HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN

HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN Espacios. Vol. 37 (Nº 25) Año 2016. Pág. 15

Priscila Rezende da COSTA 1; Marta PAGÁN MARTÍNEZ 2; Lucimar da Silva ITELVINO 3

Recibido: 22/04/16 • Aprobado: 23/05/2016

ABSTRACT: Structuring an overview of the innovation stages and the analysis of potentiate organizational resources of innovative solutions are essential not only for understanding the innovator behavior of midsize companies, but for rising issues that may be useful for public policies to support innovation in the Brazilian average company. Given this background, the article sought to map the innovative profile of midsize companies. The results are shown and discussed in three topics: (a) the proposition of generic stages for innovation, (b) the characterization of midsize businesses and their innovation stages, and (c) interference of organizational resources in the innovation stages in these companies. |

RESUMEN: Estructurar una visión general de las etapas de la innovación y el análisis paa potenciar soluciones innovadoras son esenciales no sólo para entender el comportamiento innovador de las empresas de tamaño mediano, que pueden ser útiles para las políticas públicas para apoyar la innovación en la empresa media brasileña. Teniendo en cuenta estos antecedentes, el artículo pretende asignar el perfil innovador de las empresas de tamaño mediano. Los resultados se muestran y discuten en tres temas: (a) la proposición de etapas de innovación, (b) la caracterización de las empresas de tamaño mediano y su innovación de etapas y (c) la interferencia de los recursos organizacionales de la innovación en las empresas. |

The innovation concept has widened and the current challenge is not just the generation of innovations in products and processes, but the continuous search for innovative solutions both organizational as well as marketing. The innovative process analysis, previously focused only on the linear generation of new knowledge, has also suffered many changes and today covers the development of open and dynamic ways to produce, implement, distribute and share knowledge, skills and technologies.

Although not so social and economic emphasized such as micro, small and large companies, the fact is that midsize companies ventured into challenging ways of Brazilian innovation and examples, and as reference we may highlight: Bematch, the Fotosensores, the Reivax and Opto. Therefore, the structuring of an overview of innovation stages of and analysis of potentiator organizational resources for innovative solutions are essential not only for theoretical and empirical understanding of this type of business, but for raising issues which may be useful for public policy to support innovation in the Brazilian average company.

Given this scenario, the study aims to map the innovative profile of midsize companies in Brazil. Specifically, it will seek offer generic stages for innovation, (b) characterize the studied midsize companies and their innovation stages, and (c) verify if organizational resources affect innovation stages of these companies.

It is important to clarify that the term "innovation" adopted in this work involves (a) the development of a new product or significant improvement of an existing product (2) implementation of a new or significantly improved method of production or distribution, and (3) implementing a new organizational method, involving significant changes in internal and external management practices (OECD, 2005). The term "midsize businesses", on its turn, refers to industrial enterprises (classification CNAE the Brazilian Institute of Geography and Statistics - IBGE) with 100-499 employees (IBGE classification). Finally, the term "organizational resources" deals with standards, practices and management practices that coordinate the tangible and intangible resources of a company.

To understand the historical evolution of the theme "innovation", it is useful to rescue the essence of neoclassical and evolutionary theories. The neoclassical school is aligned with the prospect of unlimited rationality to human behavior and the expected balance of economic relations. The innovation would be a natural consequence of a mechanical process, homogeneous, linear and natural in the course of productive activity, i.e., internal to the firm's production system, whose result is the depreciation in the average production cost (Nelson and Winter, 1977; Dosi, 1982). In contrast, the evolutionary school is marked by the flexibility of the rationality expectation and by ignoring maximizing objectivity of results. Back to the dynamic, cumulative and non-linear character of change process, where there is recognition of a dynamic competition between the productive agents (Kline and Rosenberg, 1986; Winter, 1988; Lundvall, 1992). So if the classical thought turned to the firm's innovation, the evolutionary theory was concerned to investigate the realities of business and understand their learning and innovation capabilities; their strategies, and activities of adaptation, integration, and reconfiguration of skills and resources (Bell and Pavitt, 1993; Teece and Pisano, 1994; Freeman, 1994 and 1995; Gava, 2007).

In an effort to present a historical overview of the subject innovation, it is relevant to cite the contribution of the economist Joseph Schumpeter who, for the first time, put innovation as the main source of dynamism in the capitalist system. Schumpeter (1988) showed the relationship between technological innovation and long cycles of economic growth arising from increased investment following the introduction of the most significant innovations. For this author, capitalism was developing due to stimulating the emergence of entrepreneurs, i.e. capitalists or creative inventors who were responsible for the prosperity wave in the system. Also according to the author all the innovation implies a "creative destruction". The new is not born from the old, but beside it, beating it. Thus, innovations are characterized by the introduction of new and more efficient productive combinations or changes in production functions, which constitute the fundamental impulse that drives and keeps the capitalist engine in motion.

Besides the historical background of the subject innovation, it is necessary to discuss the management of innovation process and to this end, three basic phases are explored: (a) "concept phase", in which new ideas are found, (b) "development phase", in which ideas are turned into projects, and (c) "business / marketing phase", in which projects are transformed into new businesses. Each phase of the innovation process requires different tasks of management and administration. In the concept phase, the main managers' task is to create a favorable climate to innovation by using the cultural approach. At the development stage, the main task is the creation and definition of proper mechanisms to enable the creation and development of projects. In the business / marketing phase, it is suggested to follow the classical approach: planning, action, and control. Through this division, it becomes clear that managing the innovation process is actually managing paradoxes. The complete innovation process requires good management of all stages, which often conflict among themselves. The way companies manage the innovation process and its paradoxes leads to two approaches to the innovation process, the innovation closed approach and innovation open approach to (Chesbrough, 2003; Docherty, 2006; Van Der Meer, 2007; Engeroff and Balesrin, 2008).

