Vol. 38 (Nº 62) Year 2017. Páge 30

Vol. 38 (Nº 62) Year 2017. Páge 30

Viktor Alekseevich OSIPOV 1; Nina Vladimirovna SHASHLO 2; Alexey Alexeevich KUZUBOV 3

Received: 06/10/2017 • Approved: 30/10/2017

ABSTRACT: Evaluation of the economic sustainability of an enterprise using approaches based on the accounting model excludes consideration of investment risks and the required rate of return, which necessitates their transformation in accordance with modern advances in the value-based theory. It was proved that the value-based theory was based on the need to account for the cost of capital in the context of limited traditional indicators of security. The purpose of the article is to develop a theoretical and methodological approach to assessing the economic security of entrepreneurship using the toolkit of the value-based theory. Methods of theoretical generalization, induction and deduction, analysis and synthesis were used to achieve the goal. It was proved that the "financial health" of the company was diagnosed in terms of three projections within the financial analytical model: the current economic performance, liquidity and balanced business growth. The logic of using VBM models to assess and identify the states of the enterprise economic stability was formed, according to which the excess of financial profitability of equity costs was the basic condition of a sustainable state. It was revealed that aside from the current values of spread indicators, the dynamics of their changes were also informative. It was substantiated that the basis for distinguishing between a stable/unstable state was the criterion of profitability, which was expedient to determine by the spread of the return on sales. It was argued that an objective assessment of sustainability did not allow using fixed scales and rigid limitations for the identification of states. It was actualized that the scale of states of sustainability and the priority of indicators had a certain variability in accordance with the analytical needs of users. It was proved that an economically sustainable enterprise was able to generate positive business value added flows. |

RESUMEN: La evaluación de la sostenibilidad económica de una empresa utilizando enfoques basados en el modelo contable excluye la consideración de los riesgos de inversión y la tasa de rendimiento requerida, que necesita su transformación de acuerdo con los avances modernos en la teoría basada en el valor. Se demostró que la teoría basada en el valor se basaba en la necesidad de tener en cuenta el costo del capital en el contexto de indicadores de seguridad tradicionales limitados. El objetivo del artículo es desarrollar un enfoque teórico y metodológico para evaluar la seguridad económica del emprendimiento utilizando el conjunto de herramientas de la teoría basada en valores. Los métodos de generalización teórica, inducción y deducción, análisis y síntesis se utilizaron para lograr el objetivo. Se demostró que la "salud financiera" de la empresa se diagnosticó en términos de tres proyecciones dentro del modelo analítico financiero: el desempeño económico actual, la liquidez y el crecimiento comercial equilibrado. Se formó la lógica de usar modelos VBM para evaluar e identificar los estados de estabilidad económica de la empresa, según los cuales el exceso de rentabilidad financiera de los costos de capital era la condición básica de un estado sostenible. Se reveló que, aparte de los valores actuales de los indicadores de dispersión, la dinámica de sus cambios también fue informativa. Se comprobó que la base para distinguir entre un estado estable / inestable era el criterio de la rentabilidad, que era conveniente determinar mediante la distribución del rendimiento sobre las ventas. Se argumentó que una evaluación objetiva de la sostenibilidad no permitía usar escalas fijas y limitaciones rígidas para la identificación de estados. Se actualizó que la escala de estados de sostenibilidad y la prioridad de los indicadores tenían una cierta variabilidad de acuerdo con las necesidades analíticas de los usuarios. Se demostró que una empresa económicamente sostenible podía generar flujos positivos de valor agregado empresarial. |

Evaluation of economic sustainability of entrepreneurship is of interest both from the academic and practical standpoints, since it acts as an information constructor for making weighted managerial decisions. It is appropriate to recall the words of John Gardner in this context: "... most ailing organizations have developed a functional blindness to their own defects. They are suffering not because they cannot solve their problems, but because they cannot see their problems" (Gardner 1965, p. 24).

