Vol. 38 (Nº 26) Año 2017. Pág. 29

Kleber Alves da Silva FRANCULINO 1; Rogério GOMES 2

Recibido: 15/12/16 • Aprobado: 23/01/2017

3. The pharmaceutical industry in Brazil

4. The pharmaceutical industry in India

5. Methodology and analysis of trade indicators

8. Exports by therapeutic class

9. Average values and countries for participation

10. Revealed comparative advantages

ABSTRACT: This study aims to evaluate how public policies adopted by Brazil and India in past decades have influenced the development of the pharmaceutical industry in these countries. The industry performance is measured by international trade indicators, from 1995 to 2011, to capture the effects of the adoption of the TRIPS Agreement on the productive structure of medicines. Two hypothesis are assumed: international trade flows may express aspects of the industry competitiveness; and the success of these public policies implicates in increased competitiveness. The results indicate that the continuity of the policies is crucial to explain the differences of industry competitiveness in both countries. |

RESUMO: Este estudo tem como objetivo avaliar como as políticas públicas adotadas pelo Brasil e pela Índia nas últimas décadas influenciaram o desenvolvimento da indústria farmacêutica nesses países. O desempenho da indústria é medido por indicadores de comércio internacional, de 1995 a 2011, para captar os efeitos da adoção do Acordo TRIPS sobre a estrutura produtiva dos medicamentos. Duas hipóteses são assumidas: os fluxos comerciais internacionais podem expressar aspectos da competitividade da indústria; E o sucesso dessas políticas públicas implica no aumento da competitividade. Os resultados indicam que a continuidade das políticas é crucial para explicar as diferenças de competitividade da indústria em ambos os países. |

The productive environment and the development opportunities of each region and country vary significantly. Considering the type and the amount of production and international trade of nations, different performances can be founded. However, these differences are more noticeable when the degree of industrial development of certain countries are related to their consolidated technologies. In science and technology (S&T) intensive industries, such as the pharmaceutical industry, these differences are quite visible.

This study aims to evaluate the results of public policies directed to the development of the pharmaceutical industry in Brazil and India. To that end, the government measures adopted by both countries were analyzed. Then, assuming that competitiveness of an industry can be estimated by trade flows as a reflection of the industrial structure, some indicators were used in order to measure the pharmaceutical industry competitiveness in both countries, such as average value, revealed comparative advantage, among others. These indicators were calculated from 1995 to 2011 to capture the effects of important changes from the intellectual property rules (TRIPS) on the agents' effort to build productive and technological capabilities. There are two assumptions underpinning this study: i) the success of public policies is translated into increased international competitiveness; ii) international trade flows express aspects of the productive structure and therefore the industry competitiveness.

Beyond this introduction, the article presents some theoretical elements related to technological learning and its relevance to international trade, public policy and business strategy. Then, to emphasize the importance of public policies, considerations are shortly made over the development of the pharmaceutical industry, followed by a brief history of the industry in Brazil and India. Subsequently, the methodology and the indicators used are presented. Finally, the conclusions seek to highlight how the differences in the policies adopted by Brazil and India can explain the differences in the international trade performance.

Dosi & Soete (1988) argue that the technological paradigm under which certain goods are produced results in a pattern of technical change relatively cumulative and irreversible. This pattern is consistent with the evolutionary path of the industry and is influenced by specific characteristics of the countries. The technical change process follows an evolutionary logic of innovation and diffusion of new productive techniques and products, which, according to the degrees of opportunity, cumulativeness and appropriateness of technology (Malerba & Orsenigo, 1997), may lead to a higher degree of convergence or divergence of technological capacities of countries and companies.

According to Amendola, Dosi & Papagni (1993), the technological differences between countries are essential to explain trade patterns. The existing technological asymmetries — result of specialization — affect the competitive performance of countries in world trade, specially the latecomers. However, the development of greater productive efficiency is not a process that occurs naturally through the acquisition of machinery and equipment with a higher degree of technology, but it depends on the building of non-incorporated internal capacities and not derived directly from capital assets or the acquisition of technological know-how (BELL & PAVITT, 1995).

The technological capacity that occurs with the development of absorption capacity depends on the history. In other words, it depends on the path followed by agents to employ efforts directed to improve the scientific, technological and innovative basis (Cohen & Levinthal, 1990). Thus, the examination of the development of high technology intensive industry in a less developed country requires the rescue of the historical process that promoted structural changes. The search for a higher level of industrial development, understood as the gain in competitiveness, finds its expression in the adoption of industrial policies.

Government policies can play an important role in construction and consolidation of environments and opportunities propitious for the development of different industries. The active participation of governments is able to influence not only the way companies operate in the market and how they take strategic decisions, but also the emergence of new firms. Hence, in many times this action implies results and consequences that have connection with the consolidation of a favorable economic environment.

In terms of government industrial policy influencing economic activities, there are different perspectives in the literature. The evolutionary approach proposes an active industrial policy, directed to sectors or activities capable of inducing technological change, and to the economic and institutional environment responsible for influencing the development of enterprises and industries (Suzigan & Furtado, 2006). In this perspective, public policy can stimulate the creation of competitive advantage in firms and countries. However, it is essential that the incentives generated by the policy are perceived and properly exploited by the agents (Guennif & Ramani, 2012).

Even if the success of a determined measure depends strongly on economic conditions that are not directly influenced by the state, the adoption of certain public policies can be decisive for the industrial and technological development. In this perspective, the conduct of a policy should be based on the response of the agents, given the changes in the competitive environment and the appearance of windows of opportunity. In the latter case, the actions of the State to facilitate access to these new conditions, through, as example, changes in regulatory frameworks, can speed up the response of firms in the search for higher levels of technical and productive capacity. In any case, the combination given by the degree of productive and technological capacity of firms and the competitive environment in which agents operate and make decisions define the real possibilities for development of an industry.

The business strategy planned to use or build competitive advantages should consider the industry structure and the forces that make up their competitive logic, as the bargaining power of suppliers and buyers, the threat of entry of new companies and products and the rivalry of existing competitors (Porter, 1989). National regulatory regimes are essential to the relationship between corporate behavior, strategic decisions and government policies.

