3 Research methodologies

It was carried out an exploratory research with qualitative treatment of the data. Regarding the data gathering, the study is transversal and ex-post facto, using the single case study method of a Brazilian company. Accordingly to Yin (1994), the decision on the adoption of a single case or multiple case must consider how critical is the case in the testing of a well formulated theory and how revealing is the nature of the case. As in this research, it is adopted the same methodology as in the original research, a single case study in a big size company, with history of diversification and high technological intensity.

The context is the petrochemical industry, characterized by its strong economic importance and by its intensive use of technology and capital. Odebrecht Química, founded in 1944, was chosen for the case study, since it has intensive use of capital and technology, showing a rich history of diversified growth, and also is the main shareholder in Braskem, the petrochemical leader in Brazil, a result of the consolidation of diverse assets control, which achieved annual revenues of more than 10 Billion Dollars in 2008, and has 18 facilities in Brazil.

In this study, twenty-six episodes of growth and diversification were analyzed (3 mergers, 4 acquisitions, 2 joint ventures, 3 minority shareholding, 3 licensing, 2 internal ventures, 2 products developments and 7 market developments), being 20 considered successful, 6 average and 4 failures. The validation of the model is then verified in a wider universe of research. Additionally 4 episodes of technological partnerships for eventual framing in the model are verified. For the collection of data are used, as primary sources, in depth semi-structured interviews and the application of questionnaires, with closed questions with reference to resource and performance indicators, and, as secondary source, the documentary analysis. The interviews and the questionnaires were applied to 4 executives in the company-case, the director of Technology and Innovation, the manager of Market Development, the manager of Corporate Planning and the director of Chemical Specialties.

To evaluate the validity of the theoretical model, two stages had been followed:

-

Positioning of the episodes in the quadrants of the matrix and comparisons with the nature suggested as optimal mode of entrance by the theoretical model. The adherence to the quadrant is verified, and, inversely, if those badly succeeded are outside of the suggested quadrants as optimum modes, and, it is balanced the relative degree of performance in these cases. The percentage of adherence is then calculated;

-

The selection factors (constructs of the model) are evaluated, analyzing them to each cluster of mode episodes and balancing them against the degrees and the determinant factors for the performance, in order to identify the optimum situations for the selection of each mode. A ranking for the significance of these factors in each cluster is then created.

Finally, some episodes that had not received specific treatment in the original model had been identified, such as mergers, acquisitions with vertical integration and technological partnerships. It is searched a suggestion of the positioning of the first two in the matrix and the search of new evidences to technological partnerships for checking in future studies.

It follows the variables raised in the questionnaire and deepened qualitatively in the interviews, exactly as defined by the theoretical model.

Technological newness: situation on which the technology or service is not formally incorporated to the company products. It can assume one of 2 situations: base or new.

Market newness: situation in which the current products of the company are not directed to the new market. It can assume one of 2 situations: base or new.

Technological familiarity: degree to which knowledge referring to the technology already exists inside the company, without necessarily being incorporated to the existing products.

Market familiarity: it is defined as the degree to which the markets characteristics and the commercialization standards of the new business fit to the existing businesses and are understood in the company, but not necessarily as a result of that market participation.

Success: It is considered that it can be a failure or success. The performance received the valuation from 1 to 4 in a scale, positive or negative, reflecting the achievement of the forecasted strategic and financial objectives on the exact moment of the growth or entry strategy, considering the following possibilities: low (1), average (2), upper average (3), and high (4), only assuming initiatives that had lasted at least 3 years.

Determinant factors for the strategy selection: factors for the selection of that strategy in detriment of the others, measured through the influence of the factor in the selection of the strategic mode, receiving relative weight of 0 (less important) to 10 (very important).

Determinant critical factors for the performance: measured by the influence of the factor in the performance of the chosen strategic mode. It can varies from 0 (less important) to 10 (very important), and can be positive (favorable result) or negative (not favorable result).

