1. Introduction

Due to the increasing demands of customers regarding quality, cost and delivery, it is important that only products that face those requirements should be launched. In this sense, portfolio management ensures that the set of projects are selected and maintained in the portfolio meet organizational objectives (Kendall and Rollins, 2003).

To provide a greater value to the organization, the portfolio should balance project types and levels of risk, and the number of projects should be limited to ensure that all projects can afford effectively, but sufficient to allow an adequate flow projects and new product launches (Killen et al., 2008). Portfolio management is the organization of all product projects associated with the organization's strategic objectives in a consistent way considering the resources available (Miguel, 2008).

In this context, the objective of this work is to conduct a diagnostic of portfolio management practices in a textile company, based on survey from PDMA. The study aims at answering a research question of how the process of product portfolio management occurs in the company, based on new product development (NPD) literature. There is a lack of studies of product portfolio management within the textile industrial sector. This sectors is responsible for an important part of the Brazilian economy, corresponding to 3.5% of GDP (ABIT, 2011). Based on data collected directly from the company a case study is considered as the methodological research according to the literature (Yin, 2001). Managers were interviewed using PDMA survey for gathering data from the company which is compared to the literature. The paper is divided as follows. Firstly, the related literature is outlined followed by research methods. Then, the empirical results are presented and, finally, the conclusions.

2. Related literature

This section outlines the theoretical background of this investigation. It highlights the concepts behind portfolio management and discusses some relevant issues associated to the elements required for effective portfolio management. Some aspects of new product development are also outlined.

Portfolio management is a dynamic decision process wherein a list of active new products and development (R&D) projects is constantly updated and revised (Cooper et al., 1997a). In this process, new projects are evaluated, selected and prioritized. New projects might be introduced and existing projects may be suspended, aborted, or de-prioritized. Those decisions are important to allocate resources to the active projects. There are some problems that arise when portfolio management is lacking, such as: there are limited resources available and far too many projects to develop; projects to be developed do usually not reflect the business’ strategy so many projects are disconnected to the strategic priorities of the business; go/kill decision points are weak so poor projects are often not killed; wrong projects are selected so the portfolio’s quality is poor.

As a consequence, firms should choose the right projects to have an enviable portfolio of high value projects. Besides, the portfolio should be properly balanced and most importantly support the business strategy. Hence, the broad macro goals are value maximization, balance, and strategic direction (Cooper et al., 1997a).

The strategic alignment in portfolio of projects requires general approaches such as: building strategic criteria into project selection, i.e. incorporating numerous strategic criteria into the go/kill and use of prioritization models, and application of top-down strategy models, i.e. setting funds for different types of projects (Cooper et al, 1997b). Castro and Carvalho (2010) confirm that the project portfolio management (PPM) has become a significant factor in the success of long-term strategies of organizations and is related to the role of senior executives and key decision makers responsible for validating significant investments, and formulate and set goals and objectives. In many organizations, projects are built and managed to achieve the goals without a functional overview of strategic alignment and organizational impact (Lockett et al., 2008).

The portfolio management approach can provide the following benefits (Mikkola, 2001): a systematic review of projects; strengths and weaknesses of the projects to be revealed, the consensus among the different functions, performance evaluation with respect to the level of business and clear gaps and opportunities for future development, to be highlighted. Portfolio management provides a major contribution to business leaders, providing a detailed examination of the strategic dimensions that should guide the balancing of the portfolio and allow for proper prioritization of projects, as well as mechanisms of control and disposal projects (Rabechini Jr. et al, 2005).

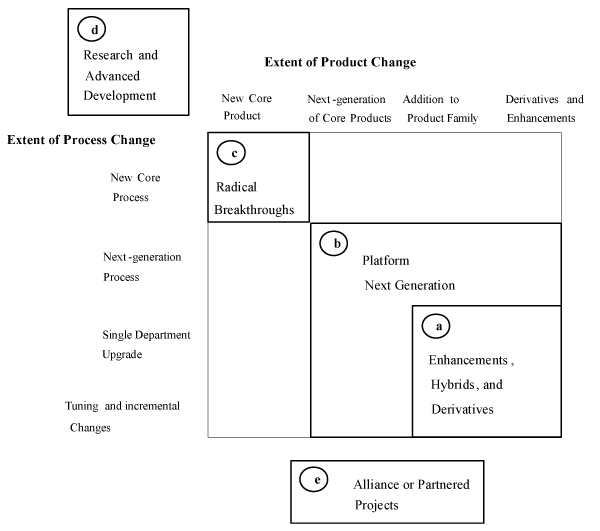

One of the most useful categorization to classify development projects is according to the degree of change represented by the project. In this sense, projects types can be divided into breakthrough, platform, and derivatives (Clark and Wheelwright, 1993), as illustrated in Figure 1. It is important to consider a mix of development projects that builds both market position and desired development capabilities. Nevertheless, companies need projects to yield major breakthroughs and real competitive advantage. In addition, balance among the projects is important, namely: the optimal investment mix between risk versus return, maintenance versus growth, and short-term versus long-term new products projects (Cooper et al., 1997a).