The pharmaceutical industry in Brazil began in the 1920s with the installation of the first national laboratories. Initially, companies were operated by local small-scale production and had high dependence on foreign source inputs. With the onset of World War I, the restrictions on imports of inputs promoted the expansion of domestic production. During this period, the more permissive patent law enabled the industry development not only in terms of production, but also of new medicines (Urias, 2009). After the end of World War II, with the resumption of international trade, domestic demand was again met by imports, which represented a strong disincentive to domestic production.

From the 50s, the expansionist strategies and government policy of attraction of foreign capital stimulated the entry of these companies in the country. In addition, the import substitution policy practiced in the period encouraged the installation of multinationals in Brazil as access requirement to the national market. However, multinationals only transferred the final stages of production and marketing of drugs, but not the stages of Research and Development (R&D) and production of pharmaceuticals (Paranhos, 2010). Moreover, due to their smaller scale, national companies could not use the measures adopted to facilitate the import of equipment. In short, as a result of policies, multinational companies began to import components and active principles, expanding its production in Brazil (Guennif & Ramani, 2012).

The drug imports declined as multinational companies increased production in the country. The imports, which accounted for 70% of national consumption of drugs in 1953, fell to residual levels at the end of the decade. In addition to the significant reduction in imports of medicinal products, the presence of multinationals in the country allowed that there was an increase in the technical, organizational and managerial standards of production. However, production was excessively concentrated in a group of companies that make no innovation activities. Moreover, these companies purchased the necessary supplies from its headquarters in the countries of origin, often practicing transfer pricing (Palmeira Filho & Pan, 2003).

In the 1960s, was observed the emergence of government measures that aimed to reduce national dependence on imported inputs. Among them, the constitution of the Conselho Nacional da Indústria Farmacêutica (Pharmaceutical Industry National Council), the establishment of the Union monopoly in order to import pharmaceutical raw materials and the creation of the Farmoquímica Brasileira S/A (Farmobrás), which has not been effectively implemented (Bermudez, 1994). Guennif & Ramani (2012) point out that the difficulty of access to essential medicines in the period led to the development of these projects, demanding the government to take quickly a position to encourage domestic production.

In 1969 enters into force the law that prohibited the granting of patents for processes of production of substances, materials or pharmaceutical chemicals. There was also, in 1971, the promulgation of the Código de Propriedade Industrial (CPI; Law 5772), which did not recognize patents or chemical processes of input obtainment (Palmeira Filho e Pan, 2003). According to Vidal (2001)), this code prohibited patents in the areas of food, pharmaceutical products and processes, as a policy to promote local pharmaceutical companies.

In the 70s Brazil was the largest seller in Latin American market, but with high dependence on import of drugs, as 75% of the domestic market was supplied by multinational companies (Paranhos, 2010). Thus, the CPI stimulated domestic companies to produce copies of patented drugs in the country with its own brand, a fact that characterizes the beginning of the similar product in the country. These drugs were advertised as having effects similar to those effects of the original product, but had the advantage of being produced at a lower cost (Palmeira Filho & Pan, 2003).

In 1984, the Ministries of Health and of Industry and Trade edited the Portaria Interministerial No. 4, as an effort to encourage domestic production of drugs. Through this ordinance, import tariffs for drugs were elevated and the import of some inputs was prohibited in order to protect and stimulate the domestic market. As a result, there was an increase in the installation projects of these inputs production plants in the country (Palmeira Filho & Pan, 2003). At the end of the decade, more than 70% of the drug market was served by domestic production (Radaelli, 2003), allowing the sector revenues to rise by more than 100% during the period, from US$ 270 million in 1980 to about US$ 500 million in 1990.

The institutional changes initiated in the late 1980s changed the overview of the industry. The reduction of tariffs and subsequently import liberalization induced the companies established in the country, both domestic and foreign, to import inputs once produced in the country, or that could be produced in the future (Radaelli, 2003). In 1996, the Lei de Propriedade Industrial (9.279) allowed back the protection of knowledge over chemicals and pharmaceuticals, establishing patent protection for 20 years. This law follows the rules of the TRIPS (Trade-Related Aspects of Intellectual Property Rights), fulfilled at the conclusion of the Uruguay Round, in which were also realized other arrangements and created the World Trade Organization (WTO) (Paranhos, 2010).

The International Patent Agreement, prior to the one established by the TRIPS agreement, gave the right to choose which areas would be established patent (food, microorganisms, processes and pharmaceuticals, etc.), enabling the country to preserve the patents in areas of national interest. According to Vidal (2001), the new legislation imposed to the world a neoliberal model, since the nations – in the grant of patent history – aimed to protect themselves by not deferring the patents while they did not have acquired some technological competence to the medicines production. Thus, Brazil accepted the patent protection rules even before the constitution of an internal structure able to produce essential medicines to the population. In addition to the structural limitations of the domestic industry, the adoption of these rules made even more difficult to control the domestic supply and increased the country's dependence on foreign production.

In 1999, the Lei dos Genéricos encouraged the increase of production and number of national firms. Despite the generic medicines production, there was a persistent decline in the drug market, concomitant with the elevation of drug and medicines imports. The strategy adopted by the Brazilian subsidiaries of the multinational companies was to deactivate the production of pharmochemical in the national territory and import them from the headquarters (Palmeira Filho & Pan, 2003).

The domestic pharmaceutical industry produces drugs in its final form and pharmacochemicals, being able to formulate and produce some of the active ingredients used in the production of final products. However, the sector is highly dependent on raw materials and intermediate inputs from abroad (Vieira & Ohayon, 2006), since most of the domestic and foreign companies work in drug production final stages and marketing. Industry limitations are in the first two phases (R&D and production of pharmaceuticals), which require large amounts of investment and have a high degree of uncertainty, characteristic of research and development activities. These activities are mostly developed by academy/university, with no significant presence of private companies. Some multinational companies also operate in the synthesis process and production of drugs, but in insufficient volumes to meet the national needs and dependence on active ingredients and intermediates.

The Indian pharmaceutical industry starts with the establishment of several British research institutes for tropical diseases, such as the King Institute of Preventive Medicine in Madras in 1904, the Central Drug Research Institute in 1905, and the Pasteur Institute in 1907. The industry grew during World War I because the impossibility of importing. However, the country remained heavily dependent on European countries (especially France, UK and Germany) until the independence (Felker, Chaudhuri & Gyorgy, 1997). During this period, the multinational companies predominated in the market, importing drugs and supplies.

