Vol. 39 (Number 13) Year 2018 • Page 25

Hojjat VAHDATI 1; Seyed Hadi Mousavi NEJAD 2; NEDA SHAHSIAH 3

Received: 18/11/2017 • Approved: 05/12/2017

2. Problem Statement and Research Important

4. Relationship between Variables and Hypotheses Development

ABSTRACT: In a nowadays competitive condition, since the banks can succeed in a competitive market than competitors and to gain competitive advantage, it is a key method of using generic competitive strategies that can increase the likelihood of success in the market. Accordingly, the present study aims to investigate the effect of generic competitive and their effects on the competitive advantage type. The present study is an applied research in terms of its objectives, its causal-effect in terms of research nature and approach, its descriptive survey in terms of data collection and it's a quantitative in terms of data type. The study statistical population consists of all Tejarat bank branches customers in Khorramabad in 2015, which used a questionnaire to collect data from customers. The results using structural equation modeling showed that generic competitive strategies have significant and positive effects on the dynamic and sustainable competitive advantages. As well as a variety of competitive strategies, including cost leadership, differentiation and focus strategies have significant and positive effects on dynamic and sustainable competitive advantages and in the meantime, cost leadership strategy known as the most important strategy in Tejarat bank competitive strategy to achieve both sustainable and dynamic competitive advantage. |

RESUMEN: En situaciones actuales, los bancos pueden tener éxito en un mercado competitivo frente a sus pares y obtener ventajas de ello; usar estrategias competitivas genéricas son un método clave para aumentar la probabilidad de éxito. En consecuencia, el presente estudio tiene como objetivo investigar el efecto de la competencia genérica y sus efectos sobre el tipo de ventaja competitiva. El presente estudio es una investigación aplicada en términos de sus objetivos, su efecto causal en términos de naturaleza y enfoque de investigación, su encuesta descriptiva en términos de recopilación de datos y es cuantitativa en términos de tipo de datos. La población estadística de estudio está compuesta por todos los clientes de sucursales bancarias de Tejarat en Khorramabad en 2015, que utilizaron un cuestionario para recopilar datos de los clientes. Los resultados, utilizando el modelo de ecuaciones estructurales, mostraron que las estrategias competitivas genéricas tienen efectos significativos y positivos sobre las ventajas competitivas dinámicas y sostenibles. Además de una variedad de estrategias competitivas, que incluyen liderazgo de costos, diferenciación y estrategias de enfoque tienen efectos significativos y positivos sobre ventajas competitivas dinámicas y sostenibles y, mientras tanto, estrategia de liderazgo de costos conocida como la estrategia más importante en la estrategia competitiva del banco Tejarat para lograr ambos ventaja competitiva sostenible y dinámica. |

Today as compared to long-ago, people’s requirement to bank services increasing and they have expectancy rather and further services. In attention to significant growth of banks and creating of competitive climate, the banks pursue the desirable performance toward acquire of more resources and customers. Indeed, banks include governmental and private have closed competitive together which in this competitive, success is for banks that have more market share with minimum cost. This tenet is based on the good design and fulfillment of marketing good strategy. In current time, any bank can’t serve the best services in different fields. In addition, one bank can’t serve their services to whole potential market-customers. They should discover to ways to adopt of successful strategy for present to customers than other banks or competitors. This is some ways that can create and development the different competitive position than competitors and obtains to competitive advantage. In this regard, a main method to achieving the competitive advantage is apply generic competitive strategies which can be used in single or collective manner and increasing the possible of success in market (Porter, 1990). Therefore, present study aims to recognition the most efficacious of bank’s generic competitive strategies especially Tejarat bank as well as investigate and analysis the effect of these strategies on different competitive advantage, that finally bring about to present the effective recommendations toward enhance Tejarat bank’s competitive capability.

Entry of governmental and private banks and also financial and credibility institutions to target market, cause to increase the competitive intensity in market and decrease the some bank’s market share which make a weak their competitive position. For instance, Tejarat bank is a main private bank in Iran which isn’t safe for market share and has a descend procedural at market share recently. According to Vivannews report, industrial management organization (IMO) publishing the one hundred Iranian superior companies for fourteenth years continuously. In this report, Tejarat bank in financial year 2010, has a tenth rank with sales of 42 thousand and 195 billion and 300 million rials (42.195.300.000.000 rials- unit of currency in Iran). Moreover, according to Iran’s banking (Bankia), Tejarat bank encounter to decrease in market share in reception of deposit in recent years, which its deposit market share decline of 11.2 percent in end of year 2012 to 10.1 percent in end of current year. The Banker journal is one of the most important journals in ranking the world banks, showing Tejarat bank among other Iranian banks has a seventh rank base on the performance criterion (ratio of profit/ asset), fourth rank base on the banking power criterion and eighth rank base on the return of asset (ROA) criterion in 2012. In addition, this journal in ranking of July 2014, indicate that Tejarat bank has a fifth rank totally.