All scientific approaches to the quantitative measurement of economic sustainability are fundamentally based on the financial indicators of business activity and their ratios, which are usually determined on the basis of the accounting analytical model. These studies are reflected in the papers of such domestic scientists as B.N. Gerasimov (2012), V.V. Bocharov (2009), E.A. Kozlovskaya (2010), O.S. Cheremnykh (2005), O. Chernozub (2009), M.A. Yakubovich (2005), S.N. Yashin, E.V. Koshelev and Makarov S.A (2012), V.V. Kovalev (2007), D.A. Buryakov (2011), V.G. Kandalintsev (2010), S.I. Krylov (2010), G.M. Kharisova (2011), and others. Such a format of evaluation excludes the consideration of investment risks and the required rate of return, which leads to the need to transform existing approaches in accordance with modern advances in the theory of corporate finance based on the principles of economic profit (Ivashkovskaya 2013, pp. 115-123; Grant 2010, pp. 11-19). The value-based business model does not disprove the key importance of traditional sustainability indicators (sales volumes, optimality of the structure of formation sources and capital distribution, liquidity, solvency, profitability) but focuses on their limitations (Pettit 2007, pp. 28-30) and proves the objective necessity of taking capital costs during the analysis into account.

As such, the development of modern diagnostic tools for the economic evaluation of processes and phenomena actualizes the need for their implementation in the specific problems of scientific research, including the sustainability of enterprises. Substantiation of the theoretical and methodological approach to the evaluation of economic sustainability on the basis of the value-based model, which is an analytical innovation, necessitates formalization of the level of economic sustainability in accordance with the needs of modern economic diagnostics and real business.

The goal of this article is to develop a theoretical and methodological approach to evaluating the economic sustainability using the toolkit of the value-based theory, namely, the value-based model, which is an analytical innovation and allows to formalize the levels and states of economic sustainability in accordance with the needs of modern economic diagnostics and real business focused on long-term economic growth.

The following research methods were used to obtain the results of scientific study: theoretical generalization for systematization of modern VBM (Value-Based Management) models; induction and deduction to form an analytical toolkit for evaluating the economic sustainability of an enterprise; analysis and synthesis to determine the range of key monitoring indicators of sustainable/unsustainable state of the enterprise.

The thesis is postulated in academic publications of E. P. Kochetkov that "... securing sustainability is the goal of a new business management paradigm that will replace the paradigm of the value-oriented management," while "Value destruction is a consequence of the loss of financial and economic sustainability of the enterprise" (Kochetkov 2012, p. 451). Pretending to no reasoning of the urgency of changing the scientific management paradigm of value to a sustainable-oriented one, the authors consider it expedient to set forth their own vision of using the potential of the value-based analytical model as a multicriterial methodological basis for diagnosing the level and states of the enterprise economic sustainability.

One of the inherent properties of enterprise sustainability is the ability to maintain parameters that reflect the normal (healthy) state of business operation within the framework of the rules balancing in case of a violation of business conditions. From the standpoint of modern theories of efficiency (performance, productivity) of enterprise activities and corporate finance, "financial health" is defined "... based on the ability of the company to manage monetary resources (generate them, attract from external markets and distribute across compliance centers, settle with the capital owners)" (Teplova 2012, p. 54). Traditional estimates based on the accounting analytical model are extended by certain innovations in modern business analytics, which involve:

- supplementing the traditional system of financial indicators from a set of non-financial indicators;

- expanding the range of analytical indicators from the traditional accounting to financial ones, such as earnings before interest and tax (EBIT,) earnings before interest, tax, depreciation and amortization (EBITDA), free operating cashflow (FOCF), free cashflow to the firm (FCFF).

- building a system of financial analytics on the basis of indicators logically connected with the formation of business value.

Results of systematization of the conceptual basis of the modern theory of financial and economic evaluation of economic entities allow to say that the scientists and business analysts of the top consulting companies diagnose within the framework of the company “financial health” value-based analytical model, as a rule, in terms of three meaningful areas (projections):

- projection of the current economic performance, which was interpreted in the traditional (accounting) analytical model as a "projection of profitability (profitability)", since the vast majority of metrics were based on profit indicators. In this projection, the level of resource utilization efficiency is estimated, i.e. the resource costs are compared with the results from their use;

- projection of liquidity (or viability), which is related to the analysis of the ability of the enterprise to generate cash flows and the ability to satisfy claims under liabilities to investors, creditors and capital owners;

- projection of the balanced business growth, which involves evaluation of capital and diagnoses the appropriateness of activities build-up.

