Vol. 38 (Nº 48) Year 2017. Page 21

Botagoz KALIMURATKYZY 1

Received: 12/06/2017 • Approved: 10/07/2017

ABSTRACT: The study examines the relationship between anti-money laundering (AML) legislative framework and its effectiveness in modern conditions. In particular, it is aimed at the identification of general strengths and weaknesses of current legislation as well as the factors that determine them. Based on T11 test developed by the Ministry of Justice of the Netherlands, the author assesses the effectiveness of existing AML legislation in the Republic of Kazakhstan highlighting its major strong points and constraints. The results are indicative of the fact that the slowness in the execution of sanctions as well as the lack of possibility for practical implementation of legal norms are one of the most serious issues that the domestic AML system currently faces. The study is relevant in terms of practical implications, since the descriptive analysis of the questionnaire as well as the evaluation of Kazakhstan experience can be applied in different countries and used for educational purposes. |

RESUMEN: El estudio examina la relación entre el marco legislativo contra el blanqueo de dinero (AML) y su efectividad en las condiciones modernas. En particular, tiene por objeto identificar las fortalezas y debilidades generales de la legislación vigente, así como los factores que los determinan. Basándose en la prueba T11 desarrollada por el Ministerio de Justicia de los países bajos, el autor evalúa la efectividad de la legislación ALD existente en la República de Kazajstán en la que se destacan sus principales puntos fuertes y sus limitaciones. Los resultados son indicativos del hecho de que la lentitud en la ejecución de las sanciones, así como la falta de posibilidad de aplicación práctica de las normas jurídicas son uno de los temas más graves que el sistema nacional de ALD enfrenta actualmente. El estudio es relevante en términos de implicaciones prácticas, puesto que el análisis descriptivo del cuestionario así como la evaluación de la experiencia de Kazakhstan se puede aplicar en diversos países y utilizar para los propósitos educativos. |

In recent decades, the issue of money laundering and terrorism financing has become increasingly international in scope. Today most of the countries realize the necessity to coordinate the efforts and implement concerted actions to prevent and combat this criminal activity both at national and international levels. In this way, one of the measures aimed at fostering the international cooperation has become the development of a unified system of organizations and common standards – so-called legal field or external environment of international Anti-money laundering and countering the financing of terrorism (AML/CFT) system. The idea of creation of a global AML/CFT system originates with long-standing international organizations such as UN, G8, European Council, International Monetary Fund, Basel Committee on Banking Supervision, and etc., as well as specialized international institutions.

Nowadays, the activity of these organizations directed at the establishment of uniform regulations, norms and recommendations constitutes the basis for the international cooperation in AML/CFT field. It is important to note that the central element of a global AML/CFT system is the Financial Action Task Force (FATF), which was founded in 1989 on the initiative of G7 member countries. The FATF’s main instrument used to implement its mandate is the 40+9 AML/CFT recommendations that are revised on average once every five years (International Standards On Combating Money Laundering And The Financing Of Terrorism & Proliferation, 2016).

Today, with Kazakhstan joining World Trade Organization and elimination of some customs restrictions, the risks associated with the transfer of criminal capital abroad with the purpose of laundering significantly increases. As a result, the role of effective national AML/CFT system becomes increasingly important as well.

It is possible to point out the most significant stages in the development of AML/CFT system in the Republic of Kazakhstan. Thus, in 2004, Kazakhstan has become one of the countries that founded the Eurasian Group on Money Laundering. Further, in 2008 the first practical step towards the formation of the country’s national AML/CFT system has been undertaken to create the Financial Intelligence Unit (FIU) of the Committee for Financial Monitoring (CFM) under the Ministry of Finance of the Republic of Kazakhstan in 2008.

In general, a unified AML/CFT system of the Republic of Kazakhstan is based on the Law dated August 28, 2009 “On Countering Legalization (Laundering) of Funds Obtained by Criminal Means and Terrorism Financing” that became effective on March 9, 2010, Laws of the Republic of Kazakhstan, Decrees of the President of the Republic of Kazakhstan, Government Decrees on the issues related to the fight against money laundering and terrorism financing, as well as regulations of other authorized state bodies (The law of the Republic of Kazakhstan “on Counteracting Legalization (Laundering) of Ill-gotten Proceeds and Terrorist Financing” of 28.08.2009).