Therefore, attention to much competitive condition in financial market and exist of many cost to achieving competitive advantage for banks especially Tejarat bank, it is said that Tejarat bank hasn’t a good performance in this complex condition. Whereas, the banks to apply the Michael Porter strategies (generic competitive strategies) can production closely to customers need, focus on the special sectors of market that are applicants for different and expensive product and inexpensive product, finally used of marketing researches in different geography zone and production relative to any zone’s requirement, thereby prepare the necessary context to competitive and improvement their performance. So it is necessary that Tejarat bank relation to its competitive advantage use appropriate strategies. Except the tajarat bank, it is needful for any banks to apply competitive appropriate strategies to achieving competitive advantage and guarantees their survival in this competitive climate. Now it is question that can generic competitive strategies help to banks to achieving competitive advantage and cause to their success in a complex environment? And, which competitive strategies are effective in achieving sustainable and dynamic competitive advantage?

According to changing of today’s world rather to the past, secret of organizations’ survival and success is applied of the appropriate competitive strategies. Moreover, according to this point that banks are economy vital artery of every country and the effort of majority of world’s financial institutions and banks are toward increase efficiency, in this study it is assumed that banks are not exception from this rule, and those are affected by this competitive market and all Porter‘s competitive strategies is true at the banks success and received competitive advantage. In following research will be discussed about generic competitive strategies and competitive advantage.

Generic competitive strategies. Michael Porter (1998, p.38) stated that in faced with the five competitive forces, there are three generic strategic types to get ahead of company’s other competitors in the industry which in the following research to be addressed. Successful implementation of these strategies requires to general commitment and supporting organizational arrangements. The generic strategies are approaches to overcome existing competitors in the industry. From Porter’s view, these strategies (include cost leadership, differentiated products and services and focus on specific products and services) enable organization to exploit the competitive advantages from three different bases. Porter calls these strategies as generic strategies which will be discussed in the following.

Competitive advantage. Competitive advantage is a set of factors or capabilities that always enabling the company to show better performance rather than competitors (Burgaise, 1995). Competitive advantage is a factor or combination of factors that in a competitive environment cause to success of organization rather than other organizations and competitors cannot easily imitate it (Feurer & Chaharbaghi, 1995). It is note that the organization should think to internal capabilities and competitive position in the market not as separate but as mutually to achieve competitive advantage and formulation of marketing strategy (Hourly et al., 2003).

It is gain sustainable competitive advantage as one of the outputs of application of competitive strategy according to situations. Moreover, competitive strategy will be affected by the company’s resources and capabilities. More resources of company will be increased its capabilities and this matter caused the development of competitive strategies and gain the dynamic competitive advantages for company (Barney, 1991). Porter (1990) argues that the company may be chosen one of the three general strategies; it can be used of cost leadership and differentiation strategies at the wide market, and used of focus strategy at the narrow market for achieving the competitive advantages. Among these three general strategies, Porter defined the cost leadership strategy as the clearest strategy and expressed that it is a key for gain advantage.

The whole research that has been done in this regard also suggests that competitive strategies have positive impacts on the competitive advantages. Thus in the following, few examples of the most important researches are mentioned. Teece et al. (1997) in their research entitle “Dynamic capabilities and strategic management” believe that there is an obvious relationship between global dynamic capabilities and dynamic competitive advantage and stated that a global dynamic capability is non-imitative compounds of resources which can provide an organization's competitive advantage. In fact, dynamic capabilities cause the organization to change simultaneously with environmental changes and strengthen its position in the market compared to other competitors and finally achieves to the advantages that is basic for the organization’s efficiency. Yamin et al. (1999) accomplish the research in the manufacturing companies of Australia and showed that companies that use of cost leadership and differentiation strategies, they are more effective than other companies in increasing financial performance and market share. As well as, Ghemawat (2005) believe that to do wonderful job, the companies should adopted differentiation strategy to achieving sustainable competitive advantage and thereby have always been persistence and pioneering. In addition, Jusoh and Parnell (2008) in their research in Malaysia concluded that differentiation and cost leadership strategies directly and indirectly have positive effects on the organizational performance. The effect of differentiation strategy than cost leadership strategy has stronger effects on the performance and can provide a gaining competitive advantage.

