Vol. 39 (# 06) Year 2018. Page 30

Olga Viktorovna LENKOVA 1

Received: 30/11/2017 • Approved: 15/11/2017

ABSTRACT: The article substantiates the urgency of risk management in oil and gas companies in the current context. The main risk management bodies and their functions are presented in the context of one of the Russian oil and gas companies. Based on the systematization of risk types, the author distinguishes major risks in oil and gas business. Among the external risks the author identifies the groups of political, socio-economic, environmental, and scientific-technical risks. It is proposed carrying out analysis of internal risks within the following groups: risks of production activity, risks of the support activity, risks in the reproductive sphere, risks in the sphere of circulation, and risks in the sphere of management. The article presents results of expert assessments of these risks for oil extraction and refining segment of concerned oil and gas company as well as suggests recommendations on the corporate risk management. |

RESUMEN: El artículo corrobora la urgencia de la gestión de riesgos en las compañías de petróleo y gas en el contexto actual. Los principales organismos de gestión de riesgos y sus funciones se presentan en el contexto de una de las compañías rusas de petróleo y gas. Con base en la sistematización de los tipos de riesgo, el autor distingue los principales riesgos en los negocios de petróleo y gas. Entre los riesgos externos, el autor identifica los grupos de riesgos políticos, socioeconómicos, ambientales y científico-técnicos. Se propone realizar análisis de riesgos internos dentro de los siguientes grupos: riesgos de la actividad productiva, riesgos de la actividad de apoyo, riesgos en la esfera reproductiva, riesgos en la esfera de la circulación y riesgos en el ámbito de la gestión. El artículo presenta los resultados de las evaluaciones de expertos de estos riesgos para el segmento de extracción y refinación de petróleo de la compañía de petróleo y gas en cuestión, y sugiere recomendaciones sobre la gestión del riesgo corporativo. |

If approaching the issue of understanding the essence of risk widely, considering it as the probability of not receiving the desired (planned) result, in recent times, the number of conditions and factors that predetermine this probability is increasing every year. External business environment is characterized by lowering the degree of certainty and predictability over time. Difficulties arise in the activities of not only small and medium-sized businesses, but large companies as well, and especially those, the corporate portfolio of which contains international projects. Russian oil and gas companies, many of which have wide geographical (country) diversification, are not an exception. At that, risk defining conditions and factors for noted industry actors are quite diversified (natural, economic, political, etc.), and most of them can be hardly formalized. So, oil and gas companies under the influence of low world market prices on oil and imposed sanctions in relation to the export of technologies and equipment are forced to make a lot of adjustments in their strategies. However, taking into account complex structure of oil and gas companies, high cost of errors (risks), and the need for making rapid managerial decisions, we can talk about actualization of the problem concerning the improvement of risk management system effectiveness at industrial enterprises.

While considering this problem on the example of specific oil and gas company it should be noted that PJSC LUKOIL pays a great attention to risk management issues to ensure the corporate confidence in the sustainable development despite the negative impact factors. The company actively operates risk management system that is primarily aimed at reducing the major risks, especially those associated with the occurrence of significant losses and failure to achieve the set goals of long-term company development. The development of risk management within the framework of PJSC LUKOIL is based on the improvement of the enterprise-wide risk management system, i.e. Enterprise Risk Management (ERM).

