Vol. 38 (Nº 49) Year 2017. Page 14

Roza Kibjanova SERKEBAYEVA 1; Assiya Akanovna KORZHENGULOVA 2; Zina Makyshevna SHAUKEROVA 3; Bakytnur Zhumashevich UTEYEV 4; Arthur Mazhitovich ZIYATDINOV 5

Received: 12/06/2017 • Approved: 05/07/2017

ABSTRACT: One of important factors of sustainable economic development is creation of the knowledge-intensive economy and ensuring an increase in its competitiveness due to the development ofthe scientific capacity of the country and the national innovative system. The development of innovative economy isnot a prerogative of countries with ahigh level of income anymore; developing countries even more often develop the policy aimed at increasing the innovative potential and creatingthefavorable economic climate for thedevelopment of innovations. The successful development of economy and an increase in its competitiveness require the development of the scientific capacity of the country and the national innovative system. Now the innovative economy is the engine of economic growth. With respect thereto, special attention is paid to the development of an innovative system, the intensificationof innovative activities and the implementation of innovative projects. There is a question of financing of research and development and measurement of efficiency of financial supportmeasures. The state and theprivate sector shall be interested in the enhancement of engineering procedures, in performance improvement of work and product quality which, in turn, have economic and social value. The consideration of innovative activities as manifestations of the creative beginning in the increase in production efficiency due to the use of non-standard decisions is the strategic way of development of the country leading to ensuring the independence of economy of sale of the raw material resources, foreign loans and other similar factors influencing social and economic development. By means of innovations, new knowledge arises and extends, increasing the economy potential in creation of new products and more and more productive methods of functioning. |

RESUMEN: Uno de los factores importantes del desarrollo económico sostenible es la creación de la economía del conocimiento intensivo y el aumento de su competitividad debido al desarrollo de la capacidad científica del país y del sistema nacional innovador. El desarrollo de la economía innovadora no es una prerrogativa de los países con un nivel de ingresos asumos más; los países en desarrollo aún más a menudo desarrollan la política destinada a aumentar el potencial innovador y el clima económico creatingthefavorable para el desarrollo de las innovaciones. El desarrollo exitoso de la economía y el aumento de su competitividad requieren el desarrollo de la capacidad científica del país y del sistema nacional innovador. Ahora la economía innovadora es el motor del crecimiento económico. Con respecto a ello, se presta especial atención al desarrollo de un sistema innovador, a la intensificación de las actividades innovadoras y a la implantación de proyectos innovadores. Existe una cuestión de financiación de la investigación y el desarrollo y la medición de la eficiencia de la supportmeasures financiera. El estado y el sector privado estarán interesados en la mejora de los procedimientos de ingeniería, en la mejora del rendimiento del trabajo y en la calidad de los productos que, a su vez, tienen valor económico y social. La consideración de las actividades innovadoras como manifestaciones del comienzo creativo en el aumento de la eficiencia de la producción debido al uso de decisiones no estandarizadas es la forma estratégica de desarrollo del país que lleva a garantizar la independencia de economía de venta de los recursos de materia prima, préstamos extranjeros y otros factores similares que influyen en el desarrollo social y económico. A través de innovaciones, el nuevo conocimiento surge y se extiende, aumentando el potencial económico en la creación de nuevos productos y más y más productivos métodos de funcionamiento. |

One has to agree that innovations can be seen as a factor of social development through which the potential of the economy andproductive ways of its functioningincrease. J. Schumpeter, a famous American economist, indicated the relation between innovation and the level of economic development (2007).

According to the Commercial Code of the Republic of Kazakhstan, innovation means the introduction of any new or significantly improved product (service), process, new marketing method, organizational method in business practice, creation of jobsor external relations (Commercial Code of the Republic of Kazakhstan No. 375-V of October 29, 2015).

