Vol. 38 (Nº 49) Year 2017. Page 19

Uzak Akzamovich TEKENOV 1; Asima Narbekovna DAURENBEKOVA 2; Medet Zhaugashtievich KONYRBEKOV 3

Received: 12/06/2017 • Approved: 20/07/2017

ABSTRACT: Since the proclamation of independence of the republic, there have been significant structural changes in agriculture, as in the whole economy of the country. After the failure of the centrally planned economy out a series of measures has been carried out aimed at radically reforming the crop sector, agriculture. In general, the political result of reformation was the transformation of the state ownership to the private one, as well as the creation of the legal framework of a market economy. The economic consequences of changes were in steel production and land relations, pricing liberalization, the credit system, the establishment of a competitive market infrastructure. Animal husbandry in the Republic is one of the main industries of the agrarian sector of the economy. The rich pastures and favorable climatic conditions provide a good basis for the development of the industry. Animal husbandry segment occupies about 47.5% of the total volume in the agricultural sector and least of all influenced by weather conditions and global factors, fluctuations in world prices for the volume of production, unlike crop segment. The animal husbandry segment is the most vulnerable part of agriculture, primarily due to the low efficiency of small farms, the absence of large cooperations as in crop industry and the lack of competitiveness of products in the domestic and foreign markets. Relatively low competitiveness of animal husbandry enterprises as compared with producers in other countries manifests itself in significantly lower export activity and the preferred orientation of the domestic market. This study examines: the current state and prospects of development of the animal husbandry industry in Kazakhstan; overview of support measures from the government; the current state of the animal husbandry sector in the EAEC countries; the statistical analysis, SWOT-analysis of the animal husbandry industry and was developed a matrix of barriers and restrictions in animal husbandry farming and food industry. |

RESUMEN: Desde la proclamación de la independencia de la República, se han producido importantes cambios estructurales en la agricultura, como en toda la economía del país. Tras el fracaso de la economía centralmente planificada, se han llevado a cabo una serie de medidas destinadas a reformar radicalmente el sector agrícola, la agricultura. En general, el resultado político de la reforma fue la transformación de la propiedad estatal a la privada, así como la creación del marco legal de una economía de mercado. Las consecuencias económicas de los cambios fueron la producción de acero y las relaciones de tierras, la liberalización de los precios, el sistema crediticio, el establecimiento de una infraestructura de mercado competitiva. La ganadería en la República es una de las principales industrias del sector agrario de la economía. Los pastos ricos y las condiciones climáticas favorables proporcionan una buena base para el desarrollo de la industria. El segmento de cría de animales ocupa alrededor del 47,5% del volumen total en el sector agrícola y menos de todos los influidos por las condiciones climáticas y los factores globales, las fluctuaciones en los precios mundiales del volumen de producción, a diferencia del segmento de cultivos. El segmento de cría de animales es la parte más vulnerable de la agricultura, principalmente debido a la baja eficiencia de las pequeñas granjas, la ausencia de grandes cooperaciones como en la industria de los cultivos y la falta de competitividad de los productos en los mercados domésticos y extranjeros. La competitividad relativamente baja de las empresas de cría de animales en comparación con los productores de otros países se manifiesta en una actividad de exportación significativamente menor y en la orientación preferida del mercado nacional. Este estudio examina: el estado actual y las perspectivas de desarrollo de la industria de la ganadería en Kazajstán; visión general de las medidas de apoyo del gobierno; el estado actual del sector de la ganadería en los países CEEA; el análisis estadístico, el DAFO de la industria de la ganadería y se desarrolló una matriz de barreras y restricciones en la ganadería y la industria alimenticia de los animales. |

Agro-industrial complex of Kazakhstan is a priority for the state. One of the most important factors for the sustainable development of agriculture is the orientation of the economic effectiveness of agricultural production and processing, which involves the rational and integrated use of land, labor, material and natural resources. A special role is assigned to the rational development of the territorial aspect, leading to more efficient use of basic types of resources.

The main directions in animal husbandry, which accounts for 48% of gross agricultural production are meat and dairy cattle, sheep and horse breeding, the production of poultry meat. Cattle are bred mainly in the northern part of the country, as well as in the foothills of the Southern and Eastern Kazakhstan. Sheep breeding is more developed in the south and west of the country, as well as in the east, where there are extensive pastures all seasons. Horse breeding is developed in all regions of the country.

Animal husbandry for rural people - is a generator of employment and income. It provides the population of the country with such high-value food products such as meat, milk, eggs, butter, cheese, dairy products, sausages, smoked meat, etc.

Kazakhstan has huge opportunities in this industry, as there are enough areas for the development of this sector. Currently it is implemented the program for the development of cattle breeding, where were directed substantial sums and the result of this program should be increasing of food resources, g population levels of livestock, expansion of land for pastures and their equipment. As a result of all the objectives of the program, the export potential of Kazakhstan will increase significantly. Also, will be satisfied the internal demand for meat and dairy products mostly.

