Vol. 38 (Nº 31) Año 2017. Pág. 34

TORRES-BARRETO, Martha L. 1; ANTOLINEZ REYES, Diego F. 2

Recibido: 01/02/2017 • Aprobado: 15/03/2017

ABSTRACT: This paper presents a theoretical model in which intellectual capital and entrepreneurial orientation interact and may have an effect on firm´s competitiveness. A six equations model is presented and we propose their empirical contrast by using a six years robust panel data from Colombian industrial companies. The data comes from a census of 10 300 firms per year. A set of instrumental variables to be used during the empirical phase, is proposed at the end of the paper. |

RESUMEN: Este artículo presenta un modelo teórico en el que el capital intelectual y la orientación empresarial interactúan y pueden tener un efecto en la competitividad de la empresa. Se presenta un modelo de seis ecuaciones y se propone su contraste empírico utilizando un panel robusto de seis años de empresas industriales colombianas. Los datos provienen de un censo de 10 300 empresas por año. Un conjunto de variables instrumentales que se utilizarán durante la fase empírica, se propone al final del documento. |

The intellectual capital of a company is regarded as one of the key resources in generating competitive advantages, which are precisely those that enable organizations to position themselves in a demanding and highly dynamic environment, ultimately differentiating them from their competitors (Ambastha & Momaya, 2004; Barney, 1991; Oral & Kettani, 2009). As long as companies operate in regard of these key resources and factors, it would be possible to raise the country's competitiveness, and if this happens, the economy could be bound to prosperously grow and the rates of return obtained from investments would be bound to increase as well, which may turn out into tangible growth. Given the implications of the changes within the business environment, an in-depth analysis about the determinants of competitive advantages continues to be the central topic in both: the economic and business policies of a considerable number of nations around the world.

Taking into account these premises, this paper examines the determinant aspects that define business competitiveness, in particular, the effect of an intangible resource: the relational intellectual capital. In order to assess this subject, and given that these interactions have been previously explored from different perspectives (Bontis, 1998; I.M. Cockburn, Henderson, & Stern, 2000; Curado & Bontis, 2007; Sharabati, Jawad, Bontis, NajiJawad, & Bontis, 2010; Torres-Barreto, M., Martínez, Meza-Ariza, Muñoz 2015), the research at hand aims to evaluate the effect of intellectual capital upon the competitive advantages, including in the model a third dimension: The entrepreneurial orientation.

According to its entrepreneurial orientation, companies can act alongside according to an innovative approach, a more proactive one, or even towards behaving like risk prone-oriented, compared to similar firms of the same environment. In a first instance this research intend to evaluate the impact of entrepreneurial orientation on firm´s competitiveness, and the moderating role of intellectual capital on this relationship. The ultimate purpose is to evaluate the existence of joint effects of entrepreneurial orientation and intellectual capital that could lead companies to a higher competitive position.

The concept has its origins in the nineties, with authors from mainly two countries: the United States and Sweden (Bontis, 1998; Bradley, 1997; Brooking, 1997; Edvinsson & Malone, 1997; T. Stewart, 1997; Sveiby, 1997). However, nowadays, the term is continually used and studied by a variety of scholars worldwide (Petty & Guthrie, 2000).

The origins of the term are linked to the analysis of the value of the company itself. It was proposed that the IC is constituted by the value of intangible assets and the knowledge the organization, and, at the same time, these two could make a difference between the value of the company on the accounting records, and its real market value (Brooking, 1997; Edvinsson & Malone, 1997; Sveiby, 1997). Other approaches indicate that the IC of a company constitutes all those resources that are neither physical nor monetary.

From another perspective, the IC is analyzed as the intellectual material of knowledge, the information, the intellectual property and every experience that can be used by the company to create benefits (T. Stewart, 1991).

As for the analysis of its components, the IC has been broken down into: human capital, structural capital and relational capital (Bontis, 1998; Curado & Bontis, 2007; Farhadi & Tovstiga, 2010); on a more simplified definition, other authors have reduced this classification to only two components: human and structural capital (Edvinsson & Malone, 1997). The latter is further divided into organizational and customer capital. Finally, it should be noted that Sveiby (1997) proposed a model for monitoring intangible assets, consisting of an internal structure, an external structure and some key attributes linked to a company.

Although the number of authors who have dedicated themselves to the study of IC is high, there is a common denominator in the assumptions made by them: IC represents the aspects of value that are not precisely visible and that are associated with the intangible assets of a company.