P.F. Drucker gives the following definition of innovation: "...innovation is the development and implementation of a new thing, previously not existing, with the help of which old and known elements impart new outlines to the economy of this business..." (Drucker, 2008, p. 52). We can conclude from this definition that business in the sphere of innovation in most cases is the enterprises formed for the first time; whereas self-financing as a method of investing in innovation is not the only one.

In order that an enterprise canconduct its business effectively in this day and age, it should constantly create and implement innovations that are the result of the implementation of innovative projects. That is why, in order to increase the economy's growth rate and competitiveness, enterprises should develop and implement innovative projects that are the object of innovation activity and an important stage in the operation of anenterprise. Innovation activity involves investing in research and development projects aimed atqualitative changes in the state of productive forces and progressive intersectoral structural shifts, as well as developing and introducing new types of products and technologies (Santo, 1990; Alekseev, 2012).

One of the objects of innovative activity isinnovative projects that have a significant share in the structure of the economic mechanism of the enterprise. The main reasons why enterprises implement innovative projects are the needs of consumers, some competitive advantages, increase of profits, search for ways to solve problems when conducting the enterprise's business, as well as surplus funds and improvement ofenterpriseactivities.

The most important features of innovative projects, according to researchers, are the following:

1. The implementation of the innovation project is influenced by the internal and external environment. The factors of the internal environment include the problems of financing, marketing, production, material support, infrastructure and direct project management. Without them, it is impossible to create competitive goods and services that are in demand in the market. External factors: political, economic, social, legal, scientific and technical, cultural, natural and environmental, infrastructural, etc.

2. The project as a system is divided into elements with a relation between them.

3. In the process of development and implementation, the description of the project changes both under the influence of the latest achievements of scientific and technological progress, and also due to the changes in the own capabilities of developers and customers (financial, etc.). It has dynamic nature; that is why it is possible to add new elements in comparison with those stipulated at the initial stage of its execution, and, accordingly, there is an opportunity for removal of a number of elements (objects) (Baluyevet al., 2011, pp. 83-84).

The innovation project is based on the concept of its life cycle, which assumes that the innovation project is a process that occurs from the time the new product strategy is developed up to the time of liquidation (obtaining the last benefit), that is, it includes the acts performed at the stages of preparation, implementation and operation of the project. However, we should note that the division into stages largely depends on the specifics of the project. Taking into account the diversity of stages of the life cycle indicated in some scientific works (Mazuret al., 2007, Zavlina, 2000;Hotyasheva, 2005), it is necessary to distinguish the following stages:

- development of a new product strategy. At this stage, the strategy of a new product is developed and the target market is determined, that is, a general idea of the future product is formed;

- formation of an innovative idea. The strategy and the target market are the basis for creating alternative ideas for the future product and determining the ultimate goal of the project;

- evaluation of alternatives. The evaluation of alternative ideas is being carried out;

- project development. The comparative analysis of the options is carried out to achieve the ultimate goal of the project, develop an implementation plan for the innovation project, name executors, determine the project budget, conclude agreements with suppliers and contractors;

- business analysis. The analysis of quantitative parameters of the project is being carried out: costs for production and launch of a new product, calculation of the break-even point and the payback period of the project, possible financial risks, methods of financing, etc.

- implementation of an innovation project. Actions directed to the tasks at hand. At this stage, it is also advisable to monitor the implementation of calendar plans, expenditures and adjust deviations, if any;

- completion of a project. Completion of the life cycle of the innovation project;

- operating phase. Production management of a new product, its sales, returns on investment and profit-making are performed.

The high risk of innovation activity stipulates certain difficulties with the search for sources of financing and, accordingly, the specifics of its financing. The implementation of the innovation project can be done by means of: own funds; funds of state or local budgets; funds of domestic or foreign investors; credit means; venture capital; other sources of financing.

Investing in innovation has a positive impact on production and economic activities; it makes it possible to update the production and technical base and overcome some crisis situations. The society in its turn receives the updated production, the balance of the state budget, new jobs, and an increase in the level of material prosperity, which leads to positive social and economic consequences (Ryazanov, 2011, p. 151).