However, the experts of the European Council, who have approved the First Round Mutual Evaluation Report of the Republic of Kazakhstan in AML/CFT field in June, 2011, consider that the Law as well as entire AML/CFT legislative framework of Kazakhstan do not fully comply with the FATF recommendations (The mutual evaluation reports, AML/CFT Mutual Evaluation Report – 2011). Thus, the country is aimed at the elimination of the problems related to the performance of AML/CFT system that have been identified in the course of the First Round review. In this regard, the study as well as the assessment of the effectiveness of AML/CFT legislation is viewed to be relevant and important, since it might provide sufficient input for the improvement of law-making practice.

The issues related to money laundering and terrorism financing are of particular interest to economists and lawyers, and are heavily investigated in recent decades. Specifically, the term “legalization (laundering) of criminal proceeds” has been put into scientific practice; common patterns for organizing criminal schemes have been revealed, as well as their generic model has been formulated.

American researchers C.L. Karchmer and D. Ruch determine money laundering as a process of concealing illicit income and converting it in other form of payment with the intention to distort the nature of these monetary means presenting illegally obtained income as a legal one (Karchmer and Ruch 1992).

H. Kerner and E. Dach suggest that money laundering can be viewed as a process of facilitating various operations aimed at disguising the origin of those material values that are obtained as a result of committing a crime with the purpose of extraction of regular income (Kerner and Dach 1996).

S. Chernov provides a broader definition for laundering, determining it as any activity, operation or transaction implemented with the purpose of concealing the sources of origin, existence, distribution, redistribution and consumption of monetary means obtained as a result of crime (Chernov 2016).

A. Yemelina, G. Tosunyan, N. Tanyusheva, B. Orlova, O. Rushkina. Y. Truncevsky, and A. Yakovenko examine the problems of legal support and improvement of Russian legislation in AML/CFT field.

Further, the study of the phenomenon of illicit income legalization is constantly conducted by the experts of a number of competent organizations (FATF, EAG, EGMONT). However, it is important to note that different countries tend to have different specific features related to money laundering process, and sometimes the adoption of international standards may conflict with such features.

In the Republic of Kazakhstan (2014), currently the definition of money laundering is implemented to large extent in Article 218 of New Criminal Code of the Republic of Kazakhstan. Thus, the legalization (laundering) of funds and (or) other property obtained by criminal means is referred to as an involvement of illicit funds and (or) other property in legal circulation by facilitating the transactions in the form of conversion and transfer of property derived from criminal offense, concealing and disguising its genuine nature, source, location, disposition, movement, rights with respect to, or ownership of property that it is derived from a criminal offense, as well as possession and use of this property or intermediation in legalization of money and (or) other property obtained by crimes (The Criminal Code of the Republic of Kazakhstan of 3.07.2014).

Experts in AML/CFT field of the second-tier banks of the Republic of Kazakhstan (2015), A. Mukasheva, L. Khamzina, R. Khramovskaya, and M. Shagdarov, under the coordination of international expert K. Bugayec, as well as with the support of state authorities, develop a certified AML/CFT program for financial sector of the country. The program considers the issues related to the international requirements in the examined field, as well as the interrelation of corruption and money laundering. Further, the most common methods used for laundering are presented and vulnerabilities increasing the risk of money laundering are identified (Certification programme for combating the legalization (laundering) of proceeds of crime and financing of terrorism, 2015).

To conduct a comprehensive evaluation of legislation the standard iT11 Test method is applied. This method has been developed by the Ministry of Justice of the Netherlands to assess the efficiency of practical implementation of legal norms and regulations (The Netherlands Table of Eleven).

The survey is conducted using anonymous questionnaire. It should be noted, that no additional explanations are provided to interviewees before the survey.

Respondents are offered a scale from 0 to 10 to answer each question (zero value is interpreted as “difficult to answer”). There are three blocks/groups of respondents as discussed below. Within the group the total score for each question is estimated as an arithmetic mean of all group members.

As for the sample, the elements of the national AML/CFT system include state authorities (as well as specialized authorized bodies) who organize the activity of dependent bodies, namely financial intermediaries (credit institutions, insurance companies, leasing companies and other organizations). The above mentioned elements are interrelated in AML/CFT system and governed by the principles of integrity, divisibility, organization, emergence and hierarchy.

Standard AML/CFT system can be divided into three components or blocks based on object and subject characteristics (Figure 1).

The first block that serves as a foundation of countering system is a financial and supervisory block, where the main participants are financial intermediaries who are involved in criminal schemes in first instance. Within the framework of this unit, the following objectives are met: a) identification of parties engaged in financial transactions and determination of corresponding beneficiaries; b) identification of suspicious transactions that might be related to legalization of criminal proceeds or terrorism financing; c) reporting suspicious transactions to authorized bodies. Following that, the information is transferred to the second block, which is operational and analytical block. Given unit continually monitors and controls transactions executed in the credit and financial sector, receives information from financial intermediaries, and conducts an analysis to verify the presence of any signs of money laundering and terrorism financing (according to the international standards, these functions are assigned to the single central authority of the country, which is FIU). If the fact of money laundering or terrorism financing is determined, the FIU further directs corresponding information to the third block that is represented by law enforcement agencies. Within the framework of this unit, law enforcement authorities verify the information provided by FIU, investigate administrative and criminal cases, and deliver judgement in these cases (Zubkov and Osipov, 2007).

