Vol. 38 (Nº 54) Year 2017. Page 25

Iryna MARKINA 1; Artur HNIEDKOV 2; Mykola SOMYCH 3

Received: 14/07/2017 • Approved: 25/08/2017

ABSTRACT: Nowadays Ukraine has the highest level of the shadow economy in the Eastern Europe. Many entrepreneurs in this country operate in the informal sector of the national economy. In the given paper, the key reasons because of which the business-owners prefer to keep their business operations in the informal sector of the economy have been analyzed. Due to the various global indices, published by the world’s most respected and trustworthy research organizations, the weaknesses of the Ukrainian economy, affecting the “shadow” activity of the registered enterprises, were identified. The combination of high-level corruption and bureaucracy in the country has led to an increase in the level of confidence of entrepreneurs in state authorities. The common characteristic of “shady businessmen” in Ukraine is that the operating in the informal sector is their conscious choice for more business opportunities.Understanding the motivations that drive entrepreneurs is essential to develop effective policies to facilitate the formalization of the selected informal businesses. The “carrot and stick” method, which is considered to be the traditional one in Ukraine, is not effective in terms of political instability and lack of reform. That is why the given paper presents a complex model of the formalization of the shadow economy in Ukraine, which combines both direct and indirect approaches. |

RESUMEN: En la actualidad, Ucrania tiene el nivel más alto de la economía de las sombras en la Europa Oriental. Muchos emprendedores en este país operan en el sector informal de la economía nacional. En el documento dado, las razones principales por las cuales los dueños de negocios prefieren mantener sus operaciones comerciales en el sector informal de la economía han sido analizados. Debido a los diversos índices globales, publicados por las organizaciones de investigación más respetadas y confiables del mundo, se identificaron las debilidades de la economía ucraniana, afectando a la actividad "Shadow" de las empresas registradas. La combinación de corrupción y burocracia de alto nivel en el país ha llevado a un aumento del nivel de confianza de los empresarios en las autoridades estatales. La característica común de los "hombres de negocios sombríos" en Ucrania es que el funcionamiento en el sector informal es su opción consciente para más oportunidades de negocio. Entender las motivaciones que impulsan a los emprendedores es esencial para desarrollar políticas efectivas que faciliten la formalización de los negocios informales seleccionados. El método "zanahoria y palo", que se considera el tradicional en Ucrania, no es eficaz en términos de inestabilidad política y falta de reforma. Es por ello que el documento presentado presenta un modelo complejo de la formalización de la economía de las sombras en Ucrania, que combina enfoques tanto directos como indirectos. |

Socio-political and economic changes in many post-socialist countries, including Ukraine, in one way or another, affect the increase in size of the shadow economy sector. There is no country in the world without a shadow economy (Schneider, Buehn & Mentenegro, 2010; Komekbayeva, Legostayeva, Tyan & Orynbassarova, 2016), however, the share of the informal sector in the developed economies actually reaches 18 % and in the developing transition economies it reaches nearly 37 % (Buehn & Schneider, 2012). According to various indicators, the volume of the shadow economy in Ukraine amounted to 54 % of GDP in 2015 (Conditions, 2016; Ministry of Economic Development and Trade of Ukraine, 2016). On the basis of recent studies only 10 % of Ukrainian entrepreneurs are operating officially, that is one of the lowest levels in the Eastern Europe (Williams, 2009). Various crisis phenomena led to an increase in the informal sector of the national economy, where the crisis may be not only economic, but also the political and social ones. As a result, the socio-economic policy of Ukraine, as in many other countries with similar economic performance is considered to be ineffective (Blackburn, Bose & Capasso, 2012; Capasso & Jappelli, 2013).

In the pre-crisis period of 1999-2008, the shadow economy in Ukraine has had a tendency to decrease; respectively in the period between 2011 and 2014 the total level of shadow economy has had the very same tendency. Thus, it was a reflection of the gradual stabilization of the economic situation in the state (Vinnychuk & Ziukov, 2013). However, the political crisis that began in 2014, and the ensuing events associated with the annexation of the Crimea and the war in the East of Ukraine, led to further destabilization of both the economic and social sphere and the further transformation of the part of national economy into the shadow one (Conditions, 2016).

