Vol. 38 (Nº 59) Year 2017. Page 21

Sara ISSAKOVA 1; Aigul MOLDABEKOVA 2; Altynay MOLDASHEVA 3; Marina KENZHEBAEVA 4; Galiya TULEYEVA 5

Received: 14/08/2017 • Approved: 10/09/2017

2. Methods for estimating fair value

ABSTRACT: This article examines equity investments fair value measurement features under IFRS 9 through other comprehensive income. The standard requires dividends received on these investments be recognized in profit or loss unless they represent a partial return on the investment value. Changes in the fair value of these investments will be recognized in other comprehensive income, and income and expenses will not be reclassified from other comprehensive income to profit or loss under impairment, sale or disposal of an investment. |

RESUMEN: Este artículo examina las características de la medición de valor justo de las inversiones de equidad bajo las NIIF 9 a través de otros ingresos integrales. La norma exige que los dividendos recibidos en estas inversiones se reconozcan en ganancias o pérdidas a menos que representen una devolución parcial del valor de la inversión. Los cambios en el valor razonable de estas inversiones serán reconocidos en otros ingresos integrales, y los ingresos y gastos no serán reclasificados de otros ingresos integrales para ganancias o pérdidas bajo deterioro, venta o eliminación de una inversión. |

The need for theoretical research in the field of accounting and reporting is determined in the conditions of the development of market relations by new requirements for the organization of accounting and the preparation of financial statements on the principles of international financial reporting standards.

International Financial Reporting Standards (IFRS), developed by the International Accounting Standards Board (IASB), are recognized worldwide as an effective tool for generating transparent, reliable and understandable information about the activities of organizations. Transparency of financial reporting and quality of management will become the criteria that investors and creditors will be guided by when choosing objects for investment (Jelnova, 2013; O.V. Ozerchuk, 2014).

Accounting and reporting of Kazakh organizations should be oriented towards international financial reporting standards, the priority objective of which is to satisfy the needs of interested users of financial reporting in the information necessary for making managerial decisions.

Integration of any state into the world economy requires the inclusion of international norms or separate documents in national law and giving them the status of normative legal acts.

Thus, the Law of the Republic of Kazakhstan No. 234-111 as of February 28, 2007 "On Accounting and Financial Reporting" introduces the norm of Art. 16, according to which the International Financial Reporting Standards (hereinafter referred to as IFRS) should become an integral part of the national legislation, and certain art. 2 of the above Law, business entities are required to prepare financial statements in accordance with these standards.

The question of determining the optimal valuation model for various accounting objects that best meets the criteria for the real value of the asset or liability becomes particularly relevant.

The study of this and other issues is of particular importance and relevance at the stage of its adaptation to international financial reporting standards. The necessity of solving the problems existing in this field determines the theoretical and methodological relevance and practical significance of the research.

Issues such as the willingness of the Kazakh economy to introduce and use fair value, the specifics of determining the fair value in terms of various assets and liabilities in a crisis, the assessment of the risks associated with its application in the relevant areas of accounting, are still open.

The most important requirements of IFRS 7 "Financial Instruments: Disclosure of Information" are applied to disclosure of information about the financial risks that the organization bears (market risks, liquidity risk and credit risk). But it is impossible to consider and settle all aspects of accounting in one document. In addition, IAS 32, "Financial Instruments: Presentation of Information", adopted in 1996, highlighted only the simplest issues of reporting on financial instruments.

In accordance with IAS 39 "Financial Instruments: Recognition and Measurement", as a result of the performance of a contract, a financial asset is simultaneously created between one company and a financial liability or an equity instrument - in the other. From this it follows that the concept of "financial instrument" covers both assets and liabilities. This is what distinguishes this term from the term "financial investment", which means only certain types of financial assets - cash, the right of claim under a contract of money or another financial asset, the right to exchange for another financial instrument, equity instrument.

