HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN

HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN Espacios. Vol. 37 (Nº 24) Año 2016. Pág. 2

Martín KRAUSE 1

Recibido: 13/04/16 • Aprobado: 09/05/2016

ABSTRACT: Personnel Economics has allowed us to better understand compensation schemes in face of the problems coming out of the principal-agent relationship, with individuals pursuing their own private interests making necessary a mechanism to promote the alignment of interests within the organization. The theory had to simplify its assumptions, particularly reducing the utility maximization principle to its monetary value. This paper considers the need to introduce the "heterogeneity" of agents for monetary and non-monetary incentives. There are problems with the limitation of knowledge and the possibility preferences may be revealed through some kind of exchange in which the principal offers a "menu of contracts". |

RESUMEN: La economía personal nos ha permitido entender mejor los esquemas de compensación frente a los problemas de la relación agente -principal, con individuos persiguiendo sus propios intereses privados que hace necesario un mecanismo para promover la alineación de intereses dentro de la organización. La teoría tuvo que simplificar su hipótesis, particularmente reduciendo el principio de maximización de utilidad a su valor monetario. Este trabajo considera la necesidad de introducir la "heterogeneidad" de los agentes de incentivos monetarios y no monetarios. Hay problemas con la limitación de los conocimientos y las preferencias de posibilidad pueden ser reveladas a través de algún tipo de intercambio en el que el principal ofrece un "menú de contratos". |

Economic theory as related to incentives and compensation within organizations, also called by some authors "Personnel Economics" (Lazear, 1996), has extensively developed in the last decades bringing a new understanding on the mechanisms of compensation and introducing innovations. Most of the questions related to motivation derive from problems in the principal-agent relationship, as long as individuals pursue their own interests and a mechanism is needed that promotes their alignment with the interests of the organization.

As any other economic theory, it had to simplify its assumptions in order to achieve a higher level of formalization and rigour, with quite success in outlining the problems and much less in providing solutions, considering the narrow focus of the researcher (Lazear, 1996, p. 2).

Many works in this field considered compensation systems with the goal to complete the basic theory on remunerations according to which each worker receives a competitive salary set in the marketplace without going into details regarding the form such remuneration takes, how it changes in time and how to explain different incentives linked to a panoply of positions and functions within the organization.

One of the simplifying assumptions is the reduction of the utility maximization principle to a monetary value. If x is the individual's budgetary restriction or the amount of monetary wealth she has available and y are all other non-monetary variables affecting her preferences, then the utility function takes the form u(x, y). If there is no "wealth" effect, it is considered there is always a cash equivalent value that could be assigned to the non-monetary variables (y) and the utility function can be written as u(x, y) = x + v(y), where v(y) is the money equivalent of all other non-monetary variables affecting the individual decision.

The so-called wealth effect is that situation when, given two possible alternative decisions d1 y d2, there is a definite amount of money, M, enough for the individual to be indifferent between the two; if the decision maker were first given an amount of additional wealth before it would not change the amount needed to reach her indifference, and the decision maker must have enough money for the required payments to move from the less to the more preferred alternative.

In the specific framework of compensation systems it applies in the same way, converting the non-monetary elements of remuneration to its monetary equivalents [2].

This article will attempt to point out the future steps a theory of compensation should take in order to remove such a restriction and to consider the different reaction individuals have "within" one organization on both kinds of incentives.

A basic model of compensation states the level of effort e an employee chooses can be related to a certain variable measurable by, for example, hours of work or production, which are imperfect in any case since they can be affected by circumstances beyond the employee's will.

Formalization of non-monetary variables to their monetary equivalent started with the work of Rosen (1974) where he called "hedonic prices" the implicit prices of attributes revealed to individuals in the prices of different products and the number of attributes associated with each of them. The literature on compensation called this "compensation differentials", transforming non-monetary components into its monetary equivalent (Rosen 1978, 1986).

Adam Smith had already clearly seen the importance of monetary and non-monetary variables as components of what we now call compensation [3], explaining the differences in wages by the dissimilar characteristics of each job. The base of the theory that would later evolve was the recognition of the need for such differences in the level of wages in order to level the set of monetary and non-monetary attributes among different jobs. This led to stress that maximization of outcomes required the alignment of the right kind of worker with the right kind of company assigning workers to their specific 'niches', either within or between companies (Rosen, 1986).

