Vol. 40 (Number 3) Year 2019. Page 2

KOLOMEYTSEVA Angelina A. 1

Received: 06/08/2018 • Approved: 27/11/2018 • Published 28/01/2019

ABSTRACT: The article highlights the current trends in the global oil market development. Based on economic and statistical analysis of the main factors forming the oil market environment, it is shown that today its functioning takes place in a new normal. The fall in oil prices below $50/b has required the development of a coherent policy of the major oil exporting countries to stabilize the market. Nevertheless, despite albeit stabilization, the dynamics of oil prices and the imbalance of the global market are still cyclical and require further analysis. |

RESUMEN: El artículo destaca las tendencias actuales en el desarrollo del mercado mundial del petróleo. Sobre la base del análisis económico y estadístico de los principales factores que forman la coyuntura económica de dicho mercado, se demuestra que hoy su funcionamiento tiene lugar en una nueva normalidad. La caída de los precios del petróleo por debajo de los 50 dólares por barril ha requerido el desarrollo de una política coherente de los principales países exportadores de petróleo para estabilizar el mercado. No obstante, a pesar de la estabilización, la dinámica de los precios del petróleo y el desequilibrio del mercado mundial siguen siendo cíclicos y requieren un análisis más profundo. |

The global oil market, as well as the global economy, is never in a state of market equilibrium but tends to it. The current situation on the global oil market is characterized by a sharp collapse in prices. In 2016, oil prices reached a low, falling below $50/b. There are two main reasons for such a significant drop in oil prices - the instability in the Middle East and the shale revolution in the US. For the last two years, OPEC countries have been successfully complying with the agreement to cut oil production, but apparently, they are not going to continue to do so as the situation slowly but improves.

This study aims to highlight the factors that influence the global oil market and the prospects of its development in a new normal, i.e. in the conditions of low oil prices. To that end the author set the following objectives:

The specifics of the oil industry development have been analyzed by a number of international scientists such as M. Davis, R.G. Newell, B.C. Prest, B. Putnam, etc., as well as Russian researchers: A.A. Konoplyanik, A.A. Makarov, A.N. Spartak, S.V. Zhukov, and many others.

The article comprises a literature review and an empirical study. As a research tool, we used the methods of analysis and forecasting of time series, as well as tabular and graphical methods of presentation of research results. The information base of the study was made up of official data from OPEC member countries, the International Energy Agency, as well as official Internet sources.

The construction of a predictive model for commodity markets is significantly complicated by the lack of our knowledge of the multi-factor relationships of the currency, stock and commodity markets in the current situation. Therefore, attempts to predict commodity markets are increasingly reduced to the analysis of the present trend and its extrapolation to the future with the imposition of possible bifurcation deviations.

The primary focus of the research is to determine current trends in the development of the global oil market. The author provides an overview of the global oil market on the basis of economic and statistical analysis of the following indicators in dynamics: reserves, production, consumption, foreign trade.

According to OPEC data published in the Annual Statistical Bulletin 2018, OPEC oil reserves in 2017 amounted to 1214 bn b or 81.9% of the global reserves. At the same time, Venezuela has the largest oil reserves – 302.8 bn b, followed by Saudi Arabia – 266.2 bn b, Iran – 155.6 bn b and Iraq – 147.2 bn b (Table 1).

Table 1

The dynamics of oil reserves in OPEC countries for 2012-2017 (billion barrels)

Country |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

World, % |

Venezuela |

297.73 |

298.36 |

299.96 |

300.88 |

302.25 |

302.80 |

20.42 |

Saudi Arabia |

265.85 |

265.79 |

266.68 |

266.45 |

266.20 |

266.26 |

17.96 |

IR Iran |

157.30 |

157.80 |

157.53 |

158.40 |

157.20 |

155.60 |

10.49 |

Iraq |

140.30 |

144.21 |

143.06 |

142.50 |

148.76 |

147.22 |

9.93 |

Kuwait |

101.50 |

101.50 |

101.50 |

101.50 |

101.50 |

101.50 |

6.85 |

United Arab Emirates |

97.80 |

97.80 |

97.80 |

97.80 |

97.80 |

97.80 |

6.60 |

Libya |

48.47 |

48.36 |

48.36 |

48.36 |

48.36 |

48.36 |

3.26 |

Nigeria |

37.13 |

37.07 |

37.45 |

37.06 |

37.45 |

37.45 |

2.53 |

Qatar |

25.24 |

25.24 |

25.24 |

25.24 |

25.24 |

25.24 |

1.70 |

Algeria |

12.20 |

12.20 |

12.20 |

12.20 |

12.20 |

12.20 |

0.82 |

Angola |

9.05 |

9.01 |

8.42 |

9.52 |

9.52 |

8.38 |

0.57 |

Ecuador |

8.23 |

8.83 |

8.27 |

8.27 |

8.27 |

8.27 |

0.56 |

Gabon |

2.00 |

2.00 |

2.00 |

2.00 |

2.00 |

2.00 |

0.13 |

Equatorial Guinea |

1.70 |

1.70 |

1.10 |

1.10 |

1.10 |

1.10 |

0.07 |

OPEC |

1204.50 |

1209.87 |

1209.57 |

1211.28 |

1217.85 |

1214.18 |

81.89 |

*Republic of Congo joined OPEC in 2018, so it is excluded from the analysis.

