Vol. 38 (Nº 52) Year 2017. Page 14

Michael Nikolaevich PAVLENKOV 1; Valeryi Glebovich LARIONOV 2; Pavel Mikhaylovich VORONIN 3; Ivan Mikhaylovich PAVLENKOV 4

Received: 21/06/2017 • Approved: 20/07/2017

ABSTRACT: The key condition for the development of the municipal solid waste (MSW) industry is facilitation of investment activities through promotion of investment programs, coordination and interaction of the state, local governments, market actors in the course of their implementation. The proposed approach to the monitoring of investment programs allows creating a system of reporting and test indicators, the structure and forms of monitoring reports, control periods, registering deviations of actual indicator values from planned ones, reasons for this and analysis. |

RESUMEN: La condición clave para el desarrollo de la industria de residuos sólidos municipales es la facilitación de actividades de inversión a través de la promoción de programas de inversión, coordinación e interacción del estado, gobiernos locales, actores del mercado en el curso de su implementación. El enfoque propuesto para el seguimiento de los programas de inversión permite crear un sistema de informes y de indicadores de pruebas, la estructura y las formas de seguimiento de los informes, los períodos de control, el registro de las desviaciones de los valores reales de los indicadores de los planificados, razones para esto y análisis. |

Considering solid municipal waste management, municipalities often encounter systemic problems, the solution of which requires strategic development programs, whereas feedback is a prerequisite for effective program management, i.e. it is necessary to obtain up-to-date information on the status of the program regularly and timely (LARIONOV, 2011; SHARHOLY et al., 2008; WANG et al., 2009; XU et al., 2015; YANG et al., 2007). This is achieved by monitoring, which is the most important management mechanism, enabling communication that complements, but does not replace, direct contacts between various parties in the program (AFANASYEV, 2001; BURTSEVA, 2012; GOTIN, KALOSHA, 2007).

The relevance of the research stems from a combination of interrelated factors:

• increased requirements for environmental protection;

• acceleration of the cities urbanization and the urban management becoming more complex;

• the need to attract extra-budgetary sources to finance the development of municipal solid waste system.

All this requires improving organizational and economic approaches to the evaluation and selection of investment projects. It should be based on multilateral expertise, taking into account a number of contradictory indicators reflecting certain quantitative and qualitative characteristics, including economic, environmental and social, in order to create investment programs for the development of the MSW industry. They should also enable interaction of all parties aimed at reducing negative environmental impacts.

The effective management of investment programs for the MSW industry development necessitates determining the monitoring procedure.

This will allow linking the strategic goals of the program with the current results, to improve the MSW investment management, to timely implement strategic priorities concerning the technical, economic, environmental and social development of this sphere, to provide stakeholders implementing individual projects with reliable information on the results and prospects of their implementation so that they can take effective management decisions.

Monitoring not only ensures the implementation of the program, but is also used to solve other tasks dealing with the management of municipal solid waste (ZUBKOVA, 2014; SANJEEVI, SHAHABUDEEN, 2015).

The research findings were applied to devise a strategy for the social and economic development of the urban district of the city of Dzerzhinsk, Nizhny Novgorod region until 2030, adopted by the decision of the City Duma of Dzerzhinsk, Nizhny Novgorod region of June 18, 2015 No. 948 (“On the approval of the Strategy for the socio-economic development of the urban district of the city of Dzerzhinsk until 2030”), as well as to work out the investment program and substantiate investment decisions in the MAG Group Holding, adopted by the government of the Nizhny Novgorod region on March 29, 2016 No. 349-r (“On approval of the investment program of MAG Group Holding, Nizhny Novgorod, for the inter-municipal facility Modern Solid Domestic Waste Landfill”).

The work was comprised of the following sections:

1. Creation of an investment program for the development of municipal solid waste. This section deals with the organizational and economic foundations for the formation of an investment program for the development of municipal solid waste on the basis of a multilateral expert review that takes into account the economic, environmental and social indicators of investment projects (MINAKOVA, ANIKANOV 2013).

