Vol. 38 (Nº 62) Year 2017. Páge 5

Vol. 38 (Nº 62) Year 2017. Páge 5

Irina Petrovna KOMISSAROVA 1; Elena Aleksandrovna MAYOROVA 2; Alexander Fedorovich NIKISHIN 3; Olga Vladimirovna ROZHNOVA 4; Albina Nikolaevna MAYOROVA 5

Received: 06/10/2017 • Approved: 20/10/2017

ABSTRACT: One of the modern trends in the development of retail, including in Russia, is a steady growth of the private labels segment. An essential aspect of managing private labels is the choice of product categories. The present study focuses on the assessment of perceptions of private label products of different categories by young consumers of Moscow. To achieve this goal, we have interviewed Moscow consumers at the age of 18-25 years. The results confirmed that private label products of various categories are perceived differently by consumers, and showed that, except for certain goods, in general consumers still prefer national brands over private labels; the main reason for not purchasing private label products is their low quality; while the main incentive for purchasing private label products is their low price. It was revealed that the most developed products in the private labels segment are paper and wet napkins, bottled water; such products as spices and seasonings, bread, juices, ice cream, frozen vegetables, cereals and grains also show good prospects; in terms of private label products, such products as washing powder and sunflower oil are considered disputable, since their realization is associated with significant risk; undesirable products for private labels are personal hygiene products, frozen meat and fish, butter, chocolate, fish and canned meat, tea, coffee, hand and face cream, cottage cheese and sour cream, clothing, shampoo, milk and animal feeds; products like cosmetics, fragrances, vitamins, beer, baby food and spirits are considered unacceptable in terms of private label marketing. |

RESUMEN: Una de las tendencias modernas en el desarrollo del comercio minorista, incluso en Rusia, es un crecimiento constante del segmento de marcas privadas. Un aspecto esencial de la administración de etiquetas privadas es la elección de categorías de productos. El presente estudio se centra en la evaluación de las percepciones de productos de marca privada de diferentes categorías por parte de los consumidores jóvenes de Moscú. Para lograr este objetivo, hemos entrevistado a consumidores de Moscú a la edad de 18-25 años. Los resultados confirmaron que los productos de marca privada de diversas categorías son percibidos de manera diferente por los consumidores, y mostraron que, a excepción de ciertos bienes, en general los consumidores siguen prefiriendo las marcas nacionales sobre las privadas; la razón principal para no comprar productos de marca privada es su baja calidad; mientras que el principal incentivo para comprar productos de marca privada es su bajo precio. Se reveló que los productos más desarrollados en el segmento de las marcas privadas son papel y servilletas húmedas, agua embotellada; productos tales como especias y condimentos, pan, jugos, helados, verduras congeladas, cereales y granos también muestran buenas perspectivas; en términos de productos de marca privada, productos como el detergente en polvo y el aceite de girasol se consideran discutibles, ya que su realización está asociada a un riesgo significativo; productos indeseables para etiquetas privadas son productos de higiene personal, carne y pescado congelados, mantequilla, chocolate, pescado y carne enlatada, té, café, crema para manos y cara, requesón y crema agria, ropa, champú, leche y alimentos para animales; productos como cosméticos, fragancias, vitaminas, cerveza, comida para bebés y licores se consideran inaceptables en términos de comercialización de marca privada. |

One of the modern trends in the development of retail is a steady growth of the private label segment. According to Nielsen's survey, published by the Private Label Manufacturers Association, in 2015 the share of private labels has increased in the markets of 13 of the 20 European countries and amounted to 52% in Switzerland, 50% in Spain and over 40% in the UK, Germany, Belgium, Austria and Portugal (PLMA, 2016a). In the United States, in the same year private labels have reached the maximum values for all time, both in the market share (17.7%) and sales volume ($118.4 billion) (PLMA, 2016b). In recent years, the market share of private labels has increased in Australia, China, Latin America (Nielsen, 2014). In the Russian market, according to the data for March 2016, private labels have accounted for 8% in physical terms, 5% in cash, adding 1 percentage point to the previous year, and are projected to continue to grow (Nielsen, 2016).