4 Results and Discussion

4.1 Analysis of the adherence to the theoretical model

The degree of newness and familiarity made possible the framing of the episode in the quadrants of the familiarity matrix and the verification of the adherence to the theoretical model. In the case that one unsuccessful episode is framed outside one quadrant the model described as one of the optimal strategies, it is considered adherent to the model. In the same way, if one successful episode is framed inside one quadrant that the model described as one of the optimal strategies, the episode can be also considered adherent to the model. Otherwise, in the case that one successful episode is framed outside one quadrant that the model described as one of the optimal strategies, the episode is considered non adherent to the model.

Of the total of the 26 episodes under analysis, 22 were considered successful (84.6%) and 4 failures (15.4%). Of the successful ones, there was 87% of adherence to the matrix and only 13% were found in other quadrants. Of the failures, 100% were found in different quadrants of the one recommended by the matrix, therefore they presented adherence to the model. From the total of 26 episodes, 23 presented adherence, resulting in a total degree of adherence to the model of 88.5%.

In the business-oriented groupings, the results are as follows:

- Diversification and vertical integration in vinyl businesses: 80% of adherence.

- Diversification and vertical integration in olefins businesses: 100% of adherence.

- Diversification in olefins specialties businesses: 100% of adherence.

- Market development in olefins businesses: 71.5% of adherence.

- Products development in olefins businesses: 100% of adherence.

- Licensing in olefins businesses: 100% of adherence.

4.2 Analysis of the moderating variables - determinant factors of the selection and critical factors of performance

In general, the episodes of internal developments of products and markets have had as motivation, the judgment of availability of resources: financial and of knowledge. In the case of one unsuccessful market development, for example, the lack of market knowledge in one episode was considered the determinant factor of failure. In the situations where there was the necessity of specialization and focus on a new business, there was the adoption of the internal venture with very good results. Also in this in case, the issue of the refractory behavior to interaction in the main company was clear in 2 episodes.

The initiatives of minority shareholding had not generated great growth for Odebrecht in short term. On the other hand, when it acquires the control of companies (acquisitions) in which it withheld minority shareholding, the subsequent growth is well faster, as it is seen in 12 episodes.

Regarding the licensings, 2 episodes make it clear the points described by Roberts and Berry: they guarantee fast access to already proven technologies and reduce the capital expended; therefore the payment is effected by means of royalties payment allowing amortization along time. On the other hand, it generates technological dependence.

In joint ventures, the successful episode of OPP-Borealis enhanced the synergy gains between the partners, since the JV was motivated by the partner (Borealis) aspect of global competence as supplier in the automotive industry. On the other hand, in the unsuccessful joint venture OPP-Mariani, there were difficulties related to the scale of production and old technological route of the plant added by its partner, due to the non-technological familiarity.

According to analysis of the scores statistics and its ranking in clusters, it was verified that the great majority of the moderating variables mirrored the relation established in the theoretical model. Also some new evidences had been found and merged as a refinement of the model, which is marked in bold in Table 1.

Finally, it was also treated in this research some modes not considered in the original research, like mergers and acquisitions with vertical integration, also marked in bold in Table 1, with the showing up of strong characteristic evidences of these specific modes in the investigated episodes.

5 Conclusions and recommendations

The research allowed to test the model as well as to obtain qualitative advances that can support new propositions and wider researches in search of refinements. It can be concluded that great part of the episodes had presented adherence to the model, not only to the matrix but also to the constructs (intervening factors – selection motivators) that conduct the causality between the independents (newness and familiarity in two dimensions) and dependents variables (mode definition). The relation between the independent and dependent variables is made explicit through the familiarity matrix.

