Vol. 41 (Issue 01) Year 2020. Page 20

LOZHKINA, Svetlana L. 1; KOVALEROVA, Lyudmila A. 2; SAVINOVA, Evgenya A. 3; BARANOVA, Irina A. 4; TISHENKOVA, Galina Z. 5 & PETUSHKOVA, Galina A. 6

Received: 09/10/2019 • Approved: 11/01/20 • Published 15/01/20

3. The Method of Discounted Cash Flow

ABSTRACT: Purpose: to study evaluation methods for venture projects and determine the prospects for their use in evaluating venture financing. The authors analyze the features and disadvantages of evaluation methods, determine the practical and functional features of the evaluation methods used, and highlight their bottlenecks. The study proposes promising criteria for selecting venture financing facilities: amounts of financing, phasing (periodicity) of cash flows, the degree of financing discreteness, and risk identification including a set of technologies for their implementation. |

RESUMEN: El objetivo: estudiar los métodos de evaluación de los proyectos de riesgo y determinar las perspectivas para su uso en la estimación de financiamiento de riesgo. Los autores analizan las particularidades y desventajas de los métodos de evaluación, fijan las características prácticas y funcionales de los métodos ya utilizados y señalan sus puntos críticos. El estudio propone los criterios prometedores para la selección de proyectos para financiamiento de riesgo como el volumen de las inversiones, la periodicidad del flujo de fondos, el grado de discrecionalidad del financiamiento, y la identificación de riesgos, incluido un conjunto de tecnologías utilizadas para su implementación. |

In modern financial theory, the traditional methods and approaches used in evaluation of the effectiveness of innovative projects in most cases demonstrate their limitation, since such methods are mainly intended for companies operating in a stable business sector (Muzyko, 2015). Thus, the basic theory of evaluation of investment projects by private participants is usually presented in financial management courses (Brigham, 1997), as well as in specialized basic courses (Birman & Schmidt, 1997, Mertens, 1997).

As is commonly known, innovative projects are characterized by a lack of profitability at the initial stage of their implementation and a high risk, which is associated with a high estimation uncertainty in relation to the predicted cash flow generated by them, so standard methods do not allow a comprehensive study of the feasibility of investments and quantitatively determine the reliability of the dynamics of projected indicators, especially in high-tech industries.

The difficulties of evaluating the economic efficiency of innovative projects are related to their specificity. Firstly, such projects are characterized by an increased degree of uncertainty of the future. The result of innovation investment is often impossible to predict.

Secondly, there is no historical data on comparable, similar projects - there is no necessary statistics to make a forecast due to the innovative nature of the analyzed investment project. An example is the development and launch by Amazon of a project to use air drones for the quick delivery of goods (Amazon Prime Air service): in a situation where such projects did not exist before, building a reliable number of cash flows becomes a very difficult task. Thirdly, large initial investments are required with a long payback period. These projects often include several stages that are not typical of ordinary investment projects: research and development, experimental testing, studying the obtained characteristics, marketing research of the received product, patenting, etc. These stages require additional investments. A good example is the pharmaceutical industry. The introduction of new drugs to the market is accompanied by a huge amount of work: laboratory tests of new chemical compounds, preclinical and clinical trials, registration of a new product, and construction of a separate workshop or factory (Yarygin, 2016).

Fourth, evaluation of the strategic effect of a project is extremely complex. The implementation of initial investments, for example, in research and development (R&D) is a necessary condition for the further implementation of the project, or these initial investments are a link in a chain of interconnected projects that open up opportunities for future growth (new generation of goods or technologies, exit to new markets, etc.).

The problem of evaluation of innovative projects in the current conditions of financial turbulence remains relevant for many innovative companies. Companies face unforeseen market changes and have risks in evaluating the cost-effectiveness of projects. The way out of this situation may be the use of new financial instruments and the development of promising criteria for the selection of venture financing facilities by detailing the stages and the methodology for evaluation of projects.

The study of the element content and factors influencing the formation and functioning of the innovation economy makes it possible to exploit and develop the existing innovative potential of the country, to create conditions for economic growth and to contribute to the growth of the general welfare of the state (Pоpova, Maslova, Korostelkina, Dedkova, Maslov & Lozhkina, 2019).

Innovation activity involves a whole range of technological, financial, scientific, organizational, commercial, and marketing activities, which together can lead to innovation (Maslennikov, 2009).

