Vol. 39 (Nº 01) Year 2018. Page 20

Vol. 39 (Nº 01) Year 2018. Page 20

E.G. POPKOVA 1

Received: 28/08/2017 • Approved: 28/09/2017

ABSTRACT: In this article the dynamics of economic growth in various developed and developing countries is calculated using the technique of “underdevelopment whirlpools”; the factors of the imbalance of economic growth in developed and developing countries are determined by constructing model of Uzawa-Lucas which provided an insight into the development of an economic system based on human capital and the dynamics of natural resources. As a result of the analysis, it was found that the dynamics of the share of GDP of developing countries in the long term is defined as the dynamics of human capital, as well as the dynamics of oil and gas. For the group of economically developed countries the impact of oil and natural gas has also been positive, but less significant (3 times) than for developing countries. At the same time, the influence of the specific dynamics of accumulation of human capital in developed countries has been more significant than in developing countries. The authors determined positions of developed and developing countries on the issue of economic development imbalances in the global economy: positions with the methods of economic-mathematical modeling, analysis of the expenses of developed countries for support of developing countries is conducted, and analysis of competition between countries in the global economy is conducted. The authors analyzed the Index of use of marketing practices of the countries and the results of the cluster analysis of the countries are shown: the level of marketing practices in each cluster, a comparative analysis of the economic growth of the world economy at different stages of globalization is conducted, and measures for support of developing countries by developed countries are identified. The result showed inconsistencies of economic growth in today's global economy, which is reflected in simultaneous competition and mutual support of economic systems. |

RESUMEN: En este artículo, la dinámica del crecimiento económico en varios países desarrollados y en desarrollo se calcula utilizando la técnica de "torbellinos de subdesarrollo"; los factores del desequilibrio del crecimiento económico en los países desarrollados y en desarrollo se determinan mediante la construcción de un modelo de Uzawa-Lucas que proporciona una idea del desarrollo de un sistema económico basado en el capital humano y la dinámica de los recursos naturales. Como resultado del análisis, se encontró que la dinámica de la participación del PIB de los países en desarrollo a largo plazo se define como la dinámica del capital humano, así como la dinámica del petróleo y el gas. Para el grupo de países económicamente desarrollados, el impacto del petróleo y el gas natural también ha sido positivo, pero menos significativo (3 veces) que para los países en desarrollo. Al mismo tiempo, la influencia de la dinámica específica de la acumulación de capital humano en los países desarrollados ha sido más significativa que en los países en desarrollo. Los autores determinaron las posiciones de los países desarrollados y en desarrollo sobre la cuestión de los desequilibrios de desarrollo económico en la economía global: posiciones con los métodos de modelado económico-matemático, análisis de los gastos de los países desarrollados para apoyar a los países en desarrollo y análisis de competencia entre los países en la economía global se lleva a cabo. Los autores analizaron el índice de uso de las prácticas de comercialización de los países y se muestran los resultados del análisis de clúster de los países: el nivel de prácticas de comercialización en cada grupo, un análisis comparativo del crecimiento económico de la economía mundial en diferentes etapas de se lleva a cabo la globalización y se identifican las medidas para el apoyo de los países desarrollados a los países en desarrollo. El resultado mostró inconsistencias en el crecimiento económico en la economía global de hoy, que se refleja en la competencia simultánea y el apoyo mutuo de los sistemas económicos. |

The current situation in the world economy is characterized by existence of developed and developing countries. Uneven economic development of different countries causes the emergence of various crises. Crises are not always economic in nature, but they always have economic manifestation and economic consequences. For example, competition for water in developing countries periodically lead to armed conflicts that threaten not only their original participants, but the entire international community; to resolve them, the interference of developed countries is needed, and all parties to conflicts incur expenses. The costs are shown not only in the form of the cost of military operations, but also in view of lost profits of business partners in conflict countries around the world.

As another example is epidemics in developing countries as a result of unsanitary conditions which rapidly spread to other countries; overcoming of them also requires joint efforts by developed countries, as developing countries do not have necessary technology and investments for that. To overcome these crises, there must be a thorough analysis of the structure and dynamics of global economic growth and identification of causal relationships of a certain level of economic development of different countries – which is the subject of this article.

