Vol. 39 (Nº27) Year 2018. Page 14

Vol. 39 (Nº27) Year 2018. Page 14

Oksana Vyacheslavovna BUTORINA 1; Natalya Pavlovna PAZDNIKOVA 2; Yuliya Vladimirovna KARPOVICH 3

Received: 20/05/2018 • Approved: 08/06/2018

ABSTRACT: The research methodology of the cyclic processes of social reproduction in the regional economy based on inter-cyclical recurrence is presented in the article, on the basis of which direct and inverse relationships between the main cycle are determined, defining a "face" of modern social development. Taking into account the given dependencies a system of indicators is proposed, characterizing features of cyclic processes in innovation, investment, technological, technical and industrial, social and structural components of the regional development in complex. |

RESUMEN: En este artículo se presenta la metodología de investigación de los procesos cíclicos de reproducción social en la economía regional basada en la recurrencia intercíclica, sobre la base de la cual se determinan las relaciones directas e inversas entre el ciclo principal, definiendo una "cara" de las redes sociales modernas desarrollo. Teniendo en cuenta las dependencias dadas, se propone un sistema de indicadores que caracteriza las características de los procesos cíclicos en innovación, inversión, tecnología, componentes técnicos e industriales, sociales y estructurales del desarrollo regional en complejos. |

Economic processes in social development at the modern stage have revived interest in the problems of determination of essence, of identifying the causes, studying negative and positive consequences of the cyclic dynamics, as well as focused attention on the development of specific management decisions having the anti-crisis nature. It has been largely mediated by the peculiarities of the current crisis, which is defined by many domestic and foreign researchers as "the deepest", "system", "...having no analogues in the history of mankind...." Such intrinsic characteristics are largely determined by its distinctive features:

1) synchronicity of manifestation of the phase of cyclical development in different areas shows a close relationship of causes involving not only economic, but also social, political, cultural components of social development;

2) the interdependence of the causes that form the basis of modern economic cycles;

3) superimposition of the crisis-depressive phases of cycles of different levels and order, substantially deepening and increasing their duration;

4) the global nature of the crisis, elements of which are broadcast in different countries, catalyzing the negative trends of national economy development in whole and its regions in particular.

The above highlighted provisions of relevance define the purpose of this article. It is to construct a general algorithm for the analysis of cyclic processes in the economy of the region on the basis of the authors’ recurrent approach to the study of cycles as a form of progressive development.

Particularly it should be noted that recursive approach is based on the recognition of interdependence between the cycles of different levels and orders of magnitude and phases within each of them. Undoubtedly, the interdependence and mutual influence of cycles and phases within them have been the object of study in economic science for over three centuries, although the term "recursiveness" has not been used (for the first time in relation to economic cycles it was used by E. Lobanova in 1992 in the article "Forecasting the cyclical nature of economic growth" (Lobanova 1991, p.20)).

Originally the works of representatives of classical bourgeois political economy (W. Petty, A. Smith, D. Ricardo, T. Malthus, etc.) were devoted to an organic unity of cyclic processes in the economy, most evident in the consistent alternation of negative (crisis) and positive (up) trends, caused by various reasons: the efficiency of factory labor and production (David Ricardo), the growth of capital accumulation (A. Smith), fluctuations in food prices and the price of labor and its results (W. Petty). Such a perspective of the research in modern conditions can be considered within the boundaries of the reproduction approach.

The greatest contribution to the study of cyclical from the standpoint of reproduction was made by K. Marx and F. Engels, explaining its objective nature as a consequence, continuity, repeatability and periodicity. They have proven the technological basis of cyclic processes in the economy (the machine mode of production, established in the first quarter of the XIX century, formed the basis of the periodicity of crisis conditions in the economy), associated with objective trends service lives of fixed capital and technological updates of the means of production. Research papers by N.D. Kondratiev, M. I. Tugan-Baranovsky to a greater extent reflect the relationship of the cyclicality of the technology and economic processes in the country and in the industry.

Such technological approach to an essential cycle characteristic is associated with the cyclical nature of major innovations, which, according to an Austrian scientist Schumpeter, "...contribute to the violation of the old combinations in the use of resources and become the backbone of economic growth based on new technology..." (Schumpeter 1982, p.43). An innovation component of technological and economic development in modern conditions is considered in the framework of the innovative approach to the study of the interdependence of economic cycles (Seliverstov 2008, p. 196).

