Vol. 38 (Nº 51) Year 2017. Page 30

Vladimir Aleksandrovich ARTEMOV 1; Larisa Vladimirovna DAVYDOVA 2; Alexander Mikhailovich KONOREV 3

Received: 05/10/2017 • Approved: 18/10/2017

ABSTRACT: The relevance of this study is determined by the necessity to use new methods of the financial support mechanism for social investments to ensure sustainable development of the social sphere. It is advisable to reformat the algorithm of the financial mechanism for social investment and, first of all, financial control. The purpose of this article is to identify new approaches to implement social investment performance audit from the position of the normative and targeted planning concept. The system of indicators is the basis of the social investment performance audit. The article substantiates a modified version of the algorithm for calculating integral indicators, reflecting the effectiveness of financing social investment in the region based on the model by W. Pluta. The values of the constructed integral index-indicator of the social development level (SDL) for the regions of the Central Federal District, indicating a significant differentiation of the regions of the Central Federal District by the level of the social sphere development, are calculated. The obtained results are useful in the implementation of the financial control procedure in the process of financing social investment; this social investment performance audit algorithm can be used by managers of the regional administration and private investors pursuing personal purposes. |

RESUMEN: La relevancia de este estudio está determinada por la necesidad de utilizar nuevos métodos del mecanismo de apoyo financiero para las inversiones sociales para garantizar el desarrollo sostenible de la esfera social. Es aconsejable reformatear el algoritmo del mecanismo financiero para la inversión social y, ante todo, el control financiero. El objetivo de este artículo es identificar nuevos enfoques para implementar la auditoría del desempeño de la inversión social desde la posición del concepto de planificación normativa y focalizada. El sistema de indicadores es la base de la auditoría del desempeño de la inversión social. El artículo corrobora una versión modificada del algoritmo para calcular indicadores integrales, que refleja la efectividad de financiar la inversión social en la región en base al modelo de W. Pluta. Se calculan los valores del indicador índice integral construido del nivel de desarrollo social (SDL) para las regiones del Distrito Federal Central, indicando una diferenciación significativa de las regiones del Distrito Federal Central por el nivel de desarrollo de la esfera social. Los resultados obtenidos son útiles en la implementación del procedimiento de control financiero en el proceso de financiamiento de la inversión social; este algoritmo de auditoría del rendimiento de la inversión social puede ser utilizado por los administradores de la administración regional y los inversores privados que persiguen objetivos personales. |

The current economic situation in the Russian Federation is characterized by underfinancing of investments both in the real sector of the economy and in the social sphere. Social differentiation is characteristic for market conditions of economic development, therefore, special attention should be given to the social and economic system formation that invests in the social sphere, which turns the investments in the social sphere in catalyst for innovations to the develop human capital (Minakova and Anikanov, 2013; Jelnova, 2013).

Now, the identification of new mechanisms for the social investments financing is gaining new impetus from the point of the normative and targeted approach that dominates the management of public finances. Nevertheless, the social investments performance audit issues remain poorly understood. It should be noted that a large number of studies have been carried out in the area of social investments financing, but despite of this, a holistic conceptual approach to the social investments financial mechanism has not been formed yet, especially in the financial control methodology or the social investments performance audit. First, the specifics of the social investment financial control depend on the investments financing sources. Secondly, from the point of social investments processes financial control view, the investments performance audit is fundamentally different from the social infrastructure investments performance audit. Thirdly, different social investments financial control algorithms are distinguished depending on the degree of state participation. The situation that has arisen requires analysis, generalization and systematization of methods and approaches to the implementation of social investments financial control.

For financial and economic science, the direction of cause-effect relationship between the ways of social investment processes financial provision and the final social development level is still insufficiently studied. On the one hand, the social sphere development level significantly influences the social investments financing methods used, on the other hand, the financing methods are purposefully applied in a specific economic situation and are aimed at achieving the established milestones for the social development.

In this context, it is required to provide a clear direct link between the volume of distributed financial resources and the planned social development indicators in accordance with the key objectives of state financial policy, one of which is the strengthening of the social orientation of the Russian economy.