IAS 39 defines the following 4 categories of financial assets:

1) A financial asset or financial liability that is measured at fair value, with its changes recognized in profit or loss;

2) Investments held to maturity that are financial assets with fixed or determinable payments and a fixed maturity date and which the organization intends and is able to own before maturity, with the exception of loans and receivables provided by the bank;

3) Loans or receivables that are non-derivative financial assets with fixed or determinable payments for which active market quotes are absent, with the exception of loans or receivables that will be sold in the near future (classified as held for trading);

4) Available-for-sale financial assets that are non-derivative financial assets that do not fall into the following categories:

- Loans and receivables provided by the bank;

- Investments held to maturity;

- Financial assets at fair value through profit or loss.

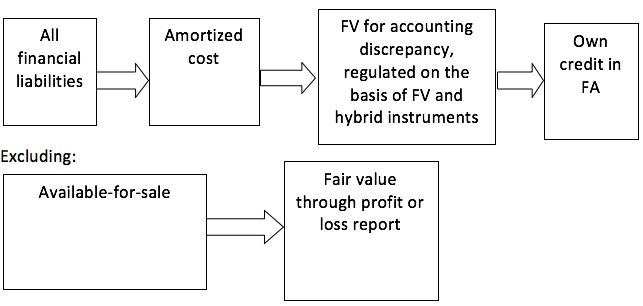

Financial liabilities are allocated to the following categories:

- Financial liabilities at fair value through profit or loss;

- Financial liabilities measured at amortized cost, etc.

At initial recognition, the amortized cost for which the financial asset or financial liability is adjusted on initial recognition is as follows:

- Minus repayment of principal;

- Plus or minus the accumulated amortization of premiums or discounts on the instrument (the difference between the original cost and the amount due for redemption) calculated on the basis of the effective interest rate;

- Minus any deductions for depreciation or due to the hopelessness of debt collection.

After the initial recognition (subsequent recognition), financial instruments are recorded in:

- At fair value;

- At amortized cost;

- At cost.

The principles for assessing financial assets (FA) and liabilities (FL) are different. Possible options for the subsequent evaluation of financial assets and financial liabilities are shown in Table 1.

Fair value of a financial instrument is the amount of cash that is sufficient to acquire an asset or perform an obligation in a transaction between knowledgeable, willing parties in an arm's length transaction.

Amortized value of a financial instrument is the initial valuation of a financial instrument, reduced or increased by the amount of accumulated amortization, the difference between the original cost and the repayment price, less principal repayments or partial write-offs due to impairment or bad debts.

Table 1

Principles for the subsequent measurement of financial assets and liabilities

Indicators |

Accounting at fair value |

Accounting at amortized cost |

Accounting at cost |

Initial valuation |

At fair value |

At fair value plus transaction costs directly attributable to the acquisition or issue of FA or FL |

|

Subsequent valuation |

All objects are stated at fair value without any deduction for transaction costs on sale and other disposal of assets |

All objects are stated at cost of acquisition less accumulated amortization of accumulated impairment losses |

All objects are stated at cost of acquisition less accumulated amortization of accumulated impairment losses |

Change in fair value |

Profit (loss) from the change in fair value is relative to the net profit or loss for the period in which they arose, i.e. are recognized in the income statement |

|

|

Depreciation |

|

The impairment losses included in the income statement are recognized |

The impairment losses included in the income statement are recognized |

Amortization |

Amortization is not accrued |

Amortization is accrued |

Amortization is not accrued |

Exceptions |

In the event of the disappearance of a data source for the reliable measurement of the fair value, the carrying amount of the property at the date of the change is recognized as cost and the item is carried at cost less impairment losses until a data source appears for reliable measurement of fair value |

|

|

Categories of financial assets |

Financial assets at fair value through profit or loss; Available-for-sale financial assets |

Investments held to maturity; Loans and receivables |

Financial assets for which there are no quoted market prices in an active market and whose fair value cannot be reliably estimated |

