Felipe Mendes Borini y Moacir de Miranda Oliveira Junior

We selected the universe consisted on the 1000 largest, in terms of capital, multinational subsidiaries located in Brazil. A questionnaire was mailed to the corresponding CEO´s of each of these 1000 firms. Some of the addresses were repeated and some were not available; so out of the 1000 we came to universe of 853, of which we had a return of 118 multinational subsidiaries (14 %). For this kind of survey this is quite expected.

Our sample shows 55% of business on the industrial sector, 32% on services, and the rest on agribusiness and financial areas; which is representative of the universe of the largest multinational subsidiaries in Brazil. They come from 21 different countries, mostly from the US (32%), Italy (8.5 %), Germany (8.5%), Spain (7.5%), and UK (6%). On the average 480 employees, although almost 30% have more than 1000 employees.

Models Multiple choice questions using Lickert scales (1 to 7) were applied.

Four variables were selected as dependent variables to represent SRS (Birkinshaw, Hood e Jonsson, 1998): the contribution of subsidiary for adding value to the corporation; Whether the subsidiary is globally competitive in its own area of activity; headquarters positioning in relation to the importance of the subsidiary as strategically relevant; A mean strategic relevance variable formed by the average of these three variables.

Competencies were analyzed in relation to the following areas: R&D, production, sales, marketing, management of international activities, management of interface with headquarters, innovation, and entrepreneurship.

Regarding to the SEO - Subsidiaries Entrepreneurial Orientation, five variables were considered (Birkinshaw, 1996; Birkinshaw, 1997), asking for each one the degree to which: they feel support from top management regarding entrepreneurial activities, top management have experience on innovation activities, they feel support for individual decisions involving risks, they feel support for calculated risk activities, and if the subsidiaries consider assuming risks as a positive attribute.

In relation to communication and integration between subsidiaries and headquarters (Nohria and Ghoshal, 1997) questions have been asked regarding the extent to which: there is work relations between subsidiaries and headquarters, there is sharing of information between managers at headquarters and subsidiaries, and there is good understanding of the top management at headquarters about the subsidiaries´ competencies.

About autonomy of the subsidiary (Birkinshaw, 1996), eight variables have been selected to check where the decisions were taking place, at headquarters, at a regional subsidiary, or at the subsidiary itself regarding: change in design of products/services, hiring top executives autonomy for outsourcing of activities, decision for entering new markets, approving annual budget, introducing new products, organizational changes, change in production processes.

Regarding credibility of the subsidiaries (Birkinshaw, 1996) and well as its past history, the next variables were considered: the accomplishment of the goals of the subsidiary along the operations of its business in the country; the development of essential competences along time in the subsidiary; the experience in the activities regarding international sales; and (4) if the international sales grew along the last years.

In relation to global competitiveness of industry, the question was focused in business area and asking whether: needs of consumers/suppliers are worldwide standard; there are competitors in all key markets; local competitiveness is intense International competitiveness is intense; business activities are susceptive to global scale economies; main product/service has world recognition ; production technology is standard and worldwide available ; competitors are commercializing a worldwide standardized; introduction of new products happens simultaneously on the main markets (Birkinshaw, Hood e Jonsson, 1998).

To test some of the hypotheses, two more blocks of variables were formulated representing the performance of the subsidiaries and its initiatives.

Regarding the performance of the subsidiary the variables considered were related to: investments return; earnings; productivity; sales and market share.

Some initiatives of the subsidiaries were analyzed regarding international responsibility (Birkinshaw, Hood and Jonsson, 1998; Birkinshaw, 1997), namely: the new products development to Brazilian market and subsequently exported; results of successful corporative investments in Brazil; activities of international business created in Brazil; increment and adaptation in the products line already adopted internationally new corporative investments in R&D or productive processes obtained by the subsidiary.