With the country's independence in 1947, there was a clear government's emphasis on creating a strengthened public sector, defining specific areas of focus for the public and private sectors. Thus, India has managed to make some progress in the production of inputs used in medicines, while remaining dependent on imports. In 1952, some drugs were produced locally, but at a very high price. Attempts to reduce imports were made with the creation of public enterprises (FRANÇOSO, 2011).

Through 1960 to 1965 the government made strong investments in public companies. When there was no local alternative to the technology of the multinationals, the government sought to attract foreign investment. However, multinational firms did not invest in production plants, even having great profitability given by the protected market (Felker, Chaudhuri & Gyorgy, 1997). With research institutes created between 1950 and 1960 (more specifically Hindustan Antibiotics Ltd in 1954 and the Indian Drugs and Pharmaceuticals (IDPL) in 1961), the country developed skills to adapt technologies of foreign companies to the reality of Indian firms. This learning would be especially important in the future for the production of generic medicines. Research institutes, public companies and subsidiaries of multinationals settled later made possible the creation of a knowledge base for the industry (FRANÇOSO, 2011). Companies of United States, Switzerland, Germany, Italy and the United Kingdom, in collaboration with Indian companies, provided denser technical knowledge to the country.

With the establishment of the IDPL first plant, several other companies in the pharmaceutical industry were established in the city of Hyderabad. It is estimated that the founders of one third of the existing Indian firms have worked in IDPL. Public companies were historically important because they represented a training site for the technical personnel and executives who later migrated to the private sector.

Since 1970, important institutional changes occurred and contributed to the latest development of the pharmaceutical industry in India. Were established The Drug Price Control Orders (DPCO) in 1970 and later in 1979, as an effort to combat the continued rise in drug prices. The Foreign Exchange Regulation Act (FERA) in 1973 and the New Drug Policy in 1978 also represented government intervention in order to stimulate the sector (RAY, 2008). The Patent Act, in force since 1911, gave protection to the product and the process for a period of ten years, renewable for another six years, acting as a deterrent to the development of local technology. Hence, it was modified in 1972, protecting the manufacturing processes for seven years. Thus, several local companies started to produce drugs that were imported (FRANÇOSO, 2011), so that only substances developed in India were entitled to patent protection (Ray, 2009).

The 1979 DPCO expanded price controls that had been fulfilled in 1970 to about 80% of the Indian pharmaceutical industry, while the FERA sought to regulate the operations of foreign companies, in order to protect and encourage the capacity of local companies through foreign capital control (Ray, 2009). The quality regulatory authority maintained the quality standard at a low level, stimulating small businesses that produced without access to sophisticated equipment for testing. Despite the frequent lower quality compared to the internationally adopted one, India was able to produce these medicines at affordable prices and being able from then on to elevate its production standards.

The Hatch-Waxman Act in the United States in 1984 provided the necessary window of opportunity for Indian companies producers of generic medicines (Guennif & Ramani, 2012). The access to a large consumer market, combined with productive and technological capabilities, as well as capabilities to connect with regulations, encouraged Indian companies, strongly contributing to the elevation of their export-orientated production.

The changes brought after 1990 through the WTO, which had as one of the objectives to encourage free trade and to remove "distortions" in the economy caused by government policies, imposed challenges to the Indian pharmaceutical industry. The modification of the Intellectual Property Rights regime to comply with the TRIPS agreement prevented the marketing of branded drugs through reengineering (Guennif & Ramani, 2012).

However, the production structure previously developed contributes to the results of the Indian pharmaceutical industry. Considered one of the most successful industries in India, the pharmaceutical industry has in the country a well-structured base of public enterprises, local private companies and subsidiaries of large multinational companies, which has shown strong growth since the country's independence (Felker, Chaudhuri & Gyorgy, 1997).

In India, in addition to search by multinational companies for cheap and skilled manpower, production is stimulated by the costs, estimated to be 50% lower compared to Western countries, R&D costs about one-eighth and clinical trials one-tenth. India created institutions to train researchers and technicians for the industry, enabling the development of pharmaceutical processes in order to capacitate producers to provide high quality products as well as being able to reproduce efficiently drugs originated outside (Felker, Chaudhuri & Gyorgy, 1997).

With technical and production structure quite consolidated, local producers have been successful in developing generic drugs from the time the patent was no longer valid.

In this section we analyze the foreign trade of the pharmaceutical industry in Brazil and India through different indicators. These indicators are used as instruments to assess structural and performance conditions, productive and technological capabilities of the two countries and determine the degree of dependence of a country in relation to foreign production and relevance in the international market. Export flows of goods produced by a country can reveal the degree of competitiveness, while import flows may indicate dependence of both inputs - international participation - as of produced final goods - (in) external dependence. Thus, in addition the reflection of the technical-productive reality of a country, international trade can also reveal the degree of maturity of their industry.

The basic hypothesis is that countries export goods in which they have competitive advantages, while import goods in which do not have such advantages. The second assumption is that countries with skilled labor and availability of capital can produce and export goods that have high added value. Alternatively, countries with less of these features have strong technological dependence, which are reflected in the low levels of exports of high-technology goods, along with high rates of imports of such goods.

However, the productive strategies adopted by multinational companies, can influence the outcome of the calculated indicators. This is especially true when is considered the internationalization of different stages of the same production chain. In the case of the pharmaceutical industry, the trend is observed in the concentration of higher value-added production steps in more developed countries. The least developed countries act in steps that have lower technical and economic dynamism. In addition, multinational companies can use a country as an export base for other regions. Thus, it is required attention to the historical conditions to understand certain results achieved in terms of international trade. It should be noted, however, that the multinational company allocates a productive process stage in a country if it recognizes in that country the existence of advantages to be exploited (Ietto-Gillies, 2005). Thus, although the export is made by a multinational company, the discussion about the advantages or disadvantages of countries still valid.

For the construction of the indicators were used the data provided by COMTRADE (United Nations Commodity Trade Statistics Database). The data have four-digit level of disaggregation, which allows a distinction between the different therapeutic classes: antibiotics (code 5421); hormones (5422); alkaloids (5423) and; n.e.s. drugs (Not elsewhere specified) (5429). The monetary values were deflated by the Producer Price Index: Pharmaceutical Preparation Manufacturing, US pharmaceutical preparations producer price index. The indicators used in this article are described below.

