Vol. 38 (Nº 04) Año 2017. Pág. 11

Alejandra MEJÍA Vallejo 1; José ARIAS-PÉREZ 2

Recibido: 10/08/16 • Aprobado: 02/09/2016

ABSTRACT: The purpose of this article is to explore the differences in product and process innovation capabilities (ICs) and financial performance (FP) in manufacturing companies in Colombia. In the methodology, a cluster analysis was performed which identified three groups of companies with similar characteristics: innovators, explorers and stragglers. An analysis of variance (ANOVA) was also performed to establish meaningful differences in the means. The results show that for product ICs there are significant differences in the development of routines aimed at developing environmentally friendly products and improvements in design. Meanwhile, for processing ICs there are significant differences with regard to the incorporation of basic but essential business technologies and the management of interrelated technologies. However, for financial performance differences are significant in terms of sales growth and increased market share. In conclusion, the development of product and process ICs does not guarantee better results in sales growth and market share compared with smaller companies that have made less of an effort to consolidate such routines. This is probably due to other organizational capabilities that may be more decisive in the commercial success of products. |

RESUMEN: El propósito del presente artículo es explorar las diferencias en materia de capacidades de innovación (CI) de producto y proceso, y desempeño financiero (DF) en empresas manufactures de Colombia. En lo metodológico, se realizó un análisis clúster que permitió identificar tres grupos de empresas con características similares: innovadores, exploradores y rezagados; también, se efectuó un análisis de la varianza (ANOVA) para establecer diferencias significativas en medias. Los resultados muestran que en materia de CI de producto, son significativas las diferencias en el desarrollo de rutinas orientadas al desarrollo de productos amigables con el medio ambiente y la mejora en diseño; por su parte, en CI de proceso, son significativas las discrepancias en lo concerniente a la incorporación de tecnologías básicas y claves para el negocios y la gestión de tecnologías interrelacionadas; en cambio, en el DF, lo son en cuanto a crecimiento en ventas y aumento en participación de mercado. En conclusión, el desarrollo de CI de producto y de procesos no garantiza un resultado superior en crecimiento en ventas y participación de mercado, en comparación con empresas que han hecho menores esfuerzos para consolidar este tipo de rutinas, probablemente por la incidencia de otras capacidades organizacionales que pueden ser más determinantes en el éxito comercial de los productos |

Currently, a strong emphasis is being placed on innovation in business, in particular on the development of organizational routines, also known as innovation capabilities (ICs) (Lawson & Samson, 2001; Lema et al., 2015; Liu & Jiang, 2016). These allow the real transformation of ideas into new and better processes and products, and the creation of an innovative and organizational performance that is superior to the competition (Teece et al, 1997). Hence, the direct relationship of ICs with the possibilities the company has to achieve innovative success and adequately address problems need to be repeatedly analyzed (Robledo & Ceballos, 2008).

Since the beginning of the century the number of publications in the literature that analyze ICs and their links to business results has significantly increased. Publications mainly focus on financial performance (FP), showing positive effects on sales and growth in profits and market share, among other aspects. (Calantone et al, 2002; Yam et al, 2004; Sher & Yang, 2005; Guan et al, 2006; Yang et al, 2009).

However, at a national level studies of the relationship between ICs and FP have been superficial, and have been carried out mainly from the results of a national survey of innovation (Jimenez, 2009; Gómez & Robledo, 2011). The results of the survey are tied to many methodological restrictions, since the scales are more geared to measuring innovation activities than to ICs. Another line of research developed nationally seeks to evaluate the financial performance of companies that have invested most in innovation, but without establishing direct relationships with ICs (Rivera & Ruiz, 2011). There are also multiple studies that individually examine ICs in Colombian companies (Robledo & Ceballos, 2008; Gómez & Robledo 2009; Gómez, 2009; Aguirre, 2010; Robledo et al, 2010; Arias & Castaño, 2014).

However, no studies have been conducted that specifically analyze significant differences in ICs and FP or establish whether companies with greater IC development are in turn those which experience a higher FP. Such a study would indicate which variables businesses are concentrating on to attempt to develop organizational routines, and suggest how these efforts are really impacting business results. Strategies could then be developed to intensify and redirect IC development to other aspects that can create a greater value for businesses.

Therefore, this article explores the differences in product and process ICs and FP in Colombian manufacturing companies. To achieve this, a cluster analysis was carried out which identified three groups of companies with similar characteristics: innovators, explorers and stragglers. An analysis of variance (ANOVA) was also performed to establish meaningful differences in means and provide data for analysis and discussion.

