Vol. 38 (Nº 61) Year 2017. Page 25

Svetlana V. LOBOVA 1; Aleksei V. BOGOVIZ 2

Received: 17/10/2017 • Approved: 16/11/2017

ABSTRACT: Today, e-commerce has become a major industry and generates huge revenues from online sales. The catalyst for the development of e-commerce is the spread of the Internet. The article examines the state and dynamics of e-commerce development in Russia, its scale, commodity categories of Internet sales. It is shown that the main barriers to the development of electronic commerce in Russia are the uneven tax burden on online stores, the underdevelopment of logistics and fullfilment, the existence of the so-called "gray" commodity market. |

RESUMEN: Hoy en día, el comercio electrónico se ha convertido en una industria importante y genera enormes ganancias a partir de las ventas en línea. El catalizador para el desarrollo del comercio electrónico es la difusión de Internet. El artículo examina el estado y la dinámica del desarrollo del comercio electrónico en Rusia, su escala, las categorías de productos básicos de las ventas en Internet. Se demuestra que las principales barreras para el desarrollo del comercio electrónico en Rusia son la carga impositiva desigual en las tiendas en línea, el subdesarrollo de la logística y el cumplimiento, la existencia del llamado mercado de productos "grises". |

The Internet has a tremendous impact on the economy, both globally and nationally. Many companies (large and not so) open their offices on the Internet - corporate websites. Other companies completely transfer their business to the Internet. Trend 2016 was the so-called "universal mobile", people began to use the smartphone more often than a computer, laptop or tablet. A huge number of people buy goods in online stores, play online casinos, read online newspapers and magazines, sell goods they do not need using Internet platforms. This phenomenon is generally known as “e-commerce”. A rapidly growing Internet audience is a market for products for companies of very different profiles. The absence of geographical barriers to advertising and the distribution of goods and services attract new companies in the Internet business. The digitization of economies also means that the Internet can affect trade through its impact on productivity, which in turn increases the competitiveness of these businesses domestically and globally (Bernard et al., 2007).

In 2015, the world market of Internet commerce was 1.55 trillion dollars. Leaders on the market are China (US$ 538 million), U.S. (US$ 483 million), and Great Britain (US$ 169 million). The World Bank has found that a 10% increase in broadband penetration results in a 1.38% rise in economic growth in developing countries and 1.21% in developed countries (Meltzer, 2016).

The purpose of this article is to describe the situation of Internet commerce (or digital commerce, or e-commerce) in Russia.

During the research methodological basis were the works of foreign and Russian scientists on the theory of electronic commerce, problems and the scale of its development of Internet commerce. Their analysis shows that e-commerce is today an integral and important part of the economy of any country. This is one of the fastest growing technological markets in the world.

Until now, there is no single, well-established understanding of what e-commerce is all about (Wirtz, 2001). This term is understood as the process of remote acquisition of physical and non-physical services and goods directly through a telecommunications network (Sokolova, Gerashchenko, 2010), processes that touch customers, suppliers and external partners, including sales, marketing, order taking, delivery, customer service, purchasing of raw materials and supplies for production and procurement of indirect operating-expense items, such as office supplies (Bartels, 2000), online transactions involving the transmission of products, services or payments (Weber, 2015), retail and wholesale purchase / sale of goods and services through an electronic network (Sedykh, 2016). E-commerce is understood as part of e-business, which also includes, for example, video conferencing and teleworking (Fichter, 2002). The general definition is that they reflect the interconnection of economic agents through electronic communications in the processes of creating value, commodity circulation, the mechanism of market functioning.

As an information basis for writing the article, the data of various studies of the omnibus GfK (Gesellschaft fur Konsumforschung) Group, the World Bank, the Association of Internet Trade Companies (ACIT) and other consulting and analytical organizations. Such information allows us to assess the current economic situation and analyze the development of this segment.

The results of studies by the world's leading organizations, such as the World Bank (The World Bank Group, 2016) and the Organization for Economic Cooperation and Development (OECD, 2015), show that the growth of digital trade is parallel to the growth of Internet use around the world.

"The Russian Internet audience - the largest in Europe, exceeds 80 million users, 62 million of them go online every day" (from the speech of the President of the Russian Federation Vladimir Putin at the First Russian Forum "Internet Economy", December 22, 2015).

