Vol. 41 (Issue 01) Year 2020. Page 24

KHEYFETS, Boris A. 1 & CHERNOVA, Veronika Yu. 2

Received: 03/09/2019 • Approved: 11/01/2020 • Published 15/01/2020

ABSTRACT: The paper explores the monetary cooperation within the Eurasian Economic Union (EAEU). It discusses theoretical approaches to the development of monetary policy in macro-regional integration alliances. The research analyses the current economic conditions for developing a monetary union within the EAEU. The results prove the significance of monetary cooperation for participating countries. However, the examination of the present macro-economic situation and factors in the institutional environment demonstrates that today there are no prerequisites for forming a full-fledged monetary union within the EAEU. The article proposes an approach to choosing a monetary policy that allows the existing economic union to maintain or potentially amplify its positive synergy effect. |

RESUMEN: El artículo explora la cooperación monetaria de los países de la Unión Económica Euroasiática (UEEA). Se discuten los enfoques teóricos para el desarrollo de la política monetaria en las asociaciones de integración macrorregionales. Se realiza el análisis de las condiciones económicas actuales para el desarrollo de la unión monetaria en el marco de la UEEA. Como resultado del estudio, se demuestra la importancia de la cooperación monetaria entre los países participantes. Sin embargo, el examen de la situación macroeconómica actual y los factores en el entorno institucional demuestra que hoy no existen los requisitos previos para formar una unión monetaria completa dentro de la EAEU. |

The Eurasian Economic Union (EAEU) is an international alliance of regional economic integration established in 2015 which replaced the Customs Union. The EAEU embraces five states: the Republic of Armenia, the Republic of Belarus, the Russian Federation, the Republic of Kazakhstan and the Kyrgyz Republic. The union initially pursued the following purposes: to implement comprehensive modernization of the national economies; to enhance their competitiveness; to create a single commodity and financial market, including currency integration as an integral part of the rapprochement. There were attempts made to promote integration initiatives in the countries through creating a customs union and encouraging labor and capital mobility, but so far no efforts have been taken to coordinate monetary policy. However, the issues of monetary cooperation are still high on the agenda, since there is no conventional decision on the time frame and stages of its implementation. The main reason behind that is a lack of clear system-wide approaches to managing currency relationships within the Eurasian Economic Union.

Over the past years, the discussions on problems and prospects of creating a monetary union within the EAEU nations have become increasingly relevant. This is due to the fact that under the growing trend towards regionalization of the global economy the EAEU countries need to develop coherent positions on implementing a competitive monetary policy. An approach with a theoretical and empirical grounding will make it possible to maintain or potentially amplify a positive synergy effect arising from the creation of the very economic union. Nevertheless, in the context of today’s economic challenges faced by some nations, the future of the monetary union is ambiguous.

The purpose of this study is to examine the prospects for cooperation between the EAEU member states in the monetary sphere. We aim to complete the following objectives: to investigate theoretical approaches to forming a monetary policy in macro-regional integration alliances as well as to analyze the current economic conditions in the EAEU and prospects for monetary integration taking into account the urgent development issues.

There is a broad array of research on the prospects for monetary integration within the EAEU and the the Commonwealth of Independent States (CIS) economies. Having analyzed a number of relevant scientific works, we conclude that some economists anticipate a further deepening of integration processes in Eurasia, which can be interpreted as the emergence of a monetary union. Among other things, these processes embrace a planned harmonization of fiscal policy, a transition to settlements in national currencies, the creation of a supranational currency, etc.

Kulakova (2016) analyzes the positive and negative aspects of monetary integration in the European Union and looks at a possibility to borrow the European integration experience for establishing a common monetary system within the EAEU. She explores the reasons why the Russian ruble cannot be used as a single currency and reveals the fundamental conditions for a monetary union to exist. We agree upon the major objectives of setting up a single monetary system, which are: to devise an integrated structure of the payment space; to narrow the gap between the development levels of the participating countries; to reduce the inflation rate and to overcome the exchange rate volatility.

