Vol. 39 (# 08) Year 2018. Page 17

Elena A. RODIONOVA 1; Olga A. SHVETSOVA 2; Michael Z. EPSTEIN 3

Received: 25/10/2017 • Approved: 08/11/2017

2. Theoretical Framework of Investment Project’s Evaluation

ABSTRACT: Multi-Criteria Decision Making (MCDM) methods have evolved to accommodate various types of applications. Dozens of methods have been developed, with even small variations to existing methods causing the creation of new branches of research. This paper performs an original research of Multi-Criteria Decision Making methods in investment management, examines the advantages and disadvantages of the identified methods under risk environment, and explains how their common applications relate to the effectiveness of investment projects. The analysis of MCDM methods performed in this paper provides a clear guide for how MCDM methods should be used in investment project’s analysis. |

RESUMEN: Los métodos de toma de decisiones de criterios múltiples (MCDM) han evolucionado para adaptarse a varios tipos de aplicaciones. Se han desarrollado docenas de métodos, incluso con pequeñas variaciones de los métodos existentes. Este documento proporciona una investigación original de la Decisión Multi-Criteria en el campo de las estrategias de inversión. El análisis de los métodos MCDM realizados en este documento proporciona una guía clara sobre cómo los métodos MCDM deben usarse en el análisis del proyecto de inversión. |

The most common problem of developing and introducing more advanced forms and methods of management into the broad practice is investment analysis. Important steps in the process of making economic decisions are 1) the creation of a indicators’ system (including decision criteria) 2) analysis and prediction of the problem’s development for the subsequent generation and selection of alternatives (Lukicheva, L.I. ,2016). The quality of the decisions made is essentially determined by the choice of the alternative.

The choice of the investment’s direction directly depends on the effectiveness’s evaluation of the analyzed alternatives. In the case of strategic decisions, this circumstance should be taken into account, since it is a question of spending a considerable amount of resources.

The multilateral nature of economic activity cannot be expressed by one one-dimensional index. Strengthening the tendency to more fully take into account the entire set of goals facing the economic organization, reflection in the analysis of real decision-making conditions, explains the growing interest in multidimensional methods of analysis and evaluation of economic decisions (Brigham, F. E., Ehrhardt, C. M., 2015).

All enterprises are more or less connected with investment activities. Decision-making on investment includes the need to take into account various complicating factors: the limited financial resources available for investment, the type of investment itself, and the possible losses that the enterprise may incur in the event the project is less efficient than it appears at the time it was drafted. Risk management allows increasing the validity of the project solution and reducing the likelihood of adopting an inefficient project.

The goal of this research is to implement multicriterial approach to investment projects’ risk evaluation.

Authors submit research questions (RQ):

RQ1: What are the benefits of implementing multicriterial approach into investment projects’ evaluation?

RQ2: What are the limitations of implementing multicriterial approach into investment projects’ evaluation?

This research has a limitation: authors use sample model for improving or rejecting research questions.

We may find a large number of economical indicators, which are known well in business and they can allow managers to compare various alternatives to investing (Savchuk, V.P. , 2007). Methodical documents most often recommend the use of the following indicators: net present value (NPV), discounted payback period (DPP), internal rate of return (IRR) (Mazur, I.I. , 2014).

These indicators help decide whether to accept or reject a project or choose the best alternative from several options. However, they describe the effectiveness of the analyzed project from several different points of view. This leads to the necessity of constructing a multidimensional criterion.

Discussing the economic literature, we pay attention to both main methods of calculating the indicator "payback period":

Comparison of alternative projects based on these indicators can lead to different ordering of the analyzed options. This is all the more true, given the dynamics of various factors that affect the effectiveness of projects. The NPV index reflects a look at the effectiveness of the company's management. According to this, in our case, it is advisable to use the indicator of the payback period calculated on the basis of the received profit’s measurement for the formation of a multidimensional criterion.

Based on the IRR index, it is also possible to obtain an ordering different from that obtained on the basis of the NPV index (Stoyanova, E.S., 2006; Syroezhin, I.M., 1980). The indicator of the internal rate of return is specific. He, in fact, measures the effectiveness of capital investments. This indicator allows to partially solve the problem of comparing investment projects with different amounts of capital investments and different terms of implementation. In other words, the requirement of the same amount of investment and / or the term of alternative projects is mandatory from a theoretical point of view. Typical methodological recommendations for calculating the effectiveness of investment projects solve this problem, simply preferring the indicator of NPV.

