Vol. 39 (# 11) Year 2018. Page 18

Sankalp SRIVASTAVA 1; Charu BISARIA 2

Received: 06/11/2017 • Approved: 10/12/2017

2. The repercussion of Liquidity crunch

3. The Effect of Demonetisation on Indian Economy

4. The Impact of Demonetisation on Indian Economy and GDP

5. Prospects and the road ahead

6. Income tax raids and seizures

ABSTRACT: Demonetisation is an act by which government of a nation strips or nullify the circulation of one or more than one currency unit of its status as a legal tender. This process of demonetisation is largely done keeping in mind the goal of unearthing black money accumulated through corrupt means. While the efforts resulted Successful in the developed and liberalised economies like United States and Australia. It could not ensure any success in the developing or underdeveloped nations in Asia. Not only India but several other countries like USA in 1969; Zaire in 1990; Australia in 1996; Zimbabwe in 2010 and North Korea in 2010 have resorted to demonetisation. This paper attempts to study the impact of demonetisation on Indian economy & GDP in long term & short term. The paper also studies the reasons for deflation in real estate prices due to demonetisation. |

RESUMEN: La desmonetización es un acto por el cual el gobierno de una nación despoja o anula la circulación de una o más de una unidad monetaria de su condición de licitación legal. Este proceso de desmonetización se hace en gran medida teniendo en cuenta el objetivo de desenterrar el dinero negro acumulado a través de medios corruptos. Mientras que los esfuerzos resultaron exitosos en las economías desarrolladas y liberalizadas como Estados Unidos y Australia. No podría garantizar ningún éxito en los países en desarrollo o subdesarrollados de Asia. No sólo la India, sino varios otros países como Estados Unidos en 1969; Zaire en 1990; Australia en 1996; Zimbabwe en 2010 y Corea del norte en 2010 han recurrido a la desmonetización. Este documento intenta estudiar el impacto de la desmonetización en la economía y el PIB de la India a largo plazo y a corto plazo. El artículo también estudia las razones de la deflación en los precios de las propiedades inmobiliarias debido a la desmonetización. |

Demonetisation is a generation’s memorable experience and is going to be one of the economic events of our time. Its impact is felt by every Indian citizen. Demonetisation affects the economy through the liquidity side. Its effect will be last longing because nearly 86 per cent of currency value in circulation was withdrawn without replacing bulk of it. As a result of the withdrawal of Rs. 500 and Rs. 1000 notes, there occurred a huge gap in the currency composition as after demonetisation Rs. 100 and Rs. 2000 is the only denomination. Existence of black money is one of the fundamental reasons for the endurance of high economic inequalities, poverty and unemployment in the country. The Wanchoo committee in its report on black money 1971 described black money as a “cancerous growth in the country’s economy, which if not checked, will surely lead to ruination”. Manifestation of black money in social, economic and political space of our lives has a debilitating effect on the institution of governance and conduct of public policy in the country. Success of inclusive development strategy critically depends on the capacity of our society to root out the evils of corruption and black money from its very foundations. The taxable income earned from the demonetisation exercise will be spent on economic growth boosting the development activities and also the economic upliftment of the poor.

A liquidity crisis is a negative financial situation characterized by a lack of cash flow. For a single business, a liquidity crisis occurs when the otherwise solvent business does not have the liquid assets (i.e., cash) necessary to meet its short-term obligations, such as repaying its loans, paying its bills and paying its employees. For the economy as a whole, a liquidity crisis means that the two main sources of liquidity in the economy, banks and the commercial paper market, severely reduce the number of loans they make or stop making loans altogether. Because so many companies rely on these loans to meet their short-term obligations, this lack of lending has a ripple effect throughout the economy, causing liquidity crises at a plethora of individual companies, which in turn affects individuals. Demonetization technically is a liquidity shock; a sudden stop in terms of currency availability. It creates a situation where lack of currencies jams consumption, investment, production, employment etc. In this context, the exercise may produce following short term/long term, consumption/investment, and welfare/growth impacts on Indian economy. The intensity of demonetization effects clearly depends upon the duration of the liquidity shocks. Liquidity shock means people are not able to get sufficient volume of popular denomination especially Rs 500. This currency unit is the favourable denomination in daily life. It constituted to nearly 49% of the previous currency supply in terms of value. Higher the time required to resupply Rs 500 notes, higher will be the duration of the liquidity crunch. Current reports indicate that all security printing presses can print only 2000 million units of RS 500 notes by the end of this year. Nearly 16000 million Rs 500 notes were in circulation as on end March 2016. Some portion of this was filled by the new Rs 2000 notes. Towards end of March approximately 10000 million units will be printed and replaced. All these indicate that currency crunch will be in our economy for the next four months. Most active segments of the population who constitute the ‘base of the pyramid’ uses currency to meet their transactions. The daily wage earners, other labourers, small traders etc. who reside out of the formal economy uses cash frequently. These sections will lose income in the absence of liquid cash. When liquidity shortage strikes, it is consumption that is going to be adversely affected first.