As for the efficiency projection, its content in the value-based analytical model is filled in accordance with the logic of performance evaluation based on the projections of the accounting model that contains the following key aspects: level of financial dependence/independence from external investors and creditors, provision of the working capital reserves, level of liquidity and solvency in terms of securing the timely satisfaction of creditors' claims, level of rationality (optimality) of the capital structure, a set of indicators of business activity, investment attractiveness, etc.

Free cashflow to equity (FCFE) is the basis for the formation of the projection of business liquidity within the application of the value-based analytical model. This aspect serves as one of the key financial innovations in the modern business analytics. The logic of the FCFE formation defines cash flows that remain after the definition of the invested capital required for the strategy implementation and payments to creditors, i.e. describes the financial ability to cover investment and current needs for funding the economic activities, as well as the level of the enterprise solvency. The FCFE value is a strategic characteristic of the quality of capital that is invested in the enterprise, quite informative in terms of financial performance, and well-reasoned from the standpoint of use in business analytics.

The projection of a balanced growth is also an analytical innovation, which requires substantial interpretation in the context of further use in the process of diagnosing states of economic sustainability/unsustainability of business. The term "sustainable growth" has traditionally been studied from the standpoint of the national economy in scientific research. However, it has been applied to the microlevel over the last decade as well. The most well-known models of corporate growth evaluation are the following: growth-based models that are secured by proprietary funding sources (balanced growth model ("golden rule of corporate economics")); model of sustainable growth rate (SGR) based on the calculation of the ratio of sustainable growth rate; R. Higgins’ model of internal growth (Model of Optimal Growth Strategy), models of value-based growth presented in scientific publications of G. Arnold, E. Brigham, S. Valdaitsev, A. Dolgoff, A. Damodaran, I. Egerev, I. Ivashkovskiy, Yu. Kozyr, M. Kudina, S. Mordashov, A. Rapport, S. Ross, C. Walsh, G. Khotynskaya, N. Shevchuk, as well as in the papers of T. Copeland - T. Koller -J. Murin, K. Caster - R. Brealey - S. Myers and L. Frolova - A. Lisnichenko.

Provided systematization of analytical growth models is very conditional. In the framework of this study, the emphasis on them is projected only from the standpoint of formation of analytical toolkit that will be efficient from the point of view of the practical use during evaluation of the state of enterprises’ economic sustainability. If the projections of a modern analytical model serve as the basis for aligning the logic of evaluating the states of economic sustainability, then it is logical to justify the choice of the VBM model that will serve as the conceptual basis of such an evaluation. In the modern scientific research, the most popularized VBM models are the following: economic added value (EVA), residual income (RI), market value added (MVA), shareholder value added (SVA), cash value added (CVA) and modified cash value added (МCVA), cash flow return on investment (CFROI), internal rate of return (IRR), stakeholder value added (STVA). Each of the above models provides for the calculation of a set of indicators that signal the state of the company's "financial health" within the projections of "Efficiency" – "Liquidity" – "Growth" and are further transformed into a pyramid of analytical indicators that serve as benchmarks for achieving goals across impact levels. Pretending to no generalization of advantages and disadvantages of the practical use of modern VBM models (this issue is sufficiently fully described in the modern academic literature), let’s formulate the logic of their application in the process of evaluating and identifying the states of the enterprise economic sustainability.