2. Specifics of the investment program monitoring. This section considers the specific features of monitoring in the management of the municipal solid waste industry. The monitoring objective and main tasks are determined. In addition to that, we identified the main methods of collecting and processing information during the monitoring.

3. Monitoring of the investment program implementation. This section introduces the general scheme for the monitoring of the investment program for the MSW industry development. Monitoring provides data for the analysis of the overall status of the program implementation in a municipality, for individual investment projects and activities.

These activities aim is to develop recommendations for effective monitoring of investment projects of municipalities of the Nizhny Novgorod region of the Russian Federation in the municipal solid waste sector.

Ensuring environmental safety of the area, including the collection, removal and disposal of municipal solid waste is the most important element of the social and economic development of the city. The city needs a system that allows monitoring the overall situation in the industry, and responds promptly and efficiently to changes and threats, aiming to provide the most favorable and comfortable living conditions (LARIONOV, 2011; PAVLENKOV et al., 2016; SHARHOLY et al., 2016).

The main prerequisite for the development of municipal solid waste can be promotion of investment activities which will ensure the renewal of all components of this complex. This cannot be achieved without the city creating an attractive investment climate, which is why this task becomes a crucial one.

When creating an investment program for the MSW industry, it is viable: first, to formulate goals and objectives, and secondly, to identify specific features and to develop a mechanism for selecting and evaluating investment projects (LABAZOVA, PAVLENKOV, 2014; PAVLENKOV et al., 2013).

Depending on the objectives, results and sources of return on investment, we propose to divide all MSW investment projects into:

• projects aimed at generating revenues, to cover outlay and capital costs incurred during the project implementation through direct consumer payments;

• projects, the return of investments in which comes from increased taxes, rent or other income (the growth of economic activity allows receiving additional tax revenues), except direct consumer payments;

• projects, providing social and environmental benefits for citizens.

When selecting and analyzing investment projects carried out with central funding, it is necessary to take into account that the main task of local government is to perform social functions, with commercial projects adopted only if they primarily aim at social goals (JELNOVA, 2013). Priority of social projects is determined by the source of funding as they are mainly budget ones, while private funds can become a source of financing for commercial projects.

When selecting and evaluating investment projects in municipalities, the key criteria should be their public significance (estimated by the share of the population benefiting from the project), public utility (depending on how much the public needs a particular service or the benefit derived from the project), economic and budget efficiency.

Considering the theory and practice of creating an investment program, we can identify various methods for selecting investment projects which can be divided into the following groups:

• evaluation methods that determine quantitative indicators of investment efficiency, for example, methods for calculating net present value, methods for calculating the payback period, methods for calculating the internal rate of return and the profitability index);

• methods of compromise;

• methods of expert review.

When selecting investment projects, one should rely on the assumption that the possible volume of investment is limited, so selection is relevant in the following cases:

• when holding investment project competitions;

• when planning the ways of the development of solid municipal waste industry;

• when creating a loan portfolio for an investor;

• when searching for promising areas to invest funds for an investor.

Practical and theoretical experience lets us conclude that there is no direct analytical solution for these tasks, whereas investment projects are evaluated according to the list of all possible indicators, and one can apply various methods to select a project.

It is impossible to evaluate an investment project without taking into account many factors and their significance. When implementing various projects, any of the factors may have different importance for investors, so one needs a method for selecting investment projects that would consider expert reviews and the influence of many factors and that would lead to a compromise of the interests and goals of all parties in the process.

Investment decisions are taken on the basis of different formalized and non-formalized methods. Methods are combined depending on various circumstances, for example, the key competencies of a particular expert, how well they are familiar with the analytical tools applicable in different cases. In practice, when selecting projects, it is necessary to use expert (informal) methods to take into account numerous factors and their interrelations, while projects cannot be selected on the basis of one formal criterion. Projects should be analyzed using a multilateral expertise that takes into account a variety of different, sometimes conflicting, project indicators, both qualitative and quantitative. Some of them relate to the economic, environmental and social outcomes of the project, while others reflect a variety of risks associated with the project implementation (KORCHAGIN, MALICHENKO, 2008; LUMPOV, 2012; ROMANUK, 2011).