Figure 1 – Types of Projects (Clark and Wheelwright, 1993).

In addition, resources should be split across product lines. Figure 2 depicts a number of projects being developed at the same time. As can be seen some of them are cancelled or on hold. For example, how much to spend on product line C? A scoring model to allocate resources across product lines may be used in this case (Cooper et al., 1997b).

Figure 2 – Project Portfolio and Product Lines (Rozenfeld et al., 2006).

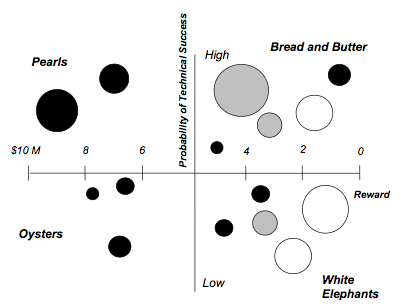

Another important portfolio management goal is to have a balanced portfolio in place. It consists of a balanced set of development projects in terms of a number of key parameters (Cooper et al., 1997a). Visual charts, such as bubble diagrams or portfolio maps, are favoured for displaying balance in new-product project portfolios. A number of dimensions may be considered for a bubble plot, such as fit with business or corporate strategy; inventive merit and strategic importance to the business; durability of the competitive advantage; reward, based on financial expectations; competitive impact of technology; probability of success; R&D costs for completion; time to completion; and capital and marketing investment required to exploit (Roussel et al., 1991). Figure 3 shows a bubble diagram for a division of a major chemical company. The size of each bubble shows the annual resources spent on each company, the color (not shown) is timing, and the shading is the product line.

Figure 3 – Bubble Diagram of a Portfolio of New-product Projects (Cooper et al., 1997a)

Chen et al. (2008) argue that uncertainty and information obscure, unknown risks or opportunities, multiple goals, strategic selection, the interdependence between different projects, many decision makers and local dynamics characterize the portfolio decision. Turnbull (1989) emphasizes that the management and portfolio analysis can be applied from the perspectives of various levels of aggregation and using different combinations of factors or components of the portfolio, depending on the intended purpose and the specific situations faced by the company. The flexibility of the concept of portfolio for use in different management levels and with different levels of sophistication further illustrates its usefulness as a powerful management tool (Turnbull, 1989).

In summary, effective portfolio management requires that three elements be in place and working in harmony with one another (Cooper et al., 1997b): the strategy of the business, a new product process with gates, and the portfolio review with its various models and tools.

2.1 Process for Developing New Products

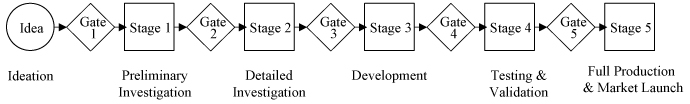

The product development process of a new product usually follows the sequence of an idea generation, investigation, design formulation, product production, after-production packaging and storing, and market launch. The literature presents a number of models for new product development (NPD). It usually consists of four stages that comprise concept and development, product planning, product and process engineering and pilot production and ramp up (Cooper, 1993). Analogously, Duncan (1996) presents a similar set of four stages but includes a ‘zero’ stage called ‘exploration’. This is relevant since much attention should be paid at the initial stages due to the complexity involved with product development which tends to increase as the time goes by (Griffin, 1997). The stage-gate system (by Cooper, 1993) is an effective approach, and the best practices for product development should be supported by the implementation of this approach (Griffin, 1997). The approach breaks the product project into discrete and identifiable stages. Each stage is multifunctional and designed to gather information needed to progress the project to the next stage or decision point. The general flow of a generic stage-gate is illustrated in Figure 4.

Figure 4 - A Generic Stage Gate New Product Development Process (Cooper, 1993).

The key stages are (Cooper, 1993): 1. Preliminary investigation: a quick investigation and scoping of the project; 2. Detailed investigation: a much more detailed investigation, including project definition and justification; 3. Development: the actual design and development of the new product; 4. Testing and validation: tests or trials in the marketplace, lab, and plant to verify and validate the proposed new product, and its marketing and production; and 5. Full production and market launch: commercialization and beginning of full production, marketing, and selling.