Innovation activity is very important for Russia. Innovative enterprises create new jobs; make products competitive for world markets, which, as a result, contributes to the growth of economic potential. Stimulating and encouraging innovation through the venture financing mechanism is becoming a priority in domestic policy.

By investing state funds in innovative projects and getting a positive result, we will not only attract additional funds to the budget and, finally, move on to the innovative development path, but also set a good example for private investors (Makarov, 2015). Amid a decline in investment activity of private investors in Russia, an increase in the share of government investments is expected in the future. Almost two-thirds of market participants now expect consolidation of the state role (Vishnyakov, 2016).

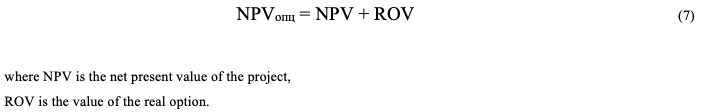

Today, the latest valuation methods are gaining popularity, which can be used both for evaluating the company from external counterparties and for making more informed management decisions aimed at managing the value of the enterprise in the foreseeable future. First of all, we should consider the ROV-method (Real Options Valuation) as such a tool. The key feature of this method is its adaptability to the rapidly changing economic conditions in which modern companies conduct their business activities (Gusev, 2009).

The term “real option” was coined by Myers St. (1977) in his book “Determinant of corporate borrowing”, but back in 1970 the term “real-estate options” was used by Marglin S. (1970) in his article “Investment and Interest: A Reformulation and Extension of Keynesian Theory”.

According to professors Copeland & Antikarov (2001), the real option method is a financial analysis technique that will completely supersede the net present value method over the next ten years, since the net present value method has drawbacks in evaluating investment projects: “Typical drawbacks can be seen in the analysis of the investment project for a period of 10 years. Suppose there are forecasts of expected revenue growth and expected costs. They make it possible to determine the volume of net cash flows minus current assets and capital costs. Then you discount the net cash flows at the weighted average cost of capital and deduct the amount of the initial investment costs. If the resulting value is greater than zero, then the project has a positive net present value, and you can accept it. However, the problem is that the managers making these decisions know that they have to rely on assumptions, which can be very tough and even wrong. For example, if you take part in a project that is being implemented with difficulty, then it may not exist for 10 years; it will either be phased down or significantly cut. If the project is successful, then it will either be extended or expanded. And finally, no one says that the initial investment needs to be done right away. They sometimes need to be done in a year, or even in two. In this case, the problem of deferred choice already arises” (Copeland & Antikarov, 2001).

The real options method is a tool to reduce the uncertainty of an innovative project by creating options (Muzyko, 2011). In the absence of uncertainty, options lose value. An important condition determining the value of an option is the rationality of management. Real options are of strategic value in cases where the project is carried out in an environment of uncertainty that directly affects the cost of the project; project management has managerial flexibility in decision making; management strategies are realistic and feasible; management is rational in implementing strategies (Brach Marion, 2003). Failure to fulfill at least one of these conditions leads to the depreciation of the real option.

Real options make it possible to assess the cost of management flexibility in the decision-making process in response to unforeseen market changes. This is the most modern approach to evaluating and managing strategic investments. It is especially useful in assessing the value of intangible assets that are in the process of development and whose commercial viability is impossible to prove. Provided that the real options method is used as a conceptual tool, this method allows management to identify and communicate to all interested parties the strategic value of the investment project (Roche, 2015).

An example of the use of the real options method in practice is a project of PwC Corporation with the name “High Technology Assessment Toolkit”. This project is an expression of the practical application of the theory of real options in order to assess high-tech corporations at an early stage of development. PwC divides the existing toolkit into three parts. The first part consists in analyzing the market, including the process of introducing the technology and its life cycle, processes for determining and segmenting the market, models of market dynamics of competitors, models of making purchasing decisions by counterparties, and scenario analysis processes. At the next stage, PwC experts offer customers a specialized financial product model containing a fully detailed cash flow model, which, thirdly, provides for a process for assessing flexibility (real options) based on the result of market analysis. “The technology life cycle consists of four stages: research, invention, innovation, diffusion and highest development. Each of them is extremely important. Each stage can be considered as a real option to purchase the next stage or as an offer of an option to refuse the next stage of development and fully or partially reimburse the costs by obtaining the residual value of the assets in the event that the product prospects are disappointing”. PwC's toolkit is designed to help high-tech companies determine their value (Roche, 2015).