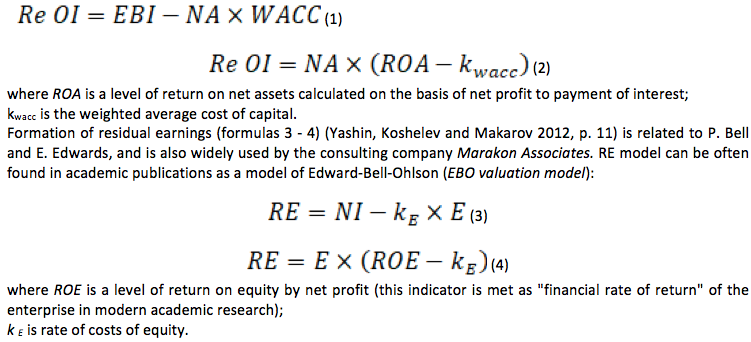

For example, let’s consider the residual income model (RIM), which is built on the principles of A. Marshall’s economic profit concept (Marshall 1983), while the formation of the model itself is directly related to the academic papers of P. Bell, E. Edwards, M. Miller, F. Modigliani, E. Fama. The RIM formation is based on the following factors: amount of invested capital at the time of evaluation, actual and expected level of return on invested capital, sustainability of the spread of results. There are two areas in the context of RIM that reveal the subject matter: operational, which is based on the concept of residual operation income (ReOI), and capital, based on residual earnings (RE).

Indicator of the residual operation income, introduced into the scientific circulation by S. Penman, is in fact analogous to the indicator of economic profit in the version of the consulting company McKinsey&Co. The information orientation of ReOI is focused on the operational effects of the enterprise performance, which determined the use of balance value of net assets (NA) as investment in the calculation (formulas 1 - 2) (Volkov 2005, p. 10).

The RE indicator describes the net effects of the enterprise performance results directly from the positions of shareholders (owners). Therefore, equity is taken as investment, net profit is taken as a result, and the level of expected return is measured on the basis of the cost of equity.

From the standpoint of modern financial analytics, scientists also highlight the methodological problem of filling analytical projections with indicators describing the "financial health" of the company. Depending on the interests of the two groups of financial holders of capital (creditors and owners), the outlines of analytical projections and their interpretation are formed in different ways; they also serve as a principal basis for distinguishing the accounting (bookkeeping) model focused on priority consideration of the creditors’ interests and the value-based one, where the reflection of the interests of the owners of capital is an advantage. However, it must be noted that the above analytical models are not conflicting, but rather organically complementing each other, depending on the ultimate goal of diagnosing the problem. As such, if we are talking about the possibility of attracting credit resources, then it is enough to conduct an analysis from the position of creditors within the accounting model. If making strategic decisions relates to investment in the enterprise development, the higher level of informativeness of the value-based model is unquestionable.

