Vol. 38 (Nº 62) Year 2017. Páge 27

Vol. 38 (Nº 62) Year 2017. Páge 27

Vera Egorovna GLADKOVA 1; Lyubov' Semenovna MOROZOVA 2; Vladimir Yur'evich MOROZOV 3; Natal'ya Vladimirovna KHAVANOVA 4; Elena Vladimirovna LITVINOVA 5

Received: 06/10/2017 • Approved: 30/10/2017

ABSTRACT: The development of the nonprofit sector is of significant help to the state in performing its social and cultural-enlightening functions, which has been the case in present-day Russian society, where the state funds public goods on a limited scale. Today’s society is faced with an array of issues that only nonprofit organizations are capable of resolving. Nonprofit organizations are quite a substantial sector within the Russian economy. Should a nonprofit organization turn financially unstable, it will not be able to fulfill the social objectives set for it. This paper shares the findings of a research study into issues related to the endowment capital of nonprofit organizations and presents a survey of the legislative framework which regulates the formation of endowments, the activity of participants in the process, and the fundamental conditions underlying this process. Creating an endowment fund is essential to the operation of organizations, inasmuch as it helps ensure a stable and continually enlarging source of funding for infrastructure facilities, social projects, etc. Compared with many other systems of funding, endowments are regarded as the most stable asset and are believed to guarantee the transparent nature of fund activity and sound control over the expenditure of funds obtained through investment, as well as help enhance strategic planning processes through ensuring financial support for the activity of nonprofit organizations. Some of the world’s largest endowments have been around for as many as several centuries and are currently worth tens of billions of dollars. |

RESUMEN: 1742/5000 El desarrollo del sector sin fines de lucro es de gran ayuda para el estado en el desempeño de sus funciones sociales y culturales, que ha sido el caso en la sociedad rusa actual, donde el estado financia bienes públicos en una escala limitada. La sociedad actual se enfrenta a una serie de problemas que solo las organizaciones sin fines de lucro pueden resolver. Las organizaciones sin fines de lucro son un sector bastante importante dentro de la economía rusa. Si una organización sin fines de lucro se vuelve financieramente inestable, no podrá cumplir los objetivos sociales establecidos. Este documento comparte los hallazgos de un estudio de investigación sobre cuestiones relacionadas con el capital de dotación de organizaciones sin fines de lucro y presenta una encuesta del marco legislativo que regula la formación de dotaciones, la actividad de los participantes en el proceso y las condiciones fundamentales que subyacen a este proceso. La creación de un fondo de dotación es esencial para el funcionamiento de las organizaciones, ya que ayuda a garantizar una fuente de financiación estable y continuamente ampliada para instalaciones de infraestructura, proyectos sociales, etc. En comparación con muchos otros sistemas de financiación, las dotaciones se consideran el activo más estable y se cree que garantizan la naturaleza transparente de la actividad del fondo y un control sólido sobre el gasto de los fondos obtenidos a través de la inversión, así como también ayudan a mejorar los procesos de planificación estratégica asegurando el apoyo financiero para la actividad de las organizaciones sin fines de lucro. Algunas de las dotaciones más grandes del mundo han existido por varios siglos y actualmente valen decenas de miles de millones de dólares. |

In the Russian Federation, it became possible to create endowment capital starting in 2007, when the government brought into effect a special law known as Federal Law No. 275-FZ on the Procedure for the Formation and Use of the Endowment Capital of Nonprofit Organizations of December 30, 2006 (Federal Law No. 275-FZ).

According to the above law, an endowment is a “portion of the assets of a nonprofit organization that is formed from donations and is placed under trust management by a management company with a view to generating profit that is used to fund the organization’s statutory activity”.

Russia’s endowment culture emerged just 10 years ago. Despite state support and an interest on the part of nonprofit organizations, the issue of the advisability of having endowment assets continues to be a matter of heated debate. Some of the questions one may ask in this respect are: ‘What is the difference between a charitable foundation and an endowment fund?’, ‘In what ways is creating an endowment advantageous to an organization?’, and ‘What objectives could be pursued using it?’

What makes endowments a popular topic all around the world today is the fact that it is viewed as a mechanism that could ensure organizations long-term financial support.

What adds relevance to having an endowment fund is that it is believed to let you accumulate financial resources and help ensure you stable development in the long run.

The study’s methodological basis is underpinned by the use of principles of system analysis and synthesis to gain a proper insight into the system of higher professional education and its segments, as well as explore some of the key subjects and objects involved in activity related to the endowment assets of nonprofit organizations.

A major strength of endowment assets is their transparent nature. Since the fund’s capital can only be directed into the organization for the support of which it has been created, it is impossible to use it to minimize taxation.