However, although the concept of real options provides an opportunity to solve problems that conventional methods often cannot cope with, you should not consider it a universal remedy and the only possible replacement for all other approaches. Evidence shows that it is advisable to apply the concept of real options where other approaches have failed so far and to follow traditional methods if acceptable results can be obtained on their basis. Traditional methods can be supplemented by the real options method to increase the accuracy and quality of valuation of real assets (Baranov & Muzyko, 2016).

Let us present a description of the main methods for evaluating venture projects, which have a different emphasis, depending on the stage of the project. For the late stage - expansion and mezzanine phase - a significant factor is the current financial situation of the subject. For large domestic companies that are focused on the late stages, the size of the turnover and profitability of the candidate company for investment is a key parameter in making a decision. The evaluation process of early stage organizations that qualify for venture capital investments is based on the calculation of the forecast values of cash flows for the medium term and the expected “terminal” value at the exit.

Despite the differences, taking into account the dependence on the development stage, the Institute of Venture Investments has developed some approaches, the modification of which may be suitable for projects of any stage. These methods have features that are different from traditional approaches, since the recipient companies do not have a market share price or share, which implies the inapplicable nature of the standard theory (for example, CAPM).

At the present stage of market management, the following methods for evaluating venture projects are most widely used (table 1): the contractual method, the method of comparable estimates, the discounted cash flow method, and the venture method (Kashirin & Semenov, 2007).

In all the above methods, it is necessary to distinguish between the valuation of pre-money companies (before the investment is received) and post-money companies (after the investment is received).

A good sign in this analysis is the approximate coincidence of the assessments of organizations by several methods (a discrepancy of not more than 20% is allowed). These methods are based on the predicted values of the development parameters of organizations by investors or their founders. If the numbers of the company’s value, which were determined by various methods, approximately coincide, then this indicates the consistency of the forecast values with each other and that these values are based on a realistic idea of the state and development of the business entity.

As a rule, during a certain period of time when the fund “holds” a block of shares of the invested entity, its value usually increases several times and the assets of the venture fund must be reevaluated quite often. In most cases, venture investors replace the value of the invested company immediately after its price has increased, i.e. at the time of completion of research and development, manufacturing of a prototype, launch of production facilities, completion of previously planned stages.

In some cases, the investment committee of a large venture fund uses the procedure for formal assessment of the fund's portfolio in monitoring mode. Its results show whether the company’s asset can be considered as successful or should it be written off. If an organization cannot achieve the expected result for 1-2 years, or it is problematic to find buyers at the “exit” at a price that would suit the fund, then the share price is formally written off to the fourth part, half or even to zero. This does not mean that the company cannot be sold at all in a few years - the process of completely writing off the project itself is carried out only after the actual smashup of the organization (Ramzaev, 2005).

We present a more detailed description of the above methods.

This method can be considered the simplest of those used during the assessment of venture projects. It is based on the achievement of consensus between the founders of the company and investors in determining the cost of the project in the process of negotiating without using any standard calculation or mathematical methods. Domestic accounting practice shows that in order to assess the venture project at the seed and start-up stages, when it is premature to determine the turnover indicators and profit, the use of this method is most preferable. This can be explained by the fact that in the presence of high risks, most investors use subjective criteria for the quality of the project and are often guided by intuition.

During the assessment of the company using the contractual method, the presence of psychological factors, mutual sympathies of the parties, desire / unwillingness to make a deal is of key importance. In rare cases, the process of determining pre-money value is based on the valuation of assets owned by the company, such as intellectual property or production equipment.

This method is based on calculating the value of the subject, using the current or forecasted values of its operating indicators, as well as applying the coefficients of the ratio of value to the same indicators determined on the basis of external market data. The indicated coefficients are used in this method as factors or market multiples.

The procedure for evaluating a subject according to its current indicators is a pre-money assessment, while the procedure for evaluating predicted values taking into account incoming investments is a post-money assessment.

The simplest and most frequently used version of the method of comparable estimates is the use of standard factors for a venture project that are independent of its specifics. Venture investors apply the following formulas:

where Value is an indicator of the company’s value;

Turnover is turnover value;

Earning is profit margin (e.g. EBIT or EBITDA).

In this method, ½ and 5 multipliers are market multiples taken for all companies that expect venture capital investments.