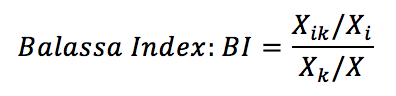

Where:

Xik: Exports made by the country i of the therapeutic class of drugs k;

Xi: Total exports of country i;

Xk: Total world exports of the k therapeutic class medicines;

X: Total world exports.

The Balassa index is a revealed comparative advantage indicator (VCR), and measures the proportion of a product in the export of a country in relation to the share of exports of the same product in world exports. This index can be calculated regarding a specific country: the product k exported by country i may have comparative advantage (indicator greater than unity) when the destination is the country j, but have no advantage (less than unity) when the destination is the country z. The calculations made here considered the world market, which means that when a country has a comparative advantage, this indicator is an advantage throughout the global market.

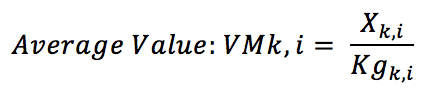

At where:

Xk, i: Value of exports of the therapeutic class of drugs k for a country i;

Kg k, i: Weight in kilograms of drugs in the therapeutic class k.

The average value measures the technology content incorporated in a product, assuming that the larger the index, the greater technological content embedded in products. This indicator is most appropriately used to compare values of the same product from different countries. Thus, the same product in different countries with different average values is indicative of international asymmetries in terms of technological field.

The reviewed period begins immediately after the Real Plan in 1995, and a year before Brazil, unlike India, complied with patent protection rules of the TRIPS agreement. For Brazil, there is a volume of imports significantly higher than exports of medicines, a result that indicates the need for the supply of the domestic market with imports, given the insufficient domestic production. Imports are both medicines and pharmaceutical raw materials needed for the production of medicines, while Brazilian exports in the period are mostly generic medicines. The Brazilian exports are composed of medicines with lower value. The reference products exported by Brazil are most often produced by multinational companies using the country as an export platform.

In the case of India, exports are greater than imports in the observed period. Unlike Brazil, with the liberalization of the Indian economy in the 90s the production of medicines and pharmaceutical goods increased. New firms entered the market and the existing ones expanded their manufacturing capacity, which was previously only allowed by authorization (GUENNIF & RAMANI; 2012). Indian production increased both in terms of finished drugs as in pharmochemicals and pharmaceutical ingredients, indicating a densification of productive stages of the industry. However, generics account for the majority of Indian exports.

Indian imports remain at low levels compared with exports: if the first increase non-linearly, the latter's growth rates were higher, showing the effort to decrease the external dependence. With the growth of production, an important part of domestic demand has to be attended by drugs produced in India by national companies. This was possible because of the expertise of these companies in the production of generic drugs, which enabled the construction of technical and production capabilities over time.

The volume and trade flows are important for comprehension of the countries' productive dynamics because this interaction helps to determine the level of productive capacity of a country. For this, we must consider not only the type of goods traded, the volume and direction of the business transaction, but also business partners.

