Vol. 39 (# 06) Year 2018. Page 32

N.V. GRYZUNOVA 1; G. S. ZAHAROVA 2; K.V. ORDOV 3

Received: 24/10/2017 • Approved: 15/11/2017

ABSTRACT: Monetary policy is evaluated on the effectiveness an inflation containment and an unemployment control. We can say the vast majority of Central banks have chosen as the main criterion its monetary policy the inflation control. The stable price level plays a special role in achieving macroeconomic equilibrium, it allow to predict the economic situation and to shape the investment climate, which led to the expansion an inflation targeting. The choice of monetary control methods depends on the object and purpose regulation, the degree of maturity of the financial system. So, constantly discusses the transmission mechanism channels and the impulses which they to create in the economy. Therefore, the necessary models to test inflation, managing the exchange rate of the national currency. The article for this purpose, the proposed model auto regression and DSGE to investigate the relationship between inflation, the exchange rates and "a replacement currency level" and the monetary aggregates volatility. The object of regulation, are macroeconomic characteristics of the lending processes. The achievement of the desired macroeconomic effect, the Central Bank provides through the use of economic levers of influence, adjusting the economic incentives of financial institutions. |

RESUMEN: La política monetaria se evalúa en la eficacia una contención de la inflación y un control del desempleo. Podemos decir que la inmensa mayoría de los bancos centrales han elegido como criterio principal su política monetaria el control de la inflación. El nivel de precios estable desempeña un papel especial en el logro del equilibrio macroeconómico, permite predecir la situación económica y dar forma al clima de inversión, lo que condujo a la expansión de un objetivo inflacionario. La elección de los métodos de control monetario depende de la regulación objeto y propósito, del grado de madurez del sistema financiero. Así pues, discute constantemente los canales del mecanismo de transmisión y los impulsos que crean en la economía. Por lo tanto, los modelos necesarios para probar la inflación, gestionando el tipo de cambio de la moneda nacional. El artículo para este propósito, el modelo propuesto regresión auto y DSGE para investigar la relación entre la inflación, los tipos de cambio y "un nivel de moneda de reemplazo" y la volatilidad de los agregados monetarios. El objeto de la reglamentación, son las características macroeconómicas de los procesos de préstamo. El logro del efecto macroeconómico deseado, el banco central proporciona mediante el uso de palancas económicas de influencia, ajustando los incentivos económicos de las instituciones financieras. |

A stable price level plays a special role in achieving the macroeconomic equilibrium, since it allows to forecast the economic situation and establish an investment climate. The banking sector has taken over the control (management) of inflation since 2007. Inflation turns from the natural one into an economic disaster for a variety of reasons, which are specific in each country up to a certain level and therefore determine the popularity of such models as VAR (Vector Autoregression) and DSGE. Inflation intensifies the risks for economic agents, which can lead to losing the faith in the domestic currency and its replacement with foreign currencies, while money, like infection, can bring economic diseases from the "anchor country". (Jonas J.2000). As a result, the country's economy will be more vulnerable to external pressure, including political one. Besides, capital outflow may increase, as it is the reverse side of external debt, and the strategic options of financial bodies may shrink, because it will become difficult to manage the money supply.

