Vol. 38 (Nº 52) Year 2017. Page 11

Izabella ELYAKOVA 1; Aleksandr KHRISTOFOROV 2; Aleksandr ELYAKOV 3; Tamara KARATAEVA 4; Larisa DANILOVA 5; Nikolay TIKHONOV 6; Afanasiy FEDOROV 7

Received: 26/10/2017 • Approved: 30/10/2017

3. Natural Gas Consumption and Production in China

ABSTRACT: The purpose of this study is to present an economic evaluation of the competitiveness of energy supply for electric heating to northern China. The paper gives a comparative evaluation of the efficiency of heat energy generation based on various fuels, such as natural gas, coal and electricity, for electric heating, as well as provides an economic and environmental assessment of its effective use in the current context. |

RESUMEN: El propósito de este estudio es presentar una evaluación económica de la competitividad del suministro de energía para la calefacción eléctrica al norte de China. El documento da una evaluación comparativa de la eficiencia de la generación de energía térmica basada en diversos combustibles, como el gas natural, el carbón y la electricidad, para la calefacción eléctrica, así como proporciona una evaluación económica y medioambiental de su uso efectivo en el contexto actual. |

According to the International Energy Agency (IEA), China could overtake European countries in terms of gas consumption by 2030, and the country’s gas demand is likely to grow up to 480 billion cubic meters, of which more than 50% are planned to be imported (Natural gas in China: A regional analysis, 2015). In China, the need for such volumes of natural gas supply is primarily dictated by huge CO2 emissions of coal power plants into the atmosphere and by multi-billion-dollar fines for emissions above the quota given to the country. Russia has already made progress in advancing to the Chinese gas market: in May 2014, Russia and China signed a contract worth $400 billion for the delivery of natural gas to China via the main “Power of Siberia” pipeline with a capacity of 60 billion cubic meters. Russia expects to export 38 billion cubic meters of gas each year for a period of 30 years from the oil and gas condensate fields of Eastern Siberia (Kovyktinskoye) and the Republic of Sakha (Yakutia) (Chayandinskoye) (The website of PJSC Gazprom).

To date, however, no evaluation has been made to determine the efficiency of supply between competitive energy sources: natural gas and electricity as the major source of heating for heat energy production in the Northern provinces of China.

The purpose of the study determines the following tasks: to evaluate the Chinese gas and electricity export market; to analyze the strategic competitive advantages of electricity and gas in the Chinese market; to propose new approaches to the development of the state price policy of the Russian Federation for the export of natural gas and electricity to China.

China is the country with the fastest growing economy in the world and the largest energy consumer and producer. Rapidly growing energy demand, including heat energy, has made China one of the most influential participants in the world market. A large share in the energy industry is played by coal as a source of primary energy. However, the deteriorating environmental situation in the country, caused by large volumes of coal consumption, makes it necessary to consider alternative sources of energy. This paper considers prospective sources of heat energy in the country (BP Statistical Review of World Energy, 2015; Emelyanov, 2002).

To present an economic evaluation of the competitiveness of Russian natural gas and electricity supplies to China in the context of inter-fuel competition, a historical analysis of China’s natural gas consumption and production was conducted.

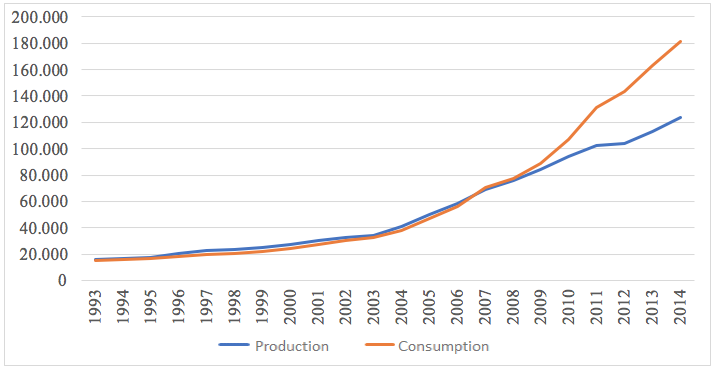

Figure 1 shows changes in China’s natural gas production and consumption rates in 1993-2014.

