Vol. 38 (Nº 29) Año 2017. Pág. 16

Roman Vladimirovich KOLUPAEV 1; Olesya Mikhailovna FADEEVA 1; Alexander Ivanovich ARDASHEV 1; Roman Anatolyevich NOVIKOV 1; Kostyantyn Anatol'evich LEBEDEV 2

Recibido: 11/01/2017 • Aprobado: 15/02/2017

ABSTRACT It has been determined that there are two approaches to estimating the level of financial safety – qualitative and quantitative approaches. However, these approaches must be specified in the context of modern conditions. The combination of classical statutory values with the average indicators offered by us in terms of sectors allowed to make the financial analysis more objective and accurate. Specific values of coefficients and selection of the adjustment coefficients were determined on the basis of both real average values according to types of the economic activity of Russian material production, and recommended statutory values. According to the results of the research, it has been determined that the enterprise can obtain one of three types of financial safety estimates: critical, insufficient, and sufficient. The critical estimate means a considerable financial danger in the enterprise activity. The insufficient estimate says about a number of problems at the enterprise. In the future they can cause crisis phenomena. The sufficient estimate means financially safe condition of the enterprise. |

RESUMEN: Se ha determinado que existen dos enfoques para estimar el nivel de seguridad financiera: enfoques cualitativos y cuantitativos. Sin embargo, estos enfoques deben especificarse en el contexto de las condiciones modernas. La combinación de valores estatutarios clásicos con los indicadores promedio que ofrecemos en términos de sectores nos permitió hacer el análisis financiero más objetivo y preciso. Los valores específicos de los coeficientes y la selección de los coeficientes de ajuste se determinaron sobre la base tanto de los valores medios reales según los tipos de actividad económica de la producción rusa de materiales como de los valores reglamentarios recomendados. Según los resultados de la investigación, se ha determinado que la empresa puede obtener uno de los tres tipos de estimaciones de seguridad financiera: crítica, insuficiente y suficiente. La estimación crítica significa un peligro financiero considerable en la actividad de la empresa. La estimación insuficiente dice acerca de una serie de problemas en la empresa. En el futuro pueden causar fenómenos de crisis. La estimación suficiente significa condición financieramente segura de la empresa. |

In the context of crisis tendencies related to the development of the global economy, enterprises perform their activity under the impact of a number of destabilizing factors. It is possible to single out the following factors: imperfection of legislation, unfair competition, and a low level of the enterprises financial safety.

The problem related to ensuring the enterprises financial safety as a tool to protect from the impacts of external and internal threats requires its compliance with the flexibility and continuity criteria, as well as the need to agree and fulfill financial interests of the management subjects. Under such conditions the primary need for economic subjects is to search for new approaches to providing and managing the enterprise financial safety.

Issues related to estimating the enterprise financial safety were considered by V.A. Baburin (2016), E.V. Belskaya (2013), K.V. Galitskova (2016), I.G. Yandulova (2012), R. Kent (2004), A.A. Sirotskiy (2016) et al.

In spite of a comprehensive nature and depth of the conducted researches, the majority of them are devoted to the issues related to developing and forming financial levers and subsystems of the enterprise financial safety. That is why in the future it is necessary to research issues related to improving the methodology to estimate the level of the enterprise financial safety formed under the impact of the current system of corporate management.

The main problems related to estimating the enterprise financial safety include imperfection of the methodology related to the coefficient analysis for forming estimation values for models and coefficients (Elgers, et. al. 2001; Fedulin, et. al. 2015). In this aspect the system of indicators related to the enterprise financial safety can be represented as Table 1. It shows formula to calculate indicators, their economic content and current statutory values.