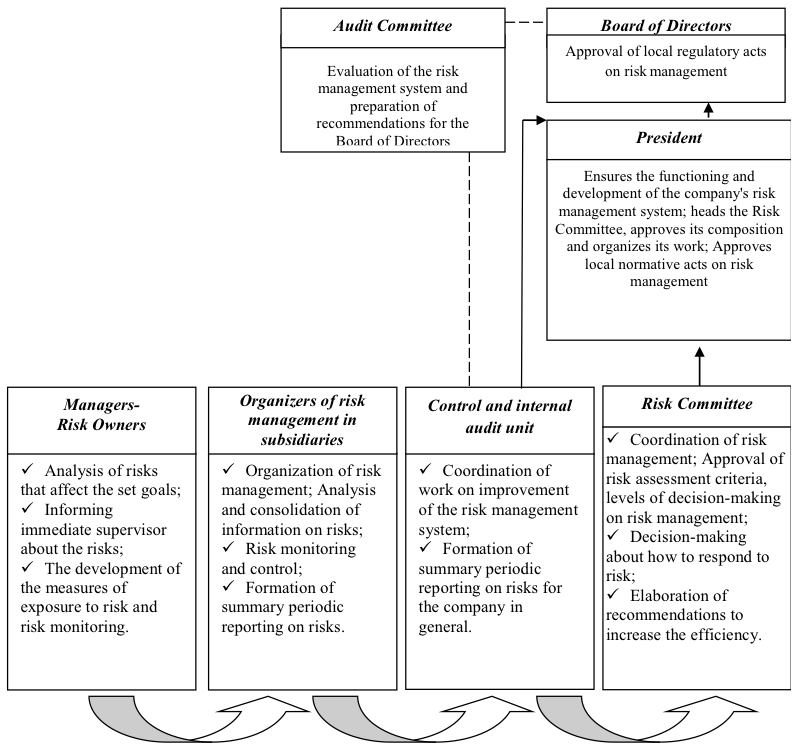

Risk management permeates the entire company and is implemented at almost every level of the hierarchical structure of all corporate subdivisions. At that, strategic risk management is concentrated at the holding company level. The major company’s governing bodies involved in the risk management system are presented in Fig. 1. Up to date, the existing risk management system can be considered as sufficiently effective. Nevertheless, the system is regularly subjected to certain improvements. In particular, this concerns the normative-methodical base of risk management. Local regulations for risk management at PJSC LUKOIL were developed and approved in 2013. These regulations include the following.

a) Risk management regulation defining the distribution of powers and responsibilities for the implementation of the "Risk Management" business process, establishing sequence of activities and interaction between business processes’ participants;

b) The instruction for generating information on the response to the risk, qualitative and quantitative assessment of the residual risk, as well as risk monitoring.

Development of measures for the regulation and methodological support of risk management policies is one of the most effective tools to prevent possible negative consequences as a result of the impacts of certain risks on the company.

Figure 1

Main bodies of risk management in the oil and gas company, and their functions

There are many risk classifications influencing the activities of the enterprise. The most commonly used is the classification, providing for the division of risks into internal and external ones, and their subsequent structuring in the frameworks of each group. The level of risks’ detail may be different. In this work it is proposed to use decomposed list of risks to build a risk profile of the company based on the use of expert assessments.

When building the risk profile, in the first place, the experts are given a general list of risk factors affecting the company’s activity. Based on expert evaluation method, this list is adjusted to the peculiarities of a particular company by excluding or adding individual factors. Next, the proposed factors are assessed on a ten point scale. Table 1 shows the results of the selection process and expert assessment of risks for the two activity segments of the oil and gas company.

Table 1

Expert assessments of the relevant risks when implementing the corporate

strategy in business segments of "extraction" and "oil refining"