Other researchers predict the financial systems of the EAEU states to function separately, since a substantial gap in the socio-economic development of the nations makes further integration impossible. According to Kabzimanyan (2017), in the territory of the EAEU, there are no prerequisites needed for creating a monetary union. It is advisable, therefore, to undertake urgent actions to harmonize the monetary policies and other economic spheres of the EAEU countries.

Danilov et al. (2018) claim that, despite possible challenges and restrictions, the functioning of a monetary union gives numerous advantages: existing separately, countries are vulnerable to external shocks, whereas an economic union would experience lesser economic fluctuations. However, the EAEU still lacks a coordinated monetary policy that could be the next step towards closer integration. One of the most important aspects of monetary integration is that the obtained monetary policy can better manage aggregate demand and stimulate investment throughout the region, whereas a coordinated one stimulates trade and investment in the region. The national financial markets of the EAEU member countries are characterized by low capacity and liquidity, and in some cases they do not have segments necessary to effectively support the creation of a currency union. Of all the participating states, forward exchange markets in Russia, Kazakhstan and Armenia are able to hedge currency risks in trade operations with the EAEU. However, the derivatives markets of Russia and Armenia do not possess the tools for hedging risks in foreign-currency transactions using the EAEU currencies without applying a reserve currency as an intermediary.

Speaking of the possibility of forming a monetary union, it is reasonable to address the experience of the European Union (Dubauskas, 2012; Dudzeviciute & Prakapiene, 2018). For example, the primary benefit of a monetary union is foreign trade, although empirical estimates of this effect are ambiguous. According to Vinokurov et al. (2017), trade expansion may produce two additional dynamic effects on economy. Firstly, foreign trade expansion results in a growth in GDP. Secondly, it is able to influence business cycle: as stated by Rose (2008), trade expansion implies business cycles of the member countries to become more synchronized, which will facilitate implementing a unified monetary policy. This effect is proved to be statistically significant for the EU states.

At the same time, Krugman (1993) argues that monetary integration causes specialization to intensify and, consequently, increases the probability of asymmetric shocks. This hypothesis is also empirically justified. Caporale, De Santis and Girardi (2013) find that the Eurozone nations are approaching increased specialization, especially if comparing the main and peripheral countries. Earlier estimates show the impact to be positive and highly significant. Rose applied gravity models of foreign trade to demonstrate that the European Union increased trade within the euro area by 8–23%. Nevertheless, a recent study by Glick and Rose (2015) displays that there is an insignificant, if any, effect of euro on stimulating export. The role of export in economic growth is discussed by Travkina (2015).

We support the view of Vinokurov et al. (2017) that, once a substantial progress in creating a common customs territory and regulations is achieved, integration alliances have to deal with potential disruptions due to poor coordination of their monetary policy. These disruptions may occur in the form of currency shocks and subsequent trade conflicts. This is evidenced, for example, by the volatility of national currencies in 2014–2015, which led to significant shifts in competitiveness. This resulted in a currency crisis in some Eurasian states. All this raises a question of how to gradually achieve a more coordinated monetary policy, what options for monetary policy are available, and how they will affect macroeconomic stability.

To establish a monetary union, there should be a number of factors existing simultaneously. Robert Mundell, who won the Nobel Prize in Economic Science for the theory of optimum currency areas, was first to study these factors. His followers supplemented the theory with other factors, such as inflation convergence (Fleming, 1962), unemployment (Ogrodnik, 1990) and openness of an economy (McKinnon, 1963).

Thus, our literature review shows that countries are able to create a monetary union, if they enjoy a high mutual mobility of production factors; business cycles in all countries are unidirectional (there is a convergence of these cycles); they experience a similar reaction to external shocks of demand and supply; the countries are close to common elasticity of price and wage, and market mechanisms lead to optimal distribution of production factors. It is also noteworthy that the central result of monetary integration is accelerated convergence and a reduced impact of crisis shocks.