Clark and Fujimoto (1991) define the activity of product development as the process to transform market information for the information needed to produce finished products for commercial purposes. When revenue growth is desired, the product development can be used as a vehicle to attract a new customer or market segment (Griffin and Page, 1996). A major challenge in managing the development of new products is the need for integration between knowledge engineering and management. This need arises because the successful management of new product development requires a deep appreciation not only technical knowledge but also skills in marketing and project management and people with diverse backgrounds (Cardozo et al., 2002).

A requirement in the process of product development is the integration of information and decisions between many areas of the company, since they must be in constant harmony and synchronization in order to achieve the expected result, considering that there are many risks and uncertainties of the activities and results. Lin and Chen (2004) conclude that, although the development of new products requires a complex management processes and involves high risk, a project to develop successful new products can certainly generate huge profits and competitive advantage.

Castro and Carvalho (2010) state that projects should be prioritized according to their importance and contribution to the organization's strategy, in a comparable way to other projects, both those who are being evaluated as those that are in progress, and also comments that the priority of each project may change with each new assessment so as to reflect changes in the environment. Goals as customer satisfaction, design, engineering and design for manufacturing must be considered simultaneously during the design phase to reduce time to market and be more competitive (Gunasekaran, 1998).

To develop successful new products an organization should identify market opportunities and align them with their capabilities. The choice of a portfolio of products is a key factor that influences the chances of a successful company. There is a need for balance between projects because, for example, would not be possible for the survival of the company to develop only high-risk projects or projects of long duration - you need to get balance between the extremes of each of the criteria (Cheng, 2000).

New product development is a process that includes the dynamic interaction between internal and external factors. In an environment with sudden and dramatic, the delay in the actions of a company that has distinctive competencies may inhibit success McNally et al., 2009). A scenario is more appropriate to suggest that firms differ with respect to new types of products they produce, and that because of its diversity, the success factors vary both in their number and their relative intensity. Moreover, the "success factors" refer to the level of complexity of new products to be developed. In essence, companies that develop products require a very complex range of factors of success, and his intensity level is probably much higher for companies that develop products for simple (Poolton and Barclay, 1998).

Having presented the theoretical background attention is turned to the research design followed by the findings of the present study.

3. Research methods

Firstly, it is worth mentioning that the topic of portfolio management in the context of product development is discussed theoretically and empirically in the literature. However, when it comes to investigating these issues specifically for the textile sector in the country, the publications are scarce in the country, despite the publication of Oliveira and Cheng (2007).

Case-based research is used as methodological research approach. The choice of this approach is justified by the research context (sectional cut company in the textile industry) in a industrial sector that correspond to 3.5% of GDP. The selection of the object of analysis (firm) was due to the need for the company to reorganize its product portfolio. The work is mainly based on a diagnostic of a current processes for managing product portfolio, based on the PDMA survey for gathering data, outlined next.

3.1 PDMA survey

The Product Development and Management Association in the USA periodically conducts a survey on product portfolio management. It is an online survey was commissioned by Planview (the questionnaire is shown in Appendix 1). Overall, almost a thousand responses to the survey of PDMA are collected (922 respondents in 2010), representing product targeted organizations through a variety of industries and geographies. The number of respondents varies by question and, in some issues more than one option could be chosen. All participants were classified as being part of the process of product development in their organizations. In 2010, 71% of participants were from North America, 20% from Europe, Middle East and Africa, 5% from Asia-Pacific, and 3% from Latin America. The objective of the questionnaire is to identify and quantify (PDMA, 2010):

- Primary issues and risks in managing a portfolio of products;

- Precision investment, projections and forecasts in terms of cost, time and expected revenue;

- Challenges associated with managing resources;

- The risk aversion;

- Evaluation and ability to design low-end performance;

- The use of PPM solutions and alternative instruments

The main findings shows that more than half of respondents reported the problem of operating with many projects or products with their available resources, and most are at risk as management priorities and business conditions change. A change from the years of recession is that organizations did not report having been able to drive innovation fast enough as a greater problem rather than cutting costs. Companies seem to be moving from the focus of the recession and budget is now focused more on speed and innovation. Still, there is a strong indication that the respondents perceive their organizations very risk averse in the innovation of new products. There is also evidence that organizations want to improve their processes and has intentions of doing it, but there is still a heavy reliance on manual, although schedules and revenue forecasts still remain unclear for many organizations.

3.2 An outline of textile industry in Brazil

With current fast development, new competitors are emerging, and today, the Brazilian textile industry has to learn how to compete with the Chinese products. However, the Brazilian textile industry is still competitive. According to the Brazilian textile association (ABIT, 2011), it is the second largest employer in the manufacturing industry in the country (1.7 million employees) with 30,000 companies. It represents 16.4% of jobs and 5.5% of the revenues of the manufacturing industry. In addition, it is the fifth largest textile producer in the world, fourth largest industrial park in the world confection, and second largest producer and third largest consumer of denim in the world. General data from the industry include (ABIT, 2011): sales of textile and apparel chain: US$ 60.5 billion; export of US$ 1.44 billion; import of US$4.97 billion; trade balance of US$ 3.53 billion negative; investments of US$ 2 billion; and an average production of 9.8 billion pieces.