Therefore, the effective evaluation and selection of investment projects requires a procedure that would take into account various quantitative and qualitative factors and would use different methods reflecting not only the impact of the factors themselves, but also their interrelation and mutual influence. In addition, ideally, the procedure should be formalized in a sequence of steps in order to exclude the influence of the executor’s competence on the investment projects evaluation and selection.

After selecting and evaluating investment projects, one creates an investment program for the development of the MSW industry.

The programs implementation is based on a set of organizational and methodological measures to carry out the activities comprising the program.

Program management is based on the procedure including (PAVLENKOV et al., 2013; SIROTKIN, KELCHEVSKAYA, 2012; PAVLENKOV et al., 2016):

• administrative support: planning procedures, organization, coordination and control of the whole process of the program implementation;

• banking support: registration, granting a loan, collecting payments and credit resources, rendering consultations, with the issues of coordinating schedules, interest rates, risks, repayment of loans being resolved;

• technical support: rational use of funds and their payback, evaluation of intermediate indicators and forecasting the results of project implementation. Development of a solution for adjusting programs;

• audit support: examination of the financial condition of the programs executor and the agent bank, intermediate audit operations.

These programs should be implemented with the support of experts working in consulting and other organizations.

Improving the quality of the environment and creating the image of an environmentally friendly region is a problem hard to solve.

Forecasting the volume of waste generation is the first step in the waste management. Inaccurate forecasts lead to unsound investment in the development of waste industry. This becomes more significant especially in a developing economy and relates both to forecasting the volumes of waste generation and evaluating possible ways to attract investors.

To solve these problems, a real large-scale investment is required. Obviously, these amounts cannot be obtained from the budget; therefore it is extremely important that the private sector is ready to invest in the development of the industry.

At the same time, after the repeal of the waste transportation licensing, statistics are formed from data provided by companies on a voluntary basis. Therefore, specifics of monitoring depend on the investment program, and it is challenging to integrate various investment projects into a single investment program of the municipality of the Nizhny Novgorod region.

Monitoring is an effective method of managing a program that comprises numerous investment projects. It enables to estimate deviations of the values achieved from the planned program indicators. This provides the initial information for making managerial decisions and adjusting the program (LABAZOVA, PAVLENKOV, 2014; ROMANUK, 2011; PAVLENKOV et al., 2015).

Monitoring enables the coordination between the creation of the information base, analysis, planning and control.

Monitoring information support is based on quantitative indicators of the program: cost, implementation period, payback period, source of financing and executors.

The program indicators are ranked by significance levels. The first level is comprised by projects with the most significant controlled indicators. The second level includes projects the indicators of which are linked to the indicators of the first level priorities. Other levels are formed in the similar way. Ranking indicators by levels simplifies the analysis and explanation of the reasons for possible deviations of the actual indicator values from the ones planned in the program.

Monitoring implies the use of different tools to collect, structure, analyze and process information.

The monitoring of the program implementation provides reliable information on the outcomes and prospects of its implementation to the companies concerned that allow them to take grounded managerial decisions (PAVLENKOV et al., 2013).

Monitoring implies that there are (AFANASYEV, FOMIN 2001; LABAZOVA, PAVLENKOV, 2014; PAVLENKOV et al., 2013):

a specific, comprehensive program that is accurate and structured clearly;

a system of reporting indicators that ensure the unity of approaches and criteria for evaluating the status of the program;

analysis of indicators and trends, time and cost being the most important of these;

a system of tools to correct identified deviations and reduce negative trends when implementing the program up to its revision.

Monitoring processes are based on (LABAZOVA, PAVLENKOV, 2014; LUMPOV, 2012; IVANENKO 2014):

data collection and determining deviations;

assessment of deviations and identification of their causes;

development of recommendations for minimizing deviations (benefiting from favorable deviations).

Monitoring includes (LABAZOVA, PAVLENKOV, 2014; PAVLENKOV et al., 2016):

a control procedure that identifies deviations from the organizational plan;

a control procedure that determines deviations of the main performance indicators from the planned ones;

a control procedure determining deviations from the approved budget;

a control procedure that determines the deviation of the basic economic indicators of the project from the planned values.