The theoretical and methodological basis of the research includes the scientific principles of currency integration; provisions on the theory, methods and organizations of monetary and tax policy.

To achieve the purpose and objectives of the study, we have applied general and specific scientific methods: dialectical cognition method – to evaluate the probability of creating a monetary union within the EAEU; monographic and system-analytical methods (Batkovskiy et al., 2015) are used when substantiating proposals regarding the measures designed to deepen financial integration that should be applicable to the current conditions and latest trends; methods of description and formalization are utilized to assess the possibility of harmonizing the norms of national legislation in the EAEU states and identifying effective tools for regulating these processes; abstract logical method is applied to justify the expediency of introducing a single currency within the EAEU.

The present study sticks to the theory of optimum currency area. The analysis of economic conditions for monetary integration within the EAEU is based on statistical data released by the International Monetary Fund (IMF), the World Bank, the Eurasian Development Bank and the European Economic Commission, as well as national central banks of the EAEU participating countries.

The development of currency cooperation depends on the structure of economy, macroeconomic conditions and the state of institutions functioning in the financial market. Despite the common historical development of the EAEU countries, as well as strong economic and political ties, many characteristics of the states do not coincide, which may cause difficulties in the process of financial convergence. The analysis of the institutional environment and macroeconomic conditions in the EAEU nations, performed to determine the prospects for their monetary integration, indicates the following:

1. The EAEU states are characterized by a significant share of state ownership in the financial sector and the dominance of several major banks (Zhukova, 2015; Chunikhin, Kuzmin & Pushkareva, 2019). Low competition in the banking sector and the leading role of state-owned banks impair the functioning of the banking system and violates the mechanisms of transmission channels, since they do not operate in market conditions.

2. There are signs of a crisis in the interbank lending market. The structure of the banking system in the EAEU is characterized as follows: in Kyrgyzstan, Kazakhstan and Belarus, the share of bank assets in Gross Domestic Product (GDP) is not more than 70%, whereas in developed countries this indicator is significantly higher than 100% (Goryunov, 2015).

3. Dollarization of the Eurasian economies is underway. Due to the instability of the Russian ruble, the dollar is still the dominant currency in trade operations between the EAEU states. For example, in 50% cases, the Republic of Belarus used the dollar in trade with the EAEU states (excluding Russia), for the Republic of Kazakhstan and the Kyrgyz Republic this indicator is even higher – approximately 80% (Danilov et al., 2018, p. 19; Manenok, 2014).

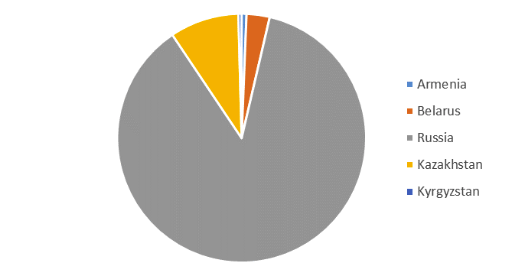

4. Russia remains the leading economy among the EAEU; in 2018, its GDP reached 1.5 billion US dollars. The size of GDP of the Republic of Kazakhstan – the second largest economy of the Union – is nearly 10 times smaller (Fig. 1).

Fig. 1

GDP of the EAEU countries

in 2018, billion dollars

The abovementioned factor demonstrates the leading role of Russia’s monetary policy. The Russian ruble plays a crucial part in the trade between the EAEU countries: during the period of 2013–2018, the ruble was used in 62–75% of business deals (Shvandar, Anisimova & Yakovleva, 2018). At that, in 2018, the share of ruble settlements slightly decreased, while payments in dollars and euros showed a modest rise; national currencies were practically not used in settlements between the countries (Table 1).