3.3 Company profile

The investigated company is large plant with about 3,600 employees and approximately US$ 400 million in annual sales. It has three manufacturing units, including textile designing and manufacturing products targeted to the domestic market (93%) and abroad (7%). The organization is considered the second largest textile company in Brazil in bed and bath and currently has a large number and variety of new products developed. These are divided into eight large product families marketed by the company with about 4,200 "collection items", i.e. standard products in its catalog. There are further 28,700 items that are not of collection, which can be classified as "exclusive" (specific orders from customers) and "others" (e.g. product outside collection, specific collection to customers, etc.). The company has a set of products in its development portfolio of around 400 items, distributed among the eight families. Those criteria associated with an easy access to data and information justifies the choice of the company.

3.4 Data collection and analysis

For data collection, the PDMA survey questionnaire was used. It consists of a set of questions (see Appendix 1) related to product portfolio management practices. The questionnaire was answered by the manager of Engineering Products and Processes and the coordinator of the Product. Data were interpreted by confronting them with the prevailing theory. In addition, company results were also confronted to the companies that participated in the PDMA survey. Then, the case was built, as reported next.

4. Results of product portfolio practices

The results are divided in the demographic data followed by some issues from the questionnaire. As mentioned earlier, the company answers are also compared with the responses from the PDMA survey.

4.1 Demographic data

As cited earlier, the company where the questionnaire was administered is a manufacturing firm. The composition of the companies that participated in the PDMA survey is as follows: 30% of manufacturing companies, 17% of technology companies and software, 10% consumer goods companies and 6% of companies in life sciences. The other participants are distributed among other sectors (e.g. government and agriculture).

The range of annual revenue is between US$ 251 million and US$ 500 million, of which 9% of companies participating in the survey were in this range, including the investigated company. The annual revenue of 40% of companies in the PDMA surveys are above US$ 501 million, a high amount which is justified due to the fact that 71% of companies are from North America.

The number of products in the product portfolio of the company is over a hundred, which correspond to almost a quarter of companies in the PDMA survey. The product coordinator from the company that responded the questionnaire is from marketing. The other manager who also answered is from industrial management. In the PDMA survey, 22% of respondents report to the executive branch, and only 6% to marketing. Others report to functional areas such as project management or research and development.

4.2 Experienced problems

The surveyed company indicated that their problems relate to the following points:

- Have many resources for their projects (57% of companies in the PDMA survey identified this problem);

- Decisions occur later or inefficiently (43% of companies in the PDMA survey identified this problem);

- The policy that dominates the decision process (28% of companies in the PDMA survey identified this problem);

- Costs are reduced, but the goals set are kept (27% of companies in the PDMA survey identified this problem).

The problems pointed out by the studied company coincide with much of what was named by the companies of the survey of PDMA. The other points cited by the companies of the PDMA survey relate to: “not being able to drive innovation fast enough”, “have no consistent and transparent way to measure the value of projects”, “inability to cope with risk and uncertainty so disciplined”, and “are not currently experiencing any problems”.

4.3 Risks

Concerning to risks, the investigated company indicated the following:

- Manage changing priorities as business conditions change (50% of companies in the PDMA survey identified this problem);

- Time to market, i.e. loss or competitive seasonal windows (48% of companies in the PDMA survey identified this problem);

- Not goals of product revenue expected (40% of companies in the PDMA survey identified this problem).

Once again, the main findings of the survey PDMA companies coincide with those of the company studied. The other points cited by the companies of the PDMA survey are: “loss of voice of the customer/market requirements and product development wrong”, “do not cut lower value products/projects that remove product features/more strategic projects”, and “go over cost projections and budgeting”.

4.4 Accuracy of projections

In the question "how accurately you usually find their forecasts for the products/projects in terms of timing, expected revenue and costs", the surveyed company reported the following: “the timing of the forecasts is not accurate”, “the forecasts of expected revenue are mostly accurate”, and “cost estimates are largely inaccurate”. For the companies in the PDMA survey, respectively are: 33% (timing of forecast), 31% (revenue), 47% (cost estimates).

4.5 Investment analysis process

Regarding the processes which best describes the investment analysis, i.e. what determines which initiatives get funding, the surveyed company answered: "the process of networking and data driven". PDMA survey showed this result for 39% of respondents.