In accordance with the Order of the Ministry of Economic Development of Russia No. 582 as of September 16, 2016 "On Approving the Methodological Guidelines for the Development and Implementation of State Programs of the Russian Federation", the performance assessment algorithm for state program should be based on actual state programs implementation performance assessment methodology, analysis of the effect or result of the state program, taking into account the volume of financial resources required for its implementation. The performance assessment algorithm for state program, applied by the responsible executor, should consider the need for the degree of achieving the planned results of implementing departmental dedicated programs and key activities, the state program level indicators in general and specific subprograms, the balance of planned costs and public funds performance, as well as other aspects of state programs implementation performance assessment taking into account industry specificity (Order of the Ministry of Economic Development of Russia as of September 16, 2016 No. 582 "On the Approval of methodological guidelines for development and implementation of state programs of the Russian Federation"). In this situation, the development of performance audit algorithm for implementing the social investments performance audit plays a special role, which is the purpose of this study.

It should be noted that a number of scientists have been engaged in the study of various aspects of social investments financial control and performance audit. For example, O.N. Karepina (2006), when examining the social investments financial control, pays special attention to "the system of supervisory bodies actions whose duties are to identify violations in the process of formation, distribution and use of financial resources allocated to social sphere institutions, as well as checking the effectiveness and performance of their expenditure, preventive measures to prevent violations of their use". I.V. Bedrin (2011) considers in general the conceptual approaches to the construction of social investment performance indicators through a classical approach to the calculation of performance, taking into account the particular features of a particular subject area. He believes that the main difficulty is "in constructing indicators and performance criteria is to calculate the performance indicators that can fundamentally differ depending on the specifics of this investment direction (economy, social sphere, ecology, etc.)". In the context of social investment, this means that in addition to making a profit, the situation is possible to achieve any social effect, making it difficult to apply a narrow economic approach. Z.F. Dzhigkaev (2015) considers ways of assessing the social investments performance based on the "incremental methodology", the drawback of which is that ineffective decisions made in the retrospective period are carried forward. In addition, indicators used in this methodology for social investments assessment (baseline values) appear without interconnection with each other, which is difficult to agree with.

The key task of social investments performance financial control or performance audit is to assess the current state and effective use of material, labor and financial resources at the disposal of participants in the investment process. Adopted by the Congress of the International Organization of Supreme Audit Institutions (INTOSAI), the Lima Declaration of Guidelines emphasizes that financial control is an integral part of the public financial management system (Lima Declaration of Guidelines on Auditing Precepts, 1977).

The international experience of financing social investments is based on the practice of applying program and targeted approaches to budget planning and budgeting based on results. The specifics of the economic systems of different countries impose an imprint on the specifics of the implementation of the program and targeted principle of financing social investments. For example, in Mexico, when evaluating state target programs, a "logical system" is used to develop indicators, consisting of four levels (result, task, component, and activities). For each level, the purpose, indicators, and methods of their verification and the risks of achievement are determined. The practice of applying the performance-based budgeting procedure in the Netherlands allows concluding that the program approach to social financing investments increases the transparency of public expenses. The key component of performance-based budgeting is the systematic control of the effectiveness and performance of the state programs implementation. The practice of the approaches application of program and targeted planning in the USA shows that it is useful to include information on the state programs implementation results for the social development in the budget, which makes it possible to redistribute investments towards the most effectively implemented programs. Therefore, the PART (Program Assessment Rating Tool) was introduced into practice.

The analysis of the assessing problem the social investments financing performance will allow to better understanding the mechanisms of social financing investment processes, understand the specifics of the various methods application depending on the level of the social sphere development, thus more differentially developing the social sphere, taking into account its specifics.

The very concept of social investment has a number of characteristics. In accordance with Russian law, the purpose of investment can be defined as profit, and a useful effect, which, as a rule, is the purpose of social investment. Therefore, social investments can be defined as investments in social sphere objects with the purpose of raising the level and quality of people's life by satisfying their material, spiritual or social needs (Kolesov and Tutov, 2011, p. 469). The state plays a special role in social investments financing.