Figure 1. Organizational and Functional Model of National AML/CFT System

Source: compiled by the author based on the Report of the CFM under the Ministry of Finance of the Republic of Kazakhstan (The Committee for financial monitoring of the Ministry of finance of the Republic of Kazakhstan)

Each of the above discussed blocks is offered the test that examines the relationship between AML legislative framework and its effectiveness in modern conditions. Compliance controllers of leading second-tier banks of Almaty and Astana, large insurance companies and microfinance institutions of Almaty act as respondents who represent the first block.

Further, the employees of the Financial Monitoring Department of Almaty form the second group of respondents.

Finally, the third group is represented by the employees of the Unit for Combating Organized Crime and employees of Economic Investigation Service of the State Revenue Department of Almaty.

The total number of interviewed specialists is 40 people. In spite of a relatively small sample size, all three elements of the system are represented in the survey as a special group, which implies that the findings might be perceived as representing the entire national system.

H1: iT11 Test method developed by the Ministry of Justice of the Netherlands for the assessment of the effectiveness of legal norms and provisions and their practical application, allows to evaluate the efficiency of AML legislation in Kazakhstan.

The purpose of the first section of the test is to reveal whether the respondents are aware of the existence of AML/CFT legislation in Kazakhstan, and whether they understand it easily.

Experts representing the analytical and operational block and law enforcement agencies assert that they are familiar with the legislation (10 points and 9 points respectively), whereas the representatives of financial and supervisory block rate their familiarity at 7 points (specifically, 25% of respondents state that they do not know the legislation).

As for the degree of understanding and clarity of the legislation, respondents in operational and analytical group rate this indicator at 10 points, representatives of financial and supervisory unit – at 8 points, and employees of law enforcement agencies – at 9 points. The results of the first section of the test are presented in Figure 2.

Figure 2. Assessment of the Degree of Familiarity with AML/CFT Legislation in Kazakhstan

Source: compiled by the author based on the results of the survey

The second section of the test is intended to reveal the respondents’ opinion toward the issue of compliance with (breach of) the legislation and consequent benefits (costs) expressed as time, money and effort.

Three groups of respondents agree that complying with the legislation requires more costs in terms of time, money and effort, whereas breaking the legislation induces less benefits (Figure 3 – “costs/disadvantages of compliance” indicator).

Bank experts assign high rating (9 points) to the disadvantages that the breach of legislation yields. As for the experts of financial and supervisory block, they consider that it requires more time, money and effort to comply with the norms of legislation, rather than break them (Figure 3 – “costs/disadvantages of compliance” indicator rated at 5 points). At the same time, the benefits associated with the breach significantly lower than the costs entailed by the compliance (Figure 3 – “benefits/advantages of breach” indicator rated at 2 points). Taking into account that the legislation violation might lead to considerable disadvantages (Figure 3 – “costs/disadvantages of breach” indicator rated at 9), experts tend to infer that the benefits from compliance significantly exceed those from breach (Figure 3 – “benefits/advantages of compliance” indicator rated at 8 points).

Experts from the operational and analytical block assign the highest rating of 10 points to the “costs/disadvantages of compliance” indicator, whereas “costs/disadvantages of breach” is assessed at 6 points. In particular, they consider that the compliance with the Law requires significant costs in terms of money. Indeed, in case of any violations they are responsible for transmitting information to law enforcement agencies; in addition to that, they tend to participate in the development and implementation of programs on international cooperation in AML/CFT field; furthermore, they have to develop and carry out activities to prevent violations of AML legislation. As a result, operational and analytical block represented by CFM allocates significant funds to ensure an uninterrupted execution of the above-mentioned functions and therefore to comply with the existing legislation. With respect to the “benefits/advantages of compliance” and “benefits/advantages of breach” indicators, CFM experts rated them at 4 points and 2 points respectively. In general, the violations might be advantageous in terms of the improvement of methods, approaches and risk assessment toward identification of suspicious transactions and operations.

As for law enforcement group, comparing the benefits and costs of legalization and its evasion, they note that the costs/disadvantages of breaking the legislation (9 points) are significantly higher than benefits/advantages it induces (3 points). The results of the second section of the test are presented in Figure 3.

