HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN

HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN Espacios. Vol. 37 (Nº 34) Año 2016. Pág. 17

Pedro HEMSLEY 1; Romero ROCHA 2

Recibido: 21/06/16 • Aprobado: 28/07/2016

ABSTRACT: We study the relationship between rural rental markets and agricultural productivity in Brazil, where rental rates are very low, with an unconditional quantile approach. Rental has a positive impact for low levels of productivity in crop farming, but this impact disappears for high productivity municipalities. This is consistent with the non-productive use of land: it is used both as a production factor and, due to the history of instability of the Brazilian financial system, as reserve of value. The latter use is pervasive when productivity is low and gains from rental have not been realized. |

RESUMO: Estudamos a relação entre mercados de arrendamento de terra e produtividade agrícola no Brasil, onde as taxas de aluguel de terra são baixas, usando o método de regressão quantílica incondicional. Aluguel de terra tem impacto positivo para municípios com baixos níveis de produtividade em lavouras, mas este impacto desaparece para municípios com alta produtividade. Isto é consistente com uso não-produtivo da terra, usada como fator de produção e como reserva de valor, devido à história de instabilidade do sistema financeiro brasileiro. A última utilização é generalizada para baixa produtividade e os ganhos com o aluguel ainda não foram realizados. |

The importance of rental for agricultural productivity is well-known. On a theoretical ground, developed rental markets make it possible to make production decisions separately from ownership decisions; hence productivity should increase as the farmer’s choice set is expanded. Comprehensive reviews of the role of rental markets in agriculture may be found in Deininger and Feder [2007] and Pica-Ciamarra [2004].

However, this relationship also depends on the level of productivity itself. This is particularly true when land has non-agricultural use. In Brazil, due to a long history of unstable financial markets, it is frequent that individuals keep land only as a form of saving, and do not pursue efficient production (for details, see Assuncao [2008]); inefficient production is an option mostly to avoid expropriation for land reform purposes. Although in principle it would be possible to achieve both goals by buying land and renting it out to efficient producers, expropriation concerns also render this unfeasible as Brazilian law considers farms the first options for land reform (Alston and Mueller [2010]).

Given the importance of land as a reserve of value, we would expect an increase in rental rates to have a higher impact on productivity for low-productivity farmers: non-productive use of land is then pervasive as owners use mostly the savings function of land, and renting it out to a farmer should increase productivity as rental farmers have no non-productive use for the rented land. Higher rental rates should have a lower impact when productivity is high: as one approaches the production frontier, the marginal productivity should be the same for owners and under-rental farmers as the gains from trade (in this case, the gains from rental) are realized. This asymmetric impact should hold whichever the reasons that prevent perfect renting: whenever such a reason is surmounted, the impact of rental on productivity takes place, and this impact depends on the previous level of productivity.

We proceed to test these points with the unconditional quantile approach developed by Firpo et al. [2009]. This approach is the most adequate since the original quantile regression developed in Koenker and Bassett [1978] makes the estimated coefficient conditional on the explanatory variables, while the theoretical impact of rental on productivity, for each quantile, does not depend only on the regressors.