A typical case is labour security. A certain level of labour risk can be 'bought' with a higher wage in a certain job, ceteris paribus (Hubler & Hubler, 2010).

The basic model on incentives generated by compensation assumes the level of effort e chosen by the employee can be measured (hours worked, for example) but cannot be directly observed since it is influenced by other factors. Therefore, observations are imperfect measures of e distorted by random factors beyond the control of the agent. For example, the volume of sales can give information over effort, but the outcome is affected by factors not related with the level of effort by the agent. In that case, it could be presented as:

V = e + x (1)

…where the volume of sales depends on effort and a random variable x not observable separately but only as a joint outcome V. The volume of sales can grow thanks to more effort, but also to a general increase in consumption, or a competitor with problems, etc. The variable x is not observable but we assume it relates to another that is, such as total demand in the industry. Linear compensation would have the following form:

S = B + β (V + py) (2)

…where B is basic wage, β measures the intensity of the incentive and p the weighting of the variable y. As x is not observable, compensation will consist of a fixed wage and a variable on the percentage of sales weighted by the evolution of total demand. Certainly, linear compensation is not the only way to do it and labour contracts include other variables, considering them as a series or parameters setting the level of effort expected from the employee and how she will be remunerated according to performance.

The random nature of x subjects the employee to a certain amount of risk. The basic model assumes the capacity of the employee to bear risk is lower than the employer's, mostly in medium size or large corporations, but if the company would take all the risk there would be no incentives for the employee to make efforts and get the best results, such as in the case of a fixed wage and complete stability in the job.

Due to the diversity of parameters in a contract a monetary equivalent is set that includes expected wage less the cost to supply needed effort and a risk prime [4]. These elements can be modified keeping the total without change, what was referred as "wealth" effect before. The maximization principle says an efficient contract is one that specifies parameters maximizing the equivalent sum of revenues, both for the employee and the employer. But contracts are incomplete, they only set the agreed level of effort compatible with compensation, but we have seen the level of effort cannot be directly observed, and is chosen by the employee who will do it as long as the marginal benefit of the compensation is larger than her marginal cost.

The process assumed in the analysis is that the employer sets the level of effort e, and then she tries to accommodate parameters B, β and p to try to achieve it at the lower cost, what is called 'the implementation problem'. It is also deduced that while designing systems of compensation total value increases when variables on performance are introduced that reduce the variability of other factors (x and y).If x and y are independent then it makes no sense to use y, but if covariance is positive a negative y should be set to compensate a "luck" factor affecting the amount of total compensation; same if covariance is negative a positive y should be set (Holmstrom, 1979).

Regarding the intensity of the incentive, it would depend on four factors: the increase in profits generated by more effort, the precision with which performance is measured, the agent's risk aversion and her responsiveness to incentives (Prendergast, 1999). Here we find for the first time a reference to the heterogeneity of agents, brought into account in relation to a different risk aversion considering that the higher the tolerance the lower the risk assumed by the agent with incentives linked closer to outcomes. But that is all, since the fourth factor, the reaction of the agent to incentives, is linked to the job characteristics and whether it allows her to respond with more production in exchange for the incentive, which in turn depends on the degree of discretion on questions such as pace of work, time schedules, tools and equipment, etc.

The monitoring intensity principle (Milgrom & Roberts, 1992, p. 221) introduces the costs of control in the basic model achieved by reducing the size of groups under the control of a supervisor, or introducing new quality controls, or verifying customers' satisfaction. All these alternatives are, of course, costly, and will be efficient to use them the more the agent's compensation is linked to outcomes.

Finally, the equal compensation principle makes reference to the case when the employee has different tasks to perform, and some of them can be precisely measured while others not. In this case, introducing a compensation mechanism based in measurement of such an activity would lead to less attention to the others.