Innovation and technological changes, undoubtedly, determine the structural changes in the economy, considered within the reproductive-structural approach implemented by the authors (S. Kuznets, J. Hicks, etc.), the existence of backward and forward dependencies between technological change and structural transformation in the economy, movement of resources, in sectoral employment, in the distribution of income was proved (Prikin 2000, p. 184).

The duration of the technological and the structural cycles is determined with the features of the formation and allocation of investment resources. The relationship between them was investigated in the framework of the investment approach. Thus, the extent of the supply of capital (F. von Hayek), the efficiency of investment, the relationship between primary investment and reinvestment (R. Frisch), the increase in the share of savings in household incomes (R. Solow), education personal savings and personal income and spending as a consequence of the difference between desired and actual consumption (F. Modigliani) can be the basis of the investment cycle (Nobel laureates of the twentieth century. economic encyclopedic dictionary, 2001, p.336).

A managerial approach may be considered as a pervasive one, where different schools (institutionalism, Keynesianism, neoliberalism, neoconservatism) proposed directions of effective anti-crisis (rarely counter-cyclical) policies throughout the twentieth century (Batalova 2009, p.99).

For organizing and identifying a causal dependency of cyclic processes in the economy we propose a summarizing table. It highlighted approaches, the authors who conducted the study of cyclicity within each of them, determined components of the overall macroeconomic ripple and identified the relationship between them (table 1).

The authors rather arbitrarily related to a particular approach, which is associated with the diversity of their research and the nature of their study cycle (XVII – XVIII centuries – simple (univariate) cycles, XIX century - the present stage – a complex (multi-factor, system) cycles).

Table 1

Systematization of approaches to the study of

interdependent cyclic processes in the economy

Approach |

Schools and main representatives |

Components of the cyclic development |

The nature of the interdependence |

Reproduction approach |

Classical bourgeois political economy (W. Petty, A. Smith, D. Ricardo, T. Malthus, etc.) |

Economic fluctuations (economic cycles) |

- |

The technological approach |

Marxist political economy (K. Marx and F. Engels, as well as N. D. Kondrat'ev, M. I. Tugan-Baranovsky) |

process cycle

|

the relationship of the cyclicality of the technology and economic processes in the country

|

Innovative approach |

Institutionalism (J. Schumpeter, Yu. V. Yakovets, E. Zang) |

Innovation cycle |

the innovation component of technological and economic development |

Reproductive-structural approach |

S. Kuznets, J. Hicks etc. |

Structural cycle |

direct and inverse relationship between technological change and structural transformation in the economy, movement of resources, in sectoral employment, income distribution |

Investment approach |

F. von Hayek, R. Frisch, R. Solow, F. Modigliani |

Investment cycle |

the duration of the technological cycles is determined by the structural characteristics of the formation and allocation of investment resources |

Managerial approach |

Institutionalism, Keynesianism, neoli-beralism, neoconservatism |

Management cycle |

pervasive character |

Based on the brief characteristics of selected approaches to the study of the interdependence of the different cycles and phases within them the main provisions of the author's recursive approach can be formulated:

- existing 1526 main types of economic cycles can be classified into groups, the occupancy of which is determined by the duration in time. It should be particularly noted that the inner content of each group is formed by the subjective assessment of the researcher, focusing on various classification criteria that, ultimately, determines the high level of conditionality when defining temporal boundaries of each group and each cycle inside it. Thus, if we accept the interpretation of Kondratiev’s cycle - "...the process of deviations from the equilibrium state... they (equilibrium states) can be of the first, the second and the third order..., deviations from which produce, respectively, small, medium and large cycles" (Vinogradov 1984, p.1261). Deviations from equilibrium of the first order – between the normal market supply and demand - give rise to short-term fluctuations. The balance of the second order is achieved in the process of formation of prices of production through inter-sectoral flow of capital invested in the equipment, and the deviation from it is associated with average cycles (Butorina, Batalovа and Fukalova 2012, p.71). The balance of the third order, combining market fluctuations in basic capital goods (industrial buildings, constructions of the physical infrastructure, etc.), is also periodically broken and there is a need for update corresponding to a new technological mode of production;