In the innovation closed approach, control over the innovation process is essential. This formalization often makes use of the Innovation Funnel and the model stagegate (Cooper, 1992; Tidd et al., 2003). This system can be exemplified by a funnel of stages in the innovation process, among which there are gates which try to filter out potential "losers" projects. According to Cooper (1992) and Besemer (2000), the main criteria for successful innovation used in stage-gates are: novelty, feasibility and effectiveness. The funnel has as inputs the ideas, turning into projects, followed by the transformation of some projects into business. The success is narrowly defined as a new product, technology, or markets for the company. This innovation closed approach is essentially focused on the internal capabilities of the organization, but only the internal R & D may elapse stages of the innovation funnel (Van Der Meer, 2007; Engeroff and Balestrino, 2008).

Innovation open approach, itself, is based on the use of internal or external paths to continue the developing of new technologies. This approach requires a different way of thinking and its ways of use can be numerous, it can be collaborative or barter, such as relationships with other companies, relationships with universities and research institutes, relations with customer, relationships with suppliers, importing and exporting ideas. The main convections of open innovation are: it is necessary to work with smart people inside and outside the company, external R & D can create significant value and internal R & D is necessary to attract and effectively incorporate this value to the company, it is not absolutely necessary to internally develop research to profit with it, build a good business model can be better than being the first company to put an innovation to market, the gain comes from the use of innovation projects and is recommended to buy and share ideas to leverage the business model (Chesbrough, 2003; Van Der Meer, 2007; Engeroff and Balestrino, 2008; Asakawa et al., 2010; Gassmann et al., 2010; Chiaroni et al., 2010; Chiaroni et al., 2011; Chesbrough et al., 2008).

To conclude the discussions on the innovation concept and management, it is important to say that Brazilian companies, whether small, medium or large, will increasingly have to seek not only for innovative products and processes but also for dynamic creation and renewal of innovative solutions using and sharing ideas inside and outside the company who are scattered worldwide. The challenge focuses, therefore, to assess how to manage open innovation and closed innovation dynamically.

The resource-based view (RBV) seeks to link sustainability of competitive advantage and exploitation and development of tangible and intangible resources, and its theoretical foundations are derived from Penrose (1959), Demsetz (1973), Wernerfelt (1984), Rumelt (1984 and 1987), Lippman and Rumelt (1982), Barney (1986, 1991 and 1995), Dierickx and Cool (1989), Reed and DeFillippi (1990), Prahalad and Hamel (1990), Teece (1980, 1982, 1986 ), Peteraf (1993), Teece, Pisano and Shuen (1997) and others.

Generally, RBV suggests that sustainable competitive advantage requires, beyond the exploitation of resources and external and internal capabilities, development (investment, renovation and leveraging) of new resources and capabilities (Prahalad and Hamel, 1990, Collis and Montgomery, 1995; Teece et al., 1997) or the skill combination (competence / abilities), and unique resources (essential / dynamic) which build, maintain and enhance the distinctive and hard to imitate advantages. Thus the interest of the Resource Based View is to link the understanding of competitive advantage and competitive advantage dynamics to the resource characteristics, and how these characteristics change over the time (Foss, 1997).

Among the several resource classifications, Barney (1991) defines them as all assets, capabilities, organizational processes, firm attributes, information, knowledge, etc, controlled by the company to enable it to develop and establish strategies to increase its efficiency and effectiveness, being grouped into three main categories: (1) physical resources such as plants and equipment, (2) human resources, which covers the entire technical team and also the company's executives and, (3) organizational resources, composed by the rules and routines that coordinate human and physical resources in the company. The author also lists four necessary attributes or conditions related to each other for a company to maintain a sustainable competitive advantage, namely: the resource must be valuable, must be rare among current and potential competitors of a company, must be imperfectly imitable, and there cannot be strategically equivalent substitutes for these resources, which are valuable, but rare or imperfectly imitable.

It is also important to point out in the RBV theory, the set especially relevant of capabilities in the company called "dynamic capabilities", whose representative authors were Teece et al. (1997), Prahalad and Hamel (1990), Dierickx and Cool (1989), Amit and Sshoemaker (1993), Sanchez (1996), among others. According to Teece et al. (1997), dynamic capabilities refer to the ability to renew competences to achieve congruence with the changing business environment. The term capacity emphasizes the role of strategic management to adapt, integrate and reconfigure internal and external organizational skills, resources and functional competences to meet the demands of a changing environment (Bruneel et al., 2010; Carayannis and Campbell, 2009; Berghe and Guild, 2008). In order to understand the determining factors for dynamic capabilities in an enterprise, the authors present three categories that involve:

Finally, it is worth noting that resources, particularly those focused on knowledge, innovation, technology and management, will provide competitive elements in the future, just as they already are at present, since they are guaranteed the necessary conditions for its operation and renewal. In other words, resource and capacity development is essentially a challenging task and requires a deliberate effort of permanent revitalization and continuous learning for the company (Wassmer, 2010; Porto et al., 2010; Petruzzelli, 2011; Hoang and Rothaermel, 2010).