The purpose of this study is to uncover the current state and prospects of agribusiness livestock industry development in Kazakhstan.

To achieve this goal the following tasks were solved:

- To reveal the history of the development of animal husbandry of the Republic;

- To consider important aspects of animal husbandry in Kazakhstan;

- To characterize the current state of animal husbandry and proposals for development in Kazakhstan.

The object of this study is the current state and prospects of development of agrarian and industrial complex of animal husbandry industry in Kazakhstan. The subjects of research are the prospects of development of animal husbandry industry in Kazakhstan, aimed at realization of the export potential of livestock production.

The methodological basis of the research are dialectical principles and methods of abstraction, as well as a systematic approach that allows to examine the processes of state support measures for the livestock industry. The paper applied the methods of empirical research, system analysis, structural and logical method, etc.

The information base of research are materials of Customs and the State Statistics Service of Central Asia, the materials of the Eurasian Economic Commission (EEC), the UN database (CommoditytradeStatistics, IndustrialCommodityStatistics, Food & AgricultureOrganization), Proceedings of the International Monetary Fund (InternationalMonetaryFund), World Bank (WorldBank), WTO ( WorldTradeOrganization), the Organization for economic cooperation and development. We used the data and publications of specialized editions and analytical overview, as well as the results of researches of marketing and consulting agencies, the materials sector institutions, professional unions and associations.

Animal husbandry is an important branch of agriculture, which gives more than half of its gross product. Meat, milk and eggs are the main food of the population and are the main sources of supply indispensable protein. It is impossible to provide a high level of nutrition without them. Animal husbandry provides valuable raw materials for the industry: wool, leather, lambskin, etc. The development of animal husbandry industry allows productive use of agricultural labor and material resources throughout the year. The livestock industry consumed crop waste, are valuable organic fertilizer - manure and slurry.

An important task of animal husbandry development is to improve the quality of products. This is facilitated by the methods of selection and evidence-based standards of feeding and watering of animals, improvement of technical equipment of farms, complete mechanization of technological processes. Common tasks that need to be addressed in animal husbandry sector, made up to ensure the growth of productivity and the number of livestock and on this basis to increase the volume of high-quality products at the lowest cost of labor and resources.

Agricultural production involves the use of productive resources industry - labor, material, land, water, in the course of which they are partially or completely consumed and their cost is transferred to the created products.

Main activities in animal husbandry intended to support the livestock and the formation of large-scale and medium livestock production.

Livestock is developing in two forms: extensive and intensive. Under extensive we understand the form of development in which production volumes increase due to the expansion of livestock, natural grasslands and use of natural fertile pastures. With intensive form the production volumes increase as a result of improving the health of livestock, increase their productivity through the introduction of scientific and technological progress, improving the forms of organization of production.

Extensive way was important for the increasing of production in the early stages of animal development. However, the historical experience of the development of most countries of the world shows that the main and most promising direction of development is the intensification of agriculture.

The objective prerequisites for the intensification of animal husbandry are:

-boundedness land suitable for grazing;

-development of productive forces;

-public division of labor;

-rising urban population, agricultural products needs.

Intensification does not exclude the extensive development, which need arises in two situations: when it is impossible to cover the growing demand for agricultural products only through intensification; if livestock extension allows at an equal amount of capital and operating costs to get more product than the intensification.

The predominance of extensive or intensive livestock development way depends on the prevailing economic conditions - availability of land, the possibility of additional investments, demand for products, the efficiency of production. In practice, increasing the number of livestock and its products often occurs through the use of two ways simultaneously. It should be borne in mind that the form of extensive livestock development under certain conditions, can be effective, therefore, extensive development is nonidentically to inefficiency. Consequently, under the intensification of livestock must be understood the additional investment of material resources, and sometimes living labor in the same area carried out by improving techniques and production technology in order to increase production at simultaneous growth in the number of animals.

Economic bases of effective development of livestock are biological benefits of cattle to milk: its ability for quick meat productivity, bear the harsh climatic conditions, efficient use of pasture grass. The lack in technology of animal husbandry a number of labor-intensive processes allows to simplify the organization of production beef. Using the process of specialization and concentration of production contributes to a specific increase in the efficiency of specialized industry.

The main features of the formation and development of the innovation process in agricultural production are the following:

- the specificity of the basic means of production in agriculture - land;

- a plurality of types of agricultural and processed products, a significant difference in the technology of cultivation and production;

- significant differentiation of individual regions of the country in terms of production conditions;

- strong dependence of production technologies in agriculture by natural and weather conditions;

- seasonality of production in the agricultural industry as a whole, in particular, a big difference in the period of production of certain types of agricultural and processed products;

- a high degree of territorial fragmentation of agricultural production;

- isolation of agricultural producers (at all levels) from organizations that produce scientific and technical products;

- different social levels of agricultural workers;

- the multiplicity of different forms and relations of agricultural producers with innovative formations;

- the lack or absence of qualified workers, professionals, workers, susceptible to scientific and technical progress;

- lack of a clear and evidence-based organizational and economic mechanism of the transmission science achievements to agricultural producers and, as a consequence, a significant backlog of industry for the development of innovations in production.