Name of the factor |

Oil extraction |

Oil refining |

External risks |

||

Political risks |

||

1. Political situation in a particular region uniting a group of countries; |

7 |

7 |

2. Internal political situation in the country; |

6 |

7 |

3. Interference of the public administration in the company activities; |

5 |

6 |

4. Breach of the contract due to the actions of the authorities of the country in which the counterparty is located; |

8 |

- |

5. Modification of regulation norms; |

|

|

Socio-economic risks |

||

1. The change in tax policy and tax rates; |

6 |

7 |

2. Currency fluctuations, change in currency regulation; |

7 |

6 |

3. Risks associated with counterparty’s banking and the possible decline of their financial sustainability; |

5 |

- |

4. The decrease in the level of demand; |

4 |

6 |

5. Change of counterparty’s contract terms; |

5 |

- |

6. The emergence of new competitors in the market where the company operates; |

- |

7 |

7. Possible hostile takeover of the company by competitors; |

- |

7 |

Environmental risks |

||

1. The adoption of new environmental laws and regulations, or their constant tightening; |

7 |

8 |

2. Environmental changes resulted from technogenic catastrophes, accidents, and incidents; |

6 |

6 |

3. Adjustments to the state environmental policy; |

5 |

- |

4. Imposition of restrictions on the use of natural resources at the place of operation; |

7 |

6 |

Scientific and technical risks |

||

1. Emergence of new technologies or activities in competing companies; |

7 |

8 |

2. Emergence of a substitute product in the market; |

4 |

5 |

3. Reduction in scientific and technical potential due to employee attrition; |

6 |

- |

4. The risk of unauthorized use of company’s technologies; |

5 |

6 |

5. Scientific breakthrough in the field that makes the company uncompetitive if it has not reached a certain level; |

6 |

7 |

Internal risks |

||

Risks of production activity |

||

1. Unscheduled downtime of equipment and the underutilization of production capacity; |

5 |

7 |

2. Inadequate equipment for more high-tech production; |

6 |

7 |

3. Production accidents; |

7 |

7 |

4. The late commissioning of production facilities; |

6 |

6 |

Risks of the enterprise's support activity |

||

1. Unscheduled costs resulting from the imperfections of logistics policy; |

7 |

7 |

2. The occurrence of conditions that do not allow for or significantly impede the fulfillment of license agreements; |

6 |

- |

3. Unsafe system of confidential data processing and accounting; |

3 |

3 |

Risks of the reproductive sphere |

||

1. The shortage of highly qualified specialists; |

5 |

6 |

2. Insufficient innovation potential of the company; |

4 |

4 |

Risks in the sphere of circulation |

||

1. Violation of raw materials’ and components’ delivery schedules by contractors; |

5 |

6 |

2. Unmotivated refusal of wholesalers in the supply of or payment for the ordered products; |

3 |

3 |

3. The bankruptcy of the counterparty; |

6 |

4 |

4. Wrong orientation of a company on a specific market; |

4 |

3 |

Risks in the management sphere |

||

1. Mistakes in planning and forecasting; |

5 |

- |

2. The outflow of key workforce; |

3 |

3 |

3. Incorrectly defined strategic goals of the company; |

2 |

2 |

4. Incorrectly projected change in the general economic situation in the company |

2 |

2 |

After evaluation, we have assessed quantitatively consistency of experts’ opinions, based on calculation of the dispersion coefficient of concordance, and revealed the reason for the mismatch of some of the judgments.

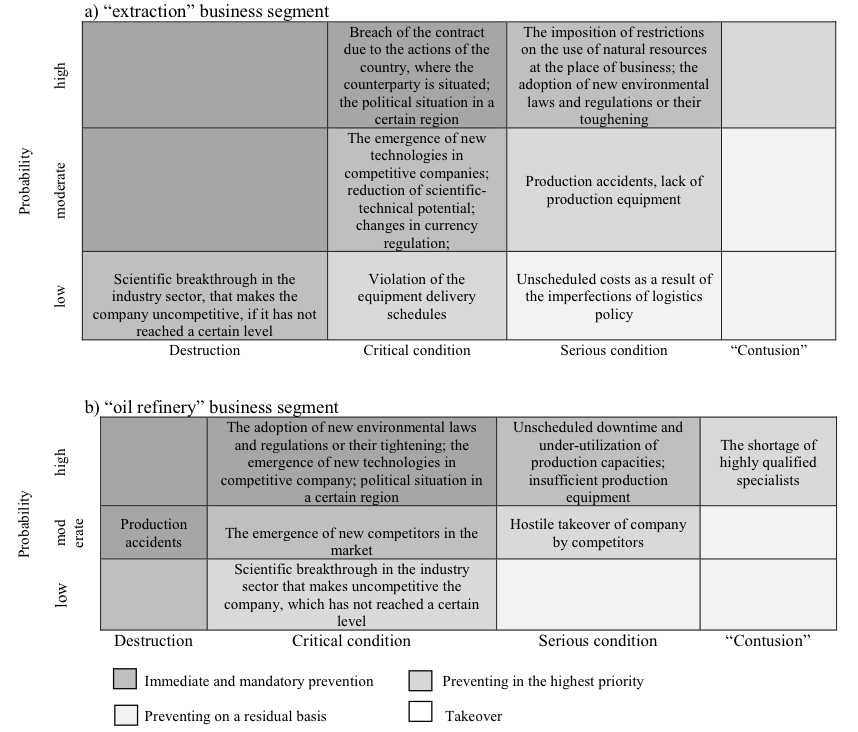

It is important to note that the most important factors that have received the highest rating based on the results of the analysis, fall into risk profile. To select these factors, it is advisable to use the matrices’ constructing method.

