Vol. 38 (Nº 14) Año 2017. Pág. 8

Josefina SANTOLAYA-SANZ 1; Eva-María MORA-VALENTÍN 2; Marta ORTIZ-DE-URBINA-CRIADO 3

Recibido: 27/09/16 • Aprobado: 21/10/2016

ABSTRACT: |

RESUMEN: El fenómeno de la coopetición ha cobrado una especial importancia en la gestión de empresas lo que ha derivado en un creciente número de publicaciones sobre el tema. La literatura ha sugerido que el fenómeno de la coopetición debe analizarse teniendo en cuenta la situación paradójica que se produce. Así y como consecuencia de dicha paradoja, los actores que participan en la coopetición experimentan ciertas tensiones que afectan a su relación. El objetivo de este trabajo es analizar la gestión de la tensión en coopetición. En ese sentido, se sugiere que las tensiones pueden administrarse mediante el desarrollo de un conjunto de capacidades. Se analiza la capacidad de coopetición y se desarrolla un modelo que define una estructura jerárquica de las capacidades generadas por la capacidad de coopetición. |

Scholarly attention to coopetition, defined as the simultaneous pursuit of cooperation and competition between firms (Brandenburger & Nalebuff, 1996; Bengtsson & Kock, 2000), has increased due to the large number of industrial, relational, and firm specific factors that motivate firms to engage in these contradictory logics of interaction (Luo, 2007; Gnyawali & Park, 2009). Despite the growing number of publications (Bengtsson & Kock, 2014), the literature is fragmented and limited, which is expressed in a diverse understanding and different definitions (Bouncken, Gast, Kraus, & Bogers, 2015).

Researchers have recognized that coopetition is a multidimensional and multi-faced concept that assumes a number of different forms and requires multiples levels of analysis (Chin, Chan, & Lam, 2008). Considering previous literature, we define coopetition as “a paradoxical and dynamic business relationship in which two or more firms, with common goals and interest, interact among them, cooperating in one or more activities trying to generate a common benefit and competing in different activities trying to obtain the biggest part of common benefit. Indeed, distribution of profit could be no equitable”.

The literature often labels coopetition as paradoxical (Lado, Boyd, & Hanlon, 1997; Gnyawali & Park, 2011; Bengtsson & Kock, 2014) and suggested that coopetition must be perceived though a paradox lens (Chen, 2008). A paradox materializes when cooperation and competition, two contradictory yet interrelated forces are juxtaposed in coopetition (e.g. Lewis, 2000). But scholarly attempts to investigate the nature of paradox in coopetition and its management are very limited (Gnyawali, Madhavan, He, & Bengtsson, 2016). Furthermore, actors involved in coopetition experience tensions that stem from the paradox that materializes in the relationship (Gnyawali & Park, 2011). The literature has emphasized the existence of tensions and has begun to explore the causes and nature of coopetition tensions (Fernandez, Le Roy, & Gnyawali, 2014). Tensions are generally viewed as negative, but tensions may lead to new ideas and methods that benefit all parties (Tidström, 2014), keeping the “creative tension” (Quintana-García & Benavides-Velasco, 2004). Previous scholars insisted in the importance of managing coopetition tensions (Walley, 2007; Gnyawali & Park, 2011) but did not explain how to manage it. Examination of the sources of tension and ways of managing them it is critical to develop a theory of coopetition (Chen, 2008; Gnyawali & Park, 2011).

Little research has been done concerning the capabilities that are necessary to coopete successfully, which implies that this relationship results in a competitive advantage. Despite the importance of capabilities, the link between dynamic capabilities and coopetition has so far not been explored in depth (Quintana-García & Benavides-Velasco, 2004). However, as these will become more important in a dynamic and complex environment, it will be crucial to delve into the conditions under which firms are able to coopete profitable (Bouncken et al., 2015).

The first purpose of the paper is to analyse the link between paradox and coopetition and to revise the literature about coopetition tensions and the ways for its management. Following Gnyawali et al. (2016), we suggest that firms experiencing the competition-cooperation paradox can manage situation by developing a set of capabilities or coopetition capability. Thus, the second purpose of paper is proposing an extended interpretation of coopetition capability and establishing a direct association with dynamic capabilities theory. Then, our most relevant contribution to coopetition research is the development of a model which defines a hierarchical structure of capabilities generated by coopetition capability. We identify several supporting capabilities for managing coopetition paradox and tensions as well as other capabilities to successfully manage other coopetition challenges.

Smith & Lewis (2011), define paradox as “contradictory yet interrelated elements that exist simultaneously and persist over time. In the context of coopetition, a paradox emerges both from the “contradictions” or priorities of the partners engaged in these relationships (Gnyawali et al., 2016) and from the inherent “dualities” that exist due to the simultaneity of cooperation and competition.

Gnyawali et al. (2016) suggest that when competing firms come together through cooperation there are several contradictions: divergent economic interest, difference in strategies and approaches and difference in identities. Although shared goals would bring the partners together (Gnyawali & Park, 2011), they may have different economic motives behind the relationship. Partners may hold different mental models about the industry’s future, which predispose them to different strategies and investment (Gnyawali et al., 2016). Difference in identities is related to partner’ views of themselves as distinct from each other.

Dualities are non-partner specific forces that exist within a unified whole (Smith & Lewis, 2011) and stem from engagement of activities that are opposing in nature. Gnyawali et al. (2016) defined three critical dualities in coopetition relationships: value creation versus value appropriation, separation versus integration and bridging versus bonding.