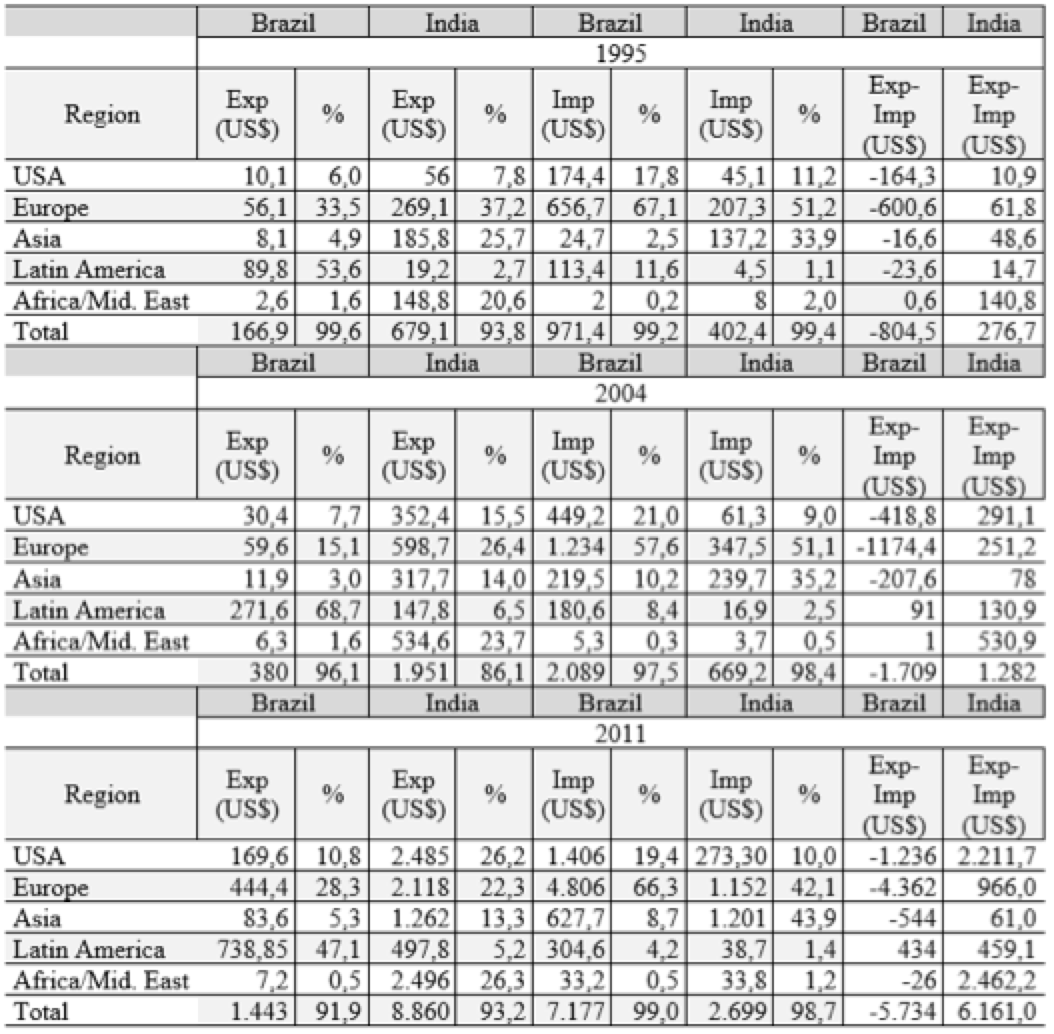

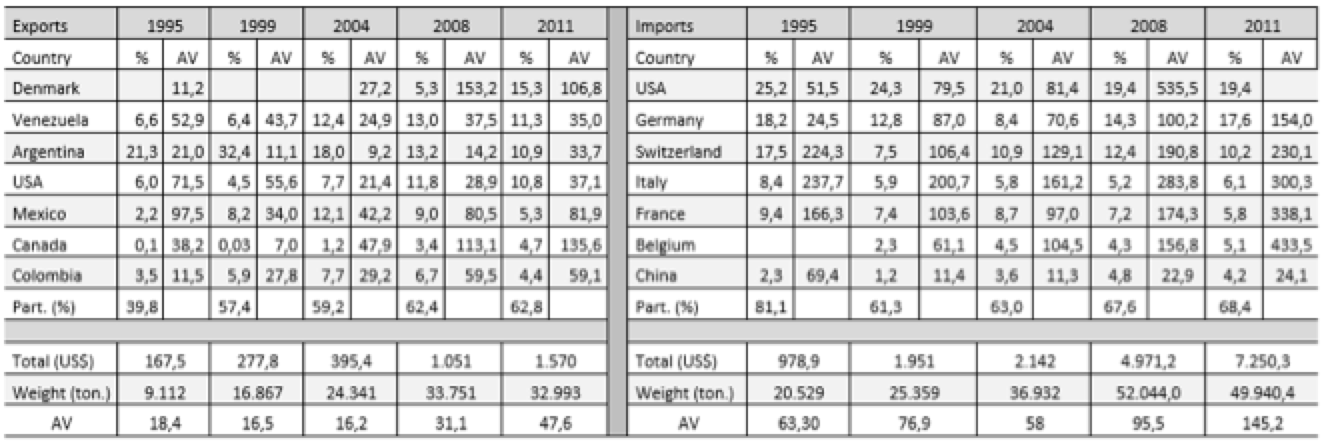

In Table 1, we see the destinations of exports of Brazilian and Indian medicines. The export destinations reveal important differences. Export to countries known to have high regulatory requirement levels implies a production that meets these requirements, which involves not only strict control in production mode, but also ability to adapt to international quality standards.

In this sense, the ability to diversify trading partners is an important indicator of ability to deal with different regulatory systems. The core countries have more stringent quality standards, and represent the most competitive markets, while less developed countries may have lower levels of regulatory requirements and markets where competition is less fierce.

In the Indian case, the prior accumulation of capabilities allowed entry into the world's major markets, which are more competitive and demanding. From 1995 to 2011, there is an increase in export flows to the United States. Sales of drugs to the United States grew from 7.12% of total Indian exports in 1995 to 17.27% in 2004 and 30.4% in 2011. In Europe and Asia, there is a decrease of such participation although the volume exports have grown up, which helps to sustain the growth of the total volume exported.

These percentages can be explained by a set of associated factors. First, the building of productive capacities by Indian firms. This achievement is often done in the long run, taking into account the time required for firms to respond to sectoral policies adopted to stimulate the production and quality. Second, the window of opportunity that has opened up, especially in 2003 and between 2005 and 2010, with the expiration of patents on several drugs in the United States, creating the possibility of commercialize generics. Third, the need to decrease health expenditures boosted sales of new generics which were presented as an alternative to drugs used by the population. Since there was a possibility to commercialize generic medicines along with the intention of reducing health costs, Indian companies succeeded to enter the US market by being able to produce generic with quality.

Table 1: Export destinations and trade balance of Brazil and India

Source: Comtrade. Prepared by the authors.

Note: Products of SITC. Ver. 3, cod. 54.

In Brazil, the destination of exports of drugs is mainly the regional market. Historically, the main destination of exports of Brazilian medicines are Latin American peripheral markets. For example, in 1995, Argentina, Chile, Peru, Venezuela and Bolivia accounted for about 70% of total Brazilian exports, indicating strong concentration on those markets. Moreover, compared to India, export volumes are significantly lower.

Although Latin America still represents the main destination of Brazilian exports, there is a growing share of the European market, despite being quite concentrated in a few countries. In 1995, of all Brazilian exports, 11.74% was destined for Europe, and of this amount 10.22% was destined for Germany. In 2004, 5.56% of exports were destined for Europe, with Germany accounting for almost all. In 2011, 31.59% of exports of medicines made by Brazil were to Europe, with Germany represented 3.4%, while Denmark accounted for 22.66% of the total.

This change in the relative share of Latin America regarding Europe can be explained by the role of multinational companies in Brazil, especially in the case of Denmark as an export destination. The emergence of Denmark as an export destination is the result of a particular strategy of the Danish company Novo Nordisk: acquisition of technology and of the production plant of Brazilian Biobrás and use of the country as an export platform of drugs containing hormones.

In short, Indian exports are largely generic drugs produced by Indian capital companies, with about 50% going to the US market and Europe. Thus, the presence of Indian drugs in the US market is largely a result of the effort involved in making the most competitive Indian pharmaceutical industry internationally.

On the other hand, Brazilian exports are largely concentrated in the regional markets (50%) or dependent on strategies practiced by multinational companies (32%). Thus, the presence in the European market is not due to construction of productive capabilities by Brazilian companies, but by the country's insertion in the international production chain through a specific product.