- in the aspect of cyclic dynamics the recursiveness can be seen as one of the basic characteristics of the loop and characterizes the relationship between the phases inside the loop (each phase consisting of the next cycle also contains an "inherited" character ("genome") determines the previous and subsequent adequate features (interfacial recursiveness)) and between cycles of different orders (each economic cycle at all stages of the history of the world economy was mediated by the nature of the previous cycle, and he, in turn, influenced the subsequent cyclical development, the presence of direct and reverse effects different in nature (nature) cycles: for example, shorter cycles in their dynamics are subjected to the progressive or regressive tendencies of longer cycles (intercyclical recurrence) (Suslov 2009, p. 29). Based on that, recursiveness can be interpreted as the general economic pattern, which is a multi-level, multi-factor, multi-criteria characterization of specific relations and specific dependencies of various cycles and their internal phases;

- their relationship which is formed with the essential characteristics of causality, is defined as the millitesla recursiveness between innovation, investment, technological, economic and structural cycles, which, from our point of view, define the essence of modern macro-processes. They can be divided into 3 groups: the first group combined investment, innovation and technological cycles that ensure fluctuations in business activity (the second group characterizing cyclic processes), their effectiveness determines the quality of structural changes, so the structural cycle is related to the third result group;

- each of the selected cycles in these groups is characterized by a temporal amplitude of the passage of the four phases of the classical cycle and the system of indicators, reflecting their dynamics;

- phase cycles of each of the preceding groups forms the basis of the conditions subsequent cycles of the group, acting as the factors of its dynamics;

- selected dependencies can lead to the elaboration of counter-cyclical policies at the regional level, the country as a whole.

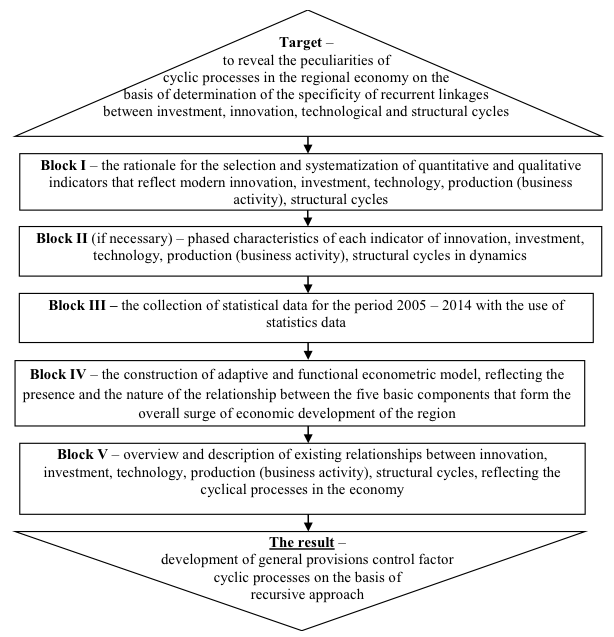

Basic provisions of the recurrence approach can be considered as the theoretical basis for the development of methods of analysis of cyclic processes and are represented by the following algorithm (Fig. 1):

Fig. 1

General algorithm of methods of cyclic processes

analysis in the economy of the region

On the basis of the presented algorithm as a goal of development of methods of cyclic processes research it is proposed to determine features of cyclical development based on the detection of recurrent interdependencies between investment, innovation, technological, economic, structural components. For that within the 1st block it is needed to select the indicators, the choice of which is stipulated by the following:

1) the specifics of the statistical base, as well as the level of the study (possibility of comparison between the regions and Russia in general); 2) the feasibility of the long term prospects of the phased analysis to determine the dynamics of indicators;3) the possibility to differentiate each group of selected basic cycles: innovation, investment, technology, production (business activity), structural; 4) possible units on their quantitative and qualitative indicators, reflecting both changes. Their general list is presented in table 2.