If the values of “Turnover” and “Earnings” use the values of current indicators, then this type of rating is called a pre-money rating. If they are based on forecast values in a few years, taking into account the investments received, then this is a post-money estimate. In the early stages of development (seed, start-up), it is advisable to take the value of turnover and profit only based on forecast values in a few years. Thus, the investor can only calculate the value of the company and, on its basis, make a managerial decision on the appropriateness of evaluating the company in the future, using more labor-intensive and more accurate methods.

A more reasonable and objective version of the multiplier approach is the version based on the choice of a market multiplier by analyzing business entities that are similar to the company assessed by industry, taking into account the size, growth rate, and level of risk. The specified evaluation method contains the following sequential operations.

1. The choice of a group of companies whose indicators will be the basis for calculating the estimated ratios.

2. The choice of the basic operational parameter.

3. Calculation of the ratio of cost to the base parameter for each organization from the group (there is an assumption that the value of the base parameter and the cost of the organization are known for each member of the group).

4. Determination of the estimated factor by using the averaging of the obtained relations (in particular, using weighting factors).

The main difficulty of the method is to find the required data. This task is more easily solved by mature companies with steady profitability, since the shares of peer companies have volatility in the stock market and information on their operating parameters and capitalization is in publicly available sources. For non-traded organizations of the early stages, the process of finding analogues is quite complicated. Experienced venture capital investors and late stage funds often use data from their practice or from the practice of their colleagues.

For domestic organizations with an early stage and expansion stage, the Russian Venture Investment Association (RVIA) suggests using another version of the method of comparable estimates:

![]()

where Sales is the value of the current sales volume of the company;

К is the value of the market valuation coefficient based on data from the domestic private equity industry over several years (Kashirin, 2007).

The method of comparable estimates is widely used because it can be considered quite understandable and relatively simple. But it has a number of bottlenecks:

- the presence of incomplete and inaccessible information about comparable companies (especially non-public ones);

- the spread breadth of the coefficients for comparable companies;

- it is necessary to amend the cost, which is calculated using data on companies listed on the exchange, taking into account higher, "venture" risks.

This can lead to the fact that in the event of a dispute, each side can find information that will be disadvantageous for the other side and can confirm that the price of the company is too high or too low in relation to the given assessment. Therefore, the result of the considered method cannot be final and it is used rather as a weighty argument in favour of one or another assessment, which was obtained using another method (Kashirin, 2007).

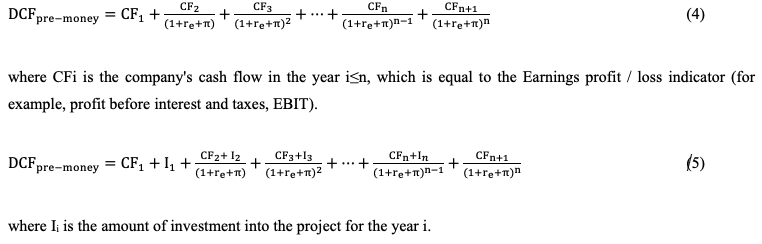

A distinctive feature of this method is the process of maximum use of forecast data on the company's cash flows. The discounted cash flow (DCF) is the sum of the cash flow values for the forecast period that are discounted using the compound interest method. As a coefficient, the weighted average amount of equity capital rE in the market (which corresponds to the expected return on investment) is used, taking into account the correction π for the amount of additional "venture" risks inherent in a particular project. Also, the DCF expression also includes the final (“terminal”) value of the company at the end of the forecast period, which is discounted to the initial period. The value of this discounted flow is a pre-money valuation of the company. In order to get a post-money assessment of the project, you need to sum the project cash flow with the given value of the investment flow:

The value of the premium for “venture” risk π is an additional tool that allows an investor to “include” a large profitability in a project, which can compensate for the increased riskiness of investments.

The main advantage of the DCF method is its theoretical validity and the existence of a clear assessment procedure. However, for non-public companies (including companies that receive venture capital investments), it may be complicated by the following circumstances (Kashirin, 2007):

- the value of real amounts of cash flows may differ significantly from the forecast;

- it is necessary to take into account possible inconsistencies in the cash flow indicators among themselves, since the search for the “terminal” value can be carried out taking into account market data, while the value of the operating cash flow can be predicted by the project managers, taking internal data as the basis (for example, order volumes);

- the subjective nature of this method is explained by the fact that the forecast of cash flows and the “terminal” value of the object of financing is based on external data in relation to the model.