Source: complied by the author on the basis of OPEC data

Among non-OPEC countries, Russia has the largest reserves of conventional oil – 80 bn b in 2017, followed by the US - 32.7 bn b, Kazakhstan - 30 bn b, and China - 25.6 bn b (Table 2).

Table 2

The dynamics of oil reserves in non-OPEC countries for 2012-2017 (billion barrels)

Country |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

World, % |

Russia |

80.00 |

80.00 |

80.00 |

80.00 |

80.00 |

80.00 |

5.40 |

United States |

30.53 |

33.37 |

36.38 |

32.32 |

32.77 |

32.77 |

2.21 |

Kazakhstan |

30.00 |

30.00 |

30.00 |

30.00 |

30.00 |

30.00 |

2.02 |

China |

24.42 |

24.38 |

24.65 |

25.13 |

25.62 |

25.63 |

1.73 |

Brazil |

13.15 |

15.05 |

15.54 |

16.18 |

13.00 |

12.63 |

0.85 |

Azerbaijan |

7.00 |

7.00 |

7.00 |

7.00 |

7.00 |

7.00 |

0.47 |

Mexico |

11.42 |

10.07 |

9.81 |

9.71 |

7.14 |

6.54 |

0.44 |

Norway |

5.37 |

5.82 |

5.50 |

5.14 |

6.61 |

6.38 |

0.43 |

Oman |

5.50 |

4.97 |

5.15 |

5.30 |

5.37 |

5.37 |

0.36 |

Sudans |

5.00 |

5.00 |

5.00 |

5.00 |

5.00 |

5.00 |

0.34 |

India |

5.57 |

5.71 |

5.74 |

4.79 |

4.62 |

4.50 |

0.30 |

Vietnam |

4.40 |

4.40 |

4.40 |

4.40 |

4.40 |

4.40 |

0.30 |

Egypt |

4.40 |

4.40 |

4.40 |

4.40 |

4.40 |

4.40 |

0.30 |

Australia |

3.92 |

3.96 |

3.98 |

3.98 |

3.99 |

3.99 |

0.27 |

Canada |

4.13 |

4.28 |

4.12 |

3.90 |

3.80 |

3.80 |

0.26 |

Malaysia |

3.67 |

3.75 |

3.75 |

3.60 |

3.60 |

3.60 |

0.24 |

Indonesia |

3.29 |

3.30 |

3.30 |

3.23 |

3.23 |

3.31 |

0.22 |

Others |

32.40 |

33.15 |

32.21 |

31.57 |

30.38 |

29.27 |

1.97 |

World |

1478.67 |

1488.48 |

1490.50 |

1486.93 |

1488.78 |

1482.77 |

100.00 |

Source: complied by the author on the basis of OPEC data

In 2017, oil production in OPEC countries amounted to 32.5 m b/d or 43.5% of the global oil production. At the same time, there was a downward trend compared to 2016 (-2.8% in OPEC countries and -0.9% in the world) as a result of the OPEC agreement to cut production volumes to stabilize prices.

In 2017, the largest oil producers in OPEC were Saudi Arabia - 9.9 m b/d, Iraq – 4.4 m b/d, and Iran – 3.8 m b/d. At the same time oil production in Venezuela, despite the largest reserves in the world, fell sharply by 14.2% compared to the previous year and amounted only to 2.0 m b/d, due to the outbreak of the economic crisis and the sanctions imposed by the United States. Fundamentally, the Venezuelan oil industry has good prospects due to its resource base and close vicinity to key markets. This fact also explains the focus of sanctions to create a competitive advantage for US producers. The long-term decline in production, which has been observed over the past years, does not correspond to the country’s resource potential and new oil production technologies.

In 2017, there was a decline in oil production in OPEC countries, with the largest fall in Equatorial Guinea – (-19.7% compared to 2016). The opposite trend was noticed in Libya, where production growth rate amounted to 109.5% (Table 3).

Table 3

The dynamics of oil production in OPEC countries for 2012-2017 (million barrels/day)