It is commonly known that the level of practice in the sphere of innovation in any country is the result of interactions of the state and market, science and production, which implies that the process of innovation management and financing has various forms. The sources of financing for innovations can be the company's own resources, resources of financial and industrial groups, investment and innovation funds, public funds and private investment. All these subjects are involved in the economic process and can contribute to the development of innovations.

Commercial loans play an important role in financing the scientific, technical and innovative activities of organizations in developed countries. Loans, as a source of financing for innovative projects, are characterized by:

- positive features – possible attraction of significant fundsand at the same time the significant outside control over the effectiveness of their use;

- negative features, namely the complexity of the loan borrowing and completion, the need to provide appropriate guarantees or pawning of property, the increased risk of bankruptcy due to the impossibility of timely repayment of loans received, loss of profits from investment activities due to the need to pay interest on the loan (Belyaeva, 2006).

Venture financing is promising; it is also possible to use multichannel investment, and attract portfolio investors, who use risky projects with a view to run into money, if these projects are successfully implemented. In any case, in order to interest investors, the detailed analysis of the innovation project is needed, as well as the analysis of possible scenarios for the development of events and the risk assessment.

The development of innovation policy in Kazakhstan is carried out on the basis of a national innovation system – the network of legal, financial and social institutions that support innovative processes.

The development of the national innovation system is conditionally divided into the following stages:

- at the first stage, the Strategy of Industrial and Innovative Development (2003) was adopted, which resulted in the formation of the organizational structure and key elements of the national innovation system (NIS), namely:

2001 – the National Development Institute was established – the Development Bank of Kazakhstan JSC.

2003 – the formation of the research and development system. The Investment Fund of Kazakhstan JSC, National Innovation Fund JSC, State Insurance Corporation for Insurance of Export Credits and Investments JSC, Center for Marketing and Analytical Research JSC, Small Business Development Fund JSC, and Kazakhstan Center for Investment Assistance were formed.

2008 –Samruk-Kazyna National Welfare Fund was created by merging of joint-stock companies: Kazyna Sustainable Development Fund and Samruk Kazakhstan holding for management of state assets;

- at the second stage, the State Program of Industrial and Innovative Development for 2015-2019 was adopted. The main goal of the Program is to stimulate diversification and increase the competitiveness of the manufacturing industry by increasing non-commodity exports, preserving productive employment and giving a new level of technology to the priority sectors of manufacturing by means of creating some innovative clusters, encouraging entrepreneurship and developing small and medium-sized businesses in manufacturing.

The implementation of the tasks set requires a preliminary calculation of the expected profitability of innovative projects with benefits of no monetary value, additionally obtained with the economic result.

Kazakhstan's business puts up money for traditional production facilities, which were developed back in Soviet times: communication technologies, chemistry, construction, metallurgy, etc.

The state's efforts in the innovation sphere initially were aimed at forming favorable investment infrastructure, but thatdid not cover all the tools for supporting innovation activities, that is why the needs of the economy were not met by regions and the country as a whole. Therefore, the government creates the most-favored-nation treatment for medium and small businesses giving them the opportunity to obtain loans at lower rates with preferential tax treatment.

An important qualitative decision to stimulate innovation is the formation of a modern innovation and infrastructure complex. The National Agency for Technological Development (NATR) is responsible for providing an effective support for innovation activity in the country. Its structure includes the Center for Engineering and Technology Transfer, 8 regional tech parks and 4 departmental design bureaus.

However, most of the projects of the NATR, as you can see in Table 1, financially support the modernization (that is, changes in accordance with the requirements of modern times, updating the existing ones and fixing them in practice), rather than innovation.

This emphasis reflects the current needs of companies, and it is confirmed by financing projects, such as: purchase of equipment, feasibility study, introduction of management technologies, etc. (see Table 2).

