HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN

HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN Espacios. Vol. 37 (Nº 28) Año 2016. Pág. 15

SoonYoung KIM 1; Tadeu GRANDO 2; Antônio Carlos BRUNOZI Júnior 3

Recibido: 20/05/16 • Aprobado: 02/07/2016

2. Theoretical Background and Testable Hypothesis

ABSTRACT: This paper investigates whether one classing companies have different firm value comparing with those of dual class picking-up the samples of 197 LCGs (Large Conglomerate Groups) firms listed in Korean Stock Market (KOSPI) with 1114 observations for 6 years (from 2009 to 2014). The assumption of Agency Theory that the conflict of interest between shareholder is used to measure the difference level which may be caused by the separation of ownership and control, and it is presumed that dual classing companies has more incentive to entrench minority shareholders when a management group's control rights exceed its cash-flow rights, and finally it could affect the firm value. The coefficient estimation with panel data shows that dual classing companies of LCGs are negatively related to firm value. This result is consistent with the hypothesis of Agency Theory that separation of control, ownership and cash flow rights brings incentive to expropriate the minority shareholders and is negative for the firm value. |

RESUMEN: En este trabajo se investiga si las empresas con una clase de acciones tienen el valor de mercado diferenciada en comparación con las empresas con las dos clases de acciones. La muestra se compone de 197 empresas LCG (grandes conglomerados) que aparecen en el mercado de valores de Corea (KOSPI) dentro de los 6 años (2009-2014), por un total de 1.114 observaciones analizadas. El supuesto teórico utilizado en esta investigación es el conflicto de intereses de la teoría de la agencia, el conflicto de intereses entre los accionistas se utiliza para medir el nivel de la expropiación que puede ser causada por la separación entre la propiedad y el control, se asume en esta investigación que las empresas con dos clases de acciones tienen mayores incentivos para expropiar a los accionistas minoritarios, especialmente cuando los derechos de control de existencias son superiores a los derechos de flujo de caja efectivo de los controladores, y este nivel más alto de expropiación pueden afectar el valor de la empresa. Los coeficientes estimados con los datos en el panel demuestra que el valor de las empresas con dos clases de acciones se relaciona negativamente cuando se compara con las empresas con una clase de acciones. Este resultado es consistente con la hipótesis de la teoría de la agencia que la separación de la propiedad y el control y los derechos de flujo de caja traer incentivo para expropiar a los accionistas minoritarios. |

The relationship between the shareholders and the managers of a corporation fits the definition of a pure agency relationship, it should come as no surprise to discover that the issues associated with the “separation of ownership and control” in the modern diffused ownership corporation are intimately associated with the general problem of agency (Jensen & Meckling, 1976).

Many international researchers have been treating Korean economic issues regarding institutional analysis before and after Asian crisis (1997) the specific governance structure such as in large conglomerate groups (chaebols), also, there are some cross-country studies to see the separation of voting right and cash-flow rights (Lee, 2010; Claessens, Djankov & Lang, 2000; Zingales, 1994). Control rights are called as voting rights, and ownership rights as cash-flow (dividend) rights.

The conflict which is not the one between corporate managers and shareholders but rather between controlling shareholders and minority shareholders (Jensen & Meckling, 1976 ; Maury, Benjamin & Pajuste, 2002) bears an agency cost of monitoring which includes more than just measuring or observing the behaviour of the agent, which is more probably generated by more excessive voting rights than cash-flow lights. And, this kind of manner is likely to enhance as a form of the expropriation by controlling shareholders (Lee, 2010) and it worsens the agency problem of inducing an “agent” to behave as if he were maximizing the principal’s welfare (Jensen & Meckling, 1976).

Recent empirical research shows that many publicly traded firms in Western Europe, South and East Asia, Middle East, Latin America, and Africa have large shareholders in control and most of them are often families. (La Porta, Lopez-de-Silanes, Shleifer & Vishny, 1999; Claessens et al., 2000) Dividend (cash-flow) payouts as an outcome of the agency conflict between managers and shareholders, as well as between controlling shareholders and outside shareholders (La Porta, Lopez-de-Silanes, Shleifer & Vishny, 2000), according to La Porta et al. (2000), dividend payouts are an outcome of the legal shareholder protection (Maury et al., 2002).

Korean companies are more likely to be subject to various agency problems, resulting in lower firm values. (Johnson, Boone, Breach & Friedman, 2000) and they argue that managers are more likely to expropriate minority shareholders during a crisis as the expected return on investment falls. Korean Large Conglomerates Groups (LCGs) are unique in that they are effectively controlled by owner-managers who, with only a small equity stake in the group, are in command of all member firms (Moskalev & Park, 2010). The affiliate firms are placed under the direct control of the group’s central planning office, which is controlled by the group’s family members (Murillo & Sung, 2013). And the controlling shareholders typically have power over firms significantly in excess of their cash-flow rights, primarily through the use of pyramids and participation in management (La Porta et al, 1999), and the controlling owner-managers are able to expropriate minority shareholders by diverting resources to maximize their own wealth (Moskalev & Park, 2010).