Country |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

World, % |

Venezuela |

2.80 |

2.80 |

2.68 |

2.65 |

2.37 |

2.03 |

2.72 |

Saudi Arabia |

9.76 |

9.64 |

9.71 |

10.19 |

10.46 |

9.96 |

13.33 |

IR Iran |

3.74 |

3.57 |

3.12 |

3.15 |

3.65 |

3.87 |

5.18 |

Iraq |

2.94 |

2.98 |

3.11 |

3.50 |

4.65 |

4.47 |

5.98 |

Kuwait |

2.98 |

2.92 |

2.87 |

2.86 |

2.95 |

2.70 |

3.61 |

United Arab Emirates |

2.65 |

2.80 |

2.79 |

2.99 |

3.09 |

2.97 |

3.98 |

Libya |

1.45 |

0.99 |

0.48 |

0.40 |

0.39 |

0.82 |

1.10 |

Nigeria |

1.95 |

1.75 |

1.80 |

1.75 |

1.43 |

1.53 |

2.05 |

Qatar |

0.73 |

0.72 |

0.71 |

0.66 |

0.65 |

0.60 |

0.80 |

Algeria |

1.20 |

1.20 |

1.19 |

1.16 |

1.15 |

1.06 |

1.42 |

Angola |

1.70 |

1.70 |

1.65 |

1.77 |

1.72 |

1.63 |

2.18 |

Ecuador |

0.50 |

0.53 |

0.56 |

0.54 |

0.55 |

0.53 |

0.71 |

Gabon |

0.24 |

0.21 |

0.21 |

0.21 |

0.22 |

0.21 |

0.28 |

Equatorial Guinea |

0.24 |

0.21 |

0.20 |

0.19 |

0.16 |

0.13 |

0.17 |

OPEC |

32.88 |

32.02 |

31.08 |

32.02 |

33.44 |

32.51 |

43.51 |

Source: complied by the author on the basis of OPEC data

In 2017, Russia was the world’s leader in oil production – 10.3 m b/d. Another major producer was the US with the amount of 9.3 m b/d. The increase in oil production was also noticed at the giant Kashagan field in Kazakhstan – by 13.3%, as well as in Brazil – by 4.5%, due to the active development of deposits in the subsalt layers. However, the opposite trend has continued over the past two years in China. In 2017, there was a decline in production by 4% due to the aging of oil fields, and therefore high production costs (Table 4).

Table 4

The dynamics of oil production in non-OPEC countries for 2012-2017 (million barrels/day)

Country |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

World, % |

Russia |

9.95 |

10.05 |

10.09 |

10.11 |

10.29 |

10.35 |

13.86 |

United States |

6.49 |

7.47 |

8.76 |

9.41 |

8.86 |

9.35 |

12.52 |

Kazakhstan |

1.31 |

1.37 |

1.34 |

1.32 |

1.26 |

1.47 |

1.97 |

China |

4.07 |

4.16 |

4.20 |

4.29 |

3.98 |

3.82 |

5.11 |

Brazil |

2.06 |

2.02 |

2.25 |

2.44 |

2.51 |

2.62 |

3.50 |

Others |

15.94 |

15.71 |

15.64 |

15.50 |

15.05 |

14.57 |

19.53 |

World |

72.70 |

72.80 |

73.36 |

75.09 |

75.39 |

74.69 |

100.00 |

Source: complied by the author on the basis of OPEC data

An important indicator for the analysis of the global oil market is a reserves-to-production ratio. This factor allows us to assess only the rate of exploitation of the current proven reserves and cannot serve as a criterion for assessing objectively existing restrictions imposed on the growth of production as a result of physical depletion of recoverable mineral resources.

Ratio = Reserves/Production

The results have shown that with the current production, oil reserves in Latin America will last for almost 130 years, in the Middle East - 70 years, in North America – 30 years, in CIS countries – 30 years, in Africa – 45 years, in the Asia-Pacific region – 20 years, and in Europe – 10 years.

The situation on the global oil market is determined not only by the level of its production but also by the level of its consumption, as well as its geographical distribution. So, in 2017, oil consumption in OPEC countries increased by 0.5% and amounted to 9.3 m b/d or 9.5% of the global volume. At the same time, the strongest demand for oil was observed in Saudi Arabia – 3.2 m b/d, and in Iran – 1.8 m b/d, while the most significant decline in oil consumption was observed in Venezuela – (-11.2%) because of the economic crisis (Table 5).

Table 5

The dynamics of oil consumption in OPEC countries for 2012-2017 (million barrels/day)