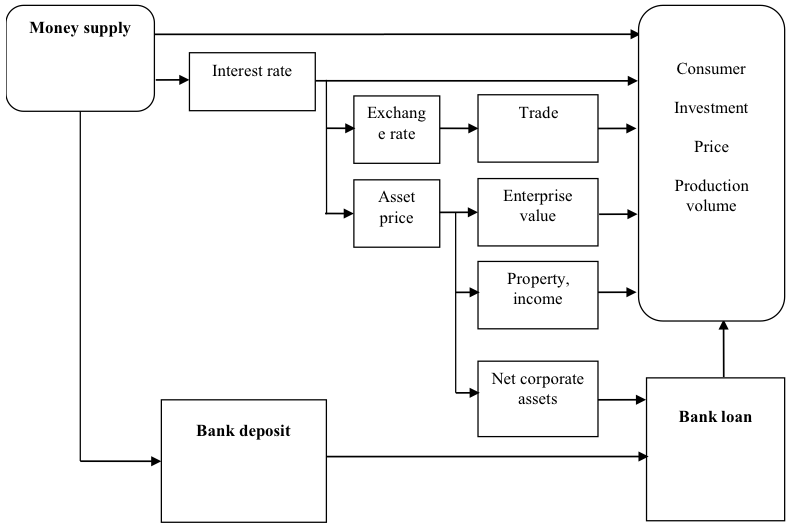

Currently, the planned reorganization of the banking system due to the needs of the real economy and the decreasing effectiveness of the main channels of the transmission mechanism: the credit, interest rate, currency and asset values, they are presented in figure 2. Changes in the Russian monetary policy are correlated with global trends. In view of the ongoing transformations, the authors proposed to change the incentives impact individual channels and maintain additional investment channel, which will increase the attractiveness of investment products in the financial market that will neutralize the problem of Bank liquidity.

Achieving the high employment is a long-term goal of the macroeconomic policy, because:

- High unemployment leads to the growing poverty;

- High unemployment generates an excess of labor and its negative consequences, resulting in a decrease in GDP;

- Unemployment not only creates a state of tension for the individual and their family, but can also become a breeding ground for social ills.

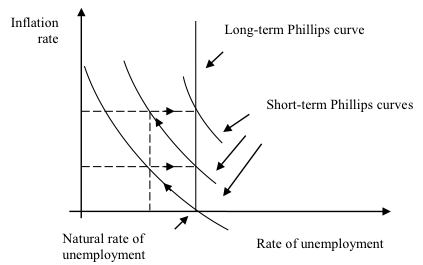

In the terminal period, the goals of economic growth and ensuring high employment are intertwined, but there is a dependence between inflation and unemployment on the explicit section (Phillips curve, A.W., 1958), as shown in Figure 1. This short-term dependence can be reasonably used in difficult circumstances. For example, the inverse dependence between unemployment and inflation was exploited in Russia in 2008 amid the crisis and in 2014 as a result of the imposition of sanctions. The curve becomes straight and parallel to the y-axis in the long run, which means there are no contradictions in the long-term goals of monetary policy regarding the price stabilization, unemployment reduction and achieving economic growth. (Khan, Mohsin S.2012) To balance the short-term needs of the economy and long-term goals of the country, many countries opt for targeting: of the exchange rate, money supply and inflation.

Targeting of the exchange rate is historically the first regime of monetary policy that was applied in countries in the form of a gold – and then dollar – standard. It was widely accepted in the early 1990s that the best results in monetary policy could be achieved using the exchange rate, if possible (Wagner H. 2017). Today, this regime is most often used in developing countries and countries with currency bands or collective monetary units, which reduces the level of dollarization of the economy and increases its saturation with money.

Figure 1

Phillips-Lucas curve

Targeting of monetary aggregates establishes the relationship between the dynamics of money supply (aggregates M1, M2 or M3) and the inflation level (Kondratov D. 2011) which is calculated using I. Fisher equation. (Fisher I. 1930)

The United States, Britain, Canada, Germany, Japan, Switzerland and the European Union are countries that have used monetary targeting. The nature and methods of this regime varied significantly, and it had both strengths and weaknesses (Batini N. and Nelson E. 2005). Basic advantages of monetary targeting are the following:

- volume of nominal money supply can be determined easily and quickly, and it can be controlled directly, as opposed to inflation;

- tight control of money supply prevents the growth of national debt, which has a certain disciplining effect on fiscal policy;

- definition of target indicators does not require significant analytical work, it requires only annual assumptions of real economic growth, trend speed of money circulation and the monetary base multiplier, which depends on the amount of reserve requirements (Oomes N. and Onsorg F.2005). Basic disadvantages of this regime are the following (Gerberding C., Seitz F. and Worms A. 2017):

Firstly, it requires the stability of the money multiplier and the constant speed of money circulation;

Secondly, the efficiency of targeting declines, if the demand for money is exposed to a variety of cyclical fluctuations and the speed of the liquidity circulation is unstable.

