Vol. 38 (Nº 18) Año 2017. Pág. 18

Bruno Ferreira FRASCAROLI 1; Nelson Leitão PAES 2

Recibido: 25/10/16 • Aprobado: 30/11/2016

2. History of the monetary policy in Brazil

3. The brazilian economy setup

ABSTRACT: In this paper we calibrate to Brazil a model based on Christiano, Eichenbaum and Evans (2005) that uses some hypotheses in a New Keynesian approach, proposed by Calvo (1983). We study the impacts and persistence of the Brazilian monetary policy shocks over some variables through the elasticities and relations between macroeconomic variables in real and nominal side of the economy. This occur in a macroeconomic context of nominal rigidities in wages and prices through a Dynamic Stochastic General Equilibrium (DSGE) on variables such as inflation, consumption, output, investment, employment, the marginal product of capital, real wages, interest rate, total supply of money and growth rate of money. As main result, we report persistence of monetary shocks and economic dynamics. The model points out to a necessity of improvements in order to capture the agent’s behavior, trying, as well, bring some contribution to understand these effects on aggregate variables of the economy. |

RESUMEN: En este trabajo calibramos un modelo basado en Christiano, Eichenbaum y Evans (2005) que utiliza algunas hipótesis en un nuevo enfoque keynesiano, propuesto por Calvo (1983) para Brasil. Estudiamos los impactos y la persistencia de los choques de política monetaria brasileña sobre algunas variables a través de las relaciones entre las variables macroeconómicas reales y nominales de la economía y sus elasticidades. Esto se hizo en un contexto macroeconómico de rigideces nominales en salarios y precios a través de un Equilibrio General Dinámico y Estocástico (DSGE) en variables como inflación, consumo, producción, inversión, empleo, producto marginal del capital, salarios reales, tasa de interés, suministro total de dinero y tasa de crecimiento del dinero. Como principal resultado, se presenta la persistencia de shocks monetarios y dinámica económica. El modelo señala una necesidad de mejoras con el fin de capturar el comportamiento del agente, intentando, así, aportar alguna contribución para entender los efectos en las variables agregadas de la economía. |

There was not always a single monetary policy driven in Brazil. In this sense, investigating domestic monetary and financial markets involves deal with a complex history of change, experiences and learning on how to make monetary policy. In terms of theoretical orientation, an effective monetary policy usually requires the adoption of rules by the monetary authority to manage the money (TOMBINI and ALVES, 2006).

After a past history of heterodox shocks started by the monetary authorities and the regime change in the exchange rate, it was adopted in Brazil by Decree No. 3.088 of June 2, 1999 the option of a monetary regime based on controlling the rate of inflation. In this regime, the Monetary Policy Committee (COPOM) represents the monetary authority, which chooses to work with expectations of inflation in the price level of the economy and takes control of this variable.

According to Carvalho et al. (2007), New Zealand, Canada, United Kingdom, Finland, Sweden, and Australia, in the beginning of the 1990’s, as well as other developing countries such as Brazil, Colombia, Czech Republic, Mexico, among others, in the end of the same decade, have been shifted to the Inflation Targeting Regime (IT). Among the advantages of this regime, there are: clarity and credibility of the information of the monetary policy in the economy, flexibility, monitoring possibility, and evaluation of money management (FRAGA and GOLDFAJN, 2002).

On the other hand, the main disadvantages are intrinsic to the inflation variable such as the foresee ability level, the definition, and the range of the added goal of the required high exchange rate flexibility. In terms of literature of the game theory, the IT is simply the appliance of an action strategy that the monetary authority takes for granted to conduct economy (BARRO and GORDON, 1983b).

Modenesi (2010) states that since 1999 the IT has been promoting a restrictive monetary policy from a high interest rate applied by the COPOM, if compared to the interest rates in other countries during the same period. There are several explanations pointed to this fact, amongst them a very high public debt, and also the adverse behavior of the managed prices, a fact that has turned out to be more difficult the existence of a less severe monetary policy.

There are several scientific works that carry forward the empirical studies about this theme, for instance: Sims (1992), Bernanke and Mihov (1995), Clarida, Galí and Gertler (1997; 1998), Minella (2001), Fraga e Goldfajn (2002), Christiano, Eichenbaum and Evans (2005), named CEE (2005), Martinez (2012), Demchuk et al. (2012), Ferreira (2015), Montes e Nicolay (2016), among others. The results of some of these studies indicate asymmetry preferences in the central bank reaction function.

Among them, the most accepted view is that Government must deal with the markets failures’, acting as a market maker, managing the public investments that are necessary to promote the private investments. On the scope of the monetary policy, ensure the stability of prices to decrease the inflationary pressures that may be distorted and cause the inefficiency location of the resources.

