Vol. 38 (Nº 43) Año 2017. Pág. 32

Roza VOSKANYAN 1; Veronica NIKERYASOVA 2

Recibido: 05/07/2017 • Aprobado: 28/06/2017

3. Data, Analysis, and Results

ABSTRACT: The article is devoted to innovative economy’s role in the world economy development. In the world market, investment sector is one of the most profitable, but there are some risks. In this regard, we made a deep analysis of factors negatively influencing Russian innovative companies’ development. We studied investment attractiveness features of innovative companies and provided proposals to improve this criterion. The authors considered such innovative company management instrument as a real option, developed a basic algorithm for its use in order to reduce the uncertainties’ impact on innovative company’s efficiency and its investment attractiveness. This goal achievement required a range of methods, in particular analytic and economic-statistic, generalized domestic and foreign experience on the subject. Thus, the real option is an effective instrument in forming innovative economy. Real option allows taking into account economic risks, thereby significantly reducing financial losses. It also forms the most productive management of financial, labor and innovation capital. |

RESUMEN: El artículo está dedicado al papel de la economía innovadora en el desarrollo de la economía mundial. En el mercado mundial, el sector de inversión es uno de los más rentables, pero hay algunos riesgos. En este sentido, hicimos un análisis profundo de los factores que influyen negativamente en el desarrollo de las empresas innovadoras rusas. Se estudiaron las características de atracción de inversión de las empresas innovadoras y se presentaron propuestas para mejorar este criterio. Los autores consideraron este innovador instrumento de gestión de la empresa como una opción real, desarrollaron un algoritmo básico para su uso con el fin de reducir el impacto de las incertidumbres sobre la eficiencia de la empresa innovadora y su atractivo de inversión. Este logro de objetivos requirió una serie de métodos, en particular analíticos y económicos estadísticos, experiencia generalizada nacional y extranjera sobre el tema. Así, la opción real es un instrumento eficaz en la formación de la economía innovadora. La opción real permite tomar en cuenta los riesgos económicos, reduciendo significativamente las pérdidas financieras. También forma la gestión más productiva del capital financiero, laboral e innovador. |

In developed countries, modern economy is directed at modernized production. In this regard, innovative component is of great importance increasing companies’ competition on world markets (Di Marco, 2014; Kusumaningrum, et al., 2016, pp. 11917-11930; Firsova, & Azarova, 2016, pp. 2492-2502).

In order to develop innovative economy and motivate innovation activities of companies, the Government in various countries develops legal framework to interact with private sector in public-private partnerships and provides a variety of state programs for innovative economy development. For example, in 2014, the Innovation Union adopted the EU Framework Programme for Research and Innovation called Horizon 2020. In 2011, the Russia Federation Government adopted an innovative development strategy of the Russian Federation for the period up to 2020 (Pacheco-Torgal, 2014, pp. 151-162; Brunner, 2015, pp. 1-10; Walshe, 2013, pp. 668-669).

The economy of countries motivating the work on innovative developments, encouraging companies implementing innovative projects, develops more rapidly. Long-term economic growth depends on motivating domestic economic environment creation and strengthening for innovative business.

The share of Russian innovative businesses of products and services in GDP verifies from 11 to 15%. For comparison, in developed countries abroad, this index is about 30%. The percentage of Russian innovative products, projects and services in total volume of shipped goods is about 6-7% in Russian innovative companies. According to innovative development strategy of the country, this index should reach 25-30% by 2020.

In Russia, the introduction of innovations in various companies traditionally is carried out in functional control of separate departments (Trifonov, Koshelev, & Kouptsov, 2012; Williams, & Tsiteladze, 2016, pp. 151-178). Only a small number of companies can finance innovation of entire company, not just one high-risk department. The latter can perform high growth in terms of both production and finance (Figure 1).

