Vol. 39 (Number 12) Year 2018. Page 19

Vol. 39 (Number 12) Year 2018. Page 19

Yulia R. RUDNEVA 1; Lyubov I. VANCHUKHINA 2; Nelly N. GALEEVA 3; Zemfira A. GAREEVA 4; Anastasia M. ROGACHEVA 5

Received: 23/12/2017 • Approved:22/01/2018

ABSTRACT: The article is devoted to the problem of complex evaluation of effective activities of banks with application of open reports. A critical analysis of the methodologies CAMEL(S), the Central Bank of the RF, and the Russian scholar V.S. Kromonov are performed. His results are set in the basis of the offered methodology, which includes expanded set of indicators accessible for calculation for a wide circle of external and internal users. |

RESUMEN: El artículo está dedicado al problema de la evaluación compleja de las actividades efectivas de los bancos con la aplicación de informes abiertos. Un análisis crítico de las metodologías CAMEL (S), el Banco Central de la RF, y el erudito ruso V.S. Kromonov se realizan. Sus resultados se basan en la metodología ofrecida, que incluye un conjunto ampliado de indicadores accesibles para el cálculo para un amplio círculo de usuarios externos e internos. |

At present, the role of banks in the system of financial and economic relations grows, and the influence on economy of any country on the whole increases.

Starting from mid-2013, tension in the Russian banking sector has been growing, which is caused by increase of licenses withdrawal from credit organizations. Besides, there’s a necessity for reducing the number of banks by means of increase of control over their functioning. Of course, in such situation the role of adequate evaluation of effectiveness of commercial banks’ activities grows. Based on monitoring of indicators from internal and external controlling bodies, it is possible to determine development of the problems, which will allow working on measuring for their elimination.

Besides, the possibility of evaluation of banks’s effectiveness by internal and external users, for whom only the published financial accounting is opened, is very important. They include the existing and potential customers of a credit organization. It is important for them to have high-quality and accessible tools for selecting a reliable bank.

Thus, development of the system of evaluation of effectiveness of credit organizations will ensure the increase of control over activities of commercial banks, on the one hand, and trust of the public to the banking system of the country on the whole, on the other hand.

Analyzing effectiveness of bank’s activities, the user strives to obtain one final evaluation of the financial state on the whole, as individual indicators can provide contradictory characteristics of bank’s activities. That’s why the scientific society developed methodologies of integral evaluation which suppose full study of commercial bank’s activities.

The authors performed analysis of the following methodologies: the Central Bank of the RF [1]; CAMEL(S), used by the Federal Reserve System of the USA [2]; the methodology, developed by a group of Russian economists under guidance of V.S. Kromonov [3].

The methodology of the Central Bank of the RF is based on the CAMEL(S) methodology, as a result of which they have similar groups of indicators: sufficiency of capital, quality of assets, quality of bank management, liquidity, profitability, and risk. For each group, the values of indicators are calculated which, according to the set scale, are transformed into points. The generalized result for the group is calculated as direct average of the received points. Additionally, the Central Bank of the RF evaluates the bank’s completing the mandatory norms.

The methodology of V.S. Kromonov includes evaluation of six indicators that characterize sufficiency of capital, liquidity, and bank risks. Normative values for a range of indicators are debatable, as they do not consider specifics of banking activities and reflect the bank’s customers’ interests not in favor of its profitability.

Comparison of the indicators of the viewed methodologies is provided in Table 1.