Minella (2001), for example, has focused in the examination of the monetary policy and in the basic model including the Gross National Product (GNP), Price Index, and Money Stock. The author has compared three distinct periods of the Brazilian economy from 1975 to 1985, 1985 to 1994, and 1994 to 2000. He taking into account the inflationary changes, and he has obtained so forth some empirical results, as: the monetary shocks have a meaningful effect over the output and they do not lead to a reduction in the inflation rate on the first two periods, however there are indications that they have increased their power to affect the prices, after the implementation of Plano Real. As well, in the recent period, the interest rate responds deeply to the financial crises. Also positive shocks in the interest rates come within a decline in the money stock during all the three periods, and, as last evidence, the durability of the inflationary periods are shorter than during the recent period.

After the consolidation of price stability in Brazil, it was possible to discuss and analyze the relationship by using theoretical models with different sets. It is more appropriate, given the empirically more stabled relationships, to discuss monetary economics using theoretical models since Friedman (1968). This allows improvement of some classical hypotheses to New Keynesian models of Calvo (1983), and therefore of CEE (2005).

Thus, the main objective of this study was to analyze the impacts and persistence of the Brazilian monetary policy through the elasticities and relations between variables in real and nominal side of the economy, in the macroeconomic context of nominal rigidities of wages and prices through a Dynamic Stochastic General Equilibrium (DSGE). We use variables such as inflation, consumption, output, investment, employment, the marginal product of capital, real wages, interest rate, total supply of money and growth rate of money.

After we estimate the solution of steady state of the model, simulations were performed, consisting of estimations of disturbances in the terms of errors of the interest rate equation, which is the central bank reaction’s (1). So was possible to analyze its effects and the transition dynamics over the variables of the system mentioned before. In the next section of this work we made a resume of the history of the monetary policy in Brazil. The model setup was described in section 3, and in sections 4 and 5 we discuss the results and conclude the main key points.

In the beginning of the 1980’s, the Brazilian economy suffered the impact of the second oil crisis, and so the elevation of the international interest rates in 1979, plus the external debt crisis, extinguishing the external resources of the country. So it was necessary to manage the reality of a non-international liquidity environment. In this set, and in the attempting of stabilizing the price level, Government used to the interest rate adjustment, charging as the causes of the inflation the public deficit and the monetary expansion.

This mistaken inflation diagnosis became clearer during the recession years, from 1981 to 1983. Due to the turbulences occurred in the Brazilian economy in the beginning of the 1980’s, it is not possible to state that there was a well-established monetary policy regime at this period. On February 1986 a new attempt of stabilization – now with a heterodox nature – was adopted and called Plano Cruzado. Launching from the idea that the Brazilian inflation was inertial, it emerged a political proposal of fighting inflation, based on price freezing and on profits (heterodox shocks). The argument for such policy was that the inertial component of inflation could not be eliminated within orthodox monetary/tax measures, i.e., by the demand restraint (CAMPELO and CRIBARI NETO, 2003).

The Plano Cruzado and the following plans, named Plano Bresser (1987), Plano Verão (1989), Plano Collor I & II (1990 and 1991) have as their diagnosis the inertial inflation diagnosis, adopting price freezing measures, which did not succeed in the fight against inflation. They could only produce a temporary inflation reduction, however they tended to come back in the former platform of each plan.

On July 1994 Plano Real was carry out, and it was a meaningful and deep change in the Brazilian economy, that got established along with the transition of the flexible currency on January 1999, and with the adoption of IT on July 1999. With the dropout of the currency anchorage, Government had to choose other forms of guiding the economy. At this time it may be noticed that Government strongly leaned over the interest rate instrument, using it as a way to attract external capital and as a main tool to handle the inflationary control.

In this set, Government not only adhered to the flexible currency regime, nonetheless highlighted two other changes: the first one was the adoption of the IT for the conduction of the monetary policy and for improve agents expectations’; and the second one was the introduction of increase taxes in order to control the disequilibrium of the public accounts. Within these measures Government assumed the permanent commitment with price stability and also achieved the divulgation of the decisions.

The Central Bank of Brazil (CBB) started to quarterly publish inflation reports that did not only inform the dynamic of the inflation, but also handled a general analysis of the Brazilian economy. The predicted future by the model used, bring up possible changes in the policies issues ahead. Herewith, this set of measures seems to be a convenient explanation for the transition and the endurance of the Brazilian economy in the state of stability, in such a way it could use interest rate shock effects over the other variables of the system.

Evidences in Silva Filho, Silva and Frascaroli (2006) points out these shocks have distinguished effects during stable/unstable periods. Nonetheless, it is a consensus among the specialized studies that in the former period of the Real Plan interest rate did not have the effect of an anti-inflationary measure. It happen due to the huge instability of the economy, which hindered the appliance of this monetary policy instrument (MONTES and NICOLAY, 2016).

During the post-Real period it was possible to recover the interest rates as instrument to control inflation, especially after the adoption of the IT. According to Aragón and Medeiros (2015), this approach reveals that the macroeconomical variable handled by the monetary policy must be the inflation rates. Additionally, low and non-volatile inflation rate is an important condition for the price system to conduct proper information to the efficient allocation of the resources.