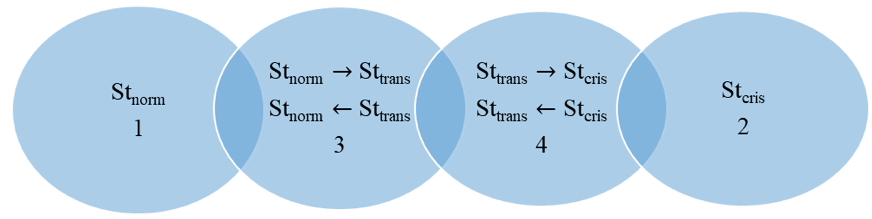

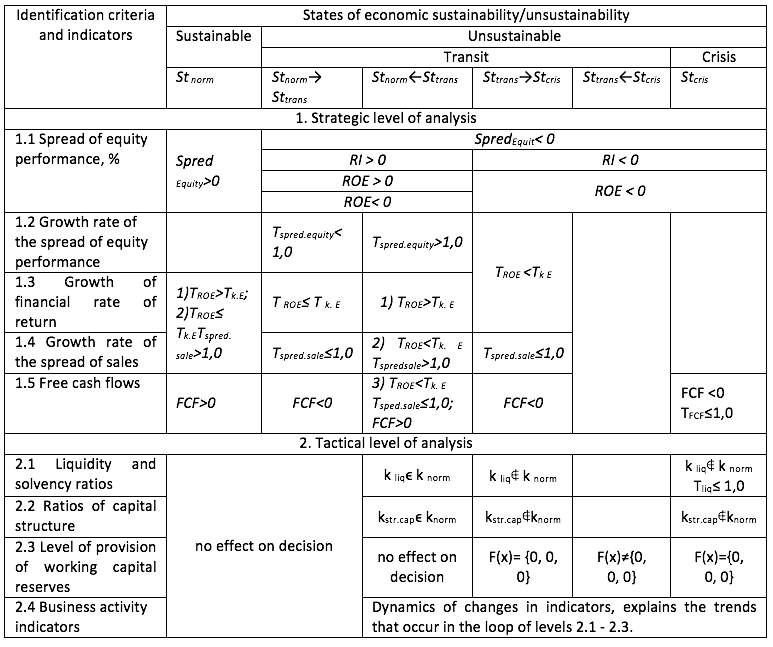

Securing the economic sustainability of entrepreneurship is a permanent process (Vorozhbit and Shashlo, n. d.), while its state can be identified as "normal - transition - crisis". If residual earnings are taken as the basic criterion for identifying the state of economic sustainability, then the level of the normal state (Stnorm) (sustainable) (Figure 1, state 1) will be identified by positive absolute RE values, generating the functioning capital. Negative RE will signal a transition from a sustainable to unsustainable state, which can be identified as transition (Sttrans) (Figure 1, state 3 - 4) or crisis (Stcris) (Figure 1, state 2).

Figure 1. Identification of the states of economic sustainability of entrepreneurship:

St norm is normal state; Sttrans is transition state; Stcris is crisis state.

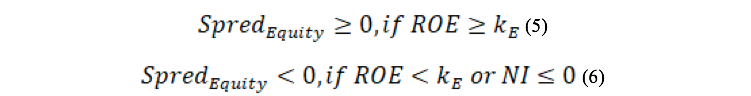

Negative RE values are determined by the negative value of the spread of productivity (return) of equity (Spred Equity), which is formed by two factors: return on equity and its cost. Formation of the positive spread value occurs in conditions where the level of financial rate of return exceeds the cost of equity (formulas 5, 6):

According to this logic, we can form the first basic condition for ensuring a sustainable state of entrepreneurship, the idea of which is that the level of financial rate of return should exceed the cost of equity (ROЕ >k Е) (Table 1). The negative value of the spread of return on equity may be either the result of unprofitableness of activities (then the enterprise may be located either in zone 2 or 4 (Figure 1) or the insufficiency of the level of financial rate of return to cover the rate of the cost of equity (zone 3, Figure 1).

Aside from the absolute value of spread indicators, the dynamics of their changes are also informative. For example, the growth trend of the spread of return on equity (Tsped. equity) (Table 1, criterion 1.2) will be secured at higher growth rates of the level of financial rate of return (TROE) (Table 1, criterion 1.3) in comparison with the growth of the rate of the cost of equity (Tk. E) (formula 7) and vice versa (formula 8):

Table 1

Criteria and indicators of identification of the state of economic

sustainability/unsustainability of entrepreneurship

Compiled by the authors

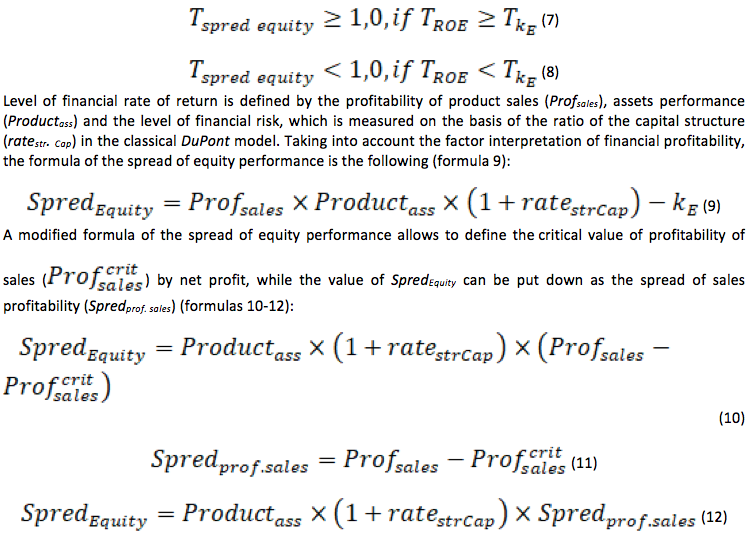

The dynamics of the sales spread are a key factor Spred Equity and are defined not only by the level of efficiency of the company's internal business processes, but also by its competitive positions in the relevant commodity markets. As such, the stability of positive dynamics of this indicator serves as a criterion for identification of the state of economic sustainability at the strategic level of its diagnosis (Table 1, criterion 1.4).