Value creation versus value appropriation is the most commonly discussed in literature on coopetition. Distribution of the created value becomes critical, because partners have the same competitive goals (Fernandez et al., 2014). A related aspect of this duality is the simultaneous need to share knowledge for joint value creation and protect core competencies and resources in order to realize more private benefits (Gnyawali et al., 2016). Separation versus integration refers to dealing with incompatible situations. Firms might pursue temporal or spatial separation of cooperation and competition activities (Bengtsson & Kock, 2000) or develop a more integrative perspective by reconciling them (Chen, 2008). And even if separation exists, integration is still needed to link different parts together (Gnyawali et al., 2016). Bridging versus bonding essentially means working closely with a competitor partners in order to create value, but no become too close and be vulnerable (Gnyawali et al., 2016). Some level of bonding is necessary to mutually create value, but if bonding becomes too dominant, the firm might become over-embedded (Uzzi, 1997).

Contradictions and dualities are important characteristics of paradox that create tension, requiring strategies to respond to its characteristics (Smith & Tushman, 2005). A paradox describes how two firms interact with contradictory logics, whereas tension is the consequence of this interaction that is experienced by individuals at different levels (Fernandez et al., 2014; Raza-Ullah, Bengtsson, & Kock, 2014). Raza-Ullah et al. (2014) theorized that tension results from cognitive evaluation of paradox. Tension comprises simultaneously holding positive and negative emotions, what is known as “emotional ambivalence”. In coopetition relationships, positive emotions results from an evaluation on collective interest, (cooperation elements), thus evokes feelings of trust and confidence. In contrast, negative emotions result from an evaluation of self-interest, (competitive elements) that bring out feelings of doubt, greed for having larger share of the created value, distrust for withholding key information, and fear of the other’s opportunistic behaviour.

The literature of paradox suggests that managing paradox requires developing capabilities to deal with tensions (Lewis, 2000). Gnyawali et al. (2016) suggested that coopetitive firms can cope with paradox situation by developing a set of capabilities, and defined “paradox management capability”, which refers to a firm’s capacity to perceive and analyse key issues and challenges in interfirm relationships.

Previous scholar stressed the necessity to manage coopetitive tensions (Bengtsson & Kock, 2000; Das & Teng, 2000; Chen, 2008). Most of the existing research on tension in coopetition focuses on potential types of tension such roles (Bengtsson & Kock, 2000), knowledge (e.g. Tsai, 2002), power and dependence and opportunism (e.g. Osarenkhoe, 2010), that occur at different levels (Fernandez et al., 2014, Raza-Ullah et al., 2014). Considering tensions at different levels of the organizations seems critical for firms to understand what kind of approach is needed to deal with each level of tension. Fernandez et al. (2014) proposed to distinguish three levels of coopetitive tensions: interorganizational, intraorganizational and interindividual. This subsection summarizes several types of coopetitive tensions describe in literature (see Table 1).

Table 1: Sources of coopetitive tensions

Type of tension |

Authors |

Organizational level |

Value creation-Value appropriation |

Oliver (2004); Gnyawali and Park (2009); Gnyawali et al. (2012) |

Interorganizational |

Roles |

Bengtsson and Kock (2000) |

|

Knowledge |

Tsai (2002); Morris et al. (2007); Chin et al. (2008) |

|

Differences in strategies and goals |

Fernandez et al. (2014) |

|

Opportunism |

Lado et al. (1997); Khanna et al. (1998); Osarenkhoe (2010) |

|

Power and dependence |

Osarenkhoe (2010) |

|

Competition between units |

Tsai (2002) |

Intraorganizational |

Cognitive tension |

Gnyawali and Park (2011); Fernandez et al. (2014) |

|

Difficulty to integrate cooperation and competition |

Bentsson and Kock (2000) |

Individual |

Source: Adapted from Fernandez et al. (2014)

Interorganizational level coopetitive tensions

In coopetition relationships, firms fight against the dilemma of working together and creating value and the temptation to be opportunist and appropriate a bigger part of this common value create (Oliver, 2004; Gnyawali & Park, 2011 Gnyawali, Madhavan, He, & Bengtsson, 2012). Each firm collaborates but, in fact, their position encourages each firm to win more than its partner (Fernandez el al., 2014). Strictly speaking, tension would appear when each partner will try to capture the value previously created.

Other type of tension in coopetitive business relationships relates to the roles (Bengtsson & Kock, 2000). Role tension stem from the tension between cooperative and competitive orientation and it involves people having different opinions about the degree and type of responsibilities (Tidström, 2014).

Another kind of coopetitive tension is due to the risks of transfer of confidential and the risks of technological imitation (Fernandez et al., 2014). Partner pool strategic resources to achieve their goals (Gnyawali & Park, 2011), but at the same time they need to protect their core competences because they remain strong competitors. Thus, knowledge represents a tension in coopetitive business relationship as it constitutes a source of competitive advantage. The cooperative aspect of knowledge sharing is related to the collective use of shared knowledge to pursue common interests (Tsai, 2002). The competitive aspect, in turn, is related to the use of shared knowledge in order to obtain private gains in an attempt to outperform partners (Khanna, Gulati, & Nohria, 1998). One of the main objectives is absorbing as much knowledge as possible (Gnyawali, He, & Madhavan, 2006); but for achieving common objectives, it is need sharing knowledge (Chin et al., 2008), as well as establishing proper protective mechanisms (Baumard, 2010). The dilemma between what to share and what to protect impact on learning dynamics and it is a main source of tension between partners (Walley, 2007). They have continually to decide what information should be shared to assure the success of relationship, and what information should be protected, since assimilated knowledge by partners can be used in future competitive scenarios and increasing opportunism risk (Fernandez & Chambaretto, 2013).