The history of endowments spans over 500 years now.

The most famous endowment fund is the one run by the Nobel Foundation (set up in the late 19th century). Endowments are created around the world by various cultural, educational, scientific, and medical institutions. These assets are formed via donations and intended to ensure that the organization can self-fund its operation. As an example, one of the world’s largest endowments – the one run by Harvard University – is currently worth over $35 billion.

In Russia, the first official legislation on endowments came out just 10 years ago (December, 2006), although it is worth noting that the nation already has some successful history of dealing with “everlasting capital”. Based on data from Donors’Forum.com, at year end 2016 Russia had over 130 endowment funds and around 20 organizations with some endowment capital forming part of the core assets (www.donorsforum.ru/projects/endowment/). Most of these endowment funds were set up to help back education and science. The total volume of assets in these endowment funds is currently 19 billion rubles (www.donorsforum.ru/projects/endowment/). The interest of nonprofit organizations in endowments is growing increasingly every year.

In the theory and practice of provision of financial support for the activity of nonprofit organizations, the term ‘endowment’ has emerged comparatively recently, although the history of donation-based investment funds spans more than 5 centuries (Gubzheva, 2013).

The term ‘endowment’ has 2 common meanings in Anglo-American economic practice.

Firstly, it is an endowment policy; secondly, it is a financial tool that enables its possessor to use a permanent source of financial support and, consequently, engage in socially useful activity. Table 1 lists a set of various definitions of the term.

Table 1

Definitions of ‘endowment fund’

(Podol'skaya & Kharlamova, 2015)

No. |

Definition of ‘endowment fund’ |

Author/source |

1 |

The portion of the assets of a nonprofit organization that is formed from donations made by a donor (donors) in the form of money and is placed under trust management by a management company with a view to generating profit that is used to fund the statutory activity of that particular nonprofit organization or some other nonprofit organizations in the manner prescribed by law (Clause 1 of Article 2) |

Federal Law No. 275-FZ on the Procedure for the Formation and Use of the Endowment Capital of Nonprofit Organizations of December 30, 2006 (as amended on July 28, 2012)

|

2 |

A special-purpose fund created for nonprofit purposes, like, for instance, funding the activity of educational, cultural, or healthcare institutions |

L. Panteleeva, head of the Investment Department at ZAO Gazprombank – Upravlenie Aktivami (Gazprombank Asset Management CJSC) |

3 |

Monetary funds formed through donations revenue from investing which is directed toward charitable objectives |

Ya.M. Mirkin, K.B. Bakhtaraeva, A.V. Levchenko, and M.M. Kudinova – the authors of the practical guide ‘Endowment Funds of State and Municipal Educational Institutions: Organization of Activity, Current State of Affairs, and Prospects for Development’ |

4 |

A form of long-term attraction and use of funds for educational, R&D, or other socially significant purposes under which the bulk of the funds stays intact and is used as a source of revenue |

Scholar O.I. Ivanov (‘The Mechanism Underlying the Operation of Educational Funds’)

|

There are a number of alternative definitions of ‘endowment’, with some reflecting the following essential conditions:

Firstly, a fund is created through voluntary donations.

Secondly, a fund consists of untouchable assets and spendable revenue.

Thirdly, a fund’s untouchable share is invested in financial assets and is a guarantee of the availability of funds in the future, while spendable revenue is profit from investing the endowment’s principal.

A crucial advantage of endowment funds over “regular” private charitable foundations lies in that revenue from the management of funds coming into the endowment is exempt from income tax. This kind of concession is provided with a view to stimulating donating from citizens and organizations in a format that ensures the highest degree of sustainability in terms of future revenue for a nonprofit organization (Bokareva, E. V., Egorova, E. N., Kuchin, M. A., & Chernikova, 2014).

By having an endowment fund, universities, museums, clinics, and local community foundations lay the groundwork for a stable financial future (Kozarezenko, 2014).

The Ministry of Economic Development of the Russian Federation has been readily supportive of the development of the institution of endowments, with a focus on building an effective system of statutory regulation of this type of activity, as well as developing and spreading best practices in endowments across the entire nation.