Consumption ↓→ Production ↓→ Employment ↓→ Growth ↓→ Tax revenue ↓.

Rural Economy which is majorly cash based is hit adversely as higher denomination notes are not always practical to use even if available. A member of the Federation of Small and Medium Industries explained why the sector has been hit so badly. "The economic cycle is short because the monetary transactions are not very high and the payments are made on a piecemeal basis and almost every alternate day which makes cash the easiest and most preferred mode. Withdrawal of Rs 500 and Rs 1000 has created an acute shortage of cash which has hit the industry," said the member. The cash transaction system is good for a country like India, but the question is? ”Is the right time and is this the right way”?

Deposit in the short term may rise, but in the long term, its effect will come down. The savings with the banks are actually liquid cash people stored. It is difficult to assume that such ready cash once stored in their hands will be put into savings for a long term. They saved this money into banks just to convert the old notes into new notes. These are not voluntary savings aimed to get interest. It will be converted into active liquidity by the savers when full-fledged new currency supply takes place. This means that new savings with banks is only transitory or short-term deposit. It may be encashed by the savers at the appropriate time. It is not necessary that demonetization will produce big savings in the banking system in the medium term. Most of the savings are obtained by biggie public sector banks like the SBI. They may reduce interest rate in the short/medium term. But they can't follow it in the long term. A CRISIL Report on May 18, 2016, states that MFIs are projected to grow at 125%11. The gross loan portfolio stood at Rs. 57,941 crore in Q2 FY-17 as compared to Rs. 31,551 Cr in Q2 FY-16 growing by almost 84% YoY in Q2, MFIN said. The growth in MFI sector has been depicted in the figure 3.1.

Figure 3.1

(Growth in Microfinance Industry, Impact of Currency Ban)

The currency shock is hitting the cash-driven sector at a time of high growth. The demonetization of high-value currency notes has descended down as a setback for MFIs, which have temporarily stopped providing credit to their customers at the same time taking a major hit on loan repayments, e.g. Bandhan Bank. Many MFIs had deferred the repayment schedule of their borrowers for the subsequent few days. Usually, MFIs record a repayment rate of 99%, but it took a blow after demonetization11. The sector is worried about taking the business forward in view of the increasing risk of loan defaults as the repayment rate has dropped to approximately 70% around November 10th following the announcement. The resultant liquidity crunch is likely to hurt repayment capacity of borrowers and lead to short-term delinquencies in loan accounts, as observed by India Ratings & Research because of demonetization hurting SMEs. In particular, a section of borrowers associated with the construction sector and unorganized sector self-employed individuals have been negatively impacted.