The research was triangular sequential (Lima, 2008), since they were adopted (1) the qualitative approach with interviews and content analysis and (2) the quantitative approach using the method of gathering and bivariate and multivariate statistical. According to Lima (2008) triangulation can be defined as a research strategy based on sequential or simultaneous use of qualitative and quantitative approaches to investigate the same phenomenon attempting to validate more accurate interpretations and reach a broader and deeper understanding of the investigated reality. The survey also was descriptive and Gil (2002) states that his main goals are the characteristic description of a given population or phenomenon or establishment of relationships between variables.

The method used was survey. According to Kerlinger (1980, apud Porto, 2000, p. 79) surveys seek to determine the incidence and distribution of people population's characteristics and opinions, obtaining and studying the characteristics and opinions of small samples and presumably representative of such populations.

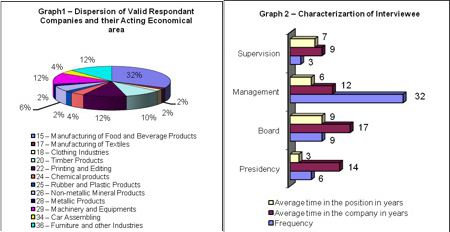

The population was represented by industrial companies cataloged at the database of "Gazeta Mercantil" which had at least 100 and no more than 5,000 employees, in a total of total of 1414 companies. From this population, the study selected economic sectors with the highest concentration of companies and which had a match with the classification CNAE fiscal 1.1 of IBGE. It counted to a total of 20 sectors and in each one, 25 enterprises were randomly selected. From these strata1 and in order to meet the specific focus of this work, sampling adjustments were made, or considered as valid only those respondent companies that had at least 100 and no more than 499 employees. Thus it is effective to a survey of 50 midsize companies, scattered in 12 different economic sectors (figure 1).

The data used in this study can be classified into primary and secondary. The primary data were collected through semi structured interviews with managers and directors by phone or via Skype (Figure 1). The secondary ones were collected in proceedings, journals and databases of "Gazeta Mercantil" and IBGE. It should be noted that to construct the interview guide, the base used was the studies of Bloom and Van Reenen (2007) on the adoption of managerial practices in foreign companies.

Figure 1. Profile of Companies (Graph 1) and Characterization of interviewee (Graph 2)

Data from: Elaborated by the authors.

The great advantage of collecting primary data in this study is that the interviewer examined the of those interviewee's responses (content analysis) and later defined the company's score for each type of organizational resource using a 5-point scale, where 1 represented the highest incipient level of application / presence of organizational resource, the intermediate level was 3, and 5 was the highest level. Besides an intensive training methodology, the interviewers had a reference to the definition and exemplification of incipient, intermediate and advanced levels for each organization resource assessed, which minimized the biases of interpretation for the definition of scores. It is worth noting that one interview was held by company, most of them were recorded and the respondents also reported the highlights points of each response on the basis of the data compiler.

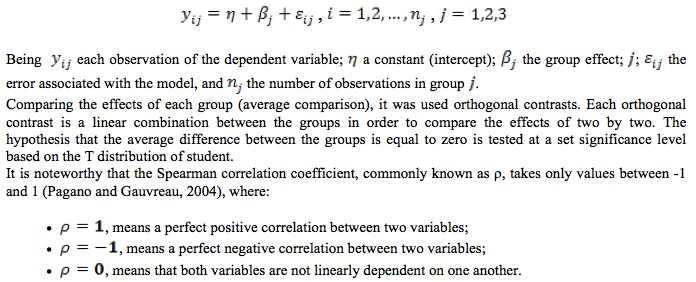

Besides content analysis, it was after estimated the correlation coefficient after Spearman and variance and cluster analysis have been done (Hair et al., 2005). To this end, the software SPSS (Statistical Package for Social Sciences) version 17.0 was used.

The analysis of variance (ANOVA) is based on partitioning the total variance of a given response (dependent variable) into two parts: the first one due to the regression model (that is, between groups) and the second one due to the residues (errors) (within groups). The higher is the first over the second, the greater the evidence of difference between the group's averages. This model has the assumption that their waste has normal distribution with average 0 and constant variance (Montgomery, 2000).

The model is given by:

Cluster analysis was based on the hierarchical method (Härdle and Simar, 2007), whose focus was the assignment of a data set into subsets called clusters. Based on the distance between the observations for the variables V1 to V12, the formed groups (clusters) contain similar observations in some characteristics (variables).

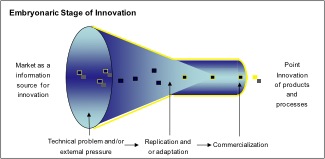

Three stages of innovation are presented, the embryo, the intermediate and mature. Varied innovation concepts and processes as (1) company innovation versus innovation between and for companies, (2) linear process versus dynamic process (3) homogeneous actions versus entrepreneurial actions, (4) closed innovation versus open innovation and (5) resource stock as a competitive advantage versus dynamic capabilities to innovate and learn to ensure the sustainability of the business were used in an adaptive form (Barney, 1986, 1991 and 1995; Bell and Pavitt, 1993; Berkhout et al., 2006; Chesbrough, 2003; Docherty, 2006; Dosi, 1982; Eisenhardt and Martin, 2000; Engeroff and Balestrino, 2008; Etzkowitz, 2004; Freeman, 1994 and 1995; Gava, 2007; Kline and Rosenberg, 1986; Leydesdorff et al., 2006; Leydesdorff and Meyer, 2006; Lundvall, 1992; Nelson and Winter, 1977; Penrose, 1959; Peteraf, 1993; Pisano, 2000; Prahalad and Hamel, 1990; Teece, 2007; Teece et al., 1997; Teece and Pisano, 1994; Van Der Meer, 2007; Winter, 1988).