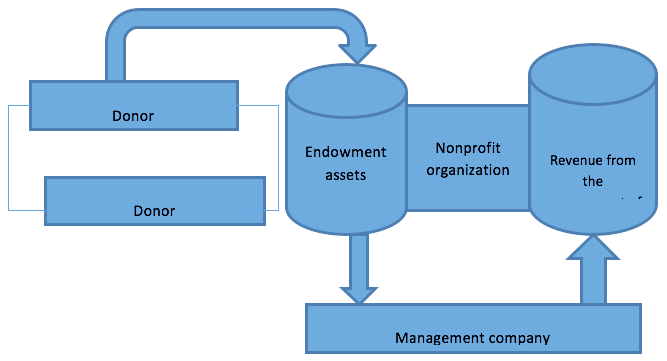

The above-mentioned federal law stipulates 2 ways to create an endowment. Based on the first one, the nonprofit organization itself establishes an endowment fund and is at once the recipient of revenue from its use (Figure 1). This way to create an endowment fund could be termed the “internal” variant.

Figure 1

Independent establishing of an endowment within

a nonprofit organization (Shit'kov, 2010)

Company type-wise, the “internal” variant may be pursued only by a foundation, an autonomous nonprofit organization, a nongovernmental organization, a community trust, or a religious organization.

If the endowment is created based on the 1st variant, donations are collected and all operations related to management, except for investment activity, are carried out “inside” the nonprofit organization.

In this case, an endowment fund is just donations received in a special manner. When an endowment fund is created, it is a ring-fenced sum of money for a special purpose. And when an existing endowment fund is replenished, a part from money donations may come as securities or real estate – donations accepted in a special manner that involve the obligation of placing them under trust management and require separate bookkeeping, auditing, financial reporting, etc.

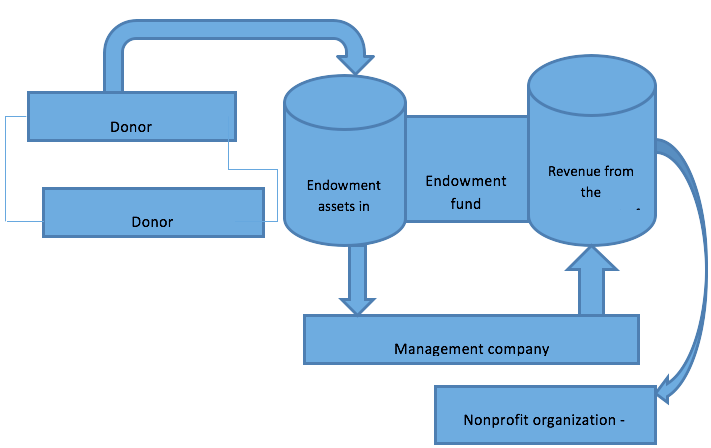

Things are different if the 2nd variant is adopted, when the nonprofit organization matches none of the forms of incorporation listed above.

The 2nd variant involves the creation of a separate legal person – a specialized organization that operates as a fund that takes care of all operations involving the endowment capital (Figure 2). This is the “external” variant.

Figure 2

Establishing an endowment through a specialized organization

(Shit'kov, 2010)

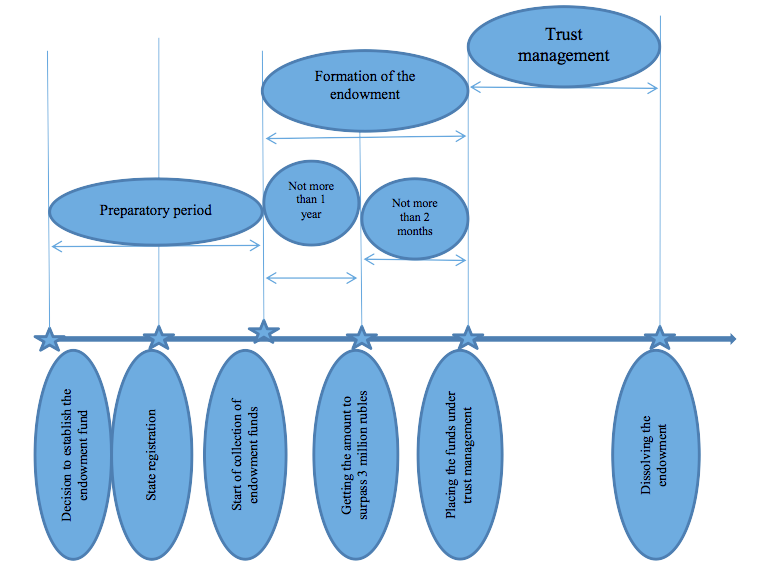

It may also be worth examining the process of managing endowment assets in time (Figure 3). Here the starting point is making the decision to form an endowment fund. The control point is the state registration of relevant incorporation documents. Then there is the point of starting to collect donations. The time period between the points may be termed the ‘preparatory’ period.

The endowment formation stage starts with the collection of funds into the endowment. A bank account needs to be opened to enable all the calculations related to the receipt of funds, as well as the formation and replenishment of the endowment capital, its placement under trust management, the use of fund revenue, and the distribution of this revenue in the favor of any other recipients.