This research analyse how the separation of ownership and control by deviation from one share, one vote (Claessens et al., 2000), that is, the companies with dual class shares will be compared with those with one class issuance to verify any differences exist the firm values. Even stock pyramids and cross-holdings creates additional agency problems in firms when large shareholders can exercise significant power while holding only a small fraction of the cash-flow rights (Bebchuk, Kraakman & Triantis, 2000), however, this research only focus to check the existence of difference of firm values by dual classing with the sampling of Korean listed companies and LCGs also.

The Agency problems regarding conflicts of interests between controlling shareholders and outside minority shareholders (La Porta et al., 2000) is based on the idea that owners who are also inside managers, but, as the theory abstracts from all other frictions away except the one between managers and owners, the empirical model we will build later on is significantly different. The theory, nevertheless, demonstrates well the fundamental conflict of interest between managers and owners.

Jensen & Meckling’s (1976) model on agency costs and ownership structure holds a central role in the corporate governance literature and they thought that the company result depends on the interest between shareholder and manager positively and have posited that professional managers with little equity in the firms they run pursue their own interests at the expense of shareholders’ interest.

Fama (1980) attempts to explain how the separation of ownership and control, typically, large corporations can be an efficient form of economic organization. Jensen & Mackling (1976) also cited that the costs of the “separation of ownership and control” which Adam Smith focused on in the passage quoted at the beginning of this paper and which Berle and Means popularized 157 years later. Berle & Means (1932) said, as the size of the company increases, the tendency to dispersion increases for the case study of American companies. This separation of function forces us to recognize "control" as something apart from ownership on the one hand and from management on the other. And when managers hold little equity in the firm and shareholders are too dispersed to enforce value maximization, corporate assets may be deployed to benefit managers rather than shareholders.

Morck, Shleifer & Vishny (1988) who explained the positive effects of high ownership concentration, the interests of controlling shareholders might be better aligned with outside minority shareholders as controlling shareholder ownership increases. However, the high concentration of manager or controlling shareholder ownership might result in firm value reduction due to management entrenchment or increase in expropriation probability.

La Porta et al. (1999) find that, except in economies with very good shareholder protection, relatively few of these firms are widely held, in contrast to Berle and Means's image of ownership of the modern corporation. Rather, these firms are typically controlled by families or the State. Jensen (1986) showed that a company with a large amount of free cash- flows is subject to higher agency costs of equity, implying negative relation between free cash- flows and performance.

In the effort to maintain control of a corporation without ownership of a majority of its share, “Pyramiding” by issuing bonds and non-voting preferred share of the intermediate companies, this kind of process can be accelerated. The owner of a majority of the share of the company at the apex of a pyramid can have almost as complete control of the entire property as a sole owner even though his ownership interest is less than one per cent of the whole (Berle & Means, 1932).

La Porta et al. (1999) defines that families often have control rights over firms significantly in excess of their cash-flow rights, and questioned who keeps the controlling families from expropriating the minority shareholders, and who monitors families, they mentioned two possibilities some other large shareholder or nobody. They showed one demonstration that controlling shareholders often have control rights in excess of their cash-flow rights.

The shareholders who control corporate asset can potentially expropriate outside investors by diverting resources for their personal use of by committing funds to unprofitable projects that provide private benefit. By diverting resources for private benefit, controlling shareholders have the opportunity to increase their current wealth without bearing the full cost of their actions (Lemons & Lins, 2003).

Not just limited to Asian regions, Mentioned, even in wealthy country, controlling shareholders, who are usually families, and also many family members are both and owners and managers, and the separation of ownership and management has yet to take place. The owners without and the control without appreciable ownership, we must ask what are the relations between them and how may these be expected to affect the conduct of enterprise. the controlling group even if they own a large block of stock, can serve their own pockets better by profiting at the expense of the company than by making profits for the Probability of expropriation (La Porta et al., 1999).

One of the main characteristic of Koran governance structure, which Claessens et al. (2000) notified the significant level of differences exist between voting right and cash-flow right, Lee (2010) mentioned when we link corporate governance issue with agency problem, the result is not consistent with research period and analysing object

Also, the relation between ownership and corporate control of Korean companies, as La Porta et al. (1999) noted, large shareholders who are also managers are able to use pyramid and cross-shareholding mechanisms to "tunnel." Accordingly, they can expropriate value from minority shareholders.

It is impossible to explain Korean agency problem or any economic hierarchy without mentioning chaebols, and chaebols (LCGs) are controlled by the members of a family thorough concentrated ownership (Morck, 1995). Bebchuk et al. (2000) termed this pattern of ownership a Controlling-Minority Structure (“CMS”; La Porta et al., 1999), which a shareholder exercises control while retaining only a small fraction of equity claims on a company’s cash-flows. Such kind of separation of control and cash-flow rights can be occurred through dual classing.

