Vol. 39 (Number 12) Year 2018. Page 16

Vol. 39 (Number 12) Year 2018. Page 16

Dmitry N. PANTELEEV 1; Andrey A. GORDIN 2; Anastasia A. SOZINOVA 3

Received: 01/11/2017 • Approved: 30/11/2017

ABSTRACT: Unsuccessful experience of import substitution predetermines the necessity for studying its causes and the possibilities for their elimination for the further adaptation of the experience to the economic reality of modern Russia for the purpose of receiving maximum profit from the policy of import substitution. The purpose of the article is to analyze the existing models of import substitution and to develop an effective conceptual model of import substitution in the modern global economy. The methodology of this research is based on using the method of systemic, problem, and comparative analysis, synthesis, induction, deduction, and formalization. The authors determine the notion and sense of import substitution and performs comparative analysis of the South African and Asian models of import substitution. Based on the results of the analysis, the authors offer a conceptual model of import substitution in the modern global economy. It allows maximizing the advantages and eliminating the drawbacks of the policy of import substitution, as well as achieving long-term positive effect related not to short-term artificial (stimulated by the state) development of entrepreneurship, but creation of natural market environment for its independent development. |

RESUMEN: La experiencia insatisfactoria de la sustitución de importaciones predetermina la necesidad de estudiar sus causas y las posibilidades de su eliminación para una mayor adaptación de la experiencia a la realidad económica de la Rusia moderna con el fin de obtener el máximo beneficio de la política de sustitución de importaciones. El propósito del artículo es analizar los modelos existentes de sustitución de importaciones y desarrollar un modelo conceptual efectivo de sustitución de importaciones en la economía global moderna. La metodología de esta investigación se basa en el uso del método de análisis sistémico, de problemas y comparativo, síntesis, inducción, deducción y formalización. Los autores determinan la noción y el sentido de la sustitución de importaciones y realizan análisis comparativos de los modelos sudafricano y asiático de sustitución de importaciones. Con base en los resultados del análisis, los autores ofrecen un modelo conceptual de sustitución de importaciones en la economía global moderna. Permite maximizar las ventajas y eliminar los inconvenientes de la política de sustitución de importaciones, así como lograr un efecto positivo a largo plazo no relacionado con el desarrollo artificial a corto plazo (estimulado por el estado) del emprendimiento, sino la creación de un entorno de mercado natural para su desarrollo independiente. |

Formation of the global markets and the global competition of entrepreneurial structures does not provide advantages related to optimization of the production & distributive processes and bears the threats, among which an important place belongs to the issue of provision of national economic security. It grows due to arrival to the internal markets of the highly-competitive foreign companies, which oust domestic manufacturers.

In the long-term, the dependence of the country on import grows, which – under the conditions of destruction of the global economic ties – may lead to an urgent deficit, related to negative social consequences. Thus, the topicality of import substitution as a basis for supporting national economic security in the conditions of globalization grows. The purpose of this article is to analyze the existing models of import substitution and to develop an effective conceptual model of import substitution in the modern global economy.

The notion “import substitution” is treated differently by modern authors. In modern Russia, emphasis is made on modernization (Mardalievа, 2015), development, and formation of competitive economy, as well as increase of its sustainability to crises (Plotnikov, 2014). M.V. Petrovich notes that import substitution supposes development and support for domestic (internal) production and consumption of goods, unlike the import of products for local consumption from other countries and regions of the world (Petrovich, 2013).

In foreign economic science, import substitution is studied through the prism of industrialization. Thus, M.P. Tolaro (1994) sees import substitution as deliberate efforts on replacing the main products of consumer import by stimulating the formation and expansion of national spheres of industry, which requires implementation of protective tariffs and quotas.

A.P.F. Mendes and his colleagues (2014) define import substitution as industrial program of development, based on protection of local spheres by protectionist tariffs, import quotas, control over the currency rate, special subsidized licensing of import of goods, provision of subsidized credits to the local emerging industry, etc. On the whole, scholars and experts agree on defining the basic characteristics of import substitution:

The methodology of this research is based on using the method of systemic, problem, and comparative analysis, synthesis, induction, deduction, and formalization.