Figure 3

Managing an endowment (Shit'kov, 2010).

Within two months of the amount received for the establishment of the endowment fund reaching 3 million rubles, the nonprofit organization must transfer the funds to the management company. Once the funds have been placed under trust management, the endowment fund may be considered as established. Therefore, the next control point is getting the amount to surpass 3 million rubles and, consequently, the next one is placing the endowment under trust management. To properly identify the endowment, you may need to mark each stage properly. Between the point of placement under trust management and that of dissolving the endowment, there is the trust management interval (Podol'skaya & Kharlamova, 2015).

Pursuant to the legislation, the initial amount needed to form an endowment must be gathered not later than 1 year from the date of receipt of the first donation. If this requirement is not fulfilled, no endowment fund may be established and the funds must be returned to the donor. During the formation period, donations can be placed in deposit accounts in credit institutions (Bokareva, 2013). The interest earned this way may be added to the actual endowment. It is worth noting additionally that only after the endowment fund has been formed it may be replenished through securities and real estate, whereas it may be formed only using money. Thus, to be able to receive securities or real estate, you first need to have received at least 3 million rubles worth of donations and placed these funds under trust management (Kut'eva, 2013).

Considering existing market rates on deposit agreements and timeframes for the formation of an endowment, it is a must for “the lion’s share of” the required sum of 3 million rubles to have been received (National Rating Agency, n.d.).

Of, perhaps, even more interest is the situation where the nonprofit organization has received enough money to establish an endowment fund (3 million rubles and up) and has an opportunity to make more by placing the funds in deposit accounts. Pursuant to the legislation, one is given 2 months to place the funds under trust management (Dolina & Ishina, 2015).

In the event the nonprofit organization receives a donation in the form of money, these funds must be placed under trust management within 30 days of receipt. As the owner of the endowment fund, the nonprofit organization is entitled to replenish it through the interest from holding funds received to form and (or) replenish the endowment fund in deposit accounts in credit institutions. Thus, the nonprofit organization is entitled to initiate a bank deposit to increase its funds (Subanova, 2011).

As was already noted above, work on the formation and replenishment of an endowment fund goes on continually, while the effect from creating it is not felt right away. On top of that, there is the need to continually feed the endowment fund with new donations, which may be quite hard to do if you lack well-developed channels for interaction with donors (Podol'skaya & Kharlamova, 2015).

Endowments are novel in Russia, with the nation’s endowment legislation having been around for just a little over 8 years. In this period, Russia has witnessed the establishment of over 130 endowments, with most set up in the area of education and science (62%) (Donors’Forum.com, n.d.) (Table 1).

Over the course of the existence of endowment funds in Russia, a lot has been said about their strengths and weaknesses. Some nonprofit organizations and donors consider this form of funding nonprofit activity promising and some tend to doubt its tenability (Kozarezenko, 2014).

Table 2

Endowment funds across Russia

(V. Potanin Charitable Foundation, 2017)

Name |

Year established |

Total volume at year end 2016, rubles |

Website |

MGIMO Development Fund, Moscow |

2007 |

1,500,000,000 |

fund.mgimo.ru |

VERA Hospice Charity Fund, Moscow |

2007 |

500,000,000 |

hospicefund.ru/endowment |

Tomsk University Endowment Fund, Tomsk |

2010 |

14,723,000 |

fond.tsu.ru |

State Hermitage Museum Endowment Fund, Saint Petersburg |

2011 |

360,043,333 |

hermitagendowment.ru |

Peterhof State Museum-Reserve Endowment Fund, Saint Petersburg |

2011 |

43,333,000 |

peterhofmuseum.ru/support/ fond |

M.K. Ammosov North-Eastern Federal University Endowment Fund, Yakutsk |

2011 |

408,000,000 |

s-vfu.ru/universitet/o-vuze/fond-tselevogo-kapitala |

‘Local Community Capital’ endowment fund, Penza |

2014 |

7,000,000 |

penza.capital |

Perm University Endowment Fund, Perm |

2014 |

4,315,000 |

psu.ru/universitet/endowment-psu |

Omsk Regional M.A. Vrubel Museum of Fine Arts Endowment Fund, Omsk |

2016 |

2,200,000 |

FOND.VRUBEL.RU |

Russian Academic Youth Theater Endowment Fund, Moscow |

2017 |

_ |

RAMT.RU/FRIENDS |

The table lists some of Russia’s most successful endowment funds. All of them are participants in the ‘Endowments: Strategy for growth’ program, launched in 2012 by the V. Potanin Charitable Foundation.