Categories of financial liabilities |

Financial liabilities at fair value through profit or loss |

Received loans and accounts payable; Other financial liabilities |

|

Accounting objects |

Investments in equity instruments for which published quoted prices are available; Interest rate swap; Options and forward contracts; Investment in convertible debt instruments; Indefinite debt instruments

|

Ordinary receivables and accounts payable, promissory notes receivable and payable, and loans from banks and other third parties; Investment in non-convertible debt instruments; Contract or right (option) for the purchase of an equity instrument; Accounts payable in foreign currency; Loans received from subsidiaries or associates and loans to such organizations issued and payable on demand; Debt instruments that are subject to immediate redemption in the event of failure by the issuer to pay interest or principal |

Ordinary receivables and accounts payable, promissory notes receivable and payable, and loans from banks and other third parties; Investment in non-convertible debt instruments; Contract or right (option) for the purchase of an equity instrument; Accounts payable in foreign currency; Loans received from subsidiaries or associates and loans to such organizations issued and payable on demand; Debt instruments that are subject to immediate redemption in the event of failure by the issuer to pay interest or principal |

Financial instruments that are subsequently measured at fair value through profit or loss include financial assets and financial liabilities held for trading and available-for-sale financial assets. According to IFRS, an entity must measure financial instruments at fair value, without any deduction for disposal or disposal costs that the entity may incur in the sale or disposal of such instruments.

Based on the study of the structure of financial instruments of Kazakh organizations, it was concluded that one of the key issues in calculating amortized cost is determining the effective interest rate less impairment. It was found that the optimal is the calculation of the effective rate in the context of each individual financial instrument, or a group of identical instruments.

The effective interest method is a method of calculating amortization using the effective interest rate of a financial asset or financial liability for an appropriate period.

Effective interest rate is the rate used when discounting the amount of future cash payments expected before the maturity date or the next revision date of the interest rate, the current net book value of the financial asset or financial liability (Minakova and Anikanov, 2013).

Such a calculation should include all fees and other items paid or received by the parties under the contract.

At the date of transition, the organization is required to:

- Estimate all derivative financial investments at fair value;

- Write off all deferred losses and profits on derivatives that were included in the financial statements under the previous accounting rules, if they were recognized as assets or liabilities.

Then, a compliance check should follow with the definitions and criteria for recognition under IFRS and in the case of the Republic of Kazakhstan and determining the need for their reclassification (Law of RK, 2007; ISFR, 2008).

Valuation of financial instruments in accordance with IFRS is as follows. Under IFRS requirements, financial instruments can be accounted for at cost or amortized cost less any amortization amount, and at fair value without any deduction for sale or disposal costs.

IFRS defines how to account for investments at fair value or amortized cost. The remaining financial instruments must be accounted for at fair value. The composition of such investments is given in paragraphs of IFRS.

It should be noted that similar requirements for the assessment of financial investments were also made in Kazakhstan's Accounting Standards (KAS). However, in accordance with the requirements of IFRS, gains and losses on revaluation of investments at fair value are to be included in current income and expenses (in the income statement), and not as part of equity.If a company has financial investments held to maturity (bonds), but does not intend to retain them, and is going to sell before maturity, then such financial investments cannot be further accounted for at amortized cost. They should be accounted for at fair value without consideration for costs of sales or disposal (de Castries, Atchinson, Scott, & van Rossum, n.a.).

The unconditional advantage of such an instrument as fair value is the receipt of reliable information about the planned cash flows and the formation of a database of comparable information. The above-mentioned is due to the fact that different assets can be purchased for a long period and, accordingly, accounted for at different prices.

The fair value is used in the following cases:

- When applying the fair value model in case of initial recognition of investment property;

- In the subsequent assessment of property, plant and equipment (when applying the revalued value accounting method);

- In determining the recoverable amount of assets in the event of their verification for possible depreciation.