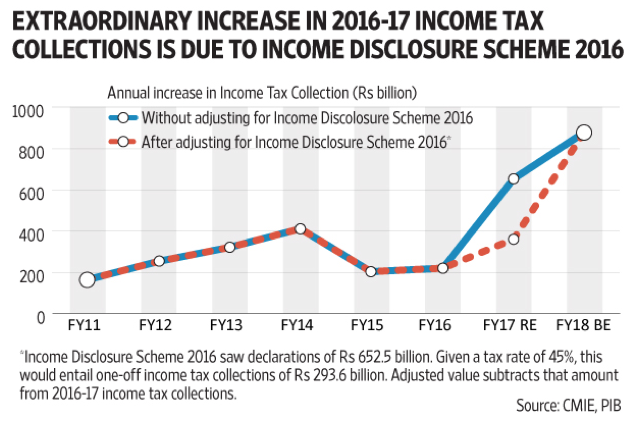

Income tax returns filed in the current fiscal year saw an increase of 25 per cent, according to a statement by the Central Board of Direct Taxes (CBDT). Substantial rise was also seen in direct tax collections during the same time period, with advance tax collections of personal income tax growing by 41 per cent. The growth in tax collection was referred to demonetisation of high denomination currency notes in 2016 and Operation Clean Money launched earlier this year. Both initiatives were carried out with the motive of curbing black money. As a result of demonetisation and Operation Clean Money, there is a substantial increase in the number of Income Tax Returns (ITRs) filed. The number of Returns filed as on August 05, 2017 stands at 2,82,92,955 as against 2,26,97,843 filed during the corresponding period of financial year 2016-2017, registering an increase of 24.7 per cent compared to growth rate of 9.9 per cent in the previous year," read a statement by Ministry of Finance.

Figure 3.2.1

The rise in tax revenue

-----

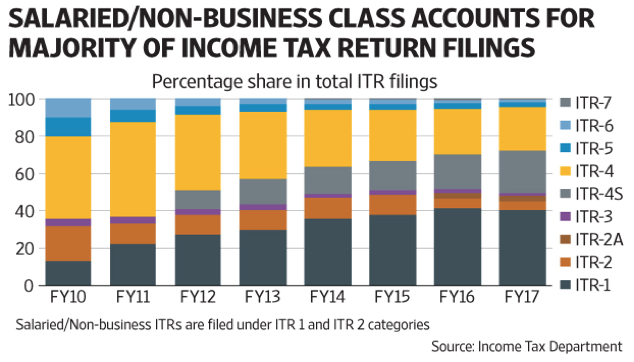

Figure 3.2.2

Different classes with their tax contribution

It is reasonable to assume that a large amount of income tax evasion happens on account of non-salaried classes, as those getting salaries have their taxes deducted at source. The income tax department classifies ITR filings on the basis of type of tax payers (figure 3.2.2). At present there are nine such categories, where ITR 1 and 2 represent individuals or Hindu Undivided Family (HUFs) earnings from salaries, interest, house income etc. These categories account for close to half of ITR filings in the country. The ITR filing data for FY17 does not show any significant change in composition of ITR filings by different categories compared to previous years.

Owning a home was a dream for many in India, but with the help of demonetization there is fall in the real estate value. High EMIs are no more a reason or not having a house of your own. Banks have started to slash lending rates for home loans. This means you will now have to pay lesser to own a house. There are been lot of transparency in the Real Estate Regulatory Act and this will help in protecting investors from delayed constructions and actual delivery of the property. New properties will not have much of negative impact due to demonetization, the actual issue lies in resale and land property markets. For the next three to six months this market is expected to be down due to negative market sentiments. Cash components play a vital role in resale and land property transactions, thus a direct impact of demonetization lies here. Unaccounted cash has been sucked by the banks as part of demonetization, thus transacting through cash for these purposes is relatively impossible. Those buyers who were ready to pay cash to purchase a property completely are now out of this market. Thus there will be lower demand for the real estate properties in the market

Figure 3.3

Liquidity has been severely impacted and this would result in a deflation with limited sales over the next three months. In short, the move has taken the real estate sector by a storm, and it would take time for all stakeholders in the sector – brokers, buyers, owners and developers to assess its repercussions on their businesses and decisions. With limited money floating in the economy, the inflation rates are expected to fall in the next 2-3 quarters. This coupled with key policy developments such as speculative repo rate cuts by the Reserve Bank of India (RBI).