In the embryonic stage the fundamental innovation strategy is the realization of technological benchmarking and monitoring of market trends. The innovation process at this stage is linear and non-systematic, in which knowledge and technology available in the market are replicated and / or adapted internally to solve a technical problem or by external pressure, generating timely product and process innovations (Figure 2).

Figure 2. General Structure for innovation and Embryonic Stage.

Source: Adapted from Chesbrough (2003).

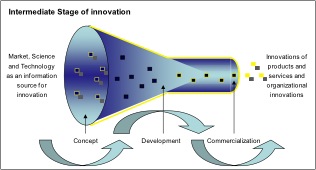

In the intermediate stage the innovation strategy is the prevalent technological and development differentiation of products and processes. At this stage the innovation process is mixed and closed, it's a logical sequence, but not necessarily continuous, whose innovation-inducing information raise when monitoring the market, science and technology, and the concept development and marketing phases are dynamically processed by the contact of business areas that are involved in the innovation process, resulting in both product and process innovations and organizational innovations (Figure 3).

Figure 3. General Structure for innovation and Intermediate Stage.

Source: Adapted from Chesbrough (2003).

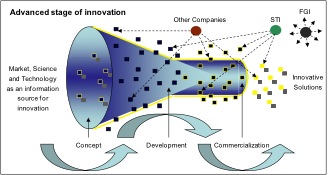

In the mature stage the imperative innovation strategy is the search for technological leadership and the systematic development of innovative solutions, such as new or upgraded products and processes, new organizational practices, and the emergence of new business. The innovation process is interactive and open, i.e., dynamic interactions occur within companies, among individual companies and with science and technology institutions (SCT), through legal and capital support of financial institutions and government (FIG), mentioning the current state of science, technology and market permeate the concept, development, and commercialization phases of innovation (Figure 4).

Figure 4. General Structure for innovation and Mature Stage.

Source: Adapted from Chesbrough (2003).

Besides the embryonic, intermediate, and mature stages, there are, in fact, many variations on innovation strategies and actions that really are considered and incorporated by midsize businesses. Therefore, the intention is not to suggest optimal conditions for innovation in the average company, if possible and feasible, but to offer indicatives that may characterize the current state of innovation of these companies and at the same time suggest pathways that may lead them to a future more robust stage in terms of innovation. Another relevant point is that many midsize companies should not necessarily readily incorporate, wholly or partially, the precepts of the mature stage, as the intermediate stage, or even the embryonic one would be sufficient to meet their momentary needs. The challenge therefore is to characterize the current stage of innovation, and then dynamically adjusts to future changes in the external and internal environment, which may require only occasional or exhaustive search for more robust stages of innovation.

The fifty companies studied are scattered in twelve different economic sectors, and 32% are concentrated in manufacturing of food and beverages products, 72% are located in the South and Southeast, 88% are privately held, employs 244 employees on average; have on average 28 direct competitors, 38% were founded in the 70's and 80's, have an average of four directors, employ an average of only one woman in management positions, have, in most cases, only one production unit, 54% are family businesses, which employ an average of two family members, and whose CEO is a family member in 85% of the cases, usually the second generation (43%).

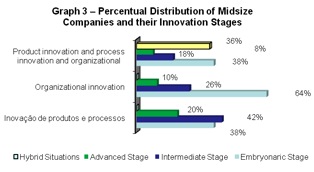

By adopting the precepts of the innovation stages (see item 4.2), it was found that for product and process innovation, most companies (42%) are in the intermediate stage (score 3) for organizational innovation, the concentration is higher (64%) in the embryonic stage (score 1 and 2), and considering both types of innovation, 38% of companies are in the embryonic stage. As for the mature stage (score 4 and 5), the largest concentration (20%) was found in product and process innovation. It is important to mention that quite a few companies are in hybrid situations, i.e. distinct stages on product and process innovation and on organizational innovation (Figure 5).

Figure 5. Graph Percentual Distribution of Midsize Companies

Source: Elaborated by the authors.

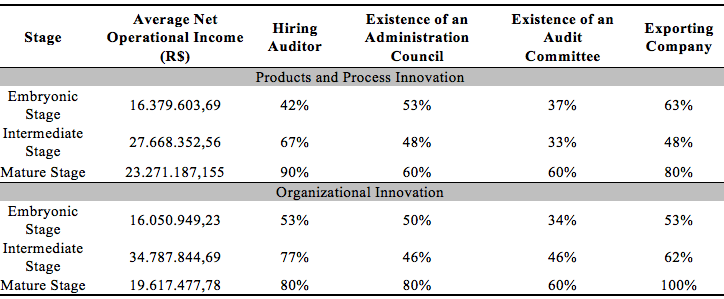

By analyzing the stages of innovation focusing on some organizational aspects, such as net operating income, hiring auditor, the existence of a supervisory and a director board, and the presence of export activity, it is evident that they tend to be more significant in the mature stages both for product and process innovation and for organizational innovation, and there is also an upward movement, i.e. as the evolving stages, the number of companies which export, contract auditing and have a supervisory and administration board is more significant (Table 1).