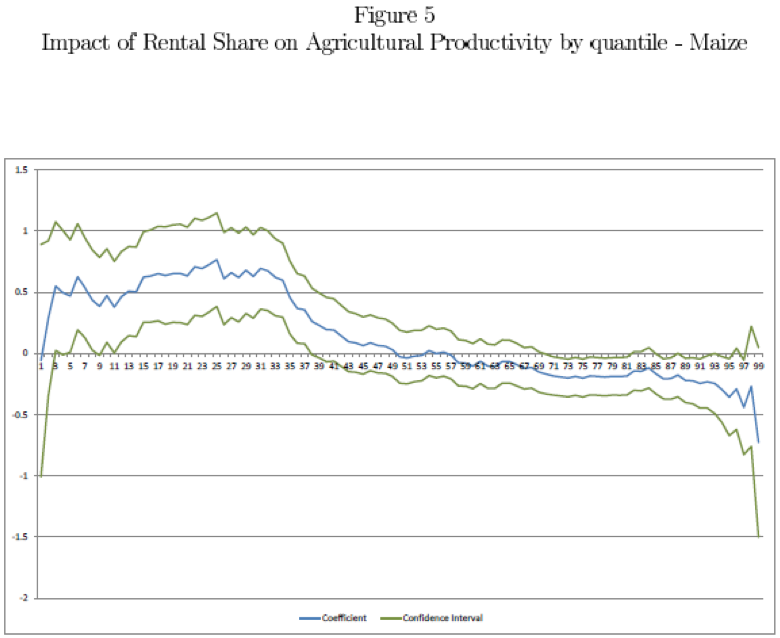

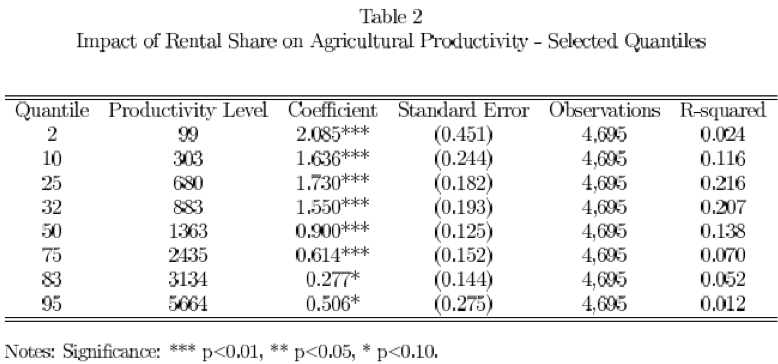

As expected, we find that the impact of rental is highest for low levels of productivity. We also implement this analysis separately for the three most important crops in Brazil: soybean, sugarcane and maize. While soybean productivity levels are similar over the country, sugarcane and maize present regional heterogeneity. Accordingly, we find the impact of rental to be equal to zero for all quantiles, since most farmers are close to the production frontier; and the impact of rental to follow the previous pattern for sugarcane and maize, exactly because of dispersion in productivity.

The next section presents the data sources and the estimation method. Section 3 shows the results and section 4 briefly concludes. Figures and tables are collected in the appendix.

Data for agricultural productivity and rental shares are obtained from the last edition of the Brazilian Agricultural Census, which took place in 2006. Crop farming productivity is defined as value of production, in 2006 Brazilian reais (BRL), by hectare. Rental shares are defined as the production area under rental divided by total production area.

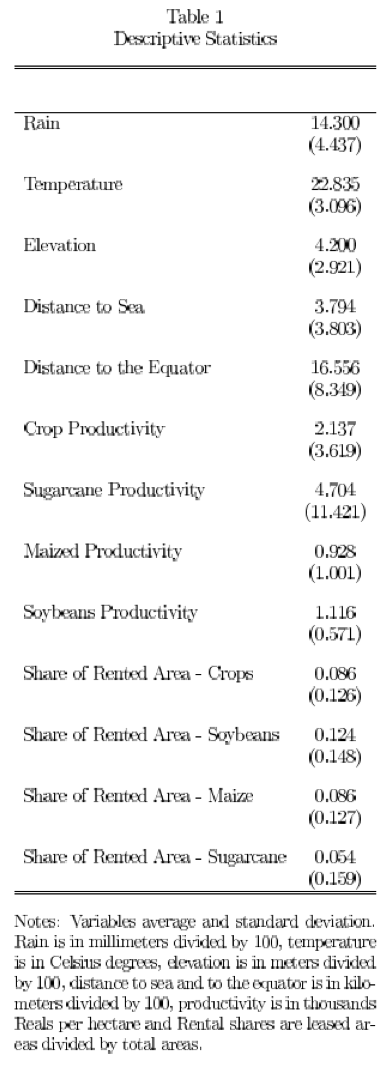

Table 1 provides a summary of the descriptive statistics for these variables as well as for other control variables also collected from the Agricultural Census at the municipality level. Controls include several determinants of productivity and are included to avoid biases due to omitted variables: rainfall, temperature, altitude, distance to the sea, distance to the Equator, and the share of each type of soil. Soil types are based on detailed GIS information from the Brazilian soil map developed by EMBRAPA, the Brazilian Agricultural Research Corporation (EMBRAPA [2011]). We also include the square of rainfall and temperature.