Tensions could also arise due to differences in the strategies and goals of each partner of the relationship (Fernandez et al., 2014; Gnyawali et al., 2016). Partners could have different strategic priorities for the partnership and such differences could lead to disagreements on resource allocations. Further, partners could have different strategic intends and hidden priorities, such as imitating the partner’s knowhow (Hamel, 1991).

In coopetition, the sharing or resources and activities can create an opportunistic situation for self-interest to exploit a weaker party’s interest (Osarenkhoe, 2010). Any opportunistic behaviour by the competitor partner can involve of knowledge, market, causing tension, confrontation and a dramatic loss of confidence (Sherer, 2003). Coopetition does not mean that firms’ private interests become irrelevant and organizations change from a “self-interest” to a “collective interest” oriented behaviour (Fernandez et al., 2014).

According to Zineldin (2004), power and dependence can also be viewed as conflict source. One party can use its power (e.g. technical, political, financial, or emotional) to force another party to act in a way that is not the latter’s best interest (Tidström, 2014). Power and dependence may also be related to the size of firms, as a smaller firm may become dependent on a larger more powerful with more resources (Osarenkhoe, 2010). An unbalance in power and dependence can consequently constitute tensions in coopetitive relationships (Tidström, 2014).

Intraorganizational level coopetitive tensions

Two main sources of coopetitive tensions exist at this level. First, the different business units (Luo et al., 2006). Managers involve in internal activities would compete with colleagues involved in coopetitive activities to obtain human, technological and financial resources from their firm (Tsai, 2002). The second source of tension concern employees involved in activities with competitors. Employees from companies competing for a long time would face difficulties to perceive each other as partners (Gnyawali & Park, 2011).

Individual level coopetitive tensions

Some scholars advocate that individuals find very difficult to integrate the coopetitive paradox on their own. Individuals can manage a single dimension, cooperation or competition, but they will have great difficult managing both simultaneously (Bengtsson & Kock, 2000). Others scholars show that individuals are actually capable of such integration and corresponding behaviour (Das & Teng, 2000; Chen, 2008; Herzog, 2010; Pellegrin-Boucher, Le Roy, & Gurău, 2013; Fernandez et al., 2014). In coopetition firms’s identities are mixed without being merged. The psychological equilibrium of the individuals could be disturber (Fernandez et al., 2014). Managers, especially those at border positions suffer from high stress levels (Bengtsson & Kock, 2008).

It is worth noting that, in practice, several of the above mentioned tensions may occur simultaneously (Tidström, 2014). There is a consequently interest of researching around the management of tensions.

The nature of coopetition is reflected in considerable managerial challenges that coopetitors have to face (Czakon, Mucha-Kuś, & Rogalski, 2014). Relevant managerial tools are required to reach this balance and to preserve it. Previous literature focused on influence factors to coopetition relationships success (e.g. Sherer, 2003; Morris, Koçak, & Özer, 2007; Chin et al., 2008; Osarenkhoe, 2010) more than specific styles or ways of coopetition management. Tidström (2014) refers to this success factors as underlying issues of managing tensions.

Morris et al. (2007) proposed three key dimensions which impact on coopetition success: mutual benefit, trust and commitment. Authors argued that, without mutual benefit, the dimensions of trust and commitment cannot adequately maintain the relationship. On the one hand, there is hostility due to conflicting interests, and on the other hand, it is necessary to develop trust and mutual commitment to achieve commons aims (Quintana-García & Benavides-Velasco, 2004). In coopetition, trust improves the exchange of information (Morris et al., 2007), knowledge and physical resources (Uzzi, 1997). Furthermore, trust enhances cooperative behaviour. Commitment is related to the perception that the other party that each party take responsibility for the goals and activities that contribute to relationship outcomes (Morris et al., 2007). Low levels of commitment by one of the parties will affect the performance of both parties (Sherer, 2003). There are other success factors treated in coopetition literature. Sherer (2003) and Osarenkhoe (2010) indicated that manager commitment and leadership are positive aspects for success.

Bengtsson & Kock (2008) argue that private and professional relationships may be necessary in coopetition, decreasing the risk of opportunism, making easier to develop new ties in order to achieve better business results. According to Uzzi (1997), strong social relationships entail information being more reliable and problem solving easier. However, Tidström (2014) indicates that although trust and good personal relationship exist, the desire for preserving firm level strategies seems to be stronger than joint coopetition strategies.

Nevertheless recent literature emphasizes that the competitive advantage comes from an efficient management of the paradox and tensions (Fernandez et al., 2014, Raza-Ullah et al., 2014; Tidström, 2014). Researchers propose two opposite principles to manage coopetition tensions: separation principle (Bengtsson & Kock, 2000; Herzog, 2010) and integration principle (Das & Teng, 2000; Chen, 2008).

The pioneers of coopetition management literature, consistent with the separation principle, explained said that “individuals can not cooperate and compete simultaneously, and therefore the two dimensions of interactions need to be separated” (Bengtsson & Kock, 2000). Thus, the management of cooperation and competition should be split for manage coopetitive tensions (Bengtsson & Kock, 2000; Herzog, 2010). When the separation principle is used, it creates internal tensions within firms, especially between employees who are in charge of cooperation and those in charge of competition. To encourage these inter-individuals relationships, an integration principle is recommended (Das & Teng, 2000; Chen, 2008). Researchers refer to the integration principle as a cognitive acceptance of paradoxes (Lewis, 2000; Smith & Lewis, 2011) and define it as the “individual’s capacity to integrate coopetition duality into their daily activities (Pellegrin-Boucher et al., 2013; Fernandez et al., 2014). Integration principle relies on individuals’ capabilities to understand each other roles (Bez, Fernandez, Le Roy, & Dameron, 2015). Recent literature highlights the possible combination of both principles to efficiently manage coopetitive tensions (Fernandez et al., 2014; Pellegrin-Boucher et al., 2013).

