Vol. 39 (Number 14) Year 2018 • Page 33

Hasan PAKDAMAN 1

Received: 30/11/2017 • Approved: 05/01/2018

4. Analytical model of research and method of measuring variables

6. Society and statistical sample

7. The criteria for determining bankruptcy

ABSTRACT: Recent corporate bankruptcies at the international level show the need for tools to assess the financial strength of companies. One of these tools is the use of bankruptcy prediction patterns. Considering this necessity, the main goal of this research is to determine the efficiency of Altman, Springate, Zmijewski and Grover models in prediction the bankruptcy status of companies admitted to Tehran Stock Exchange and compare the results of the models, which in order to achieve this goal, eight hypotheses have been developed. The statistical population of this study is 35 companies from textile and ceramic tile companies listed in Tehran Stock Exchange between 2011 and 2016. In this research, after determining the normal distribution of data using correlation tests, each of the research hypotheses has been tested and regression test has been used to answer the research hypotheses. Correlation test was also used to examine the significance of each bankruptcy model and for fitting the research model; multiple linear regression was used for panel data. The purpose of this study was to investigate the significance of Altman, Springate, Zmijewski and Grover bankruptcy models in Tehran Stock Exchange and to investigate which models have better ability to predict corporate financial crises, as a result, using this model, the financial status of the companies, as well as the issue of the continuity of their activities, can be reviewed and the quality of decision making of stakeholders and stakeholders is promoted. The findings of the research indicate that in the high bankruptcy models, Grover, Altman, Springate and Zmijewski models are better able to predict financial crises. |

RESUMEN: Las recientes bancarrotas corporativas a nivel internacional muestran la necesidad de herramientas para evaluar la solidez financiera de las empresas. Una de estas herramientas es el uso de patrones de predicción de bancarrota. Teniendo en cuenta esta necesidad, el objetivo principal de esta investigación es determinar la eficiencia de los modelos de Altman, Springate, Zmijewski y Grover en la predicción del estado de bancarrota de las empresas admitidas en la Bolsa de Teherán y comparar los resultados de los modelos, que para lograr esto objetivo, se han desarrollado ocho hipótesis. La población estadística de este estudio es de 35 empresas de empresas textiles y de azulejos que cotizan en la Bolsa de Teherán entre 2011 y 2016. En esta investigación, después de determinar la distribución normal de datos mediante pruebas de correlación, cada una de las hipótesis de investigación ha sido probada y regresada la prueba se ha utilizado para responder a las hipótesis de investigación. La prueba de correlación también se utilizó para examinar la importancia de cada modelo de quiebra y para ajustar el modelo de investigación; regresión lineal múltiple se utilizó para los datos del panel. El propósito de este estudio fue investigar la importancia de los modelos de bancarrota Altman, Springate, Zmijewski y Grover en la Bolsa de Teherán e investigar qué modelos tienen una mejor capacidad para predecir crisis financieras corporativas, como resultado, utilizando este modelo, el estado financiero de las empresas, así como la cuestión de la continuidad de sus actividades, pueden ser revisadas y se promueve la calidad de la toma de decisiones de los interesados y las partes interesadas. Los hallazgos de la investigación indican que en los modelos de alta bancarrota, los modelos de Grover, Altman, Springate y Zmijewski son más capaces de predecir las crisis financieras. |

The rapid growth of science and technology in the present era has caused the complexity of human relations, especially economic and commercial relations, with the past. The advancement of science and technology has brought the economy and business into a new stage, so that former small businesses and enterprises have become public and even multinational corporations around the world. This shift in the economy and business has made it possible for small companies to get out of competition, and other big companies that cannot compete with other companies in their industry, face the problem of stopping operations or financial crises and eventually bankruptcy. On the other hand, the competition cycle, which is itself the cause of the growing number of companies (in terms of the number of shareholders, expansion of volume and scope), the distance between the suppliers of funds (shareholders, investors, creditors and lenders) and management of the company in terms of control And increased direct oversight of the company. The aforementioned factors caused concern to the suppliers of financial resources of the companies. In the last 40 years, the topic of "corporate bankruptcy prediction" has become one of the major research topics in the financing literature. A lot of scientific research has tried to discover the best models of bankruptcy prediction based on available information and statistical techniques and not only in developed countries, but also in developing countries, researchers have made great efforts to build new models, and have provided various forecasting models for different economic and financial environments.