For effective monitoring, it is necessary to create an information system that ensures the processing of primary information into the system of reports on the status of the entire program or its individual indicators for the development and adoption of managerial decisions. The main monitoring tasks include:

defining a set of monitored indicators;

a set of organizational and methodical activities for the information collection and its processing;

generation of reports on the status of the program.

To solve the abovementioned tasks, it is necessary (BURTSEVA, 2012; LABAZOVA, PAVLENKOV, 2014; STANISLAVCHIK, 2009) to:

- define the objects of monitoring and to develop monitoring indicators;

- collect information;

- enable information exchange and analysis of information;

- provide staff, technical and financial support of monitoring processes.

Developing the procedure for information collection is an important stage, since at this point one determines the tools for collecting and analyzing information which will be used in the future. These tools determine the effectiveness of all subsequent activities within the controlling system operation. At this stage of monitoring, it is necessary to solve the following tasks (BURTSEVA, 2012; LABAZOVA, PAVLENKOV, 2014; PAVLENKOV et al., 2015):

to formalize procedures, tools and methods of monitoring;

to define monitoring status in the organizational structure of management;

to identify tools for collecting and analyzing information;

to devise a reporting system for monitoring;

to select technical and software for the implementation of monitoring tasks.

Formalization of procedures is the most important issue, as it includes a detailed description of all other aspects of monitoring implementation. A monitoring plan is an essential element. We would like to highlight the direct dependence of the monitoring plan on the content of the program, since there are various methods of collecting and processing information, including some specific ones.

The choice of the applied data collection and processing methods is determined by the concepts used which can be classified into two categories – the concept of earned value management (EVM, Earned Value Methodology) and the concept of logical framework (LFA, Logical Framework Approach). According to the LFA (ZUBKOVA 2014), each indicator is associated with some goal or task and assesses the degree of implementation. In the EVM concept, the factor analysis is used to estimate deviations. The LFA concept uses tools that link the mission and strategic objectives with current results. The EVM concept implies the calculation of specific project implementation indicators in terms of cost and timing.

The LFA applies a wide range of methods as tools for collecting and analyzing information, since the indicators used can be quite complex and it takes into account qualitative factors. The tools within the EVM concept are simpler, as almost all of the required information can be obtained from planned or primary accounting documents.

Monitoring system tools include: sampling methods, basic monitoring methods, methods for tracking changes over time, group methods, methods for analyzing relationships, ranking methods and prioritization.

Sampling methods should be used when it is impossible to perform continuous monitoring, or the economic monitoring is inexpedient. There are two sampling methods – random sampling, most suitable for quantitative data, and non-random sampling, suitable for qualitative data. Elements of the sample are selected according to predetermined criteria, for example, using quotas or a cluster approach.

The following basic groups can be identified in the LFA concept (ZUBKOVA, 2014; PAVLENKOV et al., 2015):

a method of document analysis: in most cases monitoring implies studying documentation in paper or electronic form;

a method of observation and measurement: the required information cannot be obtained from existing documents;

an inspection method: checking that the real situation corresponds with the received documents;

a method of questionnaires: identifying indicators on the basis of experts opinion;

a method of interview: in case objects monitored have a weak structure;

a project network method: acts as an important means of visualizing the hierarchical structure of works and as a source of input to analyze work schedules.

Table 1 – Tools for collecting and analyzing information for monitoring

Groups of methods |

Methods of information collection |

Methods of information analysis |

||

LFA Concept |

EVM Concept |

LFA Concept |

EVM Concept |

|

Sampling methods |

Random selection Non-random selection |

__ |

__ |

__ |

Basic methods |

Document review Direct observation Measurement Surveys Questionnaires Interviews |

Document review Direct observation Measurement Surveys |

Document review Interview Network and ribbon charts

|

Document review Network and ribbon charts Calculation tables Analysis of the basic characteristics graphs

|

Group methods |

Brainstorming Nominal group technique The Delphi method |

__ |

Brainstorming Nominal group technique The Delphi method Synectics |

__ |

Methods of interrelation analysis |

__ |

__ |

Mind maps Ishikawa diagrams Venn diagrams Coupling matrix Spider-web diagrams |

Ishikawa diagrams Spider-web diagrams |

Ranking and prioritization methods |

Scoring Matrix estimation Hierarchy analysis method |

__ |

Simple ranking Scoring Matrix estimation Hierarchy analysis method |

__ |

Group methods include brainstorming, nominal group technique, the Delphi method, synectics, etc. These methods are most relevant when one applies the concept of a logical framework to achieve the general consensus of interested parties.