Some researchers have suggested that firms’ capability to deal with coopetition is important in realizing gains (Gnyawali & Park, 2011), but little is known about what constitutes such capability (Fernandez et al., 2014). Further, following Gnyawali & Park (2011) and Gnyawali et al. (2016), we suggest that firms experiencing coopetition can manage the situation through the development of a set of dynamic capabilities.

The idea of coopetitive capability appears in Park (2011) and Gnyawali & Park (2011)’s works. They developed the concept of coopetition capability and demonstrate its critical role in the formation and evolution of coopetitionrelationships. Park (2011) defined coopetition capability as accumulated managerial competencies regarding how to manage a firm’s coopetitive ties. Park (2011) explored three different coopetition capabilities: coopetition mind-set and coopetition experience and organizational structure with a combination of dedicated and division units. Gynawali & Park (2011) stated that a firm possessing the mindset and experience relevant for coopetition may be able to handle conflicts, create value and appropriate bigger private benefits.

In this work, we propose an extended definition of coopetition capability, and following Gnyawali & Park (2011), we link coopetitive capability conceptualization with dynamic capabilities framework. Lin & Wu (2014) defined firm dynamic capabilities as “the capabilities of a firm to integrate, learn and reconfigure internal and external resources”. Internal resources represent those possessed by the firm itself, while external resources can be obtained from external players as supplier, customers or even competitors to engage in strategic partnership or coopetition (Bouncken et al., 2015). Some authors have included adaptation capability among dynamic capabilities (Wang & Ahmed, 2007), and it is defined as the ability of an organization to identify new market opportunities, adjusting its internal factors with changes in the environment or external factors. Coopetition capability is clearly in line with this “adaptability”, a generating capability of more capabilities. It is required a deeper and detailed research that conceptualizes coopetitive capability as a distinctive dynamic capability.

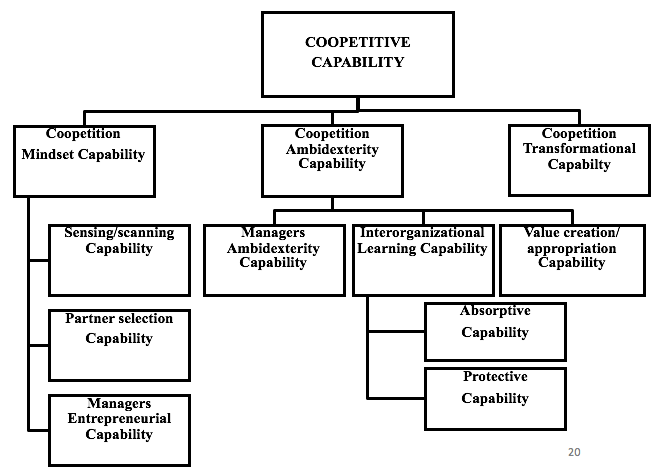

Coopetitive capability delimitation is a complex task that demands to take into account a set of required capabilities for its development and conceptualization. Winter (2003) considered that “capabilities are complex, structured and multidimensional”. In that sense, we define coopetitive capability as a high order capability which generates new capabilities in a hierarchical structure. We suggest that these generated capabilities are elements of a higher order construct and we define coopetition mind-set, coopetition ambidexterity capability and coopetition transformation capability at first level. Each of these first level capabilities is divided in a second detailed level of specific capabilities. Figure 1 shows graphically hierarchical structure of coopetition capability.

Figure 1: Coopetitive capability hierarchical structure

The coopetitive mind-set refers to the ability to cognitively perceive and understand key issues and challenges in interfirm relationships, thus analytical capabilities. Gnyawaly et al. (2015) define the concept of analytical capability as the firm’s capacity to obtain a clear understanding of the coopetition situation and enables managers to realize that both cooperation and competition are beneficial, and thus make it easier to see and accept the dualities.

Before a coopetition relationship is functional, firms need to understand the environment and to identify market requirements and new opportunities for gaining resources (Schilke & Goerzen, 2010). Firms need to have the ability to successfully identify and capture partnering opportunities (Wang & Rajagolapan, 2015). Partner selection capability, accordingly, reflects the firm’s effort in “identifying and selecting potential collaborators” and it is followed by the firm’s ability to negotiate “the terms and structures of the collaborative agreement” (Simonin, 1997). The process of selecting competitors as strategic allies for a coopetition relationship is still not fully understood. Alves & Meneses (2015) research suggests that selection of partners for coopetition is firstly based on the experience of positive prior relationships which seems to contribute as a facilitator and even a catalyser for the formation of coopetition partnerships.

Based on Gnyawali & Park (2011) which provides a connection between coopetitive capability and managers, we establish that managers’ entrepreneurial capability (Augier & Teece, 2009) is a dynamic capability that support and structures coopetition mind-set capability. Managers must act entrepreneurially, think strategically, and execute clearly if they are to lead their organizations successfully. They play a key role in asset selection, particularly when complementary assets must be assembled. They must transact with the owners of external assets, and design and implement new “business models”.

In that sense, scanning environment capability, partner selection capability and manager entrepreneurial capability are main capabilities to conform coopetition mind-set capability.