This demonstrates that this policy is driven by two channels: the first one is important as a coordinator element of the expectations, mainly for the financial market; and the second one is a transparent guide in the management of the monetary policy, which becomes dependent or not of the inflation adherence towards the established targeting (GIAMBIAGI and CARVALHO, 2001; (TOMBINI and ALVES, 2006).

After that period, in the president Luiz Inácio Lula da Silva government, we observe the permanence of the previous monetary policy regime, in terms of the minimum structured elements, since the ex-president Fernando Henrique Cardoso. We can observe many consequences of this regime, like some credit policy advances. Part of these considerations was because in the first part of the Lula’s Government, the situation of the internationals economies runs well. We can see one almost uninterrupted world growth till the crisis that started in September of 2008 in United States of America.

The main goal of this time was economic growth, driven by massive investment in the country's infrastructure, with support from BNDES and the Growth Acceleration Program (PAC). The focus of this program, in addition to economic growth, was the improvement in the living conditions of the population and the increasing number of jobs.

Thus, in late 2010 the Workers' Party (PT) is re-elected by candidate Dilma Roussef and his government began in 2011, with the partially balanced economy and the inflation rate around 6.5% per year. The government of President Dilma was marked by growing interest me protect the domestic industry, increased state size, high import tariffs, increasing the level of uncertainty and downturn in economic activity, compared to the immediately preceding two terms of President Lula.

However, the notoriously model called the New Macroeconomic Matrix previously adopted showed clear signs of exhaustion. The mobility of income and the enormous absorption of labor, especially less skilled workers caused by investments in infrastructure by the construction sector, no longer drove the economy, due to the change in the international situation of non-recovery of several European countries, motivated by the US crisis. Therefore, instead of the model lead to increased activity level in the economy, it increases the uncertainty and reduces the level of activity causing recession.

This recession, more recently presented a level of persistence, driven to a crisis that has lasted for almost two years. A high uncertainty index in the years 2014 and 2015 led strategies as wait and see, in that economic agents expect and observe how the future will reveal. In this context, consumers delay spending decisions and businesses interrupt investment decisions. Thus, the decrease in output is expected.

In 2015 a process of impeachment against President Dilma Roussef was started due to ‘fiscal maneuver’ term to refer to budget operations conducted by the National Treasury Secretariat (STN), in disagreement with the legislation which consisted of delay amounts of transfers to public and private banks, to ease the government's fiscal situation at the end of 2014.

Thus, the impeachment process followed in 2016 in the approval, ending in her deposition on August, 31. Soon after it the government of current President Michel Temer, former vice president in the support base to the PT government, of the Party of the Brazilian Democratic Movement (PMDB), toke office.