Table 1 - Key Indicators of Financial Analysis of the Enterprise Activity

Coefficient |

Calculation formulae |

Economic content |

Statutory value |

|

numerator |

denominator |

|||

Coefficient of capital assets wear |

Amount of capital assets wear |

Balance cost of capital assets |

It characterizes the degree of wear of capital assets |

< 0.5 |

Return on capital assets |

Net income from sold products |

Average annual cost of capital assets |

It characterizes the efficiency of using capital assets |

> 1 |

Profitability of assets |

Net profit |

Average cost of assets for the period |

It allows to define the efficiency of using assets |

> 0.05 |

Assets circulation coefficient |

Net profit |

Average cost of assets for the period |

It defines the potential of the enterprise related to earning profit under the current investments and capital structure |

- |

|

Coverage ratio |

Current assets |

Short-term obligations |

It characterizes the sufficiency of working assets to repay debts |

> 2 |

Financing coefficient |

Average cost of indebtedness for the period |

Average cost of own capital for the period |

It defines the correlation of the total debt and own capital |

< 1 |

Coefficient of payment capacity loss |

Income from selling |

Expenses |

It shows how flow of funds can be decreased under the possibility to make the required payments |

> 1 |

The offered methodology is based on calculating coefficients according to the data of the financial statements of enterprises with the further processing of results by means of descriptive statistics. Herewith, when performing descriptive statistics, it is offered to select representative values.

This selection must be made by deselecting non-typical values. As a rule, these are 2-3 values that most of all differ both in terms of increase and decrease. In order to form the quantitative methodology to estimate enterprises financial safety, we offer to use a comprehensive methodology with the integral value of 100 points.

It is offered to define the level of the financial safety depending on the number of the accrued points, as well as the number of points that comply with any coefficient on the basis of the expert estimates of officers of the economic department of the enterprise.

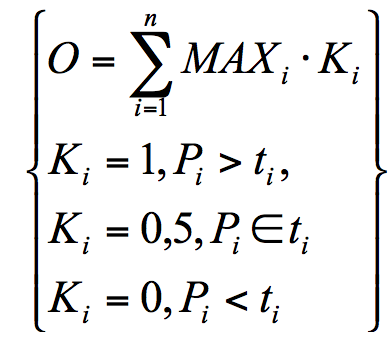

It is offered to estimate the financial safety according to the following formula (1):

(1)

(1)

where О is an integral estimate of the financial safety level; МАХi is a maximum number of points according to i coefficient; Ki is an adjustment coefficient, and Pi is an actual value of i coefficient.

As based on the general directionality of the article, to our mind, the financial safety indicators are the key ones, we offer such allocation of the contribution of every coefficient in the total results (Table 2).

Table 2 - Maximum Point Estimates in Terms of Separate Coefficients of the Financial

Analysis to Estimate the Level of the Enterprise Financial Safety

Coefficient |

Maximum number of points |

Coefficient of capital assets wear |

10 |

Return on capital assets |

10 |

Profitability of assets |

10 |

Assets circulation coefficient |

10 |

|

Coverage ratio |

20 |

Financing coefficient |

20 |

Coefficient of payment capacity loss |

20 |

Maximum possible number of points |

100 |

The next step must be defining values of the indicators by using adjustment coefficients – a number of points given by the analyst. We offer to classify the value of adjustment coefficients into three groups: 0, 0.5, and 1. It is necessary to do it taking into account three types of estimates of the financial safety level: critical, insufficient, and sufficient.

When making a research, we selected data from 65 enterprises specializing in various types of economic activity of the material production of the Russian Federation (metallurgic production, production of metallic products, chemical production, production of machines and equipment, gas and oil industry, light and food industry, production and distribution of power energy).

For the data and obtained results of the analysis to be objective enough and statistically appropriate, we have taken forms of financial statements of enterprises for 2011-2015. The obtained calculations happened to be rather accurate. For some coefficients in separate areas (energetic, machine-building) we minimally filtered them because the spread of values was rather inconsiderable. On average, about 62% of indicators were related to a rather narrow group of values.

Thus, the obtained average values comply with the real average values of enterprises whose operation is related to the material production of various types of economic activity. Table 3 shows average values of basic financial and economic coefficients in terms of types of the economic activity.