Indicators of the social effect of social investment are mainly qualitative, for example, it is difficult to quantify the standard of the population life. A criterion that describes the economic viability of social investment, taking into account the social impact that has been achieved, is needed. In this situation, the task of social investments performance assessment from the standpoint of raising the social standard of living in accordance with the social standards accepted in the society is topical. In this context, it is proposed to use the social investments performance audit algorithm based on integrated taxonometric indicators, constructed according to the method by V. Pluta.

At social investments performance audit, it is necessary to adhere to the selected performance indicators. It is advisable to generalize any set of specific indicators by an integral indicator, which ensures methodical uniformity of all the population and unambiguous interpretation of the level and dynamics of the analyzed process. An integral indicator must meet certain requirements: Clearly characterize the final results of social investment; show both sides of social development - dynamics and process, and the result; quantitatively interpret the milestones achieved as a result of the social investment introduction.

The generalizing system of the social financing performance indicators is the basis of the social investments performance audit methodology, the economic prerequisites for the social development, the reached social standard of living, identifying the need for capacities development and modifying state programs and development forecasts.

Specific integral indicators can sufficiently characterize changes in the regional development, but will be ineffective in identifying and developing measures to increase the social living standard of the region. The main disadvantage of many of the applied methods is that the indicators are not based on the reference. However, it is important that the main purpose of social investment is not to determine the indicator and not even to manage the process, but to obtain the desired result. The integral indicator in this context may be the degree of normative values achievement by specific indicators reflecting various aspects of social life.

An integral SDL (social development level) indicator was used to make the social investments performance audit of the regions of the Central Federal level. The Indicator was translated into the relative form of the chosen reference indicator for the purposes of universality. The social investment process will be considered effective if the SDL grows, approaching the reference indicator, in the analyzed period of the social investment projects implementation.

A model for constructing integral indicators is needed for the developing measures to increase the SDL of a certain region in the future period. When calculating the integral SDL, specific indicators such as real GDP per capita, employment level, total consumption of material goods and services per capita, the amount of leisure, social differentiation, the development of educational institutions, culture, health, housing and utilities, etc. In the investment process, social relations in the context of personal consumption perform two main functions - stimulating and reproducing. Therefore, the SDL will show both the level of satisfaction with the population's incomes, and the social infrastructure financing performance.

The methodology for calculating SDL considers the two key tasks. The first - of the theoretical plan - consists in the selecting primary specific measurable components, the second - of the methodical nature - consists in determining the individual components reducing methods for a single integral indicator, which are different in their nature, units of measurement, and social significance. It is advisable to solve the second problem using the model by W. Pluta (Yevchenko and Kuzbozhev, 2000).

The selected model involves comparing of targeted (normative) indicators-milestones (in the model they are designated as reference ones) and actual indicators of the social object development. The content of the integral indicator constructing model is as follows. Let each group of social objects be characterized by a set of specific indicators C. This set can be considered as a system, because, firstly, it characterizes the social objects group image as a whole, although a specific indicator describes only one specific side of social objects; secondly, each of the specific indicators is also a milestone for some social system functioning processes and is the result of other social processes in system objects of a higher level.

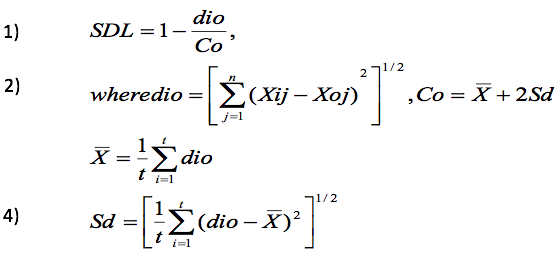

The method by W. Pluta is based on the assumption that "two social images are different if at least one Pi-th indicator from the set of CA, describing the image of the first group, differs numerically from the Pith index from the set of CC, which describes the image of the second group. In other words, if СА = {ПА1 ПА2,... ПАn} and СB = {ПB1, ПB2,..., ПBn } are the displays of the two groups, then СА СB, if at least one of the indicators is ПАi ПCi" (Yevchenko and Kuzbozhev, 2000). The CA set is the reference (milestone) for the social objects group image. The parameters set values of the reference standard CA are limiting (equal to 1 or 100%). The implementation of the performance audit algorithm begins with the definition of the differences between the social group image reference indicators (Pei) and the actual indicators (Pfi). The social group social development specific level, in other words - the degree of "approximation" of the social image actual image to a standard set, is determined by the following formulas:

The considered method by W. Pluta has a flaw in the use of threshold constants, which appear in a number of other methods. It is built upon using data matrix consisting of standardized indicators values, thus eliminating cost and natural units of measurement. In addition, all the initial specific indicators are to be converted into boosters. Value indicators with the relevant price and volume indices shall be recalculated at the overall price scale due to inflation. In addition, this method involves scaling of specific indicators relatively to the reference values of indicators, which are taken as 100%.

The society in general or its separate social institutions often see the reference values choice as a continuous process, which can change in a fairly short period of time. Therefore, the validity period for these standards can be quite short (a year or several years). When the investigated dynamic series increases, the reference indicators limits may increase or decrease. Accordingly, the integrated indicators values shall be calculated for the current time and for previous periods.

It is worthwhile to pay attention that specific indicators demonstrate the social investments performance evaluation procedure, but they do not solve the problem of selecting a representative sample of reference indicators for social group development and their limit values. Therefore, social investments performance audit algorithm may be used, based on determining the reference indicators ranks, according to which the reference indicators will be corrected by weight coefficients. Weight coefficients can be calculated by expert means, for example, paired comparisons method show rather accurate results. The essence of the paired comparisons method is in comparing different pairs of particular primary indicators: first of all, the first indicator weight is compared with the weights of the remaining ones, then the weight of the second one is compared with the weights of the third one, and this operation repeats till the last one, until an expert opinion on the relative weight of any pair of specific indicators is formed. In this procedure, the total number of comparisons shall be n(n-1)/2 (where n is the amount of indicators). The information and analytical basis of this phase is the sociological survey. The result of the paired comparison is an inverse symmetrical matched matrix whose own column is a vector of weight coefficients.

At the first stage of the integral index calculation, it is necessary to isolate only those specific indicators that are characterized by maximum variability (for which the maximum dispersion between objects is observed). After analyzing the total of the primary specific indicators, the following five are selected: the average nominal accrued salary of employees of organizations, the residential buildings commissioning, the retail trade turnover, the registered crimes amount, the average size of accrued pensions. The values of these particular indicators are published in statistical compilations (Rosstat, 2016, 2017).

The fact that any trend in the social sphere development of the Central Federal District regions, even for a relatively small number of private specific indicators, is difficult to identify, once again demonstrates the need for integrated indicators.

The next step in the social investments performance audit is to determine the primary specific indicators influence on the SDL integral indicator using weight coefficients, which are determined using the previously described method of paired comparisons. The calculated weights are shown in Table 1.

Table 1. The weight coefficient values to calculate SDL

Indicators |

The average monthly salary of employees of organizations |

The residential buildings commissioning |

The retail trade turnover |

The registered crimes amount |

The average size of accrued pensions |

Abbreviation |

MS |

RBC |

RTT |

RCA |

AP |

Weight coefficients |

0.3317 |

0.2513 |

0.0804 |

0.1759 |

0.1608 |

As the standard, the largest value of each private indicator is chosen for all areas for the analyzed period. The specific indicators reference values set is given in Table 2.