According to the factor logic of the formation of Spred Equity, the indicator of its changes is assets performance and the level of rationality of the capital structure, as well as dynamics of their changes. The strategic vector of the orientation of the value of the oriented analytical model, which underlies the methodology for identification of the states of economic sustainability, shifts the focus of management analytics from the issues of the capital structure rationalization to the plane of maximization of its profitability level, which is primarily due to changes in the corporate strategic architecture and the growth of priority influence on the shaping results of capital formation of non-financial capital forms. The basis for distinguishing sustainable/unsustainable conditions is profitability criteria, which are determined by Spredprof.sales in the proposed model. To specify the types of unsustainable state and determine the vector of entrepreneurship movement along the scale of sustainability states, the assets performance criteria and the efficiency of the capital structure formation will be used in accordance with the logic of the RE model formation.

Identification of the transition and crisis states describing the unsustainable state of the company is a more labor-intensive process that requires substantiation of a wide range of conditions, criteria and indicators, which make it possible to draw more precise conclusions (Cheremnykh 2005; Krylov 2010). An attempt to form analytical parameters for the definition of the "Transition state" necessitated the detailed elaboration of the analytical scale, since the hierarchy of criteria and possible combinations of indicators and conditions is significantly greater than in case of identification of the "normal" and "crisis" states.

To specify the meaningful interpretation of the "transition state" and to adjust the developed method to the needs of business practice, it is suggested to define the following "transit" states:

- transition from "normal" to "transit" state – “Stnorm→Sttrans”;

- transition from "transit" to "normal" state –“Sttrans→Stnorm”;

- transition from "transit" to "crisis" state – “Sttrans→Stcris”;

- transition from "crisis" to "transit" state – “Stcris→Sttrans”.

This specification will allow to more clearly define trends in changes in the company development trajectory in order to focus on the most significant aspects that secure achieving the company's targets. The conditions for the specific identification of the transition state in accordance with strategically important criteria are shown in Table 1, but they are not sufficient to identify the set of causes that determined deviations of the key (strategic) parameters shaping the state of economic sustainability of entrepreneurship and establish trends of randomness or patterns of identified states.

No fixed scales are established or rigid formalized restrictions are defined to identify the states of economic sustainability of entrepreneurship when using the developed theoretical and methodological approach. The analytical focus is on identifying significant causal factors that influence the permanence of the process of evaluating the level of economic sustainability of entrepreneurship. Meanwhile, the meaningful construction of criteria and indicators of the sustainability states identification complies with the logic of the VBM model formation. The proposed scale of economic sustainability/unsustainability of entrepreneurship can vary depending on the purposes of diagnostics and the needs of users of relevant analytics. The priority of the criteria that form the basis for the states identification is variable, but the general idea of evaluation must obey the logic that presents the ability of an economically sustainable enterprise to generate positive flows of the business value added.

Bocharov V.V., Samonova I.N. and Makarova V.A. (2009). Upravleniye stoimostyu biznesa [Managing business value]: study guide. St. Petersburg: SPbSUEF, pp. 124.

Buryakov, D.A. (2011). Ekonomicheskaya bezopasnost i finansovaya ustoychivost predpriyatiy [Economic security and financial sustainability of enterprises]. St.Petesburg: Saint-Petersburg State University of Aerospace Instrumentation, pp. 375.

Cheremnykh O.S. (2005). Strategicheskiy korporativnyy reinzhiniring: protsessno-stoimostnoy podkhod k upravleniyu biznesom [Strategic corporate reengineering: process-value-based approach to business management]. Moscow: Finance and statistics, pp. 736.

Chernozub O. (2009). Stoimostnoy podkhod k upravleniyu chastnoy kompaniyey [Value-based approach to managing a private company]. Moscow: Alpina Publisher, pp. 290.

Gardner J. W. (1965). How to prevent organizational Dry Rot. Gardner. Harper`s Magazine, 10, 24.

Gerasimov B.N. (2012). Teoriya upravleniya [Theory of management]: monograph. Samara: SIBM, pp. 404.