Overall, the structure of the paper is as follows. The first section describes the innovation capabilities and the approach outlined by Yam et al. (2011). The second section of the article gives the objective perspectives and then focuses on the perceptual perspective. Subsequently, the product and process ICs described by Camisón and Villar-Lopez (2014) are presented, where the relationship between product and process ICs and financial performance is emphasized to attempt to establish associations with different variables. The third section gives the results of the investigation, the forth section presents the discussion, and finally, the last section gives conclusions and recommendations.

Dynamic capabilities (Teece et al, 1997) are understood as the ability of an organization to create, expand or deliberately and systematically modify operational routines and face a changing environment (Winter, 2003). These capabilities constitute a source of competitive advantage, are heterogeneously distributed among companies and are difficult to imitate or transfer (Leonard-Barton, 1992).

In this regard, these routines are responsible for generating differentiation in organizations that come to promote competitive advantage. This is key to providing support and growth in the current market, which is characterized for being turbulent, changing and unpredictable. Therefore, a company must develop internal capabilities that allow its differentiation. Among the different dynamic capabilities are innovation capability and the ability to continuously transform knowledge and ideas into new products, processes and systems that benefit the organization and stakeholders (Lawnson & Samson, 2001). In other words, IC is the way a company manages to constantly adapt to its surroundings by integrating its key capabilities with the resources it possesses. This allows the company to understand its environment and stimulate the innovation that helps it establish its competitive advantage (Sher & Yang, 2005; Coombs & Bierly, 2006; Lema et al., 2015; Liu & Jiang, 2016).

The ICs addressed in the literature are predominantly from three approaches: processes, assets and functional. The first approach studies the ICs related to the stages of the innovation process, from knowledge generation to commercialization and includes support stages and transversal strategies. Furthermore, throughout the process economic resources and competitor analysis are considered, thereby achieving innovation in products and processes and the efficient use of internal systems (Yam et al, 2011).

The process approach refers to an aligned and consecutive sequence, which considers the ability to generate concepts, acquire technology, perform process innovation and product development, effectively use systems and tools, and allocate and deploy available resources. At the same time, elements such as competitors, innovation strategy and the market in general must be considered and understood from within the organization. This allows the relevant developments and cultural systems involved in the innovative process, which should be routine and sustainable over time, to be understood (Chiesa et al, 1996; Yam et al, 2011; Zawislak et al, 2012).

Meanwhile, the functional approach looks at the ICs in relation to the functional areas of the company. From this perspective, ICs that are proposed on a recurring basis are learning, R and D, allocation of resources, manufacturing, marketing, organization and strategic planning capabilities (Guan & Ma, 2003; Wang et al, 2008).

The asset approach looks at ICs in a more systemic way, not exclusively related to a specific stage of the innovation process or with a specific functional area, but as a set of tangible or intangible resources, such as human resources, knowledge, processes, patents, articles, brands and financial resources that converge to generate innovations (Li & Kozhikode, 2009; Yang et al, 2009; Menguc & Auh, 2010; Castellacci & Natera, 2013). In this approach, some jobs highlight capabilities such as knowledge, organization and human resources, (Martinez-Román et al, 2011). While it has become more important to conceive ICs according to the types of innovation, especially product and process innovation, some authors suggest the need to consider radical and incremental product ICs (Menguc & Auh, 2010), or product ICs and process ICs (Camisón & Villar-López, 2014).

Since the focus is active, the asset approach represents a non-fragmented way of conceiving ICs. This approach has been gaining greater importance compared to the other two perspectives. In particular, the work of Camisón and Villar-López (2014) suggest that product ICs could replace obsolete ICs, expand the range of the ICs, improve their design, develop products that are environmentally friendly, and reduce the time between new product development and market launch. Moreover, the asset approach is a way of expanding the horizons of discussion regarding ICs at a national level, where functionalist orientation models have dominated (Robledo & Ceballos, 2008; Aguirre, 2010; Robledo et al, 2010; Arias & Castaño, 2014). Similarly, Camisón & Villar-López (2014) conceive process ICs as the ability of the company to dominate, absorb and manage basic and key technologies, continuously develop programs to integrate production activities and reduce costs, as well as acquire key knowledge to improve work organization, structure processes friendly to the environment and maintain low inventory levels without affecting production.