Table 1 – Amounts of grants and submission periods of the NATD

No. |

Types of grants |

Grant size |

Project duration, months |

Grantee |

1 |

Advanced training of engineers |

< 2 million tenge |

< 3 |

Enterprises improving their productivity |

2 |

Recruitment of expatriate staff |

< 2 million tenge |

< 9 |

|

3 |

Involvement of consulting companies |

< 30 million tenge |

< 18 |

|

4 |

Introduction of management technologies |

< 15 million tenge |

< 12 |

|

5 |

Production research |

< 30 million tenge |

< 20 |

|

6 |

Technologies acquisition |

< 150 million tenge |

< 36 |

|

7 |

Support for start-up projects |

< 50 million tenge |

< 36 |

Innovators who have ideas and developments |

8 |

Patenting abroad |

< 6.25 million tenge |

< 36 |

|

9 |

Commercialization of technologies |

< 30 million tenge |

< 30 |

Source: The official website of the National Agency for Technological Development (NATD), JSC

Grants for commercialization of projects for the period of 3 years are not effective due to different motivation of participants of research organizations and private sector. The latter, as a rule, has a goal of making a profit, while the former are interested in long-term contacts with the private sector, so it is important for research institutions to provide them with long-term financing. That's where the ill-conceived organizational and methodological component of the innovation program appears, which is a consequence of insufficiently productive interaction of the structures of the innovation system.

The Agency uses the following methods in the issues of project financing: sharing the risk with private capital, fixing of finance ceiling, participating in corporate governance of companies. So, the limit on investing in investment funds or investments in project companies should not exceed 45% of the value of own capital; investment in the formation of technology parks, departmental design bureaus, is no more than 20% of the value of equity.

Table 2 – Projects declared and financed by the NATD

Grant Name |

2013 |

2014 |

2015 |

|||

Proposed |

Funded |

Proposed |

Funded |

Proposed |

Funded |

|

Commercialization of technologies |

104 |

19 |

180 |

29 |

107 |

19 |

Production of high-tech products |

21 |

4 |

28 |

2 |

22 |

4 |

Consulting and design organizations engagement |

19 |

8 |

16 |

2 |

18 |

8 |

Adoption of management and production technologies |

14 |

6 |

9 |

1 |

15 |

6 |

Technologies acquisition |

14 |

4 |

19 |

2 |

12 |

4 |

Production research |

5 |

- |

5 |

- |

5 |

- |

Patenting |

5 |

- |

11 |

- |

4 |

- |

Professional development of technical and engineering employees abroad |

2 |

2 |

5 |

- |

2 |

2 |

Recruitment of expatriate staff |

2 |

1 |

7 |

2 |

3 |

1 |

Total |

186 |

44 |

280 |

38 |

188 |

44 |

Source: The official website of the National Agency for Technological Development (NATD), JSC

In total, 328 contracts were concluded during the period of 2011-2016. The applicantsspeak about a complex procedure for selecting projects for a grant. When giving a grant, the real-world effects of the economy were taken into account; whether an applicant understands the market.

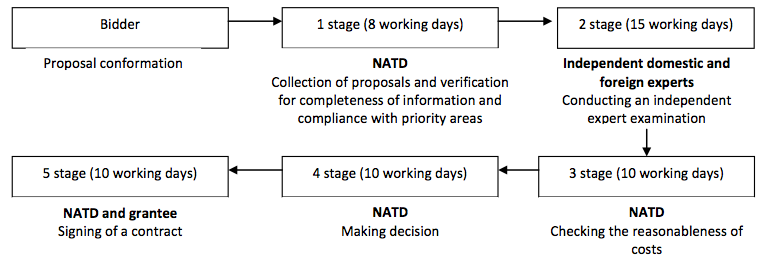

Figure 1 below shows the scheme of selection of applicantsfor innovative grants.

Figure 1

Bidding and selection process for innovative grants (Official website

of the National Agency for Technological Development)

Venture funds with the participation of Kazakhstan and foreign capital are used as additional sources of financing for innovation projects.It seems to us that this form of financing in Kazakhstan does not correspond to the declared objectives despite the messages of media sources.