Table 1. Innovation Stages and Organizational Aspects.

Source: Elaborated by the authors.

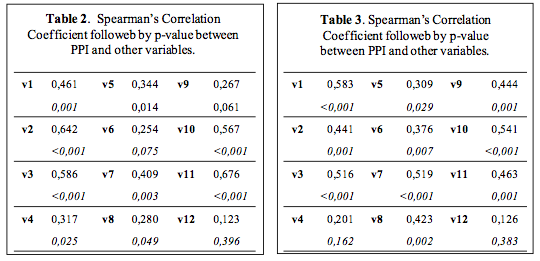

The central hypothesis of this paper is: H0 = organizational resources do not interfere in the innovation stages of midsize companies. To test this hypothesis it was calculated (a) the correlation of variables, identified (b) the difference of the averages of embryonic, intermediate and mature stages for in product and process innovation, and organizational innovation, and (c) three clusters were identified. The used variables were product and process innovation (FFI), organizational innovation (OI), adoption of modern production techniques (v1), improvement of production process (v2); monitoring the production performance (v3); promotion of professional with good performance (v4); attraction of human capital (v5); retention of human capital (v6), customer orientation (v7); relationship with interest groups (v8); social and environmental sustainability (v9) strategic planning (v10); practices of financial management (v11); and organizational levels (v12). From v1 to v12 It is seem the organizational resources, as PPI and OI refer to two types of innovation adopted in the workplace.

Table 2 and 3. Spearman´s Correlation Coefficient

Level of significance: * = 1%; ** = 5%; *** = 10%; NS = not significant

Source: Elaborated by the authors.

First, it was found through the p-value the existence of significant associations between innovation, both in products and processes as well as organizational, and organizational resources analyzed, except for variable v12, indicating that both types of innovation are not associated with the range of hierarchical levels in the midsize company. The association of professional advancement of talent (v4) and organizational innovation was not significant. As the coefficient of Spearman correlation, it was also found that the associations were more intense (between 0.4 and 0.6) in both types of innovation (IPPI and OI) for organizational resources linked to production (v1, v2 and v3), strategy (v7 and v10) and finance (v11) (Tables 2 and 3).

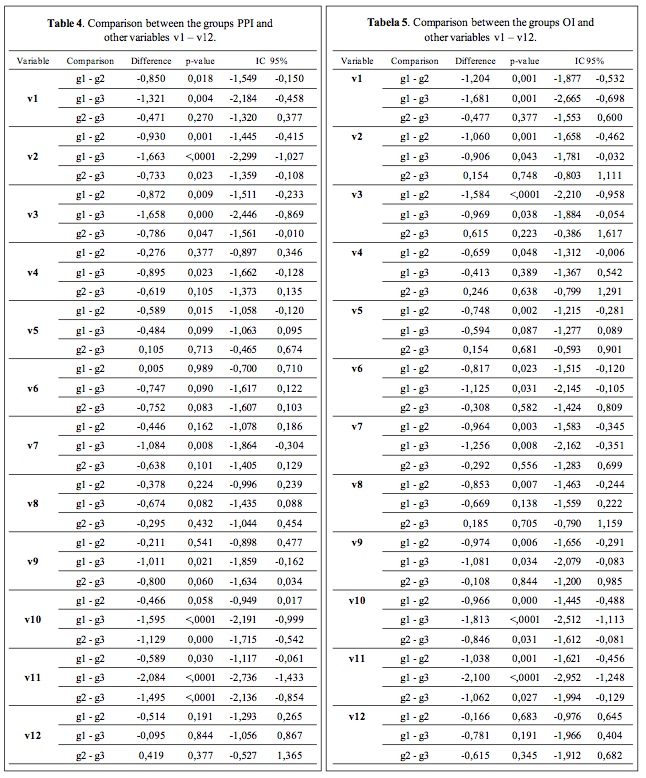

By analyzing the difference of representative groups' averages in the embryonic (G1), intermediate (G2) and mature (g3) stages, it was observed that the monitoring of production performance (v3), strategic planning (v10) and financial management (v11) are in fact the organizational resources that differ from the studied midsize companies as to their respective stages for the innovation both for products and processes (PPI) as the organizational (OI). It is noteworthy that the number of organizational levels does not differentiate the analyzed groups (g1, g2 and g3) in both types of considered innovation (PPI and OI) (Tables 4 and 5).

Specifically for the products and processes innovation (PPI) the production process improvement (v2) differentiated the groups analyzed, the adoption of modern production techniques (v1) and the attraction of human capital (v5) not only differentiate the intermediate group (G2) from the mature group (G3) and the retention of human capital (v6) and social and environmental sustainability (v9) did not differentiate the embryonic group (g1) from the intermediate group (g2). The promotion of professional performance (v4), customer orientation (v7) and the relationship with interest groups (v8), differentiated only the embryonic group (g1) from the mature group (G3) (Tables 4 and 5).

To organizational innovation (OI) the adoption of modern production techniques (v1), production improvement process (v2), of human capital attraction (v5), human capital retention (v6), customer orientation (v7) and social and environmental sustainability (v9), did not differentiate only the intermediate group (g2) from the mature group (G3). The promotion of professionals with good performance (v4), and the relationship with interest groups (v8), differentiated only the embryonic group (g1) from the intermediate group (g2) (Tables 4 and 5).