One of the more enduring ideas on organization science is that successful firms depend on its ability to exploit its current capabilities while simultaneously exploring new competences (Raisch, Birkinshaw, Probst, & Tushman, 2009). These organizations which align their management of today’s business while adapt to changes in the environment are ambidextrousorganizations (Gibson & Birkinshaw, 2004)

The generic use of organizational ambidexterity is vague and simply refers to the ability of a firm to do two things simultaneously, e.g. cooperate and compete, (Gibson & Birkinshaw, 2004). Research on organizational ambidexterity has focused within the organization (Raisch et al., 2009; Adler & Heckscher, 2013); but ambidexterity often also requires a collaborative approach to relations between organizations (Adler & Hecksher, 2013). O’Reilly & Tushman (2008) related organizational ambidexterity with the development of capabilities necessary to enable the firm to survive in face of changed market conditions.

During the implementation of coopetition, a dilemma appears; how to sharing and protecting strategic resources results from coopetition (Oliver, 2004). Ambidexterity capability is a key dynamic capability to manage coopetitive tensions arising from the dilemma between exploration/exploitation (Gibson & Birkinshaw, 2004). Inside interorganizational relationships the exploration process is based on a common pool of competencies (value creation), whereas the exploitation process is based on a private property (value appropriation). Exploitation and exploration require a different managerial mind-set, different sources of allocated resources and a distinctive knowledge process

Ambidextrous managers must manage contradictions and conflicting goals, engage in paradoxical thinking and fulfill multiple roles (Gibson & Birkinshaw, 2004; Smith & Tushman, 2005). Other authors state that ambidextrous managers have both a short-term a long-term orientation (O’Reilly & Tushman, 2004). O’Reilly & Tushman (2008) argue that ambidexterity can only become a dynamic capability if management repeatedly and intentionally orchestrates firm resources. It can be concluded that individual dimension of ambidexterity is not explored further (Raisch et al., 2009).

It has been argued that, due to accelerating environmental, it becomes problematic to rely too much on internal resource creation as the sole foundation for competitive advantage. Firms increasingly access more diverse external sources in more flexible ways, including competitors, thus coopetition relationships. Knowledge exchange is a critical factor in maintaining a cooperative relationship between competitors, because it adds value to each organization (Chin et al., 2008).

The critical issue for firms is how to facilitate knowledge exchange while simultaneously protect their core proprietary knowledge during the process of interorganizational learning (Yang, Fang, Fang, & Chou, 2014). Hamel (1991) describes the importance of protecting knowledge in strategic alliances, and Inkpen (1998) discusses how firms tend to be reluctant to engage in alliances due to the risk of knowledge leakage.

However, if the creation of knowledge-based competitive advantage can be explained by organizational capabilities, as absorptive capability, it could be assume that the sustainability of competitive advantage can also be affected by these two capabilities, absorptive capability and protective capability (Andersén, 2012). Absorptive capability and protective capability (interorganizational learning capabilities) show their complexity in coopetition relationships, and are intrinsically related to tensions arising between partners. Firms are faced with the challenge of managing the tension between “trying to learn” (knowledge exchange) and “trying to protect” (knowledge protection).

Based on the arguments about ambidexterity by Raisch & Birkinshaw (2008), Yang et al. (2014) extend the ambidexterity concept to the context of interorganizational learning, Yang et al. (2014) explain that, through the proper design of interoganizational learning mechanisms, not only can knowledge exchange and knowledge protection be accomplished simultaneously, but they can also complement each other to enhance common and private benefits. Learning mechanisms are related to establish an alliance function that supervises and coordinates all the activities (Kale & Singh, 2007). This function facilitates sharing of know-how and investigates if partners violate agreements, so firms can prevent the opportunistic behaviours and safeguard proprietary knowledge, thereby nurturing ambidextrous capabilities.

Otherwise, coopetition is a specific type of relationship in which actors need to handle simultaneously value creation in the same domain in which value appropriation takes places (Ritala & Hurmerlinna-Lakkanen, 2009). In coopetition, value creation takes place through integrating complementary and supplementary resources among competitors with the aim to create a higher value that would otherwise be possible (Bengtsson & Kock, 2000, Gnyawali & Park, 2009). Value appropriation eventually takes place on the firm level and it affects either directly -direct competition for the created value- or indirectly -potential for future competition- (Ritala & Tidström, 2014). It is acknowledged in the existing research on coopetition that objectives related to value creation and appropriation may be in conflict (Padula & Dagnino, 2007; Ritala & Hurmerlinna-Lakkanen, 2009). Coopetition initiatives to balance may be related to adaptation and refocusing individual business concepts towards the customer (Tidström, 2014). We believe that this adaptation and balance is face to face related with the development of ambidexterity capability. It is required a better understanding of how this adaptation and balance of value creation and value appropriation is developed and manage by firms involved in coopetition.

We argue that manager ambidexterity capability, interorganizational learning capability and value creation/value appropriation balance capability are capabilities generated from ambidexterity capability.

Research has interpreted structural changes within strategic alliances as a sign of failure, but recently these transformations are considered to be a natural phenomenon (Schilke & Goerzen, 2010). Consequently, in coopetition relationships it is unrealistic to expect that a perfect fit between partners can be established from the very beginning. Rather, interaction and adaptation between partners are required to establish such a fit. Schilke & Goerzen (2010) referred to this transformation capability as interorganizational coordination capability. Coordination capability captures the ability of the firm to efficiently manage the division of tasks responsibility, interdependence, and operational processes between alliance partners. The need for interorganizational coordination can also be ascribed to the fact that alliance partners do not automatically have all of the necessary information to align their own actions with the activities of their counterparts and to harmonize them to achieve mutual objectives (Schilke & Goerzen, 2010). Consequently, building on this argument, we conceptualize coopetitive transformation capability as a further dimension of coopetitive capability.