Based on the accumulated experience of implementing the policy of import substitution in the modern global economy, it is possible to distinguish its two basic models: South African and Asian. Study and analysis of this experience leads to a complex scientific problem of determining the reasons for inability to realize industrial revolution similar to East Asia in Africa south of Sahara and to achieve similar success.

Unsuccessful experience of import substitution causes the necessity for studying its reasons and possibilities for their elimination for further adaptation of this experience to economic reality of modern Russia for the purpose of receiving maximal profit from the policy of import substitution. Let us study these models in detail.

While the countries of East Asia were assigned the title of “overcoming economies” as a result of the policy of import substitution, realization of such policy in the countries of South Africa would lead to negative titles – “underdeveloped economies”, “tragedies of growth”, etc. (Easterly and Levine, 1997). Over the period of 1975-2001, South Africa had negative rates (0.9% on average) of GAP per capita growth, which is a huge contrast to 6% of East Asia (United Nations Development Programme, 2003). By the late 1990’s, the gap between the incomes of these regions was large and grew very quickly.

East Asian model of industrialization and the “Asian economic wonder” are interpreted within two different points of view in literature on economic growth and development: neoliberal (neoclassical) и structuralist (neo-Keynesian). In particular, followers of the neoliberal point of view state that dependence on unregulated market powers (non-interference of state into economy) and establishment of the strategies of open economy (supporting economy’s openness for the global trade and investments) led to effective exploitation of comparative advantages in East Asia, related to cheap human labor (excess and cheapness of such production factor as labor) (Rannisand Fei, 1975), which led to their quick economic growth and transformation into “new industrial countries”.

On the other hand, the problems of African development – in particular, the region’s incapability to achieve industrial growth – appeared due to lack of openness as to the global trade and global investments (World Bank, 1989). The neoclassical interpretation of economy’s “openness” supposes using the following criteria (Dollar, 1992):

In their turn, the followers of the structuralist point of view state that weak and ineffective governments, which have often been under the control of elites or consisted of their representatives, disrupted the markets’ effectiveness, which led to reduction of the volume of investments, as the resources were directed to the lobbied sphere of rent payments – i.e., the investments had non-production character (Collier and Gunning, 1999).

Reaction of agents to further macro-economic instability was manifested in capital outflow and striving for reducing the risk level by means of division of risks and social study (Lawanson, 2007). It is also noted that some fundamental changes took place in the institutional and normative & legal regulation of the African economy, which influenced positively the potential of development of entrepreneurship.

These changes reflect the influence of two interconnected powers. Firstly, the debt crisis and the policy of structural transformation led to “radical reconsideration” of the role of African state in the economy (Mkandawire, 2001). Secondly, globalization influenced the African states and civil society on the whole, reorganizing and developing more effective mechanisms and networks for the possibility to receive profit from expansion of trade flows, investments, finances, technologies, etc., entering the “integrated global market”, and withstand the risks of instability.

Within the structuralist point of view, the term “dynamic industrialization” is introduced, which supposes the expectation that import substitution stimulates the increase of economy’s possibilities and leads to emergence and development of new types of entrepreneurship, as well as increase of coverage and scale of activities of domestic companies. The results of comparative analysis of South African and Asian models of import substitution are given in Table 1.