Table 4 and 5. Comparison between the groups PPI and others variables (Table 4)

and Comparison between the groups OI and others variables (Table 5).

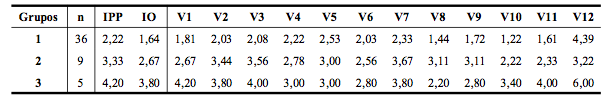

Table 6. Variable averages in the 3 forming groups

Source: Elaborated by the authors.

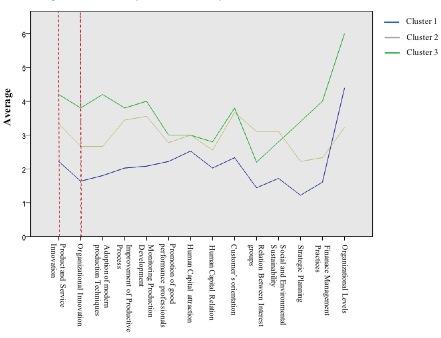

Figure 6. Variable averages in the 3 forming clusters

Source: Elaborated by the authors.

Regarding to the three clusters formed, it was found that the types of studied innovation (PPI and OI) and considered organizational resources (from v1 to v12) tend to be more expressive in the third cluster and there is also an upward trend on average from the first to the third cluster, with the exception of a few features, such as the attraction of human capital (v5), the relationship with interest groups and social and environmental sustainability (v9) (Table 6 and Figure 6). Another finding is that the number of companies decreased from the first to the third cluster and the products and processes innovation is more significant in the three formed clusters when compared to organizational innovation. If an association is established between the formed clusters, and the proposed innovation stages, it is seem that the first cluster is representative of the embryonic stage, the second one of intermediate stage, and the third one of the mature stage. Thus, one can infer that the embryonic cluster has the largest number of midsize companies, but it is the mature cluster that has the greatest robustness in terms of innovation and organizational resources. From the correlation results, ANOVA and cluster have to be rejected by conclude H0, i.e., organizational resources affect innovation stages in midsize businesses.

The innovative profile of studied midsize companies can be characterized by the intermediate stage for innovation in products and processes and the embryonic stage to the organizational innovation. This generally indicates that for product and process innovation, the prevalent strategy is the technological differentiation and development of products and processes; and the innovation process is mixed and closed. As for organizational innovation, fundamental strategy is the realization of technological benchmarking and the monitoring of market trends, and the innovation process is linear and non-systematic.

It is noteworthy that despite the embryonic and intermediate stages concentrate the largest number of midsize companies, is the mature stage that has the greatest robustness in terms of innovation and organizational resources, making it clear that organizational resources affect the innovation stages of medium size companies, especially for some features, such as adoption of modern production techniques (v1), improvement of production process (v2); monitoring of production performance (v3), customer orientation (v7) strategic planning (v10) and financial management practices (v11). In general, it is also clear that companies in the mature stage show higher values than companies at the intermediate level, which in turn prevails with higher values than companies in the embryonic stage.

Finally, one can infer that the midsize companies surveyed may seek certain strategies and actions should they decide or need to migrate to the mature stage and to combine both types of innovations, both product and process as the organizational. The first step is to understand that innovation is a dynamic, open and essentially composed of entrepreneurial actions, i.e. the phases of concept, development, and marketing are interactive and continuously influenced and even dictated, by the current state of market, technology and science. More pragmatically, this procedural logic can be implemented through strategies and internal and external actions, which are: market research and participation in fairs and technical and commercial events for exploring technology and understanding the market movement, monitor bank of patents, journals, and to participate in scientific and academic events to access knowledge in the state of art; internally encourage creativity and entrepreneurship, encourage teamwork and learning, promote the emergence of a continuous innovation culture, where the most important is to generate innovative solutions for the company and not, necessarily, by the company, seek for partners for development or research; incorporation of academic spin-offs and acquisition of technologies from universities; patent innovations, while attractive, license them, and so on.

As for future studies, it is possible to replicate the research performing detailed stratifications according to technological intensity of sector and geographical location of midsize companies, which could enrich the analysis and thus promote the proposition of sector and regional policies for innovation in average company. About the limitations of study, one can cite the relatively low number of valid cases, which made some multivariate tests that could enrich the result analysis, such as regressions and structural equations.

AMIT, R.P., & Schoemaker, J. H. (1993). "Strategic assets and organizational rent". Strategic Management Journal, 14, 33-46.

ASAKAWA, K., Nakamura, H., & Sawada, N. (2010). "Firms' open innovation policies, laboratories' external collaborations, and laboratories' R&D performance". R&D Management, 40 (2), 109-123.

BARNEY, J. B. (1986). "Strategic factor markets". Management Science, 32 (10), 1231-1241.

BARNEY, J. B. (1991). "Firm resource and sustained competitive advantage". Journal of Management, 17 (1), 99-120.

BARNEY, J. B. (1995). "Looking inside for competitive advantage". Academy Management of Executive, 9 (4), 49-61.

BELL, M., & Pavitt, K. (1993). "Technological accumulation and industrial growth: contrasts between developed and developing countries". Industrial and Corporate Change, 1 (2), 83-137.

BERGHE, L. V. D., & Guild, P. D. (2008). "The strategic value of new university technology and its impact on exclusivity of licensing transactions: An empirical study". Journal of Technology Transfer, 33, 91-103.

BERKHOUT, A. J. et al. (2006). "Innovating the innovation process". International journal of technology management, 34 (3), 390-404.