In table 2 the authors present the qualitative and quantitative indicators characterizing the features of cyclic processes in innovation, investment, technological, technical and industrial, social and structural components of modern economic cycle. Systematic indicators describing the features of cyclic processes of social development taking into account intercyclic recurrence, allow to identify the direct and inverse relationship between innovation, investment, technological, technical and industrial, social and structural components of the modern cycle (Pazdnikova 2011, p.10). Table 1 shows basic parameters of cyclic dynamics based on the study of fundamental works of scientists (the first column). For each parameter typology of structural elements was carried out that fully reveals the tendencies of cyclical development. The period for investigation may vary depending on the object of study (the second column). For each structural element in accordance with the sectoral features of the economy of the Perm region presented the basic indicators on the basis of which can be selected trajectory of cyclical development (third column), and also identified the most important indicators, reflecting complex economic development (fourth column). In this case, the italics in the table highlighted the indicators which additionally can be used to characterize the cyclic processes in the components of the cyclic dynamics of modern economic development.

Table 2

System of indicators reflecting the characteristics of

cyclical dynamics with regard to intercyclic recurrence

Basic parameters |

Structure of basic parameters |

System of indicators in accordance with the official statistics |

The most important indicators |

Innovation component (of the index of innovative activity) |

- number of organizations and staff engaged in innovative activities |

1) the proportion of organizations engaged in innovation activity, %; |

1); 2) |

2) number of organizations performing research and development per 1 million inhabitants |

|||

3) the number of employees engaged in research and development per 10,000 residents |

|||

4) the number of University students per 10,000 of the population |

|||

5) the total number of implemented innovative projects in the regions and countries |

|||

- the cost of innovative development |

1) domestic expenditures on research and development per capita, RUB |

||

2) the value share of regional and federal budgets in the total amount of financing of innovation activity of organizations, % |

|||

- introduction to the basic economics of innovation |

1) the number of innovations, implemented at the enterprises and organizations of the region, country and the world, un. |

||

2) the cost of innovation outcomes, mln.rub. |

|||

3) the share of incomes earned due to innovation activities in GDP region, country, % |

|||

Investment component (the index of investment activity) |

- provision of investment |

1) investments in fixed capital, mln. rub. |

1); 2) |

2) the volume of foreign investments, million rub. |

|||

- development of the banking sector |

1) indicators of liquidity and solvency of business entities |

||

2) the amount of credit resources for realization of investment projects, million rubles |

|||

3) the cost of credit, mln. rub. |

|||

4) change of bank requirements to the borrowers |

|||

5) changes to the discount rate, % |

|||

Technological component: |

- the efficiency of the basic production funds |

1) the value of basic production assets, mln. rub |

1) |

2) an index of physical depreciation of the basic production assets, % |

|||

3) the index of accumulated depreciation of the basic production assets , % |

|||

4) disposal rate for the basic production assets, % |

|||

5) the rate of basic production funds modernization, % |

|||

6) the value of new technologies entered in the production, mln. rub. |

|||

Technical and production component (business activity index) |

- production volume |

1) rate of GDP growth, % |

1); 2); 3) |

2) the rate of GDP growth of per capita, % |

|||

3) the factor of underloading of production capacities |

|||

4) the producer price index of industrial products, % |

|||

5) the producer price index of agricultural products, % |

|||

6) the financial results of large and medium-sized enterprises, mln.rub. |

|||

7) specific weight of profitable enterprises, % |

|||

8) the share of unprofitable enterprises, % |

|||

9) the volume of non-payments, mln. rub. |

|||

|

- volume of consumption |

1) the consumer price index, % |

|

2) growth rates of Net National Product (NNP), % |

|||

3) growth rates of NNP per capita, % |

|||

4) amount of goods sold on credit, mln. rub. |

|||

5) the capacity of the market, % |

|||

- foreign trade activity |

1) foreign trade turnover per capita, rub. |

||

2) balance of foreign trade turnover per capita, rub. |

|||

The social component total economic processes) |

- demographic processes |

1) indicators of natural movement of population, thousand people 2) the natural decrease of population, thousand people 3) indicators of population migration, thousand people |

1); 2) |

- the level of personal income |

1) cash income per capita, RUB. |

||

2) real disposable monetary income of the population, RUB. |

|||

3) average monthly accrued wages for the full range of enterprises, RUB. |

|||

4) arrears of wages, mln. RUB. |

|||

5) the producer price index of consumer goods, % |

|||

- the dynamics of unemployment |

1) the number of officially registered unemployed, thousand people |

||

2) the level of officially registered unemployment, % |

|||

The structural component (index of the structural-sectoral shifts in the national economy) |