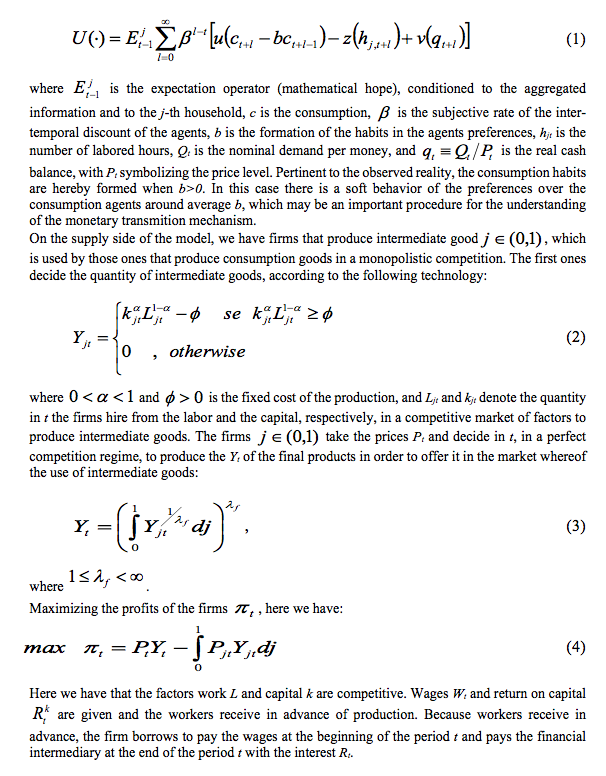

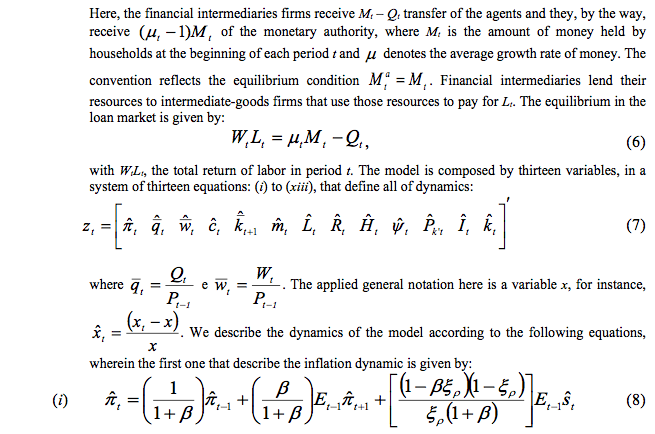

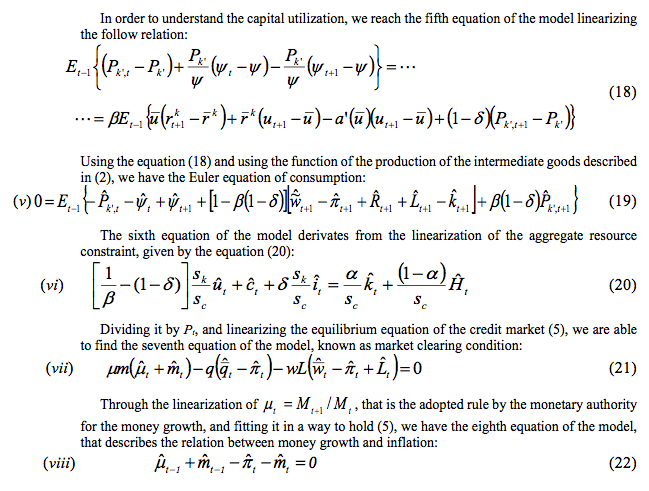

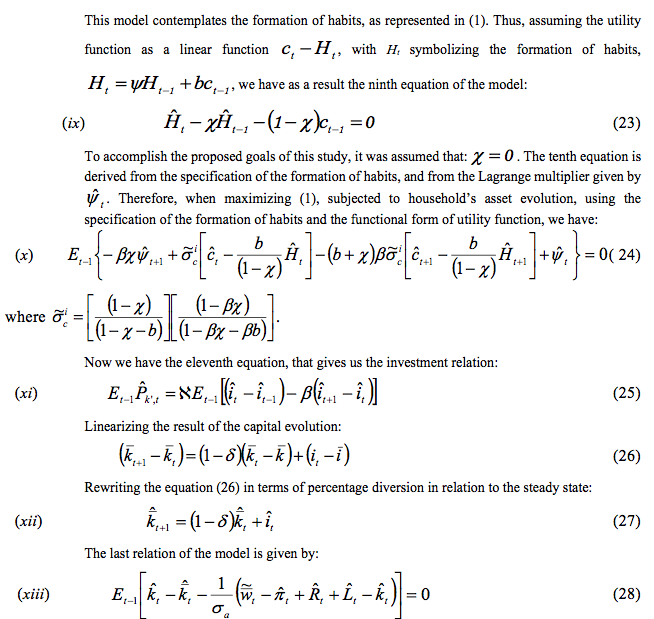

The economy set by theoretical model proposed by the DSGE is made of households, Government, intermediate-goods producers firms and final-goods producers firms. In this model we have money and uncertainty in a simple way to approach the economy and, as most part of models available in literature, we have a basic structure that incorporates elements of the New-Keynesian paradigms and approaches development in models of Real Business Cycles. Because it modeling the economy from the microeconomic agents choices’ to their macroeconomic impacts, is necessary adjacent microeconomic assumptions to we estimate the Pareto-optimal parameter.

However, criticism is also directed to these models. One of the most important ones arises from Solow (2010), originated from the assumption of representative agents, by handling an inter-temporal rationality due to their information, despite of the shocks. They are able to give satisfactory answers in terms of economic decisions that do not take into account, for instance, the possibility of involuntary unemployment (BLANCHARD and GALÍ, 2006) or conflicts among different kinds of agents, for example.

Nevertheless, the cited author states that these models are anchored in the microeconomic theory. Thus, there is the possibility of the introduction of the laziness, hypothesis about conflicts among the agents (WALQUE et al., 2009), or about their information set of information. As it was already argued, this type of model is very useful, considering their positive and negative imposed aspect limitations.

Following CEE (2005), the present work maintain the hypothesis of rational expectations, that there is no involuntary unemployment in the long term, as framework derived from models of real business cycles (RBC), with adjustment mechanisms of prices and wages do not work completely in short term.

There is one continuous number of identical households in this economy, i.e., they have the same preferences and form of the utility function. They are paid by the work offered and its assets and decide how to allocate on consumption, institutions intermediating deposits, money and labor supply in the economy. In other words, the household maximizes utility that is a money-in-utility (MIU) function type, which depends on consumption, leisure and money.

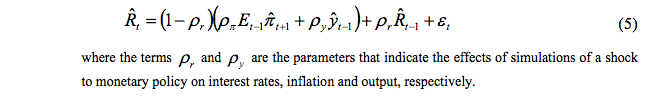

The monetary authority is the manager of monetary and fiscal policies in this model. As Demchuk (2012) it is assumed that the set of monetary policies is characterized by a version of the Taylor Rule(1995) as a reaction function of Central Bank to changes in expectations of inflation. This form of action of monetary authority became better known after the works of Barro and Gordon (1983b), for example, who postulated that the actions made by rules, in which the policymaker's preferences reflect the preferences of agents, are more appropriate.