In this manuscript, the classification of Petty and Guthrie was chosen as a basis for the research in regards to their vision of the IC being divided into three categories: human, structural and relational capital (Petty & Guthrie, 2000). Nevertheless, the attention will be focused on the relational capital, considering that the diverse management practices applied by numerous countries around the world are derived from it.

This type of IC is likely to be explored from the academia in order to provide the business environment with empirical evidence about the importance of managing intangible assets as the intellectual capital of firms.

The RC refers to the implicit knowledge within the relationships with customers, suppliers and other partners, including technological ones (Yitmen, 2011). It has to do directly with the flow of knowledge and resources derived from the relationships between different participants and the company itself, through a complex social structure (Hsu & Wang, 2012). In the literature, the RC is analyzed from a systemic perspective as an important element that is embedded in every system used to develop the relationships between the company and its stakeholders (Hsu & Wang, 2012; Saxena, 2015). Thus, this particular type of IC can be considered an intangible resource based on the continuous development of a network of relationships with employees, customers, partners, suppliers, competitors and other stakeholders that could directly influence the companies' competiveness strategies. It is indeed for this reason that relational intellectual capital is taken as the core subject of study within this research, given its position as moderator of the relationship between the entrepreneurial orientation of companies and certain aspects associated with their competitiveness.

Certain research areas continue attracting a simultaneous interest of scholars and businesses alike. Among them we can find the entrepreneurial orientation and the companies' competitive strategies (Hernandez-Perlin, Moreno-Garcia, & Yañez-Araque, 2016). This is because businesses require faster and more flexible structures that facilitate the processes needed to effectively meet the needs of its customers that, on the other hand, are in increasingly more dynamic markets than those experienced few decades ago (Mathews & Zanders 2007; TamerCavusgil & Knight, 2003). Within the strategies companies are implementing, there are those related to their orientation when facing the environment and its challenges; this area of study has to do with the entrepreneurial orientation, and was first studied in the eighties (Miller, 1983). The concept of EO is based on the processes that companies undertake to renew themselves in order to face their markets. It is determined by: The innovative character of firms, its risk acceptance profile and its proactive nature (Miller, 2011). From Miller's research, many authors have continued the study of EO, arguing that what really determines it is the personality of their leaders and CEOs, others have argued in favor of the structure of the organizations as a whole, and a third group turns its attention to the strategy of the company itself. Miller proposed a typology of organizations, which are: a) Simple. Of a small size, their power is centralized in a single visible head (leader). b) Planners. Slightly larger, their processes are carried out through the implementation of plans and formal controls. c) Organic. They adapt very well to their environment, based on their empowering experience and an open communication strategy. In the case of "simple" companies, says Miller, the EO is determined by the characteristics of the leader. "Planner" companies have their EO determined by market-integrated product strategies, and as far as "organic" companies go, their internal structure and surrounding environment are the foundations of their corresponding EO.

Within this research, we are going to use the classification of Entrepreneurial Orientation proposed by Miller (Miller, 1983), taking into account subsequent contributions (Covin & Miller, 2014; Covin & Slevin, 1989). From the perspective of these authors, the measurement for the EO involves three dimensions: innovation, pro-activeness and liability acceptance.

The academic and entrepreneurial interest on strategic management processes and specifically on the improvement of competitiveness and sustainability of firms has been growing over time. The relevance of this research area is considerably high due to its link to the sources of the competitive advantage that may differentiate one firm from another. This has been a central point of questioning regarding industrial economics, as well as strategic management (Porter, 1991; Rumelt, Schendel, & Teece, 1991), ultimately creating an augmentation of controversies that emerge from the various theories (many of them completely unconnected), about competitiveness and the origin of the competitive advantages developed by firms. I.M. Cockburn et al., 2000).

The aforementioned context allows for an easier understanding about the existence of different models used to measure entrepreneurial competitiveness. A widespread academic approach considers competitiveness as the ability of a firm to compete in a specific market, increase its market share, venture into international markets, reach higher standards of growth and profitability, and thus be sustainable over time (Cetindamar & Kilitcioglu, 2013; Porter, 1991). From a financial point of view, competitiveness has been explained as the ability to sell the "profitability of a product"; in order to be competitive, firms should work towards lowering their final product prices, offer substantially higher quality products or ones with better performance than those offered by competitors (J. Cockburn, Siggel, Coulibaly, & Vézina, 1999). A more comprehensive view demarcates competitiveness into a global context, in which it's required to include an analysis of the national and international environments side by side (Oral & Kettani, 2009).