Country |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

World, % |

Venezuela |

0.79 |

0.83 |

0.75 |

0.66 |

0.57 |

0.50 |

0.51 |

Saudi Arabia |

2.87 |

2.99 |

3.16 |

3.32 |

3.21 |

3.24 |

3.33 |

IR Iran |

1.76 |

1.78 |

1.85 |

1.79 |

1.80 |

1.82 |

1.87 |

Iraq |

0.66 |

0.71 |

0.68 |

0.69 |

0.76 |

0.79 |

0.81 |

Kuwait |

0.38 |

0.33 |

0.34 |

0.35 |

0.35 |

0.37 |

0.38 |

United Arab Emirates |

0.64 |

0.67 |

0.72 |

0.78 |

0.80 |

0.79 |

0.81 |

Libya |

0.22 |

0.25 |

0.22 |

0.21 |

0.20 |

0.20 |

0.20 |

Nigeria |

0.34 |

0.39 |

0.40 |

0.41 |

0.39 |

0.43 |

0.44 |

Qatar |

0.13 |

0.22 |

0.24 |

0.29 |

0.35 |

0.34 |

0.40 |

Algeria |

0.35 |

0.38 |

0.39 |

0.42 |

0.40 |

0.42 |

0.43 |

Angola |

0.08 |

0.15 |

0.15 |

0.14 |

0.12 |

0.12 |

0.12 |

Ecuador |

0.27 |

0.27 |

0.29 |

0.26 |

0.25 |

0.24 |

0.25 |

Gabon |

0.02 |

0.02 |

0.02 |

0.02 |

0.02 |

0.02 |

0.02 |

Equatorial Guinea |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

OPEC |

8.51 |

8.99 |

9.21 |

9.34 |

9.22 |

9.28 |

9.55 |

Source: complied by the author on the basis of OPEC data

One more significant indicator for the analysis is the demand for oil from non-OPEC countries. In 2017, the major oil consuming countries were the US with the consumption of 19.9 m b/d, China - 12.3 m b/d, India – 4.5 m b/d, Japan – 3.9 m b/d, Russia - 3.5 m b/d, and South Korea – 2.6 m b/d. Consumption in these countries increased steadily during 2012-2017, except for Japan (Table 6).

Table 6

The dynamics of oil consumption in non-OPEC countries for 2012-2017 (million barrels/day)

Country |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

World, % |

United States |

18.49 |

18.99 |

19.15 |

19.58 |

19.72 |

19.92 |

20.49 |

China |

9.79 |

10.40 |

10.79 |

11.49 |

11.80 |

12.32 |

12.67 |

India |

3.63 |

3.67 |

3.79 |

4.05 |

4.39 |

4.47 |

4.60 |

Japan |

4.63 |

4.50 |

4.25 |

4.12 |

4.02 |

3.94 |

4.05 |

Russia |

3.32 |

3.37 |

3.55 |

3.43 |

3.43 |

3.48 |

3.58 |

Brazil |

2.96 |

3.10 |

3.18 |

3.11 |

3.07 |

3.10 |

3.19 |

South Korea |

2.32 |

2.33 |

2.35 |

2.47 |

2.63 |

2.65 |

2.73 |

Germany |

2.39 |

2.44 |

2.37 |

2.37 |

2.41 |

2.50 |

2.57 |

Canada |

2.47 |

2.46 |

2.38 |

2.37 |

2.38 |

2.42 |

2.49 |

Mexico |

2.10 |

2.09 |

2.04 |

2.00 |

2.03 |

1.93 |

1.99 |

Indonesia |

1.58 |

1.61 |

1.64 |

1.67 |

1.68 |

1.72 |

1.77 |

France |

1.73 |

1.71 |

1.69 |

1.69 |

1.66 |

1.71 |

1.76 |

United Kingdom |

1.53 |

1.51 |

1.51 |

1.55 |

1.59 |

1.58 |

1.63 |

Thailand |

1.25 |

1.32 |

1.33 |

1.33 |

1.38 |

1.41 |

1.45 |

Spain |

1.30 |

1.21 |

1.20 |

1.25 |

1.29 |

1.30 |

1.34 |

Italy |

1.37 |

1.26 |

1.27 |

1.27 |

1.25 |

1.28 |

1.32 |

Australia |

1.09 |

1.13 |

1.11 |

1.11 |

1.10 |

1.18 |

1.21 |

Others |

18.97 |

19.06 |

19.26 |

19.88 |

20.49 |

21.01 |

21.61 |

World |

89.43 |

91.15 |

92.07 |

94.08 |

95.54 |

97.20 |

100.00 |

Source: complied by the author on the basis of OPEC data

In 2017, oil exports from OPEC countries decreased by 1.5% and amounted to 24.88 m b/d or 55.6% of the global volume. The largest oil exporters in OPEC were Saudi Arabia - 7.0 m b/d, Iraq – 3.8 m b/d, the UAE – 2.4 m b/d, Iran – 2.1 m b/d, and Kuwait – 2.0 m b/d. Almost all OPEC countries, except Libya, Iran, Iraq, and Nigeria, were dominated by the negative contribution of the foreign trade component to the development of the oil market. This is primarily due to the decline in production in OPEC countries. The positive contribution was most evident in Libya, where oil exports increased by 126.2% in 2017 (Table 7).

Table 7.

The dynamics of oil exports from OPEC for 2012-2017 (million barrels/day)