The shape of the equation of monetary policy (5) is a mixed type with elements of backward-looking and forward-looking based in first place in Lucas (1976) and assumed in CEE (2005), Bueno (2008), Pinto and Andrade (2009) and Vereda and Cavalcanti (2010). For instance:

On the other hand, we assume that the government has access to lump-sum taxes and pursues a Ricardian fiscal policy. Although in Brazil is almost popular the acknowledgement that taxes are distorted, this characteristic is desirable in the model because it did not change the allocations of steady state and it does not make pressure over inflation or over any other aggregate variables.

First of all, after linearization of all relations in the model, we ran all the equilibrium in sense of calculate the steady state condition, as mentioned in section 3. We found in the results that inflation responds to a shock in monetary policy in t. The model is therefore consistent with an identification key finding in empirical works, mainly those with econometric approaches: the price level responds contemporaneously to a shock in monetary policy. Second, inflation depends on expected future marginal costs, and third as a result, for any process describing inflation is more inertial (CAMPELO and CRIBARI NETO, 2003) in the scheme of dynamic updating of prices, than in the static scheme.

Another interesting result is that nominal wage rigidity coeteris paribus plays a relatively more important rule in model than the rigidity of prices. This is partially consistent with the hypothesis that firms determine their own markup on marginal cost, and they last consisting, at most, of expenditures on wages and capital rent. By allowing the capital after a shock rises in interest rates, the positive use of capital helps to smooth the increase in the price of capital.

In Table 1 we have a summary of these parameters and their sources, combined in terms of the model structure, in which stand out a conservative monetary policy which is aligned with Barro and Gordon (1983b) and Galí (2008), who justify that we reach better results with monetary policy that places a greater emphasis on price stability than on the stability of the product (GDP).

Table 1 – Model Parameters

Parameter |

Value |

Source |

Preferences |

||

β |

0.985 |

Vereda and Cavalcanti (2010) |

b |

0.71 |

Sin and Gaglianone (2006) |

R |

1/β |

CEE (2005) |

ψ0 |

1 |

CEE (2005) |

χ |

0 |

CEE (2005) |

Technology |

||

α |

0.40 |

Sin and Gaglianone (2006) |

δ |

0.025 |

Vereda and Cavalcanti (2010) and Carvalho and Valli (2010) |

Parameters of Frictions – Calvo (1983) |

||

ξw |

0.50 |

CEE (2005) |

ξρ |

0.42 |

Carneiro and Duarte (2001) |

Indexations |

||

λw |

1.05 |

CEE (2005) |

λf |

1.45 |

CEE (2005) |

Substitutions / Elasticities |

||

η |

8 |

Carneiro and Duarte (2001) |

s |

η-1/η |

CEE (2005) |

Monetary Market |

||

|

1.015 |

CBB |

ρπ |

1.5 |

Taylor (1995), CEE (2005), Sin and Gaglianone (2006), Silveira (2008) |

ρy |

0.1 |

CEE (2005) |

ρr |

0.7 |

Sin and Gaglianone (2006) |

σε |

0.25 |

Galí (2008) |

Other Calibrations |

||

|

1 |

CEE (2005) |

σa |

0.01 |

CEE (2005) |

σq |

9.966 |

CEE (2005) |

|

3 |

Carneiro and Duarte (2001) |

Source: The authors' work based on selected studies.

The results of the simulations from a positive monetary policy shock are in Figure 1, in the Appendixand illustrate the impulse response functions (IRFs) as a shocks in the monetary policy. Specifically, of 0.25 in the standard deviation of the residues of the nominal interest rate, considering price and wages frictions’. In the same figure, the model shows the responses of the variables: inflation, consumption, investment, output, money stock, growth rate of money, capital price, marginal product of the capital, interest rates, and real wages, respectively, in a period of 20 quarters ahead.

It is necessary look carefully the results of the IRFs estimated to compare with another estimations. In Vereda and Cavalcanti (2010) and Carvalho and Valli (2010), for example, we have shocks in interest rates lead to different effects on inflation and GDP. In Carneiro and Duarte (2001) and Bonomo and Brito (2002) was tested multiples specifications, generation different results. In terms of nominal effects, our results are in line with CEE (2005). Our work pointed to necessity of more research investments on modeling monetary policy.

We also verified a reduction in the inflation during the early periods, with elevated persistence, as mentioned before. Ours results concerned to the signal of parameters, its proportion, and response time of the inflation, are in line with the results found in CEE (2005). And our model could respond to positive shocks in the monetary policy quickly and more intensely.

The main difference of the results of cited authors, and the ones obtained in our study is the magnitude of the effects after the monetary policy shock. Ours tend to be often more elevated for the Brazilian economy, in relation to the ones found by the authors, who are reflected also by the shock magnitude: for while we use 0.25 of the standard deviation originated from the nominal interest rate of the residue, as well as highlighted in Table 1, the authors use 0.15. However, in a general evaluation of the model, we have a lot of similarities that may be pointed out.