Average productivity is BRL 2.13 thousand per hectare, with high variation across municipalities. On average, the rental share across municipalities is 8.6%, which is very low for international standards (for details, see Assuncao [2008]). We have 4,695 observations.

We use the following model to assess the impact of rental on productivity.

yi = bsi + XiL+ei

where yi represents productivity and si stands for the rental share in municipality i. Xi is a vector of controls (with coefficient vector L) for each municipality and ei is the error term.

Along with the average impact of rental on productivity, measured by the OLS estimate, we evaluate the impact bt of rental shares for each quantile t of the distribution of productivity. These estimates cannot be computed using traditional quantile regression proposed by Koenker and Bassett [1978] since this method estimates the impact of rental at different quantiles of the distribution of productivity conditional on rental rates and on the whole set of covariates included in the estimates. Recovering unconditional quantile estimates from conditional ones requires several assumptions as it involves computing marginal distributions from conditional distributions, as shown by Machado and Mata [2005].

We examine this relationship using the unconditional quantile estimator proposed by Firpo et al. [2009]. The estimator is simple and can be computed using OLS estimation. It is based on the concept of influence function (IF). The influence function of a distributional statistic is the influence of an individual observation on that statistic. The IF can be used to compute the Recentered Influence Function (RIF) for a general distributional statistic and for each quantile of the distribution of the dependent variable.

Firpo et al. [2009] show that the marginal effect (of a change in the distribution of covariates on the unconditional quantile of the distribution of the dependent variable) is the coefficient from a regression of the Recentered Influence Function on the covariates. Hence, the impact of rental rates on agricultural productivity on a given quantile of the distribution of productivity is the coefficient of rental rates of the regression of the Recentered Influence Function on rental rates and other covariates. The authors describe three different methods for estimating the unconditional partial effect of a change in an explanatory variable in the distribution of the dependent variable. We use the RIF-OLS method, which may be implemented in Stata and is consistent if the distribution of the dependent variable conditional on the explanatory variables is linear in the regressors. Firpo et al. [2009] provide evidence that estimates using the RIF-OLS are quite similar to the ones using RIF-Logit (which considers this distribution to be logistic) or RIF-NP (which is non-parametric).

We estimate the impact of rental rates on productivity for all quantiles of the productivity distribution using the RIF regressions. We expect this impact to be positive for low levels of productivity and to decrease towards zero over quantiles: as one approaches the production frontier, represented by the highest levels of productivity, the gains from rental should decrease and eventually become insignificant.