Country |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

World, % |

Venezuela |

1.72 |

1.53 |

1.96 |

1.97 |

1.84 |

1.60 |

3.58 |

Saudi Arabia |

7.56 |

7.57 |

7.15 |

7.16 |

7.46 |

6.97 |

15.58 |

IR Iran |

2.10 |

1.21 |

1.11 |

1.08 |

1.92 |

2.13 |

4.76 |

Iraq |

2.42 |

2.39 |

2.52 |

3.00 |

3.80 |

3.80 |

8.49 |

Kuwait |

2.07 |

2.06 |

1.99 |

1.96 |

2.13 |

2.01 |

4.49 |

United Arab Emirates |

2.45 |

2.70 |

2.50 |

2.44 |

2.41 |

2.38 |

5.32 |

Libya |

0.96 |

0.84 |

0.33 |

0.29 |

0.35 |

0.79 |

1.77 |

Nigeria |

2.37 |

2.19 |

2.12 |

2.11 |

1.74 |

1.81 |

4.04 |

Qatar |

0.59 |

0.60 |

0.60 |

0.49 |

0.50 |

0.47 |

1.05 |

Algeria |

0.81 |

0.74 |

0.62 |

0.64 |

0.67 |

0.63 |

1.41 |

Angola |

1.66 |

1.67 |

1.61 |

1.71 |

1.67 |

1.58 |

3.53 |

Ecuador |

0.36 |

0.39 |

0.42 |

0.43 |

0.41 |

0.39 |

0.87 |

Gabon |

0.22 |

0.21 |

0.21 |

0.21 |

0.21 |

0.19 |

0.42 |

Equatorial Guinea |

0.20 |

0.21 |

0.20 |

0.18 |

0.16 |

0.13 |

0.29 |

OPEC |

25.29 |

24.31 |

23.34 |

23.67 |

25.27 |

24.88 |

55.60 |

Source: complied by the author on the basis of OPEC data

-----

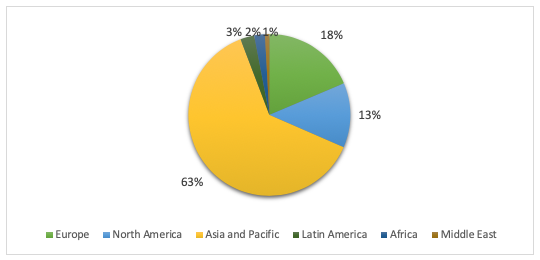

Figure 1

The geographical structure of OPEC exports in 2017

Source: complied by the author on the basis of OPEC data

In 2017, the largest oil exporters from non-OPEC countries were Russia - 5.0 m b/d (ranked second after Saudi Arabia), Canada – 2.91 m b/d, Kazakhstan – 1.37 m b/d, Norway – 1.36 m b/d, Mexico – 1.26 m b/d, Brazil – 1.13 m b/d, and the United States – 1.12 m b/d. At the same time, there was an increase in exports from the US by 89.8% compared to 2016. Also, oil exports from Brazil showed good growth rates - 26.9% (Table 8).

Table 8

The dynamics of oil exports in non-OPEC countries for 2012-2017 (million barrels/day)

Country |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

World, % |

Russia |

4.76 |

4.69 |

4.49 |

4.90 |

5.08 |

5.06 |

11.31 |

Canada |

1.76 |

2.06 |

2.28 |

2.30 |

2.74 |

2.91 |

6.5 |

Kazakhstan |

1.37 |

1.28 |

1.25 |

1.23 |

1.23 |

1.37 |

3.06 |

Norway |

1.30 |

1.19 |

1.20 |

1.23 |

1.37 |

1.36 |

3.04 |

Mexico |

1.33 |

1.27 |

1.22 |

1.25 |

1.27 |

1.26 |

2.82 |

Brazil |

0.49 |

0.37 |

0.52 |

0.74 |

0.89 |

1.13 |

2.53 |

United States |

0.07 |

0.13 |

0.35 |

0.47 |

0.59 |

1.12 |

2.50 |

Others |

5.35 |

5.53 |

5.55 |

5.76 |

5.83 |

5.66 |

12.65 |

World |

41.72 |

40.83 |

40.20 |

41.55 |

44.25 |

44.75 |

100.00 |

Source: complied by the author on the basis of OPEC data

The results have shown that in 2017, China was ahead of the largest oil importer in the world – the United States. Imports to China increased by 10.5% to 8.4 m b/d, compared to 7.9 m b/d in the US. Despite the slowdown of economic growth, China has a persistently high demand for imports of mineral resources, higher than domestic supply. However, despite the fact that the supply sources are quite diversified, the Middle East is the largest oil exporter to China. This factor indicates the strong dependence of China's economy on crude oil from this region (Table 9).

Table 9

The dynamics of oil imports in the world for 2012-2017 (million barrels/day)

Country |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

World, % |

China |

5.42 |

5.66 |

6.18 |

6.73 |

7.63 |

8.43 |

18.15 |

United States |

8.53 |

7.73 |

7.34 |

7.36 |

7.85 |

7.91 |

17.03 |

India |

3.68 |

3.79 |

3.79 |

3.94 |

4.31 |

4.34 |

9.34 |

Japan |

3.46 |

3.41 |

3.24 |

3.23 |

3.16 |

3.24 |

6.98 |

South Korea |

2.56 |

2.45 |

2.48 |

2.78 |

2.93 |

3.04 |

6.54 |

Germany |

1.88 |

1.83 |

1.81 |

1.84 |

1.84 |

1.83 |

3.94 |

Italy |

1.38 |

1.18 |

1.09 |

1.26 |

1.23 |

1.34 |

2.88 |

Spain |

1.18 |

1.17 |

1.19 |

1.31 |

1.29 |

1.33 |

2.86 |

France |

1.14 |

1.11 |

1.08 |

1.15 |

1.09 |

1.14 |

2.45 |

Netherlands |

1.00 |

0.95 |

0.96 |

1.06 |

1.09 |

1.09 |

2.35 |

Others |

12.82 |

12.29 |

12.05 |

12.16 |

12.22 |

12.76 |

27.48 |

World |

43.05 |

41.57 |

41.21 |

42.82 |

44.64 |

46.45 |

100.00 |

Source: complied by the author on the basis of OPEC data

A special emphasis is placed on pricing principles of the global oil market. The author analyses the dynamics of changes in oil prices, as well as considers the key factors that cause price fluctuations.