One of them is that the main nominal rigidity of it is referred to the wages and not to the prices. This fact is partly because of the hypothesis that the firms determine their markup over the marginal cost, being the last one composed, mainly, by the expenses of the wages and by the hiring of the capital. When allowing the capital to increase after a shock in the interest rate, the positive variation of the capital use helps to balance the increase related to the capital price.

In terms of variables effects’ after the shocks, we noticed the result of the steady state over the inflation, means an increasing of the nominal consumption after the shock and, therefore, in the level of the GDP. It is also important to observe that a more persistent change in the price of the capital, means the increasing in the investments. This occurs because, coeteris paribus, the costs of the adjustment of the investments induce the agents to behave as “forward-looking” types, i.e., a permanent increase of only 1% in the price of the capital induces in the increase of ![]() in the investments, for here the Tobin’s q takes into account other marginal costs than only the capital price.

in the investments, for here the Tobin’s q takes into account other marginal costs than only the capital price.

The dynamics points to a temporary and positive increasing of investments (1.5%), starting on the second quarter, persisting for the next periods. In the same period of the initial increasing of the investment, the GDP has also a positive transitory increase in the order of 0.55% up until the fourth year. Also, as expected, we have the variance of the investment being one of the most elevated among the variables with the value of approximately 20.49.

According to the dynamic in Figure 1, the positive shock of the monetary policy leads a negative transition variation of more than 0.3% over the inflation, with the persistence of 13 quarters, increasing in 0.1% after this period, meeting up with the results of Minella (2001), which have been already pointed out. In other words, the contrast generated by those and our results, is that the monetary shocks here do not have small effects over the GDP, since the reactions functions in literature.

The dynamic of the IRF to the shocks is also verified in the nominal interest rates, with a negative transitory variation of 0.3%, surviving for 14 quarters and been followed by increasing of 0.1% after this period. This characteristic of the nominal rigidity of the wages, among other reasons, has helped to improve modeling of problems concerned to the monetary economy.

Our results are also in consonance with Silva Filho, Silva and Frascaroli (2006), who reported the results of Markov-Switching Vector Autoregression (MS-VAR). Besides, the shock has a momentary positive effect over the M1 (0.35%), being 0.19% over the consumption and 0.3% over the wages, all of them during approximately 14 quarters. The difference of results was showed by a positive effect over the wages, which happens around the third quarter.

The model has also allowed taking into account several characteristics of the monetary policy practiced in Brazil, such the IT, which leads to a hybrid reaction function of CBB, with backward-looking e forward-looking elements based on CEE (2005), Bueno (2008), Pinto and Andrade (2009), and Vereda and Cavalcanti (2010). This is in line with objectives of the IT, coordinating the expectations and guiding the transparency in the conduction of the instruments of the monetary policy.

The IRFs responses were also generated an unbalanced inertial response towards the inflation regards to a positive shock. It happened either with a persistent positive response of the investment, of the consumption, of the labor, of the marginal product of the capital, and of M1+M2, and finally a small response to the real wages. On the other hand, the interest rates and the increasing money rates have negative effects after a monetary policy shock, and as pointed out, the rigidity of the nominal wages and the non-rigidity of prices are the keys to the performance of the model results.

In terms of Brazilian characteristics our approach is not in line with a fiscal policy type by soft budget constraint with populist tonic, which Brazil lost the macroeconomic support and enters in a crisis that has lasted about two years. Multiple factors led to high uncertainty index in the years 2014 and 2015, deeply affecting the Brazilian economy. This scenario of deteriorating expectations led on 31 August 2016 to the deposition of President Dilma Roussef.

Therefore, as consequence, the fiscal adjustment cost will still make this downward trend of interest rate found in IRFs still something that involves other dimensions. Among them, the recovery of Brazilian degree of investment rating, lost in 2015. In this sense, an example is the PEC nº 241/ 2016 (Constitutional Amendment Process) which proposes an equilibrium of public depth in Brazil by ruling Government spend in a federal level. This reduces the level of uncertainty in results of models such the developed by CEE (2005).

In the present study it was developed a model for the analysis of the Brazilian monetary policy with the moderate presence of nominal rigidity in prices and wages. In this sense, we estimated a dynamic response of the Brazilian economy to shocks in the monetary policy by using the DSGE approach. After some effort we modeling 1) the Selic rate on the basis the BCB's reaction function - given the relative independence and the preferences of the BCB -, 2) considering the estimations there was some small space for one of the highest interest rates in the world fall, which took place after a long period, by the COPOM Report on October 19, 2016.

The model proposed elucidates in what is concerned to an important aspect in terms of backgrounds of macroeconomic foundations: reduce the distance of aggregate results to the microeconomic instrumentation. This has allowed an interesting advance in relation to the recovery of the information of the agents towards the action of the policymaker, observed by the simulations of the monetary policy shocks.