To identify imbalances of economic growth in developed and developing countries, a method of calculating “underdevelopment whirlpools” is used, a detailed description of which is represented in numerous writings of E.G. Popkova [1-3]. Comparative calculation of the dynamics of economic growth in various developed and developing countries with the use of “underdevelopment whirlpools” technique allows determining the depth of a gap (“whirlpool”) and the speed of sucking in the “whirlpool” (Table 1).

Table 1

Calculation of the dynamics of economic growth in various developed and

developing countries using the “underdevelopment whirlpools” technique [4]

Countries |

GDP, billions USD |

Depth of “underdevelopment whirlpool” (behind the leader – the USA) in 2013, years |

Average speed of underrun for 2011-2013, years for 1 year |

||

2011 |

2012 |

2013 |

|||

Developing countries |

|||||

Russia |

2011 |

2012 |

2014 |

15 |

3 |

Kazakhstan |

198 |

200 |

201 |

23 |

4 |

China |

8205 |

8215 |

8227 |

8 |

5 |

Mexico |

1100 |

1154 |

1178 |

11 |

2 |

Argentina |

465 |

469 |

474 |

19 |

3 |

Brazil |

2230 |

2245 |

2252 |

10 |

5 |

Developed countries |

|||||

Netherlands |

765 |

770 |

772 |

- |

- |

USA |

16020 |

16150 |

16244 |

- |

- |

United Kingdom |

2440 |

2450 |

2471 |

- |

- |

Norway |

472 |

485 |

499 |

- |

- |

Canada |

1803 |

1810 |

1821 |

- |

- |

Australia |

1513 |

21540 |

1532 |

- |

- |

To determine the causes of imbalance of economic growth in developed and developing countries, let us turn to models Uzawa-Lucas model which is a two-sector model of economic growth, where a separate sector is dynamics of human capital which is represented explicitly in the production function [5-6]. Modification of Uzawa-Lucas model is to include it in the factor of natural resources. Thus, it allows analyzing the development of economic system, taking into account the human capital and dynamics of natural resources.

Using the modified model Uzawa-Lucas, the effect of human capital and natural resources on economic growth in developed and developing countries is determined [7]. The group of economically developing countries includes Russia, Kazakhstan, China, Mexico, Argentina, and Brazil; the group of economically developed countries includes the Netherlands, the US, the UK, Norway, Canada, and Australia. This choice is caused by the fact that the above-mentioned countries in varying degrees have reserves of oil and gas resources, and there is necessary statistical information on them.

The simulation revealed that in developing countries, human capital has a significant impact on economic growth (coefficient of “f” is significant, and its value is quite high - 0.566). At the same time, the dynamics of production of oil and gas resources has a positive impact on economic growth, albeit less than human capital (P = 0.194). Thus, an increase in human capital by 1% can lead with a 95% chance to higher growth rates of GDP share in the range of 0.47 to 0.66%, assuming constant returns to scale of the considered factors of production function. On the other hand, an increase of 1% of the oil and natural gas production may eventually have a lot less modest impact on the dynamics of the share of GDP. With 95% chance, the specific growth rate of GDP may be in the range of 0.1 to 0.28%, which is about 3 times less than the effect of human capital.

Analyzing the estimates obtained using series of human capital with different depreciation rates, we see that the assessment of the impact of human capital will range from f = 0.561 (with 5% depreciation rate) to f = 0.57 (at 1% depreciation rate), and the influence of oil and gas resources will be in the range from P = 0.192 (with 1% depreciation rate) to R = 0.197 (with 5% depreciation rate). Thus, we see that the variation of the depreciation of human capital has no significant effect on the growth rate of the share of GDP.

In developed countries, the dynamics of the oil and natural gas production also has a positive impact on economic growth, but this effect is smaller than in developing countries (p = 0.065). A more significant impact on the dynamics of economic growth is committed by dynamics of accumulated specific human capital (p = 0.743).