Figure 3. Assessment of Benefits Associated with Compliance/Breach of AML/CFT Legislation in Kazakhstan

Source: compiled by the author based on the results of the survey

Respondents agree that the compliance with the legislation requires additional costs in terms of time, money and effort, but at the same time they consider that lawbreakers tend to face significant disadvantages and costs. Thus, in general compliance induces more benefits and advantages rather than breach.

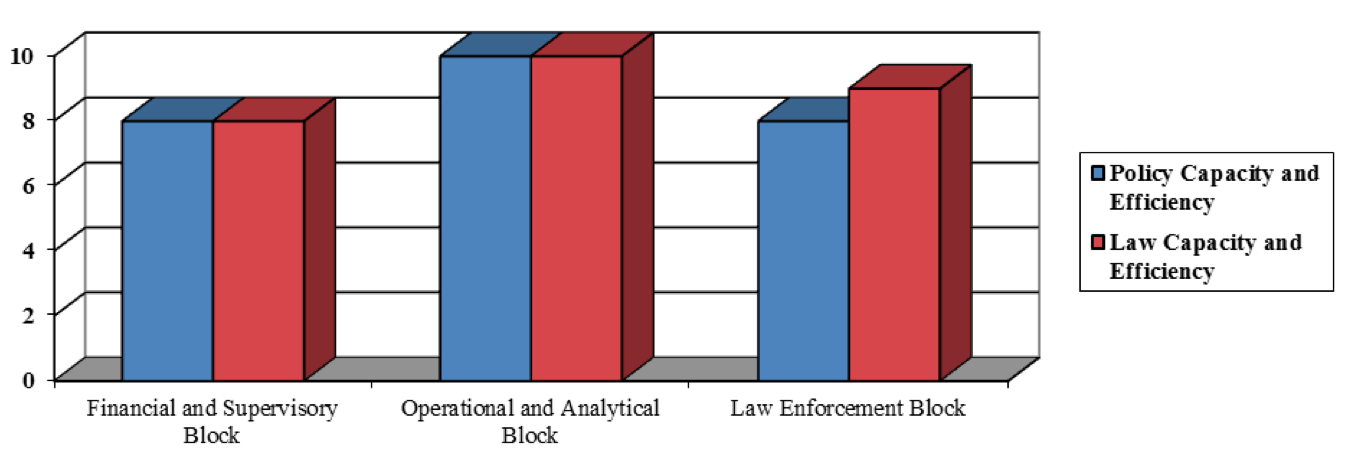

The third section of the test is based on the evaluation of the national countering system capacity.

Respondents in all three groups give high rating to the practical implementation of the country’s policy in AML/CFT field (financial and supervisory block – 8 points, operational and analytical block – 10 points, law enforcement block – 8 points), as well as to the norms (laws and regulations) that are used to execute this policy (financial and supervisory block – 8 points, operational and analytical block – 10 points, law enforcement block – 9 points). The results of the third section of the test are presented in Figure 4.

Figure 4. Assessment of the Capacity of AML/CFT System

Source: is compiled by the author based on the results of the survey

The fourth section of the test considers the degree of respondents’ loyalty with respect to the legislation.

In this regard, the highest degree of readiness to abide the laws, norms and regulations is demonstrated by the representatives of law enforcement unit (“loyalty to the law” indicator rated at 9,7 points), whereas both financial and supervisory block and operational and analytical group assess “loyalty to the law” as above average, namely at 8 points. As for own cultural and religious values, the results are indicative of the fact that their presence does not impede the representatives of operational and analytical block and officials of law enforcement agencies to adhere to the law (“priority of own values” indicator rated at 10 points and 9 points respectively). For the experts from financial and supervisory block personal values tend to be more important than laws and norms (8 points). The results of the fourth section of the test are presented in Figure 5.

Figure 5. Assessment of Respect to Authority

Source: compiled by the author based on the results of the survey

The fifth section includes two questions. The first question is focused on social control and formulated as follows: does the community (neighbours, colleagues, competitors, relative and etc.) that becomes aware of the violation of legislation tend to correct lawbreakers’ behavior? The second question is aimed at assessing the role of horizontal supervision. In particular, respondents are asked whether they see the horizontal non-governmental supervision (e.g. financial auditing, disciplinary codes, auditing for certification and etc.) as an additional form of control over the compliance with the legislation.

Even though experts in all three groups admit that there is a certain positive impact associated with the social control, representatives of financial and supervisory unit, as well as respondents from operational and analytical block believe that in general, community does not tend to interfere in the affairs related to the breach of the legislation (5 points and 4 points respectively). Law enforcement officials, on the other hand, suggest that community tend to participate in the affairs related to violation of the AML legislation (8 points).