Table 1

Currency structure of export–import payments

between the EAEU states in 2013–2018, in %

Currency of payment |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Ruble |

61.8 |

67.4 |

68.1 |

74.1 |

74.9 |

72.7 |

US dollar |

30.3 |

26.3 |

25.0 |

19.3 |

18.3 |

19.2 |

Euro |

6.8 |

5.2 |

5.1 |

5.2 |

5.2 |

6.8 |

Other |

1.1 |

1.1 |

1.8 |

1.4 |

1.6 |

1.3 |

5. The export structure of the EAEU countries is characterized by weak diversification of the majority of the economies, with the exception of Belarus. Commodities export is of special importance for the region, which makes all the nations susceptible to market shocks. The exposure to these shocks varies, because the share of commodities exports is different in each country, but it is obvious that Russia, Kazakhstan (oil price) and Kyrgyzstan (gold price) are highly sensitive to market shifts. The CIS nations, which are potential candidates for the EAEU membership, exhibit a similar business environment in external markets (Humbatova et al., 2019).

6. Tax policies of the EAEU members are inconsistent (Table 2). This is due to the volatile geopolitical situation and the level of global oil prices that limit the opportunities for tax cuts in Russia.

Table 2

Tax rates in the EAEU states in 2019

Country |

Corporate tax |

Value Added Tax (VAT) |

Income tax |

Insurance payments |

Russia |

20 |

20 |

13 |

22 |

Belarus |

10–25 |

10–20 |

13 |

29 |

Kazakhstan |

10–20 |

12 |

10 |

9.5 |

Armenia |

20 |

20 |

9–15 |

0 |

Kyrgyzstan |

20 |

12 |

10–20 |

>17 |

Source: The data was obtained from the

databases of the EAEU tax authorities

The tax competition of particular countries of the EAEU is escalating. This results in a mismatch between the economic and financial policies, which affects the transformation of trade and investment flows within the EAEU.

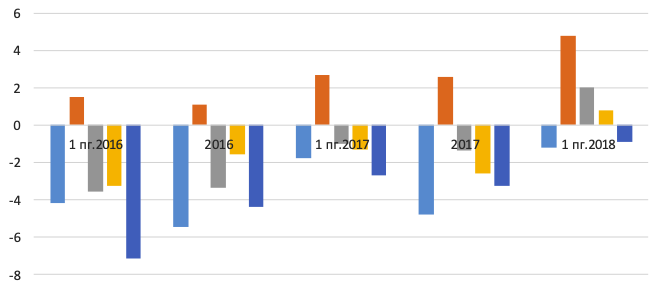

7. The EAEU members still find themselves amid the economic and financial crisis. As a result, over three years, the state budget deficit in all the EAEU countries, excluding Belarus, has increased (Fig. 2). At that, in Russia and Kazakhstan, it is at the upper limit of the budget deficit criterion established for the EAEU (3%), whereas in Armenia and Kyrgyzstan it exceeds the upper limit.

Fig. 2

Ratio of the budget deficit (surplus)

of the EAEU states to GDP, in %

Source: Statistical data of public finances

of the Eurasian Economic Union (EAEU, 2018).

8. Instability of the political factor which is of significant importance when forming monetary policy.

All the aforementioned factors indicate that the creation of a single currency space within the EAEU is hardly possible in the nearest future. However, it is necessary to take further efforts to develop and encourage integration processes, as a deepening monetary integration stimulates economic development and makes conditions for cross-country cooperation more productive.

Overcoming the obstacles is possible through the EAEU integration, improving the investment climate, diversifying the economy, creating multinational corporations to operate in the Eurasian space, developing a single financial market and stimulating small and medium-sized enterprises (Litau, 2018; Toomsalu et al., 2019). It is required, therefore, to eliminate numerous constraints in mutual trade and build strong business ties between the EAEU countries.

A currency union in any form suggests abandoning independent monetary policy. This results in that the issue of establishing a currency union within the EAEU is widely debated at all levels.