During the past two decades it has been a substantial growth of publications dedicated to coopetition. As a consequence, the current body literature is extensive, but certain research areas in this field are still limited. Coopetition field faces several challenges that call further investigation.

Recent literature on coopetition has given attention not to explain differences between coopetition and other interorganizational relationships, but to individualize key characteristics of coopetition as a central issue in coopetition research. These essential characteristics are based on paradoxical condition of coopetition. Then, coopetition must be perceived and understood through a paradox lens, as it engages rival firms to cooperate with each other and raises managerial complexities. The paradox perspective enables to juxtapose concepts of cooperation and competition and promote the divergent thinking to understand the complex and contradictory phenomenon. Future research could explore deeper into the nature of paradox in coopetition and into the unifying and divergent forces that initiate contradictory interactions between firms. Further, while managers confront the paradox of coopetition, the field lacks a coherent framework to help managers to understand and manage it (Gnyawali et al., 2016). Additionally, research on coopetition paid less attention to how individuals perceive the coopetition paradox. Individuals need to integrate the coopetitive paradox, by accepting cognitively it and to integrate both contradictory dimensions into their daily activities.

Gnyawali et al. (2016) based on paradox theory, introduces the concepts of contradictions and dualities as key issues in coopetition paradox. However, and although the inclusion of this aspects is a big step in developing coopetition theory, there is not a clear separation of what could be categorized as potential tensions and what could be considered as management tools. The importance of these underlying aspects requires substantial investigation to understand where and how tension arises.

Literature acknowledged that tension is an integral part of coopetition paradox and suggests that managing paradox requires developing the capability to deal with tensions (Lewis, 2000). A significant contribution of the current investigation is different types of tensions occur at different levels. Future research should develop a multi-level understanding of the tension phenomenon and explore how it is experienced and managed across the different levels of an organization.

Generally tensions represent a negative side of business relationships (Das & Teng, 2000) and searches for solutions to minimize tension (Bengtsson & Kock, 2000). Fang, Chang, & Peng (2011) criticize earlier studies on negative aspects of tensions and argue the need for more research into relationship tensions. Literature on the outcomes of tensions in coopetition is limited. Tidström (2014)’s work reveals that tension can viewed as more positive that might expected, and argues that it is hard to manage tensions to the satisfaction of all parties involves. Each type of tension, its parts and development over time should be analysed in future research.

As tension is a psychological and behavioural phenomenon, it is important to include cognitive and emotive dimensions when investigating tensions in coopetition. Behavioural responses have consequences for performance of the firm and the relationship. Fernandez et al. (2014) argue that cognitive and behavioural factors play important roles in dealing with tensions. Authors encourage future researches to more systematically identify and examine such cognitive and behavioural factors.

Related to the different styles of management tensions, research shows that both integration and separation principles are simultaneously required to manage tensions (Fernandez et al., 2014). However simultaneously pursuing both is a challenge. Investigate more deeply conditions under which separation and integration will work separately is required.

We believe that coopetition management should be seen as a whole, in a more general and holistic way, not only focused on management of tensions. Some researchers have suggested that a firm’s capability to deal with coopetition is important to realizing gains (Gnyawali & Park, 2011), little is known about what constitutes such capability. We argue that other aspects of the relationship must be taken into account, e.g. firms need to identify challenges and opportunities, select partner, negotiate, leverage complementary assets, generate ambidexterity capabilities etc.

This paper contributes to coopetition research by extending the concept of coopetition capability and its conceptualization as a higher order capability which generates a flow of capabilities. Among the capabilities generated by coopetitive capability, we consider the importance of development capabilities to manage tensions, especially ambidexterity capability as the key capability intrinsically related to paradox and tensions. We believe that this theoretical construct opens a wide path and multiple ways for future investigation. Each of the capabilities defined could be investigated in depth and related them with different phases of life cycle of coopetition relationships, analysing their impact for successfully coopetition.

In that line, the proposed coopetitive capability hierarchical model shapes future research. A crucial implication for study is the asymmetry between partners in coopetition relationship. Coopetition researcher should be focus on this topic. Partners may have different levels of coopetition capability, thus the partner with high level of capabilities will be able to manage coopetition better and to focus on extracting private benefits (Khanna et al., 1998) from the partnership. How asymmetry impacts on coopetition relationship is an interesting and promising research subject.

This paper provides a solid and unexplored basis for future researchers to design and conduct systematic empirical research and in-depth case studies. We encourage scholars to investigate how firms develop the flow of capabilities in order to provide meaningful and valuable academic and managerial advances in coopetition research field.

Adler, P., & Heckscher, C. (2013). The collaborative, ambidextrous enterprise. Universia Business Review, 40, 34-51.

Alves, J., & Meneses, R. (2015). Partner selection in co-opetition: a three step model. Journal of Research in Marketing and Entrepreneurship, 17(1), 23-35.

Andersén, J. (2012). Protective capacity and absorptive capacity: managing the balance between retention and creation of knowledge-based resources. Learning Organization, 19(5), 440-452.

Augier, M., & Teece, D.J. (2009). Dynamic capabilities and the role of managers in business strategy and economic performance. Organizational Science, 20(2), 410-421.

Baumard, P. 2010. Learning in coopetitive environments. In Yami, S., Castaldo, S., Dagnino, G.B. and Le Roy, F. (eds.), Coopetition: winning strategies for the 21s century (pp. 74-100). Massachusetts: Edward Elgar.

Bengtsson, M., & Kock, S., (2000). Coopetition in business networks: to cooperate and compete simultaneously. Industrial Marketing Management, 29(5), 411-426.