Thus, in developed countries, the increase in the share of accumulated human capital by 1% may with 95% chance lead to higher growth rates of GDP share in the range of 0.68 to 0.807%, assuming constant returns to scale of the considered factors of production function. This range is at a higher level than in developing countries. On the other hand, an increase of 1% of growth of oil and natural gas production can with 95% chance increase the growth rate of the share of GDP by amount in the range of 0.016 to 0.113%, which is much lesser than the impact of human capital and lesser than that of the confidence interval for developing countries.

The estimates obtained for the series of human capital depreciation rate that is different from 3% will vary as follows. The impact of human capital is in the range of f = 0.741 (5% depreciation rate) to f = 0.746 (1% depreciation rate), and the influence of oil and gas resources varies from p = 0.063 (1% depreciation rate) to R = 0.067 (5 depreciation rate %).

As the result of this analysis, it was found that the dynamics of the share of GDP of developing countries in the long term is defined as the dynamics of human capital, as well as the dynamics of oil and gas production. But at the same time, the influence of human capital significantly exceeds the impact of oil and gas production. This result is quite understandable from the perspective of economic theory, as economic growth in the long term is determined by the dynamics of innovation and related R&D expenses and the dynamics of human capital. Moreover, a well-known phenomenon of Dutch disease suggests that large rents from natural resources production may slow economic growth in the long term.

For the group of economically developed countries, the impact of oil and natural gas has also been positive, but less significant (3 times), than for developing countries. At the same time, the influence of the specific dynamics of accumulation of human capital in developed countries has been more significant than in developing countries. A very high value of human capital for economic growth can be attributed to more effective institutional environment in developed countries than in developing countries, allowing relying more heavily on innovation and technological development. Expenses on education, health, and research and development are main factors of economic growth in developed countries. A higher level of human capital observed in developed countries generates much greater opportunities for economic growth based on the development and implementation of new technologies.

At the present stage of development of the world economy, there is an acute problem of differentiation of countries in terms of economic development which causes the differentiation to developed and developing countries. For developing countries, this problem is manifested in a high degree of economic deprivation, low level of their political influence and insufficient capacity to defend national interests at the international level, and lack of resources, especially investment ones, to improve economic situation.

For developed countries, this problem is manifested in the growth of migration from developing countries which becomes more difficult to control, growth of discontent in developing countries and constant wars for survival; the problem is complicated by the rapid population growth due to cultural factors, which leads to a catastrophic shortage of economic benefits available to people.

In the context of globalization, a high interdependence of countries, regardless of their level of economic development, is established. International division of labor and the law of absolute and relative advantages of Adam Smith necessitate close cooperation of various countries. Thus, developing countries constitute together a global provider of innovative technologies and global investors, while the advanced developing countries are a global manufacturer of industrial products, and lagging developing countries are a global provider of natural resources and agricultural products.

The modern world economy evolves according to market principles, hence the need for countries to compete with each other. This competition is distinctive for absolutely all spheres: the countries compete for investments, human and natural resources, markets, etc. While competing, countries use different marketing strategies.

Analysis of the results of selected countries/groups of countries with a comparison of indices of use of marketing practices is presented in Table 2. This is an important indicator of analysis of marketing activities which is the average for each type of marketing and has a value from 0 to 1. According to previous studies, the rate below 0.6 is considered low, in the range from 0.6 to 0.79 is average, above 0.8 is high [8].

Table 2

Index of using marketing practices in the countries

Marketing practices |

Developed countries |

Developing countries |

Transactional marketing |

0.79 |

0.62 |

Database marketing |

0.68 |

0.55 |

Interactive marketing |

0.75 |

0.71 |

Network marketing |

0.64 |

0.74 |

As we can see from Table 2, the indices of all countries on all types of marketing practices have average values. The only low value belongs to the index of use of database marketing in developing countries. The most actively used types of marketing practices in all countries are transactional and interactive marketing.

The most important part of the analysis of the GMR research is the classification of companies in accordance with the predominance of a particular marketing practices or combinations thereof. The classification in all countries was conducted by a single scheme, based on cluster analysis by the method of k-means. Table 3 shows the results of cluster analysis for all countries, except Russia.