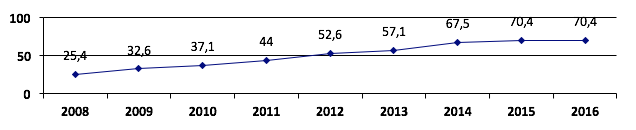

According to Omnibus GfK, 84 million people (70.4% of the total population of the country – Fig.1) aged 16 and older form an audience of Russian Internet users, and the penetration of the Internet into the environment of young Russians (16-29 years old) has reached practically limit values - 97% (Research GfK, 2017). This is a potential Russian audience of online stores, both local and foreign. The share of Internet users with the help of smartphones is 42.1% of the country's population. Use the Internet on the tablets 19% of the population (Internet trading in Russia, 2016). 66.8% of Russian households have broadband access and 68.3% have subscriber contracts for the use of mobile communication services, which on average is more than two subscribers per household (Comprehensive diagnostic study, 2017).

Figure 1

Dynamics of changes in the Internet audience (16+) in Russia, percentages

Source: (Study GfK, 2017)

According to OnLife research, 55+ users use the Internet on average 4 hours on weekdays and 4.3 hours on weekends, and representatives of the "digital" generations Y and Z (young people aged from 16 to 24) spend on the Internet on weekdays 5 1/3 hours, at the weekend about 6 hours (What does ..., 2017).

Today, a resident of a metropolis, a large town, a small town, to be considered "truly modern", almost always has to be "online": with a 24-hour mobile phone, set up to instantly notify about a new e-mail (e-mail), online in client programs for instant exchange and several social networks of the Internet environment. Over the past three years, the number of smartphones in Russia has doubled - now they have 60% of the population. This is more than in Brazil, India and Eastern Europe (Aptekman et al., 2017).

The poll results of the Public Opinion Foundation show that 3/5 of Russian Internet users (60%) find the benefits of using the Internet in obtaining useful and publicly available information, almost a third (31%) in realizing broad opportunities for communication between people, 8% in fast access to information, 4% - in the ability to make remote purchases, pay bills (Research GfK, 2017).

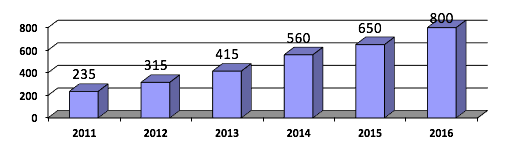

The wide penetration of the Internet in Russia contributed to the fact that the volume of the Internet market in the country in 2016 grew by 21% compared to 2015 and amounted to 920 billion rubles (Internet trading in Russia, 2016). At the same time, the volume of in-country online sales has doubled over the past three years (Fig. 2). This is primarily due to the fairly rapid global expansion of broadband (fixed and mobile) Internet access, and the fact that many large retailers enter the online market, opening their online stores and investing in the development of this particular distribution channel. The economic crisis and trade sanctions also affected the activity of Russian consumers in the online sphere. According to (Baubonienė, Gulevičiūtė, 2015) the main motivating online shopping factors are such advantages as security, fast delivery, comparable price, convenience, cheaper prices and a wider choice. Russian people now make purchases more consciously, plan them, look for discounts and special offers.

However, despite high growth rates, the share of Internet commerce in the total retail trade in Russia remains quite low (about 4%), that is, there is a potential for growth. For comparison, in developed countries, according to expert data, its share is at the level of 12% (Sedykh, 2016).

Figure 2

Dynamics of domestic on-line sales in 2011-2016, RUB Bn

Source: (Internet Commerce in Russia, 2017)

The growth rate of the cross-border trade market (an increase of 37% compared to 2015) outstrips the growth of domestic trade. In addition to unequal competitive conditions between Russian and foreign Internet shops, the devaluation of the ruble played an important role in the growth of cross-border trade volumes in terms of tax burden. Prices for goods in foreign online stores have grown, but still remained on average 15-20% lower than in Russian online counterparts (Sedykh, 2016). The leaders of sales to Russia are China, which accounts for 90% of shipments (in monetary – 52%), the European Union – 4% (23%) and the United States – 2% (12%).

