Ely Laureano Paiva* y Teniza da Silveira**

Recibido: 14-04-2010 - Aprobado: 12-09-2010

|

ABSTRACT: |

|

RESUMEN: |

Studies that analyze the dynamics of knowledge integration among different functional areas, hierarchical levels and among different organizations are usual in management research . Since both processes can enhance organizational performance and competitiveness, companies need to create capabilities to attain it.

In accordance with this scenario, we have carried out a study with the food and machinery industries, that analyses capability creation from a cross-functional perspective. More specifically, we investigated the integration between manufacturing, R&D and marketing. We claim that when function actions are focused in a specific part from a value network there is a higher level of integration with this one. Therefore, capability creation in this case suggests to be a result from an asymmetric effort along the value network.

The article presents the following structure. Firstly, we present the theoretical references. Secondly, the research methodology is discussed. Thirdly, we present the results. Fourthly, we present the our first conclusions.

Manufacturing integration with other functional areas and other external actors like suppliers and clients is a current topic in OM research. Nevertheless a few articles explore this issue in an integrated approach. Swink et al. (2007) was one of the first articles showing the relationship between corporate strategy, competitive priorities and performance.

This research aims to explore the three levels of cross-functional integration related to the strategic, tactical and operational levels (Parente, 1997). Nevertheless, diversely from Swink et al. (2007), we analyzed manufacturing integration with marketing and R&D areas.

Integration between manufacturing and marketing has been studied along the last decades (Abernathy, 1976, Shapiro, 1977, Hutt and Speh, 1984, Crittenden, 1992; Malhotra and Sharma, 2002; Hausman et al., 2002; O’Leary and Flores, 2002). Nevertheless, despite the importance given to the interactions among marketing and others functions in market orientation literature (Kohli and Jaworski, 1990, Narver and Slater, 1990, Slater and Narver, 1994, 1995), there is no much empirical evidence about how these interactions has developed. More recently, Maltz and Kohli (2000) analyzed the relative effectiveness of the integrating mechanisms commonly used in reducing conflict between marketing and other functions, including manufacturing. Cross-functional team use appears as an useful mechanism in reducing conflict between marketing and manufacturing, while other five mechanisms (i.e. multifunctional training, social orientation, spatial proximity, compensation variety and formalization) did not appear as effective ones.

Parente (1998) identified different focus in manufacturing-marketing integration research. The first focus is related to the level approach: strategic, tactical or operational. According to her, the contacts between the actors are more direct than in the other levels at the operational level, because short time adjustments are needed in this context. While in the tactical level individual characteristics are not at the center of the interaction, at the strategic level individual and functional integrations are the spotlight. The author suggested future studies related to the transaction and communication processes related to the strategic, tactical and operational levels. Song, Montoya-Weiss and Schmidt (1997) identified that evaluation criteria, reward structures, and management expectations affects positively cross-functional cooperation during the New Product Development (NDP) process. In a similar way, Shapiro (1977) in his seminal article on manufacturing and marketing integration identified quality assurance, breadth of product line and NPD, among others aspects, as critical issues for cross-functional integration.

Initially, Skinner (1969) and Wheelwright (1984) claim that operation strategy should be aligned with the company’s strategic planning. Wheelwright and Hayes (1985) were pioneers in identifying manufacturing as a main source of competency. Furthermore, capabilities have been one of the main focus in the literature on operation strategy presently (Hayes and Pisano, 1996; Zahra and Das. 1993; Stalk et al., 1992). From the marketing strategy point of view, the literature has stressed the competitiveness focus not just on customers, but also on cross-functional coordination, competitors, and profitability aspects, what is called market orientation (Kohli and Jaworski, 1990, Kohli, Jaworski and Kumar, 1993).

At the same time, strategy literature has studied the emergence of companies’ networks and the influence of this type of configuration on competitiveness (Tapscott, 1999; Venkatraman and Subramaniam, 2001). Oliver and Liebeskind (1997) studied the biotechnology industry. identifying inter-organizational and intra-organizational networks. In the first case the networks are created among different companies. In the second case, the network is created internally among company’s functional areas. However, few studies on operations strategy have analyzed the role of operations in companies’ networks and, more specifically, its integration with other functional areas.