The development of private labels is due to their significant advantages for both retailers and consumers. Retailers receive high unit margins on the private label itself and higher unit margins on the national brands, while consumers get access to a wider range of products at lower average prices (Pauwels, & Srinivasan, 2004). Private labels may also serve as a tool to increase loyalty to the store (Gonzalez-Benito, & Martos-Partal, 2012). Private labels allow retailers to optimize their assortment and pricing, improve their image and reputation, increase consumer loyalty, and generally enhance the competitiveness (Ivanov, & Mayorova, 2015). Given the current trends and the importance of private labels, their management issues are highly relevant to retailers.

One of the key aspects of managing private labels is the choice of product categories (Dhar et al., 2001; Badin, & Tamberg, 2008; Shcherbakov, & Gorba, 2014; Gusakova, 2014). It is known that sales volumes and the market share of private label products of the same category vary significantly geographically (Nielsen, 2014). The present study focuses on assessing the perception of private label products of different categories by young consumers of Moscow.

In the Russian market, the introduction of private labels was held quite randomly, in the first place Russian retailers tried to cover a variety of product categories – both food and non-food products. However, it quickly became apparent that the most profitable product category for private labels is everyday goods. In this regard, there had been a steady trend to introduce private labels in the categories of food products that form the basis of the consumer basket, in seasonal goods, and also in the component of the assortment matrix, which has the least brand dependence (Vakhrusheva, 2011).

The results of Nielsen's research (2014, 2016) show that in the Russian market in the private label segment, the largest share of sales among food products falls on basic packaged food products, dairy products and confectionery, among non-food products – on cotton-wool products, childcare products and cleaning supplies. In physical terms, alcoholic beverages, tea and coffee, juices, drinking water and vegetable oil demonstrate the highest growth rates. According to the research conducted by Ipsos Comcon (2016), the most popular private label product categories in Russia are cereals and grains, paper products and dairy products; the lowest probability of buying private labels is typical for categories with high emotional affection for the brand.

Stratienko (2012) notes that along with dairy products, groceries, paper products and frozen foods, retailers promote private labels in such categories as canned food, beverages (including alcoholic beverages) and household chemicals. On the contrary, such products as personal hygiene products, products for children and others, for which quality and safety characteristics are fundamental, are not in high demand in the private label segment (Lobova, & Ilyushnikov, 2014). Under various strategies, private labels can be successful in selling vegetables, groceries, baked goods, frozen products, etc., but for products like beer, spirits, cosmetics, perfumes, branded clothes and cigarettes private labels are often ineffective (Badin, & Tamberg, 2008). In general, the most suitable for private labels are "brand-independent" product categories with low brand loyalty and tendency to a quick switch from one manufacturer to another; long-term storage product categories and those requiring expensive advertising; product categories that are less likely to be of poor quality, that is, where this quality can be easily assessed (Gusakova, 2014).

As part of this study, in early 2017, we have interviewed 350 consumers aged 18 to 25 years living in Moscow. Of these, 347 people (99%) were familiar with the concept of private labels and have completed the questionnaire. The respondents were offered a questionnaire with 30 items of everyday goods, of which 22 were food, 8 – non-food products. For each product they were asked to choose one of the following response options characterizing their perception of private labels: "I purchase products under private labels more often than those under national brands", "I purchase products under private labels less often than those under national brands", "I do not purchase products under private labels, but I'm willing to buy them", "I do not purchase products under private labels and I am not ready to purchase them", "I do not purchase goods of the specified category". At the end of the survey we verbally asked the respondents, first, why they refused to buy private label products, secondly, what, on the contrary, encouraged them to purchase such goods.