Therefore, the fact that law enforcement officials assess the tendency within the community to report on breaches at 8 points indicates that the existence of social control is recognized by them, as opposed to banking sector and operation and analytical unit.

The results of the third section of the test are presented in Figure 6.

Figure 6. State of Non-Governmental Control in AML/CFT Field in Kazakhstan

Source: compiled by the author based on the results of the survey

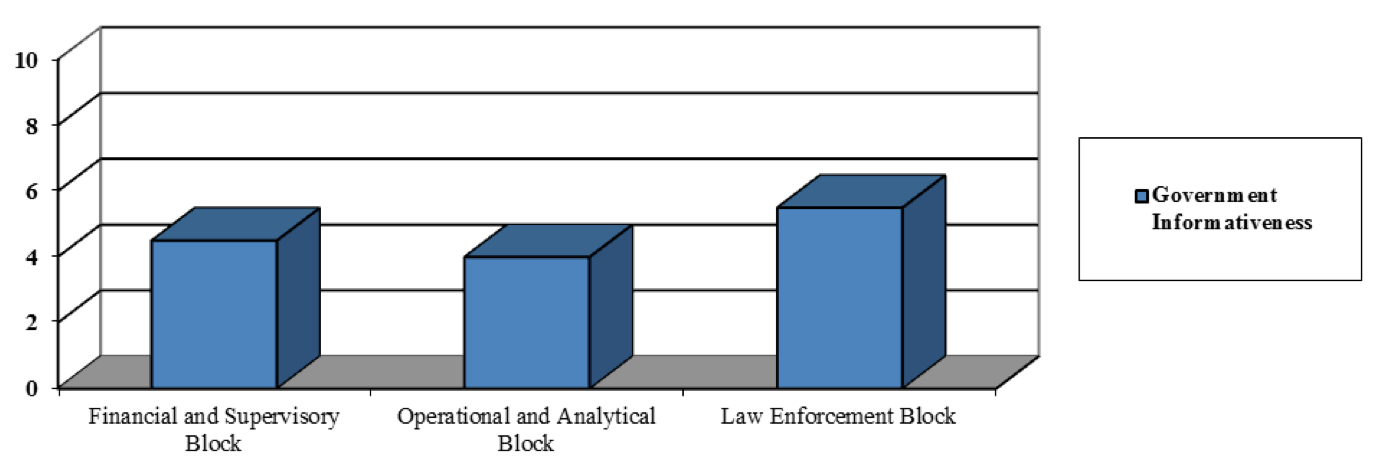

The sixth section is aimed at evaluation of the effectiveness of horizontal non-governmental control in AML/CFT field. To assess the effectiveness of such control, the analysis of the probability that government becomes aware of the violation of AML legislation through non-governmental sources is conducted.

Respondents consider that community and non-governmental bodies of supervision do not tend to inform government on revealed violations in the field of money laundering (rating by financial and supervisory block is 4,5 points, rating by operational and analytical block is 4 points, and rating by law-enforcement block is 5,5 points). The results of the third section of the test are presented in Figure 7.

Figure 7. Assessment of the Effectiveness of Non-Governmental

Control with respect to Countering Money Laundering

Source: compiled by the author based on the results of the survey

In accordance with the iT11 methodology, the seventh section of the test examines the role of records inspections and physical inspections.

Financial and supervisory block assesses the probability of inspections related to AML activities relatively low (6 points for the probability of records inspections and 4 points for the probability of physical inspections). Such results requires careful consideration, since according to the Law, in Kazakhstan banking sector is charged with the responsibility to conduct a total inspection of legal documentation of customers, as well as total investigation of all bank operation and transactions of customers. Moreover, banks must carry out regular inspections in relation to cash discipline of their customers, namely conduct on-site verification of the documents confirming receipt/payment of cash by company. Thus, the state AML system is implemented exactly through the inspection of payment and other documentation provided to banks and other participants of financial monitoring by customers in order to execute corresponding transactions.

Respondents from operational and analytical group rate the probability of records inspections at 9 points, whereas the probability of physical inspections is assessed at 4 points. Relatively high rating assigned to records inspections as opposed to the rating of financial and supervisory block, is probably due to the fact that FIU tend to conduct documentation reviews and verification more frequently than other sectors. Indeed, all reports on financial monitoring entities are thoroughly verified and further processed by operational and analytical block. It is logical, therefore, that the probability of records inspection exceeds the probability of physical inspections.