Even though the basic model just briefly presented considers non-monetary incentives, although only through its monetary equivalent, economists turned mainly to the analysis of compensation systems based in monetary remunerations [5].In this sense, they were confronted by a number of authors, particularly from the field of psychology, quite critical of monetary incentives. Deci (1972) presented the results of a research project according to which extrinsic motivation, not only including contingent monetary payments but also threats of punishment for low performance or negative evaluations, reduced "intrinsic" motivations. Contingent monetary payments would not improve them while verbal encouragement did. Herzberg (1987) classified incentives in "motivating" factors including the recognition to goal achievement, the job itself, responsibility and personal growth or development and those that try to prevent dissatisfaction such as the company's policies, supervision, interpersonal relations, job conditions, status and security based on a sample of 1685 employees pointing the first were the main source of satisfaction. Particularly, the achievement of goals had a selection rate of over 40%, recognition 30% while wages would not get to 10%. To Kohn (1993) monetary compensation is not a motivator but actually a punishment when a premium is not received to do something, deteriorating cooperative relations, ignoring the reasons why employees do not perform as expected, discouraging risk assumption and destroying the employee's interest on her job.

Lately, the debate moved to the field of experimental economics: Gneezy & Rustichini (2000) found a 'non-monotonic' relation between piece payments and an intelligence test. Performance was lower when a piece payment was offered as when no payment existed, although piece payment would get a better outcome if higher. To the authors, the payment rule (gratis, small payment, large payment) sent a signal on the experimenter's goal. If participants got paid before the experiment it was interpreted they had already be remunerated and they should give their best possible effort on their part. If, further, there was a "piece" payment it was interpreted the experiment's goal was money and the outcome was worse with a low payment, though one better with a high one. To Bénabou & Tirole (2003) the experiment shows once more the 'crowding out' effect of monetary incentives over non-monetary ones. In the framework of a 'principal-agent' model the principal knows better the capabilities of the agent or the job characteristics, and both know this difference. The monetary incentive linked to productivity would be in this case a bad sign, since it would point to the need to offer a monetary incentive due to the low capability of the agent or the bad characteristics of the job.

Dessi & Rustichini (2011) performed an experiment to verify these two theories, and affirm in their conclusions that for tasks requiring talent it is better "no pay at all" when intrinsic motivation is sufficiently high since in this case monetary incentives elicit too much effort but not enough performance but paying 'enough' when intrinsic motivation is insufficient to motivate talented individuals.

Kube et al (2008) performed an experiment in a natural setting, hiring employees to catalogue books at the library for a limited time duration offering a payment of 12 Euros per hour. In a second instance they implemented an unexpected wage increase of nearly 20%; in a third they replaced the increase for a gift in-kind of equivalent monetary value and in a fourth they told the employees the exact value of the gift in-kind received. Results showed the wage increase had a negligible impact on employees' productivity; the gift in-kind of equivalent monetary value generated an increase in production over 30%, remaining during the entire period. The result remained unchanged when the monetary price of the gift was communicated to employees. The behavioural contrast was verified in a following experimental questionnaire study, finding that the gift is significantly more likely to signal kind intentions than the wage increase and is reciprocated with higher productivity. It is the symbolic value of the gift that generates the response. Similar results are found by Heyman & Ariely (2004) with 614 students of Berkeley and the MIT [6]. Gneezy & List (2006) confirm the same outcome with a similar experiment but stressing such a conduct persists after the first period, though later results are the same.

Following Herzberg, another branch in the literature emphasized the 'design' of tasks as an important motivator; Hackman and Oldham (1976) developed the 'model of the job characteristics' saying these are an intrinsic incentive: when the job is 'significant' employees are more committed, are more focused, pay more attention, reason more carefully and work more.

The reply of economists to this challenge brings some interesting points. Baker et al (1988, p. 597) say criticisms of pay-for-performance systems do not show they are ineffective but rather they are too much, that they motivate people to do exactly what they were told to do, although sometimes generate unintended consequences because it is difficult to specify what people should do and therefore, how their performance should be measured. G. Bennett Stewart III says the price system efficiently allocates scarce rewarding people who conserve and penalizing those who fail to respond, and asks …, "can it be true, as Kohn seems to think, that people respond to monetary incentives when they spend their income but not when they earn it?" (1993, p. 4).

Amabile et al (1986) y Amabile (1993) comment on studies with artists on creativity pointing that though it is right that artists prefer non-commissioned to commissioned works in fact what affects creativity most are restrictive clauses that the second may have, but that artists welcome that kind of jobs: "Kohn accurately documents the evidence that rewards can undermine creativity. But he fails to mention the evidence that tangible rewards can actually enhance creativity under certain circumstances, most notably when the individual's primary focus is on the intrinsic reward of the work itself" (1993, p. 7).

More recent defences of pay for performance are Lazear & Shaw (2007) and Lazear et al (2011).