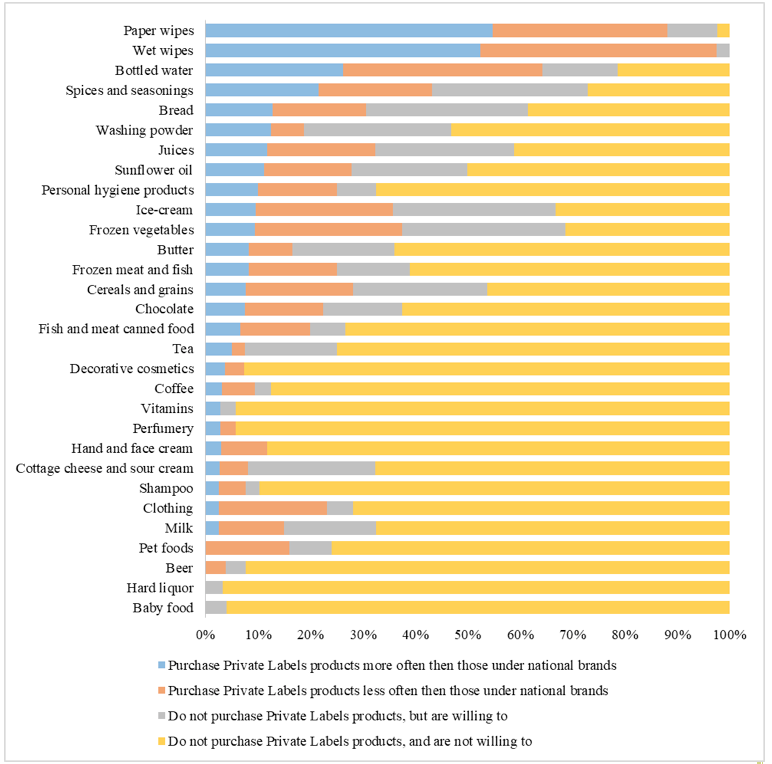

The results of the survey (Table 1) show that currently among young consumers of Moscow, the most popular private label products are paper and wet wipes. Over 50% of respondents buy these products under private labels more frequently than under national brands. 100% and 97.6% of the respondents purchase and are ready to purchase private label wet wipes and paper napkins respectively. The respondents also show positive perception of private label bottled water – over 50% of them already purchase it, while another 14.3% are willing to purchase it.

Such products as spices and seasonings, bread, juices, ice cream, frozen vegetables, and cereals turned out sufficiently attractive private labels. In aggregate, over 50% of the respondents already purchase or are ready to purchase them. The fact that over 25% of respondents have declared their readiness to purchase these goods indicates their particularly high potential. In addition, washing powder and sunflower oil are potentially acceptable but rather risky for private labels – the respondents' opinions of these products split into positive and negative approximately equally, with more than 20% of respondents not yet purchasing such products, while expressing their readiness to purchase them.

Less attractive for private labels are personal hygiene products, frozen meat and fish, butter, chocolate, fish and canned meat, tea, coffee, hand and face cream, cottage cheese and sour cream, clothing, shampoo, milk and pet feeds. Over 50% of respondents do not purchase these products and say they are not going to. And finally decorative cosmetics, perfumes, vitamins, beer, baby food, hard liquor turned completely unacceptable private label products. Over 90% of respondents said they do not purchase and do not intend to purchase these goods under private labels.