Table 3 - Average Values of Key Financial Coefficients of Enterprises According to

Types of Economic Activity in the Russian Federation

Type of economic activity |

Coefficient of capital assets wear

|

Return on capital assets

|

Profitability of assets |

Assets circulation coefficient

|

Coverage ratio |

Financing coefficient |

Coefficient of payment capacity loss

|

Chemical production |

0.51 |

1.55 |

0.03 |

0.71 |

1.55 |

0.38 |

1.08 |

Production of machines and equipment |

0.48 |

0.93 |

-0.01 |

0.36 |

1.66 |

1.02 |

0.93 |

Gas and oil industry |

0.45 |

2.80 |

0.03 |

1.02 |

1.44 |

1.31 |

1.06 |

Metallurgic industry |

0.57 |

3.03 |

0.06 |

1.17 |

1.55 |

0.96 |

1.09 |

Production and distribution of power energy |

0.54 |

1.73 |

-0.04 |

0.68 |

0.83 |

1.78 |

0.94 |

Light and food industry |

0.27 |

2.76 |

0.02 |

1.15 |

1.07 |

1.42 |

1.03 |

Statutory values |

< 0.5 |

> 1 |

> 0.05 |

- |

> 2 |

< 1 |

> 1 |

The analysis of the basic financial coefficients according to types of economic activity showed that there were corrupted and inaccurate tools of analysis. For the majority of indicators we have considered, the real average indicators according to areas differ from the recommended statutory values, i.e. on the general background the enterprise can have a relatively stable financial state and perform rather efficient activity, while the existing standards will characterize its financial state as negative. It may affect relations with creditors, counteragents, and investors.

The combination of classical statutory values with the average indicators we offered in terms of areas will allow to make the financial analysis more objective and accurate. We defined specific values of coefficients and selection of the adjustment coefficient for them on the basis of both real average values according to types of economic activity of the Russian material production area, and recommended statutory indicators (Table 4).

Table 4 - Defining the Adjustment Coefficient According to Key Indicators of the

Financial Analysis in Russian Material Production in 2015

Coefficient |

Adjustment coefficient |

||

0.00 |

0.50 |

1.00 |

|

Coefficient of capital assets wear |

> 0.65 |

0.45-0.65 |

< 0.45 |

Return on capital assets |

< 1.00 |

1.00-1.90 |

> 1.90 |

Profitability of assets |

< 0.00 |

0.00-0.04 |

> 0.04 |

Assets circulation coefficient |

< 0.45 |

0.45-0.85 |

> 0.85 |

|

Coverage ratio |

< 0.75 |

0.75-0.95 |

0.95-1.50 |

Financing coefficient |

> 1.10 |

0.85-1.10 |

< 0.85 |

Coefficient of payment capacity loss |

< 0.85 |

0.85-0.95 |

> 0.95 |

Thus, when defining the adjustment coefficient, we were basically guided by real data of economy of the Russian Federation without losing the logical relation with the economic content of each specified financial indicators.

The research has shown that according to the results of the analysis, the enterprise can get one of the three types of estimates related to the level of the financial safety: critical (less than 50 points), insufficient (50-70 points), and sufficient (70-100 points). The critical estimate means a considerable financial danger in the enterprise activity. The insufficient estimate says about a number of problems in the activity of the enterprise that in the future may cause crisis phenomena. The sufficient estimate means financially safe state of the enterprise.

We will show the offered methodology related to estimating financial safety of the enterprise through the example of “Renault Russia” LLC as on 2015 (Table 5).

Table 5 - Defining the Level of Financial Safety of “Renault Russia” LLC for 2015

Coefficient |

Coefficient value |

Adjustment coefficient |

Maximum number points |

Real number of points |

Coefficient of capital assets wear |

0.24 |

1 |

10 |

10 |

Return on capital assets |

3.22 |

1 |

10 |

10 |

Profitability of assets |

-0.02 |

0 |

10 |

0 |

Assets circulation coefficient |

1.44 |

1 |

10 |

10 |

Coverage ratio |

1.02 |

1 |

20 |

20 |

Financing coefficient |

0.55 |

1 |

20 |

20 |

Coefficient of payment capacity loss |

1.00 |

1 |

20 |

20 |

In total |

- |

- |

100 |

90 |

The reliability of the above methodological methods to estimating the enterprise financial safety is proved by the fact that the use of statutory values of coefficients will considerably simplify the work of financial analysts, and their activity results will be more objective.