The European Union (EU) on its side, has set a global trend by proposing a measuring scale for industrial competitiveness based on 25 indicators, which are grouped in the following competitive factors: 1) Ability to innovate, 2) Sustainability, 3) Ability to export, 4) Entrepreneurial environment and entrepreneurship, 5) Public administration, 6) Finance and investments. These six factors could be linked to the pillars that comprise the Global Competitiveness Index (GCI), which is published by The World Economic Forum. Table 1 shows the competitiveness factors proposed by the EU and its possible equivalence with the "pillars" presented by the GCI.

Table 1: Competitiveness factors: European Union Vs. Global Economic Forum

European competive factors |

Global Economic Forum factors |

Ability to innovate |

Innovation Higher education and training Work force efficiency Technological readiness |

Sustainability |

Different approach |

Ability to export |

Size of the market Goods markets efficiency |

Entrepreneurial environment and entrepreneurship |

Business sophistication |

Public administration |

Institutions |

Finance and investments |

Financial market development |

Source: Adapted from (Voinescu & Moisoiu, 2015)

By this way, and considering the persistent differences in the performance of firms, the need to carry out a detailed internal and external analysis on the aspects that influence their competitive position is necessary. This could allow for the identification of key factors in the origins of competitiveness.

In the case of this particular research, competitiveness will be understand from the vision proposed by the European Union (explained in Table 1), where the ability to innovate, the ability to export, the relations with public administrations and their finances and investments will be key to the analysis.

In the literature there is a set of studies examining the influence of EO on competitiveness, which support the existence of a positive relationship between these two aspects (Acar, Zehir, Özgenel, & Özşahin, 2013; Covin & Slevin, 1989; Miller, 2011; Rauch, Wiklund, Lumpkin, & Frese, 2009; Zahra & Covin, 1995). Among the indicators used to measure competitiveness, one that understands competitiveness from a geographical perspective is identified and associated with changes in a firm's activity outside its traditional boundaries (Sapienza, Autio, George, & Zahra, 2006), which in turn allows firms to reduce their dependence on domestic markets (Ciravegna, Majano, & Zhan, 2014).

Other researchers understands competitiveness from the perspective of service improvement offered by companies (Acar et al, 2013; Chien & Hung, 2008), while a third group uses technological leadership as an indicator that allows a firm to aggressively compete with rivals (Dosi, Grazzi, & Moschella, 2015; Zahra & Covin, 1995).

Nevertheless, a common denominator seems to be the identification of a positive relationship between different types of entrepreneurial orientation and entrepreneurial performance (Leskovar-Spacapan & Bastic, 2007, Manu & Sriram, 1996; Morgan & Strong, 2003), which validates the use of EO as a key factor that could lead to greater competitive advantages. However, there's no reference of a previous company-level analysis on how intellectual capital, through the types of entrepreneurial orientation, could be a source of competitive advantage; in this sense, it is then appropriate to delve into empirical studies addressing this topic (Rauch et al, 2009;. Wales, Gupta, & Mousa, 2011).

On the other hand, the approach regarding relational intellectual capital and its relationship with the creation of competitive advantages has been based on a perspective of strategy and operations, alongside with a purely economic focus (Ambastha & Momaya, 2004). Arguments in literature support that the creation of knowledge within organizations has been the most important source of international competitiveness (Bontis, 1998; Toffler, 1990; Von Krogh & Roos, 1996), and that it could even become the replacement for other resources that firms have at their disposal. It is, in fact, proposed that the most prosperous and thriving firms of our days see themselves as "learning organizations" that continuously improve its knowledge associated assets (Senge, 1990; Smith, 2001).

Still there are some studies that focus on organizational culture and the market orientation of firms as part of their intellectual assets (Bontis, 1998), while others analyze the variables associated with intellectual capital within the framework of different models and methodologies used by recognized firms around the world such as Skandia Navigator (Edvinsson & Malone, 1997), Dashboard (Kaplan & Norton, 1996), Ericsson (Lövingsson, Dell'Orto, & Baladi, 2000), Infineon Technologies (Kircher-Kohl & Welzl , 2006), Intangible Assets Monitor (Sveiby, 1997) and Measurement system IQ (Stewart, 2007).

However, measurements of causality between intellectual capital and entrepreneurial performance in terms of competitiveness leave out plenty of room for analysis, since the effects of interactions between the intellectual assets of companies and other variables such as entrepreneurial orientation are not yet explored in the literature. Thus, there's challenge of answering questions that arise as a result of a growing international competitive environment in which companies strive for survival that still persists (Oral & Kettani, 2009; Torres-Barreto, Mendez-Duron, Hernández-Perlines; 2016); this condition fuels the need for research development, such as this one.