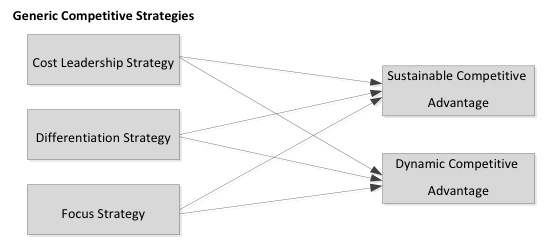

Because this study looking for effective factors that make the success of Tejarat bank and it achieve to competitive advantage in the competitive market, so tried to use of Michael Porter’s Generic competitive strategies as a key factor for receive advantage and designing main framework of the main conceptual model. In this regard, the hypotheses were developed that have been presented as follows:

The final conceptual model is presented in Figure 1. In the present model, competitive advantage is considered in the framework of competitive strategy, which will examine the bank position in the competitive environment.

Figure 1

Research Conceptual Model

The present study is an applied research in terms of its objectives, and it is quantitative in terms of data collection and it is a descriptive survey in nature. The statistical population of this study consists of the all customers of Tejarat bank in Khorramabad, Lorestan. The statistical sample of the present study was calculated to be 384 persons by means of Cochran’s Formula. Given the sample size, 440 questionnaires were distributed randomly among the customers, out of which 363 questionnaires were collected and analyzed. The questionnaire used in this study consists of two parts: the first part included questions about respondents’ demographic characteristic including gender, age, marital, education and income. The second part of the questions, about of evaluation variables and consists of two sections as generic competitive strategies (GCS) and sustainable and dynamic competitive advantage (SCA and DCA), which it design is based on the five-option Likert scale. Moreover, in order to test of research hypothesis and conceptual model use a structural equation modeling technique by Amos 18 software.

In order to measure the reliability of the research instrument, the Cronbach Alpha method and for measure the validity, the content and construct validity methods were used. The content validity of the research instrument was corroborated by the viewpoints of experts, university professors and other texts. In order to determine the construct validity of convergent and divergent, the correlation coefficients (R), the determination coefficients (R2), and the total variance extracted (TVE) of the variable were used. The significance of correlations among the variables indicates the convergent validity, and the critical value of TVE higher than the R2 of variables indicates the divergent validity. In addition, it does to adequacy data test (KMO) to assess the reliability of the using factor analysis. The results of these analyses are presented in Table 1.

Table 1

Results of R, R2, Cronbach Alpha, KMO and TVE

|

Cost Leadership |

Differentiation Strategy |

Focus Strategy |

Sustainable Advantage |

Dynamic Advantage |

Questions |

Alpha |

KMO |

TVE |

Cost Leadership |

- |

|

|

|

|

9 |

0.87 |

0.89 |

0.50 |

Differentiation Strategy |

0.53* (0.28)** |

- |

|

|

|

7 |

0.84 |

0.87 |

0.52 |

Focus Strategy |

0.55 (0.30) |

0.61 (0.37) |

- |

|

|

4 |

0.76 |

0.75 |

0.58 |

Sustainable Advantage |

0.66 (0.44) |

0.53 (0.28) |

0.52 (0.27) |

- |

|

3 |

0.82 |

0.71 |

0.60 |

Dynamic Advantage |

0.44 (0.19) |

0.40 (0.16) |

0.43 (0.18) |

0.56 (0.34) |

- |

3 |

0.82 |

0.70 |

0.61 |

*All correlations at level 0.05 are significant.

** The value of parentheses represents R2.

As the results in table 1, alpha coefficients higher than 0.7 show that the data collection instrument has an appropriate reliability (Cronbach, 1951). Moreover, KMO values were extracted by means of the heuristic factor analysis for the research variables. Since all values are more than 0.7, the data are appropriate for the confirmatory factor analysis (Hinton et al. 2004). In addition, according to pearson test results for the variables which are significant and also AVE values higher than 0.5 (Fornell & Larcker, 1981), it can be seen that the convergent validity is appropriate. As well as, by comparing the results of AVE and R2 it can see that the AVE in all variables is greater than R2 (AVE> R2), which indicated the research instrument has an appropriate divergent validity.