The example of such matrix is shown in Fig. 2.

Figure 2

Matrices of risk factors for oil and gas company.

The last and final stage consists in building directly a risk profile for the company, which contains a number of recommendations for effective risk management (Table 2).

Table 2

Risk profile for implementing the development strategy of oil and gas company in Russia

Business segment |

Importance |

Risk factor |

Recommendation |

Extraction |

1st group |

1. Breach of the contract due to the actions of the country, where the counterparty is situated; |

Consider all possible coordination options for projects under interest; if reconciling the project is impossible, exclude the project from development program; |

2. Political situation in a certain region uniting a group of countries |

Diversification of corporate operations, and in conjunction with activities in unstable regions, implementation of projects in partner countries, as well as signing long-term agreements that protect the company against such risks; |

||

3. The imposition of restrictions on the use of natural resources at the place of business |

Improvement of work process through the implementation of high-tech equipment and the latest development methods; |

||

4. The adoption of new environmental laws and regulations or their tightening |

Improvement of work process through the implementation of high-tech equipment and the latest development methods; |

||

2nd group |

1. The emergence of new technologies in competitive companies |

Carrying out R&D |

|

2. Reduction of scientific-technical potential of the company; |

Carrying out R&D |

||

3. Changes in currency regulation |

Minimization of currency risks through operations with derivative financial instruments carried out within the framework of corporate dealing; in order to mitigate the currency risks, issuing loans to subsidiaries in local currencies within intra-group financing. |

||

4. Scientific breakthrough in the industry sector, which makes the company uncompetitive, if it has not reached a certain level |

Carrying out R&D |

||

3rd group |

1. Production accidents |

Funding preventative and predictive maintenance of fixed assets; |

|

2. Lack of production equipment |

Consider the possibility of retrofitting of production or its modernization; |

||

3. Violation of the equipment delivery schedules |

The imposition of penalties and other measures for such violations |

||

4. Unscheduled costs as a result of logistics policy imperfections |

Building partnerships with state monopolies and government authorities, signing long-term contracts with consumers, retaining an optimum share of the petroleum product markets, as well as detailed development of transportation schemes; |

||

Oil refining |

1st group |

1. The adoption of new environmental laws and regulations or their tightening; |

Improving work process by the implementation of high-tech equipment and the latest methods of hydrocarbon raw materials processing; |

2. The emergence of new technologies in competitive companies |

Carrying out R&D; |

||

3. Political situation in a certain region; |

Diversification of corporate operations and in conjunction with activities in unstable regions, the implementation of projects in partner countries, as well as signing long-term agreements that protect the company against such risks; |

||

4. Emergence of new competitors in the market |

Assessment of competitors’ status in the market and development of measures for the protection and maintenance of own competitiveness; |

||

5. Production accidents |

Funding for preventative and predictive maintenance of fixed assets; |

||

2nd group |

1. Unscheduled downtime and under-utilization of production capacities; |

Optimizing production processes by maximizing load of all available capacities and rational use of labor time; |

|

2. Insufficient production equipment; |

Consider the possibility of retrofitting of production or its modernization; |

||

3. Hostile takeover of company by competitors; |

Development of measures for the company protection;

|

||

3rd group |

1. The shortage of highly qualified specialists; |

Focusing on integrated development of human potential; creating and replenishment of the skill pool from among the most experienced and promising employees. |

Guidelines, proposed in the risk profile may be supplemented in accordance with the change in the status of the company and prospects of its future development. In addition, for more complete and accurate information it is necessary to calculate the economic component of these measures.