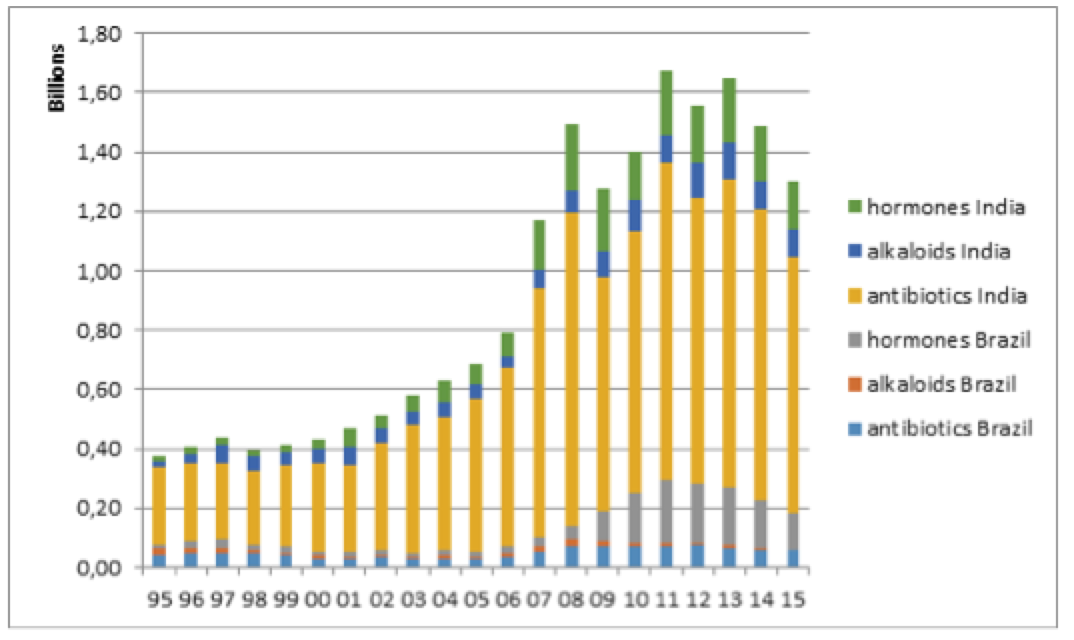

In Chart 1, we can evaluate the export flows of drugs by therapeutic class. The participation of each country in the amount of world exports can be observed by drug class. As the chart, most of the Indian exports consist of antibiotics. The flows of these products predominate since the beginning of the series, with strong growth trend. In 2008, 8% of all exports of the world's antibiotics were made by India, therapeutic class in which the country is specialized. In addition to this apparent expertise, Indian exports of alkaloids and hormones and drugs n.e.s. also grew, but at lower rates that antibiotics. This performance is explained by the historical effort of the public sector to enable Indian industry in this segment.

The big change in global pharmaceutical company, which enabled the growth of exports of Indian antibiotics, was the end of unprecedented amount of drugs patents. The set of blockbuster drugs that had their patents expired includes drugs for depression, diabetes, cholesterol, dizziness, allergies, HIV, hepatitis, viral, allergens, baldness, anticoagulants and antibiotics. Analysts revealed that between 2005 and 2010, drugs that moved 55-60 billion dollars had their patents expired (ECONOMIC TIMES, 2004). Thus, the windows of opportunity created by the expiration of patents were well perceived and incorporated by the Indian companies.

The results also indicate that Indian firms have succeeded in trying to get permission to produce antibiotics, developing production capacities and the ability to deal with regulatory systems. Therefore, the export of these products increases in periods of expiration of patents for such medications. Before the end of the patent of a drug, the generic manufacturing companies anticipate to apply for permission to produce it. This strategy allows firms to ensure their right of production of generic medicines, an essential element for competition in this segment.

Chart 1: Participation in global trade by therapeutic classes

Source: COMTRADE. Prepared by the authors.

Note: products of SITC. Ver. 3, cod. 5421 and 5413, 5422 and 5415.5423 and 5414

In Brazil, the emphasis is on growth hormones exports. As mentioned, this export flow is the result of the Danish company's performance, Novo Nordisk, which acquired the Brazilian company Biobrás, a pioneer in insulin production in Brazil (VALOR, 2001). The acquisition of this national capital company follows the strategy of large multinational companies to seek new markets and assets. In this case, in addition to accessing a portion of a new market, Novo Nordisk has added to its portfolio a production technology that it did not have.

Thus, the increase in exports of hormones produced in Brazil does not represent a gain in productive capacity, but only transfer of ownership. Furthermore, Biobrás was the only producer of insulin in Brazil. In this sense, the control acquisition of Biobrás by a foreign firm may be indicative of worsening external dependence on drugs.

Tables 3.1 and 3.2 (annex) show the average values (AV; dollars/kg), destinations or origin and the percentage that each of the trade flows represented in total in Brazil and India. To the average value, it was assumed that a high value indicates a higher technological content of the product. This study selected only exports and imports from countries representing more than 1% of the total. If we associate this little restrictive approach to the small number of countries, we see the concentration of trade flows in a few destinations.

In the Brazilian case, a concentrated structure of the export market is observed. During the analyzed period, 80% of the Brazilian medicines exports were destined to 12 countries, the largest part to countries from Latin America. Only in most recent years, countries from outside this region became part of the Brazilian medicines destinations, excepting Germany, which figures as an export destination since 1995.

Another important point to note is the average value of exported drugs. For Latin America, the average values remain at much lower levels compared to other destinations. Considering it as an indicator of technological content, the highest average value of goods destined for Europe and the United States is explained by the use of Brazil as an export platform for multinational companies. In the case of reference products, these companies allocate the latter stages in Brazil, especially the manufacturing process, and export to its main markets. Although the value of exports is high, the stage held in Brazil is the manufacturing of the final product, i.e., "assembly" of pharmaceutical ingredients which, together with an imported active ingredient, results in the final product. Multinational companies also export generic drugs, but if are considered the differences in the average values of exports destined to developed and developing countries, these goods should preferably be directed to the local and regional market. Pfizer, as an example, acquired the Brazilian company Teuto, specializing in generic to produce in Brazil generic drugs of their own medicines which had the patent expired (O ESTADO DE SÃO PAULO, 2014).

Although the Indian case also observes certain concentration in a few countries, it occurs less if compared to Brazilian exports. In 1996, the selected countries accounted for 57% of Indian exports, while in 2011 they accounted for 70%, with special participation of the United States. In addition to the fact that exports have more diverse destinations in Asia, Africa and Europe, throughout the series new countries appear as export destination, such as South Africa, Australia, Brazil, Canada and France. The successful expansion of trade and the conquest of new markets can be understood as a result of absorption of technological skills and policies adopted by India.

The average values of exports are lower than the values of the drugs exported by developed countries because India is an exporter of generic copies of the reference products. Thus, these drugs become more accessible to lower-income countries, allowing India to export these drugs to various destinations.