The above considerations lead to the conclusion that it is necessary to use methods for evaluating the effectiveness of alternative investment projects that are based on a multi-criteria choice. Known methods of multicriteria choice are not brought to the methodical solutions that can solve the problem of choosing the optimal investment solution (Rua, B., 1976). The choice of an effective investment project includes a best combination’s analysis of the values of disparate indicators characterizing the investment project. The need to evaluate alternative solutions from the point of view of several criteria in the task of choosing the direction of investment is complicated by the multiplicity of indicators, because they precise estimates, due to the complexity of the conditions for the implementation of projects, and therefore cannot be obtained.

Also we should recognize another serious problem, that investment projects are generally implemented in a risk environment. This means significant environmental uncertainty. Its changes are caused by a decrease or increase in cash flows generated during the implementation of the analyzed investment project. Because of this, it is possible that the goals set by the investor will not be reached, and the latter will incur losses.

The size of losses and their probability characterize the risk that is typical for each type of entrepreneurial activity. Without consideration of risk, the evaluation of the alternatives under consideration becomes unrealistic (Orlovsky, S.A., 1981; Parrino, R., Kidwell, D., Bates Th., 2014).

There are two mutually complementary types of project risks’ analysis: quantitative and qualitative. Qualitative analysis determines the factors, scope and types of risk. Before the quantitative analysis, the task is to quantify the size of the identified risks and the damage from failure to achieve the project objectives.

The variety of risks of the investment project seriously complicates the tasks of qualitative analysis, including risk classification. Discussing economic literature we can obtain different approaches to solving this problem. In the analyzed case, it seems appropriate to classify the risks from the point of view of their origin (Khokhlov, N.V., 2011).

The calculation of economic efficiency in terms of risk involves identification of risk factors in classified areas, identification of risk situations, and the correlation of the risk situation with the consequences as the results of the investment project points’ implementation (Rodionova, E.A., Epshtein, M.Z., Petukhov, L.V., 2013).

Risk factors are unplanned events that can occur and cause a deviation from the planned progress of the project. There is a dynamics of risk factors’ values, which affects the effectiveness of the project. The combination of possible risk factors’ values and consequences from them determine the situation of risk.

The stage of "quantitative risk analysis" includes the quantification of both individual risks and the risk of the entire project. At this stage, the possible damage (risk) is also determined. The most common methods of quantitative risk analysis include: statistical analysis, scenario building, expert assessments, analytical methods, and the use of decision trees and simulation modeling (Bukhvalov, A., 2011). Each of these methods has certain drawbacks (disadvantages). They can be compensated for using an integrated approach.

Modern methods of calculating the effectiveness of the investment project assume the use of a one-dimensional criterion. The risk situation is taken into account in them using the sensitivity assessment procedure. It consists in analyzing the changes in project results depending on the dynamics of risk factors. Different authors suggest a different approach. It is based on the use of the multicriteria selection method. The peculiarity of the proposed approach is the use of multi-criteria choice with an interval estimation of the project's riskiness.

In previous survey of authors the complex approach was proposed based on the calculation for each analyzed alternative of net discounted income, the discounted payback period, and the internal rate of return (Rodionova, E.A., Epshtein, M.Z., Petukhov, L.V., 2013). The peculiarity of this approach is also that it takes into account the uncertainty of the external environment. To do this, expert estimates of the likelihood of damage from the implementation of the project and the intervals of fluctuations of the above criteria for the effectiveness of the investment project are used.

Authors will continue the development of this approach and consider in more detail the accounting of the risk component of the multidimensional estimation. It is known that uncertainty presupposes the presence of factors under which the results of actions are not deterministic, and the degree of possible influence of these factors on the results is unknown (Vedernikov, Y.V., 2011). Authors will more closely consider the uncertainty factor and the possibility of the occurrence of damage. To do this, let us include in the expert opinion the forecast of the market situation in the future and the risk assessment in each of the possible situations. This approach allows us to include a generalized risk indicator, which can reflect, as components, various types of risk.

Based on the results of the expert survey, Authors estimate the ranges of values for all indicators taking into account the risk for alternative investment projects. Intervals are determined by experts both in absolute values of indicators, and in points (Rodionova, E.A., Epshtein, M.Z., Petukhov, L.V., 2013).