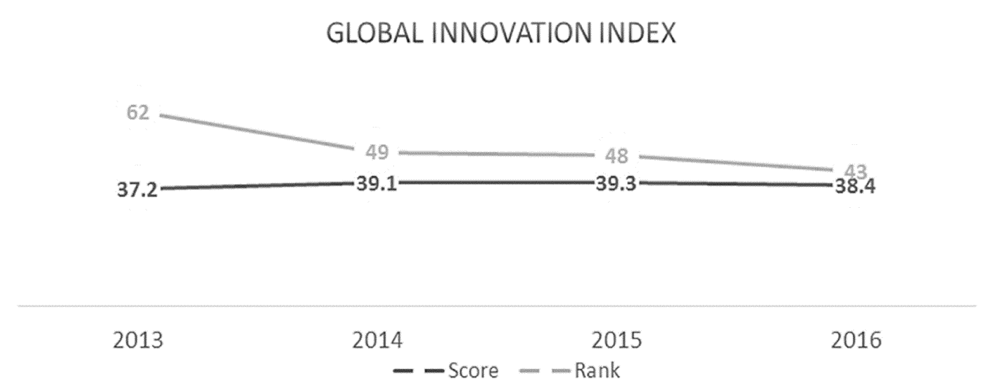

Figure 1. Russia in global innovation index, 2013-2016

According to this chart, Russia is rising in this index in recent years. The country demonstrated a rapid change in 2014 rising up to 49th place in the rank. However, the crisis in the Russian economy slowed the innovation growth. This is reflected in slower growth in global innovation index. However, in 2016, Russia has raised up to 43 in the rank, despite the fact that innovative development index of the country fell by 0.9 because of unstable market conditions environment (Williams, & Tsiteladze, 2016, pp. 151-178).

However, it is necessary to focus on those factors that have a negative impact on Russian innovative companies’ development:

3. Low growth rates (Di Marco, 2014; Brunner, 2015, pp. 1-10). Innovative companies’ poor support from private investors does not allow them to grow at a rate corresponding to the world. Since the Russian economy is associated with high financial risk and is not stable enough for long-term investments, innovative companies with long payback period from the date of initial investment are not promising for funding. State-owned companies and companies engaged in resource production still remain most preferred for investments. Innovative companies find it difficult to compete with them on a number of important for any investor criteria, such as payback period, NPV, low risks, high cost-effectiveness and rich retrospective information that allows assessing not only the company’s past, but also to give the most accurate scenario of future development.

Complex business exit is also a problem for venture financing development of innovative Russian companies. In exiting a business, venture investor has to not only successfully exit the project with profit, but also to choose a way to exit the business according to sponsored innovative companies’ goals and development. In this context, examples of successful exits from venture projects of innovative business can also contribute to this segment development in Russian financial market, attracting more and more venture investors.

In Russia, innovative business development depends on attracting foreign venture capitalists, who will only financially support new companies, but also will in company management, sharing their experience in financial management.

There must be legislative changes protecting rights of minority shareholders. At the same time, there must be professional events for stakeholders and investors to meet. Finally, it is necessary to motivate financing of innovative companies at the state level – for example, tax incentives that were successful in Europe.

Thus, the purpose of this study is to examine the real option functions in companies’ innovative activities.

Theoretical and methodological basis of the research is the theory of economic processes’ sustainable development in a variety of business patterns and integration trends of economic development. There are used scientific methods of analysis. The conclusions were made under generalization of domestic and foreign experience, abstract and logical, analytical, historical, economic and statistical methods, in particular methods of economic groupings.

Investment attractiveness features of innovative companies. Investment attractiveness of innovative companies depends on many factors and is resulted from specificity of its activities.

Already proven innovations can insure an innovative company from the high risk of uncertainty, to save time on research and to forecast future profits. At the same time, there is a risk of new innovative products in the market by the time of presenting company’s innovations borrowed from other companies. Therefore, innovative processes introduced in the company would be irrelevant. In addition, in borrowing innovations from foreign partners, the companies should be aware that any company should carry out their activities in accordance with the medium-term program of socio-economic development of the country. Because if the company's innovative activity is supported by the state, there is a significantly lower financial risk for the owners and investors of the company. Therefore, its market value rises.