These indicators suggest that any indirect approach used to measure the volume of the shadow economy in Ukraine will provide only very approximate data. In contrast, the direct methods of estimating the volume of the shadow economy are too expensive and not accurate due to the nature of the shadow economy, because its main economic subjects do not wish to be revealed (Markina, 2016).

The “shadow economy” in Ukraine is considered to be a non-registered in the prescribed manner the economic activity of the enterprise, which is characterized by minimizing the costs of production of goods, works and services, tax evasion, custom duties (mandatory payments), as well as statistical reporting avoidance, which results in the violation of statutory regulations, like minimum wages, working hours, conditions and safety (Ministry of Economic Development and Trade of Ukraine, 2016; Williams, 2009; Markina, 2016). We follow the definition provided by Friedrich Schneider as legal business activities that performed outside the reach of government authorities and deliberately concealed from them (Schneider & Schneider, 2004; Schneider, 2016; Schneider, 2015).

Until now, the scientific community has no opinion on the most accurate methods for investigating the various indicators of the shadow economy (Feld & Larsen, 2005; Feld & Schneider, 2010; Schneider, 2005).

The main methods used for estimating the volume of the shadow economy in Ukraine, are the following ones (Ministry of Economic Development and Trade of Ukraine, 2016).

1) Direct methods:

“the consumer spending – retail turnover method”, which is used to identify the presence of shadow economy in the certain country through comparing the amount of household expenditures on goods with the amount of purchase of goods in retail networks;

2) Indirect methods:

financial method, which is based on the assumption that the dynamics of the cost of goods, labor and services used in production process and the gross income of the business entities must be coincident;

monetary method, used to identify the changes in correlation between cash and bank deposits for a specific reporting period;

electricity consumption method, which is based on comparison of the dynamics of electricity consumption and GDP.

During 2014-2015, these methods revealed the following trends of the shadow economy of Ukraine (Ministry of Economic Development and Trade of Ukraine, 2016):

1) “the consumer spending – retail turnover” method allowed to fix the reduction of the level of shadow economy by 2 % (i.e. to 54 % of overall official GDP);

2) the method of loss-making enterprises allowed to reveal the reduction of the shadow economy level reached 3 % (approximately 33 % of the overall official GDP growth);

3) monetary method showed a decrease in the level of the shadow economy by 1 % (approximately 30 % of official GDP);

4) electricity consumption method recorded an increase in the shadow economy level by 2 % (34 % of the overall official GDP).

These methods have a large number of conditions, the implementation of which is difficult and sometimes impossible to verify. These indicators clearly demonstrate how much can be different indicators of the shadow economy depending on the selected method of its evaluation. So, the difference between the highest and lowest rate is 24 %.

The estimation of the volume of the shadow sector in any national economy in the whole world is based on the combination of Multiple Indicators Multiple Causes (MIMIC) procedure and the currency demand method (Schneider, 2005). Under this method, the average size of the shadow economy in Ukraine in the analyzed period of 1999-2015 was 44.6 %. However, the error rates can be approximately equal to 10-15 % (Schneider, 2016).

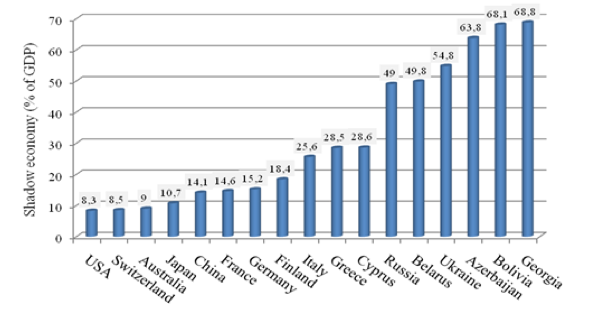

For example, the recent study, conducted by the World Bank and the Johannes Kepler University (Schneider, 2014), provides a ranking of countries according to the level of the shadow economy in the period between 1999-2014. Thus, 162 countries were analyzed by the experts. The gained results of such an investigation are selectively shown in Figure 1 (Schneider, 2015).