Another issue that has caught the attention of IC researchers is how they impact financial performance. The literature talks about two perspectives. The first explores the relationship between the ICs and FP from the information supplied by the company’s results. The second takes a perceptual perspective, which investigates the management’s appreciation for the results of the company, usually in relation to the competition (Yam et al, 2004; Sher & Yang, 2005).

In the first perspective, two financial indicators are usually considered: return on assets (ROA) and return on sales (ROS). The first of these is strongly related to the ICs associated with R and D, human resources and the building of exogenous innovation links for cooperation in technology acquisition (Yam et al, 2004; Sher & Yang, 2005). ROS is greatly influenced by the development of ICs of R&D and resource allocation (Yam et al, 2004; Sher & Yang, 2005; Yam et al, 2011).

The perceptual perspective seeks to establish management appreciation for the results of the company using measurement scales. Investigations are carried out which describe in a quantitative manner, but not exactly from the financial indicators, the relationship between the ICs and performance of the company (Calantone et al, 2002; Guan & Ma, 2003; Yang et al, 2009; Akgün et al, 2009; Lau et al, 2010; Sok & O'Cass, 2011, Saunila & Ukko, 2012; Lang et al, 2012).

In this work we consider the impact of ICs on financial performance, particularly in terms of increased sales and exports, increased market share and growth in earnings. With regard to growth in sales and exports, R and D and resource allocation ICs have a positive influence. Establishing routines for R and D can ensure a high rate of innovation and product competitiveness in medium and large companies, while resource allocation capability facilitates the transformation of innovative ideas into products that can be sold, resulting in excellent sales performance (Guan & Ma, 2003; Yam et al, 2004; Lau et al, 2010; Yam et al, 2011).

Market share is the other indicator that needs to be dealt with. It is the result of developing the IC of continuous education and the IC of inventing, developing, introducing and marketing innovative products. This involves routine development, consolidation of intra and inter-organizational information communication and integration processes. It results in the ability to develop and deliver products to the market more effectively than the competitors (Branzei & Vertinsky, 2006; Calantone et al, 2002, Sok & O'Cass, 2011).

From the assumptions of Kmieciak et al, (2012) the business-level ICs that are most related to an increase in profits should be highlighted. These ICs are: the capacity to invest in innovation; having internal and external communication that allows the needs of end users (clients) to be identified; and alignment of management and innovation strategies which streamline the generation of ideation and creation and develop products required by the market.

Therefore, this article focuses on the perceptual perspective. The literature has criticized the use of objective indicators in innovation studies because of methodological limitations, biases associated with their construction, and difficulties in demonstrating the specific impact of innovation activities (Klingenberg et al, 2013). However, other authors advocate using measurement scales because in the long run results differ little from what is shown by the company’s results (Judge & Douglas, 1998).

This research is a descriptive and transversal cut study. The principles of Hernández et al, (2010) suggest that studies of this kind "seek to investigate the incidence of the variables under study in a determined context and time", in this case, product and process ICs and the FP of Colombian manufacturing companies. The instrument was applied in a single moment in time. It should be highlighted that such studies provide comparative descriptions between groups, as is addressed in this research.

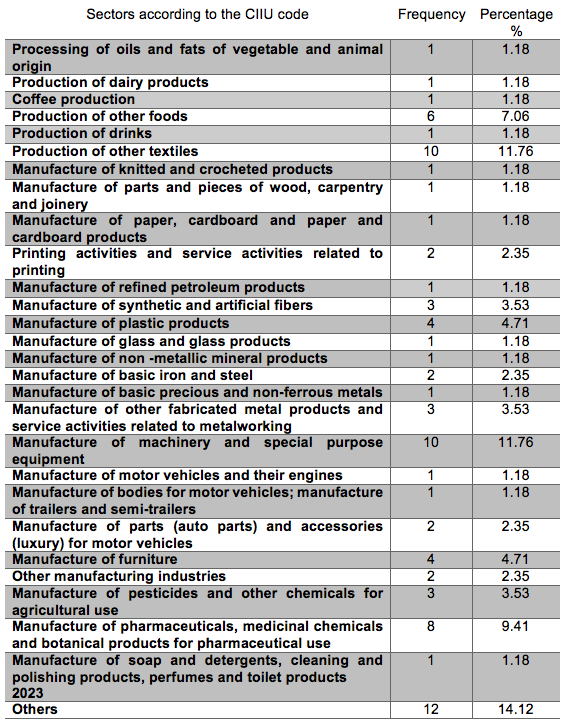

The research was conducted through a questionnaire sent by email to manufacturing companies in Colombia listed on a database. 85 valid responses were obtained for the analysis of the final results and findings (See Table No. 1).