Grant R. (2010). Shareholder value maximization: Rehabilitatinga “dumb idea”. Competitive Strategy Newsletter, 4 (1), 9–11.

Ivashkovskaya I.V. (2013). Financial demensions of corporate strategies. Stakeholder approach: monograph. Moscow: INFRA-M, pp. 115-123

Kandalintsev V.G. (2010) Innovatsionnyy biznes: primeneniye sbalansirovannoy sistemy pokazateley [Innovation business: applying balanced scorecardъ]. Moscow: Delo, pp. 172.

Kharisova G.M. (2011). Stoimostnoy podkhod k upravleniyu investitsionno-innovatsionnoy deyatelnostyu regionalnykh integrirovannykh obrazovaniy v realnom sektore ekonomiki (na primere Respubliki Tatarstan) [Value-based approach to managing investment and innovation activities of regional integrated entities in the real sector of the economy (by the example of the Republic of Tatarstan)]. Kazan, KSUAE, pp. 145.

Kochetkov E.P. (2012). Finansovo-ekonomicheskaya ustoychivost organizatsii: diagnostika ugrozy utraty na rannikh stadiyakh kak odin iz faktorov ekonomicheskogo rosta Rossii (stoimostnoy aspekt) [Financial and economic sustainability of the organization: diagnostics of the threat of loss at early stages as one of the factors of Russia's economic growth (value-based aspect)]. Proceedings of the Free Economic Society of Russia, works of the winners of the scientific youth competition “Russia’s Economic Growth”, 161, 447-466.

Kovalev V.V. (2007). Upravleniye denezhnymi potokami, pribylyu i rentabelnostyu [Managing cash flows, profit and profitability]. Moscow: Prospect, pp. 336.

Kozlovskaya E.A., Demidenko D.S., Yakovleva E.A. and Gadzhiev M.M. (2010). Stoimostnoy podkhod k upravleniyu innovatsionnym protsessom na predpriyatii [Value-based approach to managing innovation process at the enterprise: textbook]. St. Petersburg: SPbSTU, pp. 205.

Krylov S.I. (2010). Razvitiye metodologii analiza v sbalansirovannoy sisteme pokazateley [Developing methodology of analysis in a balanced scorecard]. Moscow: Finance and statistics, pp. 149.

Marshall A. (1983). Printsipy politicheskoy ekonomii [Principles of Economics]. Moscow: Publishing House Progress, pp. 416.

Pettit, J. (2007). Strategic Corporate Finance. 2nd ed. New Jersey: John Wiley & Sons, pp. 28–30.

Teplova T.V. (2012). Innovatsii v finansovoy analitike [Innovation in financial analytics]. Modernization. Innovation. Development, 12(4), 54-61.

Volkov D.L. (2005). Pokazateli rezultatov deyatelnosti: ispolzovaniye v upravlenii stoimostyu kompanii [Performance indicators: use in the management of corporate value]. Russian Journal of Management, 3(2), 3-42.

Vorozhbit O.Yu. and Shashlo N.V. (n. d.). Integration Processes and a Common Agricultural Market under the Conditions of the Eurasian Economic Union. International Business Management, 10(19), 635-643.

Yakubovich M.A. (2005). Finansovyye pokazateli effektivnosti funktsionirovaniya predpriyatiy [Financial indicators of enterprise efficiency of operation]. Planning and economics department, 9, 36-39.

Yashin S.N., Koshelev E.V. and Makarov S.A. (2012). Analiz effektivnosti innovatsionnoy deyatelnosti [Analysis of innovation efficiency]: study guide. St. Petersburg: BHV-Petersburg, pp. 288.

1. Federal State-Funded Educational Institution of Higher Education “Vladivostok State University of Economics and Service”, 690014, Russia, Vladivostok, Gogolya str., 41; E-mail: Viktor.Osipov@vvsu.ru

2. Federal State-Funded Educational Institution of Higher Education “Vladivostok State University of Economics and Service”, 690014, Russia, Vladivostok, Gogolya str., 41

3. Federal State-Funded Educational Institution of Higher Education “Vladivostok State University of Economics and Service”, 690014, Russia, Vladivostok, Gogolya str., 41