According to the authors, the creation and operation of a venture innovation fund for research and development works conducting, if the fund will work in accordance with the standards of public services of the country, may not be effective. The venture industry in Kazakhstan even with the active support of the government is impossible without an effectively functioning financial market.

Given the contemporary trends of globalization, the completeness of material resources, the world society is increasingly focusing on innovation, creating opportunities for a significant increase in the level of competitiveness.

There is a reduction in financing of innovative activities by commercial banks in the world. Commercial banks are more likely to finance innovative projects at the stages of implementation rather than at the stages of development, as well as existing enterprises, rather than those that have recently been created. That is why the important role of stimulating innovation in the current economic conditions belongs directly to the governments.

The government rather actively finances innovative activity in the USA. At the same time, one of the forms of such support is a partial guarantee of bank loans by local authorities. Annually, for supporting bank loans for innovation, the budgets of all levels allocate about $50 billion(Andrewet al., 2009), which creates the opportunity to increase the volume of financing innovation.

In general, three pillars the American innovation strategy leans on are the following: investing in blocs of American innovation, in particular R&D, human, physical and technological capital, encouraging competitive markets that stimulate industrial entrepreneurship, and stimulating breakthroughs in national priorities such as developing alternative energy sources and improving public health (Chesbrough, 2006). In the United States of America, the country's primary financial defense is provided by military establishment. In addition, a significant number of developments are then used in industry. At the same time, most enterprises work directly for a quick profit.

The most competitive industries in the USA are: aviation and aerospace, engineering, automotive, computer manufacturing and software development. The experience of the USA in financing innovative projects according to the "business angel" scheme is interesting. Investors provide their start-up budget for the period of 3 to 7 years without guarantees and pledges in return for a chunk of companies. The examples of the participation of business angels are Google search system and Amazon.com online store (Vorobyova, 2015).

The UK also has the experience of providing bank loans by the government; it guarantees the return of 70% of the value of loans provided to venture firms, and reimburses up to 50% of all expenditures for innovation and subsidizes small innovative firms. In the UK, the network of more than 325 accelerators is quite developed which is regulated by the Centre of Business Incubators (Biegelbauer, &Borrás, 2003). The priorities of the UK's innovative activity include medical technologies, renewable energy, protection of communication infrastructure, biotechnologies, intelligent management systems and environmental management. The development and promotion of high technology environmental services to the world market are of great importance.

There are various methods of state stimulation of innovation activity; in general, they are divided into direct and indirect ones. Direct methods mainly include budget financing, lending, public contracts, subsidies and grants. Indirect methods, as a rule, stipulate for tax incentives, which show in the form of tax credits, improvement of legislation, improvement of innovation infrastructure, etc. At the same time, grants and subsidies are focused on specific projects that have potentially high social returns. Tax credits and benefits, in turn, provide an opportunity to reduce the marginal cost of innovative projects. Today, there is a gradual growth of indirect methods of stimulating innovation through tax incentives in the world. Each country independently chooses the ratio between direct and indirect forms mainly giving preference to one of them.

It is tax incentives among indirect methods that play an important role of state stimulation of financing innovative activity. Tax credits are actively used by the governments of 11 OECD countries. In particular, tax incentives are quite popular in Japan. It was Japan that for the first time introduced tax credits fornational companies in order to increase financing for R&D.

Finland also has significant innovative investment activity, the innovative model of which is one of the most effective in the world. Despite the fact that there has been the decrease in financing innovative activity throughout the world, in Finland, on the contrary, the costs of financing innovative activity continued to grow; it has led to the increase in the number of enterprises based on innovation. State financing of innovative activity in Finland is carried out through strategic centers of science, technology and innovation. Government support for financing of innovative activity is based not only on the financing on a competitive basis, but also on the active use of indirect methods to stimulate innovation, in particular, ensuring the continuous development of the innovation structure (Burnaeva, 2007).