Based on the data collected from the questionnaire, the frequency of subjects based on demographic variables evaluated that results has been presented in Table 2.

Table 2

Demographic Characteristic of Respondents

Characteristics |

Frequency |

% |

|

Gender |

Male |

271 |

74.7 |

Female |

92 |

25.3 |

|

Age Group |

Less than 30 years |

103 |

28.4 |

31-40 years |

167 |

46.0 |

|

41-50 years |

89 |

24.5 |

|

More than 51 years |

4 |

1.1 |

|

Marital status |

Married |

285 |

78.5 |

Single |

78 |

21.5 |

|

Education |

Less than Diploma |

51 |

14.0 |

Associate Degree |

83 |

22.9 |

|

Bachelor |

186 |

51.2 |

|

Master or higher |

43 |

11.8 |

|

Income |

Less than 5 million IRR |

8 |

2.2 |

5-10 million IRR |

133 |

36.6 |

|

10-15 million IRR |

163 |

44.9 |

|

15–20 million IRR |

37 |

10.2 |

|

More than 20 million IRR |

22 |

6.1 |

|

Total |

363 |

100 |

|

After the data collection, in order to determine to what extent the measured items are acceptable for the measurement of latent variables, it is necessary to separately test every observed variable to the latent variables. Indices of overall fitness, for the measurement models (confirmatory factor analysis) by means of the software, Amos 18, can be seen in table 3.

Table 3

Confirmatory Factor Analysis of Model’s Measurement Patterns

Index Model |

CMIN |

CMIN/DF |

TLI |

CFI |

NFI |

RMSEA |

Cost leadership |

6.321 |

2.11 |

0.923 |

0.934 |

0.908 |

0.039 |

Differentiation |

3.512 |

1.76 |

0.917 |

0.931 |

0.902 |

0.005 |

Focus |

4.203 |

2.10 |

0.981 |

0.994 |

0.998 |

0.055 |

Sustainable |

2.833 |

1.42 |

0.955 |

0.981 |

0.941 |

0.011 |

Dynamic |

5.779 |

2.89 |

0.969 |

0.990 |

0.984 |

0.070 |

Decision Criterion |

P>0.05 |

1<CMIN/DF<5 |

TFI>0.9 |

CFI>0.9 |

NFI>0.9 |

RMSEA<0.1 |

NOTE: GFI= Goodness of Fit Index, RMSEA= Root Mean Square Error of Approximation,

CFI= Comparative Fit Index, NFI=Normed Fit Index.

As can be seen in table 3, all fitness indicators are desirable, so the models enjoy and appropriate level of fitness, and accordingly, the structure of each variable can be confirmed (Tinsley & Brown, 2000). After the measurement models are surveyed and confirmed, it is consider to analysis of structural model, fit and versatility statement, and significance tests for each parameter in structural equation modeling using the t-value (CR) index. Table 4 show obtained the path standardized coefficients and significance between the research structures.

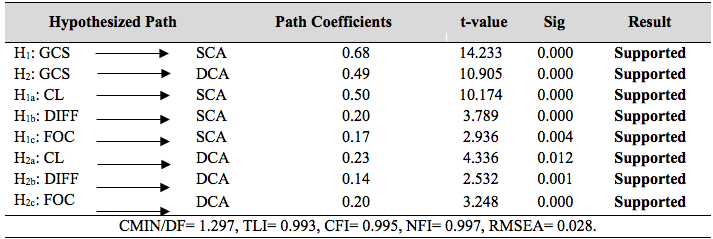

Table 4

Path Coefficients and Critical Values of the Research Hypotheses

Note: GCS= Generic Competitive Strategies, SCA= Sustainable Competitive Advantage,

DCA= Dynamic Competitive Advantage, CL= Cost Leadership, DIFF= Differentiation, FOC= Focus.