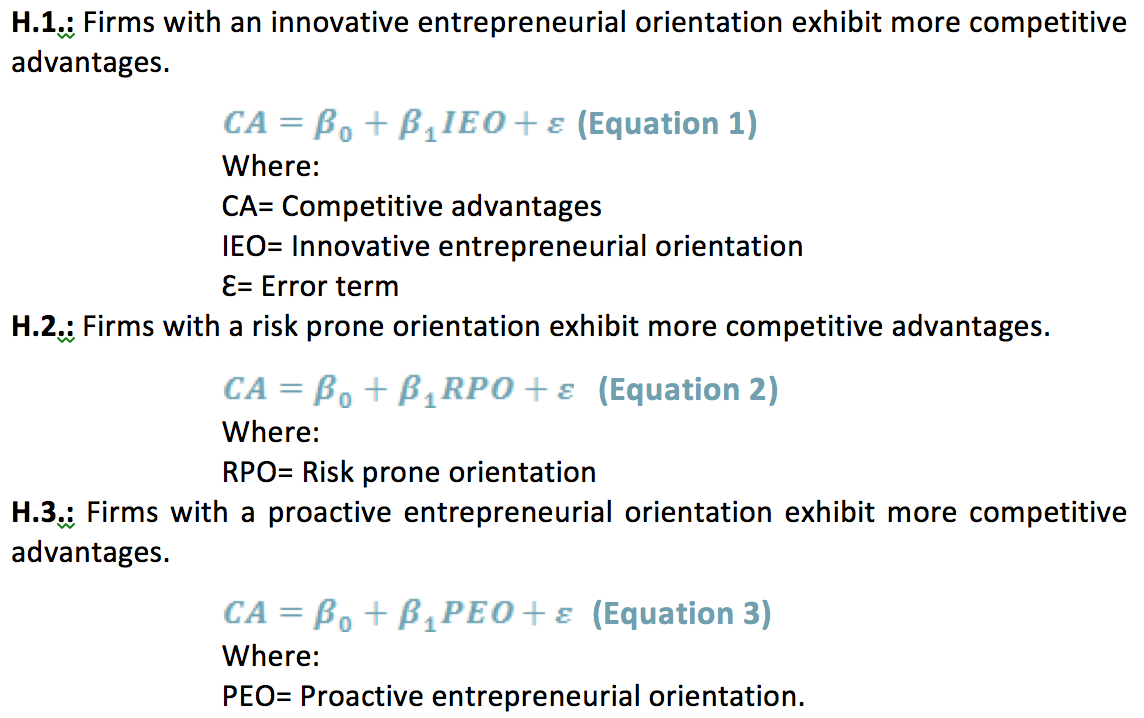

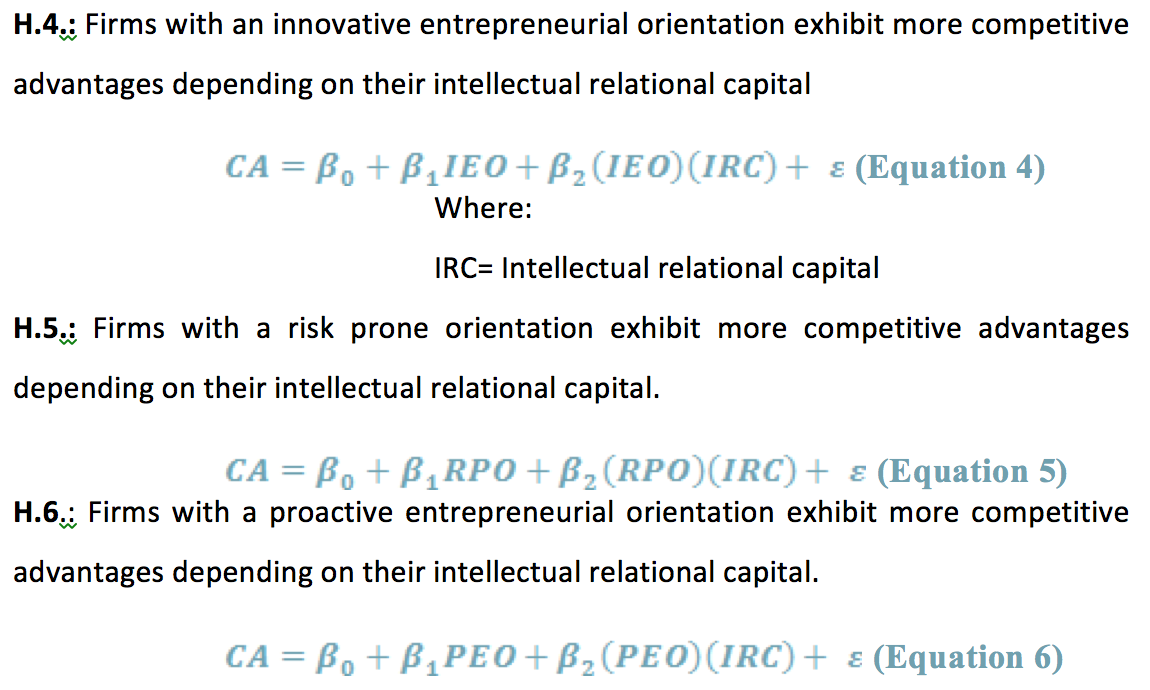

The hypotheses have to do directly with the relational intellectual capital (Bontis, 1998; Curado & Bontis, 2007; Farhadi & Tovstiga, 2010), its interactions with the EO (Miller, 1983) and its effect on the competitiveness of firms, based on the competitiveness perspective proposed by the EU (European Commission, 2013).

The structure of the hypothesis is as follows:

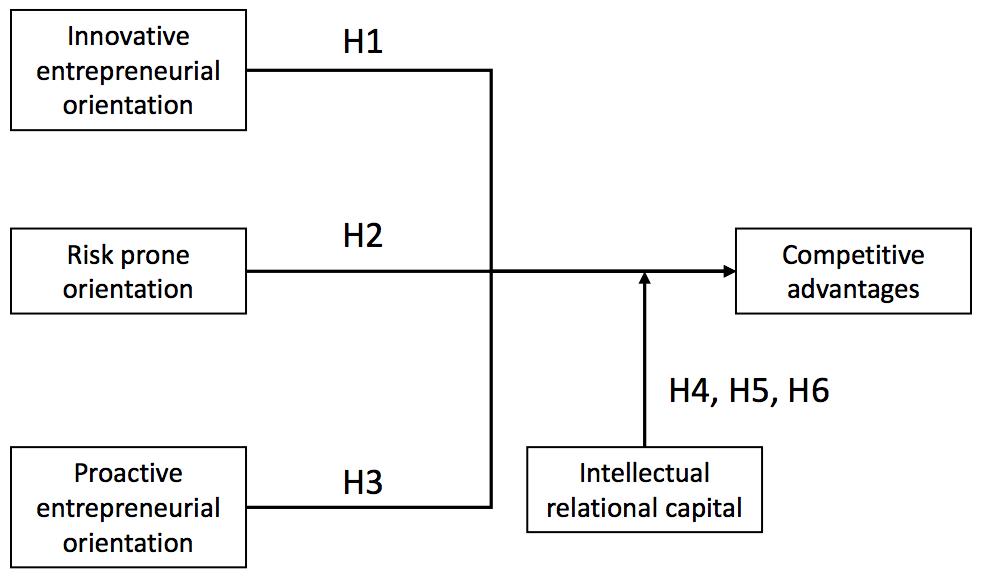

From the definition of the research problem and the exploration of the state of the art, this research presents a theoretical model comprising the proposed interactions between intellectual capital, entrepreneurial orientation and competitiveness, which are presented in figure 1.

As shown in the model, hypothesis 1, 2 and 3 represent a direct relationship between different entrepreneurial orientations and competitiveness, while hypotheses 4, 5 and 6 pose the interactions of the intellectual relational capital on the relationship between the entrepreneurial orientations and competitiveness.

Figure 1: Research model. Source: The authors.

This research will use a panel of data, since various time periods will be included in the proposed model, and the analysis level would be the firm. One of the advantages of this type of data is that we can make a closer approach to the hypothesized variables and -consequently- we may accomplish a greater external validity.

The National Administrative Department of Colombian Statistics - DANE- implemented the National Data Archive - ANDA - a catalog in which users can browse, search, compare, request access and download information related to censuses, sample surveys and statistical use of administrative records, in which the EDIT (Survey on technological innovation in Colombia) is found. The EDIT is proposed as the basis for this analysis, whose design is presented in Table 2. The information published in the ANDA is documented under the international standards DDI and DublinCore; this increases the transparency, comparability, quality, reliability and credibility of the statistics produced by the SEN.

The EDIT industry is divided into six chapters, which gather information from a total of 533 variables. Among the entire set of variables available, previous subgroups that may be useful for the proposed research have been identified. These are presented in Table 3.