State programs on development of agro-industrial complex have been adopted in the Republic of Kazakhstan, among them:

1. First - the development program of agricultural production of the Republic of Kazakhstan for 2000-2002 years, aimed at stabilizing the production of main crop and livestock production, economic growth (increase in sales) in the competitive sectors of agriculture by identifying "points of growth" (production competitive. agricultural products in price and quality). Special measures of state support focuses exactly on them. All other types of agricultural products are provided with state support measures of a general nature (The development program of agricultural production of the Republic of Kazakhstan for 2000-2002).

2. The second - the State agro-food program of Kazakhstan for 2003 – 2005 years, providing provision of republic food security on the basis of formation an effective system of agricultural production, increasing production of competitive products and increasing the volume of sales of agricultural and processed products in the domestic and foreign markets. The decision was carried out through the creation of the legal framework appropriate to the needs of market production, pricing regulation, growth of state support (State agro-food program of the Republic of Kazakhstan for 2003 – 2005).

3. The third - State Programme for Rural Development of the Republic of Kazakhstan for 2004-2010 years. It aimed at creating conditions for the normal village life support based on the optimization of rural settlement (The State Programme for Rural Development of the Republic of Kazakhstan for 2004-2010).

4. The fourth – “State Program on development of agro-industrial complex in the Republic of Kazakhstan for 2010 – 2014 years” is aimed at the financial recovery of agribusiness; increasing affordability of products for agriculture subjects of works and services; the development of state systems provide agribusiness entities; I\improving the efficiency of state regulation of livestock. (The program for the development of agro-industrial complex in the Republic of Kazakhstan for 2010 – 2014)

5. The program "Development of export potential of cattle meat in the Republic of Kazakhstan" aimed at ensuring the increase in the number of commercial cattle herd, development of export potential of cattle meat (Kazakhstan cattle meat export potential development program for 2011-2020).

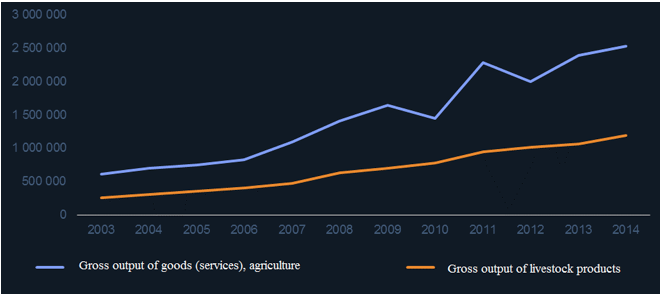

In 2014, the gross output of agriculture amounted to 2.5279 trillion tenge, 48% of gross agricultural output is livestock, 1.1896 trillion tenge. Since 2003, the gross output of livestock products increased by 4.6 times (Figure 1).

Figure 1

The gross output of agriculture and livestock in the years 2003-2014 years, mln. tenge in current prices

Source: Committee on Statistics MNE RK

The main areas of livestock are beef and dairy cattle, sheep and horse breeding, production of poultry meat. Cattle are grown mainly in the northern part of the country, as well as in the foothills of the Southern and Eastern Kazakhstan. Sheep breeding is more developed in the south and west of the country, as well as in the east, where there are extensive pastures all seasons. Horse breeding is developed in all regions of the country.

Industry structure

Gross output of agricultural products in the Republic of Kazakhstan in 2014 amounted to 2.5 trillion tenge. In value terms, the production of livestock products was 47.5%. The largest share in the cost of livestock products occupy: dairy cattle - 15%, cattle breeding - 14% and dilution of small cattle - 6% (Table 1).

Table 1

The structure of the agricultural production of the Republic of Kazakhstan in 2014

Products |

Output, mln. tenge |

In % of total |

Agricultural products in totall |

2 527 890 |

100% |

Crop production |

1 327 855 |

52,5% |

Livestock products |

1 189 555 |

47,5% |

Breeding of dairy cattle |

377 158 |

14,9% |

Breeding of other cattle and buffalo breeds |

355 319 |

14,1% |

Breeding of horses and other equines |

111 081 |

4,4% |

Breeding of camels and camelids |

11 089 |

0,4% |

Breeding of sheep and goats |

155 722 |

6,2% |

Breeding pigs |

58 954 |

2,3% |

Poultry farming |

112 345 |

4,4% |

Breeding of other animals |

7 888 |

0,3% |

Source: Committee on Statistics MNE RK

The number of cattle in agricultural formations in 2014 increased by 34% compared with 2012 and amounted to 2 116.3 thousand heads, sheep and goats by 14.3% (7 031.0 thous. heads), horses by 29.4% (897.9 thous. heads), camels by16.3% (74.9 thous. heads), birds by 12.6% (23.3 million. heads).