Table 1

Consumer survey results on private labels in different

product categories (compiled by the authors)

Products |

Purchase products of the specified category, persons |

Purchase private label products |

Do not purchase private label products |

||

more often than under national brands,% |

less often than under national brands,% |

but are ready to purchase,% |

and are not ready to purchase,% |

||

Paper wipes |

340 |

54.8 |

33.3 |

9.5 |

2.4 |

Wet wipes |

331 |

52.5 |

45.0 |

2.5 |

0.0 |

Bottled water |

332 |

26.2 |

38.1 |

14.3 |

21.4 |

Spices and seasonings |

289 |

21.6 |

21.6 |

29.7 |

27.0 |

Bread |

315 |

12.8 |

17.9 |

30.8 |

38.5 |

Washing powder |

259 |

12.5 |

6.3 |

28.1 |

53.1 |

Juices |

296 |

11.8 |

20.6 |

26.5 |

41.2 |

Sunflower oil |

306 |

11.1 |

16.7 |

22.2 |

50.0 |

Personal hygiene products |

345 |

10.0 |

15.0 |

7.5 |

67.5 |

Ice-cream |

317 |

9.5 |

26.2 |

31.0 |

33.3 |

Frozen vegetables |

259 |

9.4 |

28.1 |

31.3 |

31.3 |

Frozen meat and fish |

291 |

8.3 |

16.7 |

13.9 |

61.1 |

Butter |

298 |

8.3 |

8.3 |

19.4 |

63.9 |

Cereals and grains |

315 |

7.7 |

20.5 |

25.6 |

46.2 |

Chocolate |

331 |

7.5 |

15.0 |

15.0 |

62.5 |

Fish and meat canned food |

248 |

6.7 |

13.3 |

6.7 |

73.3 |

Tea |

316 |

5.0 |

2.5 |

17.5 |

75.0 |

Decorative cosmetics |

224 |

3.7 |

3.7 |

0 |

92.6 |

Coffee |

259 |

3.1 |

6.3 |

3.1 |

87.5 |

Hand and face cream |

275 |

2.9 |

8.8 |

0 |

88.2 |

Perfumery |

290 |

2.9 |

2.9 |

0 |

94.3 |

Vitamins |

290 |

2.9 |

0 |

2.9 |

94.3 |

Cottage cheese and sour cream |

316 |

2.7 |

5.4 |

24.3 |

67.6 |

Clothing |

346 |

2.6 |

20.5 |

5.1 |

71.8 |

Shampoo |

343 |

2.6 |

5.1 |

2.6 |

89.7 |

Milk |

316 |

2.5 |

12.5 |

17.5 |

67.5 |

Pet foods |

197 |

0 |

16.0 |

8.0 |

76.0 |

Beer |

192 |

0 |

3.8 |

3.8 |

92.3 |

Baby food |

193 |

0 |

0 |

4.0 |

96.0 |

Hard liquor |

251 |

0 |

0 |

3.2 |

96.8 |

In general, as clearly shown in Figure 1, young consumers in Moscow prefer national brands over private labels. And if asked "Why do you refuse to purchase private label products?" the respondents unanimously asserted that such goods are of poor quality. The key factor encouraging consumers to purchase private label products is their relatively low price.

Figure 1

Consumer survey results on private labels in different product categories (compiled by the authors)

While in general in Russia 87% of residents know about the existence of private labels (Ipsos Comcon, 2016), almost all the consumers who participated in the survey were familiar with the concept (99%). This fact can be explained by the respondents' limitations on age (18-25 years) and on the territory of residence (Moscow). It is known that private labels are more developed in megacities, and also that the leader in the turnover of private labels goods in Russia is the Central Federal District (Nielsen, 2016). Despite the fact that most consumers still prefer national brands, a good awareness of the youth audience about private labels indirectly indicates their prospects.

The key factors behind the decision to purchase private label products are quality and price. The quality problem is one of the most important in the management of private labels and can be considered in two aspects. Firstly, for retail reasons, it is difficult for retailers to control the quality of production, and secondly, modern consumers still conform to a stereotype that private label products by definition are of poor quality (Gusakova, 2014). Due to the fact that the quality of goods is of paramount importance for consumers (Mayorova, & Lapitskaya, 2016), the important direction of development for private labels is the strengthening of quality control of production and further at all stages of commodity circulation, as well as informing consumers about the quality of goods through advertising, tastings, distribution of samples and the like. Low prices, on the contrary, are traditionally considered the main advantage of private labels (Stratienko, 2012). At the same time, modern Russian retailers already introduce and develop private labels in the middle price category, as well as in the premium class category.