- development of the manufacturing sector |

1) GDP per capita, rub. |

1); 2); 3) |

2) the industrial production index, % |

|||

3) scope of work for construction contracts, rubles per capita |

|||

4) agricultural products per capita, rub. |

|||

5) the structure of employment by main economic activities in production, % |

|||

6) structure of the monthly average accrued wages of the enterprises of main economic activities in manufacturing sector, rub. |

|||

- development of the non-manufacturing sector |

1) retail trade turnover per capita, rub. |

||

2) volume of paid services per capita, rub. |

|||

3) volume of transported (shipped) goods, thousand tons |

|||

4) freight turnover, million ton/km, passenger turnover mln. passengers/km |

|||

5) structure of the monthly average accrued wages of the enterprises, rub. |

The 2nd block of the algorithm is not compulsory to build the model (in the framework of this publication), although from the point of view of the theory and practice of management, determination of development trends for each of the selected indicators for each phase of the cycle will allow to identify patterns of innovation, investment, technology, production (business activity), structural cycles in the economy of the region, the country as a whole.

The 3rd block involves the collection and systematization of statistical data that reflects the underlying cyclical processes in the economy of the Perm region to the full extent. On the basis of statistical data officially published in the "Regions of Russia", "Perm region in figures", the underlying table was compiled, which reflects both qualitative and quantitative indicators of cyclic processes in the period 2005 – 2014.

The figure identifies five components of cyclic processes in the Perm region, described from the point of view of basic indicators. The choice of these indicators is stipulated with the statistical base in the regional aspect of research, as well as a long analysis period, which we believe will allow us to fully identify the features of the outbreak of the phased changes. It is obvious that a longer analysis period, and the increase in the number of indicators can significantly improve its quality.

Targets reflected in Fig.2 formed the basis of the econometric model (block IV). Its description is presented in table 3, which presents the main findings of the factor based on cyclical developments in typological context (tab. 3).

Table 3

Justification significance / insignificance of the basic

parameters for the development of cyclic processes

The following specific features ("block V " of the algorithm) were revealed on the basis of the constructed adaptive functional model of the cyclic processes of the Perm region economic development: the calculations showed that there are moderate and strong dependence between selected components of the innovation, investment, technology, production (business activity), structural cycles.

Moderate relation of the innovation cycle with investment and structural ones, as well as relation of the innovative cycle with production (economic) one, social cycle with innovation and investment cycles, economic cycle with investment one demonstrate the interdependence of these processes (Balatsky 2004, p.28). All of them also have reverse dependencies. Strong direct and inverse relationship was observed between technological and social components of the cyclic processes in the economy of the region.

Identified dependences prove the existence of strong and moderate recurrent relations between innovation, investment, technology, production (business activity) and structural cycles, determining a total amplitude of regional economic development that can become the basis for developing a comprehensive counter-cyclical policies (Yakovets 2001, p. 344).

To elaborate on the areas of their development we need to consider in more detail the causal dependencies between the selected five basic cycles in terms of a general theory of cyclicity. Figure 2 presents the author's vision of the relationship between cyclic processes.

Fig. 2

Interrelation of cyclic processes

The given scheme, we believe, allows to determine the factors of direct and indirect influence on the dynamics of economic development in general.

Direct correlation of depreciation of fixed assets and needs in updating the active part of fixed capital (the industrial cycle of K. Marx) are generated by the objective processes of technological progress (technological cycle by N. Kondratiev) and objective-subjective nature of innovation (innovation cycle by J. Schumpeter). The dual nature of innovation is due to the high share of subjective factors, and first of all, in any economy in each phase of development is determined by "leading", i.e. those who "creates and runs the risk of using new combinations of resources in production". The commercialization of the innovation investment cycle by R. Frisch) causes changes in the movement of capital, which in turn will undoubtedly lead to sectoral shifts (structural cycle of S. Kuznets), but also to changes in the social sphere (business cycle by I. Juglar). While industrial and social changes, according to Western economists, may indicate the changing phases of the industrial cycle (Butorina, Batalovа and Fukalova 2012, p. 68)

An inverse relationship, as reflected in the figure dotted arrows, can be represented by the following relationship: investment resources invested in commercialization of innovation, promote the development of a new technological mode of production with the subsequent update of all the factors that will lead to sectoral structural changes in the economy and employment. The empirical dependence become the basis of the systematization of management ways for the cyclical development of the regional economy (table 4).