Figure 1

Natural gas production and consumption

in China, million cubic meters, 1993-2014

Note. Compiled by the authors based on data from U.S. Energy Information

Administration (The website of U.S. Energy Information Administration (EIA)).

As can be seen from Figure 1, natural gas production volumes are rapidly increasing – for 20 years they have grown more than 7 times from 15,801 million cubic meters in 1993 to 123,461 million cubic meters in 2014. In 2013, China outstripped Norway and ranked sixth in terms of natural gas production (Natural gas in China: A regional analysis, 2015).

At the same time, there is an increase not only in natural gas production, but also in its consumption. The main reason for the growth in natural gas consumption is the transition from coal to natural gas. Natural gas consumption is growing faster than its production. This necessitates the import of natural gas (U.S. Energy Information Administration, China: International energy data and analysis, 2015; Ivanov and Matveev, 2016; ITAR TASS, 2014).

The share of natural gas in China’s energy sector lagged behind in 2014. However, government plans suggest active development and investment in natural gas power plants. In general, China is trying to move away from coal power plants towards natural gas power plants in the long term (International Energy Agency, World Energy Outlook, 2012). For the development of such power plants, gas production volumes are already increasing, and the “Power of Siberia” gas pipeline from Russia is under construction (The website of PJSC Gazprom).

However, natural gas is not an ideal source of energy for heat production in China. Natural gas, like other traditional sources of energy, releases carbon dioxide when used in power engineering. The most promising in terms of environmental friendliness is the use of electric heating. At the same time, electricity must be generated by renewable energy sources, such as solar, wind and water. Hydrogeneration is the optimal source of energy for use in heat energy generation on a large scale. Hydroelectric power plants, as a rule, can produce more power and work continuously, regardless of weather conditions, unlike solar and wind installations (BP Statistical Review of World Energy, 2015; U.S. Energy Information Administration, 2015; Mitrova and Galkina, 2013; Business Journal Neftegaz.RU, 2016). The development of renewable energy sources, especially the construction of new hydroelectric power plants, will significantly reduce the volume of coal production and consumption in the country.

China ranks first in the world in terms of the amount of electricity generated. In 2014, it exceeded 5 thousand TWh observed in 2013. In terms of both generation and consumption, China shows stable growth rates in the energy sector – electricity generation from 2005 to 2014 doubled. This is due to economic growth and industrial demand, which reduced their growth rates in 2008-2009, but continued their steady growth after 2012. The Chinese industry consumes almost three quarters of electricity generated (The website of JSC South Yakutia Hydroelectric Complex RusHydro). Table 1 presents data on electricity generation and consumption in China.

Table 1

Electricity generation and consumption in China for 1993-2014

Years |

Electricity generation, billion kW/h |

Electricity consumption, billion kW/h |

Years |

Electricity generation, billion kW/h |

Electricity consumption, billion kW/h |

1993 |

796 |

739 |

2004 |

2104 |

1955 |

1994 |

880 |

819 |

2005 |

2373 |

2196 |

1995 |

956 |

877 |

2006 |

2717 |

2524 |

1996 |

1005 |

921 |

2007 |

3108 |

2892 |

1997 |

1070 |

983 |

2008 |

3297 |

3071 |

1998 |

1104 |

1017 |

2009 |

3527 |

3290 |

1999 |

1172 |

1077 |

2010 |

3975 |

3704 |

2000 |

1281 |

1178 |

2011 |

4483 |

4200 |

2001 |

1427 |

1315 |

2012 |

4750 |

4450 |

2002 |

1585 |

1459 |

2013 |

5207 |

4882 |

2003 |

1810 |

1677 |

2014 |

5388 |

5067 |

Note. Compiled by the authors based on data from U.S. Energy Information

Administration (The website of U.S. Energy Information Administration (EIA))

However, due to large domestic coal reserves, China continues to use coal as the main fuel for power plants. Nevertheless, it is planned to smoothly reduce the share of coal power plants. The Chinese government plans to close small and inefficient power plants in favor of more efficient and environmentally friendly plants (BP Statistical Review of World Energy, 2015; U.S. Energy Information Administration, 2015; The website of PJSC Gazprom).