Table 2. The reference values set to calculate SDL

|

X0J |

||||

X01 |

X02 |

X03 |

X04 |

X05 |

|

Abbreviation |

MS |

RBC |

RTT |

RCA |

AP |

Indicator Name |

The average monthly salary of employees of organizations |

The residential buildings commissioning |

The retail trade turnover |

The registered crimes amount |

The average size of accrued pensions |

Unit of measurement |

Russian rubles |

Square meters |

Russian rubles |

Number of crimes by 100,000 persons |

Russian rubles |

Region |

The Moscow Region |

The Moscow Region |

The Moscow Region |

The Ryazan Region |

The Moscow Region |

Year |

2016 |

2014 |

2016 |

2016 |

2016 |

Scaled value |

33.17 |

25.12 |

8.04 |

17.59 |

16.08 |

The calculated SDL values of the Central Federal District regions for 2011-2016 years are shown in Table 3.

Table 3. Significance of the regional social development levels by years (and their ranks)

Regions |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

Total rank |

||||||

Value |

Rank |

Value |

Rank |

Value |

Rank |

Value |

Rank |

Value |

Rank |

Value |

Rank |

||

Russian Federation |

0.282 |

8 |

0.268 |

8 |

0.289 |

9 |

0.289 |

7 |

0.264 |

9 |

0.268 |

8 |

8 |

The Central Federal District |

0.342 |

5 |

0.345 |

4 |

0.337 |

5 |

0.316 |

5 |

0.318 |

4 |

0.287 |

5 |

4 |

The Belgorod Region |

0.459 |

3 |

0.470 |

3 |

0.511 |

2 |

0.542 |

2 |

0.479 |

2 |

0.537 |

2 |

2 |

The Bryansk Region |

0.166 |

16 |

0.190 |

15 |

0.249 |

13 |

0.237 |

11 |

0.215 |

15 |

0.250 |

10 |

13 |

The Vladimir Region |

0.194 |

14 |

0.214 |

13 |

0.194 |

15 |

0.220 |

13 |

0.230 |

12 |

0.210 |

14 |

14 |

The Voronezh Region |

0.299 |

7 |

0.240 |

12 |

0.297 |

7 |

0.274 |

9 |

0.306 |

5 |

0.284 |

6 |

7 |

The Ivanovo Region |

0.053 |

19 |

0.072 |

19 |

0.076 |

19 |

0.066 |

19 |

0.088 |

19 |

0.072 |

19 |

19 |

The Kaluga Region |

0.352 |

4 |

0.258 |

10 |

0.353 |

4 |

0.351 |

4 |

0.289 |

7 |

0.341 |

4 |

5 |

The Kostroma Region |

0.111 |

18 |

0.147 |

18 |

0.139 |

17 |

0.170 |

16 |

0.126 |

18 |

0.148 |

17 |

18 |

The Kursk Region |

0.272 |

11 |

0.289 |

6 |

0.251 |

12 |

0.229 |

12 |

0.240 |

11 |

0.216 |

12 |

11 |

The Lipetsk Region |

0.461 |

2 |

0.473 |

2 |

0.501 |

3 |

0.499 |

3 |

0.479 |

3 |

0.493 |

3 |

3 |

The Moscow Region |

0.686 |

1 |

0.724 |

1 |

0.733 |

1 |

0.651 |

1 |

0.700 |

1 |

0.616 |

1 |

1 |

The Oryol Region |

0.280 |

9 |

0.259 |

9 |

0.295 |

8 |

0.266 |

10 |

0.216 |

14 |

0.237 |

11 |

10 |

The Ryazan Region |

0.274 |

10 |

0.285 |

7 |

0.266 |

11 |

0.282 |

8 |

0.263 |

10 |

0.259 |

9 |

9 |

The Smolensk Region |

0.242 |

12 |

0.256 |

11 |

0.289 |

10 |

0.164 |

17 |

0.264 |

8 |

0.212 |

13 |

12 |

The Tambov Region |

0.306 |

6 |

0.318 |

5 |

0.325 |

6 |

0.299 |

6 |

0.297 |

6 |

0.272 |

7 |

6 |

The Tver Region |

0.159 |

17 |

0.213 |

14 |

0.223 |

14 |

0.194 |

15 |

0.225 |

13 |

0.196 |

15 |

15 |

The Tula Region |

0.174 |

15 |

0.173 |

17 |

0.125 |

18 |

0.122 |

18 |

0.175 |

16 |

0.104 |

18 |

17 |

The Yaroslavl Region |

0.211 |

13 |

0.178 |

16 |

0.190 |

16 |

0.200 |

14 |

0.127 |

17 |

0.180 |

16 |

16 |

The calculated data (Table 3) shows a significant differentiation of the Central Federal District regions in the level of social investments financing efficiency. The Moscow Region is the undisputed leader in the level of social investments financing efficiency, which is caused by the significant superiority of the social sphere development in the Moscow Region. The Belgorod, Lipetsk, Kaluga, Tambov, and Voronezh Regions may also be referred to the regions with the most effective use financial resources for social investment. The lowest level of social investments efficiency is observed in the Ivanovo and Kostroma Regions.