Bengtsson, M., & Kock, S. (2008). Role conflicts in coopetitive relationships. Working paper, Umeä business school, University of Umeä.

Bengtsson, M., & Kock, S. (2014). Coopetition quo vadis? Past accomplishments and future challenges. Industrial Marketing Management, 43(2), 180-188.

Bez, S.M., Fernandez, A. S., Le Roy, F., & Dameron, S. (2015). Integration of coopetition paradox by individuals. A case study within the French banking industry. XXIVème conférence annuelle de l’Association Internationale de Management Stratégique.

Bouncken, R.B., Gast, J., Kraus, S., & Bogers, M. (2015). Coopetition: a systematic review, synthesis, and future research directions. Review of Managerial Science, 9(3), 577-601.

Brandenburger, A.M., & Nalebuff, B.J. (1996). “Coopetition”. Doubleday Currency, New York.

Chen, M.J. (2008). Reconceptualizing the competition-cooperation relationship: a transparadox perspective. Journal of Management Inquiry, 17(4), 280-305.

Chin, K.S., Chan, B., & Lam, P.K. (2008). Identifying and priorizing critical success factors for coopetition strategy. Industrial Management & Data Systems, 108(4), 437-454.

Czakon, W., Mucha-Kuś, K., & Rogalski, M. (2014). Coopetition research landscape. A systematic literature review 1997-2010. Journal of Economics & Management Strategy, 17, 122-150.

Das, T.K., & Teng, B.S. (2000). A resource-based theory of strategic alliances. Journal of Management, 26(1), 31-61.

Fang, S.R., Chang, Y.S., & Peng, Y.C. (2011). Dark side of relationships: a tensions-based view. Industrial Marketing Management, 40(5), 774-784.

Fernandez, A.S., & Chambaretto, P. (2013). How to manage tensions in coopetition? The role of information systems. In the European Academy of Management, 13th Annual Conference, Istambul.

Fernandez, A.S., Le Roy, F., & Gnyawali, D.R. (2014). Sources and management of tension in co-opetition case evidence from telecommunications satellites manufacturing in Europe. Industrial Marketing Management, 43(2), 222-235.

Gibson, C.B., & Birkinshaw, J. (2004). The antecedents, consequences, and mediating role of organizational ambidexterity. Academy of Management Journal, 47(2), 209-226.

Gnyawali, D.R., He, J., & Madhavan, R. (2006). Impact of coopetition on firm competitive behavior: an empirical examination. Journal of Management, 32(4), 507-530.

Gnyawali, D.R., & Park, B.J.R. (2009). Coopetition and technological innovation in small and medium-sized enterprises: a multilevel conceptual model. Journal of Small Business Management, 47(3), 308-330.

Gnyawali, D.R., & Park, B.J.R. (2011). Coopetition between giants: collaboration with competitors for technological innovation. Research Policy, 40(5), 650-663.

Gnyawali, D.R., Madhavan, R.M., He, J., & Bengtsson, M. (2012). Contradictions, dualities and tensions in cooperation and competition: a capability based framework. In annual meeting of the Academy of Management, Boston, MA.

Gnyawali, D.R., Madhavan, R.M., He, J., & Bengtsson, M. (2016). The competition-cooperation paradox in interfirm relationships: a conceptual framework. Industrial Marketing Management, 53, 7-18.

Hamel, G. (1991). Competition for competence and inter-partner learning within international strategic alliances. Strategic Management Journal, 12(4), 83-103.

Herzog, T. (2010). Strategic management of coopetitive relationships in CoPS related industries. In Yami, S., Castaldo, S., Dagnino, G.B. and Le Roy, F. (eds.), Coopetition: winning strategies for the 21st century. Massachusetts: Edwar Elgar.

Inkpen, A.C. (1998). Learning and knowledge acquisition through international strategic alliances. Academy of Management Perspectives, 12(4), 69-80.

Kale, P., & Singh, H. (2007). Building firm capabilities through learning: the role of the alliance learning process in alliance capability and firm‐level alliance success. Strategic Management Journal, 28(10), 981-1000.

Khanna, T., Gulati, R., & Nohria, N. (1998). The dynamics of learning alliances: competition, cooperation, and relative scope. Strategic Management Journal, 19(3), 193-210.

Lado, A., Boyd, N.G., & Hanlon, S.C. (1997). Competition, cooperation, and the search for economic rents: a syncretic model. Academy of Management Review 22(1), 110-141.

Lewis, M.W. (2000). Exploring paradox: toward a more comprehensive guide. Academy of Management Review, 25, 760-776.

Lin, Y., & Wu, L.Y. (2014). Exploring the role of dynamic capabilities in firm performance under the resource-based view framework. Journal of Business Research, 67(3), 407-413.

Luo, X., Slotegraaf, R.J., & Pan, X. (2006).Cross-functional “coopetition”: the simultaneous role of cooperation and competition within firms. Journal of Marketing 70(2), 67-80.

Luo, Y. (2007). A coopetition perspective of global competition. Journal of World Business, 42(2), 129-144.

Morris, M.H., Koçak, A., & Özer, A. (2007). Coopetition as a small business strategy: implications for performance. Journal of Small Business Strategy, 18(1), 35-55.

Oliver, A.L. (2004). On the duality of competition and collaboration: network-based knowledge relations in the biotechnology industry. Scandinavian Journal of Management, 20(1), 151-171.

O’Reilly, C.A., & Tushman, M.L. (2004). The ambidextrous organization. Harvard Business Review, 82(4), 74-83.