Figure 1

Ranking of countries by average level of the

shadow economy for the period of 1999-2014

To reduce the size of the shadow sector of the national economy of Ukraine to the level of the developed European countries, necessary to improve the macroeconomic indicators, it is important to carry out the various economic, social and political actions, aimed at pulling the economy out of the shadows. The strategy of further actions can be defined by a deep analysis of the causes that contribute to the development of the shadow entrepreneurship across the country.

The overall purpose of this paper is to conduct systematic analysis of the possible causes of the increasing of shadow entrepreneurship in Ukraine and the development of certain motivational techniques of its withdrawal from the shadow.

The total volume data on the shadow economy in Ukraine was taken from the available statistic reports of the Ministry of Economic Development and Trade of Ukraine of 2013-2015 and the relevant estimates made by Friedrich Schneider (Conditions, 2016; Ministry of Economic Development and Trade of Ukraine, 2016).

The main statistical indicators, which should be used for the estimation of socio-economic processes in the country, are the World Bank’s the Worldwide Governance Indicators (Bank, 2014). In addition, anyone can rely on such indicators of global indices, as the World Bank’s Doing Business 2016 (Bank, 2016), Corruption Perceptions Index 2015 by Transparency International (International, 2015), The Global Competitiveness Index 2016 (Schwab, 2016), and Freedom in the World 2016 by Freedom House (House, 2016).

Thus, the estimation is made on a set of the following indicators, which are also known as the main dimensions of governance:

1) citizen’s voice and government accountability – the indicator, which shows the extent to which citizens of a certain country or territory are able to participate in the process of the selection of their government, as well as the degree of freedom of expression, freedom of association and freedom of media;

2) government effectiveness – the indicator, concerned with the quality of public services and the quality of civil service, as well as the degree of the government independence from any political pressures, and even the quality of the state policy formulation and implementation;

3) regulatory quality – measures perceptions of the government’s ability to formulate and implement sound policies and regulations, which contribute to the private sector development;

4) rule of law – the indicator, which shows the extent to which the main agents have confidence in and follow the rules and laws of society and, especially, the quality of contract enforcement, property rights, the police and the Court system, as well as the likelihood of crime and violence.

5) control of corruption – captures perceptions of the extent to which public power is committed to getting the financial result as well as to control elites and private interests;

6) political stability and absence of violence / terrorism – measures perception of the risk of political instability in the country, as well as the political violence, including terrorism.

The value for each of these indexes ranges from a maximum of +2.5 (there is an almost complete absence of adverse effects) to a minimum of -2.5 (there is the lack of this indicator). The zero value is considered as the minimum level, necessary for the democratic and sustainable development (Bank, 2014).

In order to determine the effect of the shadow economy on the various social and economic processes, as well as to identify specific reasons for the growth of the shadow economy, and to establish the key features of the shadow economy in transition economies and methods of the de-shadowing of the national economy, the publications in Scopus and Web of Science databases for the period of 1995-2016 were analyzed in the paper.

The shadow economy is a phenomenon characteristic of all countries in the whole world (Schneider, 2014). However, as noted above, the average level of the shadow economy in the developed countries is more than 2 times lower than the average level of the corresponding indicator in transition economies. Actually, these indicators are not mere coincidence, but the result of a number of economic and social factors. By analyzing the differences in socio-economic systems of the developed and transitions economies it is important to allocate the following factors leading to the growth of the shadow entrepreneurship activity in the country:

1) tax burden

The tax burden is one of the main drivers for the progression of the shadow entrepreneurship (Schneider, Buehn & Montenegro, 2010; Buehn & Schneider, 2012). As an important political tool, state regulation of the Ukrainian economy is usually carried out regardless of the existing economic interests. In addition, the reduction in the tax burden, and consequently, reduction of the shadow sector in the national economy should be systematic. According to the index Paying Taxes 2016, Ukraine occupies position 107 globally (in contrast, its position in the previous year was almost of same level). When the weighted average tax rate among the countries of Eastern Europe is 34.8 %, it reaches 52.2 % in Ukraine (Bank, 2016).