Unstable financial situation of innovative companies is often due to changing business plans, depending on production and innovations’ introduction. Such actions negatively affect market value and investment attractiveness of the company.

The introduction of innovations in any company is due to expenses on personnel retraining. Depending on innovative activity, these expenses can significantly reduce the cost of the company, as a strong financial burden. At the same time, the qualification growth of employees positively affect its cost and potential for future development. In assessing the cost of the company, many investors are primarily looking for its growth potential, measuring investments and their possible return in business development in the medium term. For example, possibilities of a competent use of intangibles, intellectual property rights, established in the innovation process by the transfer of rights of their use to other companies. This entails additional revenue. The study shows that statistics confirm the strengthening role of intangibles in company's activities: in 1978, the average amount of intangible assets was 4% of all assets of the company, by 1998 the number had risen to 72%, and now it is about 75-85% (Ciprian, et al., 2012, pp. 682-688).

Traditionally, the companies are engaged in innovations’ development and presentation. The main purpose of innovation is to lower production costs. Thus, they are able to reduce production costs, thereby presenting the market a product at a lower cost, increasing performance, wages and competitiveness.

Defining and meeting customer demands, innovative companies are increasing their market share, become leaders on it, thus attracting qualified employees and improve its investment attractiveness and market value.

By investing in any company, the investor wants to have true information not only about future income in terms of profits, but also about the way this profit is made and what risks he or she may face due to company’s activity.

There are three main risks in innovative projects: financial – failure to provide an innovative project; legal – possible changes in revenue code, export and import restrictions and non-execution of a contract; marketing and sales risks – incorrect choice of the market segment, sales strategy of new products, etc. (Abdikeyev, Grineva, & Kuznetsov, 2013, pp. 8-17).

Innovative companies are the most risky for investors, because there are factors that directly affect their activity and, accordingly, the company's profitability.

The external factors are relevant information on inflation, GDP, political stability in the country, the Government's strategic programs and support in innovative companies’ development in various sectors of economy. These and many other factors must be considered not only with respect to the State, but also to the regions, where the company will develop. The internal factors are often considered in terms of finance and economy: licensing and patent registrations, as well as other intangibles increase the overall cost of the innovative company.

We should also highlight the uncertainty affecting the cost of innovative companies and their production and particular innovation process. It simultaneously attracts and looks unfavorable to different investors. At the same time, this risk can be managed to receive benefit. Innovative activity of any company should be focused on the current market. If it is ahead of it, it is possible to postpone the presentation or to carry out it gradually.

Real option is one of the innovative company management instruments, as an opportunity or the right to make management decisions in the future. The purpose of this instrument is to make company's management capable of implement pre-formed plans for innovative projects’ development to reduce the impact of undesirable risk factors, or of using their beneficial effects, if there are any adverse effects of decisions made or favorable market environment. In terms of innovation companies, real options can be interpreted as a decision-making postponement: to wait for more favorable market environment, when innovative project presentation will be more profitable – it is only one type of real options. We present another example – company development is a base for real options, as the option to expand the project allows expanding company production and to make more profit (Guo, & Zmeskal, 2016, pp. 65-73). Such an instrument of innovative company management improves the efficiency of risk management and allows the participants of economic relations to develop more effective investment strategy.

Real option has an advantage over the financial option – ability to influence the innovative company management on the price of underlying asset. By controlling the factors affecting the revenues from innovative project sales, the company's management can increase the price of underlying asset. For example, in attracting more investment by attracting higher-quality financial and human resources, the risk among the owners and investors diversities and decreases in case of unfavorable event.

Successful real option exercise in innovative company requires a number of conditions, such as the availability of innovative project’s financial model, uncertainties’ impact on the results, the ability to make changes at any stage of the project. There is also a problem of identifying the strategically important sources of uncertainty. This determines the choice of appropriate real option and its parameters (Rózsa, 2015, pp. 316-323). The option is pointless if there is no uncertainty in the investment project, or this uncertainty does not result in a significant change of project's efficiency. Therefore, the instrument is preferred for economic agents with a large investment capital.