Within the framework of the classical theory of economic integration, Balassa (1982) argues that a currency and economic union represent the fourth stage of integration preceded by the free-trade zone, the customs union and the joint market for the free movement of products, services and capital. In our case, the EAEU was jumping ahead in creating institutions of the fifth stage, namely political integration, while there were serious unresolved problems in establishing a single market and even in implementing a common customs policy. In this respect, the experience of the European Union is rather indicative, since only 19 out of 28 its members are members of the euro area (Akelyev & Ermushko, 2011). New economic mega partnerships no longer raise the issue of currency integration. The primary purpose of new alliances is to ensure the free movement of goods, services and capital within a common barrier-free internal market.

The creation of a single currency space is only reasonable if the benefits of its creation exceed the associated costs, which is not true for the current situation. The theoretical benefits and drawbacks of a currency union within the EAEU are presented in Table 3.

Table 3

Benefits and drawbacks of a

currency union within the EAEU

Currency (monetary) union and currency area |

|

Benefits |

Drawbacks |

A rise in GDP as a dynamic result of other factors; accelerated development of intraregional trade and investment; convergence of the countries regarding the major monetary indicators; decreasing transaction costs associated with currency exchange; anticipating and dealing with asymmetric external shocks; reducing a negative effect of currency volatility; reducing the level of dollarization (settlements, credits and investments are conducted in the national currency); lowering interest rates; improved transparency in pricing and enhanced competition |

Lack of flexibility when performing monetary policy (no leverages to react to asymmetric external shocks); resolving the problems of peripheral countries at the expense of the donor states; a growing public debt of the crisis countries; additional costs incurred in the introduction of the new currency |

The creation of a currency union should produce significant benefits for the participating economies; on the other hand, it may cause much more serious drawbacks. The experience of the European Union has shown that the forced introduction of a single currency might lead to acute problems that outweighed all its advantages. That is why the central banks of the EAEU member states are so cautious about initiating the currency union (Ivanova, 2016). Financial turmoil and economic shocks are projected onto a company’s sustainability translated into its survival capability. In Russia, the level of long-term survival rate is established to be higher than in the EU; at the same time, the short-term survival rate of Russian companies is lower (Kuzmin, Vinogradova & Guseva, 2019).

The economies of the EAEU countries differ significantly in term of the level of economic development and the scale of the economy as a whole. Kyrgyzstan and Armenia are remarkably different from the other member states in such aspects as low GDP per capita, high external debt and the dependence on transfers due to labor migration. From the perspective of the structure of the economy in Belarus, the ratio between export and import is quite balanced, whereas the share of imports in GDP of Kyrgyzstan and Armenia is extremely large. Almost all countries of the EAEU are engaged in the raw materials sector. At that, mostly Belarus exports secondary products to external markets (Ivanova, 2016).

Despite the economic problems faced by the countries at the national level, the issue of further integration, including currency union, are still vigorously debated. In the long-term, a single currency space is expected to bring about an additional positive effect equalizing the levels of economic development of the EAEU nations. As for the medium and short-term scenario, monetary policies of the EAEU countries should be coordinated.

The coordination of monetary policy within the EAEU does not obviously entail significant costs. Such cooperation should mostly exert a positive effect on the development of intraregional trade and mutual investments (through stabilization of agents’ expectations about the national currencies volatility towards each other), as well as the economic development of the countries at large. We can assume that this stage of currency cooperation will be successfully completed.

The deepening of integration processes in the monetary sphere can deliver considerable long-term benefits for three “small” economies of the EAEU, namely Armenia, Belarus and Kyrgyzstan. The benefits will be derived from the “import” of economic stability due to falling long-term interest rates (Vinokurov, 2017). The EAEU nations should make a concerted push to stabilize inflation, reduce the economies’ dollarization, and ensure the effective functioning of the monetary policy transmission mechanisms.