Inflation targeting was first applied by the central bank of New Zealand in 1990, followed by Canada (1991), Great Britain (1992), Sweden, Finland and Australia (1993), and Spain (1994). Then the Czech Republic, Brazil, Israel and Chile joined the banners. In Europe, the central banks of Switzerland, Norway and Iceland switched to inflation targeting (Svenson L. 2002). In most of the above countries, such evolution of the central banks' strategy resulted from the unsatisfactory practice of targeting of monetary aggregates or the exchange rate (Levchenko D.V. 2015).

The necessary prerequisites for successful inflation targeting are the following (Masson P. 1997; Jonas J. (2000):

1) low volatility of inflation;

2) high degree of the central bank autonomy;

3) stability of the fiscal system;

4) developed financial markets capable of securing financing of government loans by a non-monetary method;

5) developed money markets, which create conditions for the efficient use of monetary instruments;

6) capability of monetary regulators to model and forecast the dynamics of inflation, taking into account time lags based on the developed models of the monetary policy transmission mechanism.

It is also necessary to remember about the transmission mechanism. Kuttner, Mosser and Eichengreen, et al. (Kuttner, K., and P. Mosser, 2002; Eichengreen B. 2015) proved the relationship between the efficiency of the monetary policy and its creators' abilities to accurately evaluate the timing and efficiency of its implementation through transmission channels on the economic activities of market agents and price control, using the DSGE models (Cims C. A).

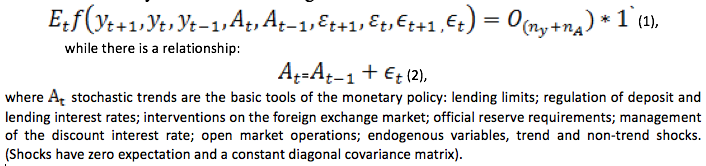

We use a system of the following form in this work:

Continuous differentiability by all arguments, full rank for the matrix and availability of the unique bounded equilibrium state are also assumed. If the values of stochastic trends are known, the characteristics of the equilibrium state can be expressly determined. Let’s suppose there is a unique non-explosive solution in the field of interest for each, and work with this case only.

Monetary policy is transformed into the economy through four channels – interest rate, assets (property) and credit, exchange rate channels, as shown in Figure 2. The change in money supply by the central bank influences the economy primarily through the interest rate transmission channel according to the following scheme:

M↑=> ir↓ => I↑ => Y↑ (3)

Where, М is money supply by the central bank; ir is real interest rate; I is investment; Y is output.

It is common knowledge that the stimulating monetary policy of the central bank (M) grows, which actually reduces the interest rate (ir declines), which leads to a reduction in investment costs and a growth in investment incentives (I grows). During regulation, the authors recommend that the discount rate be made a constant and the monetary aggregate be formed with a varying gradient. Growth of investment leads to an increase in aggregate supply (AD) and, ultimately, to an increase in output (Y grows). According to Fisher equation (ir = i - π), increase in money supply leads to an instant decline in the nominal interest rate i, while the price of the commodity does not change, and the actual interest rate ir declines (Frederic S. Mishkin.2010). The study of the Bank of Russia statistics for the period from 2014 to 2016 reveals that the dynamics of monetary aggregates are amazing. Volatility of monetary aggregates (aggregates M1, M2 or M3) can serve as monitoring. Statistics are taken from (www.cbr.ru)

Figure 2

Bank's monetary policy transmission channels

In addition, the shift in priorities between monetary aggregates must be taken into consideration. While earlier – a decade ago – M2 aggregate dominated, now M1 dominates, since it is price-setting. It should be noted that within two years the growth of M2 was negative, which helped to curb inflation but not business activity. activity.