The whole debate, nevertheless, focuses on the 'supply' side of incentives towards a homogeneous set of agents to get a better performance, underestimating the 'demand' side of incentives. A view from that side would lead to consider heterogeneity. Such heterogeneity comes from the fact that companies, through signalling their culture and compensation system, among other things, can imperfectly set self-selection by those interested in working with them, but they end up hiring 'biased' agents with different preferences (Prendergast, 2008), when they cannot hire with regard to a specific outcome.

Such heterogeneity has not been much considered by the literature, and when it does, it considers differences in capabilities (Balafoutas et al, 2012) and the impact this could have in the compensation design system. Or the reactions individuals in general have on certain tasks and functions, when in some monetary incentives have effects, but not in others [7] (Camerer & Hogarth, 1999).

In the analysis of what has been called "hedonic model' (Lazear & Shaw, 2007), non-monetary benefits and agent heterogeneity are considered, but only as exogenous to the company. Their signalling allows agents to select themselves according to their preferences, but even then, and considering the diversity of task within a company, heterogeneity will be inevitable. It seems unavoidable to introduce the analysis of heterogeneity "within" the company.

The basic hypothesis on this subject is that agents are necessarily heterogeneous in their preferences over different systems of motivation and compensation and that will have an important impact in the efficiency of those systems. Besides the debate on the preference of monetary or non-monetary incentives, there will inevitably be agents within a company that are more motivated by one or the others and, in fact, by different combinations of each. In that sense, an 'efficient' motivation and compensation system will be one such that promotes the highest degree of efforts from the agent to achieve the goals selected by the principal. A general system will get close to the optimum but inevitably will not accommodate to all individual preferences, as could do only one that would take them into account and would accommodate to these individual preferences.

One such system faces the problem of the limitations of knowledge (Hayek, 1945). It would not only be highly costly for an organization to develop a motivation and compensation system adapted to the individual preferences of each agent but it will not have the knowledge available to do so [8]. Nevertheless, these knowledge limitations do not imply the principal has to leave aside any attempt to align employees' incentives with those of the organization, in the same way the dispersion of knowledge does not prevent the existence of a system for its transmission, imperfect as it may be. That is the price system, where consumers and producers preferences are revealed and transmit information that allows for a coordination of the decisions of some with those of the others.

The heterogeneity of preferences, then, only will allow, as in the outside market, some signalling agents will use to self-select. For the moment, the only way this happens is called a "menu of contracts".

The problems have been presented, correctly, as part of the need to get "private" information from agents, not available to the principal, such as the potential performance in some task or the results to get from different projects. Two mechanisms are proposed to make use of such private information: menus of contracts and administration by goals (Milgrom & Roberts, 1992, p. 401). In the second case the agent and the principal, be this a supervisor which is in turn agent regarding other levels of the hierarchical structure, deal over some criteria and parameters over which the agent performance will be evaluated.

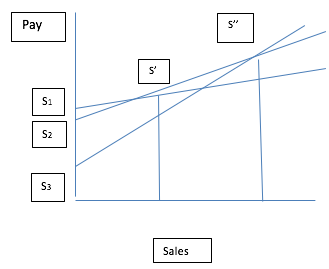

Regarding the first, the menu of contracts is considered a way to reveal private information, but not on individual preferences. Then, the case shown in Figure 1 relates to different forms of compensation: S1 offers a fixed wage relatively high and a small variable component the result of a commission on sales; S2 offers a lower fixed wage but a higher commission, and finally S3 offers the lowest wage but the highest commission.

Figure 1

In order to know the true sales potential of different territories, if a menu is offered to salesmen on each, information will become available and salesmen will self-select: those expecting low sales will choose S1, those expecting moderate sales will choose S2 and those expecting high sales will choose S3.

The logic of the argument cannot be denied, but the problem we are considering is different and to make it clear we will take the same example. Although related to one of the tasks where measurement of outcomes is easier, the case does not take into consideration the existence of non-monetary incentives which, for the analysis, were turned into their monetary equivalent. From the perspective of the employer it is easier to understand since one incentive or the other will cost the same. Nevertheless, what happens if we remove the assumption and allow the consideration of preferences from demanders or incentives and compensation?