It should be noted that for 2014 the share of cattle in organized farms amounted to 35.1%, respectively, in private farms the proportion of cattle (PF) - 64.9%. For comparison, at the beginning of 2010, the national average proportion of animals in organized farms was 18%, respectively, in PF - 82%.

The specific weight of cattle for the last 5 years has increased from 5.6% to 9.8%. At the same time, the proportion of breeding cattle meat productivity in the total number of livestock for meat production was 18.6% in 2014.

As for August 1, 2015, in the republic compared with the same date of the previous year in all categories of farms the number of horses increased by 8.2% and amounted to 2 228.9 thousand heads, cattle - by 2.4% (6969 8 thousand heads), sheep and goats - by 0.9% (22 145.8 thousand heads), poultry of all kinds - by 6% (39 330.4 thousand heads) (table 2).

For 8 months of 2015 the production of meat increased by 2.9% and amounted to 474.4 thous. tons of milk by 2.3% (3 138,7 thous. tonnes), chicken eggs by 12.7% (2 742 million. pieces).

In the ranking of a monetary volume of production the second most important branch of agriculture in 2014 is the breeding of dairy cattle and other cattle and their share amounted to 15% and 14%.

Table 2

Rating output production by industry of agriculture in terms of money

Agriculture industry branch |

mln tenge |

2013 |

2014 |

|

|

|

in % of total |

mln tenge |

in % of total |

Total |

2 386 103 |

100 |

2 527 890 |

100 |

Breeding of dairy cattle |

333 629 |

14,0 |

377 158 |

14,9 |

Breeding of other cattle |

328 427 |

13,8 |

355 319 |

14,1 |

Breeding of sheep and goats |

147 158 |

6,2 |

155 722 |

6,2 |

Poultry farming |

91 513 |

3,8 |

112 345 |

4,4 |

Breeding horses |

96 336 |

4,0 |

111 081 |

4,4 |

Source: Committee on Statistics MNE RK

In agriculture in 2014 were employed 19% (1,605,000 people) of all employed people in the country. The main share falls on the self-employed - 70% (1.145 million people) employed in agriculture.

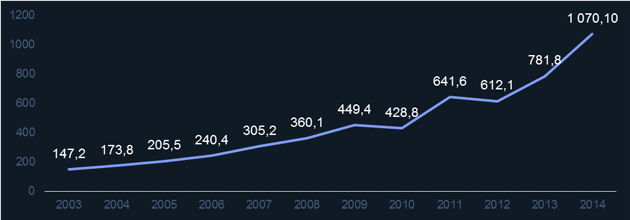

Labour productivity in agriculture increased by more than 7 times in the period since 2003. The greatest increase in performance was in 2011 (50%) and in 2014 (37%) (Figure 2)

Figure 2

Labour productivity in agriculture, thous. of tenge per capita

Source: Committee on Statistics MNE RK

For the period from 2008 to 2014 investment in fixed assets in the sector of Agriculture of the Republic of Kazakhstan increased by 123% - from 78 to 173 billion tenge. Agricultural GDP during the same period increased by 101% - from 853 to 1.718 trillion tenge. Thus the investment growth rate surpassed GDP growth of industry. The annual share of investment in GDP of agriculture sector for the period under review ranged between 7-10% (Table 3).

Table 3. GDP and investments in the sector of agriculture of

the Republic of Kazakhstan in 2008-2014 years, in billions of tenge.

Name |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

Growth in 2008-14 |

Investments in agriculture |

78 |

78 |

84 |

109 |

134 |

140 |

173 |

123% |

GDP of agriculture |

853 |

1 045 |

984 |

1 409 |

1 330 |

1 621 |

1 718 |

101% |

Share of investments to GDP of agriculture |

9% |

7% |

8% |

8% |

10% |

9% |

10% |

1% |

Source: Committee on Statistics MNE RK

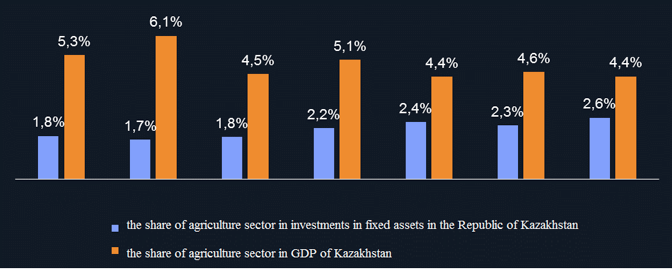

The share of investment in the agricultural sector in total investment volume to the fixed assets in the Republic of Kazakhstan since 2011 is steadily growing. However, investment in agriculture in relative terms, is still below the contribution made by the industry in total GDP (Figure 3).