Table No 1. Business sectors, fields of study, positions, size of the company and functional areas of the respondent

Source: Authors

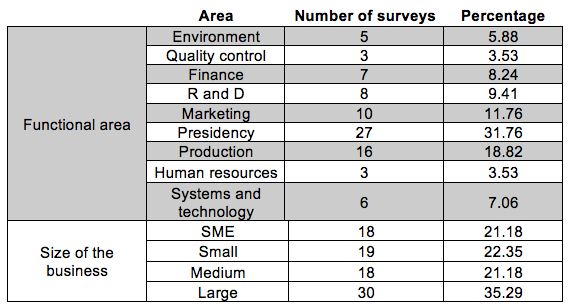

The questionnaire responses used for the final analysis reveal that the manufacturing companies covered in this study are located in four of Colombia’s five regions: Caribbean, Andean, Pacific and Amazon. The size and functional area described are significantly in favor of the goals set (See table No. 2).

Table N° 2: Functional area of the businesses under study

Source: Authors

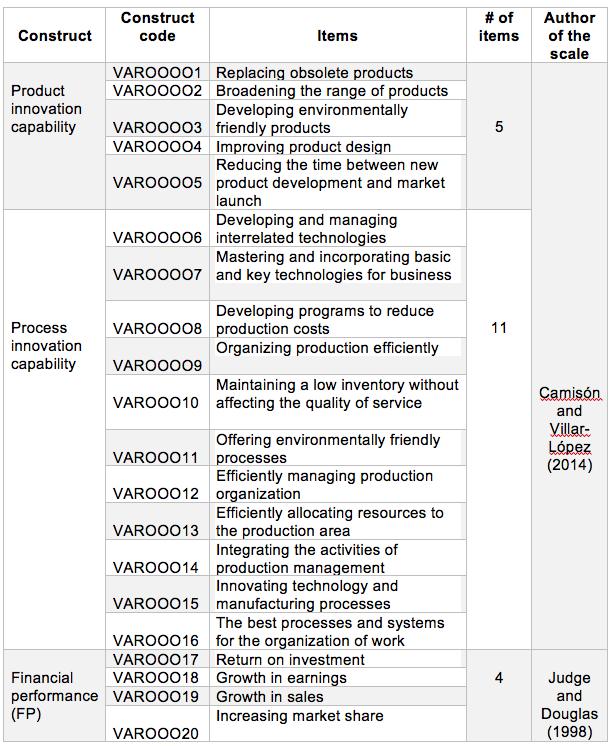

The scale proposed by Camisón and Villar-López (2014) was used to measure ICs in products and processes. It consists of sixteen (16) items and proposes five (5) response options, with 1 being much lower than the competitors and five much higher than the competitors. The scale of Judge and Douglas (1998) was used in the case of FP, which consists of four (4) items and five (5) response options, with 1 being very low compared to other companies in the sector and five much higher than other companies (See table No. 3).

Table N° 3 Measurement scales

Source: Authors

The reliability of the scales was then verified and it was established that all constructs have Cronbach's alpha higher than 0.8 (Carmines & Zeller, 1979). In the case of product IC the value was 0.85, for process IC it was 0.91 and for FP it was 0.89. For data analysis, first a hierarchical cluster analysis was performed by applying the method of Ward, which identified three groups of companies with similar characteristics in product IC, process IC and FP. Subsequently, an ANOVA analysis involving the application of the Levene and t-tests was performed. The first test established the homogeneity of variance. If this gave an affirmative result, the second test was performed, which sought to establish which differences in means were significant (Hair et al., 2006).

The cluster analysis identified three groups of companies with similar characteristics in terms of ICs and FP: innovators, explorers and stragglers. The first group consists of thirty-two companies, the second has thirty-one, and the third has twenty. The results indicate that in terms of ICs, the innovators are the leaders, the explorers are in the middle, and the stragglers have a low level of organizational routine development.

The data values were classified into three (3) interest groups. Group 1 refers to the Innovators, with 32 observations; Group 2 is the Stragglers, with 31; and Group 3 is the Followers, with 21, giving a total of 85. For a better visualization of the results, they are shown in terms of the constructs investigated, their respective groups, the averages, and the results of the Levene test and Student’s t-test.