BESEMER, S. P. (2000). "Creative Product Analysis to Foster Innovation". Design Management Journal, 11 (4), 59–64.

BLOOM, N., & Van Reenen, J. (2007). "Measuring and Explaining Management Practices Across Firms and Countries". Quarterly Journal of Economics, 122 (4) 1365-1366.

BRAGA JUNIOR, S. S., & Santos, R. B. M. (2015). Environmental gains from the practice of reverse logistics retail supermarket. [Ganhos ambientais com a Prática da Logística Reversa no Varejo Supermercadista] Espacios, 36(5), 14.

BRAGA JUNIOR, S. S., Merlo, E. M., Freire, O. B. L., Da Silva, D., & Quevedo-Silva, F. (2016). "Effect of environmental concern and skepticism in the consumption green products in brazilian retail". Espacios, 37(2)

BRUNEEL, J., Este, P. D., & Salter, A. (2010). "Investigating the factors that diminish the barriers to university – industry collaboration". Research Policy, 39 (7), 858-868.

CARAYANNIS, E. G., & Campbell, D. F. J. (2009). "Mode 3 and Quadruple Helix : toward a 21st century fractual innovation ecosystem". International Journal of Technology Management, 46 (3/4), 201-234.

CHESBROUGH, H. W. (2003). Open innovation. Harvard Business School Press, Boston, MA.

CHESBROUGH, H., Vanhaverbeke, W., & West, J. (2008). Open innovation: researching a new paradigm. Oxford University Press.

CHIARONI, D., Chiesa, V., & Frattini, F. (2011). "Technovation The Open Innovation Journey: How firms dynamically implement the emerging innovation management paradigm". Technovation, 31 (1), 34-43.

CHIARONI, D., Chiesa, V.; & Frattini, F. (2010). "Unravelling the process from Closed to Open Innovation : evidence from mature, asset-intensive industries". R&D Management, 40 (3), 222-245.

COLLIS, D., & Montgomery, C. (1995). "Competing on resources strategy in the 1990s". Harvard Business Review, 118-128.

COOPER, R.G. (1992). "The NewProd System: The Industry Experience". Journal of Product Innovation Management, 2, 113–127.

DEMSETZ, H. (1973). "Industrial structure, market rivality and politic policy". Journal of Law Economic Organization, 16, 1-10.

DIAS, K. T. S., & Braga Junior, S. S. (2016). "The use of reverse logistics for waste management in a brazilian grocery retailer". Waste Management and Research, 34(1), 22-29. doi:10.1177/0734242X15615696

DIAS, K. T. S., & Junior, S. S. B. (2015). "The importance of environmental education in the implementation of reverse logistics retail". Turkish Online Journal of Educational Technology, 2015, 624-631.

DIERICKX, I., & Cool, K. (1989). "Asset stock accumulation an sustainability of competitive advantage". Management Science, 35 (12), 1504-1511.

DOCHERTY, M. (2006). "Primer on open innovation: Principles and practice". PDMA Visions Magazine, 30 (2), 13-17.

DOSI, G. (1982). The nature of the innovative process. In: Dosi, G. et al. (eds.), Technical change and economic theory. London: Pinter.

EISENHARDT, K. M., & Martin, J. A. (2000). "Dynamic capabilities: what are they?" Strategic Management Journal, 21, 1105–1121.

ENGEROFF, R.; & Balestrin, A. (2008). Inovação fechada versus inovação aberta: um estudo de caso da indústria de cutelaria. In: XXV Simpósio de Gestão da Inovação Tecnológica, 2008. Anais... Brasília: ANPAD.

ETZKOWITZ, H. (2004). "The evolution of the entrepreneurial university". International Journal of Technology and Globalisation, 1 (1), 64-77.

FOSS, N. J. (1997). "The Resource-Based Perspective: An assessment and Diagnosis of Problems, DRUID Working Paper 97-1". Copenhagen Business School, 14 (3), 133-149.

FREEMAN, C. (1994). "The economics of technical change". Cambridge Journal of Economics, 18, 463-514.

FREEMAN, C. (1995). Innovation in a new context. STI Review 15, OCDE.

GASSMANN, O., Enkel, E., & Chesbrough, H., 2010. "The future of open innovation". R&D Management, 40 (3), 213-221.

GAVA, R. (2007). Um Estudo sobre a Iniciativa de se constituir um Sistema de Inovação em Nível de Firma no Mercado Brasileiro de Telecomunicações. In: XXXI Simpósio de Gestão da Inovação Tecnológica. Rio de Janeiro: ANPAD.

GIL, A. C. (2002). Métodos e técnicas de pesquisa social. 4 ed. São Paulo: Atlas.

HAIR, J. F; et al. (2005). Análise Multivariada de Dados. São Paulo: Bookman, 5 ed.

HÄRDLE, W., & Simar, L. (2007). Applied multivariate statistical analysis. 2 ed. Springer.

HOANG, H. A., & Rothaermel, F.T. (2010). "Leveraging internal and external experience: exploration, exploitation and R&D project performance". Strategic Management Journal, 31 (7), 734-758.

KLINE, S., & Rosenberg, N. (1986). An Overview of Innovation. In: Rosenberg, N. (orgs.), The Positive Sum Strategy. Washington, DC: National Academy of Press.

LEYDESDORFF, L., Dolfsma, W., & Panne, G. V. D. (2006). "Measuring the Knowledge Base of an Economy in terms of Triple-Helix Relations among Technology, Organization, and Territory". Research Policy, 35 (2), 181-199.