The fair value of a financial instrument is the amount of cash that is sufficient to acquire an asset or performance an obligation to enter into a transaction between knowledgeable, willing parties in an arm's length transaction

Fair market value usually means the cost at which the farm can be sold by a voluntary seller to a voluntary buyer after the sale is announced. This excludes any coercion and it is understood that both the seller and the buyer are competent people and have sufficiently reliable information on the subject of sale and purchase.

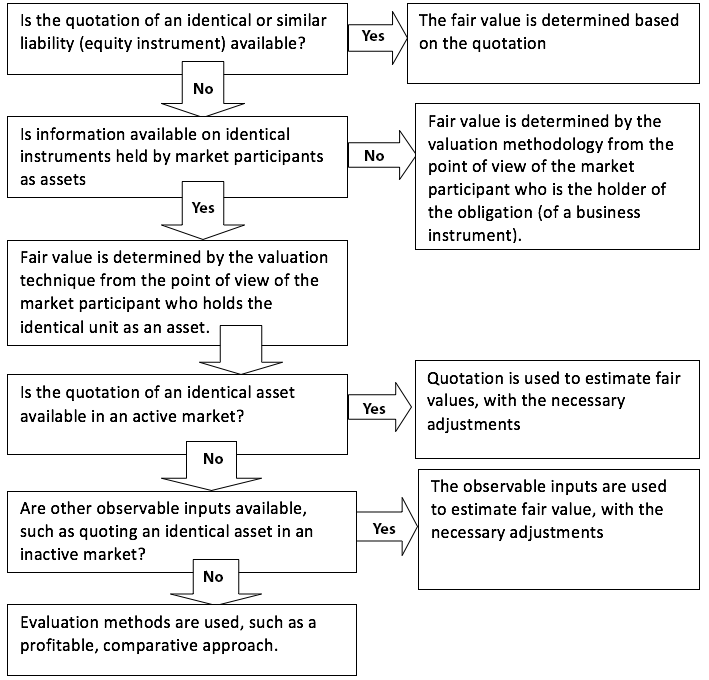

In accordance with IFRS 13 "Fair Value Measurement", effective as of 01 January 2013, fair value is a market valuation rather than an entity-specific estimate. For some assets and liabilities, there may be observable market transactions or market information. For other assets and liabilities, observable market transactions or market information may be absent. However, the purpose of estimating fair value in both cases is the same: determine the price at which an operation is conducted in an organized market, for the sale of an asset or the transfer of an obligation between market participants as of the valuation date in the current market conditions (i.e., the target price on the valuation date from the point of view of the market participant that holds the asset or has an obligation).

If the price of an identical asset or liability is not established in the market, the entity estimates fair value by applying another valuation method that maximizes the use of relevant observable inputs and minimizes the use of unobservable input data. Since fair value is a market valuation, it is determined using assumptions that market participants would apply in determining the value of an asset or liability, including assumptions about the risk. Consequently, the intention of an entity to retain an asset or to settle or otherwise fulfill an obligation is not an appropriate factor in estimating fair value.

Sale of own liabilities or equity instruments is a less obvious situation than the sale of an asset. IFRS 13 describes the characteristics that should be considered when assessing their transfer. It is assumed that the sale occurs at the date when the fair value was estimated, but the instrument is not paid off at that time. The party assuming the obligation (the hypothetical buyer), undertakes to execute it under the same conditions within the same period as the transferring party. An important factor affecting fair value is the credit risk of the debtor, that is, the risk of failure to fulfill the obligation (an integral characteristic of the instrument). The assessment assumes that this risk is unchanged before and after the transfer of the instrument. This means that a hypothetical party, assuming an obligation or an equity instrument, has the same credit risk as the transferring party. Methods to reduce the credit risk of the debtor, such as collateral, guarantee, surety and others, strongly affect the fair value of the instrument itself. The decision whether to take them into account in estimating fair value depends on the individual record of the debtor.