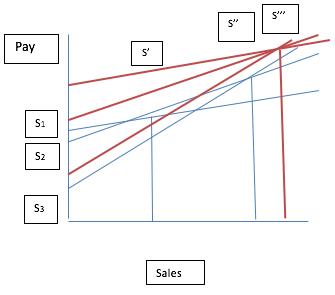

Figure 2

As shown in Figure 2 with red lines, the three can reach a point such as S''', but with different combinations presenting a larger percentage of non-monetary remuneration in the case of S1, somewhat less in the case of S2 and even less in the case of S3. The example is presented as if the non-monetary incentive had a fixed monetary equivalent, but it could also be variable. Also, the option with lower fixes wage, S3, also shows the lowest preference for non-monetary incentives but this could not necessarily be so, it just helps the graphical presentation. The main point is that if the company sets S''' as a goal there are, at least, three possible incentive packages, and in fact, many more.

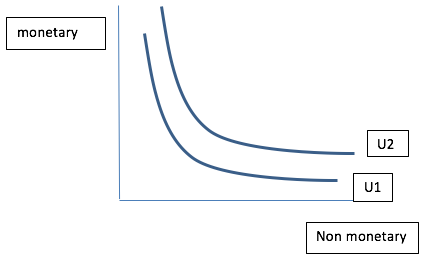

Let's see this from a different perspective. We can assume that any agent has preferences over the compensation and motivation system that include both monetary and non-monetary incentives that can be depicted graphically as her indifference curves (Brickley et al, 1997, p. 258) (Fig. 3).

Figure 3

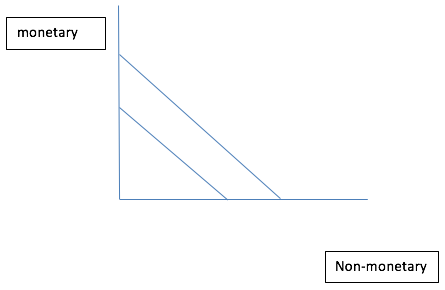

As mentioned, the principal is indifferent on the mix of one or others as long as it just takes into account the costs of both, that will try to minimize. Her isocosts curves, therefore, will have a slope of -1 reflecting this (Fig. 4):

Figure 4

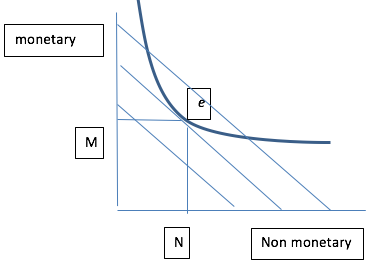

For a particular agent the optimal contractual point will be e, Fig 5, where the indifference curve that shows her reservation level is tangent to the lowest isocost for the principal:

Figure 5

This graph would be representative of the situation a Company faces if all agents had similar preferences, in principle, between monetary and non-monetary incentives. If we remove the assumption, we will find heterogeneous agents both with respect of ones and the others as well as within monetary components (some prefer more fixed than variable or the other way around, what is usually presented as different risk aversion), or non-monetary ones (some prefer more training, others more vacations or time flexibility). In the company as a whole, and for a certain level of compensation and motivation, we would have different indifferent curves tangent in one extreme or the other of the isocost curve.

Given the characteristics shown by the isocost curves, taking into consideration these preferences would mean a Pareto improvement: for example, one agent could increase her utility receiving a non-monetary incentive with a similar cost as the monetary one received before.

4.1. "Cafeteria style"

Nevertheless, knowing these preferences will not only be very costly but also impossible, given their subjective nature and the lack of exchanges that would reveal them. The menu offers an alternative, though not free of costs, precisely proposing exchanges.

Existing plans are usually called "Cafeteria Style" or Flexible Benefits Plans, given the chance to choose over a menu offered [9]. The University of Delaware, for example, offers a plan of this kind to its employees giving them "Udollars" that they can spend choosing from a varied menu of non-monetary benefits, with the possibility of choosing even beyond the amount received in an internal account and paying in pre-tax dollars. If they spend less they get the difference in these same dollars [10].

But this is not the only field for options. It was mentioned before the same job "design" is motivating for the agent and there is as much variety here as already mentioned. The McKinsey consulting firm organizes a contest together with Management Innovation and eXchange (MIX), from Gary Hammel and the Harvard Business Review called "Beyond Bureaucracy", and in its 2012 version awarded a prize, among others, to a Microsoft group that allows members choice in their next task. Something similar happens at the Brazilian Company Semco (Siehl et al, 1999).