The practice has shown that the considerable dispersion of coefficients values according to types of the economic activity stipulates a rather broad typical range. It does not allow to get an accurate idea about the limits of the indicator fluctuations where any change will not be interpreted as worsening of the financial state or incompliance with its statutory values.

It is considered to be necessary to use the typical ranges normalized according to the recommended statutory values for the material production as a whole and in terms of separate sectors. It will enable the analyst to most accurately and objectively estimate the enterprise state.

Even taking into account our recommendations, the financial indicators considered above only partially estimate the level of the enterprise financial safety (Karaulova, et. al. 2013; Lebedev 2014). On the one hand, when using a considerable number of coefficients, there is an opportunity to most comprehensively analyze the activity of the enterprise and its current, and probably, future financial state. On the other hand, a lot of financial indicators considerably complicate the work of analysts, and can cause ambiguity as a result of contradictory values of various indicators.

It has been determined that there are two approaches to estimating and diagnosing the level of financial safety – qualitative and quantitative approaches. However, these approaches must be specified in the context of modern conditions.

It has been proved that according to the results of the analysis, the enterprise can obtain one of three types of financial safety estimates; critical (less than 50 points), insufficient (50-70 points), and sufficient (70-100 points). The critical estimate means a considerable financial danger in the enterprise activity. The insufficient estimate says about a number of problems at the enterprise, which can cause crisis phenomena in the future.

Baburin, V.A. and Goncharova, N.L., (2016), Finansovaya bezopasnost I innovatsii strahovogo marketinga na predpriyatiyah [Financial Safety and Innovations of the Insurance Marketing at Enterprises]. Problems of Modern Economy 1, 101-105.

Belskaya, E.V. and Dronov, M.A., (2013), Osobennosti upravleniya finansovoy bezopasnostyu na predpriyatii [Peculiarities of Managing Financial Safety at Enterprise]. Bulletin of the Tula State University. Economic and Legal Sciences 2-1, 209-217.

Elgers, P.T., Lo, M.H. and Pfeiffer, R.J.Jr., (2001), Delayed Security Price Adjustments to Financial Analysts' Forecasts of Annual Earnings. Accounting Review 76 (40), 613.

Fedulin, A.A., Sakharchuk, E.S. and Lebedevа, O.Y., (2015), Organization Aspects of Professional Skills Improvement in Tourism. Actual Problems of Economics 166 (4), 327-330.

Galitskova, K.V., (2016), Finansovaya bezopasnost v upravlenii predpriyatiem [Financial Safety in Managing an Enterprise]. New Science: Strategies and Vectors of Development, 3-1 (70), 130-133.

Karaulova, N.M., Sizeneva, L.A., Orlova, N.V., Lubetskiy, M.S. and Chernykh, A.V., (2013), System Analysis and Synthesis of the Concept "Economic Interests' Protection". World Applied Sciences Journal 27 (13A), 329-331.

Kent, R., (2004), Trust and Financial Security. Lesbian News 29 (12), 10.

Lebedev, K.A., (2014), Marketing Technologies in Stimulation of Recreation and Tourism Potential of Regions. Actual Problems of Economics 161 (11), 186-190.

Sirotskiy, A.A., (2016), Information Security of the Automated Systems of Financial Credit Institutions. Contemporary Problems of Social Work 2 (6), 185-193.

Yandulova, I.G., (2012), Upravlenie finansovoy bezopasnostyu predpriyatiya [Managing Financial Safety of Enterprise]. Modern Tendencies in Economy and Management: New View 14-2, 161-166.

1. Russian State Social University, Russia, 129226, Moscow, Wilhelm Pieck street, 4. email: roman.v.kolupaev@mail.ru

2. Institute for Tourism and Hospitality, Russia, 125438, Moscow, Kronstadt Blvd., 32a