Let's estimate the effectiveness of alternative options and choose the most preferable one based on the built-in interval preference ratio (IPR). We use the notation introduced in survey “Scientific and methodical apparatus of vector preference…” (Vedernikov, Y.V., 2011).

As a discount rate, a risk-free interest rate or a rate of interest for projects with the same degree of risk, or the sectoral coefficient of capital investments’ efficiency, are generally used. By this criterion, a project with a maximum value with the same value of r is selected. Net present value depends heavily on the discount rate. An ungrounded forecast of the discount rate leads to an incorrect management decision: a good project can be rejected, and a bad one can be accepted. Due to the specification of NPV interval values, this problem goes to the background. The optimal condition for the NPV criterion is its maximum.

The discounted payback period is expressed in a time interval. The optimal option for this criterion corresponds to its minimum. The internal rate of return is expressed in percentages and is given by an interval value. By this criterion, a project corresponding to the maximum value of this criterion is selected.

Risk assessment is reflected by interval values in points. Assuming that the interest rate r is a random variable for which the probability of a random event can be found, NPV (r, t)> 0, P (NPV (r, t)> 0) = P (r <IRR) = F (IRR) . Here F (x) = P (r <x) is the distribution function of r, IRR is the internal rate of return, which is found as a solution to the equation NPV (t, r) = 0. For different r, it is possible to establish the probabilities that the project will not pay off at time t, and then construct score scores using the valuation procedure. Let make the riskiness evaluation of the project according to the above methodology for the three possible predictable market conditions, and experts estimated the likelihood of implementing each of them. Authors note that the criterion for assessing the risk of investment project requires choosing the best option from the condition of minimum value of the criterion.

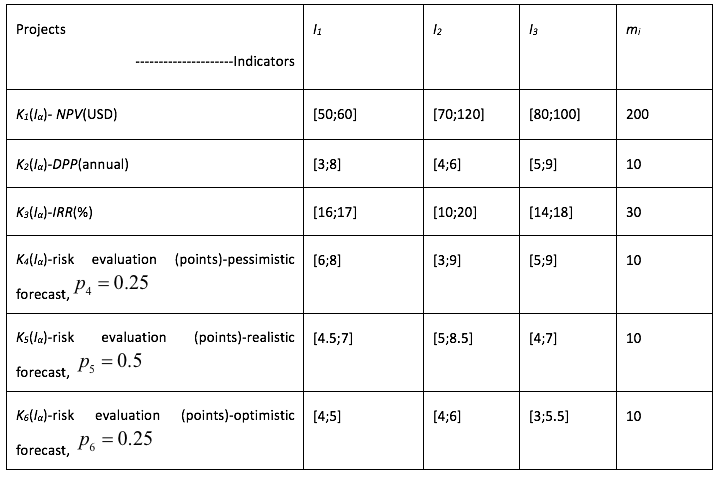

On the basis of known theoretical representations, the values of mi are chosen as the maximum permissible for the considered criteria. The initial data required for the calculations for the investment projects analysis are presented in Table 1.