The group of methods for tracking changes in time include:

keeping critical event registers: filtering events that claim attention and response;

keeping monitoring diaries: this unites the monitoring work plan and the main outcomes of implemented activities;

trend analysis: comparative tables, graphs, histograms, pie charts, dispersion diagrams.

The method of relation analysis is used to determine the relationships between various factors that influence the indicators. The group includes mind maps, cause-effect diagrams, coupling matrices, Venn diagrams, spider-web diagrams (sometimes called M&Ewheels), etc.

Ranking and prioritization methods include scoring, matrix estimation, simple ranking, and hierarchy analysis method.

The above set of methods used in the LFA concept can be extended and depends on the project, the number of stakeholders, the composition of the indicators, whereas in different circumstances other tools and techniques can be used.

The choice of applied methods is largely determined by the composition of the forms of the initial and auxiliary documentation for analysis, as well as forms of the final reporting on monitoring.

Rational choice of suitable tools for data collection and analysis ensures that the monitoring of the program implementation is efficient and, as a consequence, makes the controlling system efficient.

Monitoring is used to follow indicators and determine deviations of actual indicators from planned ones in order to identify the causes of these deviations (PAVLENKOV et al., 2016).

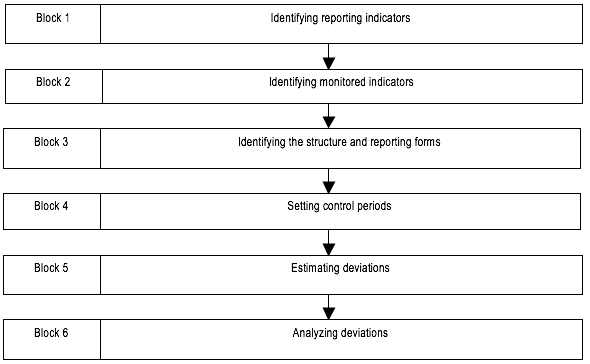

Figure 1

General chart of the monitoring of the MSW investment development program

Block 1. Identifying reporting indicators. The reporting indicators are used for making calculations, as well as for aggregating the program indicators.

Block 2. Identifying monitored indicators, including indicators that show the actual results achieved during the implementation of the program, the quantitative values planned which accurately correspond with the system of program indicators. A system of indicators should be developed in accordance with the algorithms for calculating individual monitored indicators, using the primary information base of the system.

Block 3. Identifying the structure and reporting forms. Reporting forms build a system of data carriers which must be standardized and contain the actual value, deviation and reasons for the indicators deviations.

Block 4. Setting control periods. Control periods can be established both for the whole program, and for each project or event, for project executors, for all or specific controlled indicators, etc. Control periods are determined by regulations or the requirements that ensure effective implementation of the program. For strategic programs, the quarterly and annual control periods seem to be the most viable.

Block 5. Estimating deviations. Deviation of actual indicators values from planned ones is reflected both in absolute and relative indices. Deviations in relative indicators, in turn, are subdivided into positive, negative “empty”, and negative “critical” deviations.

In practice, there may be gradations by other criteria that differ depending on the controlled periods.

Block 6. Analyzing deviations. Deviations can be analyzed for a municipality, a program, for individual projects and activities, as well as for executors. It is necessary to analyze indicators with deviations from the planned values and to identify the reasons.

Having studied the data on the level of the program activities implementation, one can assess the level of implementation of the entire program.

Each activity must be completed by a certain period of time t. Monitoring allows not only evaluating whether the activity is completed within a given period of time, but also the level of its implementation. In this regard, the following levels of implementation can be used:

C – completed;

N – not completed;

I – being implemented (successfully).