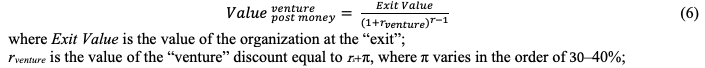

This method can be considered an adaptation of the DCF method to the case of a startup, since it takes into account the fact that for the most part the main objects of venture investment are early stage companies.

The process of determining the value of an object using the venture method includes the following steps:

- forecasting the "terminal" value of companies at the "exit";

- discounting the terminal value using a special “venture” rate (up to 75%), taking into account the high risk π.

T is the period before the “exit”.

The use of the venture method is especially suitable in cases where the buyers, the terms of the transaction, the legal justification (type) of the transaction in the event that the investor’s share in the project is realized, and the amount of cash compensation at the “exit” are known. This option is popular with venture investors, as it is considered the most optimal. But the venture method does not allow taking into account the value of interim dividends, if any.

The “bottlenecks” of this method are as follows (Kashirin, 2007):

- in the process of choosing a discount coefficient, the probability of random and subjective values is high;

- there is no accounting for the implementation of financing in several stages, and no early termination of investments is provided;

- no accounting of interim dividends.

Thus, the considered methods for evaluating venture financing projects allow us to assess the amount of future promising investments with a significant degree of detail, as well as identify weaknesses in the implementation of the project, which seems to be decisive in conditions of ensuring state participation.

At the stage of selecting venture financing projects, investors have to take into account a combination of factors that minimize the risks of various etiologies. In this regard, the study proposes a set of promising criteria for selecting venture financing facilities (Figure 1).

The system of criteria for selecting venture financing facilities is as follows:

1) the identification of the milestones of the project and the calculation of the cost of the venture investment project using traditional methods of analysis (cash flow discounting method);

2) given the variety of forms of organization of venture financing, it is necessary to determine the method, type and forms of project financing for each stage of development;

3) the construction of a multi-link binary decision tree in accordance with the stages of the innovation cycle;

4) the construction of the base asset value tree (base tree), determining the amount of cash flows for each node of the binomial tree;

5) the construction of the option value tree (option tree) by transforming the tree of cash flows into the tree of the value of the venture project, taking into account the options;

6) determination of the cost of the project, taking into account the real option (NPVопц) according to the formula:

Moreover, there is a cyclic repetition of the steps of the discrete financing algorithm for venture projects in accordance with each stage of the development of the project with continuous monitoring of its activities by the investor during the post-investment period.

The financial manager himself can create options - take steps to level losses on the project or realize new opportunities opened by the adoption of this investment project (Teplova, 2000).

7) making a rational informed decision on the feasibility of further financing a venture project for each control value (point), which makes it possible to maximize the value of the project. In each node of the binomial tree, the following scenario is possible:

- continuation of the venture project and obtaining the value of the current project taking into account the option;

- project financing in order to increase production capacity;

- termination of project financing and exit from the business with obtaining the residual value of the project and cash flow of the current period.

4. Determination of the likely risks associated with the inability to implement the project (administrative, tax, infrastructure, etc.).

A characteristic feature of the real options method is that it takes into account the fact that the risk of a venture company changes over time (Muzyko, 2013). This allows us to attribute this method to the criterion for selecting venture financing objects “funding volumes”, since this method makes it possible to determine the volume of venture investments not from the position of the project as a whole, but from the position of the venture fund.

The criterion for the selection of venture support objects “step-by-step discreteness of financing” is provided by the method of step-by-step discrete financing of venture projects. The main advantages of this method include the fact that it is focused on the result, which gives an opportunity to effectively make the planned investments, make rational decisions on further financing of the project, depending on how effective the achieved indicators are. The method can be well synchronized with the step-by-step financing method at the stages: “raw ideas”, at the conceptual stage of the project, at the stage of a feasibility study, at the development stage, at the stage of early commercialization and at the stage of commercial success. This approach is sufficiently flexible and dynamic, meets the condition of constantly changing external factors. Carrying out continuous monitoring of project indicators, the method allows suspension of the financing of unsuccessful projects in a timely manner and, thereby, helps to reduce the degree of risk.

This method makes it possible to take into account the cost of financial flows over time, as well as the strategic value of the project, given the ability of the investor to take an active part in the process of managing the company during the implementation of the project, and quickly respond to a number of negative changes and minimize losses.