Claessens et al. (2000) examined 9 East Asian countries and found not only that voting rights frequently exceed cash-flow rights by virtue of pyramid structures and cross-holdings, but also that more than two-thirds of these firms were controlled by a single shareholder. Top management of the closely held firms often comprised relatives of the controlling shareholder’s family, and overall, a substantial share of East Asian corporate wealth is concentrated in the hands of just a few families.

1st ranking LCGs in Korea, Samsung Group has approximately 60 companies, including Samsung Electronics and Samsung Life Insurance, accounted for 13% of Korea’s GDP in 2011, and, just the biggest 5 LCGs have 55% of market influence vs. GDP (Kim, 2014). Claessens et al. (2000) inside the cross-country studies with other eastern Asian countries, showed us the result of “ratio of cash-flow right to voting right” of Korea as 85,8% with 211 companies (average of East Asia is 74,6%) when they picked up the sample of the largest controlling holder at least 5% of the voting rights.

2.4.1. Preferred share in Korea

The revised Korean Commercial Act in 2011 change the word of Korean dual class share from “preferred share” to “other type share”, and, and abolished minimum dividends obligation to preferred share at that moment. The word “preferred” means that this type of stockholder has a privilege to receive before than any other shareholder in the event of liquidation. And, also abolished the clause that only preferred share can issue nonvoting rights (Yulchon, 2011).

The below is main characteristics of preferred share comparing with common (ordinary) shares: i) The other types of shares with non-voting right cannot exceed 25% of total number of shares to be issued, ii) Korean law does not allow the dual-class on common (voting right) share (one share - one vote principle), iii) Company can issue other type share which allows differentiation regarding dividends of profit and allocation of the surplus assets, voting right in shareholders’ meeting, conversion and redemption, iv) For the clause iii), each type of shares must be defined with the total number of share and contents in Article of Association of company, e v) When company issues other type share which allows differentiation regarding dividends of profit: the type of dividends asset, calculation method of value of dividends asset, conditions of dividends of profit must be defined to the shareholder of this type of shareholder in Article of Association.

2.4.2. Definition of large conglomerate group (defined by KFTC)

According to the definition of KFTC (Korean Fair Trade Commission), a controlling shareholder is a business group of companies ‘‘of which more than 30% of shares are owned by the group’s controlling shareholder and its affiliated companies.’’ Each year KFTC ranks LCGs in the country based on the Fair Trade Act in Korea which aims to regulate and monitor large conglomerates if any unfair thing happens to outsiders of Groups (Moskalev, 2009).

KFTC designates LCGs which total assets values are more 5 Trillion KRW (approximately 4.5 Billion USD) based on Fair Trade Act Article 9. And the purpose of this designation is to prevent mutual shareholding between mother companies and son companies in the designated LCGs. As of April 2014, 63 LCGs are selected for these groups, each group has averagely 26 companies and, the average asset size of them is approximately 31 Billion USD.

The annual Revenue of big 5, Samsung group has 250 Billion USD, SK gruop140 Billion USD, Hyundai Motor group 135 Billion USD, and LG has 105 Billion USD, Lotte 58 Billion USD with the exchange rate of 1 USD equivalent to 1100 KRW. (KFTC, 2014)

Berle & Means (1932) analyze that the firm’s ownership structure is a primary determinant of the extent of agency problems between controlling shareholders and outside shareholders, which has important implications for the valuation of the firm. Lemmon & Lins (2003) examined whether differences in ownership structure at the firm level can explain differences in the firm performance, and use Tobin’s Q, defined as the ratio of total liabilities plus market value of equity divided by the book value of total assets.

Claessens et al. (2000) study showed the results that Asian countries to show that expropriation of value from minority shareholders by large shareholders is the rule rather than the exception. They found that concentration of control via deviations from the one-share, one-vote rule (that is say; dual classing) are negatively associated with market value. Also, they find that East Asian firms are positively related to cash-flow ownership and negatively related to the separation of ownership and control, and the results are consistent with the view that the separation between cash-flow and control rights is the determinant of the incentives of controlling shareholders to expropriate minority shareholders.

Agency costs of equity can arise when the interests of a firm’s managers are not aligned with those of the firm’s shareholders, especially when managers do not have large stakes in their company (Jensen & Meckling, 1976). Likewise, the interests of controlling shareholders might be better aligned with outside minority shareholders’ as controlling shareholder ownership increases. However, too much concentration of manager or controlling shareholder ownership might result in firm value reduction due to management entrenchment or increase in expropriation probability (Morck et al., 1988).

The existence of blockholders might enhance the value of a firm because blockholders

have incentives to closely monitor management or controlling shareholders, resulting in less agency costs of equity (Lemmon & Lins, 2003). The purpose of issuing the preferred shares in Korea are providing more cash without diluting the voting rights, and it’s more preferable for the companies which controlling shareholders possess high share rate inside the companies (Kim, 2011).