Table 3

Results of the cluster analysis of the countries: level of marketing practices in each cluster

Countries |

Name of the cluster |

ТМ |

MD |

ІМ |

NM |

Cluster share, % |

Developed countries |

transactional |

0.81 |

0.63 |

0.63 |

0.48 |

33 |

pluralistic |

0.85 |

0.78 |

0.82 |

0.75 |

35 |

|

relational |

0.65 |

0.60 |

0.79 |

0.71 |

32 |

|

Developing countries |

pluralistic |

0.86 |

0.79 |

0.80 |

0.82 |

66 |

relational |

0.29 |

0.39 |

0.78 |

0.90 |

7 |

|

transactional |

0.71 |

0.48 |

0.57 |

0.50 |

27 |

The largest number of clusters was allocated in developed countries. Traditional relationship cluster includes local companies with a high level of interactive marketing (focus on personal contacts). Traditional transactional and transactional progressive clusters include the companies which actively use elements of transactional marketing (targeted at single transactions through traditional 4P-instruments), with the difference that transactional progressive cluster includes mostly companies with foreign or mixed capital. Relationship progressive cluster includes companies with foreign capital which actively use elements of both interactive and networking marketing. Pluralistic cluster is characterized by the active use of the elements of all types of marketing practices.

An unexpected result of cross-country comparison was that, as the result of cluster analysis in developed countries and developing countries, the same clusters were defined: transactional, relationship, and pluralistic. Transactional cluster covers companies using traditional elements of the marketing mix, relational cluster – companies with a high level of interactivity and network marketing, and pluralistic cluster - all types of marketing practices which are actively applied.

At the same time, clusters’ filling varies considerably – judging by the differences that have been identified by comparing the characteristics of research databases, indexes, marketing activities, as well as on the number (shares) of companies that are included in a specific cluster. Thus, the presence of a unified methodology for the comparable research does not guarantee similarity of informative content with identical clusters (as in the case of developed countries).

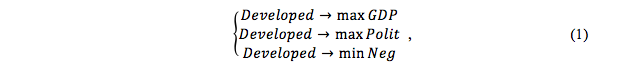

Imbalances in economic development of the world economy are, to some extent, in the interests of developed countries which are interested in maintaining their dominant position. Therefore, the position of developed countries in eliminating imbalances of economic growth is to try to maximize their own total income and political influence while minimizing the negative effects arising from the low level of economic development of developing countries.

The major adverse effects include uncontrolled migration of unskilled labor from developing to developed countries, accompanied by growing unemployment and crime in the developed countries and the need of welfare payment to migrants, spread of epidemics in developing countries, wars, etc. With the tools of economic and mathematical modeling, the position of developed countries in eliminating imbalances of economic growth can be formulated as follows:

where developed – developed countries;

GDP – GDP;

Polit – political influence;

Neg – negative effects.

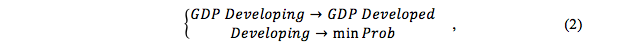

The position of developing countries in solving the problem of imbalances of economic growth is to try to at least catch up and overtake a maximum of developed countries in the level of economic development and solve their own macroeconomic challenges: rapid population growth, unemployment, inflation, water and food shortages, epidemics due to unsanitary conditions, etc. With the tools of economic and mathematical modeling, the position of developing countries in solving the problem of imbalances of economic growth can be formulated as follows:

where developing – developing countries;

Prob – macroeconomical problems.

Therefore, the uniqueness of the competition in the world economy lies in the fact that the most competitive developed countries have to maintain less competitive developing countries that are not able to exist and develop without such support.

According to official UN data, this support is manifested in the following forms:

Dynamics of the total direct and indirect expenses of developed countries for support of developing countries in 2009-2013 is shown in Table 4.

Table 4

Dynamics of the total direct and indirect expenses of developed

countries to support developing countries in 2009-2013, billion USD.

Countries |

2009 |

2010 |

2011 |

2012 |

2013 |

Netherlands |

22.24 |

22.47 |

22.69 |

22.92 |

23.16 |

USA |

468.11 |

472.84 |

477.62 |

482.44 |

487.32 |

United kingdom |

70.24 |

70.95 |

71.67 |

72.39 |

73.13 |

Norway |

14.38 |

14.52 |

14.67 |

14.82 |

14.97 |

Canada |

52.47 |

53.00 |

53.54 |

54.08 |

54.63 |

Australia |

44.14 |

44.59 |

45.04 |

45.50 |

45.96 |

As can be seen from Table 4, the expenses of developed countries to support developing countries are quite high - they are on the average of 3% of their GDP and increase annually due to increasing gap in the level of economic growth.