Table 1

Comparative analysis of the indicators evaluated as the methodology

of determining the financial sustainability of a credit organization

Indicator |

CAMELS |

Methodology of the Central Bank of the RF |

Methodology of V.S. Kromonov |

Sufficiency of own capital |

- coefficient of sufficiency of fixed capital - coefficient of sufficiency of total capital |

- indicator of sufficiency of own capital - indicator of total sufficiency of capital |

K1 - general coefficient of reliability K5 - coefficient of capital protection |

Evaluation of quality of assets |

- ratio of total risk of assets to bank’s capital |

- indicator of the risk of loss of assets on the whole - indicators of quality of credits - indicators of the risk of concentration of credits - indicator of the volume of reserves for losses on credits and other assets - aggregated indicator of of risk of losses |

- |

Evaluation of bank’s profitability |

- coefficient of profitability |

- indicator of profitability of assets - indicator of profitability of capital - indicator that characterizes the share of administrative and managerial expenditures in net income - indicator of net interest margin - indicator of net spread from credit operations |

K6 - Coefficient of stock capitalization of income |

Evaluation of liquidity |

- level of reliability of funds sensitive to changes of interest rate - capability of assets to be exchanged for cash - accessibility of money markets - effectiveness of the strategy of management of assets and liabilities, management in this sphere - correspondence of achieved indicators to internal policy on observation of liquidity - contents, volume, and anticipated use of large agreements for future date |

- indicator of total short-term liquidity - indicator of instantaneous liquidity - indicator of current liquidity - indicator of the structure of attracted assets - indicator of dependence on inter-bank market - indicator of risk of own bill liabilities - indicator of risk of creditors and investors - indicator of the state of non-bank credits - averaging of mandatory reserves -non-execution of the liability for completion of reserve requirements assessed in calendar days - indicator of non-execution of requirements before creditors

|

K2 - coefficient of instantaneous liquidity K4 – general coefficient of liquidity |

Evaluation of quality of management |

- average-weighted evaluation of all other components of bank’s reliability |

- indicator of the system of risk management - indicator of the state of internal control - indicator of management of strategic risk - indicator of management of risk of material motivation of personnel |

- |

Evaluation of sensitivity to risks |

- evaluation of the level of market risks - evaluation of the system of risk management |

- coefficient of unprofitability of credit operations -coefficient of credit risk - coefficient of total credit risk |

K3 – cross-coefficient, equals the ratio of total liabilities to working assets |

Integral coefficient |

Aggregated ranking on the basis of six positions |

Average weight of all indicators |

N=45*K1+20*K2+10* K3+15* K4+5* K5+5* K6

|

As a result of the performed study of the methodologies of integral evaluation of effectiveness of banks’ activities, several drawbacks were determined.

Firstly, in the aspect of evaluation of effectiveness, there are no relative indicators that characterize the level of the system of bank’s risk management and evaluation of the risk level.

Secondly, evaluation of the indicators of quality of management in the methodologies CAMELS and the Central Bank is expert and requires presence of large experience and objectivity – therefore, it is difficult for external user.

Thirdly, in the V.S. Kromonov’s methodology, insufficient attention is paid to profitability of activities – though, it is very important for determining the effectiveness of bank’s activities.

Fourthly, complexity of analysis of assets’ quality. It is necessary, but in the studied methodologies this calculation is related to large analytical work, in the process of which main investments of the bank are considered individually in the aspect of evaluation of their real risk. The methodology of the Bank of Russia fits the Russian conditions the best.

A large drawback of the studied methodologies is lack of dynamic indicators, which does not allow for evaluation of tendencies of the bank’s development.