Option cost assessment is carried out mainly by the means of Black-Scholes model. Braley R. and Myers S. considering this model noted that the Black-Scholes formula was derived based on the premise that underlying asset price has a continuous range of values. Thus, option duplication requires investors to check their investments (Brealey, & Myers, 2010, p. 562). At the same time, real options are a financial function and depend on six factors: underlying asset price, striking price, option period, risk-free rate, as well as standard deviation and expenses under option period (Čirjevskis, & Tatevosjans, 2015, pp. 50-59). The basic value growth of real option enhances its total cost, as well as the option period, because it increases financial management flexibility (Weskamp, Braun, & Bauernhansl, 2015, pp. 151-156).

The innovation introduction is expensive for current enterprises. Therefore, they tend to attract different investors. That is why real option development for risk hedging in innovative companies requires parity of interests of both investors and owners.

In this regard, before developing new innovative activity, the company has to conduct SWOT-analysis for each specific case and to study in detail the factors influencing it at this point in the medium term. These factors include the lack of own funds, low demand for innovative products of the company, long payback period, weak intellectual property rights protection, lack of market innovative infrastructure development, complex commercialization of innovative ideas.

The factors considered in the article underscore the viability of financial company management to be able to make flexible management decisions. This is possible through real options. They allow reducing risks of the company and keeping, if not increasing, its investment attractiveness in changing market environment. They also allow making changes to the plans for innovative project development, modifying made decisions in accordance with changing market environment, increasing the number of opportunities for their innovative projects and the percentage of successful presentation, providing a positive impact on the investment environment in the industry.

Real option as an instrument for achieving long-term strategic objectives of the company is related to high financial costs on their performance. It should be noted that in addition to the costs for successful business plan creation of an innovative company, there are costs of creating business models for unsuccessful innovative activity and methods of their correction. There will also be transaction costs – in this case, commission charges and the costs for incomplete information that can later be a risk.

Despite the real option advantages, it has a number of financial problems. The main problem is that some companies have real options, but do not use them. Such a situation may result in an excessive increase in innovative project’s value, which could actually be unprofitable.

In using real option, it is necessary to focus on setting a financial target, since incorrect setting can result in wrong and ineffective management decision (Trifonov, Koshelev, & Kouptsov, 2012).

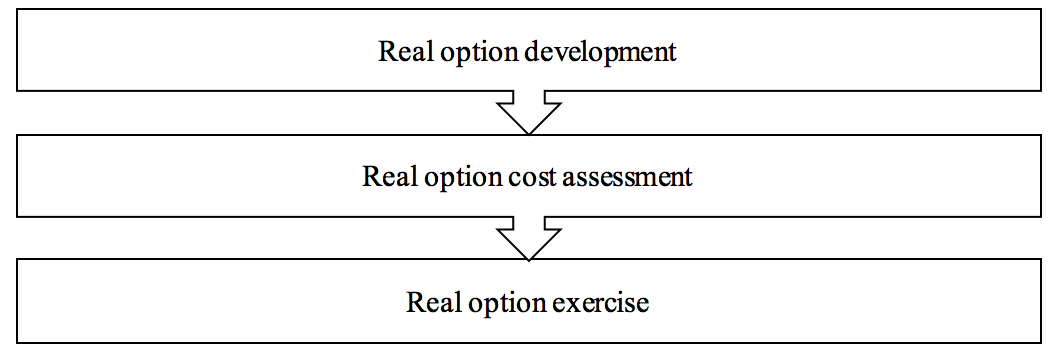

The companies attempting to use this instrument of financial management shall develop a basic model for using a real option in each case (Figure 2).

Figure 2. Real option exercise algorithm to correct management decisions in the company

The authors propose an algorithm for real option exercise to correct management decisions in the company. The algorithm consists of three stages:

Thus, the real option is an innovative management instrument that allows using such features of innovative companies as high risk and uncertainty effectively. In proper strategic management by real option, financial management of the company may increase its performance and investment attractiveness, as one of the main criteria of advantages and disadvantages of a particular asset.