Figure 3

Share of agriculture sector in investments in fixed assets and the GDP

of the Republic of Kazakhstan in 2008-2014, respectively, as a percentage

Source: Committee on Statistics MNE RK

Information analysis about sources of investment shows that the largest share of investments - over 70% of the total amount of investment in agriculture accounts for own resources of entrepreneurs. The share of borrowed funds account for about 25%.

The largest areas of production beef are Almaty region - 16%, East Kazakhstan region - 15%, and South Kazakhstan region - 12% of the total volume of beef production in Kazakhstan. At the same time 77% of beef produced in small private farms of the population, which to some extent is the reason for the low efficiency of the industry.

The largest areas for the production of mutton are South Kazakhstan - 21%, Almaty region - 16%, East Kazakhstan - 16%, and Zhambyl region - 11% of the total lamb production in Kazakhstan. At the same time 76% of mutton produced in small private farms of the population, which to some extent is the reason for the low efficiency of the industry.

The largest areas for the production of horse meat are Almaty region - 15%, East Kazakhstan - 13%, -10% Karaganda and South Kazakhstan - 10%, of the total production of horse meat in Kazakhstan. At the same time 75% of horse meat is produced in small private farms of the population, which to some extent is the reason for the low efficiency of the industry.

The largest areas of pork production are North Kazakhstan - 18%, Kostanay - 18%, Almaty - 12% and Akmola - 11% of total pork production in Kazakhstan. At the same time 61% of the pork produced in small private farms of the population, which to some extent is the reason for the low efficiency of the industry.

Imports of meat (beef, lamb, horsemeat and pork) for the period from 2005 to 2014 increased by 4 times from 7.4 to 29.8 thous. of tons. Beef imports increased by 3 times, pork - by 4.9 times, mutton - by 1.7 times, horsemeat – by 31 times (Table 4).

Table 4

Imports of meat (beef, pork, mutton, horse meat) in the Republic

of Kazakhstan for the period from 2005 to 2014, tons

Product |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

Beef |

5485 |

13284 |

18843 |

11689 |

6032 |

10404 |

12703 |

22236 |

23904 |

16830 |

Pork |

1614 |

2907 |

4262 |

9074 |

8176 |

7466 |

8861 |

13739 |

11277 |

7928 |

Mutton |

171 |

112 |

35 |

277 |

131 |

63 |

71 |

634 |

757 |

287 |

Horsemeat |

154 |

274 |

0 |

2016 |

2755 |

2597 |

3680 |

5981 |

4758 |

4729 |

Total |

7425 |

16578 |

23 139 |

23056 |

17093 |

20530 |

25 316 |

42591 |

40697 |

29774 |

Source: State Revenue Committee MF RK

Exports of meat during the study period from 2005 to 2014 increased by 15.7 times from 224 tons to 3.5 tons, including beef by 2.4 times, pork - by 10 times. Export of lamb and horse meat was not implemented in 2015 (Table 5).

Table 5. Exports of meat (beef, pork, mutton, horse meat) of

the Republic of Kazakhstan for the period from 2005 to 2014, tons

Product |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

Beef |

115,8 |

21,0 |

- |

399,9 |

22,0 |

- |

18,9 |

- |

265,7 |

2383,4 |

Pork |

108,3 |

75,0 |

- |

- |

22,0 |

- |

260,8 |

144,2 |

59,8 |

1107,9 |

Mutton |

- |

- |

- |

- |

15,9 |

324,5 |

369,4 |

- |

15,5 |

24,8 |

Horsemeat |

- |

- |

- |

- |

- |

- |

- |

- |

0,9 |

0,5 |

Total |

224,1 |

96,0 |

- |

399,9 |

59,9 |

324,5 |

649,1 |

144,2 |

342,0 |

3516,6 |

Source: State Revenue Committee MF RK

In recent years, despite the significant increase in domestic production, the domestic poultry market also observed increase in imports.

According to the Customs Control Committee of the Ministry of Finance of the Republic of Kazakhstan for the past ten years the volume of imports of poultry meat in the Republic of Kazakhstan has grown more than twice, and in 2012 reached a record for 204 thousand. Of tonnes.

The main supplier of poultry meat in Kazakhstan is the US, which in 2013 was 70% of all imports. For the United States, follow Russia and Ukraine with a share of 15% and 11%, respectively.

In view of the high import dependence of Kazakhstan, exports of poultry meat remain small and in the past five years did not exceed 1.5 tons. The main export destinations are Russia and Kyrgyzstan.

In the livestock sector for the period 1991 - 2014's, with the exception of meat production, output of production has the most stable character and provide domestic needs.

Current meat production is far behind the performance of the Soviet period, it should be noted that in recent years we observe, the process of restoring industry. During the period 1991 - 2014 years, meat production decreased by 1.7 times.