Other explorations may be developed with the introduction of some kind of rigidity in the currency adjustment factor in the utility function typed by money-in-utility (MIU). If we considering that the real profits are, mainly, other goods consumption, it could be possible to withdraw the currency itself. Thus, it is possible to investigate which are the effects of this utility under the hypothesis of the lack of the necessity of the agents to demand money. It can be checked out by the exponential rising of the utilization of the electronic means for economy payments worldwide.

This model is known in literature as cashless economy and nonetheless, for a deeper investigation that might use this type of analysis, it must be assured that, among other requirements, the agents find access to new payment forms, like payments cards, electronic currency (Bitcoin, for example). Thus, it is necessary to spread more investigations, mainly in the microeconomic sense, including this type of hypotheses in a macroeconomic model.

For modeling the Brazilian economy is also possible to improve the decision making by introducing a microfundamented financial system and argue about the market clearing assumption. For instance, is also recommended open the economy, and considering the presence of a high public indebting are essential to bring more reality to produced results. The advantage of this approach is the possibility to improve the macroeconomic view by describing more precisely the decisions in a microeconomic level.

Central Bank of Brazil, (2016): Statistics and public data. Avaliable in: <http://www.bcb.gov.br/> Access in: marh, 16, 2016.

Barro, R J. and Gordon, D., (1983b): Rules, discretion and reputation in a model of monetary policy. Journal of Monetary Economics, v. 12, p. 101-21.

Bernanke, B. and Blinder, A., (1992). The Federal Funds rate and the channels of monetary transmission. American Economic Review, n. 82, September, p. 901-921.

Bernanke, B. and Mihov, I., (1995): Measuring monetary policy. Cambridge: National Bureau of Economic Research, working paper n. 5145.

Blanchard, O. and Galí, J., (2006): A new keynesian model with unemployment. National Bank of Belgium Working Paper n. 92.

Bonomo, M. A. C. and Brito, R. D., (2002): Regras monetárias e dinâmica macroeconômica no Brasil uma abordagem de expectativas racionais. Revista Brasileira de Economia, v. 56, p. 551-589.

Bueno, R., (2008): Did the Taylor rule stabilize inflation in Brazil? In Latin American and Caribbean Economic Association (LACEA) and Latin American Meeting of the Econometric Society (LAMES) 2008 Parallel Meetings, Rio de Janeiro – RJ.

Calvo, G., (1983): Staggered prices in a utility-maximizing framework. Journal of Monetary Economics n. 12, p. 383-398.

Campelo, A. K. and Cribari Neto, F. (2003): Inflation inertia and inliers: the case of Brazil. Revista Brasileira de Economia, Rio de Janeiro/ RJ, v. 57, n. 04, p. 713-739.

Carneiro, D. D. and Duarte, P. G., (2001): Inércia de juros e Regras de Taylor: explorando as funções de resposta a impulso em um modelo de equilíbrio geral com parâmetros estilizados para o Brasil. In XXXVII Brazilian Economics Meeting, Salvador, BA.

Carvalho, F. A.; Valli, M., (2010): An estimated DSGE model with government investment and primary surplus rule the brazilian case. In 32º Meeting of the Brazilian Econometric Society, Salvador, BA.

Christiano, L. J; Eichenbaum, M; Evans L. C.. (2005): Nominal rigidities and the dynamic effects of a shock to monetary policy. Journal of Political Economy, v. 113 n. 1, Chicago.

Clarida, R; Galí, J; Gertler, M., (1997): Monetary policy rules in practice: Some international evidence. National Bureau of Economic Research, Working Paper n. 6254, Cambridge.

_________, (1998): Monetary policy rules and macroeconomic stability: evidence and some theory. National Bureau of Economic Research, Working Paper n. 6442. Cambridge.

Demchuk, O.; Łyziak, T.; Przystupa, J.; Sznajderska, A. and Wróbel, E., (2012): Monetary policy transmission mechanism in Poland. What do we know in 2011? National Bank of Poland, Working paper, n. 116. Warsaw.

Ferreira, D., (2015): Regra de Taylor e política monetária no Brasil: considerações empíricas a partir de um modelo DSGE para uma pequena economia aberta. Teoria e Evidência Econômica - Ano 21. n. 44. p. 09-35.

Fraga, A. and Goldfajn, I., (2002): Política monetária no Brasil. Relatório de Inflação. Banco Central do Brasil.

Friedman, M. (1968): The role of monetary policy. American Economy Review. N. 58 p.1-17, USA.

Galí, J. (2008): Monetary policy, inflation, and the business cycle: An introduction to the new keynesian framework. Princeton University Press, Princeton, NJ.

Giambiagi, F. and Carvalho, J. C., (2001): As metas de inflação: sugestões para um regime permanente. Rio de Janeiro: BNDES-DEPEC, Texto para discussão n. 86.

Lucas, R., (1976): Econometric policy evaluation: a critique. in Brunner, K.; Meltzer, A. The Phillips curve and labor markets. Carnegie-Rochester Conference Series on Public Policy. 1. New York: American Elsevier. p. 19-46.