Law enforcement officials assign 6 points to the probability of records inspection and 9 points to the probability of physical inspection. It implies that document verification and examination are less important in the practice of law enforcement agencies. The results of the third section of the test are presented in Figure 8.

Figure 8. Probability of Inspection Related to AML activities

Source: compiled by the author based on the results of the survey

The purpose of the eighth section of the test is to evaluate the probability of detecting the violations in AML/CFT field in the course of inspections. In this regard, experts are proposed two sets of questions.

The general idea of the first set of questions can be expressed as follows: if one assumes that someone breaks the AML legislation, what is the probability of detecting such violations by state authorities in the course of records inspections?

The general idea of the second set of questions can be expressed as follows: if one assumes that someone breaks the AML legislation, what is the probability of detecting such violations by state authorities in the course of physical inspections?

Evaluation of inspections completeness, i.e. the adequacy of information available to those who conduct records inspections, basically reflects the experts’ evaluation of their probability (the seventh section of the test). Specifically, representatives of financial and supervisory block rate the completeness of inspections at 4 points, experts of operational and analytical block – at 7 points, and law enforcement officials – at 5 points.

The ease, with which inspectors can detect the violations of AML legislation in the course of records inspections is assessed in the following way: financial and supervisory unit – 5 points; operational and analytical group – 3 points, and law enforcement agencies – 5,5 points. In general, it might be assumed that respondents or entities carrying out records inspections do not possess sufficient authority for gaining access to the documents, based on which it is possible to establish unambiguously the fact of violation. Alternatively, it might be the case that the documents, access to which is provided by current legislation and by-laws of various government departments, including National Bank, are not sufficient to detect all violations related to money laundering.

Banking sector (financial and supervisory block) that does not have power to ascertain the authenticity of the documents presented by customers, suggests that in three cases out of ten documents might be falsified (“probability of falsification” indicator), whereas operational and analytical unit and law enforcement agencies, i.e. the institutions that are familiar with counterfeiting technologies and their detection, lower the level of falsification to 2 cases.

As a result, there is not much consensus among different groups of respondents on the overall effectiveness of records inspection in terms of fight against money laundering (“probability of detection” indicator). Experts of financial and supervisory block assess the probability that each fact of AML violation is detected in the course of records inspection at 4 points, whereas operational and analytical unit and law enforcement agencies evaluate such probability at 8 points and 5 points respectively. As stated above, the employees of operational and analytical group tend to believe that violations might be revealed through records inspection, while two other blocks do not agree with this notion.

Figure 9. Effectiveness of Records Inspections in AML/CFT Field

Source: compiled by the author based on the results of the survey

As for physical inspections, respondents in all three groups agree that certain factors (for instance, time and place) might reduce the efficiency of inspections (“restrictions in inspections” indicator). However, the significance of such factors is assessed in different manner (3 points for financial and supervisory block; 2,5 points for operational and analytical block; and 7 points for law enforcement agencies). The probability of violation detection in the course of physical inspections is also assessed as below average (except for law enforcement group). The results of the third section of the test are presented in Figure 9 and 10.

Figure 10. Effectiveness of Physical Inspections in AML/CFT Field

Source: compiled by the author based on the results of the survey

The ninth section of the test is related to the assessment of particular aspects of the policy implemented in AML/CFT field.

In given section, one can note relatively low assessment of expertise or qualification of those who conduct inspections (“expertise of inspectors” indicator). Of particular concern is the respond of the experts in the issues related to the fight against money laundering, who represent financial and supervisory block as well as operational and analytical group (2 points and 4 points respectively). At given stage of testing, it remains outstanding whether such results refer to the experts’ self-assessment or reflect their opinion with respect to other supervisors and controllers in AML/CFT field. The results of the third section of the test are presented in Figure 11.

Figure 11. Impact of Certain Aspects of the Effectiveness of AML/CFT State Policy

Source: compiled by the author based on the results of the survey

The tenth section of the test is intended to assess the role of the system of sanctions in motivating the compliance with legislation in the field of combating money laundering.

Respondents in all three groups believe that offenders of the countering legislation tend to assume the risk of being punished (“risk of sanctions” indicator is equal to 5 points in financial and supervisory block, 6 points in operational and analytical block, and 8,5 points in law enforcement block).

In the same manner all three blocks assess the “probability of sanctions” indicator. In particular, 7 points in financial and supervisory block, 6 points in operational and analytical block, and 6 points in law enforcement block. Thus, the degree of probability that sanctions might be imposed to the offenders is viewed to be above average. The results of the third section of the test are presented in Figure 12.

