. In: Bebchuck, L., ed. Corporate Law and Economic Analysis.

Goncharov, V.V. (1998). Creation and functioning of joint-stock companies. М. Mnepu:, p. 112.

Gubin, E.P. (1999). Management and corporate control in the joint-stock company. M.: Jurist, p. 248.

Koryakovtseva, O.A., Doronina, I.I., Panchenko, T.M., Karabulatova, I.S., Abdullina, Z.M. (2016). Research of category “Motivation” as a basic tool of personnel management. International Review of Management and Marketing, 6(1S), 293-299.

Kovalev, V.V. (1997). Financial analysis: management of capital. The choice of investment. Analysis of reporting. 2nd ed., Revised and addited, - Moscow: Finances and Statistics.

Schneidman, L.Z. (1998). On the way to the international standards of financial reporting. Accounting, 1(January).

Shupiro, V.M. (1997). Transformation of state property in the period of economic reforms. Moscow: VShPP, p. 248.

Vynslav, Yu.B. (1996). About the basic tendencies of organizational development of the privatized enterprises. Russian Economic Journal, 10.

1. Dr in Sc. (Economics), professor MGIMO University, Institute of socio-political research RAS Russia. Email: yurina_iriha@mail.ru

2. For example, the means of production.