Innovation capacity associated with products demonstrates the urgent need for companies to continue renovating, expanding, developing and creating new products and services for the market. However, in relation to product ICs, the results were able to establish significant differences in the averages in two of the five variables of the construct. This means that the groups under study had a greater impact on the following items: the development of environmentally friendly products and improving product design (see Table 4).

Table. N° 4 Significant differences in averages for product ICs

Constructs |

Groups |

Average |

Levene’s test for equal variances |

T-test |

|||

F |

Sig. |

F |

Sig. |

||||

Product IC |

VAROOOO1 |

1 |

4.2188 |

2.458 |

0.092 |

22.929 |

000 |

2 |

2.7097 |

||||||

3 |

3.1429 |

||||||

VAROOOO2 |

1 |

4.3125 |

0.667 |

0.516 |

15.821 |

000 |

|

2 |

3.0323 |

||||||

3 |

3.5238 |

||||||

VAROOOO3 |

1 |

4.4688 |

3.694 |

0.029 |

15.056 |

000 |

|

2 |

3.0968 |

||||||

3 |

3.5714 |

||||||

VAROOOO4 |

1 |

4.5625 |

4.298 |

0.017 |

26.165 |

000 |

|

2 |

3.1613 |

||||||

3 |

3.9048 |

||||||

VAROOOO5 |

1 |

3.8125 |

0.093 |

0.911 |

22.592 |

000 |

|

2 |

2.3548 |

||||||

3 |

3.4286 |

||||||

Note: Classification of target study groups: Innovators (1); Stragglers (2); Followers (3)

Source: Authors

The above table shows that for the product IC construct, the average for the VAROOOO4 code of Group 1 gives 4.5625, Group 3 gives 3.9048 and Group 2 gives 3.1613. This suggests that improving product design is key when it comes to analyzing the processes of organizational ICs. However, in contrast, for other groups the VAROOOO 3 code is shown to be significant as it expresses that the IC can only be viable and successful in the market if environmentally friendly products are developed. This was reconfirmed by Group 1 with 4.4688, Group 3 with 3.5714 and Group 2 with 3.0968.

Table No. 5 shows the average differences for the process IC construct in the organizations under study. There were significant differences in the averages in two of the eleven variables of the construct. For the process ICs investigated, it can be observed that the indicators for the groups of interest in the respective averages are not equal. The most relevant value is found in the VAROOOO7 code for groups 1, 3 and 2 consecutively. In other words, for the innovators (4.375), followers (3.1429) and stragglers (2.6129), the process ICs are classified as mastering and incorporating basic and key technologies for business. However, VAROOOO6 is shown to be of greater significance in developing and managing interrelated technologies for groups 1, 3 and 2, with values of 4.0625, 3.0476 and 2.5806 respectively.

Table N° 5 Significant differences in the means for Process ICs

Constructs |

Groups |

Average |

Levene’s test for equal variances |

T-test |

|||

F |

Sig. |

F |

Sig. |

||||

Process IC |

VAROOOO6 |

1 |

4.0625 |

4.391 |

0.015 |

23.285 |

000 |

2 |

2.5806 |

||||||

3 |

3.0476 |

||||||

VAROOOO7 |

1 |

4.375 |

3.233 |

0.045 |

40.157 |

000 |

|

2 |

2.6129 |

||||||

3 |

3.1429 |

||||||

VAROOOO8 |

1 |

4.125 |

1.568 |

0.215 |

16.904 |

000 |

|

2 |

2.871 |

||||||

3 |

3.381 |

||||||

VAROOOO9 |

1 |

4.125 |

1.957 |

0.148 |

16.591 |

000 |

|

2 |

3 |

||||||

3 |

3.2857 |

||||||

VAROOO10 |

1 |

4 |

0.177 |

0.838 |

10.69 |

000 |

|

2 |

3.0323 |

||||||

3 |

3.2857 |

||||||

VAROOO11 |

1 |

4.3125 |

0.766 |

0.468 |

17.965 |

000 |

|

2 |

3.0323 |

||||||

3 |

3.3333 |

||||||

VAROOO12 |

1 |

4.0938 |

1.026 |

0.363 |

14.88 |

000 |

|

2 |

3 |

||||||

3 |

3.3333 |

||||||

VAROOO13 |

1 |

4.1875 |

2.479 |

0.09 |

22.131 |

000 |

|

2 |

3.0645 |

||||||

3 |

3.1429 |

||||||

VAROOO14 |

1 |

4.2188 |

1.538 |

0.221 |

24.565 |

000 |

|

2 |

3.0323 |

||||||

3 |

3.1905 |

||||||

VAROOO15 |

1 |

4 |

2.302 |

0.107 |

19.135 |

000 |

|

2 |

2.5806 |

||||||

3 |

3.5238 |

||||||

VAROOO16 |

1 |

3.875 |

0.836 |

0.437 |

17.967 |

000 |

|

2 |

2.6774 |

||||||

3 |

3.381 |

||||||

Note: Classification of target study groups: Innovators (1); Stragglers (2); Followers (3)