Thus, the instruments for financing innovative projects in developed countries are the same as in Kazakhstan; however, the final results have different quality levels. The Kazakhstan society is inert. The society did not manage to form such an innovative need and culture that would equallystimulate and ensure the interests of the government, private business and consumers. According to the authors, it is a consequence of the mentality that has been formed during the years of Soviet power, when human resourcesof many Central Asian republics were oriented towards liberal arts education rather than engineering and technical one. The emigration of most specialists of these categories after the collapse of the USSR has led to the functional void in society, the repercussion of which is still with us. The lack of qualified engineers, designers and workers is an obstacle for a technological breakthrough of the country. It is this occupational group, for the most part, that is the basis for the success of innovative endeavors with the appropriate financial support throughout the world.

In general, the reasons restraining innovation processes in Kazakhstan can be grouped as follows: socio-economic, political, organizational and methodological ones.

The socio-economic reasons should be the following: lack of scientific, technical and innovation potential; lack of own circulating assets; lack of long-term and easy money in the credit market and the weakness of the stock market. For example, the share of new scientific products in Kazakhstan's GDP is about 1.1%; the activity of enterprises for the production of scientific products is 2.3%(The Analysis of Trends in World Science and the Problem of Increasing the Competitiveness of Kazakhstan's Science, n.d.). The main players in Kazakhstan securities’ market are large investors; they do not allow creating demand and supply with fully market-based methods; therefore, the processes of price formation are non-marketable.

The political factor is directly related to the position of Kazakhstan in the international division of labor. Kazakhstan firmly holds the position of minerals and hydrocarbons’ supplier that imposes a certain stereotype of the country's perception in the world economic community, and, coupled with growing competition in the world innovation market, makes it difficult to attract foreign investors for the development of high-tech industries. Often, international contacts of Kazakh businessmen remain at the stage of memorandums of intent. The growth of indicators of the productive sectors of the country's economy is achieved due to the transfer of foreign technologies. More than 60% of the total number of imported goods are such products as equipment, vehicles, appliances and devices, as well as the products of the chemical industry, i.e. high-tech products.

Organizational and methodological reasons for the weakness are the insufficient development of methodological materials about the issues of making management decisions including organizational and financial ones depending on the scope of the project application in order to obtain a high final result. The latter assumes an optimal combination of advanced theory and practical recommendations for the management of innovative projects in a single information production process based on the effective use of all types of resources – material, intellectual, labor and financial ones.

One can agree with the opinion that representatives of Kazakhstan's business "consider the introduction of new technologies as a separate activity, costly and labor-intensive, and not as a way to increase their competitiveness" (Sabden, 2009). In addition, the Kazakh business is rational, it does not try to invest in high-tech projects because of the pressure of competitive advantages in technologies of large corporations, and gives the right to take risks for the government.This gives the state the possibility to ask the report about the use of directed funds so that society can really experience the results through the growth of the revenue side of the budget, and as a consequence, the growth of the well-being of the population as a whole.

Aninnovative project is a complex system of interrelated elements aimed at the implementation of certain tasks in the direction of the development of science and technology. However, it should be noted that an innovative project that is effective for one enterprise may not be effective for another, so it is necessary to take into account various factors, such as the location of the enterprise, the level of personnel qualifications and the state of the resources available at the enterprise.

The experience of developed countries, which are the leaders in the world market, showed that to stimulate innovation and increase the volume of financial provision, active participation of state authorities was necessary. For domestic enterprises, the active use of a tax credit will be quite actual.

Andrew, J.P., DeRocco, E.S., &Taylor, A. (2009). The Innovation Imperative in Manufacturing: How the United States Can Restore Its Edge. National Association of Manufacturers. Retrieved May 15, 2017, from www.bcg.com/documents/file15445.pdf

Biegelbauer, P., &Borrás, S. (2003).Innovation Policies in Europe and the US: The New Agenda. Burlington, VT: Ashgate Publ. Co. (p. 325).

Chesbrough, H. (2006). Open Business Models: How to Thrive in the New Innovation Landscape. Boston: Harvard Business School Press.(p. 224).

