Vol. 38 (Nº 62) Year 2017. Páge 23

Vol. 38 (Nº 62) Year 2017. Páge 23

Irina Pavlovna KOMAROVA 1; Vladimir Leonidovich USTYUZHANIN 2

Received: 06/10/2017 • Approved: 30/10/2017

ABSTRACT: The purpose of this article is to study the reasons for the loss of competitiveness by the leading world companies taking the leading positions during a long period of time. The analysis of the experience of the largest world companies of the aircraft industry, motor vehicle industry, chain retail, IT industry and pharmaceutical industry allowed revealing the so-called "bifurcation points" (critical states of a company that arise as a result of changes in the conditions of its activity and create the uncertainty of the further development), determining and classifying the factors that promote their appearance. In the work, it is concluded that the loss of the sustainable competitiveness by a company occurs as a result of the combined action of external and internal factors. This conclusion was proved by the particular examples from the analyzed branches of economy. The case study method was used as a key method of this research. |

RESUMEN: El objetivo de este artículo es estudiar los motivos de la pérdida de competitividad de las principales empresas mundiales que ocupan los primeros puestos durante un largo período de tiempo. El análisis de la experiencia de las mayores empresas mundiales de la industria aeronáutica, industria automotriz, cadena minorista, industria de TI y la industria farmacéutica permitió revelar los llamados "puntos de bifurcación" (estados críticos de una empresa que surgen como resultado de cambios en las condiciones de su actividad y crea la incertidumbre del desarrollo posterior), determinando y clasificando los factores que promueven su apariencia. En el trabajo, se concluye que la pérdida de la competitividad sostenible de una empresa ocurre como resultado de la acción combinada de factores externos e internos. Esta conclusión fue probada por los ejemplos particulares de las ramas de economía analizadas. El método de estudio de caso fue utilizado como un método clave de esta investigación. |

In the modern world where even the largest companies that seemed to be the unbeatable leaders of their industries lose the dominating position or even cease to exist, the problem of revealing of the main reasons for the loss of competitiveness becomes especially urgent.

The experience of development of the largest companies – leaders of the industries that lost the dominating position in the market despite the sustainable growth, knowledge of economic conjuncture, competent management and investments in new technologies, says about the necessity to analyze this economic phenomenon. Such companies as DEC, Nokia, NCR, Lehman Brothers, British Leyland that achieved impressive results and seemed to be sustainably competitive lost their positions in a relatively short period of time. As opposed to them, Ford, Boeing, IBM, Pfizer, and Aldi that crossed one hundred years are still the drivers of development of their industries.

We understand the sustainable competitiveness of a company as the ability of an organization to maintain a significant position in the hierarchy of its market field over a long period of time while facing significant changes in the operating conditions.

The issue of "sustainable competitiveness" of enterprises became the subject of research of economists quite recently – about 30 years ago. Even the term "sustainable competitiveness" is not very often used in the scientific discourse. Among the main works dedicated to the problem of sustainable competitiveness, we can distinguish "Managing Corporate Lifecycles" by Adizes (2015), "The Innovator’s Dilemma" by Christensen (2011), "Seeing What’s Next?" by Christensen et al. (2004), "The Core Competence of the Corporation" by Hamel & Prahalad (1990), "In Search of Excellence: Lessons from America’s Best-Run Companies" by Peters, & Waterman (2006), "Good to Great. Why Some Companies Make the Leap… and Others Don't", "How the Mighty Fall: And Why Some Companies Never Give In" by Collins (2001, 2009), "Built to Last: Successful Habits of Visionary Companies" by Collins, & Porras (2004), "Great by Choice" by Collins, & Hansen (2011), "Beyond Performance. How Great Organizations Build Ultimate Competitive Advantage" by Keller, & Price (2011).

The novelty of the approach offered in this research is that the authors try to go away from searching for factors that guarantee the success of the companies in the global markets to revealing the most typical factors of loss of leading positions and determination of the so-called "bifurcation points".