The most environmentally friendly is electricity generation. Due to the heterogeneity of electricity production and consumption, China imports electricity to the Northern provinces from Russia. The import of hydroelectric power solves a number of environmental problems that can arise in the case of domestic energy production based on traditional energy sources. This is the optimal source of energy for China and a promising market for the sale of energy for Russia (International Energy Agency, Russia, 2014; U.S. Energy Information Administration, 2016).

Hydropower uses virtually inexhaustible water resources and has the opportunity to recover funds invested in the construction of hydroelectric power plants in a short time. The state energy policy of Russia and China is aimed at the priority development of renewable energy sources as a source of replacement of exhaustible fuels for electric and heat energy production. In this regard, it is very important to build and develop hydroelectric power plants based on renewable water resources. China is interested in the purchase of at least 50-60 billion kWh of electric power from Russia annually (The website of JSC South Yakutia Hydroelectric Complex RusHydro; Khodyakova and Serov, 2017).

To evaluate the efficiency of the use of electric heating in the northern provinces of China, calculations were carried out to determine the cost of generating 1 Gcal of heat by various fuels. The results of these calculations are presented in Table 2.

Table 2

Calculation of the cost of generating 1 Gcal

of heat by natural gas, coal and electricity

Fuel |

Heat capacity |

Unit of measurement |

Output of 1 Gcal of heat |

Cost per unit, USD |

Cost of 1 Gcal of heat, USD |

Natural gas (98% methane) |

11711 |

kcal/m3 |

85,39 |

0,185 |

15,80 |

Coal |

6710-8680 |

kcal/kg |

132,1±16,9 |

0,08095 |

10,69±1,37 |

Electricity for electric heating |

864 |

kW/h/kcal |

1 157,41 |

0,042 |

48,61 |

Note. Compiled by the authors

The calculation involves the average export price of natural gas from PJSC Gazprom to European countries (Slav, 2017), the current spot price of Australian coal in the amount of 80.95 USD/ton (8 cents/kg) (The website of U.S. Energy Information Administration (EIA)), and the export price of electricity from RAO ES of the East to China for 2011 in the amount of 0.042 USD/kWh (4.2 cents/kWh) (Uyanaev, 2013).

As can be seen from Table 7, electricity for electric heating purposes is one of the most expensive types of energy for heat generation. This is due to the fact that the calculation uses the electricity export tariff of RAO ES of the East instead of the forecasted electricity production rates in the cascades of the Far Eastern hydroelectric power plants with the planned average annual production from 38-41.8 billion kW/h, where the tariffs for electricity will be much cheaper.

However, the targeted supply of electric power for heating purposes can take place with a lower production cost of 1 Gcal of heat. A discount on electricity is possible, especially against the backdrop of the construction of new hydropower plants in Russia. The steady export supply of electricity can help avoid bilge water discharges, improve the trade balance, attract new funds and investments for Russia, and get targeted electricity at a substantially lower price for China.

In the absence of the priority development of coal energy, the most cost-effective, as shown by calculations, in the near future and in the medium term is the use of natural gas.

In the long term, the cheapest, environmentally clean and renewable source of heat energy in China will be electricity for electric heating produced by hydroelectric power plants on a large scale. Hydrogenerated electricity does not depend on the price of natural gas and coal, it is more environmentally friendly, and with the targeted supply of electricity for electric heating, it is permissible to reduce its cost under special agreements. The environmental friendliness of such energy is especially important for China, where the deterioration of the environmental situation necessitates the choice of such sources of energy. The use of electricity in a strategic perspective can be financially more profitable – China currently pays large quotas for environmental pollution. Reducing emissions of harmful substances into the atmosphere will allow achieving savings by reducing the cost of environmental quotas only.

The results of the evaluation of inter-fuel competition between gas and electricity revealed the advantage of importing electricity over natural gas for China. The export of electricity to China, with the country’s environmental problems due to the operation of coal power plants, is the most efficient option because electric heating is an environmentally friendly and renewable commodity (natural gas power plants also release harmful emissions of nitrogen oxides into the atmosphere). Electric heating is also economically efficient due to low electricity tariffs at hydroelectric power plants, and building high-voltage transmission lines will be cheaper for the state than building a gas pipeline to the point of consumption.