The proposed list of criteria for selecting venture financing facilities is not closed. Selection criteria, including a set of technologies for their implementation, allow us to distinguish between the assessment of pre-money companies (before investments are received) and post-money companies (after investments are received), and also subject to the systematic use of the technologies described in this article, we can expect to achieve cumulative effect in the selection of venture financing facilities.

Baranov, А., & , Muzyko, E. (2016). Real options: panacea found? ECО. 11 (509). pp. 159 –167.

Birman, G. & Schmidt, S. (1997). Economic analysis of investment projects. M.: UNITY. 630p.

Brach Marion, A. (2003). Real Options in practice. John Wiley&Sonc, Inc.

Brighem, Е. (1997). Fundamentals of financial management. М. 420 p.

Copeland, T. & Antikarov, V. (2001). Real options. Texere. New York.

Gusev, А. (2009). Real options in evaluating business and investment. М.: RIOR. 118 p

Kashirin, А.I. & Semenov, A.S. (2007). Venture investment in Russia. М.: Vershina. 320 p.

Makarov, S.Е. (2015). Problems and prospects of venture capital development in the Russian economy. Actual issues of economic sciences. 9.

Marglin, S. (1970). Investment and Interest: A Reformulation and Extension of Keynesian Theory. Economic Journal. 320. Vol. 80. (December). pp. 910 – 931.

Maslennikov, N.А. (2009). Innovation Activities of Japanese Companies (1990–2000-е гг.). Abstract dis. ... Ph.D. in economics. М. 25 p.

Меrtens, А.V. (1997). Investments. Lecture course on modern financial theory. - Kiev: Kiev Investment Agency. 416 p.

Muzyko, Е.I. (2011). Analysis of the development of approaches to the interpretation of the economic essence of the category «real option». Economic analysis: theory and practice. 36 (243). pp. 12–17.

Muzyko, Е.I. (2013). On the issue of evaluating the effectiveness of venture projects using the real options method. Institutional transformation of the economy: conditions for innovative development. Novosibirsk: NGTU. pp. 300–305.

Muzyko, Е.I. (2015). Investments in innovative projects: new methods and approaches to evaluation. State and municipal management. SCAGS Scientific Notes. 1. pp. 79–89.

Myers, St. (1977). Determinant of corporate borrowing. Journal of Financial Economics. 5. pp. 147 - 175.

Pоpova, L.V., Maslova, I.A., Korostelkina, I.A., Dedkova, E.G., Maslov, B.G. & Lozhkina, S. L. (2019). Innovation economy: A study of the influence of international experience on the Russian economic system. Revista ESPACIOS. Vol. 40 (Number 10). Page 2. Taken from https://www.revistaespacios.com/a19v40n10/19401002.html .

Ramzaev, М. (2005). Cost flexibility. http://ecommerce.al.ru/analis/newecon/valuefl.htm.

Roche, J. (2015). Real options: another dead end. Taken from http://www.cfin.ru/appraisal/business/ methods/ro_criticism.shtml.

Teplova, T.V. (2000). Financial Management: Money and Investment Management. M. GU HSE. 504 p.

Vishnyakov, A.A. (2016). The modern venture investment market: problems and development prospects. Ensuring a high quality of life based on sustainable economic growth: collection of materials scientific-practical conference in the framework of the XII International Northern Socio-Ecological Congress. Vol. 1. Syktyvkar: SSU named after Pitirim Sorokin. 186 p.

Yarygin, А.I. (2016). Modeling of processes for evaluating the effectiveness of innovative projects of an enterprise using real options. Abstract dis. ... Ph.D. in economics. Spb. 21 p.

1. Professor of the Department of Economics and Finance, Moscow International University, Moscow, Russian Federation, Contact e-mail: nastyaalex2310@gmail.com, sll04@mail.ru

2. Associate Professor of the Department of Finance and Statistics, Bryansk State University Named after Academician I.G. Petrovsky, Bryansk, Russian Federation

3. Associate Professor of the Department of Finance and Statistics, Bryansk State University Named after Academician I.G. Petrovsky, Bryansk, Russian Federation

4. Associate Professor of the Department of Economics and Management, Bryansk State University Named after Academician I.G. Petrovsky, Bryansk, Russian Federation

5. Associate Professor of the Department of Economics and Management, Financial University under the Government, Russian Federation (Smolensk branch), Smolensk, Russian Federation

6. Associate Professor of the Department of Economics and Management, Financial University under the Government, Russian Federation (Smolensk branch), Smolensk, Russian Federation

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License