4.6 Ability to take risks

In the question of how to classify an organization's ability to take risks in new product innovation, the surveyed company considered "highly against the risk". Sixteen percent of PDMA survey respondents answered that. The remaining respondents of the PDMA survey answered: 45% were against the risk, 34% encourages the risk, 3% without risk and 2% encourages much risk.

4.7 Integrating the voice of the customer

The surveyed company integrates the voice of the customer into the new product development process through regular multifunctional meetings. The results from PDMA survey are the same for 42% of respondents. In addition: 51% integrated through manual process (e-mail, word of mouth), 30% through the process of gates, 22% is based on the web to capture new ideas for the ranking and review, 22% does not use any formal system, 17% by managing platforms integrated product portfolio, and 5% through other ways.

4.8 Importance of criteria in prioritizing projects/products

The criteria on how the projects/products are prioritized for both the surveyed company and the ones in the PDMA survey are shown in Table 1.

Table 1 - Criteria for prioritization of projects/products.

Companies |

Extremely important |

Very important |

Important |

Unimportant |

Not important |

Textile company |

Strategic Alignment, Competitive Positioning, Revenue, Margins and Risk Score. |

Brand Positioning and Resource Availability |

Market Share |

- |

- |

PDMA survey |

Strategic Alignment (51%) |

Revenue (39%) |

Resource Availability (32%) |

Risk Score and Resource Availability (15%) |

Brand Positioning (5%) |

Note that the prioritization of certain criteria occurs differently between the surveyed company and the respondents from PDMA survey, such as the brand's position, which is considered “very important” for the surveyed company and “no important” to firms in the PDMA survey.

4.9 Alignment with business strategy and forecasting resource capacity

On a scale of 1 to 5 (1 being “poor” and 5 “excellent”), the results of surveyed company respondent firms in the PDMA survey are shown in Table 2.

Table 2 - Ability to align projects/products with the business strategy.

Companies |

1 |

2 |

3 |

4 |

5 |

Textile company |

- |

- |

- |

X |

- |

PDMA survey |

4% |

13% |

38% |

38% |

8% |

Considering the same scale, the surveyed company rated its “ability to manage and forecast resource capacity to accurately” as grade 3. With regard to the PDMA survey: 3% rated with 5, 23% rated with grade 4, 39% rated with grade 3, 25% rated with grade 2, and 10% rated them with grade 1.

4.10 Challenges of resource capacity planning and policy for underperforming products

The questionnaire also asked about major challenges concerned of resource capacity planning. The surveyed company considered “the inability to see the demand for resources provided” (50% of firms in the PDMA the survey) and “the lack of visibility to see the use of resources board projects/products” (38% of firms in the PDMA the survey). Other major challenges in the PDMA survey are: “impact of projects that are targeted sales ‘just do it’” (57%), “the need of funds for the prediction of projects/products with precision (52%), and others (5%).

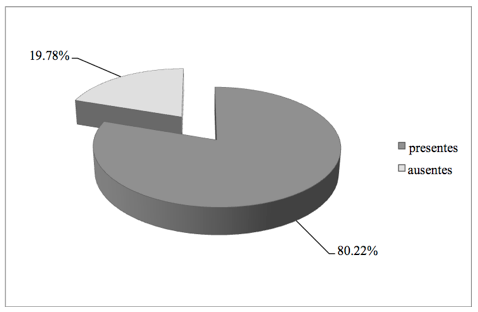

The company surveyed responded that she does not stop after products started, even lower than expected performance, as well as 19% of companies in the survey of PDMA. Among the other affirmations, 41% of companies indicate that sometimes disrupt performance products below, 25% say stop performance products below only if they are wasting a lot of money, 10% claim to break down performance products immediately and 6% did not know how to respond.

4.11 Solutions for product portfolio management

In subsequent questions, respondents were asked about the solutions their company use to tackle a variety of key management processes of the product portfolio. Those results are shown in Table 3; most used solutions and tools are emphasized.

Table 3 - Solutions and tools used for key management processes of the product portfolio.