One reason for the slow adoption for companies of these schemes is the higher administrative and accounting costs. Another is that these benefits include some kind of insurance benefits and quoting them is more difficult since the number of employees choosing them is not known in advance, although this is not an insurmountable problem. These administrative costs could be reduced through innovation by the company or its suppliers through outsourcing, but they are also usually affected by a great number of labour and tax regulations (Atchison et al, 2010).

Introducing agent heterogeneity of agents into the analysis of compensation systems in organizations raises the need for efficiency criteria to consider the different preferences of agents regarding monetary and non-monetary components, removing the assumption of the monetary equivalence of both.

This diversity brings the problem of the limitations of knowledge and the impossibility for the principal to know them in each case as long as there is no exchange to reveal them.

These exchanges could be the result of implementing a 'menu of contracts' allowing a closer match with individual preferences and a higher level of efficiency. Nevertheless, management of these systems is in itself costly, more than one that does not take them into account. Limitations of knowledge impose costs that could be high. The company will introduce such systems when the benefits in terms of productivity are larger than the costs of implementing it. As long as the late ones are reduced its use will be more extensive.

This is what the basic model presents as a "problem of implementation". Considering the heterogeneity of agents the difference is that the principal used to set the elements on formula (2): the basic B, the power of the incentive β and the weighting of the variable y, p, to get an optimal level of effort, now presents this a menu of options.

Nevertheless, at the same time, the introduction of a choice option could generate more effort, something that under other circumstances would require increasing β. The optimal intensity of incentives depends on the higher profitability coming from higher effort (P), the precision to evaluate needed tasks (V), the agent's risk tolerance (r) and her reaction to incentives C''(e):

Β = P' (e)/[1 + rVC''(e)]

Choosing from a menu of options would positively impact both (r) and C''(e).

Amabile; Teresa M., Beth Ann Hennessey & Barbara S. Grossman (1986): "Social Influences on Creativity: The Effects of Contracted-for Reward"; Journal of Personality and Social Psychology, Vol. 50, No. 1, 14-23.

Amabile; Teresa M (1993), en "Rethinking Rewards", Harvard Business Review, Perspectives, November-December.

Atchison, Thomas J.; David W. Belcher & David J. Thomsen (2010), Internet Based Benefits & Compensation Administration; ERI Economic Research Institute.

Baker, George G., Michael C. Jensen & Kevin J. Murphy (1988), "Compensation and Incentives: Practice vs. Theory", The Journal of Finance, Vol. XLIII, Nº 3

Balafoutas, Loukas; Glenn Dutcher; Florian Lindner & Dmitry Ryvkin (2012), "To reward the best or to punish the worst? A comparison of two tournament mechanisms with heterogeneous agents", Working Papers in Economics and Statistics, 2012-08, University of Innsbruck.

Baytos, L.M. (1970); "The Employee Benefit Smorgasbord: Its Potential and Limitations"; Compensation Benefits Review; January 1970 vol. 2 no. 1 16-28.

Bénabou, R. & J. Tirole (2003) "Intrinsic and Extrinsic Motivation", Review of Economic Studies, 70, Journal of Risk and Uncertainty

Brickley, James A.; Clifford W. Smith Jr. & Jerold L. Zimmerman (1997), Managerial Economics and Organizational Architecture, (Chicago: Irwin).

Camerer, Colin F. & Robin M. Hogarth (1999), "The Effects of Financial Incentives in Experiments: A Review and Capital-Labor-Production Framework"; Journal of Risk and Uncertainty, Volume 19, Numbers 1-3 (1999), 7-42 489-520.

Cartwright, Edward and Myrna Wooders, (2001) "On the theory of equalizing differences; Increasing abundances of types of workers may increase their earnings." Economics Bulletin, Vol. 4, No. 4; pp. 1−10.

Deci, Edward (1972), "The Effects of Contingent and Non-contingent Rewards and Controls On Intrinsic Motivation", Organizational Behavior and Human Performance 8, 217-229.

Dessi, Roberta & Aldo Rustichini (2011) "Work for Image and Work for Pay", IDEI Working Paper, Nº 683, September 10, 2011.

Gneezy, U. and A. Rustichini (2000), "Pay Enough or Don't Pay at All", Quarterly Journal of Economics, 115(3), 791-810.