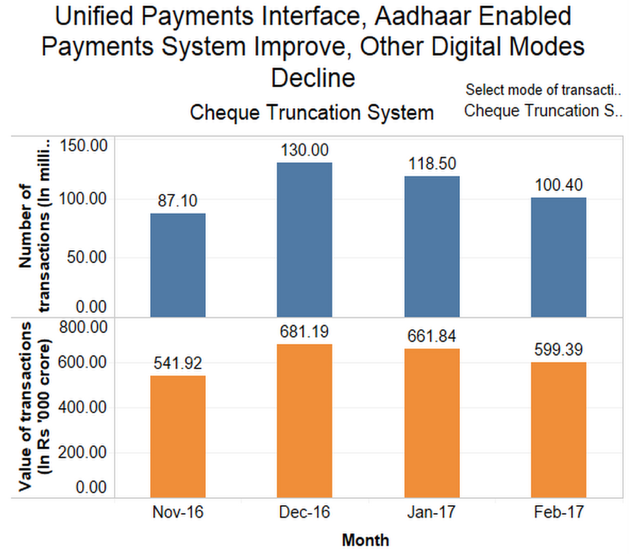

Cashless economy means more and more use of digital mode and less use of cash in transactions. The World Bank's World Development Report-2016 envisages that in many instances, digital technologies have boosted growth, expanded opportunities and improved service delivery. Larger size of digital economies is in the developed economies is one of the factors of less corruption in these countries as compared to developing countries. Therefore, in order to escape from adversaries of corruption and black money and to have more transparent and cleaner economic growth with social Justice, less use of cash is one of the suggested measures. Sweden, where 89per cent is no cash payment, ranks 3rd in C.P.I (Corruption Perception Index). In India, an estimated 22% is non cash payment and India ranks 76th in the Corruption Perception Index. This veritably proves that there is a strong negative correlation between the cashless transaction and corruption. Rural cashless Worldwide there is a tremendous interest among policymakers to explore the possibility of moving towards a cashless economy. Digitisation of transactions is the best way to move towards cashless economy. Rural areas are home to two thirds of the country’s population of some 870 million people where much of the challenge lies in achieving cashless transactions for the rest of the decade. It is estimated that rural users will constitute almost half of all Internet users in 2020. Number of connected rural consumers is expected to increase from 120 million in 2015 to almost 315 in 2020. Over 93% of people in rural India have not done any digital transactions. So the real problem lies there. The government has taken steps including announcing zero balance accounts for people, but growth of Bank branches has been low.

Figure 3.4

The push for cashless transaction with financial inclusion

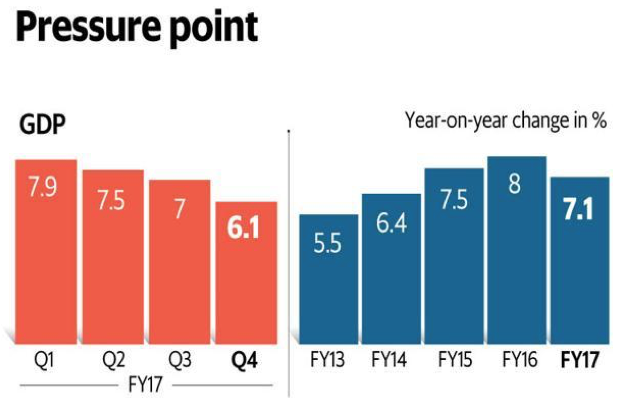

The aim of demonetization was to wash away ‘black money’ from the country and ensure India is banked, licit and taxpaying country. The micro economic benefit of this is it helps in eradicating or controlling terrorists activities with fake money but at the macroeconomic view- layman is being most affected as compared to actual gamblers and scammers. While some ministers feel demonetization will be a long term benefit as it is will help in having a spurt in the Indian economy, not everyone believes in this theory. For the next two quarters most of the economists and analysts feel there will a dip in the country’s economy and GDP. This is mainly due to the instability of the rules on the basis if demonetization and lack of confidence by public on the Government. Finance Minister believes the GDP of the country is expected to grow as there are many financial transactions which do not fall into the category of economic activities. The positivity around the demonetization is, there is hope that on the long term there is a lot of benefit from this move. Though at this point are suffering due to sudden changes in the economy.