2) quality of public institutions

In the evaluation of the public institutions’ activity in The Global Competitiveness Index 2016 Ukraine ranks 130 out of 140 countries. Moreover, in terms of the macroeconomic environment Ukraine ranks 134th of 140 economies in the whole world (Schwab, 2016). In such socio-economic conditions the shadow sector of the economy is attractive for many entrepreneurs, so Ukraine remains one of the most corrupt countries in the world and the most corrupt country in the region (International, 2015).

3) level of regulations

Shadow economy researchers emphasize the relationship between the volume of the shadow economy and the level of regulations in the country. According to the World Bank’s Doing Business Index, Ukraine drop to lowest ranking position (Bank, 2016). The obtained results show that the most problematic areas for doing business in Ukraine are: resolving insolvency, construction permits and getting electricity.

4) political situation and stability

Ukraine is in a state of armed conflict. In addition to direct economic losses, there are the losses of territory, destroyed infrastructure, and so on. That is why it is important to consider the key factors affecting the shadow economy, which are as follows: the psychological factors associated with the armed conflict in Eastern Ukraine; internally displaced persons from the conflict zones, entering state controlled areas in Ukraine. The war negatively affects the psychological state of the people. It is expected that the military actions lead to a decrease in the level of happiness of the residents of the particular country. But recent studies have convinced us otherwise. The level of happiness among Ukrainians fell by only 5 % between 2015 and 2016, as compared to the period of 2013-2014 (Coupe & Obrizan, 2016). Researchers attribute this fact to the hybrid nature of the conflict and its geographic location.

According to the World Bank’s World Governance Indicators, which reflect the influence of the political situation in the socio-economic situation in Ukraine (citizen’s voice and government accountability, political stability and absence of violence / terrorism, government effectiveness, rule of low, control of corruption and regulatory quality), the current political stability index in Ukraine plummeted to its lowest level. The development of the effective policies for the formalization of the entrepreneurship activity requires understanding of the reasons that contribute to the transition to the shadow sector of the national economy.

In the context of our study we identified the most researchers consider the categories of necessity-driven and opportunity-driven entrepreneurs. Therefore, the large number of the entrepreneurs is operating in the shadow economy because of the high density of regulations, and the high level of bureaucracy and corruption. At the same time, another share of the entrepreneurs prefers operating in the informal sector of the national economy to avoid tax/regulatory burdens and get favorable opportunities for further activity.

Traditionally it is assumed that the ratio of necessity-to-opportunity entrepreneurship is 3.5 to 1. In addition, this ratio can vary, depending on the economic situation of the country.

In this connection we can assume that in the post-Soviet countries and transition economies entrepreneurs move to the shadows and operate in the informal sector, when needed. However, empirical studies show that this is not the case in Ukraine. Smallborne and Welter (2004) find out that the main motives for the transition into the shadows for the Ukrainian entrepreneurs are those which are related to the “increasing income” (73 %), “independence” (71 %), “the possibility of self-actualization” (61 %). And the last part of the respondents (25 %) acknowledged that they did it out of necessity. Thus, the decision to move into the informal sector of the economy was a conscious decision taken on their own initiative, without the involvement of external factors. This conclusion is confirmed by further research (Aidis, Welter, Smallbone & Isakova, (2007).

So we have come to understand the reason of the existing of the shadow entrepreneurship activity in Ukraine. The decision to move into the informal sector is usually adopted on the basis of the psychological aspects, rather than economic. Entrepreneurs see more opportunities and prospects for their further activity in the shadow sector of the economy. The independence of their business from state directions and laws gives them confidence. And to move them back to the formal economy sector it is not enough to hold “superficial” reforms or their visibility.

In Ukraine, as well as in other transition economies the main approach in the fight against the shadow economy remains the “find and eradicate” approach. Thus the main objective of the state public policy is to improve the efficiency of detection of shadow businesses and strengthening sanctions for each of them.