Table 1

Comparative analysis of South African and Asian models of import substitution

Comparison criteria |

South African model |

Asian model |

Duration of the protectionism policy |

Constant protection of industrial products for internal market, selected for conduct of the import substitution policy |

Temporary protection of new spheres / products for purchasing competitive capabilities in the global market |

Character of used technologies |

Use of old technologies |

Use of leading technologies |

Ideas of the global economy |

Static idea of the global economy, in which technologies are taken for granted and are unchanged |

Dynamic (Schumpeter) view of the global market, led by innovations |

Policy in the sphere of competition |

Suppressing internal competition |

Stimulation and support for internal competition |

Source of technologies |

The main technologies are imported, industrialization lacks internal foundation, and, therefore, it is of surface character |

Main technologies are generated locally with the help of acquiring the imitation or adaptation capability to acquire foreign technologies |

Human capital management |

Weak infrastructure of human capital, lack of investments into education and low demand for educational services, and “brain drain” – large scale emigration of education workforce into the OECD countries |

Large accumulation and development of human capital through stimulation of large and sustainable demand for educational services. Industry and education are in close systemic interconnection due to emergence of the synergetic effect |

Distribution of investments, work places, and privileges |

Distribution of investments, work places, and privileges on the basis of regional/ national / political views |

Distribution of investments, work places, and privileges according to the market principle |

Agrarian reform |

Agrarian reform is paid not enough attention as a factor in the process of industrialization |

Agrarian reform (division of land) preceded industrialization |

Source of profit |

Profit is received from rental |

Profit is received from entrepreneurship |

Connection between industry and national economy |

Limited connection between industry and national economy |

Intensive connections between industry and national economy |

Regulation of geographical structure of capital import and direct foreign investments |

Geographical structure of capital import and direct foreign investments is not regulated and does not lead to transfer of technologies and technological changes, accumulation of knowledge, and support for international competitiveness of domestic entrepreneurship |

Strict regulation of capital import and direct foreign investments and orientation at maximization of knowledge for supporting international competitiveness of domestic entrepreneurship |

Source: compiled by the authors on the basis of: (Reinert, 2007)

As is seen from Table 7, these models are peculiar for different duration of the protectionism policy. The South African model supposes constant protection of industrial products for the internal market, selected for the policy of import substitution, and the Asian model – temporary protection of news spheres and products for acquiring competitive capabilities in the global market.

The character of the used technologies differs as well. While the South African model supposes the use of old technologies, the Asian model is oriented at using leading technologies. The static idea of the global economy within the South African model supposes that technologies are constant, and the dynamic Asian idea views the global market as the one led by innovations.

Within the South African model, internal competition is suppressed and technologies are imported, while the Asian model stimulates it and technologies are generated locally with the help of purchasing the imitation or adaptation capability to acquire foreign technologies.

The South African model is peculiar for weak infrastructure of human capital, lack of investments into education, and low demand for educational services, as well as “brain drain” – large-scale emigration of education work force into the OECD countries; the Asian model is peculiar for large accumulation and large-scale development of human capital through stimulation of sustainable demand for educational services. Industry and education are in close interconnection with emergence of the synergetic effect.

The South African model supposes distribution of industrial investments, work places, and privileges on the basis of regional / national / political ideas, and the Asian model – according to the market principles. In South Africa, agrarian reform – as a factor in the process of industrialization – is paid not enough attention, while in Asia the agrarian reform (redistribution of land) preceded the industrialization.

The South African model is based on the fact that profit is received from rental and supposes limited ties between industry and national economy, while the Asian model supposes receipt of profit by means of entrepreneurship and establishment of intensive ties between industry and national economy.

In the South African model, geographical structure of capital import and direct foreign investments is not regulated and does not lead to transfer of technologies and technological changes, accumulation of knowledge and support for international competitiveness of domestic entrepreneurship, while the Asian model features strict regulation of capital import and direct foreign investments, as well as orientation at maximization of knowledge for supporting international competitiveness of domestic entrepreneurship.

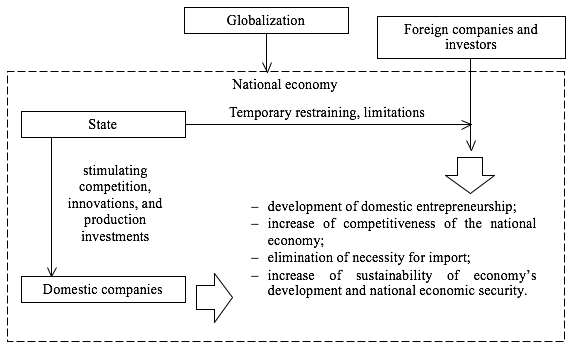

Based on the above, the successful conceptual model of import substitution in the modern global economy can be shown in the following way (Fig. 1).