Gneezy, U. & John A. List (2006), "Putting Behavioral Economics to Work: Testing for Gift Exchange in Labor Markets using Field Experiments"; Econometrica, Vol. 74, No. 5 (September, 2006), 1365–1384.

Hackman, Richard J. and Greg R. Oldham (1976), "Motivation through the design of work: test of a theory", Organizational Behavior and Human Performance, 16 (2), 250-279.

Hayek, Friedrich A. (1945), "The Use of Knowledge in Society"; American Economic Review; XXXV, No. 4. pp. 519-30.

Heyman, James & Dan Ariely (2004); "Effort for Payment: A Tale of Two Markets"; Psychological Science, Vol. 15, No. 11 (Nov., 2004), pp. 787-793.

Herzberg, Frederick (1987), "One more time: How do you motivate employees?", Harvard Business Review, September-October.

Holmstrom, Bengt (1979), "Moral Hazard and Observability", The Bell Journal of Economics, Vol. 10, No. 1, (Spring, 1979), pp. 74-91

Hübler Dominik & Olaf Hübler (2010), "The Link between Job Security and Wages: A Comparison Between Germany and the UK"; SBR 62 January 2010, 45-67.

Kohn, Alfie (1993), "Why Incentive Plans Cannot Work", Harvard Business Review, September-October.

Kube, Sebastian; Michel André Maréchal & Clemens Puppe (2008), "The Currency of Reciprocity -Gift-Exchange in the Workplace", Working Paper Series, Working Paper No. 377, Institute for Empirical Research in Economics University of Zurich

Lazear, Edward P. (1996), Personnel Economics, The Wicksell Lectures, (Cambridge, Mass: The MIT Press).

Lazear, Edward P. and Kathryn L. Shaw (2007), Personnel Economics: The Economist's View of Human Resources; NBER Working Paper No. 13653; Cambridge, MA: National Bureau of Economic Research.

Lazear, Edward P.; Steffen Altmann & Klaus F. Zimmermann (2011), Inside the Firm: Contributions to Personnel Economics; (Oxford University Press).

Milgrom, Paul & John Roberts (1992), Economics, Organization and Management (Englewood Cliffs, NJ: Prentice Hall).

Prendergast, Canice (1999). "The Provision of Incentives in Firms"; Journal of Economic Literature 37: 7–63.

Prendergast, Canice (2008), "Intrinsic Motivation and Incentives"; American Economic Review: Papers & Proceedings 2008, 98:2, 201–205

Rosen, Sherwin (1974), "Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition", The Journal of Political Economy, Vol. 82, No. 1. (Jan. - Feb., 1974), pp. 34-55.

Rosen, Sherwin (1978) "Substitution and Division of Labour" Economica, 45, 235-250.

Rosen, Sherwin (1986) "The Theory of Equalising Differences"; en Ashenfelter O. and R. Layard (eds.) Handbook of Labor Economics , Volume 1, Chapter 12 , Elsevier Science Publishers.

Siehl, Caren; Delly Killian & Francisco Perez (1999); "Ricardo Semler and Semco S.A."; Thunderbird School of Global Management; Harvard Business Review Case.

Smith, Adam (1776); An Inquiry into the Nature and Causes of the Wealth of Nations. Book I, Chapter X: "Of Wages and Profit in the Different Employments of Labour and Stock"; Edwin Cannan, ed. 1904. Library of Economics and Liberty.

Stewart, G. Bennett III (1993), en "Rethinking Rewards", Harvard Business Review, Perspectives, November-December.

1. Universidad de Buenos Aires. email: mkrause@derecho.uba.ar

2. "…economic theories are fully capable of integrating all aspects of compensation into the models. It is not necessary that remuneration take pecuniary forms. Psychic income that derives from job amenities, status, working conditions, and other factors are easily incorporated into the standard analysis. What distinguishes the economic approach from that of other disciplines is that the non-pecuniary components are converted into their monetary equivalents in the course of the analysis. As a result, economists can discuss these factors in concrete and rigorous fashion" (Lazear, 1996, p. 4).

3. "Pecuniary wages and profit, indeed, are every-where in Europe extremely different according to the different employments of labour and stock. But this difference arises partly from certain circumstances in the employments themselves, which, either really, or at least in the imaginations of men, make up for a small pecuniary gain in some, and counter-balance a great one in others; and partly from the policy of Europe, which no-where leaves things at perfect liberty."