Figure 1

The decision-making framework in assessing liabilities and own equity instruments

In our opinion, if the reflection of changes in the credit risk of a financial liability into other comprehensive income leads to inconsistencies in accounting for profits and losses, all changes in fair value are charged to profit and loss accounts.

Discrepancy in accounting should arise from the economic relationship between a financial liability and a financial asset, as a result of which the credit risk of the liability is offset by a change in the fair value of the asset.

Discrepancy in accounting:

- Should be determined at the initial recognition of the obligation;

- Is not subject to subsequent revaluation;

- Should not be caused solely by the measurement method that the organization applies to determine changes in the level of credit risk under this obligation.

The criteria that allow the right to use the estimate at fair value remain the same and are based on the following:

- Management of the liability is carried out on the basis of fair value;

- Application of the fair value accounting method will result in the elimination or reduction of accounting inconsistencies; or

- The instrument is a hybrid contract (contains the main contract and the embedded derivative tool), for which it is necessary to allocate the built-in tool.

The most common reason for using the possibility of estimating at fair value is the presence of embedded derivatives in the organization, which it does not want to allocate from the main obligation. In addition, an entity may want to use the possibility of measuring at fair value for liabilities if there are inconsistencies in accounting between liabilities and assets that should be accounted for at fair value, with changes in its profit and loss account.

The existing guidance on embedded derivatives contained in IAS 39 is retained in IFRS 9.

Organizations should continue to allocate derivatives embedded in financial liabilities, unless they are closely related to the host contract (for example, structured bills in cases where the interest rate is linked to the stock index). The allotted embedded derivative is measured at fair value, with the changes reflected in the profit and loss account, and the principal debt instrument is measured at amortized cost.

The existing guidance on accounting for embedded derivatives in IAS 39 is retained in IFRS 9 for financial liabilities and non-financial instruments. As a result, some embedded derivatives are accounted for separately at fair value, with the changes reflected in the profit and loss account. At the same time, embedded derivatives are no longer separated from financial assets.

IFRS 7 requires disclosure of the amount of change in fair value attributable to own credit risk for liabilities classified as "measured at fair value through profit or loss". The definition of the amount of credit risk in IFRS 7 has been retained and transferred to IFRS 9, and certain aspects have been clarified.

Own credit risk is defined as:

- The amount of change in fair value that is not related to changes in market risk (for example, basic interest rates) is often referred to as the "base method"; or

- Using an alternative method that, in the opinion of the organization, more accurately reflects the change in fair value due to its own credit risk (in particular, the method that allows calculating the amount of credit risk based on rates on credit defaulted financial obligations to swaps).

If changes in fair value due to factors other than changes in the credit risk for liabilities, that is, basic interest rates (such as LIBOR) are significant, the organization must apply an alternative method; the basic method in this case cannot be used.

For example, changes in the fair value of an obligation may be due to a change in the value of a derivative instrument embedded in this obligation, rather than a change in the base interest rates.

In this case, changes in the value of the embedded derivative should not be taken into account when determining the amount of own credit risk reflected in other comprehensive income.

IFRS 9 confirms that the credit risk of a collateralized liability will differ from the credit risk of an equivalent liability without collateral issued by the same entity.

The standard also clarifies that linking to the value of a share usually results in a risk of return on assets rather than a credit risk, that is, the value of the liability is changed due to a change in the value of the related asset, rather than as a result of a change in the level of the credit's own credit risk. Changes in the fair value of the liability attributable to the value of the unit due to changes in the fair value of the related asset are recognized in the income statement. They are not considered part of their own credit risk, reflected in other comprehensive income.

The components of the change in the fair value of the liability are presented in the statement of comprehensive income; changes in own credit risk are reflected in other comprehensive income, and all other changes in fair value are recognized in profit or loss.

The aggregate change in fair value does not change, but it is presented in different sections of the statement of comprehensive income.

Amounts in other comprehensive income related to own credit risk are not transferred to the income statement when the liability is derecognized and the related amounts are realized. However, this standard permits transfers within the capital.