Table 4

Directions of the cyclic regional development management

Revealed interrelations |

Management directions |

The innovation and investment components |

- formation of a stable flow of investments, primarily in the innovation sector |

The investment and technical-and-production components |

- attraction of investments for further modernization of production |

The innovation and social components |

- formation and further development of innovation as a driver of income growth and lower unemployment in the region |

The social and innovation components |

- increase of level of education, involvement of highly qualified specialists and innovators |

The social and investment components |

- increase of revenue for creating conditions for intra-regional investment |

The technological and social components |

- formation of a new technological base for increasing incomes, changes in the sectoral structure of the economy |

The technical-and-production and investment components |

- increase of investments to boost the number of high-yield productions in the region |

The directions of the cyclic processes regulation is the basis of the factor of regional economy management, under which we understand the interrelated set of management decisions aimed at leveling the negative trends and strengthening the progressive dynamics separately in the fields of innovation, investment, technology, production (business activity) and structural components taking into account the nature and strength of recurrent connections between them.

Thus, the recurrent approach proposed in this work and used for studying cyclic processes in the economy of the region accumulates previous approaches in theory and practice, can become a methodological basis for the analysis and management of cyclical development, allowing not only to identify the existing relationship between cycles of different levels and nature, but also to manage them to ensure a balanced and progressive development.

This article was prepared in the course of fundamental research Perm National Research Polytechnic University in the framework of the basic tasks of the state Ministry of Education of Russia (reference number 2014/152 topic number 1487).

Balatsky, E. (2004). Innovation sector industry. Economist, 1, 20 – 34.

Batalova, E. V. (2009). Study of control systems: a course of lectures. NOU VPO "Western-the Ural Institute of Economics and law". Perm, pp. 202

Butorina O. V., Batalovа E. V. and Fukalova Yu. S. (2012). Study of cyclic processes of the Russian economy taking into account intercyclical recurrency. Vestnik of Perm University. Series: Economics, 4, 64-74.

Lobanova, E. N. (1991). Forecasting the cyclical nature of the economy of Russia. Russian economic journal, 1, 12 – 20.

Nobel laureates of the twentieth century. economic encyclopedic dictionary. Moscow: "the Russian political and economic encyclopedia", 2001, pp. 336.

Pazdnikova, N. P. (2011). The application of models of innovative development of economy of region. Vestnik of Perm University. Series: Economics, 2, 6-12.

Prikin, B. V. (2000). Technical and economic analysis of production: textbook for universities. Moscow: Yuniti – Dana, pp. 184.

Seliverstov, V. E. (2008). Myths and reefs of the territorial development and regional policy of Russia. Region: Economics and sociology, 2, 194-224.

Suslov, V. I. (2009). Strategy of economic development for macroregion: approaches to the development, structure, model. Region: Economics and sociology, 4, 3-31.

Schumpeter, J. A. (1982). The theory of economic development (study of business profits, capital, credit, interest and market conditions).: lane S. it. Moscow: Progress, pp. 43.

Yakovets Y. V. (2001). Geoekonomika: virtuality and reality. Economic theory on the threshold of XXI century – 5: Geoekonomika. Moscow: Lawyer, pp. 624.

Vinogradov I. M. (1984). Mathematical encyclopedia. Moscow: Soviet encyclopedia, 4, 1261.

1. Perm National Research Polytechnic University, 29, Komsomolsky Av., Perm, 614990, Russia; Perm State National Research University, 15, Bukireva str., Perm,614990, Russia, ok.butorina@yandex.ru

2. Perm National Research Polytechnic University, 29, Komsomolsky Av., Perm, 614990, Russia; Perm State National Research University, 15, Bukireva str., Perm,614990, Russia, pazdnikovan@mail.ru

3. Perm National Research Polytechnic University, 29, Komsomolsky Av., Perm, 614990, Russia; Perm State National Research University, 15, Bukireva str., Perm,614990, Russia, karpushki@mail.ru