|

No solution today

|

Internally developed tools |

Microsoft tools (Excel, Power Point, Project) |

Collaboration tools such as Share Point |

Commercially available software or hosted solution |

Don’t Know |

||||||

Key Processes |

Textile company |

PDMA survey |

Textile company |

PDMA survey |

Textile company |

PDMA survey |

Textile company |

PDMA survey |

Textile company |

PDMA survey |

Textile company |

PDMA survey |

Ideation and Innovation |

|

|

X |

|

|

X |

|

|

|

|

|

|

Managing Prioritization of Projects/Products |

|

|

X |

|

|

X |

|

|

|

|

|

|

Requirements Management |

|

|

X |

|

|

X |

|

|

|

|

|

|

Brand / Competitive Impact |

X |

X |

|

|

|

|

|

|

|

|

|

|

Gated Processes |

|

|

|

X |

X |

|

|

|

|

|

|

|

Product Development and Project Execution Process |

|

|

X |

|

|

X |

|

|

|

|

|

|

Resource Planning and Management Processes |

|

|

|

|

|

X |

|

|

|

|

X |

|

Product Financial Management and Analysis |

|

|

X |

|

|

X |

|

|

|

|

|

|

Roadmap Planning |

|

|

|

|

X |

X |

|

|

|

|

|

|

Release Management |

|

|

|

|

X |

X |

|

|

|

|

|

|

Integrated Product Portfolio Management |

|

X |

X |

|

|

|

|

|

|

|

|

|

It was observed in Table 3 a high prevalence of the use of Microsoft tools and internally developed tools, i.e. software and applications created by internal teams.

As for the current and planned use of the product portfolio management, Table 4 shows the results of the surveyed company compared to firms participating in PDMA survey. As can be seen in Table 4, there is a diversity of answers among enterprises in the PDMA survey.

Table 4 - Current and planned use of the Product Portfolio Management.

Companies |

Use Today |

Evaluating 1-6 Months |

Planning 7-12 Months |

Planning >12 Months |

Don't Know |

Not Considering |

Textile company |

- |

- |

X |

- |

- |

- |

PDMA survey |

12% |

7% |

8% |

10% |

30% |

33% |

4.12 Considerations for PDMA benchmarking results and relation their with the studied company

In summary, the questionnaire PDMA survey demonstrates that organizations perform a continuously high level in delivering the right products to the market with timely delivery; in addition to the fact that costs and resources are effectively managed. These companies are also more likely to be data-driven, calculated risks in new product innovation and are the first to market products for customers and for new growth.

Some opportunities for improvement in relation to the planning process and product portfolio management exist in the surveyed company. Thus, it is proposed for future work:

- To analyze the company's products broken down by business;

- To define criteria for the selection and prioritization of new products in the portfolio;

- To implementation and test a selection and prioritization process.

Those are the next steps for the current research project.

5. Conclusions

When comparing the surveyed company with the results of PDMA survey, it can be concluded that, at the general level, respondents to the PDMA survey have many similarities in their results compared to the responses from the studied company. The main similarities observed were: “companies have many projects to available resources”, “their decisions occur later or inefficiently”, “managing changing priorities and seasonal loss windows are risk”, “integrate the voice of the customer in NPD”, “consider strategic alignment extremely important” as well as an “inability to challenge see the demand for resources provided”.

Throughout this diagnostic some opportunities for improvement in relation to the company planning process towards an effective product portfolio management have emerged. Future work will use those results to develop a proposal for product portfolio management considering those opportunities for improvement. The aim will be, at first, focused in the selection and prioritization of products to be developed by the company.

References

ABIT – Associação Brasileira da Indústria Têxtil e de Confecção. São Paulo, 2011. Informações sobre o perfil do setor têxtil. Access: 24 out. 2011. Available: <http://www.abit.org.br/site/navegacao.asp?id_menu=1&id_sub=4&idioma=PT>.

Cardozo, R. N.; Durfee, W. K.; Ardichvili, A.; Adams C.; Erdman, A. G.; Hoey M.; Iaizzo, P. A.; Mallick, D. N.; Cohen, A. B.; Beachy, R.; Johnson, A. (2002), “Perspective: Experiential Education In New Product Design And Business Development”. Journal of Product Innovation Management, v. 19, n.1, p. 4-17.

Castro, H. G.; Carvalho, M. M. (2010), “Project portfolio management: an exploratory study”. Gestão & Produção, v.17, n.2, p.283-296 (in Portuguese).

Chen, H. H.; Kang, H. Y.; Xing, X.; Lee, A. H. I.; Tong, Y. (2008), “Developing new products with knowledge management methods and process development management in a network”. Computers in Industry, v.59, p. 242-253.

Cheng, L. C. (2000), “Characterization of the management of product development: Outlining the outline and basic dimensions”. Proceedings of the II Congresso Brasileiro de Gestão de Desenvolvimento de Produto, São Carlos, SP, (in Portuguese).

Clark, K.B. and Wheelwright, S.C. (1993), “Managing New Product and Process Development”. New York: The Free Press.

Clark, K, Fujimoto, T. (1991), “Product Development Performance: Strategy, Organization, and Management in the World Auto Industry”. Boston: Harvard Business School Press.

Cooper, R. (1993), “Winning at New Products – Accelerating the Process from Idea to Launch”. Perseus Books, Cambridge, MA.