Today, rapid advances in technology and environmental change have accelerated the economy, and the increasing competition of enterprises has limited the profit gains and increased the likelihood of bankruptcy. Owners, managers, investors, business partners and creditors are as much interested in corporate governance as bankruptcy firms, as government agencies. In this way, financial decision making has become more strategic than before. The bankruptcy prediction models are in fact a combination of financial ratios, which have been tested by experienced analysts over many years in different parts of the world and presented to the world of science and knowledge. Altman, Springate, Zmijewski and Grover, using scientific-experimental methods, have succeeded in creating models of bankruptcy prediction that are well-known in their own name. In this research, bankruptcy prediction of companies is investigated using the above models, in order to determine the reliability of the results of these models in Tehran Stock Exchange and to answer the main question of the research and "which the Altman, Springate, Zmijewski, or Grover bankruptcy prediction models are better able to predict the financial crisis in the Tehran Stock Exchange?"

In recent decades, the topic of "company’s bankruptcy prediction" has become one of the major research topics in the financing literature. Researchers have been working hard to find the best models of bankruptcy predictions based on available information and statistical techniques. Each of the researchers in the above-mentioned research has come to the conclusion that some of them are briefly cited here:

- Altman is the first person to submit multivariate bankruptcy prediction models. Using the multiple differentiation analysis method and using financial ratios as independent variables, he sought bankruptcy predict of companies. He introduced his famous model called z-score model, which is known as commercial bankruptcy prediction. He chose 5 ratios out of the 22 financial ratios he considered the best ratios to predict bankruptcy. Altman, with the combination of these five ratios, presented a pattern that he believed was the best.

- Springate continued the Altman study and conducted an audit analysis to select 4 appropriate financial ratios, including working capital for total assets, profit before interest and taxes on total assets, pre-tax profit before current debt, sales to total assets, out of 19 proportions that used the best ratios to identify healthy and bankrupt companies, After testing in 40 companies, it produced a model that achieved 92.5% of the correct prediction (Springate, 1978).

- Ohlson used a logistic analysis method to create his own model and tested his sample in 105 insolvent companies and 2058 non-breakdown companies. In his model, he used nine independent variables; his pattern reached 85.1% of the correct prediction (Ohlson, 1980).

- Zmijewski used the liquidity, leverage, and performance ratios to present a suitable model. These ratios were not based on the theory chosen, but more based on his experiences in previous studies. The Zmijewski model was based on a sample of 40 bankrupt companies and 800 non-abandoned manufacturing companies and achieved 86.14% correct prediction (Zmijewski, 1984).

- After studying past studies, Shirata found that the results of previous research in Japan were not generalizable due to the limited number of samples for manufacturing companies with almost identical capital. In order to overcome these weaknesses, Shirata provided a comprehensive model to predict bankruptcy for all kinds of manufacturing, trading and service companies with any amount of capital. Shirata used a multiple differentiation analysis method for her model. His sample consisted of 686 bankrupt companies and 300 non-bankrupt companies between 1986 and 1996. Research results showed that his model could predict bankruptcy with a precision of over 86.14 percent (Shirata, 1998).

- In his research, Soleymani Amiri entitled "Review of Bankruptcy Predictor Indicators in Iran's Environmental Conditions", presented a model for predicting bankruptcy in Iran. His model included 15 independent variables, some of which were financial ratios and some qualitative variables. The z-value is closer to zero in this model, the probability of bankruptcy of companies is higher, and the closer the z value to one is, the lower the probability of bankruptcy of companies (Mehrani, 2005).

- Asgari (2008), in his research, examined the performance of Springate, Zougin and Falmer patterns in predicting bankruptcy of companies admitted to Tehran Stock Exchange, And concluded that, at a 90% confidence level, Springate model has a more accurate prediction of companies bankruptcy than Falmer and Zougin patterns.

In the analysis, the research variables are divided into two groups with independent and dependent nature. In this research, the independent variable is Altman, Springate, Zmijewski and Grover predictions of the bankruptcy prediction models, and the dependent variable is the status of the companies in terms of financial capability, which are classified as either successful or bankrupt.

X1 = Total assets / Working capital

X2 = Total assets / Accumulated profit

X3 = Total assets / Income before interest and taxes

X4 = Book value of debt / Market value of equity

X5 = Total assets / Total sales

A = ratio of working capital to total assets

B = ratio of profit before deduction of interest and expenses on total assets

C = ratio of net profit before tax to current debt

D = ratio of sales to total assets

X1 = Net income ratio to total assets

X2 = ratio of total debt to total assets

X3 = ratio of current assets to current debt

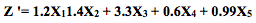

X1 = total assets / working capital

X2 = Total assets / income before interest and taxes

ROA = Total Assets / Net Profit

Table1

Evaluate patterns

Classification of hypotheses |

Significant condition |

Strong Significantly |

P<%1 |

Average Significantly |

%1≥P<%5 |

Weak Significantly |

%5>P≤%10 |

No Significantly |

P<%10 |

First hypothesis: The Altman model is significant as a prediction model for financial crises.

Second hypothesis: The Springate model is significant as a prediction model for financial crises.