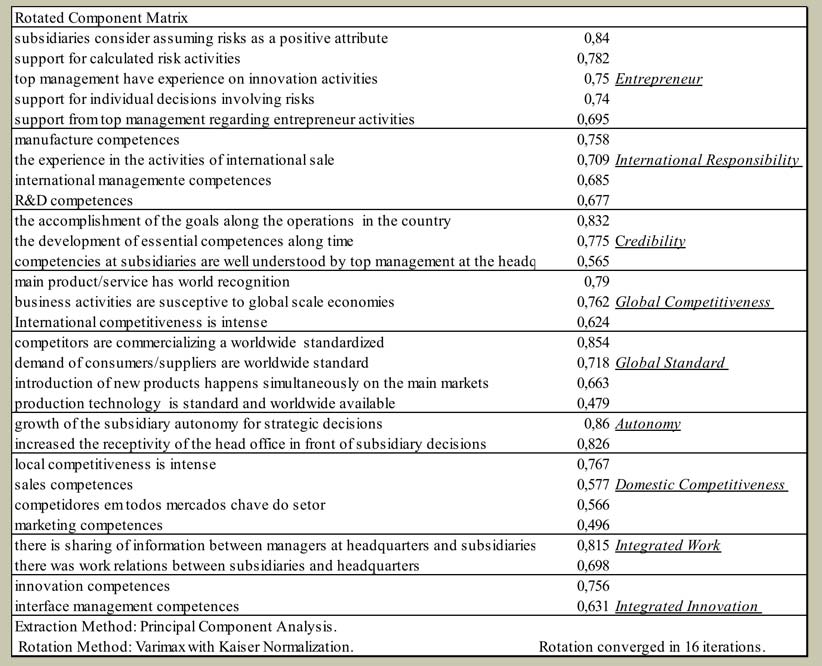

As shown in table 2 a factor analysis using the variables of global competitiveness, autonomy, communication and integration, competences, entrepreneurial orientation and credibility; gives significant results (p<0.000) with KMO showing 0.644. There is internal consistency of the factors and those with eigenvalues greater than 1 already explain 70% of the variance of the sample. The first one that may be called Entrepreneurship refers to aspects dealing with the entrepreneurial orientation (Birkinshaw, 1997). The second factor that may be called International Responsibility is the result of the experience in international sales and competences in the manufacture, R&D and management of international activities. The third one Credibility is related to the development of the competences in the subsidiary along the time and the capacity of making these competences be comprehended by the headquarters. The next one Global Competitiveness depends on how much the activities of the sector are internationalized, while the factor Global Standard is related to standardization of the products and activities world-wide. The Domestic Competitiveness is associated with competitors in the market to motivate subsidiaries to develop marketing and sales competences. The Autonomy means larger autonomy for local decisions and it’s related to better receptivity of the head office for the decisions of the subsidiaries, while the related factor Integrated Work corresponds to a working information and intense relationship between head office and subsidiary. Finally the Integrated Innovation factor corresponds to the competence of the subsidiary in creating innovation aligned to the world corporative goals, by means of the management competence of the interface with the head office.