Table 1

Data implication for variety of projects

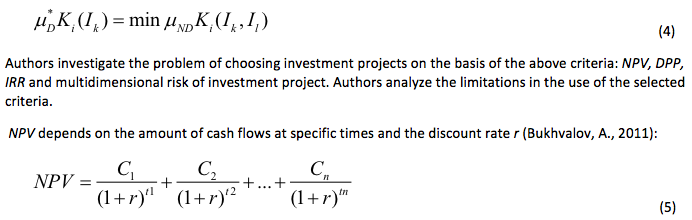

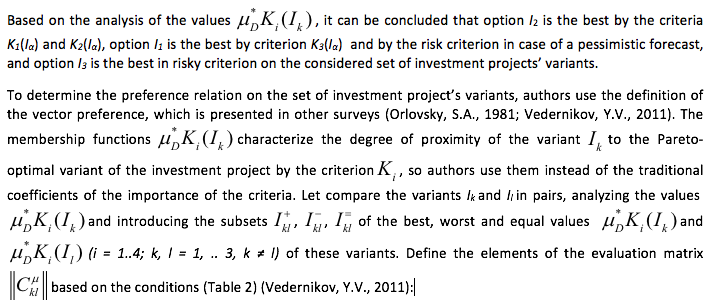

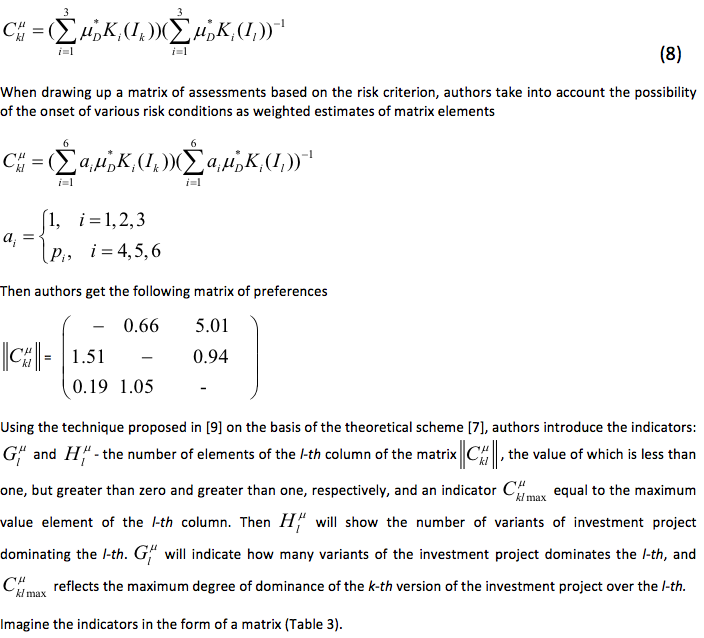

Using formula (1), we find the values of the membership function μиKi(Ik,Il) for each pair of variants for each criterion, and authors will compute the estimated matrices of them. Authors write in more detail the expression (1):

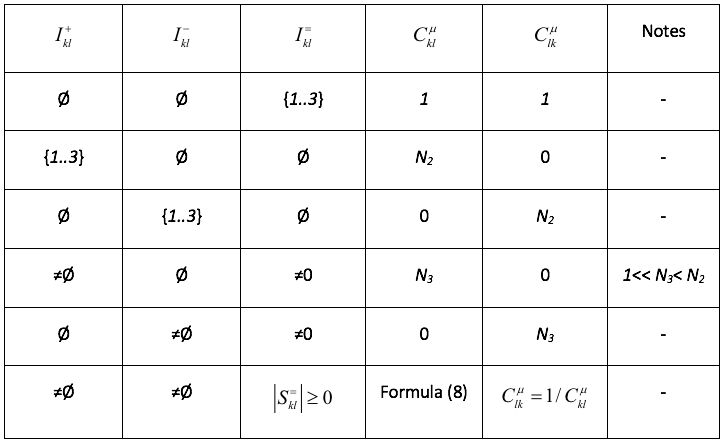

Table 2

Elements’ values of the evaluation matrix

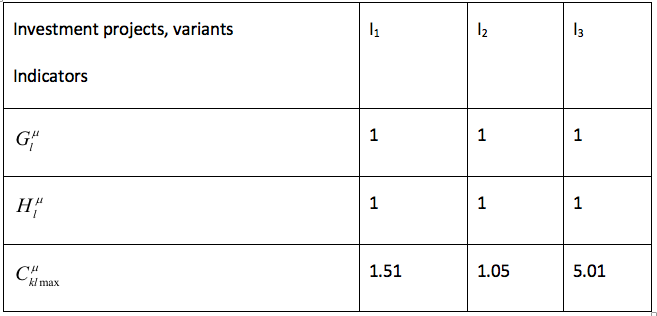

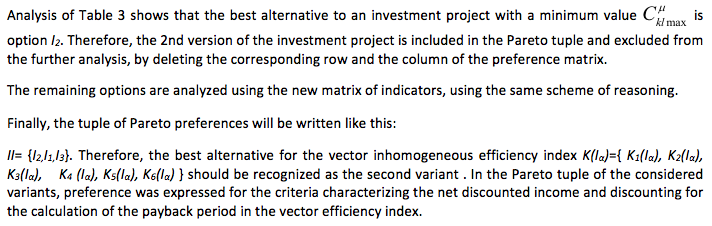

Table 3

Matrix of indicators

The application of a multi-criteria approach to the evaluation of investment projects has advantages and disadvantages. Advantages include such factors as flexibility in use, variability, the use of multiple criteria, the possibility of comparing and evaluating the whole pool of projects in one period.