As the table 4 results show, regarding to the first main hypothesis (H1), it can be seen that GCS has a positive and significant effect on the SCA in Tejarat bank with the path coefficient of 0.68 (t-value=14.23, p<0.05). So, the first hypothesis is confirmed with the confidence level of %95. This means that a one percent increases in GCS can increase a SCA as much as 68 percent. In regard to second main hypothesis (H2), result show that GCS has a positive and significant effect on the DCA (t-value=10.91, p<0.05). The value of this effect in error of 0.05 is 49 percent and is confirmed. Moreover, based on the study first sub-hypothesis (H1a), cost leadership strategy has a significant and positive effect on the SCA (t-value=10.17, p<0.05). The value of this effect in error of 0.05 is 50 percent. Therefore, the first sub-hypothesis with the confidence level of %95 is confirmed. In addition, consistent with the second sub-hypothesis (H1b) Using by SEM techniques, differentiation strategy has a positive and significantly effect on the SCA with the path coefficient of 20 percent (t-value=3.79, p<0.05). Thus, this hypothesis is confirmed with the confidence level of %95. As the table 4 shows, according to the results of the third sub-hypothesis (H1c), the focus strategy has a positive and significant effect on the SCA in Tejarat bank with the path coefficient of 0.17 (t-value=2.94, p<0.05). In addition, fourth, fifth and sixth sub-hypotheses (H2a-H2b-H2c), respectively with the path coefficients of 23, 14 and 20 percent represents a positive and significant effects of cost leadership, differentiation and focus strategies on the DCA and all hypotheses are confirmed at the error level of 5 percent (t-value=4.34, 2.53, 3.25 p<0.05).

Given the fitness indices values of the research model, the model enjoys a very good fitness (Tinsley & Brown, 2000). In addition to the testing of hypotheses in the present study, the level of each variable were measured by using of means comparison test on the basis of the data collected from of Tejarat Bank customers. Since variables level were in higher than 3 (P-value<0.05), it can be concluded that the variables examined are at an appropriate level.

Porter’s model is one of the known models about the competitive pressures and relevant strategies and it is the best method for analysis of competitiveness of an organization. Porter called these strategies as generic competitive strategies, which skillful use of them can be having significant competitive advantage for business. Gaining competitive advantage in the form of the final this research’s model based on the generic competitive strategies in Iranian banking industry and specifically in Tejarat Bank can provide success of the banks. In this regard, eight hypotheses were introduced and tested that the results are presented as follows.

According to the first hypothesis testing, generic competitive strategies have positive and significant effects on sustainable competitive advantage. Therefore, to get ahead of the company’s competitors in the industry and gaining sustainable competitive advantage in the banking industry, concentrate on generic competitive strategies can helped to Tejarat bank in achieving its goals and advantages which aren’t temporary and aren’t easily available by competitors. The results of this analysis can be aligned with researches by Esteban and Kamilo (2001) and Mnjala (2014). Esteban and Kamilo (2001) showed that the emphasis on the competitive capabilities can be the basis for achieving sustainable advantage in face to competitors and for creating superior performance. The second hypothesis testing showed that generic competitive strategies have positive and significant effects on dynamic competitive advantage. In the customer’s perspective, generic competitive strategies can be a basis for more effective of business activities in Tejarat bank which its outcome is dynamic competitive advantages for Tejarat bank and guarantees the success of bank than other competitor. The result of this analysis is in line with the results of Yamin et al. (1999) and Kungu et al. (2014) researches.

The results of the first to third sub-hypotheses testing showed that the cost leadership, differentiation and focus strategies have positive and significant effects on sustainable competitive advantage. If Tejarat bank achieve to a good cost position, then it will have a kind of shield against other competitors that can cause to positive performance and gaining sustainable competitive advantage. The results of this test can be in line with results of Berman et al. (2002) and Jusoh and Parnell (2008) researches. They show that cost leadership has a positive effect on creation of sustainable competitive advantage (Berman et al., 2002), organizational performance and gaining competitive advantage (Jusoh & Parnell, 2008) that both emphasis on the organization’s survival and profitability in long- term. In addition, should note that the results of other sub-hypotheses testing include of fourth, fifth and sixth sub-hypothesis show that all of generic competitive strategies have positive and significant effects on dynamic competitive advantage. So, it can be said that the overall cost leadership through a series of functional approaches can both receiving sustainable competitive advantage and creating dynamic competitive advantage. The result of this test can be aligned with the result of Yamin et al. (1999) and Kungu et al. (2014) researches.

Finally, according to the results of research hypotheses testing by structural equation modeling techniques, it is inference that among strategies, cost leadership strategy has the highest impact on sustainable advantage and afterwards differentiation and focus strategies have the most effects respectively. Furthermore, among generic competitive strategies, first cost leadership strategy then differentiation and focus strategies respectively have the most effects on the development dynamic competitive advantage. So it can be said that costs leadership strategy in Tejarat bank has a greater priorities and has an appropriate potential to achieving sustainable and dynamic competitive advantages.