Strengthening of economic cooperation often takes the form of the creation of integration association of countries and leads to the need of harmonization of economic development of countries in the world – it is one of the key elements of the overall process of convergence of economic growth which naturally arose on competition in the world economy. Convergence of economic growth means the process of convergence of countries with different levels of political, social, and cultural development, which includes the development and implementation of regulatory mechanisms and tools in the framework of integration association at all hierarchical levels.

This process involves the standardization of systems, integration of institutions and harmonization of approaches to stable socio-economic development of countries. The basic principles of harmonization include: harmonization of legal regulation; synchronicity of the adoption of harmonized regulations; consistency of the harmonization stages; priority of international treaties over national legislation.

Harmonization is usually associated with the further development and deepening of integration. An important problem of integration and globalization processes is international tax competition which is one of the factors contributing to the development of the global market and provides economic power of transnational corporations. In the context of globalization and deepening of economic integration, system of taxation not only preserves the function of the main source of filling the budget, but also enhances the influence on the international location of production, direct and portfolio investments.

With the increase of business mobility, national tax systems have a significant impact on decision-making of companies and individuals in the selection of countries for investment, jobs, and money making. In recent decades, there was a qualitative change in the perception of tax competition by national governments. If tax competition was originally a side-effect that resulted from the natural differences between the laws of different countries which focused on domestic priorities, nowadays international tax competition becomes a tool that is purposefully used by governments to create competitive advantages for their own country.

Developing countries use tax incentives to attract capital and development of national economies. Growing competition for international capital affected the advanced economies which also use a variety of tools and mechanisms of tax competition. This process occurs mostly within the integration structures in the absence of interstate barriers for foreign trade and movement of production factors.

To determine the characteristics of the economic growth of the world economy, a comparative analysis of economic growth in the world economy at different stages of globalization is conducted (Table 5).

Table 5

Comparative analysis of the economic growth of the

world economy at different stages of globalization

Stage |

Nature of the interdependence of countries |

Nature of competition |

Nature of relations between developed and developing countries |

Prior to the formation of a global economy |

countries develop independently of each other |

lack of countries competition |

countries do not use each other |

During the initial formation of a global economy |

establishment of dependence of countries |

competition between developed countries |

use of developing countries by developed countries |

In the modern period of formed global economy |

close interdependence of countries |

competition between developed and developing countries |

mutual use of developing and developed countries, support of developing countries by developed countries |

As can be seen from Table 5, until the formation of the global economy, countries develop independently of each other, there is no competition between countries, and countries do not use each other; during the initial formation of the global economy the dependence of the countries is established, competition between developed countries is established, and developed countries use developing countries; in modern time of formed global economy there is a close interdependence of countries, competition between developed and developing countries, mutual use of developed and developing countries, and support of developing countries by developed countries.

As a result of the study, the following conclusions could be made. Contradiction of economic growth in the world economy is manifested in the simultaneous existence of competition for resources - investment, natural, human, and markets - and the need for support of developing countries by developed countries. As a matter of fact, a key condition of the market “everyone fights against everyone” is violated - it is replaced by the so-called “smart competition” or “limited competition”, under conditions of which the competitors are interdependent and pursue not only their own, but also the common interests of global prosperity and development.

At first glance, it may seem that competition and mutual support are incompatible concepts. However, it is impossible to imagine the harmonious development of the modern world civilization in conditions of excessive luxury of some countries and absolute poverty of other countries which, as developed countries cannot exist without resources, cheap labor, and production capacity of developing countries, which in turn are not able to create innovative technologies and do not have financial resources they need. Therefore, the contradiction of economic growth in today's global economy is a necessary condition for the existence of sustainable and stable development.

1. Volgograd state technical university, Russia, doctor of economics, professor of the chair “World economy and economic theory”. E-mail: 210471@mail.ru