In this research, a bifurcation point is understood as a critical state that arises as a result of a change in the external or internal conditions of the company’s activity and creates the uncertainty: whether this state of the system becomes chaotic or it will go to the next level of orderliness (Komarova, & Ustyuzhanin, 2016).

Bifurcation points are considered as the borderline states of the company as a result of which the company has to reform its activity (to enter new markets, to offer a new technology, to reorganize the structure, etc.). This can lead either to adaptation to the new conditions of business and preservation of the competitive positions of a company in the market or to the loss of the leading positions of the company, exit from the markets.

Sampling included 30 leading companies from the following industries: the aircraft industry (Airbus, Boeing, Bombardier, Douglas, Lockheed, McDonnell), the motor vehicle industry (Daewoo, Ford, Rover, Saab, Toyota, Volkswagen), the chain retail (Aldi, Asda, Costco, Sears, Wal-Mart, Woolworth), the IT industry (ACER, ASUS, Compaq, DEC, HP, IBM, Lenovo), and the pharmaceutical industry (Allergan, Merck, Novartis, Pfizer, Roche). Case studies were used as the method of research, i.e. the description of the company’s development as a chain of events (developmental milestones), including the business ideas and crisis situations.

The analysis of the development experience of the real companies showed that getting into the bifurcation point can be explained by a significant number of factors, all of which can be divided into two groups: internal and external. At the same time, the same factors can have a different impact on the companies. For example, the change of phases of the economic cycle has a substantial significance for IT companies and companies of the motor vehicle industry, and it is much less significant for pharmaceutical companies. Another example is the appearance of disruptive innovations that in some cases can lead to the breakdown of the leading players of the market, as it happened with DEC company when the personal IBM computers appeared, and in other cases it can give a new impulse of development: using the published specifications, competitors of IBM manufactured a huge number of IBM PC clones and captured a large part of the PC market.

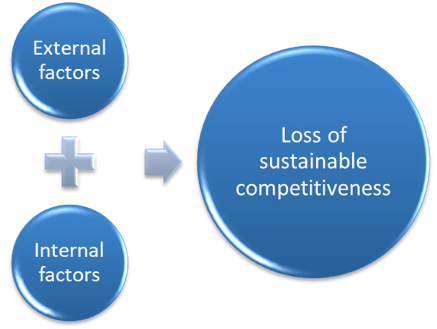

As a result of the carried out research, it was revealed that the loss of sustainable competitiveness happens as a result of the combined action of external and internal factors.

All factors that can influence the formation of bifurcation states can be divided into two groups: the internal ones and the external ones. Internal factors are events that occur within the frameworks of the company and/or depend on its activity. External factors are connected to changes in the environment of the company; they are not direct consequences of the processes that take place within the company.

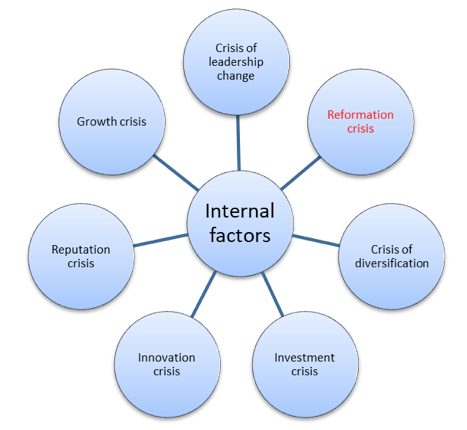

The carried out research allowed to distinguish the following internal factors (Figure 1).

Figure 1

Internal factors influencing the formation of bifurcation states

Source: the authors’ development

Growth crises can include all crises of a company’s life cycle stages:

The world leader of Internet sale Amazon faced this type of crisis when in 1995, one month after opening, the company was overwhelmed by orders from all around America and other 45 countries.

It became more difficult to manage the computer giant IBM in the early 1990s; the question of the division of IBM was risen. The CEO Louis Gerstner kept IBM as a united corporation and transformed it into the so-called "global enterprise" with divisions located in different countries.

For example, the orientation of DEC company to innovation engineering solutions weakened significantly its positions in the mature market where the main focus of competitition shifted to the area of prices while following the established standards.