First of all, the situation is unfavorable - and to resist their aggressive pricing in the light of the forthcoming accession to the WTO, where in policy can compete only large Kazakhstan companies with foreign suppliers. Private holdings and small farms for obtaining grants need to be grouped and develop special quantitative and qualitative development programs (Yeremeyeva and Kalachev 2006; Yespolov 2012). In order to transform meat livestock will be created farms with the total population of 224 thousand. of heads (Kazakhstan cattle meat export potential development program for 2011-2020).

Kazakhstan has a real opportunity to take a worthy place among the world exporters of meat and its products - a vast pasture, allowing to minimize production costs, the availability of the neighborhood capacious Russian market (which is in the common customs area) and, finally, the existing national tradition of doing beef cattle. Kazakhstan has third place in the production of meat after Russia and Ukraine.

AIC is one of the strategic sectors of the economy of states - members of the EAEC, which provides food security.

In the agricultural turnover of the Member States there are about 300 million hectares, and the total market of 182.1 million consumers.

The share of agriculture in gross domestic product on average over the last 5 years: in Armenia - 20%, Kyrgyzstan - 15%, Belarus - 8%, Kazakhstan - 4.5% and Russia - 3.5% (table 6).

Table 6. Production of agriculture in states - members of the CU and SES,

billion US dollars (Production of agriculture in states - members

of the CU and SES, billion dollars US)

Country |

2010 |

2011 |

2012 |

2013 |

2014 |

|||||

|

DP in AIC |

VI, % |

DP in AIC |

VI, % |

DP in AIC |

VI, % |

DP in AIC |

VI, % |

DP in AIC |

VI, % |

Republic of Armenia |

1,7

|

86,4 |

2,1 |

113,9 |

2,1 |

109,5 |

2,2 |

107,1 |

2,4 |

107,2 |

Republic of Kyrgyzstan |

2,5 |

97,4 |

3,2

|

102,0 |

3,6 |

101,2 |

3,5 |

102,7 |

3,6 |

99,4 |

Republic of Belarus |

12,1 |

102,5 |

9,9 |

106,6 |

11,6

|

106,6 |

11,8 |

95,8 |

12,8 |

103,1 |

The Republic of Kazakhstan |

9,8

|

88,3 |

15,6 |

126,8 |

13,4 |

82,2 |

15,7 |

111,7 |

14,0 |

100,8 |

Russian Federation |

85,2

|

88,7 |

111,1 |

123,0 |

107,5 |

95,2 |

119,1 |

105,8 |

109,8 |

103,7 |

IV – the index of agricultural output volume (in% to the previous year, at constant prices).

Agricultural production is steadily increasing.

Over the past 5 years carcass weight of cattle and poultry, transferred for processing increased by 22%.

The growth achieved by positive trends in the industries with high turnover of resources - indicators in the poultry and pig production increased respectively by 45.7 and 21.3% (Table 7).

Table 7. Production of meat in the states - members of the Customs

Union and Common Economic Space in slaughter weight, tons

(Belarus: Economy of AIC in very poor condition; Production of

agriculture in states - members of the CU and SES, billion dollars US)

Country |

2010 |

2011 |

2012 |

2013 |

2014 |

Republic of Armenia |

70

|

72 |

74 |

83 |

163 |

Republic of Kyrgyzstan |

196

|

199 |

202 |

194 |

201 |

Republic of Belarus |

971 |

1 020 |

1 092 |

1 172 |

1 073 |

The Republic of Kazakhstan |

834 |

838 |

845 |

871 |

899 |

Russian Federation |

7 167 |

7 520 |

8 090 |

8 544 |

8 925 |

CU and CES |

9 238 |

9 649 |

10 303 |

10 864 |

11 261 |

At present, domestic agricultural producers are not competitive on the world market, and the amount of state support remains low, even in comparison with countries of the Customs Union. For example, in Russia the level of state rendering distorting mutual trade of agricultural products of the Parties (yellow basket) to the gross value of produced agricultural commodities was 4%, in Belarus - 11.8%, in Kazakhstan - 3.1%. On 1 hectare of arable land is allocated on average in Kazakhstan - 19 dollars, in Russia – 60 dollars, in Belarus - 502 dollars. At the same time, according to World Bank estimations, the volume of subsidies in Belarus is up to 30%, which are veiled under other forms.

Economic plans of EAEC countries in the last 2015 were largely frustrated and lubricated by unfavorable external conditions, not only the objective of economic, but also man-made nature. At the center of this fact are sanctions against Russia, a deliberate policy of the Western countries to hold it within the constraints of the regional markets, detach from the world, first of all financial resources. And since Russia is the centerpiece of the EAEC for economic, demographic, geographic and other factors, all of the negatives that occur now, either directly or indirectly affects all participants in the Eurasian Union.