According to ACIT, the most visited website in Russia is the Chinese market-place AliExpress, in second place – the Russian hypermarket Ozon.ru (included in the TOP10 ranking DataInsight and Ruward), the third – the American online auction eBay. This fact also indicates that in Russia, cross-border Internet commerce is widely spread (Sedykh, 2016). Payment for goods ordered from an Internet seller is carried out in the following ways: (i) at the final delivery of goods to customers through couriers – in cash; (ii) online using bank cards; (iii) using electronic payment systems such as WebMoney, QIWI, Yandex money.

Currently in Russia there are more than 43 thousand online stores. Their number is explained by the relatively low barrier to enter the virtual market (up to the total lack of investment), relatively low costs in opening, promoting, maintaining the business. However, not a single Russian Internet seller can compete with such world giants as Amazon, eBay, BestBuy, Alibaba. According to the Russian Association of Electronic Commerce (RAEC), the share of the largest Russian online store does not exceed 2%, and 10 leading companies account for no more than 10% of sales (in the European Union this share reaches 23%). The concentration of online stores is low: thirty leading companies occupy one-third of the market (E-commerce, 2017). The costs of entering the market are relatively low, but the "survivability" of small shops is not high. According to Insales, more than 80% of online stores are closed within one year of existence.

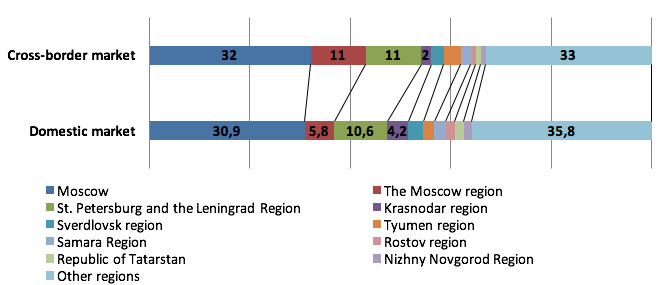

The leading Russian regions in terms of e-commerce are Moscow and St. Petersburg, where about 15% of the population lives and more than 60% of stores are concentrated. High activity was also noted in the Krasnoyarsk Krai, Sverdlovsk, Tyumen, Samara Regions (Fig. 3). These regions are leaders in the level of digitalization of the population in Russia.

Figure 3

Distribution of domestic and cross-border Internet trade in Russia in 2016 by regions, percentages

Source: (Internet trading in Russia, 2016)

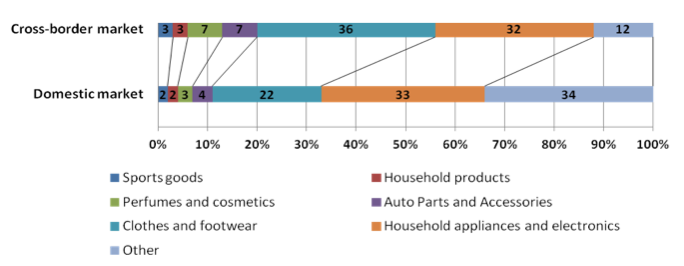

The commodity structure of the Russian e-commerce market includes a multitude of different categories: from spare parts to cars, home appliances to perfumes and art objects (almost everything that is represented in traditional retail). The most popular product categories in both domestic and cross-border markets are electronics, household appliances, clothing, footwear, as well as spare parts and goods for cars, perfumes and cosmetics. At the same time, the share of clothing and footwear in the local market is 22%, while on the local market - 36% (Fig. 4). The local market of Internet sales of household appliances and electronics grew by 17% last year and amounted to 208 billion rubles, which is a high indicator by international standards. The most popular categories are computers and laptops - 28%, telephones and smartphones - 22%. The category "other goods" consists of: accessories and gifts, pet goods, office equipment, building materials, goods for repair, jewelry, food, etc.

Figure 4

Distribution of Internet commerce in Russia in 2016 by product

categories in local and cross-border markets, percentages

Source: (Internet trading in Russia, 2016)

In 2016, in Russia 16% of Internet purchases were made through mobile devices, and the largest online stores the volume of mobile purchases amounted to more than 30% of sales (E-commerce, 2017).

Currently, the overall level of e-commerce development in Russia lags far behind the development indicators of other leading countries. To increase its scale, it is necessary to solve several problems that can be designated as "e-commerce barriers".