Martinez, T. S., (2012): Inflação e o padrão de crescimento brasileiro: considerações a partir da desagregação do IPCA. Instituto de Pesquisa Econômica Aplicada - IPEA. Texto para discussão. n. 1804.

Minella, A., (2001): Monetary policy and inflation in Brazil (1975-2000): a VAR estimation. Brasília: Central Bank of Brazil, Working Paper n.33.

Modenesi, A. M., (2010): Política monetária no Brasil pós Plano Real (1995-2008): um breve retrospecto. Economia & Tecnologia – Ano 06. v. 21. 2010.

Montes, G. C. and Nicolay, R. T. F., (2016): Comunicação do Banco Central, expectativas de inflação e profecia autorrealizável: evidências para o Brasil. Análise Econômica, Porto Alegre, ano 34, n. 66, p. 83-118, set. 2016.

Pinto, J. C. C.; Andrade, J. P. (2009): Comparação entre técnicas estatísticas na estimação de modelos novo-keynesianos aplicados ao Brasil. XXXVII Brazilian Economics Meeting, Foz do Iguaçu, PR.

Silva Filho, O. C; Frascaroli, B. F. and Maia, S. F., (2005): Política monetária e o mercado de reservas bancárias: uma abordagem SVAR. In XI Escola de Séries Temporais. Vila Velha-ES.

Silva Filho, O. C.; Silva, L. C. and Frascaroli, B. F., (2006): Política monetária e mudanças macroeconômicas no Brasil: Uma abordagem MS-VAR. In VI Encontro Brasileiro de Finanças. Vitória – ES.

Silveira, M. A. C., (2008): Using a bayesian approach to estimate and compare new keynesian DSGE models for the brazilian economy: the role for endogenous persistence. Brazilian Econometric Review, v. 62 n. 3, p. 333-357.

Sims, C., (1992): Interpreting the macroeconomic time series facts: the effects of monetary policy. European Economic Review, v. 36, p. 975-1011.

Sin H. L. and Gaglianone, W. P., (2006): Stochastic simulation of a DSGE model for Brazil. Paper for the Monetary Policy course. Getulio Vargas Foundation – Graduate School of Economics, FGV-EPGE, 2006.

Sin, H. L., (2006): Usando a estrutura a termo na estimação de Regras de Taylor: uma abordagem bayesiana. Master Degree Thesis – Graduate School of Economics, Fundação Getúlio Vargas.

Solow, R., (2010): Building a science of economics for the real world. Prepared Statement in The Subcommittee on Investigations & Oversight of the House Committee on Science & Technology.

Stiglitz, J.; Weiss, A., (1981): Credit rationing in markets with imperfect information. American Economic Review n. 71 v. 3, p. 393-410.

Taylor, J. B. (1980): Aggregate dynamics and staggered contracts. Journal of Political Economy, v. 88, p. 1-23.

_________. (1995): The monetary transmission mechanism: an empirical framework. Journal of Economic Perspectives. v. 9, n. 4, p. 11-26.

Tombini. A. and Alves, S. A. L., (2006): The recent Brazilian disinflation process and costs. Central Bank of Brazil. Working Paper Series. n. 109. 2006.

Vereda, L. and Cavalcanti, M. A. F. H. (2010): Modelo dinâmico estocástico de equilíbrio geral (DSGE) para a economia brasileira: Version 1. Brasília: Institute for Applied Economic Research (Ipea), discussion paper n. 1479.

Walque, G.; Pierrard, O.; Sneessens, H. and Wouters, R., (2009): Sequential bargaining in a new keynesian model with frictional unemployment and staggered wage negotiation. Working Paper Research n. 157, National Bank of Belgium.

Woodford, M., (2003): Interest and prices: foundations of a theory of monetary policy. Princeton University Press, Princeton, NJ.

1. Associate Professor. Graduate Program of Economics. Federal University of Paraíba. Email: frascaroli.b@gmail.com, Universidade Federal da Paraíba, Programa de Pós-Graduação em Economia (PPGE), Cidade Universitária, João Pessoa-PB, Brazil, 58051-900. Ph.D. in Economics by Federal University of Pernambuco (2010). Has experience in the area of economics, with emphasis on quantitative methods, finance, macroeconomics, econometrics, monetary policy. CV available at: http://lattes.cnpq.br/5108964340357155.

2. Assessor of Secretary for Economic Policy of Ministry of Finance, Brazil/ Associate Professor. Graduate Program of Economics. Federal University of Pernambuco. Email: < nlpaes@yahoo.com.br >, Universidade Federal de Pernambuco, Programa de Pós-Graduação em Economia (PIMES), Sala 102, Cidade Universitária, Recife, PE, Brazil, 50670-901. Ph.D. in Economics by University of Brasília (2004). Has experience in the area of economics, with emphasis on quantitative methods, macroeconomics, monetary and fiscal policies. CV available at: http://lattes.cnpq.br/4398120005151498.