Table 2: Factors

Source: authors

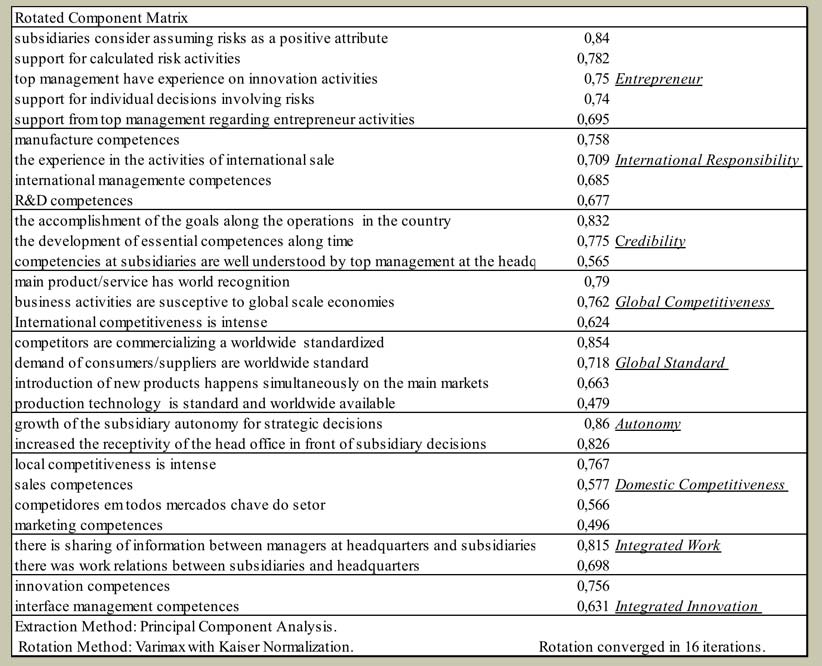

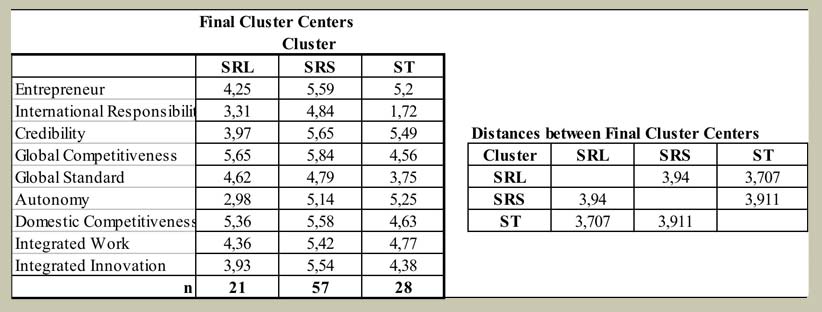

Considering these factors each one represented by index obtained as an average of the Likert values of the variables, a clusters analysis has been executed using the Varimax method. Table 3 shows the centers of the factors for each of the three clusters selected with it’s between distances,. One may naturally refer clusters 1, 2 and 3 to TS, SRS and SRL, respectively.

Table 3. Final Clusters

Source: authors

Now starting from these previous results a discriminant analysis has been executed to find out the relative importance of the factors regarding differences among TS, SRS and SRL.

From this analyzes (Table 4) it follows that the three types of subsidiaries (ST, SRL and SRS) differ mostly in terms of its international responsibility, integrated innovation, and credibility of the subsidiary. Other factors such as global competitiveness and standardization and autonomy are significant, but at a much lesser degree.

Table 4 Discriminant Function

Source: Authors

Once the differences regarding conditions for the strategic relevance of the subsidiaries are detected, one may seek to find out to what extent differences in strategic relevance are related to performance and initiative of the subsidiaries.

The ANOVA of table 5 shows that the performance difference of the subsidiaries regarding the several subsidiaries of the corporation in world scope happens related to the market share regarding the corporation, to the return on the investment (both with p < 0,01) and regarding the productivity and to the profit (both with p < 0,05).

Table 5. Subsidiaries Performance

Source: authors

Table 6 shows that, regarding performance, the SRS are the ones that have the best results comparatively to the other subsidiaries of the corporation, supporting H3b. Actually about 55% of SRS have a larger market share in comparison to the others subsidiary of the corporation. Moreover, 50% of them have higher earnings, 45% better productivity and 40% higher return on investments. On the other hand, it’s interesting to observe that at least in terms of earnings and return on investments TS behave better than the SRL, contradicting H1b and H2b. However in terms of productivity and market share SRL overcome TS, hence supporting H1b and H2b.

Table 6. Subsidiaries’ Roles and Performance

Source: Authors

Finally table 7 shows that, regarding the initiatives, the strategic relevance does distinction related to the new products developed in Brazil and sold internationally, new investments in R&D and processes (both with p < 0,01) and larger responsibility due to successful previous investments

Table 7. Subsidiaries Initiatives

Source: Authors

Actually, about 75% of SRS obtained larger responsibility due to their previous results, against 45% of SRL and barely 33% of TS. From the SRS, 60% developed new products that are sold internationally, against 20% of SRL and 33% of TS. Finally, only SRS, and practically 40% of them, received or accomplished new investments in R&D and productive processes. It’s interesting to observe that while SRL do not introduce investments in productive processes or R&D, some TS (15%) do introduce investments in this direction.

These support H3c, but rejects H3a and H3b, except for the biggest responsibility due to previous investments accomplished by the subsidiary.

[anterior] [inicio] [siguiente]

Vol. 31 (4) 2010

[Índice]