Third hypothesis: The Zmijewski model is significant as a prediction model for financial crises.

Fourth hypothesis: The Grovere model is significant as a prediction model for financial crises.

Fifth hypothesis: The Altman's model has a better ability to predict financial crises than Springate, Zmijewski and Grovere models.

Sixth hypothesis: The Springate model has a better ability to predict financial crises than Altman, Zmijewski and Grovere models.

Seventh hypothesis: The Zmijewski model has a better ability to predict financial crises than Altman, Springate, and Grovere models.

Eighth hypothesis: The Grovere model has a better ability to predict financial crises than the Altman, Springate, and Zmijewski models.

The statistical population of this research is textile and ceramic tile companies accepted in Tehran Stock Exchange. In this study, to fit bankruptcy prediction patterns, there was a need for information about two groups of bankrupt and non-bankrupt companies. Textile companies were selected as bankrupt companies because of previous research in this area as bankrupt companies. Ceramic tile and ceramic companies were also considered to be a sample of uncompromising companies, due to past research, due to the monopoly of products, and the low tensile strength of products as a medium-sized bankruptcy industry. Due to lack of access to accurate information about financial statements of insolvent and non-bankrupt companies outside Tehran Stock Exchange, the statistical population of this research is selected among the companies accepted in Tehran Stock Exchange. In this way, all companies in the statistical community that have the following conditions are included in the statistical sample:

A) Before the year 2011, the Tehran Stock Exchange has been accepted.

B) Submitted their financial statements for the period from 2011 to 2016.

In order to categorize companies into two categories of bankrupt and non-defective, the default of Article 141 of the Commercial Code has been used. According to this article: "If at least half of the company's capital is lost due to losses, the board of directors is required to immediately invite the owner of the stock to the Extraordinary General Assembly in order to resolve the issue of the dissolution or survival of the company." Thus, if a company is subject to article 141 of the law for the period from 2011 to 2016 years, it is bankrupt; otherwise, the company is non- bankrupt.

Table 2

Results of the Altman Model Estimation

|

Coefficients |

Standard deviation |

t Statistics |

Probability |

C(1) |

0.51 |

0.43 |

-1.17 |

0.23 |

C(2) |

0.98 |

0.03 |

27.79 |

0.000 |

C(3) |

-0.006 |

0.02 |

-0.24 |

0.80 |

C(4) |

1.16 |

0.32 |

3.57 |

0.000 |

C(5) |

0.15 |

0.27 |

0.57 |

0.56 |

C(6) |

1.12 |

0.34 |

3.24 |

0.001 |

Determination Coefficient (R2) |

0.92 |

|||

Durbin-Watson statistic |

1.56 |

|||

According to the results of Table 2, the variables X1, X3 and X5 are significant in the Altman model. On the other hand, the explanation coefficient is 0.92, which states that the variables in the model can represent 92 percent of the variations in the Altman model. Also, since the value of the Durbin-Watson statistic is between 1.5 and 2.5, we can assume the independence of regression error sentences. As a result, the model has a good fit for goodness in terms of the independence of the sentences.

Table 3

Results of the Springate Model Estimation

|

Coefficients |

Standard deviation |

t Statistics |

Probability |

C(1) |

1.24 |

0.78 |

1.57 |

0.11 |

C(2) |

1.59 |

0.09 |

16.31 |

0.000 |

C(3) |

5.34 |

0.93 |

5.73 |

0.000 |

C(4) |

2.69 |

2.82 |

0.95 |

0.341 |

C(5) |

0.03 |

0.21 |

0.16 |

0.866 |

Determination Coefficient (R2) |

0.84 |

|||

Durbin-Watson statistic |

1.62 |

|||

According to the results obtained in Table 3, only variables A and B are significant in the Springer model. On the other hand, the explanation coefficient obtained is equal to 0.84, which states that the variables in the model can represent 84 percent of the variations in the Springate model. Also, since the value of the Durbin-Watson statistic is between 1.5 and 2.5, we can assume the independence of regression error sentences. As a result, the model has a good fit for goodness in terms of the independence of the sentences.

Table 4

Results of the Zmijewski Model Estimation

|

Coefficients |

Standard deviation |

t Statistics |

Probability |

C(1) |

6.98 |

5.05 |

1.38 |

0.16 |

C(2) |

1.33 |

2.99 |

0.44 |

0.65 |

C(3) |

-1.15 |

0.33 |

3.48 |

0.000 |

C(4) |

-5.16 |

4.42 |

-1.16 |

0.24 |

Determination Coefficient (R2) |

0.09 |

|||

Durbin-Watson statistic |

1.56 |

|||

According to the results obtained in Table 4, only the X2 variable in the Zmijewski model is significant. On the other hand, the explanation coefficient is 0.90, which states that the variables in the model can only show 9% of the variations in the Zmijewski model. Also, since the value of the Durbin-Watson statistic is between 1.5 and 2.5, we can assume the independence of regression error sentences. As a result, the model has a good fit for goodness in terms of the independence of the sentences.