All the EAEU countries are characterized by a low degree of the economy’s monetization. Since the Russian Federation plays a primary role in the CIS economy, the currencies of the participating countries are much dependent on the trends detected in the Russian economy. Moreover, despite the common structure of the member states’ transition economy and the similarity of their problems, there exists a differentiation in the present tools applied in the monetary and currency markets, as well as in the institutional environment as a whole.

The analysis of the current macroeconomic conditions has demonstrated that at the moment there are no prerequisites for forming a full-fledged currency union within the EAEU. However, currency integration is a natural stage in the development of international economic partnership, therefore it is possible to use its simpler forms, coordination of currency policies, and the creation of unified and settlement systems as the first step towards the formation of a currency union. In the long term, a single currency space is expected to bring about an extra positive effect that should equalize the levels of economic development of the EAEU member countries.

Akelyev, E. S., & Ermushko, Zh. A. (2011). The Formation of Monetary Unions: Advantages and Disadvantages. Bulletin of Tomsk State Pedagogical University, 12, 9–13.

Balassa, B. (1982). The Theory of Economic Integration. Westport: Greenwood Press Reprint.

Batkovskiy, A. M., Konovalova, A. V, Semenova, E. G., Trofimets, V. J., & Fomina, A. V. (2015). Study of Economic Systems Using the Simulation-Based Statistical Modeling Method. Mediterranean Journal of Social Sciences, 6(4), 369–380. https://doi.org/10.5901/mjss.2015.v6n4s4p369

Caporale, G., De Santis, R., & Girardi, A. (2013). Trade Intensity and Output Synchronisation: On the endogeneity properties of EMU. DIW Berlin Discussion Paper No. 1277. https://doi.org/10.2139/ssrn.2239672

Chunikhin, S. A., Kuzmin, E. A., & Pushkareva, L. V. (2019). Studying the Banking Industry’s Stability through Market Concentration Indices. Entrepreneurship and Sustainability Issues, 6(4), 1663–1679. https://doi.org/10.9770/jesi.2019.6.4(8)

Danilov, Yu. A., Buklemishev, O. V., Sednev, V. P., & Korshunov, D. A. (2018). National Currencies in Mutual Settlements within the EAEU: Obstacles and Prospects. St. Petersburg: The EDB Center for Integration Research.

Dubauskas, G. (2012). Sustainable Growth of the Financial Sector: The Case of Credit Unions. Journal of Security and Sustainability Issues, 1(3), 159–166. https://doi.org/10.9770/jssi/2012.1.3(1)

Dudzeviciute, G., & Prakapiene, D. (2018). Investigation of the Economic Growth, Poverty and Inequality Inter-Linkages in the European Union Countries. Journal of Security and Sustainability Issues, 7(4), 839–854. https://doi.org/10.9770/jssi.2018.7.4(19)

EAEU (2018). Statistical Bulletin. Retrieved from: http://www.eurasiancommission.org/ru/act/integr_i_makroec/dep_stat/fin_stat/statistical_publications/Documents/finstat_1/finstat_1_2Q2018.pdf.

Fleming, J. М. (1962). Domestic Financial Policies under Fixed & under Floating Exchange Rates. IMF Staff Papers No. 9. Pp. 369–379. https://doi.org/10.2307/3866091

Glick, R., & Rose, A. (2015). Currency Unions and Trade: A Post-EMU Mea Culpa. CEPR Discussion Paper No. 10615. https://doi.org/10.3386/w21535

Goryunov, E. (2015). Monetary Policy of the Bank of Russia: The Strategy and Tactics. Voprosi Ekonomiki=The Issues of Economy, 4, 53–85. https://doi.org/10.32609/0042-8736-2015-4-53-85

Humbatova, S., Garayev, A. I., Tanriverdiev, S. M., & Hajiyev, N. Q. (2019). Analysis of the Oil, Price and Currency Factor of Economic Growth in Azerbaijan. Entrepreneurship and Sustainability Issues, 6(3), 1335–1353. https://doi.org/10.9770/jesi.2019.6.3(20)

Ivanova, K. S. (2016). The Economy of the EAEU Countries and the Possibilities of a Monetary Union. The Analytical Banking Magazine, 11-12, 19–22.