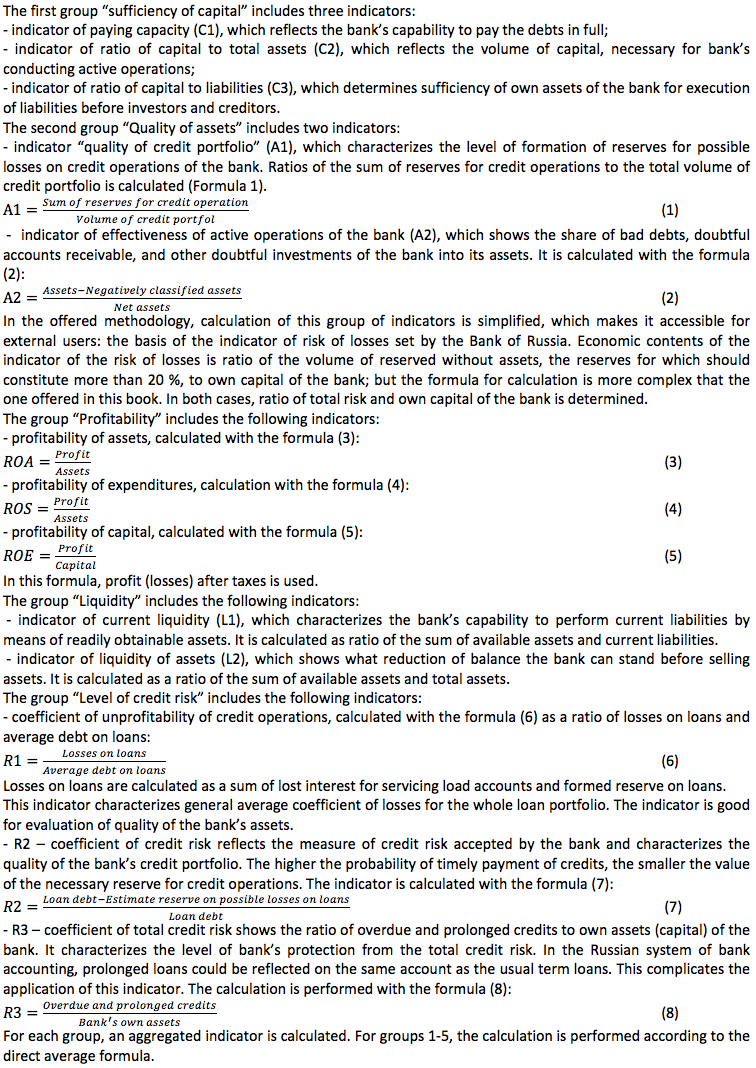

In view of the above drawbacks, the basis is the methodologies of evaluation of the Central Bank; the existing estimate indicators that characterize “sufficiency of capital”, “quality of assets”, “profitability”, and “liquidity” with the following groups: “level of credit risk” and “dynamics”. We offer the proprietary system of determining the effectiveness of the bank’s activities, which includes six groups, with 18 economic indicators.

Let us view each group of the offered indicators.

Calculation of aggregated indicator for the group “Dynamics” is performed with the formula of the weighted direct average. Distribution of weights is presented in Table 2. Weights of dynamic indicators are calculated according to significance of each group of indicators on the whole, so the highest weights are assigned to the indicators that characterize sufficiency of capital and risks.

Table 2

Distribution of weights for the groups of indicators for

calculation of aggregated indicator for the group “Dynamics”.

Title |

Symbol |

Weight |

Dynamics of sufficiency of capital |

D1 |

0.23 |

Dynamics of quality of assets |

D2 |

0.18 |

Dynamics of profitability |

D3 |

0.18 |

Dynamics of liquidity |

D4 |

0.18 |

Dynamics the credit risk level |

D5 |

0.23 |

Grouping of indicators and the order of their calculation are presented in Table 3.