The survey data confirmed that different categories of private label products are perceived differently by consumers. In general, for the majority of products, including paper and wet napkins, bottled water, spices and seasonings, bread, ice cream, frozen vegetables, cereals, cosmetics, perfumes, etc., the opinion of the respondents coincided with the results of other studies (Nielsen, 2014; Nielsen, 2016; Ipsos Comcon, 2016; Stratienko, 2012; Lobova, & Ilyushnikov, 2014; Badin, & Tamberg, 2008; Gusakova, 2014). However, for some products, the respondents have expressed the opposite opinion. In particular, according to the survey results, milk, cottage cheese and sour cream private labels are not attractive to consumers, while Stratienko (2012), Ipsos Comcon (2016) and Nielsen (2016) call dairy products one of the most popular category in this segment. Over 90% of respondents do not purchase and are not going to purchase beer and hard liquor private labels, which corresponds to Badin, & Tamberg (2008), but contradicts Stratienko (2012). In the private label segment, baby food turned out to be unsuitable for consumers. Lobova, & Ilyushnikov (2014) argue that private label children products are not in demand, since in this case the quality and safety assurance is of great importance; however, Nielsen's research (2016) results show that child care goods account for a significant share of sales in the Russian private label market. These differences may be caused, firstly, by the restriction of the territory, secondly, by the age of the respondents, and thirdly, by the number of respondents.

To sum up, based on the results of the research we can draw the following conclusions about the perception of private label products of different categories by young consumers of Moscow:

1) it was confirmed that private label products of different categories are perceived differently by consumers;

2) with the exception of certain product categories, in general, consumers still prefer national brands over private labels;

3) the main reason for not buying private label products is their low quality;

4) the main incentive for purchasing private label products is their low price;

5) the most developed in the private labels segment are such products as paper and wet wipes, bottled water; such products as spices and seasonings, bread, juices, ice cream, frozen vegetables, cereals and grains show good prospects; in terms of private label products, such products as washing powder and sunflower oil are considered disputable, since their realization is associated with significant risk; undesirable products for private labels are personal hygiene products, frozen meat and fish, butter, chocolate, fish and meat canned food, tea, coffee, hand and face cream, cottage cheese and sour cream, clothing, shampoo, milk and animal feeds; products like cosmetics, fragrances, vitamins, beer, baby food and hard liquor are considered unacceptable in terms of private label marketing.

The results presented in the present article can be used in practical activities of trade enterprises selling private label products, primarily retail trade networks. Efficiency improvement in the management of private labels will contribute to the growth of the resulting social and economic indicators.

Badin, A., & Tamberg, V. (2008). Brending v roznichnoi torgovle. Algoritm postroeniya s nulya [Branding in Retail Trade. An Algorithm for Constructing from Scratch]. Moscow: Eksmo. (p. 224).

Dhar, S.K., Hoch, S.J., & Kumar, N. (2001). Effective Category Management Depends on the Role of the Category. Journal of Retailing, 77(2), 165-184.

Gonzalez-Benito, O., & Martos-Partal, M. (2012), Role of Retailer Positioning and Product Category on the Relationship between Store Brand Consumption and Store Loyalty. Journal of Retailing, 88(2), 236-249. Retrieved July 25, 2017, from

Gusakova, E.P. (2014). Sobstvennaya torgovaya marka kak faktor povysheniya konkurentosposobnosti torgovykh roznichnykh setei [Private Label as a Factor for Increasing Competitiveness of Retail Chains]. Politematicheskii setevoi elektronnyi nauchnyi zhurnal Kubanskogo gosudarstvennogo agrarnogo universiteta, 99, 1112-1125.

https://www.ipsos.com/sites/default/files/import_destination/publications/documents/2016-08-stm.pdf

Ipsos Comcon. (2016). Potreblenie sobstvennykh torgovykh marok v Rossii po dannym regulyarnogo issledovaniya Rosindeks [Consumption of private labels in Russia Based on the Regular Survey Held by Rosindex].