Table 1: Monetary base in broad definition, bln rubles (www.cbr.ru)

Date |

Monetary base (in broad definition) |

of which: |

||||||

cash in circulation, taking into account cash on hand in credit institutions |

correspondent accounts of credit institutions with the Bank of Russia |

reserve requirements |

deposits of banks with the Bank of Russia |

Bank of Russia bonds held by credit institutions |

obligations of the Bank of Russia on securities buyback |

reserve funds for foreign exchange operations deposited with the Bank of Russia |

||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

01.01.2003 |

1,232.6 |

813.9 |

169.7 |

201.1 |

47.4 |

- |

0.5 |

- |

01.01.2016 |

11,184.4 |

8,141.9 |

2,036.4 |

478.3 |

527.9 |

- |

- |

- |

01.01.2017 |

11,882.7 |

8,789.8 |

1,822.7 |

484.7 |

785.5 |

- |

- |

- |

The exchange rate channel, which is flexibly regulated by the central bank in accordance with the market mechanism, plays an important role in export and import activities and has a great influence on the economy growth. If the domestic currency becomes weak, economic agents will be inclined to switch to more reliable and stable foreign currencies. This reaction could be observed after the Lehman shock in 2014 (imposition of sanctions, collapse of the ruble) in Russia, where supply of multi-currency private deposits sharply increased. Monetary policy influences the exchange rate according to the following scheme:

M↑ => ir↓ => Ex↑ => NX↑ => Y↑ (4)

When money supply expands (M grows), it reduces the actual interest rate (ir), which makes national currency less attractive, boosts the exchange rate and demand for foreign currency. The growth of the exchange rate leads to an increase in exports (Ex), while imports are limited. As a result, net exports and total production (NX and Y) grow. However, the volatility of the monetary unit leads to the contradictory dynamics of the currency and the value of securities. The speculative moment changes of motivation both for individuals and for organizations, changing business strategy.

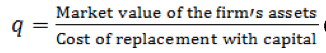

Influence of monetary policy on the economy through stock prices is reviewed in Tobin’s "theory of investment ", expressed by the following formula (Tobin J. 1978):

(5)

(5)

If the impact indicator (5) is high, the firm value (stock price) will be higher than the value of the assets replacement, and the firms will stick to the trend of nominal stock prices growth at issue and later use the funds to expand investment, and vice versa. It can be regularly heard from analysts of the Russian stock market that the assets are undervalued. When the central bank expands money supply, i.e. households become owners of more money, this stimulates spending. Therefore, the authors propose to create an investment channel, by analogy with the mortgage or the q-channel. One of the important expenditure channels is investment in the stock market, which leads to an increase in demand for them and an increase in the stock price, which can be generalized in the following scheme:

M↑ => Ps↑ = q↑ => I↑ => Y↑, (6),

where Ps is stock price.

In addition, when the Central Bank expands the money supply, this leads to a decrease in interest rates on bonds, they become less attractive than stocks, which encourages their purchase and therefore increase their prices, a similar situation exists in the Russian market of legacy. Monetary authorities impede this trend. Extending benefits and privileges on bonds and types of bonds. As for incomes, it is possible to detect that the common shares become a source of long term income. Therefore, when stock prices rise, so does income, and the constant consumer spending of citizens grows. Expansionary monetary policy leads to an increase in stock prices that in the aggregate can be represented by the scheme (in Russia 01.07.2017 tough monetary policy in stimulating transformered):

M↑ => Ps↑ => assets ↑ => consumption ↑ => Y↑ (7)

Using a credit channel, the banks pursuing an accommodative monetary policy will raise reserves and deposits, increase the volume of bank loans that will be used to expand investment and consumption. This can be represented as the following scheme:

M↑=>Bank deposits ↑ =>Bank loans ↑ =>I↑ =>Y↑, (8)

One of the important indicators taken into consideration when issuing a bank loan is the share of equity according to financial statements of organizations. A large share of equity is a condition that facilitates the loan issue by the bank. Monetary expansion boosts the stock prices and the enterprise equity and allows the bank to issue more loans, which leads to a raise in investment and gross product. These relations can be represented in the following form:

M↑ => Ps↑ => equity ↑ => loan ↑ => I↑ => Y↑, (9)

As the study revealed, the M1 monetary aggregate is currently the one playing a decisive role in pricing processes, and therefore its growth should be minimized in the inflation fight or even made negative. Inflation control is carried out through the M2 monetary aggregate because it is associated with the mandatory reserves of commercial banks and the exchange rate.

Under complex economic circumstances, it is recommended to maintain high volatility of exchange rates, because this allows exploiting the speculative motive, thus creating a “middle class” layer and encouraging organizations for open market operations, as volatility increases financial leverage. (Undoubtedly, the real sector will feel uncomfortable, but in such a situation it is unprofitable and cannot become a source of production innovation, while the financial sector can). The authors revealed that for inflation targeting, it is much more important to achieve its volatility than its drop. It is fair to say that long-term goals dominate in the various cash flows of the transmission mechanism: for example, individuals are encouraged to make long-term deposits and purchase financial products meant for at least three years; organizations are trying to stabilize through "short and frequent" payments. The pulse returns obtained from the model with the level variables indicate that the ruble depreciation leads to an increase in currency replacement, but the demand on the exchange is regulated by tariffs and volumes. Granger testing confirmed the link between the ruble exchange rate and currency replacement.

Alternative criteria can be used when choosing the tools for modeling (monetary policy). For example, (Khan, Mohsin S. 2012, Fridman A. and Verbitsky A. 2001) assign the main role to the currency replacement and inflation. (Oomes and Ohnsorge 2005) give preference to the goals of economic growth; they use the interest rate as an intermediate marker. (Harrison and Vymyatnina 2007) prefer prices stabilization and inflation curbing, choose the money supply regime, official reserve requirements and open market operations as an intermediate goal. Dorbec (2005) studied the determinants of currency replacement with an emphasis on euro. The authors give preference to the balance of the portfolio of currencies for transactions and assets and volatility levels. (Cims, C.A. and Wotson, M.V., 1990) and (Elyasiania E. and Zadeh A. 1999) suggest including the M1 monetary aggregate elements in a variation series.

Like most perturbation methods, the model proposed in this work will function only with adjusted data. In models with weak nonlinearities in the trends, some implementations of the proposed algorithm will function no better than linearization around one point. The authors evaluated Granger's causal relationship using the method developed by Toda and Yamamoto (1995), without the assumption of a balanced growth trajectory. The algorithm proposed by the authors is more flexible and allows to control the accuracy within the reference limits. In addition, the authors included the average latency period of monetary policy in the model. The influence of monetary policy on economic growth is manifested in developed countries within one year, the influence on inflation – within two years. For developing countries, the latent period will be even shorter.

A study funded in accordance with the research plan No. 26.7067.2017/B4

In this paper, presents a control algorithm for DCT from the perspective of situationif changes on the basis of DSGE, which was absent in the trajectory of balanced growth. The proposed model will enable to achieve positive changes as negative situational phenomenon entered into the model as constraints.

Bank of Russia official website. www.cbr.ru (accessed January 31, 2017)

Batini N. and Nelson E. (2005) The U.K.’s Rocky Road to Stability: Federal Reserve Bank of St. Louis Working Paper, 20, 114

Cims C. A. and Wotson M.V. (1990) Vyvod v lineynykh modelyakh vremennogo ryada s nekotorymi kornyami yedinitsy [Output of a time series with some roots of unity in linear models]. Econometrica, 58, 113-144.