Cooper, R.G., Edgett, S.J. and Kleinschmidt, E.J. (1997a), “Portfolio Management in New Product Development: Lessons from the Leaders – I”. Research Technology Management, v. 40, n. 5, pp. 43-52.

Cooper, R.G., Edgett, S.J. and Kleinschmidt, E.J. (1997b), “Portfolio Management in New Product Development: Lessons from the Leaders – II”. Research Technology Management, v. 40, n. 6, pp. 16-27.

Duncan, W.R. (1996), “A Guide to the Project Management Body of Knowledge”. Project Management Institute Publications, Pennsylvania.

Griffin, A. (1997), “PDMA Research on New Product Development Practices: Updating Trends and Benchmarking Best Practices”. Journal of Product Innovation Management, v. 14, n. 2, pp. 429-458.

Griffin, A.; Page, A. (1996), “PDMA Success Measurement Project: Recommended Measures for Product Development Success and Failure”. Journal of Product Innovation Management, v.13, n. 6, p. 478-496.

Gunasekaran, A. (1998), “An Integrated Product Development-Quality Management System for Manufacturing”. The TQM Magazine, v. 10, n. 2, p. 115-123.

Kendall, G. I.; Rollins, S. C. (2003), “Advanced Project Portfolio Management and PMO Multiplying ROI at Warp Speed”. Boca Raton, Florida: J. Roos Publishing International Institute for Learning.

Killen, C. P.; Hunt, R. A.; Kleinschmidt, E. J. (2008), “Project portfolio management for product innovation”. International Journal of Quality & Reliability Management, v. 25, n. 1, p. 24-38.

Lin, C. T.; Chen, C. T. (2004), “New product go/no-go evaluation at the front end: a fuzzy linguistic approach”. IEEE Transactions on Engineering Management, v. 51, n. 2, p. 197-207.

Lockett, M.; Reyck, B.; Sloper, A. (2008), “Managing project portfolios”. London: London Business School, v. 19, n. 2, p. 77-83.

McNally, R.; Durmusoglu, S.S; Calantone, R.J; Harmancioglu, N. (2009), “Exploring new product portfolio management decisions: The role of managers' dispositional traits”. Industrial Marketing Management, v. 38, n. 1, p. 127–143.

Miguel, P. A. C. (2008), “Implementation of portfolio management for new products: a case study”. Produção, v. 18, n. 2, p. 388-404, (in Portuguese).

Mikkola, J. H. (2001), “Portfolio management of R&D projects: Implications for innovation management”. Technovation, v. 21, n. 7, p. 423-435.

Oliveira, G. N.; Cheng, L. C. (2007), “Building a system of product development at textile company through portfolio management”. Proceedings of the VI CBGDP – Congresso Brasileiro de Desenvolvimento do Produto, (in Portuguese).

Poolton, J.; Barclay, I. (1998), “New Product Development From Past Research to Future Applications”. Industrial Marketing Management, v. 27, n. 3, p. 197-212.

Rabechini Jr., R.; Maximiano, A. C. A; Martins, V. A. (2005), “The adoption of portfolio management as an alternative management: the case of a company providing electronic interconnection service”. Produção, v. 15, n. 3, p. 416-433 (in Portuguese).

Roussel, P.K., Saad, K., and Erickson, T. (1991), “Third Generation R&D: Managing the Link to Corporate Strategy”. Cambridge, Massachusetts: Harvard Business School Press, 192 p.

Rozenfeld, H. et al. “Product Development Management: a Reference to the Enhancement of the Process”. São Paulo: Saraiva, 2006 (in Portuguese).

Turnbull, Peter W. (1989), “A Review of Portfolio Planning Models for Industrial Marketing and Purchasing Management”. European Journal of Marketing, v. 24, n. 3, p. 7-22.

Yin, R. K. (2001), “Case Study - Planning and Method”. São Paulo: Bookman (in Portuguese).

Appendix 1 – PDMA Questionnaire

II. DEMOGRAPHICS

Responses by Industry

Which of the following best describes your organizations industry?

Manufacturing

Technology (Electronics, Hardware, Software)

Other

Consumer Goods (Apparel, CPG, Food/Beverage)

Software Technology Services

Life Sciences (Medical Devices, Pharmaceutical)

Transportation

Finance, Insurace, Real Estate

Utilities/Energy

Construction

Healthcare-Providers/Insurers

Wholesale Trade

Government

Retail Trade

Agriculture, Forestry, Fishing

Responses by Company Revenue

Which range best describes your organization's annual revenue?

>$10B

$1.1B-$10B

$501-$1B

$251-$500M

$100-$250M

<$100M

Responses by Number of Products Managed

Approximately how many products are managed in your team's portfolio?