Figure 1

Successful conceptual model of import substitution in the modern global economy

This model allows for maximization of advantages and elimination of drawbacks of the policy of import substitution, as well as achievement of the long-term positive effect, related not to short-term artificial (stimulated by the state) development of entrepreneurship but creation of natural favorable market environment for its independent development.

Thus, the performed research contributes into development of conceptual provisions of the modern theory of import substitution. The offered conceptual model of import substitution in the modern global economy can be a theoretical basis for development of national corresponding models, which ensures its practical significance. However, direct application in practice requires detalization of the model, which is a perspective direction of development of the authors’ conclusions and recommendations.

Leontyev, B.B. Import substitution: view of the problem / B.B. Leontyev // ETAP economic theory, analysis, and practice. – 2014. – No . 6. – P. 85-96.

Plotnikov, V.А. Import substitution: theoretical foundations and perspectives of realization in Russia / V.А. Plotnikov, Y.V. Vertakova // Economics and management. – 2014. – No. 11 (109). – P. 38-47.

Mardalieva, E.B. Import substitution / E.B. Mardalieva, М.K. Kambulatova // Young scholar. – 2015. – No. 11. – P. 907-909.

Petrovich, М.V. Import substitution: reality and necessity / М.V. Petrovich // Problems of management (Minsk). – 2013. – No. 3 (48). – P. 86-90.

Todaro, M.P. (1994). Economic Development, Paperback Longman 5th Revised edition. Revised.

Mendes, A.P.F. Industrialization in sub-saharan africa and import substitution policy / A.P.F. Mendes, M.A, Bertella, R.F.A.P. Teixeira // Revista de Economia Politica. – 2014. – No. 34 (1). – P. 120-138.

Easterly, William, and Ross Levine, (1997); ‘Africa’s Growth Tragedy: Policies and Ethnic Divisions’ Quarterly Journal of Economics, vol.112, no.4, pp.1203-1250.

United Nations Development Programme (2003); Human Development Report. Published for the UNDP by Oxford University Press.

Ranis, G. and J.C. H Fei’ 1975; ‘A model of growth and employment on the open dualistic economy: the cases of Korea and Taiwan.’ In F. Stewart, ed., Employment, Income Distribution and Development London: Frank cases.

World Bank (1989); Sub-Saharan Africa: From Crisis to Sustainable Growth World Bank Washington D.C. World Bank (1994); Adjustment In Africa: Reforms, Results and the Road Ahead World Bank/Oxford University Press.

Dollar, D. (1992); ‘Outward-Oriented Developing Countries Really Do Grow more Rapidly: Evidence from 95 LDCs, 1976-85, Economic development and cultural Change Vol. 40, No. 3 pp. 523-44.

Collier, P. and J.W. Gunning. (1999). "Explaining African Economic Performance." Journal of Economic Literature. March, 37:1, 64-111.

Lawanson, Akanni O. (2007); ‘An Econometric Analysis of Capital Flight from Nigeria: A Portfolio Approach’ AERC Research Paper 166 (May).

Mkandawire, Thandika, (2001); ‘Thinking About Development States in Africa’ Cambridge Journal of Economics vol.25 pp. 289-313.

Reinert, Erik S. (2007); How Rich Countries Got Rich... and Why Poor Countries Stay Poor London: Constable Pritchett, Lant, (2003); ‘A Toy Collection, a Socialist Star and a Democratic Dud: Growth Theory’ Vietnam and the Philippines? In Dani Rodrik, ed. In Search of Prosperity: Analytical Narratives on Economic Growth Princeton University Press.

2. Technical director of Kibikh LLC

3. Vyatka State University, Kirov, Russia