For Russia, the results of the evaluation of inter-fuel competition between gas and electricity revealed the need to save exhaustible natural gas for future generations, and to export it with regard to the preservation of the energy balance of the country’s eastern territories, when there are favorable conditions in the gas market. It will also allow the country to develop domestic gas processing plants, to export finished products of gas chemical industry and to diversify exports.

Thus, the results of the evaluation of inter-fuel competition between gas and electricity in the long term revealed the advantage of importing electricity over natural gas for both sides.

BP Statistical Review of World Energy 2015, Data workbook (2015). Retrieved from: https://www.bp.com/content/dam/bp/pdf/energy-economics/statistical-review-2015/bp-statistical-review-of-world-energy-2015-full-report.pdf

By 2030, gas consumption in China will grow to almost 500 billion cubic meters (2016). Business Journal Neftegaz.RU. Retrieved from: http://neftegaz.ru/news/view/146950-K-2030-g-potreblenie-gaza-v-Kitae-vyrastet-pochti-do-500-mlrd-m3

Emelyanov, S. (2002). International competitiveness of producers: factors determining the position in the markets and competitive advantages (by the example of USA). Journal of Marketing in Russia and Abroad, 1, 108-111.

Gazprom to receive $25 billion prepayment for gas supplies to China (2014). ITAR TASS, Economics and Business. Retrieved June 20, 2017, from: http://tass.com/economy/732511.

International Energy Agency, Russia 2014: Energy Policies Beyond IEA Countries (June 2014).

International Energy Agency, World Energy Outlook (2012). Special Report: Golden Rules for a Golden Age of Gas, OECD/IEA, Paris.

Ivanov, A. S. & Matveev, I. E. (2016). Global power at a boundary of 2016: fight for resources, a competition aggravation. Russian Foreign Economic Bulletin, 1, 16-41.

Khodyakova, E. & Serov, M. (2017). Gazprom and China signed a gas contract. Retrieved May 25, 2017, from: http://www.vedomosti.ru/companies/news/26810681/rossiya-zhdet-avansa

Mitrova, T. A. & Galkina, A. A. (2013). Inter-fuel competition. The HSE Economic Journal, 17(3), 394-413.

Natural gas in China: A regional analysis (2015). Oxford Institute for Energy Studies. November, p.34.

Slav, I. (2017). Gazprom to hike gas prices for European markets. Oilprice.com energy news site. Retrieved from: http://oilprice.com/Latest-Energy-News/World-News/Gazprom-To-Hike-Gas-Prices-For-European-Markets.html

The website of JSC South Yakutia Hydroelectric Complex RusHydro. Retrieved from: http://www.yakutia.rushydro.ru/

The website of PJSC Gazprom: http://www.gazprom.ru/

The website of U.S. Energy Information Administration (EIA). Retrieved from: https://www.eia.gov

U.S. Energy Information Administration, China: International energy data and analysis (2015). Retrieved from: https://www.eia.gov/beta/international/analysis_includes/countries_long/China/china.pdf

U.S. Energy Information Administration, Country Analysis Brief: Russia (2016). Retrieved from: http://www.eia.gov/beta/international/analysis_includes/countries_long/Russia/russia.pdf

Uyanaev, S. V. (2013). The Russian-Chinese energy cooperation: signs of a new “Level”. China in World and Regional Politics (History and Modernity), 18. Retrieved September 19, 2017, from: http://cyberleninka.ru/article/n/rossiysko-kitayskoe-energeticheskoe-sotrudnichestvo-priznaki-novogo-urovnya

1. Department of Economics and Finance, Institute of Finance and Economics, M. K. Ammosov North-Eastern Federal University, Associate Professor

2. Department of Economics and Finance, Institute of Finance and Economics, M. K. Ammosov North-Eastern Federal University, Graduate student

3. Department of Economics and Finance, Institute of Finance and Economics, M. K. Ammosov North-Eastern Federal University, Student

4. Department of Economics and Finance, Institute of Finance and Economics, M. K. Ammosov North-Eastern Federal University, Associate Professor

5. Department of Economics and Finance, Institute of Finance and Economics, M. K. Ammosov North-Eastern Federal University, Professor

6. Department of Economics and Finance, Institute of Finance and Economics, M. K. Ammosov North-Eastern Federal University, Professor

7. Department of Economics and Finance, Institute of Finance and Economics, M. K. Ammosov North-Eastern Federal University, Associate Professor