Thus, the excessive bureaucratization of the chemical company Ecolab led to the loss of its main competitive advantage – orientation to the needs of the particular clients, and that was the reason for the sharp deterioration of its financial indicators by the 2010s.

In 1902, Henry Ford supposed that his company should produce racing cars. However, two main investors of the company supposed that it was better to produce passenger cars. As a result of these disagreements, Ford had to leave the company.

Crises of management change can be connected to the inability of the new management to manage the company efficiently either due to the insufficient level of competence or the "low compatibility" of the company and its management.

In 1964, after the death of the founder Joseph Bombardier, the company Bombardier was headed by his son who could not handle the management and had to leave the management team. The son-in-law of the founder Laurent Bouyer became the new head of the company and managed it till 1999.

Robert Hood, in 1989 a newly appointed head of McDonnell, started his activity from the reorganization program of the company, the essence of which was to transfer from the matrix management structure to the project one. If earlier the same designers could work on several projects, now they worked in the only one. 5,000 working places were cut. This program led to the cohesion of the company and a decrease in the loyalty of the staff.

Crises of reformation are crises connected to the regrouping of a company’s activity including the mergers and acquisitions and an essential change in the organizational structure and/or the management system of a company:

In the early 1950s, a share of the Ford company in the automobile market fell to 20% but a share of General Motors, that had a divisional structure, rose to 40%. The attempt to reform the Ford company – the transfer from the unitary structure to the divisional one - was made as a reaction to the loss of the competitive positions. The transfer program was launched in 1952, and in 1956 it was considered a failure. Only in the mid-1960s, the company transferred to the divisional structure.

After the consolidation of Boeing and McDonnell Douglas, the Boeing company famous for its family atmosphere, merged with a company with a rigid bureaucratic corporate culture. As a result, there were many conflicts and business processes became more expensive.

The crisis of diversification is connected, as a rule, to the expansion to the new markets and risks carried by the necessity to overcome the entry barriers as well as to integrate into the architecture of the established market field and presence (absence) of the necessary competences. The following are the examples of the crises of diversification:

In the early 1980s, Sears decided to launch a financial business. Concentrating all their efforts on the development of a new direction, the company started to lose control over the situation in the retail sector.

In 1997, the Wal-Mart corporation acquired the German supermarket chains Wertkauf and Interspar. However, in Germany the company suffered big losses. Finally, in 2006 Wal-Mart sold its shops to the Metro company and left the German market.

In the 1970-1980s, the McDonnell Douglas company was engaged in the production of military aircrafts. When the Cold War was over, the company decided to increase the output of commercial airliners. But the projects of commercial airliners were not successful either due to high prices or the low quality of planes.

The investment crisis is generated by the expenditure of significant financial funds on new projects, as a result of which a company starts to suffer the lack of cash. The examples of the investment crisis are the following:

The acquisition of the highly overestimated British software supplier Autonomy led to the loss of 5 bln. dollars by the HP company.

Pfizer invested funds in the development of a medicine containing insulin for inhalation–called Exubera. In 2007, it was revealed that the medicine increased the risk of lung cancer. As a result, the company rejected the project and lost 2.8 bln. dollars.

The innovation crisis is connected to unsuccessful innovation decisions that can concern the introduction of a new technology or the release of a new product. Among the innovation crises we can distinguish:

Between 2009 and 2014, Toyota had to recall millions of sold cars several times due to the detected defects of brakes, fastening rails of seats and windscreen wipers.

In 1989, McDonnell Douglas and General Dynamics won the tender for development of the all-weather bomber aircraft of the sea-based aviation A-12 Avenger II with the use of composite materials. The overspending on its development reached 2 bln. US dollars with the unclear outlook for the project accomplishment. After the large-scale inspection, the project was stopped in 1992. 5,600 employees were fired.

The crisis of reputation can be the result of a decrease in the product quality (Yudanov, 2001) or of illegal actions of a company's management.

The example is the international boycott of the Sandoz pharmacological products after one of the largest ecological catastrophes in Europe in 1986 that happened due to the breach of the storage norms for chemical substances.