The amendments prohibit the reclassification into the profit or loss of the amounts recognized in other comprehensive income, as a result of the termination of the recognition of the obligation.

In our opinion, these amounts can be transferred to retained earnings.

This approach is similar to the accounting for changes in the fair value of equity investments classified at fair value through other comprehensive income.

Derivatives liabilities on unquoted equity instruments should be measured at fair value.

IFRS 7 includes all information on financial instruments that should be disclosed.

IFRS 7 is based on IAS 30 (which it replaces) and sets higher requirements for quantitative and qualitative analysis of currency risk, interest rate risk, liquidity risk and other price risks.

IFRS 7 applies to recognized and unrecognized financial instruments.

Recognized financial instruments include financial assets and liabilities that are included in IAS 39.

Unrecognized financial instruments include certain financial instruments that are not included in IAS 39, for example, loan commitments.

Figure 2

Classification model: Financial liabilities

IFRS 7 applies to contracts for the purchase or sale of a non-financial item that is included in IAS 39.

The purpose is to determine the order of disclosure of information that allows users of financial statements to assess the significance of financial instruments of the organization, the nature and extent of the risks associated with them and how the organization manages them.

The main methods are the following: market, income and cost.

The final category of the estimated fair value is determined by the baseline data of the lowest level.

In our opinion, adjustments made to the original data, such as adjustments of a similar asset to the state of the valuation, or, in assessing the liability, adjustment of a similar asset to exclude the effect of the issued guarantee from its price, should be taken into account.

Framework 3. Adjustments framework that lower the final level of evaluation

Level 1 |

Source data - quoted prices (uncorrected) in active markets for identical assets or liabilities |

Level 2 |

Source data - directly or indirectly observed data for an asset or liability |

Level 3 |

Source data - non-observed data for an asset or liability |

The market approach uses prices and other relevant information based on the results of market transactions related to identical or comparable (i.e. similar) assets, liabilities or a group of assets and liabilities, such as business.

Valuation methods that are compatible with the market approach include a matrix pricing method. Matrix method of price determination is a mathematical method used primarily for the valuation of certain types of financial instruments, such as debt securities, which does not rely solely on the price quotations of certain securities, but relies on the connection of these securities with other quoted securities.

When cost method reflect the amount that would be required in a real time operating power to replace asset (often referred to as the present value substitution).

In many cases, the replacement cost method is used to estimate the fair value of tangible assets that are used in combination with other assets or with other assets and liabilities.

Income method involves converting future amounts (for example, cash flows or revenues and expenses) into one current (i.e., discounted) amount. When a revenue approach is used, the fair value estimate reflects the current market expectations for these future amounts.

These evaluation methods include, for example, the following:

a) Methods based on the calculation of present value;

b) Option price determination models, such as the Black-Scholes-Merton formula or the binomial model (that is, the discrete approach model) that provide a calculation of the present value and reflect both the time value and the intrinsic value of the relevant option;

c) A multi-period model of excess profit, which is used to estimate the fair value of intangible assets.

In determining fair value, special attention is paid to assets and liabilities, because they are the main object of accounting valuation.

The accounting policies of the organization should clearly define accounting principles for the recognition and measurement of financial assets and financial liabilities, the procedure for disclosure and presentation of information on financial instruments. As a result, when the information is reflected in the financial statements, the organization will not have difficulties with different interpretations of national and international financial reporting standards.

In the long run, the price based on market value best suits the criteria of the real value of the financial asset. However, in the period of the crisis, due to short-term fluctuations that are subjective, it is necessary to apply various reasonable assumptions to the market value. In the presence of objective signs of undervaluation or overvaluation of the financial market, it is recommended to establish a fair value based on a trend, taking into account individually identified characteristics, such as the type of financial instrument, the analysis period, the industry, etc.

The organization should group financial instruments into classes that correspond to the nature of the disclosed information and the characteristics of these financial instruments.