"The five following are the principal circumstances which, so far as I have been able to observe, make up for a small pecuniary gain in some employments, and counter-balance a great one in others: first, the agreeableness or disagreeableness of the employments themselves; secondly, the easiness and cheapness, or the difficulty and expence of learning them; thirdly, the constancy or inconstancy of employment in them; fourthly, the small or great trust which must be reposed in those who exercise them; and fiftly, the probability or improbability of success in them". Smith (1776), Retrieved May 24, 2012 from the World Wide Web: http://www.econlib.org/library/Smith/smWN4.html

4. Assuming the measures of x and y are zero, and r is the employee's risk coefficient the equivalence becomes = B +βe – C(e) – ½ β2 Var (x + py); (Milgrom & Roberts, 1992, p. 217). There is also an equivalent formula for the employer but since the focus of our analysis we are only concerned with the agent.

5. "Economic models of compensation generally assume that higher performance requires greater effort or that it is in some other way associated with disutility on the part of workers. In order to provide incentives, these models predict the existence of reward systems that structure compensation so that a worker's expected utility increases with observed productivity. These rewards can take many different forms, including praise from superiors and co-workers, implicit promises of future promotion opportunities, feelings of self-esteem that come from superior achievement and recognition, and current and future cash rewards related to performance. Economists, while recognizing that nonmonetary rewards for performance can be important, tend to focus on monetary rewards because individuals are willing to substitute nonmonetary for monetary rewards and because money represents a generalized claim

on resources and is therefore in general preferred over an equal dollar-value payment in kind" (Baker et al, 1988, p. 594).

6. "Two real-behaviour experiments and one hypothetical-behaviour experiment were carried out in a general setting of one-shot games, in which payment was granted or credibly promised before effort was exerted. The results support the two-markets perspective: When payments were given in the form of gifts (candy) or when payments were not mentioned, effort seemed to stem from altruistic motives and was largely insensitive to the magnitude of the payment. In contrast, when payments were given in the form of cash, effort seemed to stem from reciprocation motives and was sensitive to the magnitude of the payment.

Finally, in mixed markets (payment was in the form of gifts but cost was also mentioned), the mere mention of monetary payment was sufficient to switch the perceived relationship from a social-market relationship to a money-market relationship. That is, money itself can be a cue to the type of exchange that individuals consider themselves to be in, which in turn influences their propensity to exert effort. (p. 791)

7. "The presence and amount of financial incentive does seem to affect average performance in many tasks, particularly judgment tasks where effort responds to incentives (as measured independently by, for example, response times and pupil dilation) and where increased effort improves performance. Prototypical tasks of this sort are memory or recall tasks (in which paying attention helps), probability matching and multicue probability learning (in which keeping careful track of past trials improves predictions), and clerical tasks (e.g., coding words or building things) which are so mundane that monetary reward induces persistent diligence when intrinsic motivation wanes. In many tasks incentives do not matter, presumably because there is sufficient intrinsic motivation to perform well, or additional effort does not matter because the task is too hard or has a flat payoff frontier. In other tasks incentives can actually hurt, if increased incentives cause people to overlearn a heuristic (in problem-solving "insight" tasks), to overreact to feedback (in some prediction tasks) to exert "too much effort" when a low effort habit would suffice (choking in sports) or when arousal caused by incentives raises self-consciousness (test-taking anxiety in education)." (p. 1)

8. "The peculiar character of the problem of a rational economic order is determined precisely by the fact that the knowledge of the circumstances of which we must make use never exists in concentrated or integrated form but solely as the dispersed bits of incomplete and frequently contradictory knowledge which all the separate individuals possess. The economic problem of society is thus not merely a problem of how to allocate "given" resources—if "given" is taken to mean given to a single mind which deliberately solves the problem set by these "data." It is rather a problem of how to secure the best use of resources known to any of the members of society, for ends whose relative importance only these individuals know. Or, to put it briefly, it is a problem of the utilization of knowledge which is not given to anyone in its totality" (p. 519).

9. "Implementing a Cafeteria-style benefits plan": http://www.cbsnews.com/8301-505125_162-51064280/implementing-a-cafeteria-style-benefits-plan/ . Also Baytos (1970).

10. http://www.udel.edu/ExecVP/policies/personnel/4-73.htm