Experts have identified 2 major weaknesses of having endowment funds. Firstly, it is the fact that most endowment funds do not help resolve our social issues here and now, with many tending to just “conserve” sizable capital instead of directing this money toward the resolution of many tough issues faced in society today. Secondly, there is a question mark over the possibility of deriving worthwhile economic gain from the activity of endowments, while revenue from investing endowment capital is often in no position to compete with inflation (Grishchenko, 2013).

One of the biggest problems facing endowment funds is the difficulty of convincing benefactors to donate money toward a certain issue that takes time to resolve. It is much easier for potential donors to approach a situation where money is needed to treat a child, build a church, or fund humanitarian aid for victims of natural disasters. Here it is always apparent who specifically is getting the money, as it is possible to track the actual outcome of your help. As an example to illustrate this point, if you have donated money to the endowment fund of, say, a university, you may not see new buildings on campus in 2 years’ or renovated classrooms in a few months’ time (Bokareva, 2013).

When it comes to the strengths of having an endowment fund, it is, above all, its transparent nature and the use as intended of the benefactor’s money, with the entire process being regulated by law (e.g., the requirement to produce public reports and the need to have entered a donation agreement that specifies the program the money is going to).

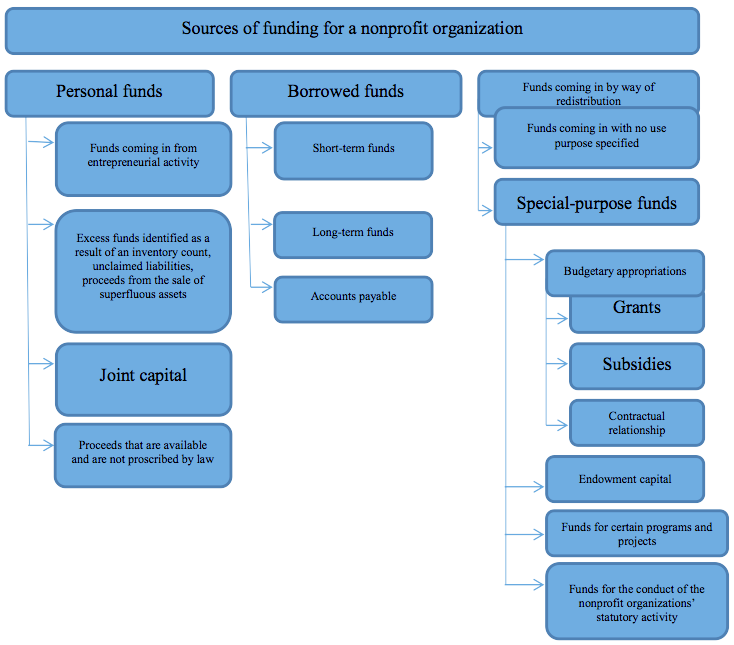

Figure 4

Sources of funding for nonprofit organizations

(Zavgorodnyaya & Khamalinskii, 2015).

The cornerstone of endowments is the open and easy-to-understand nature of the process of expenditure of these funds. The kind of financial reporting practiced in today’s endowment funds, the amount of attention devoted by financial regulators to managing their assets (Zavgorodnyaya & Khamalinskii, 2015), as well as the amount of care with which donors assess the resources they are providing – many nonprofit organizations may find it quite useful to explore and adopt some of the best practices in all of this (Figure 4).

Another advantage of endowments is concessional taxation. Note, though, that currently tax concessions are only available to private donors, who qualify for a tax rebate of about 25% of taxable revenue. Corporate donors cannot benefit from this rule as yet, which pretty much aligns with Russia’s current policy of taxing charity as a whole (Bokareva, Chernikova, Egorova, & Egorova, 2014).

Endowment capital is an additional source of funding. The possibility of generating additional capital gains from donations via effective management enables a nonprofit organization to benefit from its endowment assets to bolster its financial position (Lavrova, 2010).

It is up to the nonprofit organization to decide how to distribute its endowment capital among management companies. The possibility of placing the endowment through several management companies would simplify significantly the process of receiving donations for nonprofit organizations. It may also be worth taking account of some of the risks that may inevitably arise in conjunction with investments in real estate. Note that in the securities market the management company acts pursuant to legislation that regulates individual trust management and is expected to operate exclusively in the stock market and only acquire securities that match the requirements of the law (Kirilina & Morozova, 2010). There is no regulation of this kind in the real estate market, which gives the manager much greater latitude. Under the agreement, the trustor is entitled to get the assets in trust management back if the management company does a poor job managing them, but when it comes to real estate the process may take as long as several months (Larina & Baigulov, 2014).