Source: Authors

Significant averages were established in two of the four variables of the FP construct. For the VAROOO19 code in Group 1 (Innovators) the average is 3.4688, for Group 2 (Explorers) the average is 4.1429 and for group 3 it is 2.6774. In terms of increased market share, the analysis showed that for Group 1 the significant mean is 3.4688, for Group 2 it is 4 and for Group 3 it is 2.5161 (see Table 6).

Table N° 6 Significant differences in the means for Financial Performance

Constructs |

Groups |

Mean |

Levene’s test for equal variances |

T-test |

|||

F |

Sig. |

F |

Sig. |

||||

Financial performance |

VAROOO17 |

1 |

3.5313 |

2.185 |

0.119 |

41.73 |

000 |

2 |

2 |

||||||

3 |

3.9524 |

||||||

VAROOO18 |

1 |

3.5 |

0.939 |

0.395 |

38.466 |

000 |

|

2 |

2.0323 |

||||||

3 |

3.9048 |

||||||

VAROOO19 |

1 |

3.4688 |

3.539 |

0.034 |

15.716 |

000 |

|

2 |

2.6774 |

||||||

3 |

4.1429 |

||||||

VAROOO20 |

1 |

3.4688 |

3.788 |

0.027 |

16.505 |

000 |

|

2 |

2.5161 |

||||||

3 |

4 |

||||||

Note: Classification of target study groups: Innovators (1); Stragglers (2); Followers (3)

Source: Authors

The results show that efforts to develop ICs in companies are being directed mainly towards managing technology and its incorporation in production processes. Similarly, there is a strong interest in developing organizational routines that can generate products that incorporate concern for the environment and add value from a design point of view of.

However, it should be noted that the group of innovative companies that is making a greater effort to develop product and process ICs, does not exhibit the best business results, particularly in terms of sales growth and market share. To a certain extent, this contradicts the literature which suggests that further development of ICs represents outstanding financial results. This situation may be due to the effects generated by other organizational capabilities, probably from the commercial dimension, which deal with bringing products to market and distributing them. Ultimately, this also affects the FP.

The development of product and process ICs may be insufficient to obtain a better FP. This suggests that such routines must be complemented by other organizational capabilities that are oriented to other types of innovation. For example, marketing and organizational innovation (OECD, 2005) usually generates competitive advantage due to the introduction of innovations into the market, and thus complements the ICs from a technological dimension.

From an academic point of view, the main contribution made by this paper is by showing that concentrating on developing product and process ICs does not guarantee a better result in terms of sales growth and market share than companies that have only made minor efforts to consolidate such routines. This is probably because of the incidence of other organizational capabilities that may be decisive in the commercial success of products. This means that in the manufacturing sector, the development of ICs with a strong orientation toward technology can be carried out in a way that is disconnected from the market requirements. Therefore, this strategy is insufficient to achieve outstanding business results.

In business practice, the organization should not focus exclusively on the development of products and processes that only cover the technological dimension. It is also necessary to enhance complementarity with other organizational processes that are more oriented to stimulating the introduction of product innovations in the market, taking into account the significant differences in sales growth and market share. In other words, we must give greater importance to ICs that are more connected with the market pull innovation approach. This would place greater emphasis on the recognition of customer needs, market trends, and anticipation of changes in consumer behavior.

There are working limitations, like the use of a highly relevant theoretical IC model that does not consider ICs associated with other types of innovation that can have a major impact on financial performance, such as the marketing organizational IC. Equally, the number of observations assumes there are restrictions when making generalizations, meaning that these findings are exploratory.

With respect to future research, the results show significant differences in the development of capabilities aimed at generating environmentally friendly products and design improvements. Therefore, it would be appropriate to conduct more specific studies that explore this reality from constructs such as green business ICs (Lin et al, 2011) and product design ICs (Swan et al, 2005). This could highlight the real achievements of companies in the above constructs.