Alexeev, V. (2012). Aktualnyyevoprosyinnovatsionnoyekonomiki[Pressing Issues of Innovative Economy]. Intellektualnayasobstvennost. Promyshlennayasobstvennost, 7, 20‑30.

AnaliztendentsiirazvitiyamirovoinaukiiproblemypovysheniyakonkurentosposobnostinaukiKazakhstana[Analysis of Trends in the Development of World Science and the Problem of Increasing the Competitiveness of Science in Kazakhstan]. (n.d.).Retrieved May 15, 2017 http://www.science-fund.kz/post

Baluev, R.V., Steshenkov, L.P., Ushakova, E.V., &Shamina, L.K. (2011). Innovatsionnyiproektkak instrument razvitiyainnovatsionnogopotentsiala[Innovative Project as a Tool for Developing Innovative Capacity]. Saint Petersburg: AdministratsiyaLeningradskoioblasti, GU "AgentstvoekonomicheskogorazvitiyaLeningradskoioblasti".

Belyaeva I. (2006). Innovatsii v ratsionalizatsii[Innovations in Rationalization]. Upravleniekompaniei, 2, 425-427.

Burnaeva, E. (2007). Finlyandiya: tendentsiizarubezhnogoinvestirovaniya[Finland: Trends in Foreign Investment]. Mirovayaekonomikaimezhdunarodnyeotnosheniya, 7, 30-39.

Vorobieva, I.M. (2015). Analizzarubezhnogoopytapoupravleniyuinnovatsionnoydeyatelnostyu[Analysis of Foreign Experience in Innovation Management]. Molodoyuchenyi, 10, 580-586.

Drucker, P. (2008). Innovatsiiipredprinimatelstvo[Innovation and Entrepreneurship]. Moscow: Unity.

Zavlina, P.N. (2000). Osnovyinnovatsionnogomenedzhmenta[Fundamentals of Innovation Management: Theory and Practice]. Moscow: Ekonomika. (p. 475).

Masur, I.I., &Shapiro, V.D.,&Ol'derogge, N.G. (2007). Upravlenieproektami[Project Management]. Moscow: Omega-L. (p. 664).

National Agency for Technological Development. (n.d.).Retrieved May 15, 2017, fromwww.natd.gov.kz.

PredprinimatelskiykodeksRespubliki Kazakhstan No. 375-V ot 29 oktyabrya 2015 goda[Commercial Code of the Republic of Kazakhstan No. 375-V]. (2015, October 29).

Ryazanov, M.A. (2011). Investirovanieinnovatsionnoydeyatelnosti[Investing in Innovation. Nauchnoemnenie, 2, 150-154.

Sabden, O. (2009). Konkurentosposobnayaekonomikaiinnovatsii[Competitive Economy and Innovation: Monograph]. Almaty: Exclusive. (p. 152).

Santo, B. (1990). Innovatsiyakaksredstvoekonomicheskogorazvitiya[Innovation as a Means of Economic Development].Moscow: Progress. (p. 296).

Hotyasheva, O.M. (2005). Innovatsionnyymenedzhment[Innovative Management]. Saint Petersburg: Piter. (p.318).

Shumpeter, Y.A. (2007). Teoriyaekonomicheskogorazvitiya[The Theory of Economic Development].Moscow: Direct-Media.

1. Turan-Astana university, Republic of Kazakhstan, 010000, Astana, Dukenuly St. 29. E-mail: serkebayevar@mail.ru

2. Turan-Astana university, Republic of Kazakhstan, 010000, Astana, Dukenuly St. 29

3. Saken Seifullin Kazakh Agro technical University, Kazahstan, Astana

4. University of international business UIB, Kazahstan, Almaty

5. The branch of Federal State Budgetary Educational Institution of Higher Education “Ufa State Petroleum Technological University”, Russia, 452600, Bashkortostan, Oktyabrsky, Devonskaya Street, 54a