The empirical contrast within the model will be made under the scheme proposed in this paper. The results of the hypotheses' contrast are unknown yet, but the generation of new knowledge related to derived products is expected, as long as the regressions for each of the six scenarios that the hypotheses represent are run.

The control dummies will be focused on the size of the firm, and its sub-specific activity, and since the dependent and independent variables are expected to be continuous, it is feasible to make linear regressions to get a previous diagnosis. In order to correct possible problems of heteroscedasticity, contemporary autocorrelation or heterogeneity, other tests will be run. The existence of a main model and some alternatives that will allow for the selection of the best fitting specification is considered within this research.

The proposal presented is part of one of the most discussed topics in industrial engineering schools around the world: The intellectual capital. The trends identified around this issue include the study on how a firm can properly manage this resource in order to get more out of it in terms of entrepreneurial performance. Furthermore, the identification of other factors that by acting together with the intellectual capital, improve the competitive position of firms is worked upon. Such improvements have direct implications on the competitiveness of a country and its position in the international context. It is for this reason that a trend comprising the analysis of intellectual capital has been widely increasing in the international environment. This proposal presents a model of interactions between intellectual capital and entrepreneurial orientation, which could have an impact on competitiveness. The way of approaching the model consists of a system of equations that will be empirically tested using a panel data from the DANE by applying econometric techniques.

It is expected that the results from the empirical contrast enrich the global state of the art regarding this subject, and on the other hand, substantiate positive changes in the competitiveness and sustainability of firms by sharing it with local and international "practitioners".

Regarding the academic impact, the research will allow for the participation in an international scientific community strengthening scenario by interacting with researchers from different universities in Europe and America, and it will be possible to publish the results to international academic communities.

Since the model is expected to be run on a census panel data, the impact of the results obtained is also expected to be high, considering the substantial external validity given by the nature of data and the possibility of generalization of the results.

Table 2: Panel design - EDIT

Country |

Colombia |

Population |

Colombian industrial enterprises with 10 or more employees, or, with an anual production over $136.4 million COP per year. Those firms are included in the Annual Manufacturing Survey (EAM). |

Type of study |

Panel - correlations |

Statistical unit of analysis |

The firm. |

Average response rate |

88% (in a five years window). |

Average number of surveyed firms |

10 315. |

Reference period |

2009-2014. |

International references |

EDIT accomplishes most of the methodological standards of the OECD, primarily those considered within the Oslo Manual. Also follows the Ibero-American Network of Science and Technology indexes (RICYT), of the Manual de Bogotá. Most of this recommendations have been adapted to the particular necessities of information and, also adapted to some technical restrictions identified for the case of Colombia. EDIT survey also has some other measurement references, namely: the European Survey of Innovation (CIS); The Canadian Research and Development Survey, Uruguayan Innovation on Services Survey; The Spanish Innovation of Firms Survey (INE) and the Research and Development Brazilian Survey. |

Source: The authors.

Table 3: Prospect variables to be studied

Resource or capability to be studied |

Chapter of the EDIT survey considered for study |

Prospect proxies |

: Innovative Entrepreneurial Orientation

|

INNOVATION AND ITS IMPACT ON FIRMS CHAPTER I |

Number of new products and / or services placed in the national market. |

Number of new products and / or services placed in the international market. |

||

Number of new or significantly improved production / distribution / delivery methods, or logistic systems placed in the market. |

||

Number of new organizational methods implemented within firms internal functioning, or in its knowledge managing system, or in the workplace organization, or in the management of external relationships of firms. |

||

Number of new commercialization techniques adopted by firms with the purpose of maintain its market. |

||

|

CHAPTER IV |

Total number of employees participating on scientific / technological / innovative activities. |

|

FIRMS´ RELATIONSHIPS CHAPTER. V |

R&D internal department as a source of innovation |

|

Proactive entrepreneurial orientations |

CHAPTER VI |

Number Of quality certifications obtained by the firm |

FIRMS´ RELATIONSHIPS WITH DIFFERET ACTORS CHAPTER. V |

COLCIENCIAS |

|

SENA |

||

ICONTEC |

||

Superintendencia de Industria y Comercio |

||

Intellectual Property Organizations at a national level |

||

Ministries |

||

Universties |

||

Tecnological development centers. |

||

Research centers |

||

Business incubators |

||

Technological clusters |

||

Regional productivity centers |

||

Science and Technology Regional Centers (CODECyT) |

||

Competitivieness Regional Commissions |

||

Chambers of commerce |

||

PROEXPORT |

||

Other enterprises |

||

Risk prone orientation |

SCIENTIFIC, TECHNOLOGICAL AND INNOVATIVE INVESTMENTS CHAPTER II |

Investments on scientific / technological / innovative activities using national private Banks funding |