Figure 4.1

The change in GDP year after year respectively

The Jan Dhan Aadhaar Mobile (JAM) can encourage digital transaction culture. It is spreading to reach each remote corner of the country. A large number of government transfers (DBT) are made through JAM mode. This will help people to get digital transaction awareness. The role of the government in these cases will be to make cashless transactions mandatory for certain payments and make it mandatory for certain services exceeding a certain amount which has already been initiated.A tax rebate (of say 1% to 2%) on payments made by households as salary to unorganised sector (domestic servants, sweepers etc) can boost cashless payments. This will do two things, one the households will have an incentive to go cashless and two; large portion of the unorganised sector will be financially included. The 5 A's of promoting financial inclusion through cashless payment instruments which are availability, accessibility, acceptability, affordability and awareness. Government should assure basic necessities in rural areas and focus on developing infrastructure. Special drives through schools, colleges, panchayats etc. can help create awareness about cashless/ banking transactions. Financial literacy is a must for bringing more and more people to the digital platform. Digital payment or payment through banks, instead of paying cash should be encouraged. Linkage of all welfare activities with bank accounts is a very strategic step. A strong banking base is the basic prerequisite for the cashless economy. Targeted financial education programs can improve financial skills and Credit Management, and increase account ownership in rural India.

More and more money will come to the banking system in the form of either current or savings account. The savings will push up investment and lead to capital formation in the economy. The opening of new bank accounts for depositing the banned currencies shows that it has promoted banking literacy among the general population and connected the common man who was out of the net of the banking system with the banking system. It has strengthened the banking system, as many Bank branches were facing acute problem of NPA. The capabilities of banks to lend more will be enhanced which would raise investment in the economy. The excess income deposited in the banks can generate taxable income for the government which can be spent on various welfare programmes for the poor in different sectors of the economy. People who have earned black money through corruption and unfair means will be exposed and be punished so that it will pave the way towards a corruption free society. It will help to create a corruption free administrative and political environment in the country. It will enhance the flow of FDI to the economy, as the foreign investment requires a corruption free environment and it will also be helpful to control the outflow of illicit money to other developed countries for foreign bank accounts. It will promote social and cultural development in the society. Corruption and black money erodes social and cultural systems. It will put a break on unethical social development. It will help the nation to achieve a real and cleaner economic growth rate, not an artificial and dirty economic growth rate achieved with the help of Black Money. Any growth rate achieved through distributive justice and with less economic inequality is the true growth rate for a developing country like India. Less growth rate with less poverty and lower income inequality is more desirable and better for the Happiness Index than high growth rate with more number of people living below the poverty line and there is huge income inequality between the rich and poor. India is a great democracy where the people at large despite inconvenience supported the demonetization drive by the government for unearthing black money and counterfeit currency.