In developing real option, ultimate goal must be taken into account to make effective management decisions. Increasing the scope of real options for innovative projects will make it possible to generate a number of advantages in designing innovative economy.

This article may serve as a theoretical source of information in forming an innovative economy of enterprises.

Abdikeyev, N. M., Grineva, N. V., & Kuznetsov, N. V. (2013). Methods and models for financial support of innovative enterprises considering investment risks. Journal of Financial analytics: science and experience, 23 (161), 8-17.

Brealey, R., & Myers, S. (2010). Principles of corporate finance. Moscow: ZAO «Olymp Business», 562.

Ciprian, G. G., Valentin, R., Madalina, G. A., & Lucia, V. M. (2012). From Visible to Hidden Intangible Assets. World Conference on Business, Economics and Management, 62, 682-688.

Čirjevskis, A., & Tatevosjans, E. (2015). Empirical Testing of Real Option in the Real Estate Market. Procedia Economics and Finance, 24, 50 – 59.

Guo, J., Zmeskal, Z. (2016). Valuation of the China internet company under a real option approach. Perspectives in Science, 7, 65 – 73.

Rózsa, A. (2015). Real option as a potential link between financial and strategic decision-making. Procedia Economics and Finance, 32, 316 – 323.

Weskamp, M., Braun, A. - T., & Bauernhansl, T. (2015). Real Option-Based Evaluation of Eco-Oriented Investment Using the Example of Closed-Loop Supply Chains. Procedia CIRP, 33, 151 – 156.

Trifonov, Yu. V., Koshelev, E. V., & Kouptsov, A. B. (2012). Russian model of real options. Reporter of the N. I. Lobachevsky Nizhny Novgorod State University, 2-1.

Di Marco, L. E. (2014). International economics and development: Essays in honor of Raul Prebisch. Academic Press.

Pacheco-Torgal, F. (2014). Eco-efficient construction and building materials research under the EU Framework Programme Horizon 2020. Construction and Building Materials, 51, 151-162.

Brunner, C. (2015). BNCI Horizon 2020: towards a roadmap for the BCI community. Brain-computer interfaces, 2(1), 1-10.

Walshe, K. (2013). Health systems and policy research in Europe: Horizon 2020. Lancet, 382(9893), 668-669.

Williams, D., & Tsiteladze, D. (2016). Assessing the Value Added by Incubators for Innovative Small and Medium Enterprises in Russia. Technology Entrepreneurship and Business Incubation: Theory Practice Lessons Learned, 151-178.

Adachi, Y. (2013). Building big business in Russia: The impact of informal corporate governance practices. Routledge.

Ardichvili, A., Jondle D., Kowske, B., Cornachione, E., Li, J., & Thakadipuram, Th. (2012). Ethical cultures in large business organizations in Brazil, Russia, India, and China. Journal of Business Ethics, 105(4), 415-428.

Dufy, C. (2015). Redefining Business Values in Russia: The Boundaries of Globalisation and Patriotism in Contemporary Russian Industry. Europe-Asia Studies, 67(1), 84-101.

Williamson, J. (2013). Guide to Business Information on Russia, the NIS and the Baltic States. Reference Reviews.

Kusumaningrum, I., Hidayat, H., Ganefri, A. S, & Dewy, M. S. (2016). Learning Outcomes in Vocational Education: a Business Plan Development by Production-Based Learning Model Approach. International Journal of Environmental and Science Education, 11(18), 11917-11930.

Firsova, I. A., Azarova, S. P. (2016). Market of business education services in development of entrepreneurship. IEJME-Mathematics Education, 11(7), 2492-2502.

1. Department of Financial Management, Plekhanov Russian University of Economics, Moscow, Russia

2. Department of Financial Management, Plekhanov Russian University of Economics, Moscow, Russia; E-mail: veronika799@mail.ru