Investments on scientific / technological / innovative activities using international private Banks funding |

||

Investments on scientific / technological / innovative activities using own funding |

||

Competitiveness |

PUBLIC FUNDING FOR SCIENTIFIC, TECHNOLOGICAL AND INNOVATIVE ACTIVITIES CHAPTER III |

Public funding for scientific, technological and innovative activities |

COLCIENCIAS funding for scientific, technological and innovative activities

|

||

INVESTMENT ON SCIENTIFIC, TECHNOLOGICAL AND INNOVATIVE ACTIVITIES CHAPTER II

|

Investment on machinery and equipment |

|

Investment on information technology and telecomunications. |

||

Investment on marketing |

||

Investment on engineering and industrial designs |

||

Investment on specialized training and education |

||

INTELLECTUAL PROPERTY (Actual number of …) CHAPTER VI

|

Patents |

|

Utility models |

||

Author rights |

||

Software registers |

||

Industrial designs |

||

Trade marks and others |

||

Vegetable variety |

||

|

CHAPTER IV |

Number of employees trained under specialized programs funded by the firm. |

|

INNOVACIÓN AND ITS IMPACT ON FIRMS CHAPTER I |

Total national sales |

|

Total exports |

||

Intellectual Relational capital |

FIRM COOPERATION WITH:

|

Customers |

Competitors |

||

Consultants |

||

Universities |

||

Technological Development Centers |

||

Research Centers |

||

Technological clusters |

||

Productivity regional centers |

||

Internacional organizations |

||

Control variables |

PERSONNEL CHAPTER IV |

Total number of employees |

Source: The authors based on DANE.com.co |

||

Acar, A. Z., Zehir, C., Özgenel, N., & Özşahin, M. (2013). The Effects of Customer and Entrepreneurial Orientations on Individual Service Performance in Banking Sector. Procedia - Social and Behavioral Sciences, 99(1978), 526–535. http://doi.org/10.1016/j.sbspro.2013.10.522

Ambastha, A., & Momaya, K. (2004). Competitiveness of Firms: Review of Theory, Frameworks, and Models. Singapore Management Review, 26(1), 45–61. http://doi.org/10.1002/ccd.10430

Bontis, N. (1998). Intellectual capital : an exploratory study that develops measures and models. Management Decision, 36(2), 63–76. http://doi.org/http://dx.doi.org/10.1108/00251749810204142

Chien, C. C., & Hung, S. T. (2008). Goal orientation, service behavior and service performance. Asia Pacific Management Review, 13(2), 513–529.

Ciravegna, L., Majano, S. B., & Zhan, G. (2014). The inception of internationalization of small and medium enterprises: The role of activeness and networks. Ournal of Business Research, 67(6), 1081–1089.

Covin, J. G., & Slevin, D. P. (1989). Strategic Management of Small Firms in Hostile and Benign Environments. Strategic Management Journal, 10(1), 75–87. http://doi.org/10.1002/smj.4250100107

Curado, C., & Bontis, N. (2007). Managing intellectual capital : the MIC matrix. Knowledge Creation Diffusion Utilization, 3, 316–328. http://doi.org/10.1504/IJKL.2007.015558

Dosi, G., Grazzi, M., & Moschella, D. (2015). Technology and costs in international competitiveness: From countries and sectors to firms. Research Policy, 44(10), 1795–1814. http://doi.org/10.1016/j.respol.2015.05.012

Edvinsson, L., & Malone, M. S. (1997). Intellectual Capital: Realizing Your Company’s True Value by Finding Its Hidden Brainpower. Collins. Retrieved from http://www.amazon.com/exec/obidos/redirect?tag=citeulike07-20&path=ASIN/0887308414

European Commision. (2013). Strategic Research Agenda. Brussels. Retrieved from http://www.trustindigitallife.eu/uploads/TDL-SRA-version-2.pdf

Farhadi, M., & Tovstiga, G. (2010). Intellectual property management in M&A transactions. Journal of Strategy and Management, 3(1), 32–49. http://doi.org/10.1108/17554251011019404

Kaplan, R., & Norton, D. (1996). Translating strategy into action: The balance score card. (H. Press, Ed.) (1st ed.). Boston, MA.

Kircher-Kohl, M., & Welzl, A. (2006). Intellectual Capital Report 2005 of Infineon Technologies Austria. In OECD Conference on Intellectual Assets-based Management. Austria: Infineon Austria.