Even Claessens et al. (2000) studied regarding the separation of ownership and control with pyramiding and cross-shareholding with all shareholders who control over 5% of the votes and they identified owner such as individual family group or family group.

However, this study is reviewing the separation of ownership and control impact on firm value between one classing companies and dual classing companies focusing LCGs in Korea. This difference of measuring object or tool is different from many prior researchers have already been doing.

Hypothesis 1. The companies with one class share and those with dual class share will have different firm values which are measured by Tobin’s Q. The listed companies of Large Conglomerate Groups (LCGs) which is defined by KFTC (Claessens et al., 2000) will be the population for this research, and those with one-class share and company has dual-class share will have different value of company (Chang, 2003) and the companies with one-class share have better firm value

Even the existence of controlling shareholders might enhance the value of a firm because they have incentives to closely monitor management or controlling shareholders, resulting in less agency costs of equity (Lins, 2003). However, the separation of voting right and cash-flow is frequently happened in LCGs, as company displays a gap between ownership and control by dual classing mechanism, stronger incentive and possibility for expropriation (Morck et al, 1988) by LCGs, and it will bear more negative results to dual classing companies than one classing companies and also affect the firm value., and it will bear more negative results to dual classing companies than one classing companies and also affect the firm value.

This research will testify the existence of difference of firm value by the separation of voting rights and cash-flow rights mechanism, and the differences of firm value can be measured between the companies with one classing and those of dual classing. For the data collection, all the firms listed on the Korean Stock Exchange (KSE), financial information of KOSPI companies were collected using Korea Listed Companies Association (KLCA)’s Database, KOCOINFO (TS 2000) and I collect 6 years data from 2009 to 2014.

For the selection of the population, I consider the LCGs (Large Conglomerate Groups) due to the economic influences and representativeness of LCGs groups in Korea, (for instance, 20 LCGs have assets which are equivalent to 85% of Korean GDP (KISLINE, 2012), and LCGs also dominate 36% assets of Korea (Korean Economy Reformation Institute, 2013) in 2011, also, according to Gibson (2003), special characteristics governance structure of chaebols which most of scholars (Almeida, Park, Subrahnamyam & Wolfenzon, 2010; Claessens et al., 2010; La Porta et al. 1999) are interested in, for these various reasons, the LCGs are chosen for the population to testify Hypothesis 1 (H1).

Aforementioned, every April of each year, KFTC ranks and publishes the LCGs which aggregate asset values are more than 5 Trillion KRW (approximately 4.5 Billion USD), main reason of these classification is to monitor and regulate mutual shareholdings between them. And, even the listed companies of LCGs in KOSPI market are used as population, however, the below LCGs or the companies are excluded from the population because they are not fit for the purpose of research.

And, after the exclusion, the number of companies to be used as samples for the test of hypothesis.

Table 1 - One classing and dual classing companies population by year

Year |

One-classing Companies |

Dual-classing Companies |

Total |

||

2009 |

110 |

66,70% |

55 |

33,30% |

165 |

2010 |

122 |

69,00% |

55 |

31,00% |

177 |

2011 |

136 |

71,90% |

53 |

28,10% |

189 |

2012 |

137 |

71,30% |

55 |

28,70% |

192 |

2013 |

136 |

70,10% |

58 |

29,90% |

194 |

2014 |

138 |

70,00% |

59 |

30,00% |

197 |

Total |

779 |

|

335 |

|

1114 |

And, there are total population of 779 one-classing companies and 335 dual-classing observation with 197 companies and we use multiple linear regression for the analysis with OLS (Ordinary Least Square) method with Panel data. and initially, the below variables are tested by Software Eviews 7 to get the coefficient estimation between dependent variables and independent variable with control variables.

To economically design and control the relationship with variables, three models of Tobin’s Q are used as dependent variable for the test of hypothesis, Lee & Tompkins (1999), Chung & Pruitt (1994), Shin & Stulz (2000), and will finally choose general model of Shin which explains well about the estimation of other variables (Lemons & Lins, 2003). To measure the difference of firm value, Dummy method are use One-Classing companies (1) and Dual-Class companies (0) as a independent variable.

And regarding the control variables to regulate the conditions of variables, considering the number of shares in sample (Korean Stock Market), probably, the correlations between CSC (Common Share Ratio of Controller) and TSC (Common share and preferred share ratio of controller out of total shares issued) could be strong, in this case, I will choose one of them as a control variable. And other control SIZE, ROE, DEBT RATIO, YEAR (from 2010 to 2014 with Dummy variables for each year).

The variables of the study are indicated in the Chart 1.