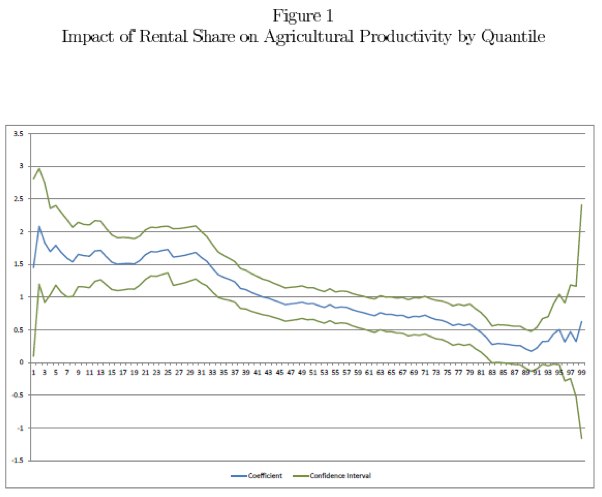

Results are presented in figure 1, which plots the coefficient estimates by quantile and the 95% confidence interval. The impact of rental share is higher for low levels of productivity, as expected, and is highest when productivity is at the second percentile, which corresponds to productivity level equal to BRL 99 per hectare. The estimated coefficient for this percentile is 2.08. This impact decreases on average and becomes statistically equal to zero when productivity reaches BRL 3.1 thousand per hectare, which corresponds to 55% of the productivity level at the 95 percentile. The overall impact (the OLS estimator) is 1.02 and is significant at the 1% level. Hence the OLS impact hides major differences across quantiles as it amounts to only half of the highest estimated coefficient. The impact of rental on productivity is quantitatively much more relevant for municipalities at the bottom of the distribution of productivity (Results are unchanged when the square of the rental share is included as a regressor: bt decreases over t irrespective of the share of rental in each quantile).

This is in line with the interpretation of unrealized gains from rental for low-productivity farmers – i.e., producing owners have much lower productivity than rental producers. Given the imperfection of rental markets, this result suggests that land has a relevant non-agricultural use, such as an asset to substitute for the financial system.

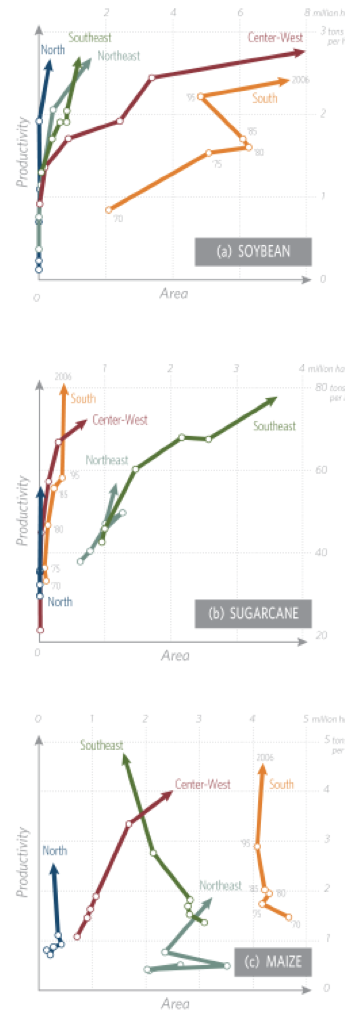

We further investigate this point by conducting this analysis for the three most important crops in Brazil: soybean, sugarcane and maize. Figure 2 depicts productivity patterns, in terms of physical production, for these crops in different regions (Brazil is divided in five geopolitical regions: North, Northeast, Southeast, South and Center-west.). Each line shows the evolution of productivity and harvested area for each crop, for each year when the Agricultural Census was taken from 1970 to 2006. Soybean productivity levels have converged and are essentially the same in all five regions of the country. Sugarcane and maize display more heterogeneous patterns: productivity dispersion is higher. Hence we expect the impact of rental shares on soybean productivity to be the same for all quantiles, since it is a crop for which most farms are close to the national production frontier. The pattern observed for overall crop farming productivity should be more accentuated for maize and sugarcane.