The organization provides the necessary information to ensure reconciliation of individual items presented in the balance sheet.

The classes of instruments are defined by the organization and differ from the categories of financial instruments specified in IAS 39 that determine how financial instruments are valued and in which cases changes in fair value are recognized.

Identify the classes of financial instruments, the organization should:

- Distinguish between instruments measured at amortized cost and instruments that are measured at fair value.

- Consider as a separate class or classes those financial instruments that are not included in IFRS 7.

The organization should disclose information that allows users to evaluate the importance of financial instruments for the financial position (balance sheet) and results of operations (income statement or statement of comprehensive income).

Therefore, the carrying amount of each of the following categories in accordance with the definition in IAS 39 is disclosed in the balance sheet itself or in its notes:

1. Financial assets at fair value through profit or loss are shown separately at fair value after initial recognition and those classified as held for trading;

2. Investments held to maturity;

3. Loans and receivables;

4. Available-for-sale financial assets;

5. Financial liabilities recorded at fair value through profit or loss; (1) those liabilities that are accounted, therefore, from initial recognition in the accounts and (2) those that are classified as held for trading;

6. Financial liabilities measured at amortized cost.

Casualty Actuarial Society. (2000). Casualty Actuarial Society Task Force. Arlington: Casualty Actuarial Society.

de Castries, H., Atchinson, B., Scott, J., & van Rossum, A. (n.a.). Governance, Trust, Transparency and Customer Relations. Geneva Papers on Risk and Insurance: Issues and Practice, n.a.

de la Martiniere, G. (2003). The Complexity of Managing a Global Company: Regional Exposure v Global Exposure. Geneva Papers on Risk and Insurance: Issues and Practice, n.a.

Dickinson, G. (2003). The Search for an International Accounting Standard for Insurance, Special Report to the Task Force on Accountancy of the Geneva Association. Geneva Papers on Risk and Insurance: Issues and Practice. Special Issue., n.a.

Group of Chief Financial Officers. (2002). letter sent on 11 October, 2002, from the Chief Financial Officers of twenty of the world’s leading insurance groups sent to International Accounting Standards Board titled ‘‘Accounting for Insurance Contracts: the Industry’s Position’’ . n.a.: n.a.

Hairs, C. J. (2002). Fair Valuation of Liabilities. British Actuarial Journal, n.a.

Hirshliffer, J. (2001). Investor Psychology and Asset Pricing. Journal of Finance, n.a.

Horton, J., & Macve, R. (1997). UK Life Insurance: Accounting for Business Performance. FT Finance, a division of Pearson Professional, n.a.

IAS/IFRS. (n.a., n.a. n.a.). Exposure draft "Financial instruments: amortized cost and impairment". Retrieved from www.iasb.org: http://www.iasb.org

IAS/IFRS. (n.a., n.a. n.a.). Exposure draft “Derecognition”. Retrieved from www.iasb.org: http://www.iasb.org

IASB. (n.a., n.a. n.a.). Financial Instruments. Retrieved from www.iasb.org: http://www.iasb.org

IASB. (n.a., n.a. n.a.). Financial Instruments with Characteristics of Equity . Retrieved from www.iasb.org: http://www.iasb.org

IASB. (n.a., n.a. n.a.). Financial Instruments: Impairment of Financial Assets. Retrieved from www.iasb.org: http://www.iasb.org

IASB. (n.a., n.a. n.a.). Financial Instruments: Replacement of IAS 39. Retrieved from www.iasb.org: http://www.iasb.org

IFRS. (n.a., n.a. n.a.). Financial instruments. Retrieved from www.iasb.org: http://www.iasb.org

International Accountimg Standards Board. (2001). Insurance Steering Committee report set under the IASC (with further additions in January 2002) Draft Statement of Principles on Insurance Contracts, prepared by the Insurance Steering Committee. London: International Accounting Standards Board.