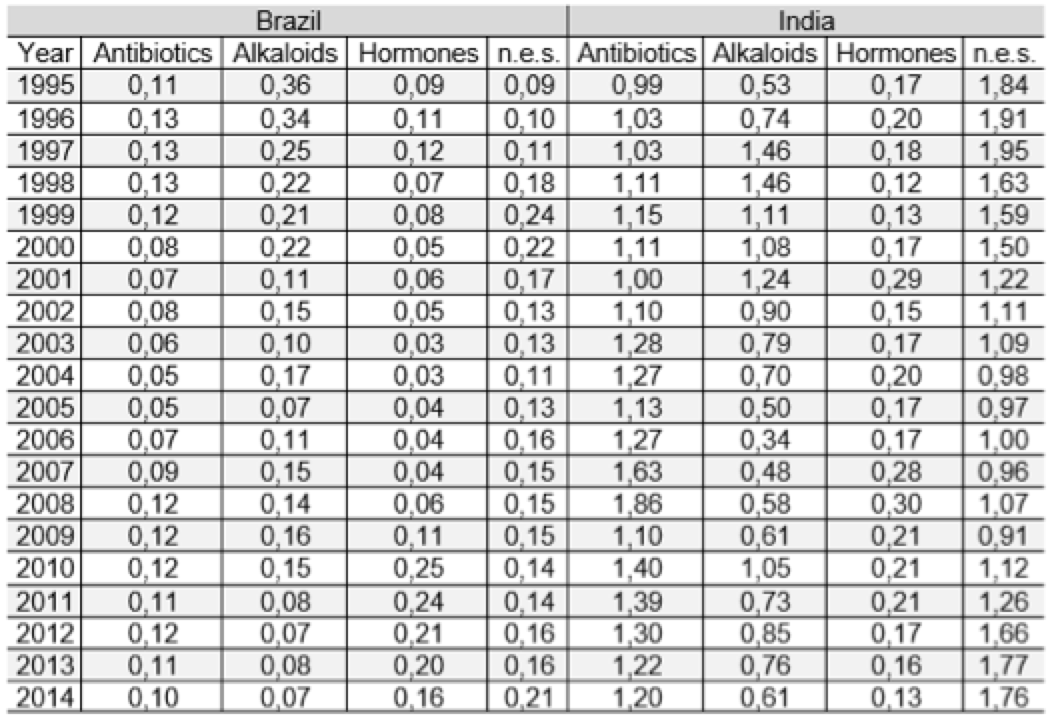

Table 2 shows the index of revealed comparative advantages for Brazil and India, by drug class. The revealed comparative advantage index allows to highlight the performance of Indian antibiotic drugs with high advantage in this class of drugs throughout the study period. Despite the fluctuations, it is clear that the comparative advantage in antibiotics remains in a continuing basis in the country. The constancy and the high degree of comparative advantage indicate a competitive production structure. The drugs n.e.s. also reveal high competitiveness. Indian drugs based on hormones showed low comparative advantage indices throughout the series. In the case of alkaloids, however, it is observed considerable fluctuation in rates, recovering from 2007. In short, if the other drug classes do not have the same performance as antibiotics, we can assume that pharmaceutical advances have resulted in certain Indian specialization.

Table 2: revealed comparative advantages - Brazil and India: 1995-2014

Source: COMTRADE. Prepared by the authors.

SITC. Ver. 3, cod. 5421 and 5413.5422 and 5415.5423 and 5414, 5429

In Brazil, there is a lack of comparative advantage in all classes of drugs for the observed period. Only from 2010, in the class of hormones, the country began to show a slight improvement in the indicator but, is not possible, however, admit the existence of comparative advantage. The use of Brazil as an export platform may explain the progressive increase of the hormones that starts in 2004. For the alkaloids, there is strong fluctuation in indicators, marked by periods of increase in values followed by sharp declines, indicating inability to hold the position.

In this work the performance of the pharmaceutical industry in Brazil and India was evaluated. The study consisted in the evaluation of foreign trade indicators from historical aspects of the industry in both countries. The macroeconomic context, in addition to the different forms of perception of the agents about the policies adopted are important elements to explain the different results for the two countries. However, it appears that the different positions of the Indian and the Brazilian governments in the adoption process of the new intellectual property regime established by the TRIPS Agreement is a key element to explain the observed differences in results (Hasenclever & Paranhos, 2013). While Brazil decided not to use the harmonization period allowed for compliance to TRIPS, accelerating the process of implementation of the new rules, India used all the allowed period. The implication of this difference in policy fell mainly on the way of learning and technological capability of firms, subsequently reflecting different trajectories in the performances obtained in international trade. Therefore, although both countries have adopted liberalizing macroeconomic policies, industrial and technology policies were different, creating different opportunities for domestic enterprises. In this sense, the adoption of long-term industrial and technological policies are crucial to success in the training of national industries.

Both Brazil and India have specialized in the production of generic drugs. India, however, has become exporter to major central countries, especially the United States. The construction of productive and technological capabilities, along with the enactment of the Hatch-Waxman Act in the United States in 1984, provided the necessary window of opportunity for the Indian companies producers of generic medicines (Guennif & Ramani, 2012). Thus, the United States grew considerably as export destination for Indian medicines. Indian production also supply the domestic demand, with the imports being, largely, medicines that India does not have technological and productive capacity. Both exports and imports performed by India and Brazil are concentrated in a few countries.

In Brazil's case, the exports are largely a result of the performance of multinational companies using the country as an export platform. The main example is the Danish company Novo Nordisk, which acquired the Brazilian company Biobrás, producing medicines that have hormones (especially human insulin). After this acquisition, Denmark, country of origin of the multinational, is the fastest growing as an export destination of drugs produced in Brazil, featuring the subsidiary expertise within the enterprise and intra-firm trade. Also, note the increase in exports of hormone drugs and indices of revealed comparative advantage for this class compared to other drug classes. Thus, the performance of a single company strongly influences the Brazilian indicators. Moreover, the national capital companies export mainly to regional markets in Latin America, while multinational companies export to the European market. In addition to raw materials and active ingredients for domestic production, Brazil depends on imports to supply the domestic demand.

The main activities developed in Brazil consist in the final stages of the drug production process. The final steps are those with less technical and production complexity, and represent less technological and economic dynamism. This situation occurs for both the production of multinational companies and the largest part of the production of domestic capital companies. Since, in the pharmaceutical industry, the construction of productive and technological capacity occurs when you can act in earlier stages of the production chain, Brazil remains with low levels of technological capability in the industry.