Another future line of research is to identify the organizational factors and external variables that act as inhibitors of high financial performance, particularly in the case of companies that have made greater efforts to consolidate product and process ICs. Organizational routines that complement these in terms of achieving commercial success should also be identified.

Aguirre, J (2010) Metodología para medir y evaluar las capacidades tecnológicas de innovación aplicando sistemas de lógica difusa: caso fábricas de software. Medellín. Medellín, Antioquia, Colombia: Universidad Nacional de Colombia. Facultad de Minas.

Akgün, A, Keskin, H, Byrne, J (2009) Organizational emotional capability, product and process innovation, and firm performance: An empirical analysis. Journal of Engineering and Technology Management, 26(3), 103-130

Arias, J, Castaño, C (2014) Madurez de las capacidades de innovación en empresas colombianas. Revista Venezolana de Gerencia, 19(66), 306-318.

Branzei, O, Vertinsky, I (2006) Strategic pathways to product innovation capabilities in SMEs. Journal of Business Venturing, 21(1), 75-105

Calantone, R, Cavusgil, T, Zhao, Y (2002). Learning orientation, firm innovation capability, and firm performance. Industrial marketing management, 31(6),515-524.

Camisón, C, Villar-López, A (2014) Organizational innovation as an enabler of technological innovation capabilities and. Journal of Business Research, 67(1), 2891-2902.

Carmines, E, Zeller, R (1979) Reliability and validity assessment (Vol. 17). Sage publications.

Castellacci, F, Natera, J (2013) The dynamics of national innovation systems:A panel cointegration analysis of the coevolution between innovative capability and absorptive capacity. Research Policy, 42(3), 579–594.

Chiesa, V, Coughlan, P, Voss, C (1996) Development of a technical innovation audit. Journal of product innovation management, 13(2), 105-136.

Coombs, J, Bierly, P (2006) Measuring technological capability and performance. R&D Management, 36(4), 421-438.

Gómez, M (2009) Evolución de las capacidades de innovación en la industria colombiana: Un análisis comparativo de los resultados de las encuestas de innovación de 1996 y 2005. Medellín, Antioquia: Universidad Nacional de Colombia. Facultad de Minas.

Gomez, M, Robledo, J (2011) Evolución de las capacidades de innovación en la industria colombiana: Un análisis comparativo de los resultados de las encuestas de innovación de 1996 y 2005. Colombia: Universidad Nacional.

Guan, J, Ma, N (2003) Innovative capability and export performance of Chinese firms. Technovation, 23(9), 737-747.

Guan, J, Yam, R, Mok, C, Ma, N (2006) A study of the relationship between competitiveness and technological innovation capability based on DEA models. European Journal of Operational Research, 170(3), 971–986.

Hair, J, Black, W, Babin, B, Anderson, R, Tatham, R (2006) Multivariate data analysis (Vol. 6). Upper Saddle River, NJ: Pearson Prentice

Jiménez, F (2009) Las Capacidades de Innovación Tecnológica y el Desempeño Empresarial y Sectorial en Colombia. Medellín, Antioquia, Colombia: Universidad Nacional.

Judge, J, Douglas, T (1998) Performance implications of incorporating natural environmental issues into the strategic planning process: an empirical assessment. Journal of Management Studies, 35(2), 241-262.

Klingenberg, B, Timberlake, R, Geurts, T, Brown, R (2013) The relationship of operational innovation and financial performance—A critical perspective. International Journal of Production Economics, 142(2), 317-323.

Kmieciak, R, Michna, A, Meczynska, A (2012) Innovativeness, empowerment and IT capability: evidence from SMEs. Industrial Management & Data Systems, 112(5), 707-728.

Lang, T, Lin, S, Vy, T (2012) Mediate effect of technology innovation capabilities investment capability and firm performance in Vietnam. Procedia-Social and Behavioral Sciences, 40, 817-829

Lau, A, Yam, R, Tang, E (2010) The impact of technological innovation capabilities on innovation performance: An empirical study in Hong Kong. Journal of Science and Technology Policy in China, 1(2), 163-186

Lawson, B, Samson, D (2001) Developing Innovation Capability in Organisations: A Dynamic Capabilities Approach. International Journal of Innovation Management, 5(03), 377-400.

Lema, R., Quadros, R., & Schmitz, H. (2015). Reorganising global value chains and building innovation capabilities in Brazil and India. Research Policy, 44(7), 1376-1386.