The state authorities and the regional administration shall utilize the over-time data on the regional social development level to implement the social investment policy based on levelling-off the regional social and economic development through reallocated financial flows. The Social and Economic Development Program for the regions falling behind shall envisage an increase in the social development level, as well as laying down programs to link the available financial resources with the planned socio-economic results. Bridging the living standards inequality among the population in various areas takes time, thus requiring development of social infrastructure and efficient production forces where the population living standard is lower. It makes sense to note that civil society shall appear as the main participant of the social regulatory activity, directing its efforts to gradual increase of business social responsibility based on social partnership. In addition, it is prudent to use the social investments performance audit algorithm when implementing the social investment processes financial control procedure.

The study is supported by the Russian Foundation for Basic Research (RFBR), Grant 17-32- 01189 “Methodology of influence of financing of investment processes on results of development of the social sphere”.

Bedrin, I. V. (2011). Formation of social innovations and investments managing mechanism (Candidate thesis, Saint-Petersburg State University of Technology and Design, Russia).

Dzhigkaev, Z. F. (2015). Evaluation of the executive bodies social performance in the subjects of the Russian Federation (Candidate thesis, State Federal-Funded Educational Institution of Higher Professional Training "Saint-Petersburg State University of Economics", Russia).

Jelnova, C. V. (2013). Analysis of the practice of decision-making in the field of investment policy. Contemporary Economic Issues, 4. DOI: 10.24194/41302. URL: http://economic-journal.net/index.php/CEI/article/view/83/70

Karepina, O. I. (2006). State financial control in the social sphere focused on increasing its performance (Candidate thesis, Rostov State University of Economics, Russia).

Kolesov, V. P., Tutov, L. A. (2011). Innovative development of the Russian economy: institutional environment: The Fourth International Conference. Collection of articles: Volume 1. Moscow: Lomonosov Moscow State University.

Lima Declaration of Guidelines on Auditing Precepts (adopted in Lima on October 17-26, 1977 by the IX Congress of the International Standards of Supreme Audit Institutions (INTOSAI)). URL: http://www.ksp.mos.ru/common/upload/The_Lima_Declaration_of_Guidelines_on_Auditing_Precepts.pdf

Minakova, I. V., Anikanov, P. V. (2013). Modelling of area of possible results of the innovative investment project. Contemporary Economic Issues, 1. DOI: 10.24194/11321. URL: http://economic-journal.net/index.php/CEI/article/view/34/22

Order of the Ministry of Economic Development of Russia as of September 16, 2016 No. 582 "On the Approval of methodological guidelines for development and implementation of state programs of the Russian Federation".

Rosstat. (2016). The regions of Russia. Socio-economic indicators. 2016: Statistical compilation. Moscow, 1326 p.

Rosstat. (2017). Socio-economic situation of the Central Federal District in 2016. Moscow, 83 p.

Yevchenko, A. V., Kuzbozhev, E. N. (2000). Forecasting and programming social development of the region in a transition economy: resource-based approach. Kursk: Publishing House Rosie.

1. Kursk State University, Kursk, Russia. ava_fkn@mail.ru

2. Orel State University named after I. S. Turgenev, Orel, Russia. 1946@orel.ru

3. Kursk State University, Kursk, Russia. konorev04@mail.ru