Table 3

The system of indicators of the offered methodology

of evaluation of bank’s activities’ effectiveness

Group and multiplier for the group of |

Indicator |

Calculation of indicator |

Sufficiency of capital (C) |

С1 |

Capital/Assets weighted according to the risk level |

С2 |

Capital/ Total assets |

|

С3 |

Capital/Liabilities |

|

Quality of assets (A) (weight = 0.15) |

А1 |

Reserves for credit operations/Total volume of credit portfolio |

A2 |

(Assets – negatively classified assets)/ Net assets |

|

Profitability (P) (weight=0.15) |

ROA |

Profit/Assets |

ROS |

Profit/Expenditures |

|

ROE |

Profit/Capital |

|

Liquidity (L) (weight=0.15) |

L1 |

Available assets/Current liabilities |

L2 |

Available assets /Total assets |

|

Level of credit risk (R) (weight=0.2) |

R1 |

Losses on loans / Average volume of debt on loans |

R2 |

(Debt on loan – Estimate reserve for possible losses on loans) / Loan debt |

|

R3 |

Overdue and prolonged credits / Own assets (capital) of the bank |

|

Dynamics (D) (growth rate) (weight=0.15) |

D1 |

Ccur/Cpr-1 |

D2 |

Аcur/Аpr-1 |

|

D3 |

Pcur/Ppr-1 |

|

D4 |

Lcur/Lpr-1 |

|

D5 |

(1-Рcur)/(1-Рpr)-1 |

Each group of indicators is assigned with the corresponding weight (multiplier). The largest weight, which equals 0.2, is assigned to the groups of indicators of sufficiency of capital and level of credit risk; other groups are assigned with the weight of 0.15.

Integral coefficient of financial state of the bank is calculated as a sum of products of the value of aggregated indicators for the groups and weights (Formula 10):

W = C·0.2+A·0.15+P·0.15+L·0.15+(1-R) ·0.15+D·0.2, (10)

where

W – integral coefficient of financial state of the bank;

C – value of aggregated indicator of the group “sufficiency of capital”;

A – value of aggregated indicator of the group “quality of assets”;

P – value of aggregated indicator of the group “profitability”;

L – value of aggregated indicator of the group “liquidity”;

R – value of aggregated indicator of the group “level of credit risk”;

D – value of aggregated indicator of the group “dynamics (growth rate)”.

As a rule, integral coefficient is higher than zero. In some cases, with large losses and significant aggravation of indicators, it may acquire negative value.

The larger the value of integral coefficient, the higher the effectiveness of bank’s activities. Depending on the value of integral coefficient, the bank goes to the corresponding classification group of effectiveness. Their descriptions are given in Table 4.

Table 4

Characteristics of banks according to the groups of effectiveness

of functioning depending on the value of integral coefficient

Value of integral coefficient |

Characteristics of the group of banks for effectiveness of functioning |

Above 0.7 |

High: structure of assets and liabilities is close to optimal, high profitability (above the average level of the banking system), dynamics of indicators of financial accounting are positive, acceptable level of credit risk. |

0.4-0.7 |

Medium: positive dynamics of indicators, liquid balance sheet (structure of assets and liabilities is close to optimal), volume of profitability does not exceed (or exceeds insignificantly) the average level of profitability of the banking system, sufficient level of indicators of liquidity and capitalization, acceptable for the level of credit risk |

0-0.4 |

Low: negative dynamics of development: non-liquid balance (unsatisfactory structure of assets and liabilities: large share of negatively classified assets), negative financial result, low indicators of liquidity and capitalization, high level of credit risk |

Below 0 |

Ineffective activities of the bank: high unprofitability and negative dynamics of indicators of activities |

The offered methodology allows understanding and evaluating the effectiveness of bank’s activities and analyzing significant factors that influence its activities. They include sufficiency of own capital, quality of assets, profitability, liquidity, risk level, and dynamics of each criterion. Significance of the first four groups is confirmed by international (methodology CAMELS) and Russian experience of development of the banking systems. The introduced groups of indicators that characterize the level of credit risk and dynamics of bank’s development allow considering modern problems (tendencies) of the banking sphere of Russia.

Besides, the advantage of the methodology is the fact that all indicators included into the system of evaluation could be assessed on the basis of the data of published accounting, which makes it accessible for external users.

The Central Bank of the RF conducts work on increase of sustainability of the country’s banking system by cleaning the banking sector from unfair members. For example, in 2014, 66 credit organizations had their licenses suspended, and in 2015 – 74 [4]. Due to this, it is necessary to form a modern and practical model of evaluation of effectiveness of banks’ functioning.

Let us study the above methodology on specific examples – specifically, on the basis of the data of published financial accounting [5-11] and evaluate the effectiveness of functioning of banks with different financial positions: Uralsib JSC, Sberbank PJSC, Tatfondbank OJSC, Sotsinvestbank PJSC, Uralprivatbank JSC, and Rostbank OJSC.

Table 5 presents calculations of integral coefficient of effectiveness of functioning of the banks that differ according to the financial state.