The report of the Ministry of Economic Development and Trade of Ukraine on the shadow economy in 2015 has shown the list of the accepted laws and amendments related to this sphere (Ministry of Economic Development and Trade of Ukraine, 2016). However, as noted by the various global indices, published by the most respected and trustworthy research organizations in the world, the main problem of Ukraine is related to the implementation of the adopted laws and the realization of the planned reforms. For instance, the Law of Ukraine “On National Security of Ukraine” was adopted in 2003, according to which the problem of the national economy shadowing is recognized as one of the threats to national interests and national economic security in Ukraine (Vinnychuk & Ziukov, 2013).

However, the high level of shadow economy poses a real threat to national security and democratic development in Ukraine and negatively affects the image of the country, its competitiveness and the effectiveness of all necessary reforms. Consequently, de-shadowing of the national economy should be aimed at overcoming and elimination of the causes and preconditions of shadow phenomena and processes in the country (Vinnychuk & Ziukov, 2013).

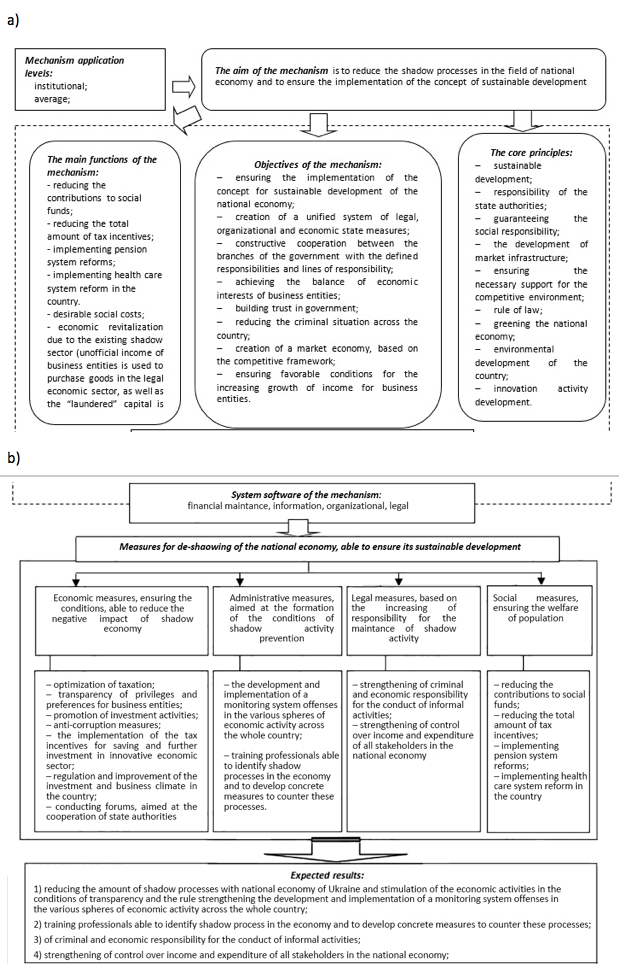

Ukrainian researchers consider the only one method in the fight against the informal sector of the national economy, which is known as the “carrot and stick” method. It is based on the necessity to increase the attractiveness of the formal economy through reforms and liberalization of the economic environment, while increasing the cost of the entrepreneurship activity in the informal sector. It is believed that if the formal economy benefits outweigh the disadvantages of the shadow one, entrepreneurs will prefer the activity in the formal economy sector. The model of shadow economy formalization (Markina, 2016) is shown in Figure 2ab.

Figure 2ab

The structure of the organizational economic mechanism of the national

economy de-shadowing [according to author’s compilation]

The policy of the state aimed at a stable and democratic development of the socio-economic sphere, will help to reduce the volume of the shadow economy across the country. That is why it is important to use both direct and indirect approaches to facilitate the formalization of the informal businesses in Ukraine. The disadvantage of the direct method is that the opportunity-driven-entrepreneurs consider, first of all, the advantages of the shadow economy, and do not move into the formal economy, if it is not provide the same benefits.