Li, J, Kozhikode, R (2009) Developing new innovation models: Shifts in the innovation landscapes in emerging economies and implications for global R&D management. Journal of International Management, 15(3), 328-339.

Lin, Y, Tseng, M, Chen, C, Chiu, A (2011) Positioning strategic competitiveness of green business innovation capabilities using hybrid method. Expert systems with applications, 38(3), 1839-1849.

Liu, L., & Jiang, Z. (2016). Influence of technological innovation capabilities on product competitiveness. Industrial Management & Data Systems, 116(5), 883-902.

Martínez-Román, J, Gamero, J, Tamayo, J (2011) Analysis of innovation in SMEs using an innovative capability-based non-linear model: A study in the province of Seville (Spain). Technovation, 31(9), 459-475.

Menguc, B., and Auh, S (2010) Development and return on execution of product innovation capabilities: The role of organizational structure. Industrial marketing management, 39(5), 820–831.

Hernández, R, Fernández, C, Baptista, L, Casas, M (2010) Metodología de la Investigación . Ciudad de México: McGraw-Hill Interamericana.

OECD (2005) Oslo manual: Guidelines for collecting and interpreting innovation data (No. 4). Publications de l'OCDE.

Rivera J, Ruíz, D (2011) Análisis del desempeño financiero de empresas innovadoras del Sector Alimentos y Bebidas en Colombia. Pensamiento & Gestión, (31), 109-136.

Robledo V, López C, Zapata, W, Pérez, J (2010) Desarrollo de una Metodología de Evaluación de Capacidades de Innovación. Revista Perfil de Coyuntura Económica, 15, 133-148.

Robledo, J, Ceballos, Y (2008) Estudio de un proceso de innovación utilizando la dinámica de sistemas. Cuadernos de administración, 21(35), 127-159.

Saunila, M, Pekkola, S, Ukko, J (2014) The relationship between innovation capability and performance: The moderating effect of measurement. International Journal of Productivity and Performance Management, 63(2), 234-249.

Sher, P, Yang, P (2005) The effects of innovative capabilities and RandD clustering on firm performance: the evidence of Taiwan’s semiconductor industry. Technovation, 25(1), 33-43.

Sok, P, O´Cass, A (2011) Understanding service firms brand value creation: a multilevel perspective including the overarching role of service brand marketing capability. Journal of Services Marketing, 25(7), 528-539.

Swan , K, Kotabe, M, Allred, B (2005) Exploring Robust Design Capabilities, Their Role in Creating Global Products, and Their Relationship to Firm Performance. Journal of Product Innovation Management, 22(2), 144-164.

Teece, D, Pisano, G, Shuen, A (1997) Dynamic Capabilities and Strategic Management. Strategic Management Journal, 18(7), 509-533.

Wang, C, Lu, I, Chen, C (2008) Evaluating firm technological innovation capability under uncertainty. Technovation, 28(6), 349–363.

Winter, S (2003) Understanding dynamic capabilities. Strategic Management Journal, 24(10), 991-995.

Yam, R, Guan, J, Pun, K, Tang, P (2004) An audit of technological innovation capabilities in Chinese firms: some empirical findings in Beijing, China. Research policy, 33(8), 1123-1140.

Yam, R, Lo, W, Tang, E, Lau, A (2011) Analysis of sources of innovation, technological innovation capabilities, and performance: An empirical study of Hong Kong manufacturing industries. Research Policy, 40(3),391-402.

Yang, C, Marlow, P, Lu, C (2009) Assessing resources, logistics service capabilities, innovation capabilities and the performance of container shipping services in Taiwan. International Journal of Production Economics, 122(1), 4-20.

Zawislak, P, Cherubini Alves, A, Tello-Gamarra, J, Barbieux, D, Reichert, F (2012) Innovation capability: from technology development to transaction capability. Journal of technology management & innovation, 7(2), 14-27.

This article is derived from a master's thesis attached to the project “Evaluación del impacto de las actividades de innovación sobre el desempeño financiero en empresas antioqueñas líderes en I+D+I”. It was supported by Research Fund of University of Antioquia, 2013-2015.

1. Master’s in Science, Technology and Innovation Management. Professor, University of Antioquia, alejamejiavallejo@gmail.com

2. PhD student in Business Administration, Master’s in Science, Technology and Innovation Management. Professor, Department of Administrative Sciences, University of Antioquia, jenrique.arias@udea.edu.co