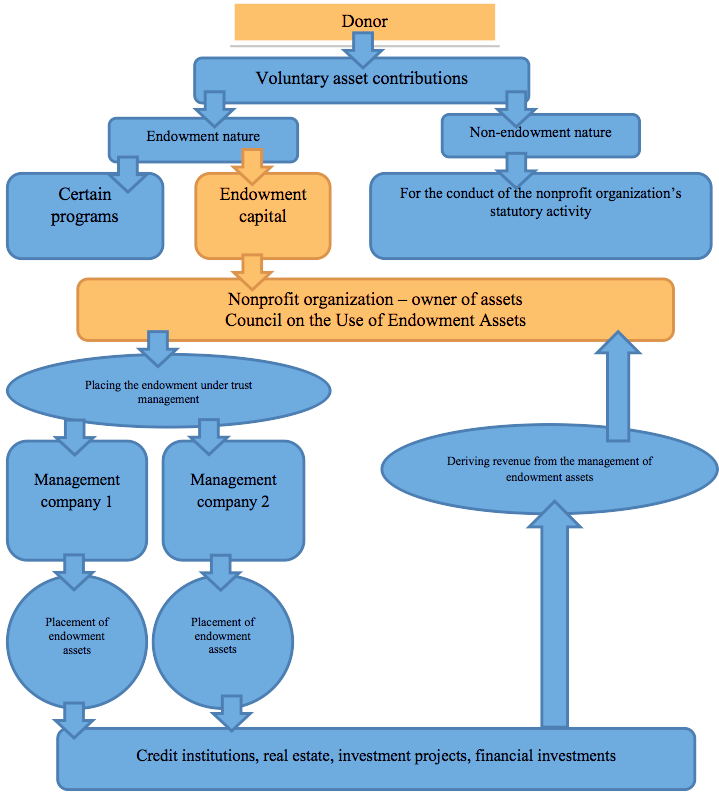

Since the law requires that assets within the endowment fund be transferred to the management company, investing these funds is always performed by professionals, who will help you select the best financial instruments so you could achieve the objectives set for the fund and at the same time preserve the capital and protect it from inflationary depreciation. Revenue generated by the fund enables it to plan its expenditure going forward and not to depend too much on fundraising, which should be resorted to frequently only to add to the main assets (Figure 5).

Figure 5.

Model for the placement of the endowment capital of a nonprofit organization

through several management companies (Zavgorodnyaya & Khamalinskii, 2015).

Right now, there is, of course, a certain degree of distrust in Russia in regard to long-term planning and the capital market as a whole. It is hard to imagine for now that a fund created today will keep operating 50 or 100 years from now. That being said, that is quite possible, as is indicated by evidence from the experience of Western endowments. As an example, the most renowned American endowments – those at the universities of Harvard, Yale, Princeton, and Stanford – have been around for a considerable amount of time and have had successful operation, characterized by continual capital gains.

Russian endowment funds have great opportunity today to draw on and try to implement some of the best international practices (Figure 5). In fact, Russians could already now draw a number of meaningful inferences from the development of the Western endowment sector and use some of these observations to further enhance the Russian one (Zavgorodnyaya & Khamalinskii, 2015).

Firstly, it definitely makes sense to take account of tax concessions. These concessions are an absolute necessity for those who donate money to charity. To a considerable degree, concessional taxation facilitates the attraction of funds into endowments and the enlargement of endowment funds.

Secondly, the possibility of investing in risky instruments, like real estate and hedge funds, may facilitate deriving greater revenue from your investments – but it is also fraught with significant losses. Right now, the investment policy of the majority of Russian endowments is extremely conservative, with most investing their capital in bonds and holding their funds in bank deposits, which is quite understandable in a climate of high volatility in the market and economic instability.

Thirdly, Western countries normally use around 4% of the endowment annually to cover fund expenses (administrative and project-based). By contrast, Russian funds tend to utilize 5–10% of their endowment to fund projects (Zavgorodnyaya & Khamalinskii, 2015).

Finally, a good practice to adopt for Russian funds is the policy of reducing administrative expenditure in a fund through the cultivation of partner relationships both with business and the state and with other nonprofit organizations (Zavgorodnyaya & Khamalinskii, 2015).

Below are some of the key benefits of having an endowment fund (Bokareva, Morozova, Morozov, Khavanova, & Litvinova, 2016).

5. The possibility of organizing a system of funding special social programs and promising research at the discretion of nonprofit organizations forming part of an association.

6. Minimized administrative-managerial expenditure associated with the formation and management of a particular nonprofit organization.

Thus, an endowment fund is a monetary fund formed through donations revenue from investing which is directed toward charitable objectives. Creating an endowment fund is essential to the operation of organizations, inasmuch as it helps ensure a stable and continually enlarging source of funding for infrastructure facilities, social projects, etc. The other crucial benefits of having an endowment fund include the transparent nature of fund activity and sound control over the expenditure of funds obtained through investment.