Table 5

Results of the Grovere Model Estimation

|

Coefficients |

Standard deviation |

t Statistics |

Probability |

C(1) |

1.85 |

0.08 |

21.73 |

0.000 |

C(2) |

-0.99 |

0.01 |

-95.33 |

0.000 |

C(3) |

0.89 |

0.08 |

10.42 |

0.000 |

C(4) |

0.003 |

0.002 |

1.54 |

0.125 |

Determination Coefficient (R2) |

0.98 |

|||

Durbin-Watson statistic |

2.08 |

|||

According to the results obtained in Table 5, all variables except ROA variables are significant in the model. On the other hand, the explanation coefficient is 0.98, which states that the variables in the model can represent 98% of the variations in the Grovere model. Also, since the value of the Durbin-Watson statistic is between 1.5 and 2.5, we can assume the independence of regression error sentences. As a result, the model has a good fit for goodness in terms of the independence of the sentences.

Table 6

Comparison of Estimated Models

Model |

Determination Coefficient (R2) |

Priority |

Altman |

0.92 |

2 |

Springate |

0.84 |

3 |

Zmijewski |

0.09 |

4 |

Grovere |

0.98 |

1 |

In order to confirm or reject the fifth to eighth hypotheses, according to Table 6 and the coefficient of explanation obtained for each Altman, Springate, Zmijewski and Grovere models, it is stated that: Grover, Altman, Springate, and Zmijewski have the better ability to predict financial crises, respectively.

In this research, we compared the ability of Altman, Springer, Zmijewski and Grover models to predict the bankruptcy of companies admitted to the Tehran Stock Exchange in the period from 2011 to 2016. For this purpose, the main hypothesis was considered and for the purpose of testing each hypothesis, two statistical assumptions H0 and H1 were defined. As a result, the hypothesis of H0 in each of the eight hypotheses is rejected by the hypothesis group and the assumption of H1 in each of the eight hypotheses is confirmed by the hypothesis group. According to the results of the Altman model, which is shown in Table 2, the variables X1, X3 and X5 are significant in the Altman model. On the other hand, the explanation coefficient is 0.92, which states that the variables in the model can represent 92 percent of the variations in the Altman model. According to the results obtained in Table 3, only variables A and B are significant in the Springer model. On the other hand, the explanation coefficient obtained is equal to 0.84, which states that the variables in the model can represent 84 percent of the variations in the Springate model. According to the results obtained in Table 4, only the X2 variable in the Zmijewski model is significant. On the other hand, the explanation coefficient is 0.90, which states that the variables in the model can only show 9% of the variations in the Zmijewski model. According to the results obtained in Table 5, all variables except ROA variables are significant in the model. On the other hand, the explanation coefficient is 0.98, which states that the variables in the model can represent 98% of the variations in the Grovere model. Finally, according to the results obtained, one can confirm or reject research hypotheses. Regression test was used to answer the research hypotheses. A correlation test was used to examine the significance of each Altman, Springate, Zmijewski and Grover models, and multiple linear regression methods were used to find the research model for panel data. According to the results obtained from the Altman model, this model can represent 92% of the variables in the model. Also, results from the Springate model determine the expression of 84% of the variables in the model and the results of Zmijewski's model determination model indicate that this model can only express 9% of the variables in the model, and the results of the gravity model determine that the model can express 98% of the model variables clearly. Consequently, the results of the research indicate confirmation of the first to fourth hypotheses of this research. To answer the fifth to eighth hypotheses of this research, according to the results obtained from the determination of Altman, Springate, Zmijewski and Grover bankruptcy coefficients, which are 92%, 84%, 9% and 98% respectively, the ability of the Grovere model to predict financial crises at the highest level and, consequently, the Altman model and the Springate model, and the lowest ability to Zmijewski model, are allocated to the ability to predict bankruptcy in Tehran Stock Exchange. Therefore, the Grovere model is the best model for forecasting financial crises in Tehran Stock Exchange.

The results of this study indicate that all four models of financial crisis prediction including Altman, Springate, Zmijewski and Grover models are meaningful in Tehran Stock Exchange, but the Grovere model has better ability to predict financial crises in the stock market than the other three models. Therefore, it is suggestion that the Stock Exchange be organized in order to provide researchers with an effective model for investors' use, based on the Grover bankruptcy pattern, in order to provide accurate and timely information to the organization. Also, auditors can use the Grover pattern during auditing and commenting on the continuity of the companies listed on the Tehran Stock Exchange.

1. Master of Industrial Management, Financial tendency. Email: ostadebarten@yahoo.com