Figure 12. Assessment of the Role of Sanctions in AML/CFT System

Source: compiled by the author based on the results of the survey

The eleventh section of the test is called to assess the role of consequences associated with sanctions that are applied to the offenders in AML/CFT system.

Experts of financial and supervisory sector state with certainty that they know what sanctions are applied to the offenders of the countering legislation (“familiarity” indicator is rated at 8 points), consider these sanctions, as well as consequent tangible and intangible disadvantages, as severe (“severity” and “costs/disadvantages” indicators both are rated at 8 points), and attach great importance to the publicity of the sanctions (“publicity” indicator is rated at 9 points). Further, according to financial and supervisory group, the greatest weakness of sanctions in AML/CFT system is viewed to be slowness in their execution (indicator “speed” rated at 5 points). Thus, the results obtained for this group of respondents are consistent with the role that financial and supervisory sector performs in the national system for combating money laundering.

Sanctions applied to the offenders of the countering legislation are well known among the experts of operational and analytical block (10 points), who consider them to be not severe (2,5 points) and assess the speed of their execution as low (2 points). At the same time, respondents in this group note that disadvantages entailed by sanctions as well as the issue of publicity are important and should be taken into consideration (both factors rated at 6 points).

Law enforcement officials are also familiar with the forms of sanctions applied to the offenders of AML legislation (8 points). They tend to assign average rating to the disadvantages related to sanctions (5 points) and consider the speed, with which sanctions are executed to be low (4 points). As for publicity, it is admitted to be important and assessed at 8 points.

The results of the third section of the test are presented in Figure 13.

Figure 13. Assessment of the Effectiveness of Sanctions in AML/CFT System

Source: compiled by the author based on the results of the survey

In general, the respondents in all three groups note that they comprehend the aims and objectives of AML legislation; however, its methods are less clear to the survey participants. Further, it is possible to infer that the compliance with AML legislation is associated with additional costs in terms of time, money and effort. At the same time, the breach of law induces significant costs and disadvantages. But overall, it is more advantageous to follow the legislation rather than violate it. As for the general state policy in AML/CFT field, it is considered to be capable and efficient.

All respondents including professional controllers (experts from banking sector and CFM employees) as well law enforcement officials admit their readiness to comply with AML laws, norms and regulations. However, the degree of such readiness differs across the groups and in some instances personal values appear to be more significant than laws and norms (for financial and supervisory block, the number is 20% of cases).

With respect to non-governmental control, survey participants note that they are aware with such forms of control and agree that it plays positive practical role in the national AML system. In general, they consider that the presence of non-governmental control is quite useful. However, it must be noted that the respondents consider that population and non-governmental structures do not tend to refer to specialized bodies when they have information related to the violations in AML field. At the same time, they do not exclude such possibility completely.

According to the results of survey, individual or company involved in the money laundering process is likely to be inspected by official services. However, the degree of probability is assessed differently by different groups.

As for the effectiveness of inspections, there is not much consensus among different groups of respondents on the overall effectiveness of records inspections as well as physical inspections. In this regard, respondents, except those representing law enforcement block, consider that many forms of money laundering cannot be detected in the course of physical inspections (indicator “completeness of inspections). Law enforcement officials, on the other hand, assign high ratings to the effectiveness of on-site inspections. High evaluation by this group might be attributable to the fact that the activity of law enforcement agencies is related to the investigation of committed economic crimes that is conducted at the place of offender and includes a set of different measures, such as search, review and examination, detention and interrogation, and etc.

Further, it must be noted that the frequency of inspections does not have significant impact on the behaviour of AML legislation offenders, whereas selective inspections allow to detect more violations than regular inspections do. The results also indicate that the most important factor that hinders the efficiency of state AML policy is low expertise and qualification of supervising bodies.

Finally, survey participants consider that the offenders of AML legislation are exposed to the risk of sanctions. The results are indicative of the fact that in general, the system of sanctions is viewed to be quite effective for all blocks within AML system. However, according to CFM employees and law enforcement officials the degree of severity and the speed of execution of sanctions are inadequate.

Based on the results of the analysis of the survey conducted for the purpose of assessing the effectiveness of current AML/CFT legislation in Kazakhstan, it is possible to draw general conclusions that reflect its major strengths and weaknesses (Table 1).