We developed an algorithm that allows assessing the status of the MSW development program implementation. Naturally, the evaluation of the implemented activity should be done by experts and depends on the quality of the experts review (LUMPOV, 2012). The conclusions obtained upon evaluating the program performance lead to taking various decisions:

target adjustment;

adjustment of program indicators;

adjustment of activities.

However, the crucial aspect is the impact on the works performed with a significant lag or not implemented at all.

Monitoring of the investment program aims to keep indicators within certain limits. It is necessary to obtain accurate information about the resources concerning their use, sources of acquisition, write-off, and costs. The results of monitoring can be used both for monitoring the program implementation and for solving other problems.

Monitoring specialists should evaluate information flows in a timely manner, especially those concerning investments; they should observe the operation of investment objects, the dynamics of prices, changes in indicators and the data presented in profit and loss statements.

Those responsible for the program implementation are required to maintain accounting and analytical records, records and accounts in accordance with the accounting rules established by law and internal regulations for the proper reflection of the activities and financial status of each project. In addition, they are required to submit reports on the program implementation without concealing potential problems and failures.

When monitoring the program, experts should pay planned visits to executors to get a direct acquaintance with the program progress. In addition, such visits may be made on the occasion of:

late receipt of payments;

the loss of an important supplier;

force majeure circumstances;

a change of management;

failures in the facility supply;

critical changes in the structure of expenditures;

changes in terms of payment.

Experts need to determine how big the impact of deviations on program performance is. To do this, they prepare a report on possible discrepancies between the indicators and the approved plan and payments, and also develop proposals for introducing changes. As far as the organizational plan is concerned, this can include the following:

problem analysis;

consulting with the management and with the bank’s auditors;

collection of additional information;

preparation and submission of the plan adjustments to the management.

The main problems of program implementation can be:

delay in payments;

weakening of financial standing;

increasing risks;

shortcomings of investment projects revealed by auditors during monitoring;

a change of management or the owners of the organization implementing the program.

If problems are identified, the following actions are possible:

A) holding a meeting with all interested parties;

B) temporary suspension of investment obligations within the program;

C) temporary blocking of accounts;

D) approval of new deadlines for the fulfillment of obligations;

E) negotiations with representatives of the organizations – guarantors of the program;

E) foreclosure on property or other sources of the borrower or guarantor;

G) control over the receipt of funds in the amount of unfulfilled obligations and penalties;

H) changing the terms of the contract.

The key task of monitoring is “trouble spotting” when implementing a program, its activities and projects. In practice, deviations are the basis for taking decisions on changing in the program.

The article considers the function and role of monitoring in the management of investment programs aimed at the development of municipal solid waste industry. The authors developed a mechanism for the investment programs monitoring, with the Logical Framework Approach (LFA) as the methodological basis for the collection and processing of information. This allows to link the strategic objectives of the program with current results, improve the management of investment activities in the municipal solid waste industry, to timely implement strategic priorities in the technical, economic, environmental and social development in this field, to provide executors implementing individual projects with reliable information about the results and prospects of their implementation for making informed managerial decisions.

However, in market economy, enterprises rendering services in the MSW industry are legally independent. Therefore, it is incredibly difficult to integrate investment projects into a single investment program of a municipality. One of the directions for further development in this area is the creation of an organizational and economic mechanism that would use the monitoring methodology and take into account the interests of stakeholders during the development, coordination and implementation of the MSW investment program in a municipality.

AFANASYEV YU.A., FOMIN S.A. et al. Monitoring and Methods of Environmental Control, Textbook, 2001

BURTSEVA T. Tools for Monitoring the Investment Attractiveness of Areas, Lambert Academic Publishing, 2012

VASILJEVA M.V. The Role of Innovative Clusters in the Process of Internationalization of firms. Contemporary economic issues, 2013, No.3, DOI: 10.24194/31309, Retrieved from: http://economic-journal.net/index.php/CEI/article/view/70

GOTIN S.V., KALOSHA V.P. Logical-Structural Approach and Its Application for Analysis and Activity Planning, 2007.