Leskovar-Spacapan, G., & Bastic, M. (2007). Differences in organizations’ innovation capability in transition economy: Internal aspect of the organizations’ strategic orientation. Technovation, 27(9), 533–546. http://doi.org/10.1016/j.technovation.2007.05.012

Lövingsson, F., Dell’Orto, S., & Baladi, P. (2000). Navigating with new managerial tools. Journal of Intellectual Capital, 1(2), 147–154.

Manu, F. A., & Sriram, V. (1996). Innovation, marketing strategy, environment, and performance. Journal of Business Research, 35(1), 79–91. http://doi.org/10.1016/0148-2963(95)00056-9

Miller, D. (1983). the Correlates of Entrepreneurship in Three Types of Firms. Management Science, 29(7), 770–789. http://doi.org/10.1287/mnsc.29.7.770

Miller, D. (2011). Miller (1983) revisited: A reflection on EO research and some suggestions for the future. Entrepreneurship: Theory and Practice, 35(5), 873–894. http://doi.org/10.1111/j.1540-6520.2011.00457.x

Morgan, R. E., & Strong, C. A. (2003). Business performance and dimensions of strategic orientation. Journal of Business Research, 56(3), 163–176. http://doi.org/10.1016/S0148-2963(01)00218-1

Oral, M., & Kettani, O. (2009). Modeling Firm Competitiveness for Strategy Formulation.

Rauch, A., Wiklund, J., Lumpkin, G. T., & Frese, M. (2009). Entrepreneurial Orientation and Business Performance: an Assessment of Past Research and Suggestions for the Future. Entrepreneurship Theory and Practice, 1–54. http://doi.org/10.1111/j.1540-6520.2009.00308.x

Sapienza, H., Autio, E., George, G., & Zahra, S. (2006). A capabilities perspective on the effects of early internalization on firm survival and growth. Academy of Management Review, 31(4), 914–933. http://doi.org/10.5465/AMR.2006.22527465

Senge, P. M. (1990). The Fifth Discipline: The Art and Practice of the Learning Organization. Performance Instruction (Vol. Rev. and u). http://doi.org/10.1002/pfi.4170300510

Smith, M. K. (2001). Peter Senge and the learning organization. The Encyclopedia of Informal Education, (1990), 1–18. http://doi.org/10.1016/j.lrp.2005.11.005

Stewart, T. A. (2007). The wealth of knowledge: Intellectual capital and the twenty-first century organization. (C. Business., Ed.) (I).

Sveiby, K. E. (1997). The Era of the Knowledge Organization,. (Berrett-Koehler, Ed.) (I). San Francisco. Retrieved from file:///C:/Users/matte/AppData/Local/Mendeley Ltd./Mendeley Desktop/Downloaded/Mgmt - 2001 - The Era of the Knowledge Organization,.pdf

Toffler, A. (1990). The future shock. (Bantam, Ed.).

Torres-Barreto, M., Mendez-Duron, R., Hernandez-Perlinez, F (2016). Technological impact of R&D grants on utility models. R&D Management. Vol 46 (2), 537-551. DOI: 10.1111/radm.12198

Torres-Barreto, M., Martínez, Meza-Ariza, Muñoz (2015). El cambio tecnológico en el caso de los textiles inteligentes: Una aproximación desde las capacidades dinámicas. Espacios. Vol 37(8). 12-22.

Voinescu, R., & Moisoiu, C. (2015). Competitiveness, Theoretical and Policy Approaches. Towards a More Competitive EU. Procedia Economics and Finance, 22(November 2014), 512–521. http://doi.org/10.1016/S2212-5671(15)00248-8

Von Krogh, G., & Roos, J. (1996). Managing knowledge: perspectives on cooperation and competition. (SAGER, Ed.).

Wales, W. J., Gupta, V. K., & Mousa, F.-T. (2011). Empirical research on entrepreneurial orientation: An assessment and suggestions for future research. International Small Business Journal, 31(4), 357–383. http://doi.org/10.1177/0266242611418261

Zahra, S. A., & Covin, J. G. (1995). Contextual influences on the corporate entrepreneurship-performance relationship: A longitudinal analysis. Journal of Business Venturing, 10(1), 43–58. http://doi.org/10.1016/0883-9026(94)00004-E

1. Universidad Industrial de Santander, Colombia. Faculty of engineering. Industrial Engineering School. malitorres@yahoo.com

2. Universitaria de Investigación y Desarrollo, Colombia. Faculty of Social Sciences and Economics. International Business School. dfarcol@gmail.com