Chart 1 - Definition of variables to be used for the regression

Variables |

Classification |

Contents |

Observation |

Tobin´s Q (Tobin’s Q) |

Dependent |

(Market Value + Total Debt) / Total Asset : General Model (Shin & Stulz, 2000) |

Market value to the replacement cost of its assets |

One classing / Dual classing companies Dummy (Class) |

Independent |

One-classing companies: 1; Dual-classing companies: 0 |

See the impact on firm value with or without preferred shares issuance |

TSC (TSC) |

Control |

(Common share + Preferred share of Controller)/Total share |

Ownership and cash-flow right of controller |

Size (Size) |

Control |

Log (Asset) |

Company size |

ROE (ROE) |

Control |

Net Profit/Equity |

Return on Equity |

Debt Ratio (Debt Ratio) |

Control |

Liabilities/Shareholders’ equity |

|

Observation Year (YEAR) |

Control |

Year from 2010 to 2014 |

5 years with Panel |

One-Classing firm value measured by Tobin’s Q will be higher than that of dual-classing, this assumption is based on idea that dual classing mechanism will enhance the expropriation of minor shareholders (Claessens et al., 2000; La Porta et al., 1999).

For this reason our expectation of firm value measured by Tobin’s Q, one-classing companies’ value will be higher than that of dual classing companies with LGGs listed in Korean Stock Market (KOSPI).

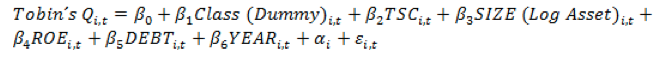

After using least squares (OLS) regression method to estimate relationship of firm value with one class and dual class companies dummies (one classing: 1; dual classing: 0) with panel data for the listed LCG companies in the KOSPI from 2010 to 2014 by KFTC definition of each year. And, finally formulated individual equations for firm i at time t as follows with year dummies also:

(1)

(1)

Where:

Tobin’s Q by Shin & Stulz (1999) is selected for estimation of the dependent variable to measure firm value (Lemons & Lins, 2003);

Q = (VM(MVE+PS)+DEBT)/TA;

VM = Market value of companies;

MVE= Market value of common shares;

PS = Market value of preferred shares;

DEBT = Accounting value of current liabilities;

AT = Accounting value of total Assets;

MVE is the product of a firm’s share price and the number of common stock shares outstanding, PS is the liquidating value of the firm’s outstanding preferred shares, DEBT is the value of liabilities, and TA is the book value of the total asset. Although, it’s not sure that such sample selection does not bias our results, the omitted firms do not appear to be different from the included ones in any observable respect. The final sample consists of 197 firms.

Class (Dummy) = One-classing: Common Shares, Dual-Classing = Common shares + Preferred shares (one class = 1; dual class = 0);

TSC = ((Common + Preferred share)/Total shares) of controlling shareholder;

SIZE = Log (Asset);

ROE = Net Income/Shareholders’ Equity;

DR (Debt Ratio) = Liabilities/Shareholders’ Equity

YEAR (Observation year) = 2010/2011/2012/2013/2014 (5 years).

Panel data method is appropriate to measure during 5 year observations, with equation option fixed cross-section in effects specification and white cross-section coefficient covariation method in EVIEW7. White's "heteroscedasticity-consistent" standard errors have been used in order to improve the efficiency of estimators and reduce other possible heteroscedasticity problems.

The main purpose of this research is to verify if there are some differences of firm value between one class companies and dual class companies in accordance with the assumption of agency theory which is the conflict of interest between major shareholder and minor shareholders (Jensen & Meckling, 1976), and expropriation can be promoted by separation of cash-flow rights and ownership rights, for this reason, dummy “0” for dual class companies are adapted because these companies are expected to have inferior result than those of one classing. Also, others variables such as ROE, company size, debt ratio are used to control other environments in a proper way to retrieve the data.

The descriptive analysis of research regarding dependent variables and independent variables and control variables are done. Considering mean, median, maximum, minimum, standard deviation, Jarque-Bera with the probability which verifies the data are in normal distribution. Table 2 shows the statistics summary of variables which are used for the regression to evaluate the level of dispersion.

Table 2 - Descriptive analysis of variables

Classifications |

Variables |

Dummy |

Mean |

Median |

Maximum |

Minimum |

Std. Dev. |

Jarque-Bera |

Probability |

Tobin´s Q |

Dependent |

No |

1.192,000 |

1,042 |

5,917 |

0,213 |

0,597 |

9,864 |

0,000 |

Class |

Independent |

Yes |

0,703 |

1,000 |

1,000 |

0,000 |

0,457 |

212,000 |

0,000 |

TSC |

Control |

No |

0,415 |

0,402 |

0,900 |

0,029 |

0,168 |

19,000 |

0,000 |

Debt Ratio |

Control |

No |

1,627 |

1,011 |

6,000 |

-8,658 |

3,238 |

750,524 |

0,000 |

Size |

Control |

No |

6,246 |

6,251 |

8,215 |

4,534 |

0,671 |

8,000 |

0,019 |

ROE |

Control |

No |

0,007 |

0,054 |

6,093 |

-7,611 |

0,612 |

213,000 |

0,000 |

Class (Dummy) = One-classing: Common Shares, Dual-Classing = Common shares + Preferred shares (one class= 1, dual class = 0),

TSC = ((Common + Preferred share)/Total shares) of controlling shareholder, SIZE = Log (Asset), ROE = Net Income / Shareholders’ Equity

DR (Debt Ratio) = Liabilities / Shareholders’ Equity.