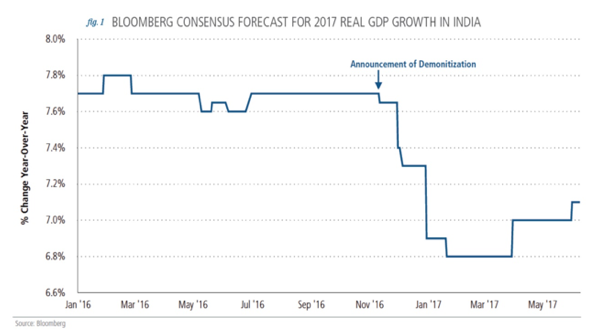

Figure 5.2

The consensus forecast of GDP after Demonetisation

The Finance Ministry instructed all revenue intelligence agencies to join the crackdown on forex traders, hawala operators and jewellers besides tracking movement of demonetised currency notes. It was reported that the Prime Minister's Office (PMO) and the Prime Minister himself were directly coordinating the raids conducted by the Income Tax, Enforcement Directorate (ED) and other agencies. As of 23 December, PMO received around 700 calls giving information about black money and it directly forwarded the information to various law enforcement agencies for further action. Income Tax departments raided various illegal tax-evasive businesses in Delhi, Mumbai, Chandigarh, Ludhiana and other cities that traded with demonetised currency .The Enforcement Directorate issued several FEMA notices to forex and gold traders .Large sum of cash in defunct notes were seized in different parts of the country .In Chhattisgarh liquid cash worth of 4.4 million (US$69,000) was seized. As of December 28, official sources said that the Income Tax department detected over 41.72 billion (US$650 million) of un-disclosed income and seized new notes worth 1.05 billion (US$16 million) as part of its country-wide operations. The department carried out a total of 983 search, survey and enquiry operations under the provisions of the Income Tax Act and has issued 5,027 notices to various entities on charges of tax evasion and hawala-like dealings. The department also seized cash and jewellery worth over 5.49 billion (US$86 million) out of which the new currency seized (majority of them 2000 notes) is valued at about 1.05 billion (US$16 million). The department also referred a total of 477 cases to other agencies like the CBI and the Enforcement Directorate (ED) to probe other financial crimes like money laundering, disproportionate assets and corruption. In a period of four months from 9 November 2016 to 28 February 2017, CBDT claims to have detected an undisclosed income of over 93.34 billion (US$1.5 billion) through more than 2,362 search, seizure and survey actions by Income Tax department.

Huge amounts of cash in the form of new notes were seized all over the country after the demonetisation .As of December 2016, over 4 crore in new banknotes of 2000 were seized from four persons in Bangalore, 33 lakh in 2000 notes were recovered from Manish Sharma, an expelled BJP leader in West Bengal, and 1.5 crore was seized in Goa. 900 notes of the new 2000 notes were seized from a BJP leader in Tamil Nadu. Around 10 crore in new notes were seized in Chennai. As of 10 December, 242 crore in new notes had been seized. It was noted in the media that while people were dying in queues to obtain a few thousand rupees in cash, persons with the right connections were able to amass crore of rupees in new notes, thus rendering the demonetisation exercise futile. It was announced by the government that the seized notes will be brought into the mainstream as soon as possible to ease out the cash problem. Earlier, agencies kept all seized material, including cash seizures, in their strong rooms as evidence till the case was adjudicated by the courts. The seized money was then deposited into the Consolidated Fund of India. Sometimes, income tax cases took years to resolve, still all seized material was kept in safe lockers of the tax department.

As per the facts nearly 90% of the total cash in circulation has come back into the banking system and hence, the stated purpose of the Demonetization exercise which was to “extinguish” black money has accomplished, but that is just one side of it. A good part of black money is eliminated from the economy and this money can be used for development of economy. With increased transparency, trust on Indian Economy is increased. Thereby foreign investments poured in. Demonetization move encouraged cashless transactions, which is a boost to Economy GDP growth was earlier estimated as 7.8%. Post-demonetization, estimates are lowered to 7.1%.Agriculture sector, small and medium scale businesses and informal sectors are the worst hit by demonetization Even though demonetization move created adverse short-term policy impact the real impact of demonetization must be assessed in the medium/long term, at this point of juncture we cannot precisely conclude whether demonetization is a failure or a success.

Renhe Liu, Eddie Chi-man, HuiJiaqi LV, Yi Chen (2016, June 07), What Drives Housing Markets: Fundamentals or Bubbles?, The journal of real estate finance and economics, November 2017, Volume 55, Issue 4, pp 395–415.

Thomas P. Boehm, Alan M. Schlottmann (2017, November), Mortgage Payment Problem Development and Recovery: A Joint Probability Model Approach, The journal of real estate finance and economics, November 2017, Volume 55, Issue 4, pp 476–510.

Marc K. Francke, Alex van de Minne (2017, August 29), The Hierarchical Repeat Sales Model for Granular Commercial Real Estate and Residential Price Indices, The journal of real estate finance and economics, November 2017, Volume 55, Issue 4, pp 511–532.

Martin Hoesli, Stanimira Milcheva, Alex Moss (2017,October12), Is Financial Regulation Good or Bad for Real Estate Companies? – An Event Study, The journal of real estate finance and economics, pp 1–39.

1. Research Scholar at Amity Business School, Amity University. Contact email : sankalps95@gmail.com

2. Dr. Assistant Professor at Amity Business School, Amity University. Contact email : chrbisaria@yahoo.co.in