As pointed out by Guennif & Ramani (2012), from the study of the pharmaceutical industry in Brazil and India four points stand out. Firstly, the window of opportunity that emerged for both countries did not occur due to a technological discontinuity. Regulatory changes generated windows of opportunity for Indian and Brazilian companies, indicating that public policies and the set of regulations of a country can generate the necessary environment to build skills.

Second, it is necessary that the stakeholders perceive the windows of opportunity and act to accumulate skills. It is clear, in this case, the differences between the Indian companies that have sought to develop new production methods, when India established a regime of more permissive patent in 1972, and Brazilian companies that have not invested in reengineering even with a patent regime more favorable, preferring to imitate the multinational companies to focus on the latest production chain stages.

Third, the adopted policies generate expected and unexpected results. In Brazil, the reformulation of the patent system did not result in accumulation of productive capacity, while the Lei dos Genéricos, aimed at the interests of public health, was perceived as an opportunity for national companies, which began to build skills in generic drugs.

Fourth, the authors point out that the agents can perceive distant windows of opportunity. Indian companies entered the US market through regulatory changes in that country and India, indicating that the enactment of the Hatch-Waxman Act in the United States in 1984 was perceived as a window of opportunity and captured by the Indian companies.

Thus, it is seen that the construction of productive and technological capabilities is fundamental so that we can take advantage of technological discontinuities and/or windows of opportunity. For this, public policies play essential role in creating the enabling environment for economic agents to respond appropriately to windows of opportunity that emerge in both the commercial aspect and the aspect of building productive and technological capabilities.

Table 3.1: Average Value (AV) – Brazilian exports, imports, and countries of destination and origin (millions US$)

Table 3.2: Average Value (AV) – Indian exports, imports and countries of destination and origin (millions – US$).

AMENDOLA, G.; DOSI, G.; PAPAGNI, E. The Dynamics of International Competitiveness. p. 451–471, 1993.

BELL, M.; PAVITT, K. The development of technological capabilities. Technology and International Competitiveness. In: HAQUE, I. U. (Ed.). . Trade, technology and international competitiveness. Washington: The World Bank, 1995. p. 69–101.

BERMUDEZ, J. Medicamentos Genéricos : Uma Alternativa para o Mercado Brasileiro. Caderno de Saúde Pública, v. 10, n. 3, p. 368–378, 1994.

COHEN, W. M.; LEVINTHAL, D. A. Absorptive Capacity : A New Perspective on Learning and Innovation. Administrative Science Quarterly, v. 35, n. 1, p. 128–152, 1990.

DOSI, G.; SOETE, L. Technological Change and International Trade. In: DOSI, G. et al. (Eds.). . Technical Change and Economic Theory. 1. ed. Londres: Pinter Publishers Limited, 1988. p. 401–432.

Economic Times. Disponível em: http://articles.economictimes.indiatimes.com/2004-12-17/news/27367599_1_drl-tentative-approval-laboratories, acesso em 17/07/2014

FELKER, G.; CHAUDHURI, S.; GYORGY, K. The Pharmaceutical Industry in India and Hungary: World Bank Technical Paper. Washington. 1997.

FRANÇOSO, M.S. A indústria farmacêutica nos países emergentes: um estudo comparativo sobre a trajetória de desenvolvimento do setor na Índia e no Brasil. Faculdade de Ciências e Letras de Araraquara, Unesp. 2011

GUENNIF, S.; RAMANI, S. V. Explaining divergence in catching-up in pharma between India and Brazil using the NSI framework. Research Policy, v. 41, n. 2, p. 430–441, 2012.

HASENCLEVER, L.; PARANHOS, J. Le développement de l’industrie pharmaceutique au Brésil et en Inde: capacité technologique et développement industriel. In: L’emergence: Des trajectories Aux Concepts. Les Editio ed. Paris: 2008. p. 81–103.

IETTO-GILLIES, G. Transnational Corporations and International Production: Concepts, theories and effects. Cheltenham: Edward Elgar Publishing Limited, 2005.

MALERBA, F.; ORSENIGO, L. Technological Regimes and Sectoral Patterns of Innovative Activities. Industrial and Corporate Change, v. 6, n. 1, p. 83–118, 1997.

O ESTADO DE SÃO PAULO, 2014. Disponível em: http://economia.estadao.com.br/noticias/geral,generico-brasileiro-tipo-exportacao-imp-,1136728, acesso em 22/12/2014.

PALMEIRA FILHO, P. L.; PAN, S. S. K. Cadeia farmacêutica no brasil: avaliação preliminar e perspectivas. BNDES Setorial, n. 18, p. 3–22, 2003.

PARANHOS, J. Interação entre empresas e instituições de ciência e tecnologia no sistema farmacêutico de inovação brasileiro: estrutura, conteúdo e dinâmica. Universidade Federal do Rio de Janeiro, 2010.

PORTER, M. E. A vantagem competitiva das nações. 8a edição ed. Rio de Janeiro: Campus, 1989.

RADAELLI, V. Os investimentos diretos estrangeiros no Brasil e a questão tecnológica na indústria farmacêutica. Universidade Estadual Paulista, 2003.

RAY, A. S. Aprendizagem e inovação na indústria farmacêutica indiana: O papel da IFI e outras intervenções políticas. Reciis, v. 2, n. 2, p. 74–80, 2009.

SUZIGAN, W.; FURTADO, J. Política Industrial e Desenvolvimento. Revista de Economia Política, v. 26, n. 2(102), p. 163–185, 2006.

URIAS, E. M. P. A indústria farmaceutica brasileira: um processo de co-evolução de instituições, organizações industriais, ciência e tecnologia. Campinas. UNICAMP - Instituto de geociências, 2009.

VALOR, 2001. Disponível: http://www.valor.com.br/arquivo/1000036525/novo-nordisk-ficacom-o-controle-da-biobras#ixzz314DslIHb, acesso em 04/03/2014.

VIDAL, J. W. B. Indústria farmacêutica: Tecnologia, Patentes e Autonomia NacionalAgência Nacional de Vigilância Sanitária - ANVISA, , 2001.

VIEIRA, V. M. DA M.; OHAYON, P. Inovação em fármacos e medicamentos: estado-da-arte no Brasil e políticas de P&D, 2006.

1. Master’s Degree student in UNESP – Universidade Estadual Paulista (FCL/Ar). Email: kleber.franculino@gmail.com

2. Teacher’s in Department of Economic’s at UNESP – Universidade Estadual Paulista (FCL/Ar)