The analysis implied that in its evolution, the global oil market has undergone a transformation from a one-segment to a two-segment market. There was a transition from a market consisting of a single segment - the market of physical oil to a market consisting of a combination of two segments: the physical oil market and the "paper" oil market.

Nowadays, the "paper" oil market segment dominates the physical oil segment. The "paper" oil market consists mainly of derivatives related to oil contracts. Therefore, in our opinion, today the movement of oil prices reflects the search for a balance of supply and demand of oil-related financial instruments rather than of physical supplies.

Pricing in the global oil market is influenced by various factors – market balance, alternative fuels prices, both cyclical and non-cyclical factors – scientific-and-technological advance, structural and sectoral crises, political events, inflation, speculation, etc.

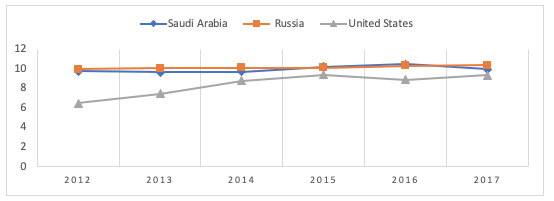

Among the factors that had a direct impact on the development of the global oil market in the analyzed period, we can distinguish the shale revolution in the United States and the subsequent abolition of the 40-year-old embargo on the export of oil in late 2015. Although the US is not a member of OPEC, nevertheless, this country has a significant impact on the formation of oil supply and the dynamics of oil prices. Today, the US ranks third in the world in terms of oil production after Russia and the largest producer in OPEC - Saudi Arabia. Thus, the first finding of the present research revealed that the role of the US in the physical oil market has strengthened in the analyzed period (Fig.2).

Figure 2

The dynamics of oil production in top 3 oil exporters for 2012-2017 (million barrels/day)

Source: complied by the author on the basis of OPEC data

The second finding of the present research revealed that the US has a greater influence on the "paper" oil market as a country with financial institutions accounting for the bulk of financial oil derivatives. According to IMEMO data, 95% of the derivatives market is controlled by four major American investment banks: JP Morgan Chase, Citibank, Bank of America, Goldman Sachs.

What is more, the US Department of energy occasionally publishes data on oil stock changes, and the exchanges react immediately. The volume of trade on NYMEX and ICE increases or decreases, and therefore affects the dynamics of oil prices.

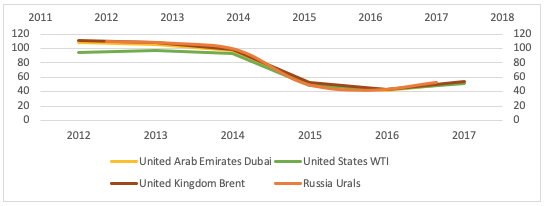

Figure 3 shows the dynamics of oil prices for the most liquid oil derivatives - Brent, WTI, Urals, and Dubai. In 2012, there was a peak in oil prices - $110/b (except for the US WTI – $94/b), which was then replaced by a steady downward trend in subsequent years and reached the bottom in 2016, barely exceeding the mark of $43/b. At the same time in 2015, oil prices fell almost twice compared to 2014.

Figure 3

The dynamics of oil prices for 2012-2017 ($/b)

Source: complied by the author on the basis of OPEC data

The results have shown that this unprecedented collapse in prices happened due to two main factors – the increase in oil production in the United States and the refusal of OPEC countries to cut production in 2014-2015, by lowering quotas. At that time, all the major oil exporting countries maintained production at the same level or slightly increased it, but the US increased it by 45% from 6.49 m b/d in 2012 to 9.41 m b/d in 2015. Thus, it should be noted that in the period of 2012-2017, the situation on the global oil market has changed for exporters for the worse. Nevertheless, in 2017, oil prices began to rise gradually, finally breaking the $50/b mark, however, in the case of a further increase in production, this trend may be replaced by a negative one.

In their turn, financial investors consider the periods of oil price decline as a good opportunity for investment. Financial investors made a significant contribution to the rapid growth of the world oil derivatives market. Many of them used the collapse of the oil prices, which began in late 2014, as an opportunity to increase the share of this commodity in the structure of their investment portfolios, as well as to make a speculative bet on the further growth of oil prices.

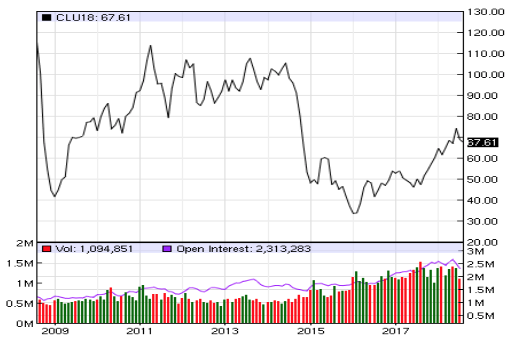

It is also indicated that today global oil trading is increasing, both in terms of volume and in open interest. A 10-year chart of ICE Brent Crude futures, the global benchmark for oil prices, shows the contract hitting 10 consecutive years of volume records while continuously setting open interest records during the same time period. Open interest is currently up to over 2.3 million open lots (Fig.4).