Table 5

Calculation of indicators of effectiveness of credit organizations

as of January 1, 2015.

Group and multiplier for the group of indicators (weight) |

Indicator |

Alfa Bank |

Sberbank |

Tatfondbank |

URALSIB |

Sotsinvestbank |

Uralprivatbank |

Rostbank |

1. Sufficiency of capital (weight = 0.2) |

C1 |

0.136 |

0.132 |

0.102 |

0.183 |

0.338 |

0.488 |

0.000 |

C2 |

0.091 |

0.091 |

0.095 |

0.128 |

0.186 |

0.339 |

0.076 |

|

C3 |

0.099 |

0.100 |

0.105 |

0.144 |

0.230 |

0.521 |

0.071 |

|

Aggregated for the group |

0.108 |

0.107 |

0.101 |

0.152 |

0.252 |

0.449 |

0.049 |

|

2 Quality of assets (weight = 0.15) |

A1 |

0.028 |

0.027 |

0.030 |

0.084 |

0.048 |

0.181 |

0.029 |

A2 |

9.449 |

9.110 |

7.108 |

6.715 |

4.080 |

2.364 |

5.468 |

|

Aggregated for the group |

4.738 |

4.571 |

3.569 |

3.399 |

2.064 |

1.272 |

2.749 |

|

3 Profitability (weight =0.15) |

ROA |

0.023 |

0.014 |

0.001 |

0.0004 |

0.005 |

0.043 |

-0.170 |

ROS |

0.364 |

0.235 |

0.008 |

0.001 |

0.050 |

0.141 |

-2.295 |

|

ROE |

0.251 |

0.158 |

0.005 |

0.003 |

0.026 |

0.107 |

0.158 |

|

Aggregated for the group |

0.213 |

0.136 |

0.005 |

0.001 |

0.027 |

0.097 |

-0.769 |

|

4 Liquidity (weight = 0.15) |

L1 |

0.130 |

0.115 |

0.203 |

0.207 |

0.112 |

0.677 |

0.101 |

L2 |

0.120 |

0.105 |

0.184 |

0.184 |

0.091 |

0.440 |

0.109 |

|

Aggregated for the group |

0.125 |

0.110 |

0.194 |

0.195 |

0.102 |

0.558 |

0.105 |

|

5 Level of credit risk (weight =0.2) |

R1 |

0.179 |

0.116 |

0.209 |

0.240 |

0.484 |

0.709 |

0.110 |

R2 |

0.877 |

0.942 |

0.915 |

0.861 |

0.912 |

0.791 |

-0.344 |

|

R3 |

0.425 |

0.160 |

0.171 |

0.427 |

0.082 |

0.193 |

1.166 |

|

Aggregated for the group |

0.494 |

0.406 |

0.432 |

0.510 |

0.493 |

0.564 |

0.311 |

|

6 Dynamics (growth rate) (weight =0.15) |

D1 |

-0.104 |

-0.079 |

-0.103 |

-0.003 |

0.080 |

0.165 |

-0.289 |

D2 |

0.173 |

0.089 |

0.084 |

0.010 |

0.139 |

-0.066 |

-1.008 |

|

D3 |

0.101 |

-0.049 |

-0.137 |

-0.054 |

2.598 |

-0.284 |

-1.843 |

|

D4 |

0.038 |

0.037 |

0.326 |

0.058 |

-0.116 |

0.345 |

-0.015 |

|

D5 |

-0.007 |

-0.012 |

-0.014 |

-0.005 |

0.097 |

-0.042 |

0.120 |

|

Aggregated for the group |

0.201 |

-0.015 |

0.156 |

0.006 |

0.513 |

0.118 |

-3.034 |

|

Integral coefficient |

W |

0.915 |

0.861 |

0.722 |

0.669 |

0.558 |

0.484 |

0.005 |

Group of effectiveness |

high |

high |

high |

medium |

medium |

medium |

medium |

|

As a result of analysis of the banks according to the offered methodology, it is possible to make the following conclusions. Alfa Bank and Sberbank have the highest integral coefficients. Tatfondbank is behind them, but they are still in the first classification group with high effectiveness. Despite the negative dynamics of capital sufficiency and increase of the level of credit risk (due to increase of the share of high-risk assets), high level of profitability allowed ensuring the banks’ high effectivenesss of activities on the whole.