The variables using for the estimation of model shows different dispersion. Standard deviation of ‘Share’ (Independent) is minimum (0,457) and control variable ‘Debt Ratio’ has the highest value of standard deviation (3,238). The general proportion between mean and median, relationship with standard deviation are not elevated in any variables.

Jarque-Bera indicates any variables other than ‘size’ have normal distribution, these results explain that these variables not violate the assumptions of linear regression model, it’s impossible to realize the test of hypothesis or forecast.

In the beginning we put the CSC (Common share ratio of controller) in the regression, but, for the correlation test in Eviews shows strong correlation with TSC (Total common & preferred share % of Controller), only TSC is adopted the regression model. After descriptive analysis of variables, application of multi-collinearity regression model with panel data with OLS method, multi-collinearity test is done to align with the hypothesis which I research (Table 3).

Table 3 - Correlation between variables

|

Tobin's Q |

Share |

TSC |

Debt Ratio |

Size |

ROE |

Tobin's Q |

1 |

|||||

Class |

-0,1215 |

1 |

||||

TSC |

-0,16145 |

0,1589 |

1 |

|||

Debt Ratio |

-0,04307 |

-0,09749 |

-0,08909 |

1 |

||

Size |

0,04368 |

-0,25168 |

-0,32699 |

0,03168 |

1 |

|

ROE |

0,08241 |

0,00268 |

0,00364 |

-0,41702 |

0,05178 |

1 |

Class (Dummy) = One-classing: Common Shares, Dual-Classing = Common shares + Preferred shares (one class= 1, dual class = 0),

TSC = ((Common + Preferred share)/Total shares) of controlling shareholder, SIZE = Log (Asset), ROE = Net Income / Shareholders’ Equity

DR (Debt Ratio) = Liabilities / Shareholders’ Equity.

The correlation test with variables, there are no variable which exceed 0,6 which indicates strong relationship with each other by the assumption of Callegari Jacques (2003). Also, have VIF (Variance Inflation Factors) test, but, no observation over value of 10, and the result of this test, none of variables are over 2,00 (Table 4).

Table 4 - VIF

Variables |

Coefficiente Variance |

Centered VIF |

Class |

0,001615 |

1,09 |

TSC |

0,012594 |

1,14 |

Debt Ratio |

0,000037 |

1,24 |

Size |

0,000816 |

1,18 |

ROE |

0,001017 |

1,22 |

C |

0,043106 |

|

Regarding the heteroscedasticity, using white-test method (H0: homoscedasticity; H1: heteroscedasticity), I treat the data with white-cross section correlation matrix, and test the autocorrelation with Breusch-Goodfrey (H0: no existence of autocorrelation; H1: Existence of autocorrelation) and also with Durbin-Watson. However, Durbin-Watson, shows autocorrelation between data, when I try to fix this problem nearly differences to correct the autocorrelation problem worsened the results of the estimation. In the final model the Durbin Watson test was marginally in the gray zone and it’s finally inside the normal distribution.

For the determination of panel data estimation, for the adaptation of fixed or random effects, Jensen & Webster (2008) provide an example of this approach by estimating company-level fixed effects for a large stock market panel data set of firms, and when we cannot consider the observation as random extract from grand population such as analysis of companies in stock, the fixed effects are recommended.

Panel data is not balanced for the factors which some companies are not present at all time series, and, multi-collinear method regression, fixed effects with white-cross section coefficient covariance result are used for the estimation of equation. In the table 5, the regression results shows that of one classing companies are positive relation to Firm value than dual classing company by 5,5% positive coefficient estimate with 5% significance level. This is consistent with the hypothesis for the research model.

Table 5 - Regression result

Classification |

Variables |

Coefficients |

Std. Error |

t-Statistic |

Probability |

Independent |

Class |

0,05519 |

0,0274 |

2,0145 |

0,0443** |

Control |

TSC |

-0,11266 |

0,16011 |

-0,70363 |

0,4818 |

Debt Ratio |

0,00062 |

0,00151 |

0,40599 |

0,6848 |

|

Size |

-0,30985 |

0,08641 |

-3,58583 |

0,0004*** |

|

RPE |

0,01362 |

0,01152 |

1,18264 |

0,2373 |

|

c |

3,14466 |

0,54803 |

5,73812 |

0,0000*** |

|

Parameters of model |

Independent Var. |

Tobin´s Q |

Hausman Test |

0,0000*** |

|

Observ. Number |

1114 |

Adjusted R2 |

0,7555 |

||

Year Effect |

S |

DW Test |

1,3532 |

||

FE/AE |

FE |

Prob. (F-Statistic) |

0,0000 |

Class (Dummy) = One-classing: Common Shares, Dual-Classing = Common shares + Preferred shares (one class = 1, dual class = 0),

TSC = ((Common + Preferred share)/Total shares) of controlling shareholder, SIZE = Log (Asset), ROE = Net Income / Shareholders’ Equity.