Table 1. Strengths and Weaknesses of Current AML/CFT System in Kazakhstan

# |

Aspect of the Research |

Weaknesses |

Strengths |

1 |

Familiarity with Legislation |

Some representatives of financial and supervisory block (pawnshops, microfinance institutions, and audit organizations) are not familiar with the legislation, whereas supervisors do not fully comprehend the methods, through which the legislation operates. |

Employees of the Committee for Financial Monitoring and law enforcement officials know the legislation. |

2 |

Costs of Compliance with the Norms of Legislation

|

Respondents consider that lawbreakers face significant costs/disadvantages. |

Respondents agree that the compliance with the legislation is more advantageous than its violation. |

3 |

Capacity of State Policy for Countering Money Laundering |

Lack of possibility for practical implementation of legal norms. |

Feasibility of state AML policy. |

4 |

Respect to Authority |

Individuals and private businesses are not ready to comply with the legislation fully. |

Experts of the Committee for Financial Monitoring and law enforcement officials are not much hindered by their own values. |

5 |

Non-Governmental Control in the System for Countering Money Laundering |

Financial and supervisory group as well as operational and analytical block consider that social control is insignificant factor within AML/CFT system. |

Law enforcement officials admit positive practical role of non-governmental control in the national AML/CFT system. |

6 |

Effectiveness of Non-Governmental Control in the System for Countering Money Laundering |

Population and non-governmental structures do not tend to refer to specialized bodies in case of emergence of some information on violations of the legislation. |

Experts do not deny such probability completely. |

7 |

Inspections |

The probability that lawbreakers will be exposed to inspections is low. |

There still exists some degree of the probability that lawbreakers will be exposed to inspections. |

8 |

Detection of Violations of the Legislation in Course of Official Inspections |

Physical inspections do not lead to detection of violations; records inspections allow to reveal violations, however the degree of probability in this case is relatively low. |

In the course of records inspections it is possible to detect legislation violations. |

9 |

Impact of Certain Aspects

|

The frequency of inspections does not significantly affect the number of detected violations; extremely low expertise and qualification of supervisors and controllers. |

Selective inspections considerably increase the probability of violations detection. |

10 |

System of Sanctions |

The risk of sanctions is relatively low. |

Respondents admit that lawbreakers are exposed to the risk of sanctions. |

11 |

Disadvantages of Sanctions |

The severity and speed of sanctions are not adequate. |

The system of sanctions is quite effective in financial and supervisory block. |

Source: is compiled by the author based on the results of the survey |

|||

The results of hypothesis testing are as follows:

H1: iT11 Test method developed by the Ministry of Justice of the Netherlands for the assessment of the effectiveness of legal norms and provisions and their practical application, allows to evaluate the efficiency of AML legislation in Kazakhstan. Thus, the hypothesis is confirmed.

Certification programme for combating the legalization (laundering) of proceeds of crime and financing of terrorism. 2015. Astana: Organization for Security and Co-operation in Europe

Chernov, S., 2016. The laundering of criminal capital as a threat to the security of russia's economy. Vestnik university (state university of management), 2 (economics: problems, solutions and prospects). Date Views 02.05.2017 www.cyberleninka.ru/article/n/otmyvanie-kriminalnogo-kapitala-kak-ugroza-bezopasnosti-ekonomiki-rossii.

International Standards On Combating Money Laundering And The Financing Of Terrorism & Proliferation. The FATF Recommendations. 2016. Date Views 02.05.2017 www.fatf-gafi.org/media/fatf/documents/recommendations/pdfs/FATF_Recommendations.pdf.

Karchmer, C.L. and D. Ruch, 1992. State and Local Money Laundering Control Strategies, U.S. Department of Justice, Office of Justice Programs, Washington. National Institute of Justice.

Kerner, H. and E. Dach, 1996. Money laundering. Guide to current legislation and legal practice. Moscow: International Relations.

The Committee for financial monitoring of the Ministry of finance of the Republic of Kazakhstan. Date Views 02.05.2017 www.kfm.gov.kz/assets/files/docs/en/informative_bulletinn_eng.pdf

The Criminal Code of the Republic of Kazakhstan of 3.07.2014 Volume 226-V.

The law of the Republic of Kazakhstan “on Counteracting Legalization (Laundering) of Ill-gotten Proceeds and Terrorist Financing” of 28.08.2009 Volume 191-IV.

The mutual evaluation reports, AML/CFT Mutual Evaluation Report - 2011. Date Views 02.05.2017 www.eurasiangroup.org/mers.php.

The Netherlands Table of Eleven (T11). Date Views 02.03.2017 www.it11.nl/.

Zubkov, V.A. and S.K. Osipov, 2007. Russian Federation in the International System for Combating Legalization (Laundering) of Criminal Proceeds and Terrorism Financing. Moscow: Gorodec, pp: 752.

1. University of International Business, 8a Abay Street, 050010 Almaty, Kazakhstan. Email: bkalimuratkyzy@bk.ru