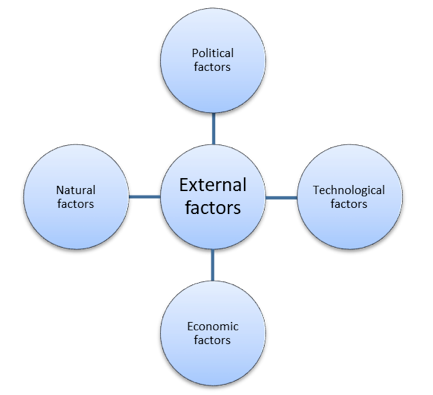

External factors can be divided into 4 groups (Figure 2).

Figure 2

External factors influencing the formation of bifurcation states

Source: the authors’ development

Political factors are mostly triggered by the aggravation of relations between countries. They include:

For example, the decrease in demand for the "haute couture" products due to the beginning of the Second World War led to the closure of the Fashion Houses of C. Chanel and M. Vionnet in 1939.

Decrease in demand for the products of Lockheed and Douglas Aircraft Company that produced military aircrafts and fighter aircrafts during the Second World War.

The example is a temporary nationalization of the American mortgage corporations (Freddy Mac, Fannie Mae) in 2008 in order to restore the mortgage system of the USA. This measure helped to save the system but the companies lost more than 80% of their value.

Technological factors are basic or disruptive product innovations changing the balance of power in the market, disruptive technological innovations, appearance of substitute goods or technologies. The following can be distinguished among them:

For example, the decrease in demand for cameras (Fujifilm, Nikon, Canon) as a result of switching to cell phones with cameras.

For example, the decrease in demand for services of traditional operators of services due to the appearance of the digital platforms.

Thus, the release of the brand new operating system Windows by Microsoft weakened the positions of IBM, producing the computers PS/2 with the integrated operating system OS/2.

The loss of its place in the hierarchy of the market field by DEC was the result of the appearance of personal computers.

For example, the introduction of the system of lean production by Toyota allowed to increase the labor productivity significantly and to gain advantages over the competitors.

Economic factors are a change of phases of economic cycle (Dementyev, 2012); structural changes in the economy leading to a change in price proportions; appearance of new strong competitors, including transnational corporations; expiry of patents and other means of legal protection of the monopolistic position; changes in institutional conditions of companies:

The example is the decrease in demand for the products of aircraft corporations, including Bombardier Aerospace, as a result of the crisis and stagnation of 2008-2015.

For example, the decrease in demand for the automobiles of General Motors with high fuel consumption and the shift of preferences to the fuel-efficient models of Toyota due to the energy crisis in 1973.

The example is the appearance of Wal-Mart in the Great Britain that weakened the positions of the chain ASDA.

For example, the expiry of the patent of AT&T for the production of telephone sets in 1894.

Decrease in sales of the Bombardier snowmobiles due to the decision of the government of Quebec (1949) about the obligatory removal of snow from the rural roads.

Natural factors can be triggered by natural disasters (earthquake, tsunami, etc.) and abnormal natural phenomena (very hot or rainy summer).

The example is the flooding in Thailand in 2011, as a result of which the plants of the two largest manufacturers of HDs (hard discs) Western Digital and Seagate were flooded.

The performed analysis showed that the loss of competitiveness by a company taking a significant position in the hierarchy of its market field occurs usually as a result of the combined action of the external and internal factors (Figure 3).

Figure 3

Loss of sustainable competitiveness of the company

Source: the authors’ development

Below you can find the examples from the analyzed industries of economy.

Sears, Roebuck and Co is an American department store chain founded in 1886. Till 1989, it was the largest retailer in the USA.

For much of the 20th century, the company grew due to the expert management and marketing. It introduced innovations constantly – the first catalogue in the history of retailing, the first car parking lots near the stores, the first self-service system, the first air conditioners in the stores, the first conveyor belts for transportation of goods, an extremely wide range of products – the department stores of Sears always offered the innovations that competitors did not have.