>100

51-100

21-50

11-20

6-10

<5

Don't Know

Part of the Organization to Which Respondent Reports

Which best describes the part of the organization to which you report?

Executive

Engineering

Product Management

R&D

Other

Marketing

Project Management (PMO)

IT

Innovation

Product Portfolio Management

Product Marketing

Finance

Brand Management

III. PPM ISSUES AND RISKS

Primary Pain Points

What are your primary pain points and issues when managing your product portfolio?

Too many projects for our resources

Decisions that go back and forth and get made late or ineffectively

Not being able to drive innovation fast enough (missing time-to-market)

No consistent and transparent way to measure the value of projects

Politics dominating the decision process

Cutting costs without cutting the future

Inability to address risk and uncertainty in a disciplined manner

We are not currently experiencing any pain points or issues

Other

Greatest Risks

What are the greatest risks when managing a product portfolio?

Managing changing priorities as business conditions change

Time to market –i.e. missing competitive or seasonal windows

Missing the voice of the customer/market requirements and developing the wrong product

Not meeting the expected revenue targets of the product

Not cutting lower value products/projects that take away resources from more strategic products/projects

Going over on cost and budget projections

Other

Accuracy of Projections

How accurate do you generally find your forecasts for products/projects in terms of schedule, expected revenue, and costs?

Highly Accurate

Mostly Accurate

Neither Accurate nor Inaccurate

Mostly Inaccurate

Highly Inaccurate

Not Projected

Investment Analysis Process

Which of the following best describes your investment analysis process,i.e., what determines which initiatives get funding?

Data-Driven Process

Mature Data-Driven Process

Random Process

Relationship & Data Driven Process

Personality-and Relationship-Driven Process

Ability to Take Risks

How would you rate your organization’s ability to take risks on new product innovation?

No Risk

Highly Risk Averse

Risk Averse

Encourages Risk

Encourages Too Much Risk

Impact of the Recession

As a result of the recession, has your organization refined the product development process?

Begun refining the process and will continue to refine this year

Process stayed the same

Refined process to be more efficient and consistent across the organization

Currently evaluating tools for refining the process

Other

Integrating the Voice of the Customer into the Product Development Process

How do you integrate the voice of the customer into the product development process?

Manual process (emails, word of mouth)

Regular cross-functional meetings

Gated process

Web-based to capture new ideas for ranking and review

No formal system

Integrated product portfolio management platform

Other

Importance of Criteria in Prioritizing Projects/Products

How important are the following criteria as you prioritize projects/products?

Strategic Alignment

Competitive Positioning

Revenue

Margins

Brand Positioning

Resource Availability

Market Share

Risk Score

Alignment with Business Strategy

How would you rate your organization’s ability to align projects/products with business strategy on a scale of 1-5, where 1 is poor and 5 is excellent?

5 -Excellent 4 3 2 1 -Poor

Forecasting Resource Capacity

How would you rate your organization’s ability to accurately manage and forecast resource capacity?

5 -Excellent 4 3 2 1 -Poor

Challenges of Resource Capacity Planning

Which of the following are major challenges with regard to resource capacity planning?

Impact of "just do it" projects that are sales-driven

Accurately forecasting resource requirements for projects/ products

Inability to see forecasted resource demand

Lack of visibility to see role-based resource utilitzation on in-flight projects/products

Other

Policy for Underperforming Products

Which of the following statements best describes your organization's policy for underperforming products?

We stop underperforming products immediately

We stop underperforming products some of the time

We stop underperforming products only if they are losing a lot of money

We don't stop products once they have been started, even if underperforming

Don't know

IV. SOLUTIONS AND TOOLS USED FOR PPM

Solutions Used Today

In the following charts, respondents were asked what solutions their organizations use today for a variety of key product portfolio management processes. There continues to be a strong reliance on the use of spreadsheets, Microsoft® PowerPoint® and project tools and manual processes. In the case of Product Financial Planning and Analysis and Product Development and Execution, they were the only two that were more likely to have a commercially available solution than no solution at all.

No solution today

Internally developed tools

Microsoft tools (Excel, Power Point, Project)

Collaboration tools such as Share Point

Commercially available software or hosted solution

Don’t Know

- Ideation and Innovation

- Managing Prioritization of Projects/Products

- Requirements Management

- Brand / Competitive Impact

- Gated Processes

- Product Development and Project Execution Process

- Resource Planning and Management Processes

- Product Financial Management and Analysis

- Roadmap Planning

- Release Management

- Integrated Product Portfolio Management

Current and Planned Use of Product Portfolio Management (PPM)

Are you using or planning to invest in an integrated PPM system?

Planning >12 Months

Planning 7-12 Months

Evaluating 1-6 Months

Use Today

Not Considering

Don't Know