Figure 4

Long term dynamics of ICE Brent Futures

Source: NASDAQ

Similarly, WTI, the benchmark for US crude oil, has been steadily increasing volumes and open interest for the last several years. Open interest is currently up to over 2.4 million open lots (Fig.5).

Figure 5

Long term dynamics of NYMEX WTI Crude Oil Futures

Source: NASDAQ

Nowadays an increasing integration of the oil market with financial markets is a global concern and poses an urgent need for coordinated international regulation.

The author introduces the concept of regulatory factors on the global oil market, highlighting such regulators as OPEC, shale revolution in the US, futures market development, a policy of non-OPEC oil exporters, oil importers, as well as national regulators, greening of the global economy, sanctions, cyclical factors, scientific-and-technological advance.

In the short-term period OPEC countries can influence the global oil market by lowering production quotas, but in the long-term period, they have no influence, especially on a further rise in shale oil production. In its turn, shale oil production rises with high oil prices and vice versa. In the long run, shale production growth will continue, evidently it has limits in terms of scale and length and requires the regular development of technologies.

The phenomenon of price volatility is linked with the emergence and intensive spread of new financial instruments on the oil exchanges. As a result of the increased interest of institutional investors in crude oil futures, virtual transactions with "paper" oil have significantly exceeded the volume of global trade in physical oil. To that end, crude oil futures provoke price fluctuations, as they are focused on short-term financial instruments to the detriment of long-term relations of market participants.

Besides, non-OPEC exporters can also influence the global oil market by changing oil reserves or production, but the role of this factor eliminates in the long run. To the contrary, oil importers do not have a significant impact on oil consumption in the short-term, as such changes are usually insufficient. But the role of this factor increases in the long-term. As oil demand is formed by such major consumers as China and the US, changes in energy consumption mix in these countries can seriously affect the oil market in the long run.

One of the most important aspects of the market is connected with the applying of sanctions. Using sanctions to create a competitive advantage in real sectors of the economy is becoming a common thing. US sanctions are extraterritorial in nature and apply not only to American companies but also to companies from other countries. In fact, there is a flagrant violation of international law and interference in the work of the market. Thus, the decision of the US to withdraw from the multilateral agreement on the Iranian nuclear program announced on May 8, 2018, puts about 5% of world production and about 10% of the world's proven oil reserves under sanctions. Due to the weakening of the sanctions regime at the end of 2015, – after the deal on the Iranian nuclear program – the production of liquid hydrocarbons in Iran increased to 4 m b/d in 2017. If we add to this the sanctioned production in Venezuela – a country that has the world's largest oil reserves, and the implemented sectoral sanctions against Russian oil and gas companies, the total amount of hydrocarbons subjected to unilateral restrictions, is about a third of the world's reserves. Thus, this factor has a great influence on the oil market both in the short-term and in the long-term periods.

The cyclical nature of the global economy also has an impact on the development of the global oil market. During the economic prosperity, the oil market environment is positive, oil demand and prices are high, but during the recession - there is a decline in oil consumption and prices, and market overstocking as a result.

Despite the steady trend towards the greening of the global economy, in the short-term, the role of this factor cannot affect the development of the oil market, since the share of renewable energy in the world energy is extremely small. However, the tightening of environmental legislation can be a significant factor in the long-term. In addition, it can have an impact on the development of shale deposits.

Another important factor is technological development. The scientific-and-technological advance provides an opportunity not only to cut production costs but to involve new, previously undiscovered or uneconomic reserves in economic circulation - a determinant in the long run.

In addition to the enumerated scientific-and-technological advance, cyclical factors and sanctions, national market regulators have an impact on the development of the oil market in the long-term. In the short-term, the regulators are able to provide conditions for the oil market stabilization and reduction of price volatility, as well as to introduce strict regulation of commodity derivatives markets. For example, Directive 2014/65/EU on markets in financial instruments (MiFID II) includes a number of changes to the regulation of commodity derivatives. MiFID II introduces a regime of limits applicable to net positions that a participant can hold at all times in commodity derivatives. This regime aims to prevent market abuse and to support orderly pricing and settlement conditions on the futures markets. In the long run, the role of market regulators is to ensure the availability of infrastructure and to increase the investment attractiveness of the oil industry and its projects (Table 10).