To the disadvantages of using a multi-criteria approach can be attributed: the instability of the external environment and caution in the use of risk factors that affect the attractiveness of the investment project.

The described algorithm for selecting an investment project is adapted to take into account the situation of risk. In addition to taking into account the diversity of economic interests inherent in the economic system, it makes it possible to reflect the uncertainty of the forecasted states of the system under study. This is achieved by describing risk situations and introducing a multicomponent representation of the risk component as one of the decision criteria.

This approach enhances the possibility of applying the multicriteria selection method for the real conditions of economic activity. It reflects the specifics of the process of adopting a complex professional managerial decision in the economic system to the greatest extent. This algorithm for choosing an investment project can be recommended for making long-term strategic decisions in a risk situation.

Brigham, F. E., Ehrhardt, C. M. (2015) Financial management: theory and practice / South-Western Cengage learning, pp. 89-145

Bukhvalov, A. (2011) Financial calculations for professionals / Bukhvalov A., Bukhvalova V., Idelson A.. - St. Petersburg: BHV, pp. 90-134.

Khokhlov, N.V. (2011) Risk Management: practical allowance for Universities / Khokhlov N.V.. - Moscow .: UNITY-DANA, pp. 67-98.

Lukicheva, L.I. (2016) Decision making process in management / Lukicheva L.I., Egorychev D.N. - Moscow .: Omega-M, pp. 45-67.

Mazur, I.I. (2014) Project Management: practical allowance for Universities / Mazur I.I., Shapiro V.D., Olderogge, N.G.; - 2nd ed., Moscow: Omega-L, pp. 123-134.

Orlovsky, S.A. (1981) Problems of decision making with fuzzy source information / Orlovsky S.A. - Moscow: Nauka, pp. 56-68.

Parrino, R., Kidwell, D., Bates Th. (2014) Essentials of corporate finance / Wiley - NY/, pp. 67-98

Rodionova, E.A., Epshtein, M.Z., Petukhov, L.V. (2013) Multivariate evaluation of investment projects based on interval preferences / Rodionova E.A., Epshtein M.Z., Petukhov L.V. // Scientific and technical sheets of the Saint-Petersburg Polytechnic University \Information. Telecommunication. Management\ Issue 2 (169), pp.141-148.

Roy, B. (1976) Problems and methods of solutions in problems with many objective functions / Roy B. // Analysis questions and decision-making procedures. - Moscow: MIR, pp. 20-58.

Savchuk, V.P. (2007) Evaluation of the investment projects’ effectiveness / Savchuk V.P. - Moscow: Phoenix, pp. 23-45.

Seitz, N. E., Ellison, M. (1999) Capital budgeting and long-term financing decisions / Harcourt Brace college Publishers/, pp. 89-96

Serguieva, A. (2014) Fuzzy interval methods in the investment risk appraisal / Serguieva A., Hunterb J. // Fuzzy Sets and Systems, Issue 142. - pp. 443-466.

Stoyanova, E.S. (2006) Financial management: theory and practice / Stoyanova Е.С., Krylova Т.B.; - 6 th ed., Moscow: Publishing house "Perspective", pp. 145-167.

Syroezhin, I.M. (1980) Perfection of the system of efficiency and quality indicators / Syroezhin I.M. - Moscow: The Economy, pp. 78-89.

Vedernikov, Y.V. (2011) Scientific and methodical apparatus of vector preference for complex technical systems characterized by quality indicators specified in a limited-indefinite form / Vedernikov Y.V., Mogilenko V.V. // Issues of modern science and practice. University of Vernadsky. System analysis. Automated management.-Issue 1 (32). -pp. 81-96.

1. Peter the Great Saint-Petersburg Polytechnic University Saint-Petersburg, Department of applied mathematics, Russia, e-mail: e_a_rodion@mail.ru

2. Corresponding author: Korea University of Technology and Education (KOREATECH), School of Industrial Management, phone +82-10-9996-9553, e-mail: shvetsova@koreatech.ac.kr

3. Saint-Petersburg State University of economics, Department of international business, Russia. e-mail: m-epstein@yandex.ru