Table 1 – Propensity for conflict between functional areas in the NPD process: different goals

| Marketing | R&D | Manufacturing | |

|---|---|---|---|

| Objectives | Create change through new products and new technology. | Create change through new products and new technology. | Achievement of efficiency in production and cost minimization. |

| Results expected | Creating and maintaining new markets and satisfied customers. | Creating new products. | Efficient utilization of resources, cost minimization, and meeting objective quality standards. |

| Areas preferences | Fast, and fluid response to customers demands. | Elegance and perfection in product design. | Accurate sales forecasts and frozen design specifications. |

| Broad products line to satisfy every customer. Rapid product delivery across a wide mix of products. |

Break-trough (patentable) revolutionary products. | Narrower product lines to gain economies of scale and minimize changeover problems. Just-in-time delivery systems that minimize inventory investment. |

Source: Adapted from Song, Montoya-Weiss and Schmidt (1997)

Complementarily, Hayes (2002) argued that in a new economy era operations management have changed in many aspects. Hayes shows that in the current context unit of analysis is not the operating unit but a network of independent parts where companies develop on-going relationships with suppliers, customers and “complementors”, seeking sometimes to develop complementary products and to manage ever changing processes and networks. Similarly, Venkatraman and Subramanian (2001) claim that strategy is changing from portfolio of capabilities to portfolio of relationships in the “knowledge economy”. For them, current context is characterized by internal and external networks, companies’ position in networks of expertise and economies of scale, scope and expertise.

Porter (1986) proposed the value chain, identifying primary and secondary activities. De Toni and Forza (1992) adapted this proposal to operations. The main differences were the inclusion of R&D as a primary activity.

Marketing, R&D, inbound logistic, production, outbound logistic and services are the primary activities in the Value Chain (VN). These activities preferentially add value to the products. Organizational systems are related to human resources orientation, leadership and other issues related to the managers’ profile. Management systems include all the managerial systems used in the VN – TQM, JIT, strategic planning, ISO etc. Technologies consider all types of technology related to hardware or software throughout the VN. This last group is named secondary activities. All of them support the primary activities listed above. Added to the primary and secondary activities, the competitive criteria (quality, cost, flexibility and delivery) focused by the company will define the decisions along the VN. Presently, the idea of networks has been extended also to the value creation (Brandenburger and Stuart, 1996). In this way, we claim that companies create value in their products/services from their VN, where internal and external networks are developed in order to integrate knowledge and to improve company’s performance.

Therefore, one of the main aspects related to the VN is the creation of added value in products or services. Porter (1986) stated that the links among each part of the value chain are able to build the needed conditions for a competitive advantage. Similarly, Brandenburger and Stuart (1996) argued that there is no asymmetry in the importance of suppliers, firms and buyers in the added value creation when we analyze companies’ competitiveness. On the other hand, for Ghemawat (2000), the most important aspect for competitiveness is not the links among the parts of the value chain, but the development of competencies in specific parts of the VN. Coca-Cola’s is an example, whose the source of competitive advantage is its distribution system compared to competitors. Other authors also have stressed specific parts of the VN. Fine (2000) stressed out the importance of environmental dynamism over the supply chain and competitiveness. Also, services have been currently identified as one of the main focus for added value creation and competitive advantage creation (Wise and Baungartner, 1999; Chase and Garvin, 1989). Shortly, while Porter and Branderburger and Stuart (1996) bring an idea of strategic alignment, Ghemawat (2000) follows an idea asymmetric focus in the VN activities.

Different authors consider the role of the knowledge integration into the companies as the support for a capability building process (Zahra and Das, 1993; Grant, 1996; Teece et al., 1997). To Grant (1996), knowledge integration is more important for competitiveness than just the knowledge itself.

Companies have tried to reinforce knowledge integration with managerial practices like NPD with cross-functional teams, TQM, and other policies related to human resources (Roth et al.. 1994; Nonaka and Konno, 1998). Therefore, one of the companies’ current challenges is to create decision making processes, which allow the existing knowledge integration in all hierarchic levels of the organization - from directory to shop-floor. This integrated knowledge creation may decrease company’s time decision and responsiveness, because strategic process will be based on a shared strategic view. These issues lead us to a central issue suggested by Mendelson and Pillai (1999): “Rapid changes in business conditions require organizations to shorten their response times in a commensurate manner.” (p. 8)

According to Grant (1996), knowledge integration needs three characteristics to support competitiveness: efficiency, scope and flexibility. The idea of cross-functionality is more related to the first aspect, because it deals with access and use of the specialist knowledge from organizational members. Through cross-functional activities, companies will be able to maintain continuos exchange process based on experience and information from their employees and functional areas. Therefore, this organizational orientation also will be able to develop a shared strategic view and to create an internal network.

Considering the current competitive environment, dynamic capabilities are also related to added value creation across the VN. Therefore, we may consider that the strategic decisions in manufacturing are not restricted to the shop-floor but they are integrated to R&D, marketing, supply-chain, outbound logistic, services, or in other words, to the whole VN. Activities deployed from these decisions will create internal and external company’s networks, involving relationships with suppliers, clients, and internally among company’s functional areas such as manufacturing, marketing and R&D. In some specific situations, R&D also includes external networks. Cooperative R&D activities may occur involving suppliers, clients and even competitors (Oliver and Liebeskind, 1997).