Eichengreen B. (2015). Monetary Regime Transformations. New York: Oxford University Press, pp. 86.

Elyasiania E. and Zadeh A. (1999). “Econometric test of alternative scale variables in money demand in open economies. International evidence from selected OECD countries”. The Quarterly Review of Economics and Finance, 39.

Fisher I. (1930). The Theory of Interest. New York: Macmillan.

Fridman A. and Verbitsky A. (2001) Zamena valyuty v Rossii [Currency replacement in Russia]. Economic education, 1, 4

Gerberding C., Seitz F. and Worms A. (2017). Money-Based Interest Rate Rules, Lesson from German Data: Deutsche Bundesbank Discussion Paper Series 1. Economic Studies, 06, 37

Harrison B. and Vymyatina L. (2007) Zamena valyuty v ekonomike [Currency replacement in the economy]: Dollarization: Russian practice. BOFIT 2007/3.

Jonas J. (2000) Inflation Targeting In Transition Economics: Some issues and Experience. Inflation Targeting In Transition Economics: The Case Of the Czech Republic. In Warren (Eds.). Prague: Czech National Bank and Monetary and Exchange Affairs Department of the International Monetary Fund, pp. 24.

Jonas J. (2000). “Inflation Targeting In Transition Economics: Some issues and Experience. Inflation Targeting In Transition Economics: The Case Of the Czech Republic”. In Warren (Eds.). Prague: Czech National Bank and Monetary and Exchange Affairs Department of the International Monetary Fund, pp. 24

Khan, M. S. (2012) Inflation, Financial Deepening, and Economic Growth. Banco de Mexico Conference on Macroeconomic Stability. Financial Markets and Economic Development, Mexico City, November. pp. 12 – 13.

Kondratov D.I. (2011). Denezhno-kreditnaya politika v stranakh Yevropy [Monetary policy in the European countries]. HSE Economic Journal, 2, 204-205.

Kuttner, K., and P. Mosser. (2002). “The Monetary Transmission Mechanism: Some Answers and Further Questions”. Federal Reserve Bank of New York Economic Policy Review, May.

Levchenko D.V. and Khandruev A.A. (2015). "Targetirovaniye inflyatsii: mezhdunarodnyy opyt i Rossii [Inflation targeting: global and Russian practice]." Moscow: BFI Consulting Group, p. 5.

Masson P., Savastano M. and Sharma S. (1997). “The Scope for Inflation Targeting in Developing Countries. IMF WP”/97/130. Washington: International Monetary Fund

Mishkin, F. S. (2010). The Economics of Money, banking and Financial Markets. Alternative Edition, pp. 9.

Oomes N. and Onsorg F. (2005) Denezhnoye trebovaniye i inflyatsiya v ekonomicheskikh sistemakh [Monetary claim and inflation in economic systems] Dollarized: Case of Russia. Economic analysis, 33, 462-483.

Phillips A.W. (1958) The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861–1957”. Economica. New Series, 25(100), 283-299.

Svenson L. (2002). “Inflation Targeting: Should it be modeled as an instrument rule or targeting rule”. NBER Working Paper, 8925, 1.

Tobin J. (1978). Monetary Policies and the Economy: The Transmission Mechanism. Southern Economic Journal, 44(3), 421-431.

Toda H. Y. and Yamoto Т. (1995). Statisticheskiy vyvod v vektornykh avtoregressiyakh s vozmozhno integrirovannymi protsessami [Statistical deduction in vector autoregressions with possible integrated processes]. Econometrics, 66, 225-250.

Wagner H. (2016) Central Banking in Transition Countries. IMF Working Paper, 126, 49.

1. Plekhanov Russian University of Economics, Russia, 117997, Moscow, Stremyanny Lane, 36

2. Plekhanov Russian University of Economics, Russia, 117997, Moscow, Stremyanny Lane, 36

3. Plekhanov Russian University of Economics, Russia, 117997, Moscow, Stremyanny Lane, 36