According to result of the first and second main hypotheses, it is recommended to managers that to receive of competitive advantages more emphasize to the total cost leadership and created a defensive shield against other banks. After cost leadership strategy, differentiation and focus strategies demand the most attention from Tejarat bank managers and require special consideration. Moreover, consistent with the first and fourth research sub-hypotheses testing (H1a-H2a), Tejarat bank managers are recommended to consider the banking standards, enhancing the manager’s skill in reduce of banking costs, and having low costs to provide of facilities and services can be the more pioneer in offering banking new services and always provide their services and facilities with the lowest cost and the best time possible, so this way, facilitate the achieving to sustainable and dynamic competitive advantages.

Furthermore with regard to results of the second and fifth research sub-hypothesis (H1b-H2b), the following recommendations in order of preference are given to managers for achieve an advantage that is flexible and is not accessible by competitors: provide of banking facility and services with innovation and creativity, customer orientation and attention to customer satisfaction, providing banking services even after receiving service by customers, and finally being aware of the people needs and provide services consistent to this needs. At last according to the third and sixth research sub-hypothesis testing (H1c-H2c), it is recommended to Tejarat bank managers that initially focusing on certain segments of the market that are applicant for different and special services, and afterward by providing of Tejarat’s customized facilities and services to the specific needs of customers, closer the Tejarat bank to gain sustainable and dynamic competitive advantages, and will strengthen their position in the market. In contrast of cost leadership and differentiation strategies, investment and attention to the focus strategy causes to acquisition of more dynamic competitive advantage compared to sustainable advantage. Therefore according to this strategy, dynamic competitive advantage will be earning more than sustainable competitive advantage which can be effective in managers’ decision-making.

Barney, J. 1991. Firm resources and sustained competitive advantage. Journal of management, 17(1), 99-120.

Berman, S. L., Down, J., & Hill, C. W. 2002. Tacit knowledge as a source of competitive advantage in the National Basketball Association. Academy of Management Journal, 45(1), 13-31.

Culpan, R. 2008. The Role of Strategic Alliances in Gaining Sustainable Competitive Advantage for Firms. Management Revue, 19 (1/2), 94-105.

Dyer, J. H. 1996. Specialized supplier networks as a source of competitive advantage: Evidence from the auto industry. Strategic management journal, 17(4), 271-291.

Feurer, R., & Chaharbaghi, K. 1995. Strategy development: past, present and future. Management decision, 33(6), 11-21.

Ghemawat, P. 2005. Regional strategies for global leadership. Harvard business review, 83(12), 98.

Hill, C. W. 1997. Establishing a standard: Competitive strategy and technological standards in winner-take-all industries. The Academy of Management Executive, 11(2), 7-25.

Hinton, R., Brownlow, C., Mcmurray, I. & Cozens, B. 2004. SPSS explained, Routledge: Taylor and Francis group.

Jusoh, R., & Parnell, J. A. 2008. Competitive strategy and performance measurement in the Malaysian context: An exploratory study. Management decision, 46(1), 5-31.

Lin, Y., & Wu, L., 2013. Exploring the role of dynamic capabilities in firm performance under the resource-based view framework. Journal of Business Research, 1-7.

Mnjala, D.M. 2014. The Challenges of Creating Sustainable Competitive Advantage in the Banking Industry in Kenya, Journal of Business and Management, 16(4), 82-87.

Porter, Michael E. 1990. The Competitive Advantage of Nations. Harvard Business Review, 68(2), 73–93.

Porter, Michael E. 1998. Competitive Strategy: Techniques for Analyzing Industries and Competitors. 1 edition, New York: Free Press.

Teece, D. J., Pisano, G., & Shuen, A. 1997. Dynamic capabilities and strategic management. Strategic Management Journal, 18 (7), 509-533.

Tinsley, H. & Brown, S. (2000). Handbook of applied multivariate statistics and mathematical modeling. Academic Press, ISBN: 978-0-12-691360-6.

Yamin, S., Mavondo, F., Gunasekaran, A. & Sarrosm J. C. 1999. A study of competitive strategy, organizational innovation and organizational performance among Australian manufacturing companies, International Journal of Production Economics, 52(1-2), 161-172.

1. Assistant Professor of Business Management, Lorestan University, Iran

2. Ph.D. Student of Management, Lorestan University, Iran (Corresponding Author)

3. Ph.D. Student of Management, Lorestan University, Iran.