The main negative factor was the fall of GDP in all the countries, inflation and a serious decline in the purchasing power of the total population of the EAEC, which basic reason was caused by the depreciation of the national currency to the currencies of the world. In this case, the central link of exchange failure was Russian, as the central and most receptive market for all other countries

But the agricultural sector of EAEC was lucky. Due to retaliatory sanctions of product imports into Russia, the agrarian market of the country continued to be an attractive destination for exports from the Union neighbors - Belarus, Kazakhstan, Armenia and Kyrgyzstan. And the whole agribusiness sector of the Eurasian Union was in growth. Especially Belarus has won in this situation. Results of the year for Belarusian agrarians can be called as quite successful. The total export of Belarusian agricultural products on the main agricultural sector is expected to reach 2.3 billion dollars, of which about 80% comes from Russia. Belarusian potatoes delivered for more than 250 thousand tons. (Temirbekova and Aldazharov, n. d.; V International Food Industry Forum EQUIPMENT; Regions of Russia. Socio-economic indicators. 2015).

In 2014 the foreign trade turnover of Kazakhstan amounted to 119,450,600,000 dollars and decreased by 10.5% compared to 2013, including export - 78.2378 billion US dollars (7.6% less), imports - 41.2128 billion US dollars (15.6% less).

Exports to Russia in 2014 amounted in 5.1781 billion US dollars (compared to 2013 decreased by 11.9%), imports -13.7303 billion US $ (23.6% less). Agricultural and food products were imported for 1.612 billion US dollars. It was mostly dairy products, bread, confectionery, tobacco, and so on.

Export of the Republic of Belarus in 2014 amounted to 29.2 million US $ (in 2013 decreased by 49.9%), imports - 727.6 million US $ (4.2%). The share of agricultural products and foodstuffs was 18.3% (more than 40% of this amount accounted for dairy products).

Exports to China in 2014 amounted to 9.815 billion US dollars, imports -7.367 billion US dollars.

Export to Kyrgyzstan in 2014 amounted to 705 million USD, import - 351 million US dollars. The bulk of exports were agri-food products and their share - 39% (corn, tobacco and tobacco products). Imports were mainly textiles (clothes) - 27%, agri-food products (dairy products, vegetables and fruits).

Exports to Uzbekistan in 2014 amounted to 1.083 billion US dollars, imports - 1.018 billion US dollars. The bulk of exports were agri-food products with their share 45.8% (flour, cereals). Imports were mainly agro-food (vegetables and fruits) - 42%.

Meat processors of meat industry use for the production of sausages, canned meat, etc. imported raw materials - cheaper frozen block meat due to the high cost of domestic meat. Thus, the volume of imports increased from 12,7 thous. of tons in 2011 to 23.9 thousand. of tons in 2013, the growth was 88.2%.

However, in 2015the import decreased to 15.4 thousand. tenge or 35.6%.

With the growth of cattle is observed beef exports growth. During the study period, exports increased 100 times from 18.9 tonnes in 2011 to 1899.3 tonnes in 2015.

Problems and prospects of development animal husbandry industry in the Republic of Kazakhstan are presented in SWOT-analysis (Table 8)

Table 8. SWOT-analysis of the livestock industry

Strong points |

Week points |

· The extensive grazing land and land resources for the development of beef cattle industry. • The cattle for expanded reproduction and increasing beef production. • The breeding core for improving breed characteristics, animal productivity and improving product quality. • Low cost of land • Low labor costs • High domestic demand for beef • A capacious beef market in the neighboring countries. • The presence of significant government support to the sector of beef cattle |

· Underdeveloped transport and logistics infrastructure, irrigation of pastures. • Low livestock productivity • Lack of qualified personnel in the industry • Lack of development of the social infrastructure of the village • Lack of forage equipment • The remoteness of markets for farmers • Long-term payback projects |

Possibilities |

Hazards |

· High demand for beef in the Russian Federation and China opens up significant opportunities for the export of beef in those countries. • development distance pasture livestock due to using unused pasture by creation irrigation pasture infrastructure • increasing the productivity of animals by conducting selecting and breeding

|

· High competition from major meat exporting countries: Argentina, Brazil, Australia, New Zealand offering frozen meat at lower prices. • unfavorable epizootic situation, disease outbreaks • The outflow of labor from rural to urban areas • Land degradation and shortage of fodder, especially succulent fodder • Reduction of livestock imported from abroad of breeding stock due to improper care |

Source: Centre for Economic Policy Research in Agricultural Sector

Based on the above conducted SWOT - analysis we can offer the following matrix barriers in animal husbandry and food industry (Table 9), which will determine the list of products of animal industry for its further development.