Ivanov, G., & Mayorova, E. (2015). Intangible Assets and Competitive Advantage in Retail: Case Study from Russia. Asian Social Science, 11(12), 38-45.

Lobova, S.V., & Ilyushnikov, K.K. (2014). Rol sobstvennykh torgovykh marok setevykh riteilerov v razvitii territorii [The Role of Retailers' private labels in the Territorial Development]. Vestnik Altaiskoi akademii ekonomiki i prava, 6, 99-103.

Mayorova, E.A., & Lapitskaya, N.V. (2016). Assessment of Customers’ Perception of Social Responsibility of Trade Business. International Journal of Economics and Financial Issues, 6(2), 158-163.

Nielsen. (2014). The State of Private Label around the World. Retrieved July 25, 2017, from http://www.nielsen.com/content/dam/nielsenglobal/eu/docs/pdf/Nielsen%20Global%20Private%20Label%20Report%20November%202014.pdf

Nielsen. (2016). Chastnye marki naladili dolgosrochnye otnosheniya s rossiiskimi potrebitelyami [Private Brands Have Established Long-Term Relationships with the Russian Consumers]. Retrieved July 25, 2017, from http://www.nielsen.com/ru/ru/insights/news/2016/private-labels-grow-rapidly.html

Pauwels, K., & Srinivasan, S. (2004). Who Benefits from Store Brand Entry? Marketing Science, 23(3), 364-390.

Private Label Manufacturers Association. (2016a). Private Label’s Market Share Climbs in 13 of 20 Countries across Europe. Retrieved July 25, 2017, from http://www.plmainternational.com/industry-news/private-label-today

Private Label Manufacturers Association. (2016b). PLMA’s 2016 Private Label Yearbook. A Statistical Guide to Today’s Store Brands. Retrieved July 25, 2017, from http://plma.com/share/press/resources/plma2016yb_comb_rpt.pdf

Shcherbakov, V.V., & Gorba, L.K. (2014). Strategicheskie prioritety razvitiya sobstvennykh torgovykh marok roznichnykh setevykh operatorov [Strategic Priorities for the Development of private labels of Retail Network Operators]. Vestnik Yuzhno-Ural'skogo gosudarstvennogo universiteta. Seriya: Ekonomika i menedzhment, 8(3), 106-112.

Stratienko, L.A. (2012). Issledovanie assortimentno-tsenovoi politiki roznichnykh setei g. Kemerovo v oblasti sobstvennykh torgovykh marok [A Study of the Assortment and Pricing Policies of Retail Chains’ private labels in the Kemerovo Region]. Mir ekonomiki i upravleniya, 12(3), 50-54.

Vakhrusheva, C. (2011). Obshchie tendentsii razvitiya chastnykh marok [General Trends in the Development of Private Labels]. Praktika torgovli. Torgovoe oborudovanie, 7. Retrieved July 25, 2017, from http://www.retailmagazine.ru/article.php?numn=4103

1. National Research Nuclear University MEPhI (Moscow Engineering Physics Institute), 31 Kashirskoe highway, Moscow, Russia, 115409

2. Plekhanov Russian University of Economics, 36 Stremyanny per., Moscow, Russia, 117997; E-mail: e_mayorova@mail.ru

3. Plekhanov Russian University of Economics, 36 Stremyanny per., Moscow, Russia, 117997

4. Financial University under the Government of the Russian Federation, 49 Leningradsky prospekt, Moscow, Russia, 125993

5. Russian State Social University, 4/1 W. Pieck str., Moscow, Russia, 129226