IVANENKO N.V. Ecological Monitoring of the Main Environments, Methodical Manual for Comprehensive Case Studies

JELNOVA C.V. Analysis of the practice of decision-making in the field of investment policy. Contemporary economic issues, 2013, No.4, DOI: 10.24194/41302, Retrieved from: http://economic-journal.net/index.php/CEI/article/view/83

KORCHAGIN YU.A., MALICHENKO I.P. Investments, Theory and Practice, 2008

LABAZOVA E.V., PAVLENKOV I.M. Monitoring of the strategic plan of the municipality, Prospects for the development of science and education: a collection of scientific papers of the International Scientific and Practical Conference, 2014, p. 85-88

LARIONOV G.V. Economic Challenges of Utilization of Solid Industrial and Household Waste of Big Cities, 2011

LUMPOV A.I., LUMPOV A.A. Business Planning of Investment Projects, 2012.

MINAKOVA I.V., ANIKANOV P.V. Modelling of area of possible results of the innovative investment project. Contemporary economic issues, 2013, No. 1, DOI 10.24194/11321, Retrieved from: http://economic-journal.net/index.php/CEI/article/view/34

PAVLENKOV M.N., LARIONOV V.G., VORONIN P.M. Approach to predictive modeling of total municipal solid waste removal volumes, 2016

PAVLENKOV M.N., LARIONOV V.G., VORONIN P.M. The method for evaluation and selection of investment projects in the field of municipal waste management, Indian Journal of Science and Technology, 2016, No. 9 (47), p. 151-155

PAVLENKOV M.N., VORONIN P.M., KEMAIKIN N.K., LABAZOVA E.V., PAVLENKOV I.M. Improvement of Management Mechanisms of Municipal Social and Economic Development, Research Institute of the Russian Academy of Science, 2013

PAVLENKOV M.N., VORONIN P.M., MAEVA L.S. Formation of prognostic functions in solid waste, Eastern European Scientific Journal, 2015, No. 3, p. 90-93

PAVLENKOV M.N., VORONIN P.M., ZHURAVLEVA T.V. The method of cluster analysis estimation of investment projects, Eastern European Scientific Journal, 2015, No. 3, p. 94-98

ROMANYUK V. Development of Methodology to Assess the Implementation of Investment Projects, Lambert Academic Publishing, 2011

SANJEEVI V., SHAHABUDEEN P. Development of performance indicators for municipal solid waste management (pims), Waste Management & Research, 2015, No. 33 (12), p. 1052-1065

SHARHOLY M., AHMAD K., MAHMOOD G., TRIVEDI R.C. Municipal solid waste management in Indian cities, Waste Management, 2008, No. 28 (2), p 459-467

Shimko P.D. International Financial Management, Textbook and Case Studies, 2016

SIROTKIN S.A., KELCHEVSKAYA N.R. Economic Evaluation of Investment Projects, Unity-Dana, 2012

STANISLAVCHIK E.N. Business Plan, Management of Investment Projects, 2009

WANG Q., YAN J., TU X., CHI Y., LI X., LU S., CEN K. Thermal treatment of municipal solid waste incinerator fly ash using DC double arc argon plasma, Fuel, 2009, No. 88 (5), p. 955-958

XU X.B., ZHAN T.L.T., CHEN Y.M., GUO Q.G. Parameter determination of a compression model for landfilled municipal solid waste: an experimental study, Waste Management & Research, 2015, No. 33 (2), p. 199-210

YANG Y.B., PHAN A.N., RYU C., SHARIFI V., SWITHENBANK J. Mathematical modelling of slow pyrolysis of segregated solid wastes in a packed-bed pyrolyser, Fuel, 2007, No. 86(1-2), p. 169-180

ZUBKOVA I.Yu. Methods for Monitoring Air Pollution in Urban Highways, Lambert Academic Publishing, 2014

1. Lobachevsky State University, Dzerzhinsk branch, Dzerzhinsk, Russia, michael.pavlenkov@yandex.ru

2. Bauman Moscow State Technical University

3. Lobachevsky State University, Dzerzhinsky branch, Dzerzhinsk, Russia