Table 9. Matrix of barriers and restrictions on livestock farming and the food industry

Nomination |

|

|||||

Milk and dairy products |

Meat and meat products |

Leather |

Wool |

|||

lack of competitiveness and costs |

lack of raw materials |

v |

v |

v |

v |

|

high tariffs for services |

v |

v |

v |

v |

||

expensive imported packaging |

v |

|||||

poor access to financial resources |

refinancing |

v |

v |

v |

v |

|

high rate% |

v |

v |

v |

v |

||

the absence of long-term loans |

v |

v |

v |

v |

||

taxation imperfection |

"1" - VAT |

v |

v |

v |

v |

|

PPI |

v |

v |

v |

v |

||

VAT exemption for all |

v |

v |

||||

CIT exemption when updating of fixed assets |

v |

v |

v |

v |

||

VAT refund for export |

v |

v |

v |

|||

marketing limitations |

in the domestic market |

adulteration |

v |

v |

||

dumping |

v |

v |

||||

levies in trade |

v |

v |

||||

lack of logistics infrastructure |

v |

v |

||||

duration of action procedures of customs and tariff regulation |

v |

v |

v |

v |

||

lack of food culture |

v |

v |

v |

v |

||

in the external market |

trade barriers |

|||||

absence of logistic infrastructure |

v |

|||||

problems of institutional development |

the absence of reliable statistical accounting PEI |

v |

v |

v |

v |

|

the deficit in the production of industry experts |

v |

v |

v |

v |

||

the absence of a single authorized agency for processing all agricultural raw materials and production of food products |

v |

v |

v |

v |

||

Source: Centre for Economic Policy Research in Agricultural Sector

In the animal husbandry industry were considered the availability of pasture and roughage rich mineralization of groundwater, etc. Based on this number of areas of Kazakhstan due to adverse agro-climatic conditions were removed from the recommended schemes of specialization. So despite the presence of dairy farms has been proved unreasonableness of milk production in the Kyzylorda region where the cost of 1 liter of milk is higher than average one in Kazakhstan twice due to lack of rain-fed crop area required to produce succulent fodder.

Most small-scale private farms are unable to equip their farmstead with appropriate technical equipment, which negatively affects the quality of products. The state is not able to fully monitor all households at once. This leads to a small-scale marketability, with particularly affected tribal trend in livestock. Along with this, there is a problem with the reproduction of animals. Thus, the prevailing level of mongrel cattle does not allow to rely on high-quality products and to maintain a competitive position in the market.

The development program of agricultural production of the Republic of Kazakhstan for 2000 - 2002. Date View June 12, 2017 https://tengrinews.kz/zakon/pravitelstvo_respubliki_kazahstan_premer_ministr_rk/selskoe_hozyaystvo/id-P000000175_/

State agro-food program of the Republic of Kazakhstan for 2003 – 2005. Date View June 12, 2017 http://kazakhstan.news-city.info/docs/sistemsc/dok_oegrni/page19.htm

The State Programme for Rural Development of the Republic of Kazakhstan for 2004-2010. Date View June 12, 2017 http://www.carecprogram.org/uploads/docs/KAZ-Rural-Territories-Development-ru.pdf

The program for the development of agro-industrial complex in the Republic of Kazakhstan for 2010 – 2014. Date View June 12, 2017 http://adilet.zan.kz/rus/docs/P100001052_

Kazakhstan cattle meat export potential development program for 2011-2020. Date View June 12, 2017 http://kgd.gov.kz/ru/section/vto

NEM RK Statistics Committee. Date View June 12, 2017 https://primeminister.kz/en/news/sotsialnaya_sfera/glava-mne-rk-i-akim-astani-proinspektirovali-stolichnie-rinki-12547

The State Revenue Committee MF RK. Date View June 12, 2017 http://kgd.gov.kz/ru/section/vto

Yeremeyeva N.V. and Kalachev S.L. (2006). The competitiveness of goods and services. Moscow: KolosS, pp. 192.

Yespolov T.I. (2012). AIC of Kazakhstan: globalization and innovation. Almaty KazNAU, pp. 436

Production of agriculture in states - members of the CU and SES, billion dollars US, Date View June 12, 2017 http: //www.eurasiancommission.org/

Belarus: Economy of AIC in very poor condition. Newsland. Date View June 12, 2017 http://www.newsland.ru/news/detail/id/635423/cat/86/

Temirbekova, A. and Aldazharov K. (n. d.). Innovative Development of the Agro-industrial Complex in Kazakhstan Economy, pp. 215

V International Food Industry Forum EQUIPMENT. TECHNOLOGIES. INNOVATIONS. Organized by: Cultural-Exhibition Complex “IMPERIA“

Regions of Russia. Socio-economic indicators. 2015: Stat. Sat. (2015). Moscow: Rosstat.

Centre for Economic Policy Research in Agricultural Sector. https://books.google.ru/books?id=XsPB7YetUVoC&pg=PA3&lpg=PA3&dq#v=onepage&q&f=false

1. JSC “Narxoz University”, Zhandosov Street, 55, 050035 Almaty, Republic of Kazakhstan

2. JSC “Narxoz University”, Zhandosov Street, 55, 050035 Almaty, Republic of Kazakhstan

3. JSC “Narxoz University”, Zhandosov Street, 55, 050035 Almaty, Republic of Kazakhstan, E-mail: kst_kmedet@mail.ru