The reasons why the company lost its position in the hierarchy of the market field were the ignoring of the disruptive innovations (discount stores) and the crisis of diversification (expanding into relatively mature markets).

In the 1970-s, the company did not pay attention to the appearance of the potential competitors, i.e. discount stores. It was explained by the fact that initially the quality of services in the stores was not acceptable for the regular customers of Sears. But gradually the quality of service in the discount stores increased and the price-quality ratio started to change in favor of the discount stores and many clients of ordinary supermarkets began to do the shopping in the cheap stores. The discount stores became the disruptive innovations in the retail market.

Sears could not see and understand in proper time the scale of threat from discount stores because being confident about its place in the retail market it decided to diversify its activity and provide financial services. Spending all their efforts on the development of the financial business, the company started to lose control over the situation in the retail sector: in 1985, the share of the company in the retail market of the USA dropped by 15%, the price of its shares – by 40%. The special departments selling financial services in the department stores had not become profitable – the sale of shares and washing machines in the same place disrupted the ability of the company to keep up with the competitors who focused on narrower business activities.

In the 1990s, bearing losses Sears started to get rid of many trading and financial subdivisions. In 2005, Sears was acquired by the American retailer Kmart.

Swedish car maker. In the late 1940s, it was engaged in the manufacture of cheap but rather powerful (equipped with a two-stroke engine) cars that provided its success among the buyers.

In the 1960s-1970s, the company for the first time in history introduced such automobile innovations as heated seats, headlamp wipers, self-repairing bumpers, impact-resistance door beams, turbocharged engines, air filters in the compartment, independent suspensions with springs, disc brakes on the wheels, a saddle-shape windscreen, etc.

Since 1987, the company bore losses and this was explained by several reasons: the crisis of growth (lagging of the organization of business processes behind the level of the industry maturity); the crisis of choice (orientation toward the highly competitive and distant market of the USA to the disadvantage of the other markets); the crisis of diversification (expanding into the new market segment already occupied by the other manufacturers).

The first problem was that the production costs of Saab were much higher than those of their competitors due to the lack of standardization and unification of production as well as the low efficiency of the production processes (orientation to innovations to the disadvantage of standardization).

The second problem was that the company focused its attention almost only on the US market (in the 1980-s). At the same time, many American car producers (Ford, General Motors) borrowed innovations of Saab, but they sold their cars at lower prices due to the lack of necessity to import them from abroad and better technologies of assembly. Finally, they began to push the Swedish company out of their market.

The last straw was the choice error. In the mid-1980s, the company decided to produce the model of luxury class Saab 9000. Thus, they tried to intrude into the market segment occupied by the German and Japanese producers. Saab 9000 was not successful among the consumers – only 60,000 cars were produced per year, and that did not even recoup the expenditures on the production.

In 1989, 50% of shares of Saab Automobile AB were sold to the corporate group General Motors. Initially, this led to an upturn. Due to the cooperation with GM and borrowing of the best managerial practices, the labor productivity at Saab doubled and the productivity rate necessary to make a profit was reduced by half. In 1994, for the first time in the previous seven years Saab closed a fiscal year with profit.

However, simultaneously a new crisis began to appear. This crisis was caused by the conflict of cultures. Immediately after the purchase of the majority stake, the management team of General Motors had a conflict with the management team of Saab. The managers and engineers of Saab wanted to continue producing the original cars equipped with unique innovations but the managers of General Motors was oriented to the standardization and unification. Eventually, in 2000 GM acquired the remaining 50% of shares of Saab, and made the Swedish company its hundred percent “subsidiary”.

The reasons for the new conflict were the crisis of innovations (imperfect product in the market) and change of phases of the economic cycle (the global financial crisis of 2007-2009).

In the mid-2000s, the corporate group General Motors made Saab produce the new cars on the basis of the Opel cars. The result disappointed the consumers – Saab cars lost their individuality. As a result, the demand for the Saab cars dropped drastically.

In 2007, the global financial crisis began. General Motors, whose financial indicators deteriorated sharply, declared its intention to sell the unprofitable subdivisions, including Saab. After several unsuccessful acts of resale, in 2011 Saab declared bankruptcy.