The results of the risk profile corresponding to the implementation of strategic initiatives of oil and gas companies, as seen from Table 2, can be developed and recommended taking preventive measures, which, in turn, will allow the company:

a) to reduce the level of industry risks through holding of tenders for the purchase of equipment, entering into direct contracts with manufacturers, as well as signing long-term contracts with suppliers;

b) to optimize financial risks, focusing on the predominant use of own funds for financing of current activities and future projects. This will allow minimizing the impact on the company of factors such as rising interest rates or reducing credit availability, as well as take into account the impact of these risk factors on operational and financial performance in the development of investment projects, the formation of plans and budgets

c) to reduce the incidence of risks associated with legal sphere by adhering to the requirements of the applicable legislation and license agreements, as well as commitments to counterparties.

Implementation of the proposed integrated risk analysis will enable the company to most effectively manage them, discover reserves, respond proactively or develop multiple alternatives that allow responding quickly to changing situations.

The issues of risk management are considered for many years in the works of Russian and foreign scientists. At that, there are currently a significant number of textbooks and manuals on risk management (Fomichev, 2010; Crewe, 2015; Firsova, 2014). Some authors consider mainly the issues related to project management technology, focusing attention on individual implementation steps of the risk management system and its realization (Glukhova, 2016; Moskvin, 2016a, 2016b; Osinovskaya, 2015). Quite a large number of studies deal with problems of individual risks management, such as economic risks (Kachalov, 2012), financial and environmental risks (Bashkin, 2007), innovative risks (Sklyarov, 2011), currency risks (Struchenkov, 2010), etc. There are scattered publications on risk management in specific industry sectors (Vorobyov, 2012; Leonovich, 2012), including the fuel and energy complex (Volyn, 2012; Volynskaya, 2002; Gazeev, 2012; Zubarev, 2016; Kozhukhova, 2011; Vorobyev and Baldin 2013). In the study of risk management significant role is given in most cases to the assessment procedure (Shvets, 2015). Also, an increased number of publications on integrated risk management systems in enterprises have emerged there recently (Vereshchagin and Ekaterinoslavsky, 2016).

Currently, there is a wide range of possibilities for the implementation of internal and external benchmarking in relation to instructional techniques for risk management. So, it is quite possible to study and use risk management experience at similar enterprises or at enterprises from unrelated industries. It is possible also adjusting the appropriate mathematical apparatus. However, this often leads to complication of the use of the methodological tools in the practical activities of specific enterprises.

In conclusion, we would like to note that, despite the use in this study of the technique consisting in illustrating proposals based on the example of a particular organization, the author's recommendations are quite versatile, and can be used at similar enterprises, the structures of which include oil-producing and oil-refining segment. Moreover, similar assessment criteria can be generated for other segments of the company's activities.

The approach proposed by the author is relatively easy to use, and if necessary, it can be easily adjusted to the activity features of industrial enterprises. It should be noted that this technique has also a weak point, which consists in a certain degree of subjectivity due to the use of expert assessments in the proposed approach. However, in our opinion, one of the main ways to ensure the promptness and thoroughness of risk assessment is in particular the use of expert assessments.

Certainly, the proposed approach can hardly be used as a standalone method. It can be recommended for the use primarily for the purpose of preliminary express-diagnostics of risks and their prioritization. The method should be supplemented with further more detailed assessment of identified basic problem areas using tools with a higher degree of objectivity. Such implementation of the proposed recommendations will allow reducing the complexity of subsequent analytical procedures.

Bashkin, V.N., 2007. Ekologicheskie riski: raschet, upravlenie, strahovanie [Environmental risks: calculation, management and insurance] [Text]. Moscow: Higher School, 360 p.

Crewe, M., Galai, D., and Mark, R., 2015. Osnovy risk-menedzhmenta [Fundamentals of risk management] [Text]. Lyubertsy, Yurayt, 390 p.

Firsova, O.A., 2014. Upravlenie riskami organizacij [Organizations’ risk management] [Text]. Moscow, Inter-regional Public Organization Safety and Survival Academy, 226 p.

Fomichev, A.N., 2011. Risk-menedzhment [Risk management] [Text]. Moscow, Dashkov and Co., 376 p.