O’Reilly, C.A., & Tushman, M.L. (2008). Ambidexterity as a dynamic capability: resolving the innovator's dilemma. Research in Organizational Behavior, 28, 185-206.

Osarenkhoe, A. (2010). A study of inter-firm dynamics between competition and cooperation. A coopetition strategy. J. Database Market. Customer Strategy Management, 17(3), 201-221.

Padula, G., & Dagnino, G.B. (2007). Untangling the rise of coopetition: the intrusion of competition in a cooperative game structure. International Studies of Management and Organization, 37(2), 32-52.

Park, B.J.R. (2011). The effects of coopetition and coopetition capability on firm innovation performance. Doctoral dissertation, Virginia Polytechnic Institute and State University.

Pellegrin-Boucher, E., Le Roy, F., & Gurău, C. (2013). Coopetitive strategies in the ICT sector: typology and stability. Technology Analysis and Strategic Management, 25(1), 71-89.

Quintana-García, C., & Benavides-Velasco, C.A. (2004). Cooperation, competition, and innovative capability: a panel data of European dedicated biotechnology firms. Technovation, 24(12), 927-938.

Raisch, S., & Birkinshaw, J. (2008). Organizational ambidexterity: antecedents, outcomes, and moderators. Journal of Management, 34(3), 1-35.

Raisch, S., Birkinshaw, J., Probst, G., & Tushman, M.L. (2009). Organizational ambidexterity: balancing exploitation and exploration for sustained performance. Organizational Science, 20(4), 685-695.

Raza-Ullah, T., Bengtsson, M., & Kock, S. (2014). The coopetition paradox and tension in coopetition at multiple levels. Industrial Marketing Management, 43(2), 189-198.

Ritala, P., & Hurmelinna-Laukkanen, P. (2009). What's in it for me? Creating and appropriating value in innovation-related coopetition. Technovation. 29(12), 819-828.

Ritala, P., & Tidström, A. (2014). Untangling the value-creation and value-appropriation elements of coopetition strategy: a longitudinal analysis on the firm and relational levels. Scandinavian Journal of Management, 30(4), 498-515.

Schilke, O., & Goerzen, A. (2010). Alliance management capability: an investigation of the construct and its measurement. Journal of Management, 36(5), 1192-1219.

Sherer, S.A. (2003). Critical success factors for manufacturing networks as perceived by networks coordinators. Journal of Small Business Management, 41(4), 325-345.

Simonin, B.L. (1997). The importance of collaborative know-how: an empirical test of the learning organization. Academy of Management Journal, 40(5), 1150-1174.

Smith, W.K., & Lewis, M.W. (2011). Toward a theory of paradox: a dynamic equilibrium model of organizing. Academy of Management Review, 36(2), 381-403.

Smith, W.K., & Tushman, M.L. (2005). Managing strategic contradictions: a top management model for managing innovation streams. Organizational Science, 16(5), 522-536.

Tidström, A. (2014). Managing tensions in coopetition. Industrial Marketing Management, 43(2), 261-271.

Tsai, W. (2002). Social structure of coopetition within a multiunit organization. Organizational Science, 13(2), 179-190.

Uzzi, B. (1997). Social structure and competition in interfirm: the paradox of embeddedness. Administrative Science Quarterly, 42(1), 35-67.

Walley, K. (2007). Coopetition: an introduction to the subject and an agenda for research. International Studies of Management & Organization, 37(2), 11-31.

Wang, C.L., & Ahmed, P.K. (2007). Dynamic capabilities: a review and research agenda. International Journal of Management Review, 9(1), 31-51.

Wang, Y., & Rajagopalan, N. (2015). Alliance capabilities review and research agenda. Journal of Management, 41(1), 236-260.

Winter, S.G. (2003). Understanding dynamic capabilities. Strategic Management Journal, 24(10), 991-995.

Yang, S.M., Fang, S.C., Fang, S.R., & Chou, C.H. (2014). Knowledge exchange and knowledge protection in interorganizational learning: the ambidexterity perspective. Industrial Marketing Management, 43(2), 346-358.

Zineldin, M. (2004). Coopetition: the organization of the future. Marketing Intelligence & Planning, 22(6/7), 780-789.

1. Bachelor in Aerospace and Aeronautical Engineering by Polytechnic University, Madrid (Spain) and Master in Business Administration by University Rey Juan Carlos, Madrid (Spain), works in an aircraft engine manufacturer and in service support leading company as consultant engineer in defence business area. Currently, she is a PhD candidate at the University Rey Juan Carlos, Madrid (Spain). Her research is focused in coopetition relationships and dynamic capabilities in aerospace sector. Email: j.santolaya@alumnos.urjc.es

2. Associate Professor of Management at the Rey Juan Carlos University, Spain. She received her PhD in Business Administration from the Rey Juan Carlos University. Her research interest includes strategic alliances, cooperative agreements and firm-research organizations relationships. Her research has been published in Research Policy, International Journal of Technology Management, Journal of Knowledge Management, International Business Research, Service Business, Science and Public Policy and Universia Business Review, among others journals. Email: evamaria.mora@urjc.es

3. Associate Professor of Management at the Rey Juan Carlos University, Spain. She received her PhD in Management from the Rey Juan Carlos University. Her research interest includes strategic alliances, mergers and acquisitions, knowledge management and innovation. Her research has been published in International Business Review, Service Industries Journal, Journal of Knowledge Management, International Journal of Technology Management, Service Business, among others journals. Email: marta.ortizdeurbina@urjc.es

*. This paper has been supported by Project ECO2015-67434-R of Spanish Ministry of Economy and Competitiveness (Spain) and for the Excellent Research Group “Strategor” of URJC-Bank of Santander.