An important practical consideration facing most endowment funds from the beginning is the willingness of the owner of an endowment to judge and control the activity of the management company and compare their portfolio with that of others. Endowments are of a clear-cut special-purpose nature. They are intended to systematically fund the activity of organizations. The principal objective behind the creation of an endowment fund is to generate and utilize revenue from the capital that will make it up, which may be regarded as a long-range sustainable additional source that will help drive the institution’s development.

Bokareva, E. V. (2013). Tselevoi kapital nekommercheskoi organizatsii: Mirovoi opyt ispol'zovaniya i normativnoe regulirovanie v sovremennoi Rossii [The endowment assets of a nonprofit organization: Global practices in its use and its statutory regulation in present-day Russia]. Finansovaya Analitika: Problemy i Resheniya, 15, 43–47. (in Russian).

Bokareva, E. V., Chernikova, L. I., Egorova, E. N., & Egorova, S. K. (2014). Functioning and development of target capitals of non-profit organizations. Asian Social Science, 10(23), 223–230.

Bokareva, E. V., Egorova, E. N., Kuchin, M. A., & Chernikova, L. I. (2014). Osobennosti upravleniya tselevym kapitalom v sisteme vysshego obrazovaniya [Characteristics of managing endowment assets within the system of higher education]. Servis v Rossii i za Rubezhom, 5, 184–195. (in Russian). Retrieved December 10, 2015, from http://electronic-journal.rguts.ru/index.php?do=cat&category=2014_5

Bokareva, E. V., Morozova, L. S., Morozov, V. Yu., Khavanova, N. V., & Litvinova, E. V. (2016, November). Starting a Financial Endowment by a Nonprofit Organization in Higher Education. Indian Journal of Science and Technology, 9(42), 104271.

Dolina, O. N., & Ishina, I. V. (2015). Sotsial'no-orientirovannye nekommercheskie organizatsii: Vektory finansirovaniya [Socially-oriented nonprofit organizations: Vectors for funding them]. Audit i Finansovyi Analiz, 3, 208–211. (in Russian).

Donors’Forum.ru. (n.d.). Tselevye kapitaly [Endowment assets]. (in Russian). Retrieved from http://www.donorsforum.ru/projects/endowment/

Federal Law No. 275-FZ on the Procedure for the Formation and Use of the Endowment Capital of Nonprofit Organizations of December 30, 2006. (in Russian).

Grishchenko, Yu. I. (2013). Optimizatsiya struktury kapitala v nekommercheskikh organizatsiyakh [Optimizing the structure of capital in nonprofit organizations]. Nekommercheskie Organizatsii v Rossii, 1, 46–49. (in Russian).

Gubzheva, L. A. (2013). Sovershenstvovanie mekhanizma formirovaniya i ispol'zovaniya tselevogo kapitala nonprofit organizations [Enhancing the mechanism underlying the formation and use of endowment assets in nonprofit organizations]. Vestnik Finansovogo Universiteta, 6, 148–157. (in Russian).

Kirilina, N. A., & Morozova, L. S. (2010). Sushchnost' i osobennosti konkurentsii na rynke obrazovatel'nykh uslug [The essence and characteristics of competition in the market for educational services]. Aktual'nye Voprosy Ekonomicheskikh Nauk, 15-2, 182–186. (in Russian).

Kozarezenko, L. V. (2014). Al'ternativnye istochniki finansirovaniya razvitiya chelovecheskogo potentsiala [Alternative sources of funding for the development of human potential]. Nauka Krasnoyar'ya, 4, 93–121. (in Russian).

Kut'eva, D. A. (2013). Mnogomernost' istochnikov finansirovaniya nonprofit organizations [The multidimensionality of sources of funding for nonprofit organizations]. Problemy Sovremennoi Ekonomiki, 4, 195–198. (in Russian).

Larina, L. R., & Baigulov, R. M. (2014). Skhema upravleniya tselevym kapitalom nekommercheskoi organizatsii [A scheme for managing the endowment assets of a nonprofit organization]. Vestnik Universiteta (Gosudarstvennyi Universitet Upravleniya), 20, 118–122. (in Russian).