The second, and less used approach is related to the use of «soft» indirect methods. Shadow entrepreneurship in the particular country exists because of the great difference between the laws, regulations and policies, formal institutions and norms, values and opinions of entrepreneurs (Feld & Schneider, 2010). This difference in the developing countries is more pronounced. The main task of the indirect approach is to reduce these differences to a minimum.

This led us to the conclusion that there is the willingness to avoid taxes in Ukraine due to distrust of entrepreneurs to the state budget. To solve this problem, the authorities should publish reports on how business taxes are used in the country. In addition, there is a need for changes in the work processes of public institutions, which will help the entrepreneurs to understand their role in the national economy and to believe that their activity is respected by the government. The credibility of the judicial system and its ability to protect the rights and freedoms of the entrepreneurs should play a major role in this process. Moreover, entrepreneurs need to know that they are paying their fair share in comparison with others. If they do not get what they pay, they will not pay at all. In this case, it is important to create a clear system of the government reports on the distribution of tax funds.

Thus, a shadow economy is a set of economic processes that bypass laws and governmental control. Economists distinguished three models of a shadow economy (Schneider, Buehn & Montenegro, 2010; Conditions, 2016):

1. Fictive economy. Activity that is known to the government and controlled by it, but is performed illegally and does not affect the budget and macroeconomic indices.

2. Grey economy. Business processes that are semi-official and quasi-legal.

3. Black economy – a type of economy, in which all processes are illegal.

Effective development of the state economy requires effective countermeasures to the shadow economy. Otherwise, all economic processes decelerate, budget revenues dwindle, and budgetary expenses grow – this primarily affects the people who depend on state funding: budget structure employees, retired persons, people who receive social benefits, etc. The most significant negative consequence of a shadow economy is its criminalization, since the bigger the shadow business grows, the stronger the illegal ways of “solving issues” get (Schneider, 1994).

In order to reduce the scale of the shadow economy, it is necessary to create conditions, in which businesses would find it more profitable to operate and develop in the real sector. One such method is to cut taxes and/or provide special tax-free periods, especially during crises. Another important factor is the fight against corruption and the improvement of the legislative framework.

Shadow entrepreneurship in Ukraine has a huge scale: only 10 % of all registered entrepreneurs are operating in the formal economy, while the other part is involved partially or wholly in the shadow sector. The main characteristic of shady entrepreneurs in Ukraine is that they work in the informal sector on their own initiative, because they believe that it gives them more freedom and opportunities for further activity.

Major economic, social and political indices, published by the respected research organizations in the world, indicate the absence of systemic changes and reforms in Ukraine. According to the great number of these indicators, Ukraine occupies one of the last places in the region that reflects its difficult socio-economic environment.

In such circumstances, the use of traditional “carrot and stick” method does not bring tangible results. The entrepreneurs will remain in the shadow sector of the national economy. Strengthening sanctions and active search of enterprises, engaged in shady activities, along with a lack of qualitative changes in the economic policy of Ukraine leads to the further shadowing of its entrepreneurship activity. Finally, the significant problems of corruption and political crises in the country affect the rise of distrust to the government’s ability to provide and protect the rights and freedoms of each citizen of the country.

Only the use of direct and indirect approaches can yield tangible results and motivate entrepreneurs to operate effectively in the formal sector of the economy. There is a significant difference between the laws, regulations and policies, formal institutions and norms, values and opinions of entrepreneurs in Ukraine. The integrated approach to the de-shadowing of the entrepreneurship activity in Ukraine is proposed in the paper.

Aidis, R., Welter, F., Smallbone, D. & Isakova, N. (2007). Female entrepreneurship in transition economies: the case of Lithuania and Ukraine. Feminist Economics, 13(2), 157–183.

Bank, T. W. (2014). Country Data Report for Ukraine, 1996-2014.

Bank, T. W. (2016). Doing Business 2016: Measuring Regulatory Quality and Efficiency.

Blackburn, K., Bose, N. & Capasso, S. (2012). Tax evasion, the underground economy and financial development. Journal of Economic Behavior & Organization, 83(2), 243–253.