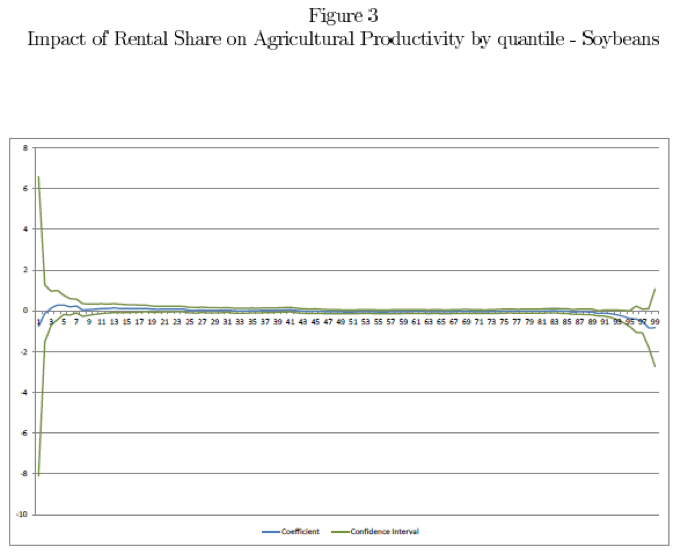

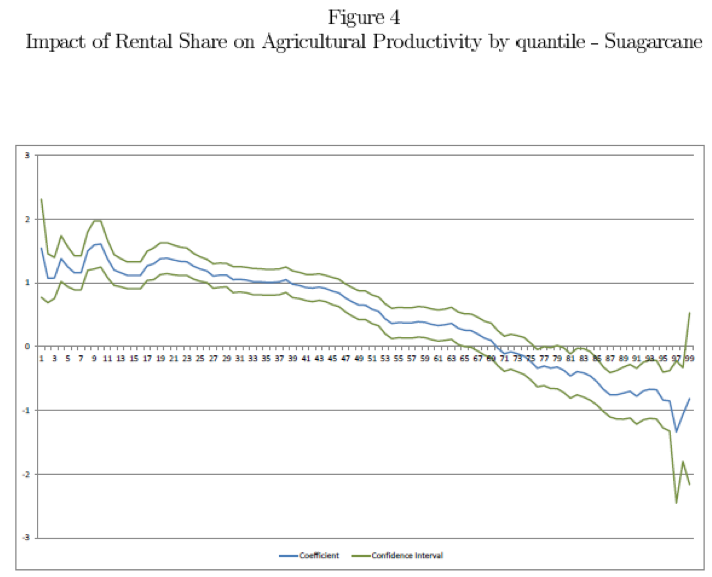

Figures 3, 4 and 5 confirm this reasoning. The impact of rental shares on soybean productivity is equal to zero for all productivity levels. The impact for sugarcane and maize is similar to the one in Figure 1, suggesting that these two crops drive the overall effect. Lastly, one may observe that the impact of rental on sugarcane productivity becomes negative for the highest productivity levels. This is due to the fact that in some production areas, sugarcane producers are willing to buy more land but are refrained to do so by local restrictions, mostly in the states of Sao Paulo and Mato Grosso do Sul.

We presented evidence that an increase in rural renting increase agricultural productivity in some instances that relate to the use of land as a production factor and as a savings deposit. When non-agricultural use of land is widespread, the impact is high: owners use land as a substitute for the financial system while renters use it as a production factor. The policy implication is straightforward: in order to use rental to increase productivity, one should focus on inefficient municipalities.

Future research should apply the Generalized Quantile Regression estimator recently developed in Powell [2013]. This approach accommodates instrumental variables and hence it allows one to determine the robustness of the results to endogeneity concerns.

J. Alston and B. Mueller. Property rights, land conflict and tenancy in Brazil. NBER Working Papers, 2010.

J. Assuncao. Rural organization and land reform in brazil: The role of nonagricultural benefits of landholding. Economic Development and Cultural Change, 2008.

K. Deininger and G. Feder. Land Institutions and Land Markets, in Handbook of Agricultural Economics, chapter 6. Elsevier, 2007.

EMBRAPA. O novo mapa de solos do brasil. MAPA, 2011.

S. Firpo, N. Fortin, and T. Lemieux. Unconditional quantile regressions. Econometrica, 2009.

R. Koenker and G. Bassett. Regression quantiles. Econometrica, 1978.

J. Machado and J. Mata. Counterfactual decomposition of changes in wage distributions using quantile regression. Journal of Applied Econometrics, 2005.

U. Pica-Ciamarra. Access to land through rental markets: a (counter-)evolution in the World Bank’ land policy? in Land Settlement and Cooperatives. FAO Information Division, 2004.

D. Powell. A new framework for estimation of quantile treatment e↵ects. RAND Working Paper, 2013.

----

Figura 2

Productivity by Crop

----

----

----

-----

-----

1. State University of Rio de Janeiro (UERJ). EMail: pedrohemsley@gmail.com

2. Federal University of Rio de Janeiro (UFRJ)