DR (Debt Ratio) = Liabilities / Shareholders’ Equity. The significance of variables are *** 1%, **5%, and *10%.

The regression result shows that the difference of firm value exists between one-classing and dual-classing companies by 5,5% with 5% significance level of P-value. And one-classing companies have positive influence than dual-classing companies with other control variables are maintained. This result is aligned with our assumption of agency theory that separation of ownership and cash-flow brings less firm value due to expropriation.

According to agency theory, the separation of voting right and cash-flow is happened in LCGs, as companies which have strong controllers displays a gap between ownership and control by dual classing mechanism, even, they may have less agency cost with blockholder concept with concentrated capital structure, but they also have stronger incentive and possibility for expropriation (Morck et al, 1988) by LCGs, and it will affect more negative results to dual classing companies than one classing companies and it finally affects the firm value.

For our regression results, the theory is consistent with the hypothesis of this research I expected, and, the conflict of interest which is not the one between corporate managers and shareholders but rather between controlling shareholders and minority shareholders (Jensen & Meckling, 1976; Maury et al., 2002) bears an agency cost of monitoring includes more than just measuring or observing the behaviour of the agent, which is more probably generated by more excessive voting rights than cash-flow lights. And this case, Lee (2010) argued that the empirical result of execution of excessive voting right than dividend rights will devaluate the firm value due to the invasion of minority shareholders’ right by the companies of LCGs.

This study analyze the separation of control and ownership impact the firm value comparing with the companies only have common stocks especially targeting the LCGs in Korean with the definition of KFTC. And, we find out some differences of firms between them which are consistent with the hypothesis based on Agency theory.

Analyzing T-test result from 2010 to 2014, we find out separation of ownership and control impacts the firm value and other control variables are not so significantly related with other variables. Even, this empirical research cannot explain what is the main reasons of difference of firm value by dual classing, but, if we can infer from Agency theory, the separation of ownership and control, LCGs have the incentives to expropriate with cash-flow rights (Jensen & Meckling, 1976) and entrench the right of minority shareholder.

Claessens et al. (2000) notified the significant level of differences exist between voting right and cash-flow right, one of the main characteristic of Koran governance structure, and, Lee (2010) also mentioned that we link corporate governance issue with agency problem with the relation between ownership and corporate control of Korean companies.

Up to now, many cross-country researchers like La Porta et al. (1999), Claessens et al. (2000) treated expropriation to minority shareholders Korean LCGs as perspectives using pyramid and cross-shareholding mechanism, but, this research are observing at the standpoint from the another aspect by separation of control and ownership with issuance of preferred shares.

Based on Agency theory, it’s not only LCGs, or Korea, but, also many countries use dual classing scheme when controlling shareholders need cash-flow without losing voting right, but, minority shareholders are being entrenched their rights with this mechanism, even La Porta et al. (2000) emphasized the protection of investor’s right for the potential shareholders and creditors finance firms because their rights are protected by the law. These outside investors are more vulnerable to expropriation, and more dependent on the law.

However, based on the research results dual classing companies of LCGs have less firm value than those of dual classing, so, for someone who is looking for the chance in Korean Stock Market (KOSPI) to buy shares of LCGs, he or she can reduce the risk of being entrenchment by expropriation by not buying the shares of dual classing companies.

Almeida, Heitor, Park, Sang Yong, Subrahnamyam, Marti G., & Wolfenzon, Daniel. (2010). The structure and formation of business groups: Evidence from Korean Chaebols. Working Paper, National Bureau of Economic Research.

Bebchuk, Lucian Arye, Kraakman, Reinier, & Triantis, George G. (2000). Stock Pyramids, Cross-Ownership, and Dual Class Equity The Mechanisms and Agency Costs of Separating Control from Cash-Flow Rights. Publisher: University of Chicago Press.

Berle, A. A., & Means, G. C. (1932). The modern corporation and private property. New York: The Macmillian.

Chang, Sea Jin. (2003). Ownership Structure, Expropriation, and Performance of Group Affiliated companies in Korea. Academy of Management Journal, 46 (z), p. 238-253.

Chung, Kee H., & Stephen, W. Pruitt. (1994). A Simple Approximation of Tobin’s Q. Financial Management, 23 (3), p. 70-74.