Buehn, A. & Schneider, F. (2012). Shadow economies around the world: novel insights, accepted knowledge, and new estimates. International Tax and Public Finance, 19(1), 139–171.

Capasso, S. & Jappelli, T. (2013). Financial development and the underground economy. Journal of Development Economics, 101, 167–178.

Coupe, T. & Obrizan, M. (2016). The Impact of War on Happiness: the Case of Ukraine. Kyiv School of Economics & Kyiv Economics Institute.

Feld, L. P. & Larsen, C. (2005). Black activities in Germany in 2001 and 2004: A comparison based on survey data. The Rockwool Foundation Research Unit, Copenhagen (DK).

Feld, L. P. & Schneider, F. (2010). Survey on the shadow economy and undeclared earnings in OECD countries. German Economic Review, 11(2), 109–149.

Freedom House. (2016). Freedom in the World 2016. [Electronic Recourse]. URL: https://freedomhouse.org/report/freedom-world/freedom-world-2016.

Komekbayeva, L. S., Legostayeva, A. A., Tyan, O. A. & Orynbassarova, Ye. D. (2016). Government Measures for Economic Support in the Conditions of a Floating Exchange Rate of the National Currency. IEJME-Mathematics Education, 11(7), 2227-2237.

Markina, I. (2016). Organizational-economic mechanism of de-shadowing of Ukrainian economy in the context of its transition to the concept of sustainable development. Scientific Letters of Academic Society of Michal Baludansky, 1(4), 97–102.

Ministry of Economic Development and Trade of Ukraine. (2016). Interim report for the first 9 months of 2015. Trends of the shadow economy in Ukraine.

Schneider, F. & and Schneider, F. (2004). The Size of the Shadow Economies of 145 Countries all over the World: First Results over the Period 1999 to 2003, University of Linz and IZA Bonn. Discussion Paper No1431.

Schneider, F. (1994). Measuring the size and development of the shadow economy. Can the causes be found and the obstacles be overcome? Essays on economic psychology. Springer, 193–212.

Schneider, F. (2005). Shadow economies around the world: what do we really know? European Journal of Political Economy, 21(3), 598–642.

Schneider, F. (2014). Size and Development of the Shadow Economy of 31 European and 5 other OECD Countries from 2003 to 2014. Johannes Kepler University.

Schneider, F. (2015). Shadow Economies all over the World: New Estimates for 162 Countries from 1999 to 2014.

Schneider, F. (2016). Comment on Feige’s “Paper Reflections on the Meaning and Measurement of Unobserved Economies: What Do We Really Know about the “Shadow Economy”?”. Journal of Tax Administration, 2(2).

Schneider, F. (2016). The size and development of the shadow economies of Ukraine and six other eastern countries over the period of 1999 – 2015. Journal of Development Economics, 2(78), 12–20.

Schneider, F., Buehn, A. & Montenegro, C. (2010). New Estimates for the Shadow Economies all over the World. International Economic Journal, 24(2), 443–461.

Schwab, K. (2016). The Global Competitiveness Index 2016-2017. World Economic Forum.

Transparency International. (2015). Corruption Perceptions Index 2015. [Electronic Recourse]. URL: https://www.transparency.org/cpi2015/.

Vinnychuk, I. & Ziukov, S. (2013). Shadow economy in Ukraine: modelling and analysis. Business Systems & Economics, 3(2), 141–152.

Williams, C. C. (2009). Beyond legitimate entrepreneurship: the prevalence of off-the-books entrepreneurs in Ukraine. Journal of Small Business & Entrepreneurship, 22(1), 55–68.

1. Management Department, Poltava State Agrarian Academy, Skovorody Str, 1/, Poltava, Ukraine. Corresponding author: E-mail iriska84@yahoo.com

2. Accounting and Audit Department, Donbass State Technical University, 84 Pobedy Ave., Lysychansk, Ukraine

3. Management Department, Poltava State Agrarian Academy, Skovorody Str, 1/, Poltava, Ukraine.