Kabzimanyan, M. G. (2017). Problems and Prospects of Monetary Regulation within the EAEU. Izvestiâ Sankt-Peterburgskogo gosudarstvennogo èkonomičeskogo universiteta=Bulletin of Saint Petersburg State University of Economics, 5, 125–129.

Krugman, P. (1993). What Do We Need to Know about the International Monetary System? Essays in International Finance No. 190. Princeton University Press.

Kulakova, E. V. (2016). Prospects for the Introduction of a Single Currency of the Eurasian Economic Union. Vestnik of Astrakhan State Technical University. Series: Economics, 2, 21–27.

Kuzmin, E. A., Vinogradova, M. V, & Guseva, V. E. (2019). Projection of Enterprise Survival Rate in Dynamics of Regional Economic Sustainability: Case Study of Russia and the EU. Entrepreneurship and Sustainability Issues, 6(4), 1602–1617. https://doi.org/10.9770/jesi.2019.6.4(4)

Litau, E. (2018). Entrepreneurship and Economic Growth: A Look from the Perspective of Cognitive Economics. In: The ACM 9th International Conference Proceeding Series. Pp. 143–147. https://doi.org/10.1145/3271972.3271978

Manenok, T. (2014). The Belarusian Nuclear Power Plant: Whose Property Will It Be? Nashe Mneniye=Our Opinion. March 17. Retrieved from: https://nmnby.eu/news/analytics/5441.html

McKinnon, R. (1963). Optimal Currency Areas. American Economic Review, 53(4), 717–725.

Ogrodnick, R. (1990). Optimum Currency Area & the International Monetary System. Journal of International Affairs, 44(1), 241–261.

Rose, A. (2008). Is EMU Becoming an Optimum Currency Area? The Evidence on Trade and Business Cycle Synchronization. Unpublished manuscript. University of California, Berkeley: Haas School of Business.

Shvandar, K. V., Anisimova, A. A., & Yakovleva, I. I. (2018). Prospects of Monetary Integration of the EEU Countries. Financial Analytics: Science and Experience, 11(2), 205–222. https://doi.org/10.24891/fa.11.2.205

Toomsalu, L., Tolmacheva, S., Vlasov, A., & Chernova, V. (2019). Determinants of Innovations in Small and Medium Enterprises: A European and International Experience. Terra Economicus, 17(2), 112–123. https://doi.org/10.23683/2073-6606-2019-17-2-112-123

Travkina, I. (2015). Export and GDP Growth in Lithuania: Short-run or Middle-run Causality? Entrepreneurship and Sustainability Issues, 3(1), 74–84. https://doi.org/10.9770/jesi.2015.2.4(7)

Vinokurov, E. Yu. (2017). The Eurasian Economic Union. St. Petersburg: The EDB Center for Integration Research.

Vinokurov, E., Demidenko, M., Korshunov, D., & Kovacs, M. (2017). Customs Unions, Currency Crises, and Monetary Policy Coordination: The Case of the Eurasian Economic Union. Russian Journal of Economics, 3(3), 280–295. https://doi.org/10.1016/j.ruje.2017.09.004

Zhukova, T. V. (2015). Ownership Structure in the Financial Market on the Neo-Continental Model Countries (The EAEU Member States Case). FinanceandCredit, 35, 2–11.

1. Institute of Economics of the Russian Academy of Science, Russian Federation; Financial University under the Government of the Russian Federation, Russian Federation. Email: bah4l2@rambler.ru

2. Department of Marketing, Peoples' Friendship University of Russia (RUDN University), Russian Federation; Department of Advertising and Public Relations, State University of Management, Russian Federation. Email: veronika.urievna@mail.ru

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License