Choi et al. (2002) pointed out that usually studies related to supply networks analyze three dimensions: formalization, centralization and complexity. Formalization is associated with rules, procedures, norms and values standardization. Centralization analyzes power concentration or dispersion across the supply networks. Finally, complexity analyzes three sub-dimensions in the supply network: horizontal complexity, vertical complexity and spatial complexity. This study follows a different orientation. The analysis is based on the degree of integration among manufacturing and other network parts. This integration will lead to knowledge integration and, consequently, capability creation.

– Study Hypothesis

Based on the prior theoretical references presented, we list the four hypotheses below. Two hypotheses (1 and 3) focus on the internal view of the VN, while the other two (2 and 4) discuss the VN’s external aspects. The first two hypotheses analyze the strategic level of manufacturing and marketing integration, evaluating strategic information exchange. We claim that information is the main resource for knowledge integration. The last two analyze operational issues, evaluating manufacturing and marketing integration related to the problem-solving processes.

Hypothesis 1

- The frequency that manufacturing and marketing exchange strategic information is lower comparing to manufacturing exchange with other functional areas.

Hypothesis 2

- Assuming that external environment influence cross-functionality, companies from different industries present asymmetric levels of exchange of strategic information along the VN.

Hypothesis 3

- The frequency that manufacturing and marketing interact in order to solve operational problems is lower comparing to the interaction among manufacturing and other functional areas.

Hypothesis 4

- Assuming that external environment influences cross-functionality, companies from different industries present asymmetric levels of interaction between manufacturing and other functional areas in order to solve problems along the VN.

We have carried out the research in two steps. The first one was a qualitative study and the second one was a survey, which are discussed bellow.

With the objective of answering the first questions above, we present three case studies following an exploratory approach.

Company Alpha has its product focus is on manufacturing automation especially for the automotive industry. It presented an expressive increment in its revenues during the last three years (more than 100%). Presently, the main part of its revenues comes from US and Europe. Beta, the second company is a manufacturer of components for agricultural machines and heavy transport equipment. Today, it is expanding its revenues. One important triumph is to become a John Deere’s global supplier. Delta is a strong global competitor in port loading equipment. It bought a German company in order to have access to advanced technologies and it has established agreements with other companies located in countries such as the United States with the objective of expanding its activities.

All the companies identified the sharp focus on specific markets as fundamental for their competitiveness. The integrated management of all parts of the VN is a key aspect for Alpha and Delta companies. Considering that both companies work with make-to-order production, flexibility and delivery are key aspects. Consequently, a capability related to the VN’s integration is fundamental. On the other hand, Beta produces following mass production logic. To this company, the production system itself is one of the most important parts of the VN in order to achieve the needed cost and quality patterns.

The three companies consider that services are another key aspect in the VN for competitiveness. In any choice - Brazilian or global markets, they believe that their companies need to provide a reliable service within 24-48 hours in any region of the world. The second and the third companies achieve this pattern in their global sales while Alpha provides any type of service in 24 hours in the Brazilian territory.

R&D is also another activity from the VN stressed by all the companies. Alpha and Delta seek to develop commercial agreements in order to access new technologies. Examples include strategic alliances (Alpha), acquisition (Delta) and even sporadic activities (Delta). Beta identifies that its R&D is able to develop suitable products to its clients even without strategic alliances.

The other VN activities were not pointed out as the most important for competitiveness. Just Beta considers the importance of its own production system. Beta and Delta produce internally only what is necessary and sometimes they buy all the components externally. For them, the VN’s key part is the supply chain. From their suppliers, they will be able to provide reliable delivery and product quality.

Therefore, the cases indicated that for Alpha and Delta, internal and external networks along the VN are simultaneously key aspects for competitiveness. On the other hand, Beta having more standardized products stressed preferentially the focus on internal networks.

We used a survey methodology to collect the data in order to test the first findings from the case studies. We mailed twice the questionnaires to the sample. We present the results after the second mail. We used a five-scale questionnaire to evaluate managers’ answers. The questions are listed at the end of the article. The steps followed during this research were: (a) framework validation with other researchers and with three companies; (b) first mail of the definitive questionnaire to the chosen sample; and (c) second mail to no responder companies.

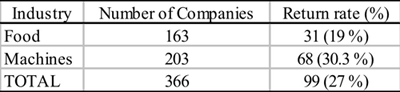

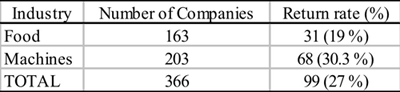

We sent the questionnaire to 366 companies located in Brazil from food and machines industries. These companies were chosen from Sebrae’s (Brazilian service for companies support) database. All the companies have more than 100 employees. CEOs, vice-presidents, manufacturing directors, and manufacturing managers answered the quesions. We received 99 valid questionnaires. (Table 2)

Table 2 – Return rate for each industry

*Fundação Getulio Vargas – EAESP, São Paulo/SP. Email: ely.paiva@fgv.br

**Universidade Federal do Rio Grande do Sul, Porto Alegre/RS, Brazil. Email: teniza@ufgrs.br

Vol. 32 (1) 2011

[Índice]