The first barrier is insufficient development of logistics and difficulties with the delivery of goods to the regions of Russia. This is especially true for cross-border trade. The main logistics operator is the "Post of Russia". Its share of delivery in the total volume ranges from 62 to 85%. The position of "Post of Russia" in relation to other postal services is almost monopolistic. The use of "Russian Post" services for many sellers is the only available option with national coverage, since prices of other express delivery operators are generally higher by several times. However, the limitations of its bandwidth limit the development of Internet trading, especially its cross-border part. Currently, the average speed of delivery of goods purchased via the Internet has been reduced to two weeks. Internet providers introduce the practice of free delivery of parcels weighing up to 2 kg. Russia has established the most loyal rules for the import of goods for personal use in the world. Currently, the threshold for duty-free import of goods purchased online is 1000 euros. However, on the part of the "Post of Russia", a proposal is proposed to reduce this limit to 200 euro from January 1, 2019, and to the beginning of 2021 - to 50 euros. Nevertheless, parcel traffic requires improvement in terms of reducing the loss of goods during transportation, guaranteeing the quality of the goods delivered, and establishing a tracking system for parcels.

The second barrier is the underdevelopment of payment systems: only 25% of online buyers use plastic cards, only one in nine pays for purchases with electronic money. Many banks for Russian retailers set high acquiring rates (the commission can be up to 3.5% per transaction for one purchase), which are especially affected by the owners of small online stores.

The third barrier is the market of counterfeit goods. The existence of a high level of the "gray market" also adversely affects the development of electronic commerce. Especially it concerns a segment of clothes and shoes, where a large number of counterfeit products, goods in violation of the rules of customs clearance.

The fourth barrier is asymmetrical competitive conditions between Russian and foreign online shops that trade directly with citizens. In order to import goods into the territory of the Russian Federation, it is necessary to pay import VAT 18%, import duties of 8%, which increases the cost of the final goods for the consumer. The difference in the cost of goods between local and foreign players is 30 or more percent. In addition, the Russian retailer must have an official importer, provide the consumer with all the necessary information in Russian, mark the goods, issue a guarantee for these goods, fulfill the requirements for protecting the rights of consumption. This all is an overhead additional costs for Russian online stores. Alignment of competitive conditions for all market participants can help the introduction of import VAT and flexible customs duties.

The fifth barrier is the inadequate development of fullfilment. Fullfilment is a series of logistical processes, such as acceptance, storage, picking, sorting, packaging, marking, shipment of goods and order processing. The Russian fullfilment market is young and not yet formed. There are very few players, the competition is weak. The market development is not fast enough. The main reason is a weak awareness of the availability of full-service services (Fullfilment for Internet commerce, 2016). The volume of the Russian market of fullfilment in 2016 amounted to 7 billion rubles and 23 million parcels. Fullfilment service is offered by: full-service operators (30%), courier services (26%), online stores (29%), 3PL and transport companies (15%). Many Russian online stores, especially young ones, do not know about а fullfilment. They do not transfer part of their own processes to outsourcing, do not reduce their own costs, do not make themselves more competitive.

E-commerce is an important and rather significant part of the economy of any country, the development prospects of which are very, very wide. It has many advantages with respect to traditional forms of trade, and the most important of which are the possibility of attracting more customers from around the world, relatively low transaction costs and costs of doing business. Moreover, the elimination of intermediaries takes place. E-commerce can reduce the cost of processing, distribution, storage, inventory and facilitate the supply chain, it reduces the time between purchase and receipt of payment for goods and services. The costs are also reduced because Internet services are much cheaper than special value-added networks, and the advertising of goods and services can be supplemented with photos, video and audio content aimed at a wide range of audiences, regardless of the place and time of perception. Buyers can exchange ideas, experiences, opinions and feedback with other consumers in online communities. At the same time, Russia has barriers to e-commerce, which require elimination. E-commerce, due to the increase in turnover, should be subject to regulation by the state in the interests of Russian sellers.

APTEKMAN, A., V. Kalabin, V. Klintsov, E. Kuznetsova, V. Kulagin, and I. Yasenovets. Digital Russia: a new reality. July, 2017. Retrieved from: http://www.mckinsey.com/~/media/McKinsey/.../Digital%20Russia/Digital-Russia-report.ashx

BARTELS, A. The Difference Between E-Business and E-Commerce. Computer World. 2000, October 30. Retrieved from: https://www.computerworld.com/article/2588708/e-commerce/e-commerce-the-difference-between-e-business-and-e-commerce.html

BERNARD, Andrew B., J. Bradford Jensen, Stephen J. Redding, and Peter K. Schott.Firms in International Trade. Journal of Economic Perspectives, American Economic Association. 2007, Vol. 21, No. 3, pp. 105-130.