LEYDESDORFF, L.; & Meyer, M. (2006). "Triple Helix indicators of knowledge-based innovation systems: Introduction to the special issue". Research Policy, 35 (10), 1441-1449.

LIMA, M. C. (2008). Monografia: a engenharia da produção acadêmica. 2. ed. São Paulo: Saraiva.

LIPPMAN, S. A., & Rumelt, R. P. (1982). "Uncertain imitability: an analysis of interfirm differences in efficiency under competition". The Bell Journal of Economics, 13, 418-438.

LUNDVALL, B. A. (1992). National systems of innovation: towards a theory of innovationand interactive learning. Pinter, Londres.

MONTGOMERY, D. C. (2000). Design and Analysis of Experiments. 5a ed. Nova Iorque: John Wiley & Sons.

NELSON, R. R., & Winter, S. G. (1977). "In search of useful theory of innovation". Research Policy, 6, 36- 76.

OECD. (2005). Oslo Manual: Guidelines for Collecting and interpreting innovation data. 3 ed. OECD Publishing.

PAGANO, M., & Gauvreau, K. (2004). Princípios de bioestatística. 2ª ed. Thompson Pioneira.

PENROSE, E. (1959). The theory of the growth of the firm. Oxford: Basil Blackwell.

PETERAF, M. A. (1993). "The cornerstones of competitive advantage: a resource-based view". Strategic Management Journal, 14 (3), 179-191.

PETRUZZELLI, M. (2011). "The impact of technological relatedness, prior ties, and geographical distance on university–industry collaborations : A joint-patent analysis2. Technovation, 31 (7), 309-319.

PISANO, G. (2000). In search of dynamic capabilities. In: DOSI, G.; NELSON, R.; WINTER, S. The nature and dynamics of organizational capabilities. Oxford: Oxford Univesity Press.

PORTO, G. S. (2000). A decisão empresarial de desenvolvimento tecnológico por meio da ooperação empresa-universidade. (Tese de Doutorado em Administração). Faculdade de Economia, Administração e Contabilidade, Departamento de Administração, Universidade de São Paulo, São Paulo.

PORTO, G., Galina, S., Costa, P. R., Moura, P., & Mata, R. (2010). Gestão de P&D de empresas multinacionais brasileiras. In: Fleury, A. (Org.), Gestão Empresarial para a Internacionalização das Empresa Brasileiras. Atlas.

PRAHALAD, C. K., & Hamel, G. (1990). "The Core Competence of the Corporation". Harvard Business Review, May/Jun., 79-91.

REED, R., & Defillippi, R. J. (1990). "Causal ambiguity, barriers to imitation, and sustainable competitive advantage". Academy of Management Review, 15, 88-102.

RUMELT, R. P. (1984). Towards a strategic theory of the firm. In: LAMB, R. B. (ed.), Competitive strategic management. Englewood Cliffs, NJ: Prentice-Hall.

RUMELT, R. P. (1987). Theory, strategic and entrepreneurship. In: TEECE, D. J. (ed.), The competitive challenge. Cambridge: Ballinger Publishing Company.

SANCHEZ, R. (1996). "Management at the point of inflection: systems, complexity and competence theory". Long Range Planning, 30 (6), 939-946.

SCHUMPETER, J. A. (1988). Teoria do desenvolvimento econômico. Tradução Maria Silvia Possas. 3 ed. São Paulo: Nova Cultural.

TEECE, D J., & Pisano, G. (1994). "The dynamic capabilities of firms: an introduction". Industrial and Corporate Change, 3 (3), 537-556.

TEECE, D. J. (1980). "Economics of scope and the scope of the enterprise". Journal Economic Behavior and Organization, 1, 223-247.

TEECE, D. J. (1982). "Towards an economic theory of the multiproduct firm". Journal Economic Behavior Organization, 3, 39-63.

TEECE, D. J. (1986). "Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy". Research Policy, 15, 285-305.

TEECE, D. J. (2007). "Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance". Strategic Management Journal, 28, 1319–1350.

TEECE, D. J., Pisano, G., & Shuen, A. (1997). "Dynamic capabilities and strategic management". Strategic Management Journal, 18, 7, 509-533.

TIDD, J., Bessant, J., & Pavitt, K. (2003). Gestão da Inovação. Integração de mudanças Tecnológicas, de mercado e organizacionais. Lisboa: Monitor.

VAN DER MEER, H. (2007). "Open Innovation – The Dutch Treat: Challenges in Thinking in Business Models". Creativity and Innovation Management, 16 (2), 192-202.

WASSMER, U. (2010). "Alliance Portfolios: A Review and Research Agenda". Journal of Management, 36 (1), 141-171.

WERNERFELT, B. (1984). "A resource based view of the firm". Strategic Management Journal, 5, 171-180.

WINTER, S. (1988). Knowledge and competence as strategic assets. In.: TEECE, D. J. (ed.), The competitive Challenge (pp. 159-184) Cambridge, MA: Ballinger.

1. Universidade Nove de Julho (UNINOVE), Brazil. E-mail: priscilarezende@yahoo.com.br

2. Universidad Estadual Paulista (UNESP), Brazil e Universidad de Murcia (UMU), Spain. E-mail: pagan.marta@gmail.com

3. Universidade Nove de Julho (UNINOVE), Brazil. E-mail: lucimarsilva@uninove.br