American aircraft company. It was founded in 1967 as a result of the merger of the aerospace companies the McDonnell Company and the Douglas Aircraft Company. It was one of the largest manufacturers of the military aircrafts in the world.

In the 1970s-1980s, McDonnell Douglas supplied the armies of many countries with warplanes. In 1988, a share of the government orders in its total sales volume was 70%.

The reasons for the loss of its position in the hierarchy of the market field and its merger with Boeing were the shortage of military orders due to the end of the Cold War; the crises of investments (new original projects, whose expenditures cannot be planned in advance); the crises of innovations (customers refused to buy the new airplane because of its characteristics that were worse than those announced); the crisis of reputation (exclusion from the list of companies-participants in the contest for the development of a new fighter aircraft).

The end of the Cold War led to the sharp decrease in the defense order. The Ministry of Defense of the USA closed two large projects in which the company was involved and decreased the orders for the others.

In 1989, McDonnell Douglas and General Dynamics won the tender for the development of the all-weather bomber aircraft of the sea-based aviation A-12 Avenger II with the use of the composite materials. Back then the composite materials were not durable enough for airplanes. The iron materials would make the plane heavier. The overspending on its development reached 2 bln. US dollars. After the large-scale inspection, the project was stopped in 1992.

In 1991, the company started the development of the wide-bodied double-deck MD-12. The airplane with a double deck was difficult to design and very expensive. In 1996, McDonnell Douglas declared the lack of funds for the project implementation. The project was suspended.

McDonnell Douglas developed the wide-bodied MD-11, the first plane in its class, on the basis of DC-10. The characteristics of the airplane MD-11 were worse than it was announced. In 1991, Singapore Airlines refused to purchase 20 airplanes.

In 1996, The Pentagon made a decision to exclude McDonnell Douglas, the main supplier of the fighter planes for the USA, from the list of the participants in the tender for development of the fighter plane of the new generation.

Without a clear outlook for the future, McDonnell Douglas started negotiations with Boeing about a merger. In 1997, this deal was approved by the government.

Allergan is an American pharmaceutical company founded in 1948. The company took the leading positions in the production of ophthalmic drugs, aesthetic medicine and plastic surgery.

The creation of the innovational hormonal drug Prednefrin, designed for the treatment of complicated ophthalmic inflammatory diseases, allowed the company to reach the sales volume of 1 mln. dollars already by 1960. The further development of Allergan was connected to the rapid growth of the market of contact lenses, for which the company developed the line of ophthalmic drugs.

The appearance of disposable contact lenses reduced the demand for some contact lens care products and that made the company look for new drivers of growth. One of them was the Botox, the sale revenues of which reached one third of all revenues of the company by the 2000s.

The reasons for the company’s loss of its position in the hierarchy of the market field and its acquisition by the Irish firm Actavis were the crisis of reputation; the crisis of investments; the appearance of substitute goods as well as an attempted hostile takeover by the rival pharmaceutical company Valeant.

As a result of the federal investigation that was completed in the USA in 2010, it was revealed that from 2000 to 2005 Allergan promoted Botox for medical indications that were not officially registered at that moment. The company had to admit its guilt and pay the penalty in the amount of 600 mln. dollars.

In 2009-2010, several lawsuits were filed against the company blaming it for illegal promotion of ophthalmic drugs in cooperation with doctors. The company agreed to pay 13 mln. dollars to settle the allegations made by the USA and 19 separate states.

Despite the expenditures connected to the settlement of many allegations, the company continued to invest actively in M&A.

In 2013, Allergan acquired MAP Pharmaceuticals for 958 mln. dollars and gained access to the experimental inhaling medicine for headache treatment Levadex that was, however, not approved by the FDA.

The appearance of a generic version of the best-selling medicine Restasis in 2013, which was approved by the FDA, led to the 10 percent decrease in the Allergan stock price.

In 2014, one more serious investigation regarding the company was started. According to the accusations, in its press releases Allergan artificially increased its market value and thus pretended to be more successful than it really was. Besides, it was revealed that as a result of the cartel agreement of Allergan and other pharmaceutical companies, the prices of generic drugs were fixed illegally.