The second group (medium effectiveness) with integral coefficient that equals 0.67 includes Uralsib PJSC. Profit has reduced over the year, but the indicators of capital sufficiency and liquidity are good. Also, Sotsinvestbank belongs to this group (integral coefficient equals 0.56). The bank has problems with liquidity, and the norms of liquidity were not observed over the several recent months. Also, the quality of assets dropped in the credit organization, which confirms Sotsinvestbank’s belonging to the problem classification group. Uralprivatbank is characterized by large reduction of profitability and quality of assets, as well as problems with liquidity.

Rostbank belongs to the group with low effectiveness. Rostbank has negative financial result and is behind all other banks of the selection according to other indicators.

One of the problems of application of this methodology is the fact that evaluation of effectiveness is performed retrospectively – i.e., it characterizes economic position of a credit organization with delay. It is caused by the fact that official report is published with large delay.

Also, subjective expert evaluations of the weights of indicators and intervals of the values of integral indicator are used for assigning the bank to a group of effectiveness.

An advantage of this methodology is the possibility of complex evaluation of effectiveness of any bank which reports are presented in free access. In Russia, most of financial accounting of credit organizations are located on the official web-site of the Central Bank of the RF.

The methodology allows for diagnostics of economic position of the bank in the market and comparing it to others. Also, in the course of analysis the bank’s management can determine the problem aspects of the bank’s activities and develop timely measures for increase of effectiveness and sustainability.

Due to the above, a conclusion is made that the offered methodology could be applied and is rather informative for a wide circle of users – both internal and external.

1. Methodology of analysis of the financial state of a bank, established by the Central Bank of the RF on September 4, 2000. [E-source]. – URL: http://cbr.ru/analytics/bank_system/print.aspx?file=metodica-2015.htm&pid=bnksyst&sid=ITM_33659 .

2. Uniform Financial Institutions Rating System by the Federal Reserve System, December 27, 1996 [on-line resource]. – URL: https://www.federalreserve.gov/boarddocs/srletters/1996/sr9638.htm .

3. Kromonov V.S. Methodology of compilation of the ranking of reliability of banks // Profile. – 1998. - No. 20 [E-source]. – URL: http://www.profile.ru/archive/item/40017-items_2365 .

4. Overview of the banking sector by the Bank of Russia (Internet version). Analytical indicators. – 2016. – No.160. – 75 p.

5. Financial accounting of Alfa Bank JSC [E-source]. – URL: http://cbr.ru/credit/coinfo.asp?id=450000036

6. Financial accounting of Sberbank of Russia PJSC [E-source]. – URL: http://cbr.ru/credit/coinfo.asp?id=350000004

7. Financial accounting of Rostbank JSC [E-source]. – URL: http://cbr.ru/credit/coinfo.asp?id=920000001

8. Financial accounting of Tatfondbank PJSC [E-source]. – URL: http://cbr.ru/credit/coinfo.asp?id=920000022

9. Financial accounting of Sotsinvestbank PJSC [E-source]. – URL: http://cbr.ru/credit/coinfo.asp?id=800000005

10. Financial accounting of Uralprivatbank JSC [E-source]. – URL: http://cbr.ru/credit/coinfo.asp?id=650000006

11. Financial accounting of BANK URALSIB PJSC [E-source]. – URL: https://www.bankuralsib.ru/bank/reports/annual.wbp

1. Ufa State Oil Technical University, Ufa, Russia. e-mail: julrud1976@yandex.ru

2. Ufa State Oil Technical University, Ufa, Russia

3. Ufa State Oil Technical University, Ufa, Russia

4. Ufa State Oil Technical University, Ufa, Russia

5. Ufa State Oil Technical University, Ufa, Russia