International Accounting Standards Board. (2002). Exposure Draft of Proposed Amendments to IAS 32, Financial Instruments: Disclosure and Presentation, and IAS 39 Financial Instruments: Recognition and Measurement. London: International Accounting Standards Board.

International Accounting Standards Board. (2002). Exposure Draft on Business Combinations (ED3). London: International Accounting Standards Board.

International Accounting Standards Board. (2002). Insurance Contracts – Project Summary. London: International Accounting Standards Board.

International Accounting Standards Board. (2003). Exposure Draft Insurance Contracts. London: International Accounting Standards Board.

International Accounting Standards Board. (2003). Revised IAS 39 Financial Instruments: Recognition and Measurement. London: International Accounting Standards Board.

International Accounting Standards Board. (2004). Amendments to IAS 39 Financial Instruments: Recognition and Measurement- the Fair Value Option. London: International Accounting Standards Board.

International Accounting Standards Board. (2004). International Financial Reporting Standard No.4, Insurance Contracts. London: International Accounting Standards Board.

International Accounting Standards Board. (2004). Revised IAS 39 Financial Instruments: Recognition and Measurement, to incorporate Macro-Hedging Revisions. London: International Accounting Standards Board.

International Association of Insurance Supervisors. (2002). letter sent on 20 June, 2002, to the International Accounting Standards Board in response to the draft DSOP on Insurance Contracts. n.a.: IAIS.

ISFR. (2008). International standards of financial reporting 2006. Almaty: BIKO.

Jelnova, C. V. (2013) Analysis of the practice of decision-making in the field of investment policy. Contemporary Economic Issues, 4. Retrieved from http://economic-journal.net/index.php/CEI/article/view/83/70 . DOI: 10.24194/41302

Langendig, H., & Swagerman, D. (2003). Is Fair Value Fair? Financial Reporting in an International Perspective. n.a.: Wiley-Interscience.

Law of RK. (2007). On accounting and financial reporting. Almaty: LP LEM.

Liedtke, P. (2003, June 01). Finding Better Rules for International Financial Reporting Standards. Retrieved from Geneva Association Information Newsletter on Insurance Economics: http://www.genevaassociation.org

Macve, R. A. (1997). Conceptual Framework for Financial Accounting and Reporting: Vision, Tool or Threat? New York: Garland Publishers.

Minakova, I. V. & Anikanov, P. V. (2013). Modelling of area of possible results of the innovative investment project. Contemporary Economic Issues, 1. Retrieved fromhttp://economic-journal.net/index.php/CEI/article/view/34/22 . DOI: 10.24194/11321

O.V. Ozerchuk (2014) Analysis of the Impact of Public Crediting Policy on the Investment Activity in Ukraine. Contemporary Economic Issues, 1. Retrieved fromhttp://economic-journal.net/index.php/CEI/article/view/99. DOI: 10.24194/11410

Schiro, J. (n.a.). Proposed Changes in Insurance Accounting Rules. Geneva Papers on Risk and Insurance: Issues and Practice, n.a.

Usier, G. (2004). The Insurance Industry, Systemic Financial Stability, and Fair Value Accounting. 29, n.a.

Wild, J. J., Subramanyam, K. R., & Halsey, R. F. (2013). Financial statement analysis. n.a.: McGraw-Hill.

1. Taraz State University named after Muhammad Khaydar Dulati, Taraz, Republic of Kazakhstan. sara_is@mail.ru

2. Taraz State University named after Muhammad Khaydar Dulati, Taraz, Republic of Kazakhstan. aigul_M73@mail.ru

3. Taraz State University named after Muhammad Khaydar Dulati, Taraz, Republic of Kazakhstan. altun_78@mail.ru

4. Taraz State University named after Muhammad Khaydar Dulati, Taraz, Republic of Kazakhstan. K.Marina_1970@mail.ru

5. Taraz State University named after Muhammad Khaydar Dulati, Taraz, Republic of Kazakhstan. Tuleeva77@mail.ru