Gazeev, M. Kh. and Volynskaya, N.A., 2012. Sovremennye ogranicheniya i riski razvitiya gazovogo sektora ehkonomiki rossii [Contemporary limitations and development risks in the gas sector of the Russian economy] [Text]. Bulletin of Higher Educational Institutions. Sociology. Economy. Policy. 3, 37-41.

Glukhova, M.G. and Varlamov, A.O., 2016. Osobennosti zarubezhnogo opyta ehkonomicheskoj ocenki investicionnyh proekt [Peculiarities of the international experience in economic evaluation of investment projects] [Text]. Economics: Yesterday, Today, Tomorrow, 7, 47-57.

Kachalov, R.M., 2012. Upravlenie ehkonomicheskim riskom: teoreticheskie osnovy i prilozheniya [Economic risk management: Theoretical foundations and applications] [Text]. Nestor-Istoriya, St. Petersburg.

Kozhukhova, O.S., 2011. Sistematizaciya faktorov riska deyatel'nosti neftegazodobyvayushchih predpri [Studying the risks that affect the activities of Russian oil and gas companies] [Text]. Economic Systems Management, 12. Retrieved from http://uecs.ru/uecs-36-122011/item/891-2011-12-

Leonovich, T.I., 2012. Upravlenie riskami v bankovskoj deyatel'nosti: Uchebnyj kompleks [Risk management in banking: Training package] [Text]. Minsk, Dikta, Misanta, 136 p. Retrieved from http://www.zavtrasessiya.com/index.pl?act=PRODUCT&id=2774

Moskvin, V.A., 2016a. Investicionnye proekty v mire social'nyh sistem [Investment projects in the world of social systems] [Text]. Monograph, Moscow, INFRA-M, 256 p.

Moskvin, V.A., 2016b. Riski investicionnyh proektov [Risks of investment projects] [Text]. Monograph, Moscow, INFRA-M, 320 p.

Osinovskaya, I.V., 2015. Prinyatie upravlencheskih reshenij v usloviyah riska [Management decision-making under risk] [Text]. Economy and Entrepreneurship, 8-1(61-1), 767-770.

Shvets, S.K., 2015. Analiz i ocenka riskov kompanii [Analysis and assessment of corporate risks] [Text]. Saint-Petersburg, Saint-Petersburg State Polytechnic University.

Sklyarova, V.V., 2011. Osobennosti ocenki i upravleniya innovacionnymi riskami [Peculiarities of estimation and management of innovative risks] [Text]. Finance and Credit. 13, 72-79.

Struchenkova, T.V., 2010. Valyutnye riski: analiz i upravlenie [Currency risks: Analysis and management] [Text]. Moscow, Knorus, 210 p.

Vereshchagin, V.V. and Ekaterinoslavsky, Yu.Yu., 2016. Integrativnyj risk-menedzhment kompanii. Koncepciya, procedury i instrumenty proektirovaniya i vnedreniya [Integrative corporate risk management. Concepts, procedures, design and implementation tools] [Text]. Monograph. Moscow, INFRA-M.

Volynskaya, N.A., 2012. Ekstensivnoe razvitie vmesto kachestvennogo rosta [Extensive development instead of qualitative growth] [Text]. Russian Oil, 12. p. 3.

Volynskaya, N.A., Guzeev, L.P. Guzhnovsky, N.N. Karnaukhov, R.V., and Orlov, R.V., 2002. Energoehffektivnaya strategiya razvitiya ehkonomiki Ross [Energy efficient strategy for the Russian economy development] [Text]. Saint-Petersburg.

Vorobyev, S.N. and Baldin, K.V., 2013. Upravlenie riskami v predprinimatel'stve [Managing risks in business] [Text]. Moscow, Dashkov and Co., 482 p.

Zubarev, A.A., Glukhova, M.G., and Makovetsky, E.G., 2016. Sistematizaciya faktorov riska deyatel'nosti neftegazodobyvayushchih predpri [Systematization of the risk factors of oil and gas companies] [Text]. Bulletin of the Voronezh State University of Engineering Technologies, 3(69), 370-374.

1. Federal State Budget Educational Institution of Higher Education Industrial University of Tyumen, 625000, Russia, Tyumen, Volodarskogo St., 38; E-mail: olga_lenkova@mail.ru