Claessens, S., Djankov, S., & Lang, L. H. P. (2000). The separation of ownership and control in East Asian. Journal of Financial Economics, 58 (1), p. 81-112.

Fama, Eugene F. (1980). Agency Problems and the Theory of the Firm, The Source. Journal of Political Economy, 88 (2), p. 288-307.

Gibson, M. (2003). Is Corporate Governance Ineffective in Emerging Markets? Journal of Financial and Quantitative Analysis, 38 (1), p. 231-250.

Jensen, Michael C., & Meckling, William H. (1976). Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure. Journal of Financial Economics, 3 (4), p. 305-360.

Jensen, Michael C. (1986). Agency costs of free cash flow, corporate finance and takeovers. American Economic Review, 76 (1), p. 323-329.

Johnson, S., Boone, P., Breach, A., & Friedman, E. (2000). Corporate governance in the Asian financial crisis. Journal of Financial Economics, 58 (1), p. 141-186.

Kammler, Edson Luis, & Alves, Tiago Wickstrom. (2009). Analysis of the Explanatory Capacity of Investment Using Tobin’s “Q” in Brazilian Publicly Quoted Companies. Revista de Administração de Empresas – RAE, 8 (2), p. 1-18.

Kim, Byungmo, & Lee, Inmoo. (2003). Agency problems and performance of Korean companies during the Asian financial crisis: Chaebol vs. non-chaebol firms. Pacific-Basin Finance Journal, 11 (1), p. 327-348.

Kim, Hwa-Jin. (2014). Concentrated Ownership and Corporate Control: Wallenberg Sphere and Samsung Group, Law & Economics. Working Paper, University of Michigan.

La Porta, Rafael, Lopez-de-Silanes, Florencio, Shleifer, Andrei, & Vishny, Robert.

(1999). Corporate ownership around the world. Journal of Finance, 54 (1), p. 471-518.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R.. (2000). Investor protection and corporate valuation, Journal of Financial Economics, 58 (1), p. 3-27.

Lee, D. E., & Tompkins, J. G. (1999). A Modified Version of the Lewellen and Badrinath Measure of Tobin’s Q, Financial Management, 28 (1), 1-19.

Lee, Seungtae. (2010). The effect of Wedge on Business Performance in Large Business Group. Korea International Accounting Review, 32 (8), p. 32-56.

Lemmon, Michael L., & Lins, Karl V. (2003). Ownership Structure, Corporate Governance, and Firm Value: Evidence from East Asian Financial Crisis. Journal of Finance, 48 (4), p. 1-25.

Lins, Karl V. (2003), Equity Ownership and FirmValue in Emerging Markets. Journal of Financial and Quantitative Analysis, 38 (1), p. 20-33.

Maury, C., Benjamin, A., & Pajuste, Anete. (2002). Controlling Shareholders,

Agency Problems, and Dividend. LTA, 1 (2), p. 15-45.

Morck, Randall, Shleifer, A., & Vishny, R.W. (1988). Management ownership and market valuation: An empirical analysis. Journal of Financial Economics, 20 (1), p. 293-315.

Morck, Randall. (1995). The Economics of Concentrated Ownership. Canadian Business Law Journal, 26 (1), p. 63-85.

Moskalev, Sviatoslav, & Park, Seung Chan. (2010). South Korean Chaebols and Value-Based Management. Journal of Business Ethics, 92 (1), p. 49-62.

Murillo, David, & Sung, Yun-dal. (2013). Understanding Korean Capitalism: Chaebols and their Corporate Governance. ESADEgeo: Center for Global Economy and GeoPolitics.

Shin, H., & Stulz, R. (2000). Firm Value, Risk and Growth Opportunities. National Bureau of Economic Research, 7808 (1), p. 1-78.

Yulchon, Attorneys at Law. (2011). Summary of Revision of new Commercial Act.

Zingales, Luigi. (1994). The Value of the Voting Right: A Study of the Milan Stock Exchange Experience. The Review of Financial Studies, 7 (1), p. 125-148.

1. Doutorando em Ciências Contábeis – Universidade do Vale do Rio dos Sinos – Endereço: Av. Unisinos 1550, São João Batista, São Leopoldo, RS, Brasil. Telefone: (51) 3081-8650. E-mail: brad.kim421@gmail.com

2. Doutorando em Ciências Contábeis – Universidade do Vale do Rio dos Sinos – Unisinos. Docente da Universidade de Passo Fundo – UPF. Endereço: BR 285 - Km 292, Passo Fundo, RS. Telefone: (54) 9163-1744. E-mail: mtadeugrando@bol.com.br

3. Doutorando em Ciências Contábeis - Universidade do Vale do Rio dos Sinos – Unisinos. Docente da Universidade Federal de Viçosa – Campus de Rio Paranaíba. Endereço: Rodovia MG 230, Km 7 – Rio Paranaíba, MG. Telefone: (34) 3855-9300. E-mail: acbrunozi@yahoo.com.br