Lavrova, S. N. (2010). Nekotorye aspekty sozdaniya vuzovskogo endowment-fonda: Prakticheskie sovety [Certain aspects of putting together a college endowment fund: Pieces of practical advice]. In E. S. Biryukov, D. A. Degterev, & A. V. Stel'makh (Eds.), Teoriya i praktika funktsionirovaniya fondov tselevogo kapitala v vysshem obrazovanii Rossii: Sbornik prakticheskikh rekomendatsii dlya uchastnikov Mezhdunarodnoi nauchno-prakticheskoi konferentsii ‘Teoriya i praktika funktsionirovaniya fondov tselevogo kapitala v Rossii’, MGIMO (U) MID Rossii, 27–29 aprelya 2010 g. [The theory and practice of the operation of endowment funds within Russia’s higher education system: A collection of practical recommendations for participants in ‘The Theory and Practice of the Operation of Endowment Funds in Russia’ international research-to-practice conference, MGIMO University, April 27–29, 2010] (pp. 23–30). Moscow, Russia: MGIMO. (in Russian).

National Rating Agency. (n.d.). Kommentarii k renkingu UK po tselevym kapitalam po itogam 2016 goda [A commentary on the 2016 ranking of endowment management companies]. (in Russian). Retrieved from http://www.ra-national.ru/ru/node/59503

Podol'skaya, A. P., & Kharlamova, E. E. (2015). Problemy razvitiya endowment-fondov v Rossii [Issues in the development of endowment funds in Russia]. In R. R. Akhunov (Ed.), Nachalo v nauke: Materialy Vserossiiskoi nauchno-prakticheskoi konferentsii shkol'nikov, studentov, magistrantov i aspirantov (16-17 aprelya 2015 g., g. Ufa) v 2 chastyakh: Chast' 2 [Proceedings of ‘It All Starts with Science’: An all-Russian research-to-practice conference for high school and college students, graduate students, and postgraduate students (April 16–17, 2015, Ufa) in 2 parts: Part 2] (pp. 142–144). Ufa, Russia: Aeterna. (in Russian).

Shit'kov, S. V. (2010). Protsedura registratsii endowment-fondov vysshikh uchebnykh zavedenii po rossiiskomu zakonodatel'stvu [The procedure for the registration of the endowment funds of institutions of higher learning in accordance with Russian legislation]. In E. S. Biryukov, D. A. Degterev, & A. V. Stel'makh (Eds.), Teoriya i praktika funktsionirovaniya fondov tselevogo kapitala v vysshem obrazovanii Rossii: Sbornik prakticheskikh rekomendatsii dlya uchastnikov Mezhdunarodnoi nauchno-prakticheskoi konferentsii ‘Teoriya i praktika funktsionirovaniya fondov tselevogo kapitala v Rossii’, MGIMO (U) MID Rossii, 27–29 aprelya 2010 g. [The theory and practice of the operation of endowment funds within Russia’s higher education system: A collection of practical recommendations for participants in ‘The Theory and Practice of the Operation of Endowment Funds in Russia’ international research-to-practice conference, MGIMO University, April 27–29, 2010] (pp. 20–22). Moscow, Russia: MGIMO. (in Russian).

Subanova, O. S. (2011). Fondy tselevykh kapitalov nonprofit organizations: Formirovanie, upravlenie, ispol'zovanie: Мonografiya [Endowment funds of nonprofit organizations: Their formation, management, and use: A monograph]. Moscow, Russia: KURS. (in Russian).

V. Potanin Charitable Foundation. (2017). Tselevye kapitaly: kak sobrat'' svoi pazl: Neklassicheskoe posobie dlya nekommercheskikh organizatsii [Endowments: How to Solve Your Puzzle: A neoclassical guide for nonprofit organizations] (p. 79). (in Russian). Retrieved from http://www.fondpotanin.ru/media/2017/04/03/1268985104/Endowments_Puzzle.pdf

Zavgorodnyaya, V. V., & Khamalinskii, I. V. (2015). Tselevoi kapital: Rol' i vozmozhnosti ispol'zovaniya dlya finansirovaniya deyatel'nosti obrazovatel'nykh uchrezhdenii [Endowment capital: The role it plays and the potential for using it to fund the activity of educational institutions]. Audit i Finansovyi Analiz, 2, 231–236. (in Russian).

1. ANO VO "Russian academy of business", 109554, Russia, Moscow, Malaya Andronyevskaya Street, 15; E-mail: gladkovave@mail.ru

2. Russian State University of Tourism and Service, 141221, Russia, Moscow Oblast, Cherkizovo, Glavnaya St., 99

3. Russian State University of Tourism and Service, 141221, Russia, Moscow Oblast, Cherkizovo, Glavnaya St., 99

4. Russian State University of Tourism and Service, 141221, Russia, Moscow Oblast, Cherkizovo, Glavnaya St., 99

5. Russian State University of Tourism and Service, 141221, Russia, Moscow Oblast, Cherkizovo, Glavnaya St., 99