Using the situation unfavorable for Allergan, its competitor Valeant together with the investment fund Pershing Square initiated in 2014 the procedure of a hostile takeover. In these conditions, the management of Allergan accepted the offer of another buyer – the Irish company Actavis. In March 2015, Actavis acquired Allergan for 66 bln. dollars, and officially declared that it would change its name for Allergan, Plc.

The research revealed that in the course of its development every company goes through several bifurcation points. These can be caused by different factors that can be divided into two groups: the internal ones and the external ones. The internal factors include the events that occur within the framework of the company and/or dependent on its activity. The external factors are changes in the environment of the company that are not direct consequences of its internal processes. The loss of a position in the established hierarchy of the market field that leads to the termination of a company’s activity or its acquisition by another company is a result of the combined action of external and internal factors. The external factors create threats to the sustainable operation of the company and the internal ones distract its attention, forces and financial resources for the implementation of inefficient strategies.

The article was financially supported by the Russian Foundation for Basic Research (Project No. 16-36-00163 mol_a "Development of the theory of sustainable competitiveness of companies during technology shifts").

Adizes, I. (2015). Managing Corporate Lifecycles. Adizes Institute Publications.

Christensen, C. (2011). The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail. Harper Business, USA.

Christensen, C., Anthony, S., & Roth, E. (2004). Seeing What's Next: Using the Theories of Innovation to Predict Industry Change. Harvard Business School.

Collins, J. (2001). Good to Great: Why Some Companies Make the Leap… and Others Don't. William Collins.

Collins, J. (2009). How The Mighty Fall: And Why Some Companies Never Give In. Collins Business Book.

Collins, J., & Hansen, M. (2011). Great by Choice. Harper Business.

Collins, J., & Porras, J.I. (2004). Built to Last: Successful Habits of Visionary Companies. William Collins.

Dementyev, V.E. (2012). Rol firm raznykh razmerov na otdelnykh fazakh dlinnoi volny [Role of Companies of Different Sizes at the Particular Phases of the Long Wave]. Ekonomika i matematicheskie metody, 48(4).

Keller, S., & Price, C. (2011). Beyond Performance. How Great Organizations Build Ultimate Competitive Advantage. John Wiley and Sons, Ltd.

Komarova, I.P., & Ustyuzhanin, V.L. (2016). Tochki bifurkatsii i ikh vliyanie na konkurentosposobnost kompanii [Bifurcation Points and Their Impact on Competitiveness of Companies]. In Materialy VIII Mezhdunarodnoi nauchno-prakticheskoi konferentsii. Ot retsessii k stabilizatsii i ekonomicheskomu rostu [Matrials of the VIII International Scientific and Practical Conference. From Recession to Stabilization and Economic Growth] (pp. 105-118). Moscow.

Peters, T., & Waterman, R. (2006). In Search of Excellence: Lessons from America's Best-Run Companies. Harper Business Essentials.

Polterovich, V.M. (2007). Elementy teorii reform [Elements of Theory of Reforms]. Moscow: Ekonomika.

Prahalad, C.K., & Hamel, G. (1990). The Core Competence of the Corporation. Harvard Business Review, 68(3), 79-91.

Yudanov, A.Yu. (2001). Konkurentsiya: teoriya i praktika [Competitiveness: Theory and Practice]. Moscow: GNOM.

Zhdanov, D.A., & Danilov, I.N. (2011). Organizatsionnaya evolyutsiya korporatsii [Organizational Evolution of Corporations]. Moscow: Delo.

1. Plekhanov Russian University of Economics, 117997, Russia, Moscow, Stremyanny Lane, 36; E-mail: komarik_ira@mail.ru

2. Central Economics and Mathematics Institute of the Russian Academy of Sciences, 117418, Russia, Moscow, Nakhimovsky Pr., 47; Plekhanov Russian University of Economics, 117997, Russia, Moscow. E-mail: vladimir-ustyuzhanin@rambler.ru