Table 10

The global oil market regulatory factors

Regulatory factor |

Short-term period |

Long-term period |

OPEC |

Changes in supply |

- |

Shale revolution |

Changes in supply |

- |

Oil futures |

Price fluctuations |

- |

Non-OPEC oil exporters |

Changes in supply |

- |

Oil importers |

- |

Changes in demand |

Sanctions |

Changes in supply |

Changes in supply |

Cyclical factors |

Changes in demand |

Changes in demand |

Environmental law |

- |

Changes in demand |

Scientific-and-technological advance |

Changes in supply |

Changes in reserves |

National regulators |

Market stabilization |

Access to infrastructure, Investment prospects of projects and industry |

Source: complied by the author

The results have shown that in 2017, some changes have taken place on the global oil market: 1) oil production declined by almost 3% as a result of OPEC agreement; 2) Russia managed to overtake Saudi Arabia and come out on top in oil production; 3) despite the production cuts, global oil consumption increased by nearly 2%; 4) oil demand from major consumers – the USA and China, increased; 5) due to lower production, oil exports from OPEC countries also fell by 1.5%; 6) the opposite trend was noticed in non-OPEC countries, where oil exports increased by 1.2%; 7) the rather expected situation was noted in imports - China overtook the US and became the largest oil importer in the world; 8) however, the Chinese economy is heavily dependent on imports from the Middle East – the region’s exports to China amounts to 43%; 9) oil prices rushed up, breaking the mark of $50/b; 10) global oil trading is increasing, both in terms of volume and in open interest - open interest for Brent and WTI futures is currently up to over 5 million open lots.

The global oil market is the largest commodity market and oil prices are tightly correlated to other mineral resources prices. It has always been difficult to predict oil prices, but as they were dependent on supply and demand in the real market, to some extent they were controlled by producers. If the trend to increase production in the largest oil–producing countries (Russia, Saudi Arabia, and the United States) continues, oil prices are likely to move downward in the near future.

Today, OPEC and other oil-producing countries have not as much influence on oil prices as they used to, because oil prices are formed in the financial markets. From our study, we can infer that with the help of exchange instruments, oil that has not yet been produced can pass from hand to hand dozens of times by various sellers and buyers. This is one of the most profound contradictions of the modern global oil market, which has a negative impact on the development of the global economy.

The research provides preliminary evidence that to stabilize oil prices, the volume of contracts for its supply should correspond to the physical volume of its production. If the turnover of derivatives continues to grow randomly, the market conditions and oil prices will remain extremely unstable, subject to excessive fluctuations. And still, there is a need to tighten regulation on oil derivatives market.

BP Statistical Review of World Energy for 2018. Retrieved from: https://www.bp.com/content/dam/bp/en/corporate/pdf/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf

Davis M. (2017). A dynamic oil landscape. Retrieved from: https://www.theice.com/article/dynamic-oil-landscape

European Commission (2018). Markets in Financial Instruments (MiFID II) – Directive 2014/65/EU. Retrieved from: https://ec.europa.eu/info/law/markets-financial-instruments-mifid-ii-directive-2014-65-eu_en

Fattouh B. (2015). Global Oil Markets – Current Developments and Future Prospects. Retrieved from: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2015/07/Global-Oil-Markets-Current-Developments-and-Future-Prospects.pdf

Global Energy Transformation: Economic and Political Factors/Zhukov S.V., ed. – Moscow, IMEMO, 2018. – 166 p.

International Energy Agency Oil Market Report for 2018. Retrieved from: https://www.iea.org/oilmarketreport/omrpublic/

Konoplyanik A.A. (2016). Oil: Stabilization or Lull Before the Storm? - European Energy Review. Retrieved from: http://www.konoplyanik.ru/ru/publications/Oil_%20Stabilization%20or%20Lull%20Before%20the%20Storm_%20-%20European%20Energy%20Review.pdf

Ling V. V. (2018). Financial analysis of oil fields development efficiency. Volume 39, 2018, number 12, p. 30. Retrieved from: http://www.revistaespacios.com/a18v39n12/18391230.html

Malova T.A., Sisoeva V.I. (2016). The world oil market: the search for balance in the new oil reality. Vestnik MGIMO-University. Volume 6, 2016, number 51, pp. 115-124. Retrieved from: http://www.vestnik.mgimo.ru/en/razdely/research-articles/world-oil-market-search-balance-new-oil-reality

NASDAQ Stock Market (2018). Retrieved from: https://www.nasdaq.com/markets/crude-oil-wti.aspx?timeframe=8y

Newell R.G., Prest B.C. (2017). The unconventional oil supply boom: aggregate price response from microdata. National Bureau of Economic Research. Retrieved from: http://www.nber.org/papers/w23973.pdf

OPEC Annual Statistical Bulletin (2018). Retrieved from: https://www.opec.org/opec_web/static_files_project/media/downloads/publications/ASB2017_13062017.pdf

Putnam B. (2018). Oil: How the market dynamics have changed. Retrieved from: https://www.cmegroup.com/education/featured-reports/oil-how-the-market-dynamics-have-changed.html

Spartak A.N. (2011). The nature of world key commodity markets. Russian Foreign Economic Journal. 2011, number 8, pp. 3-13. Retrieved from: http://www.rfej.ru/rvv/id/C0035873A/$file/3-15.pdf

World energy markets evolution and its consequences for Russia/Chief eds. A.A. Makarov, L.M. Grigoryev, T.A. Mitrova. – M. ERI RAS-ACRF, 2015. – 400 p.

1. Moscow State Institute of International Relations (MGIMO), Moscow, Russia, E-mail: angelinakolomeytseva@yandex.ru