BAUBONIENĖ, Z. and G. Gulevičiūtė. E-Commerce Factors Influencing Consumers’ Online Shopping Decision. Social Technologies. 2015, No. 5(1), pp. 74-81. Retrieved from: https://www3.mruni.eu/ojs/socialtechnologies/article/view/4295/4067

Comprehensive diagnostic study of the economy of the Russian Federation: ways to achieve comprehensive economic growth. Report of the World Bank Group. Retrieved from: http://pubdocs.worldbank.org/en/235471484167009780/Dec27-SCD-paper-rus.pdf

E-commerce: development in Russia and the world. Retrieved from: https://www.wtcmoscow.ru/services/international-partnership/analitycs/elektronnaya-kommertsiya-razvitie-v-rossii-i-mire/

FICHTER, K. E-Commerce. Sorting Out the Environmental. Consequences. Journal of Industrial Ecology. 2002, No. 6(2), pp. 25-41.

Fullfilment for Internet commerce. Data Insight. 2016. Retrieved from: https://www.cdek.ru/website/edostavka/upload/custom/files/%D0%A4%D1%83%D0%BB%D1%84%D0%B8%D0%BB%D0%BC%D0%B5%D0%BD%D1%82%20%D0%B4%D0%BB%D1%8F%20%D0%B8%D0%BD%D1%82%D0%B5%D1%80%D0%BD%D0%B5%D1%82-%D1%82%D0%BE%D1%80%D0%B3%D0%BE%D0%B2%D0%BB%D0%B8.pdf

Internet Commerce in Russia 2017. Figures and Facts. Data Insight. Retrieved from: http://datainsight.ru/sites/default/files/ecommerce2017.pdf

Internet trading in Russia. Q1 2016 results. Retrieved from: http://www.akit.ru/wp-content/uploads/2016/05/E-commerce_1Q2016-FINAL.pdf

MELTZER, J. P. Maximizing the Opportunities of the Internet for International Trade. The 15 Initiative “Strengthening the global trade and investment system for sustainable development”, 2016. Retrieved from: http://www3.weforum.org/docs/E15/WEF_Digital_Trade_report_2015_1401.pdf

OECD. OECD Digital Economy Outlook, 2015, OECD Publishing, Paris. Retrieved from: http://ec.europa.eu/eurostat/documents/42577/3222224/Digital+economy+outlook+2015/

Research GfK: Trends in the development of the Internet audience in Russia. Retrieved from: http://www.gfk.com/en/insaity/press-release/issledovanie-gfk-tendencii-razvitija-internet-auditorii-v-rossii/

SEDYKH, I. A. The Internet market in the Russian Federation. Moscow: Higher School of Economics, 2016. Retrieved from: https://dcenter.hse.ru/data/2017/03/10/1169536647/ Rynok%20InternetTrade%20в%20РФ%202016.pdf

SOKOLOVA, A.N., and N.I. Gerashchenko. E-commerce. World and Russian experience. Moscow: Open Systems, 2010.

The World Bank Group. World Development Report 2016: Digital Dividends, 2016. Retrieved from: http://www.worldbank.org/en/publication/wdr2016

WEBER, R.H. Digital Trade and E-Commerce: Challenges and Opportunities of the Asia-Pacific Regionalism (September 29, 2015). Asian Journal of WTO & International Health Law and Policy. 2015, Vol. 10, No. 2, pp. 321-348. Retrieved from: https://ssrn.com/abstract=2669347

WIRTZ, B. W. Electronic business. Second edition. Wiesbaden, Germany: Gabler-Verlag, 2001.

What does the 55+ audience do on the Internet? Retrieved from: https://www.ipsos.com/sites/default/files/2017-03/2017-03-55%2Bonline.pdf

1. Department of Personnel Management and Socio-Economic Relations. Altai State University. Barnaul, Russia. E-mail: barnaulhome@mail.ru

2. Federal Research Center of Agrarian Economy and Social Development of Rural Areas – All Russian Research Institute of Agricultural Economics. Moscow, Russia. E-mail: aleksei.bogoviz@gmail.com