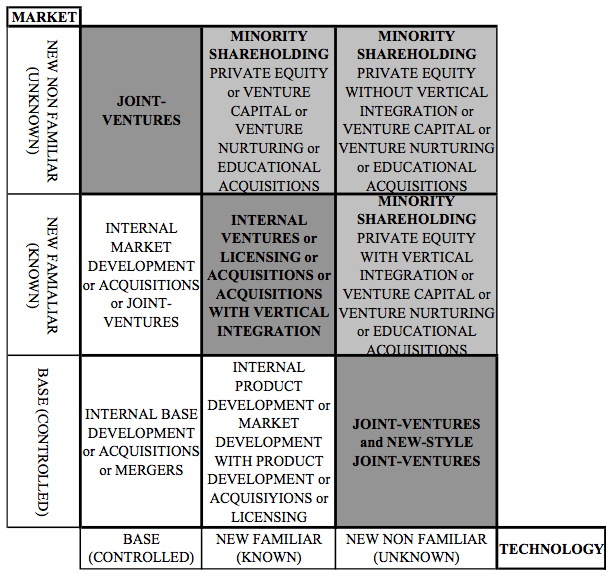

As contributions to the refinement of the theoretical model, it were enclosed in the matrix the strategies of vertical integration, as a subtype of the acquisition strategies, and the mergers strategies in the Adjusted Matrix of Familiarity – Figure 2, in bold. It was also carried out the refinement of the intervening variables, contemplating the new evidences, consolidated in bold in the Adjusted Table of the Selection Factors of the Entrance Mode - Table 1.

Figure 2: Adjusted Matrix of Familiarity

Thus, even though in practice might exist other selection factors with strong influence, as macroeconomic conditions stimulating or braking investments or even regulatory limitations, the model can be considered a proxy sufficiently adequate for the selection, based on strategic, technical and managerial aspects. Even in specific situations of limitations to the selection of one determined mode, the model can support the election of the alternative modes with higher probability of success and operate as a business-oriented portfolio tool for balancing diverse businesses with distinct rates of return and risks associated, in such a way to optimize the return and to reduce the risk. In terms of practical contributions, we believe that this research has contributed stimulating the use of a tool of easy application and great relevance for the business environment.

Table 1: Adjusted Table of the Selection Factors of the Entrance Mode.

Entrance Modes |

Bigger Advantages |

Bigger Disadvantages |

Internal developments |

|

|

Acquisitions |

|

|

Acquisitions with Vertical Integration |

|

|

Licensing |

|

|

Internal Ventures |

|

|

Joint Ventures |

|

|

Minority |

|

|

Mergers

|

|

|

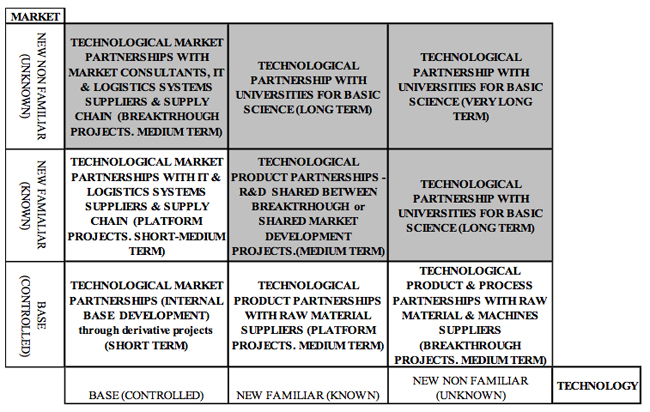

There are possibilities for adoption in other areas. We exemplify a new theoretical proposition that seems to emerge from this case study. On Table 2 are presented the four cases of technological partnerships that can eventually show some aspects to be framed in the matrix and checked in future research deepened only in this type of mode, with a larger number of episodes. Beforehand it is possible to notice that they are successful episodes of technological partnerships with distinct natures of innovation, located in different quadrants of familiarity and with different degrees of performance. Taking as reference the typology described by Clark and Wheelright (1993) for the types of project - classified in projects of basic R&D (or advanced), breakthrough projects (radical innovation), platform projects (significant improvements with new architecture and new generation of products), and finally the derivative projects (only incremental improvements for specific needs of groups of customers) - and comparing them with the type of innovation and familiarity in each type, and its complexity, it seems logical to assume that they could also be located in the familiarity matrix, adapted for the possible partnerships kinds and the type of the innovation project.

Table 2: Episodes of technological partnerships

Episode |

Type |

Type of innovation |

Performance degree |

Quadrant |

Technological partnerships |

||||

27 |

Partnership with competitor for commercial supply |

Derivative project incremental innovation |

2 |

Q (1,1) |

28 |

Partnership with manufacturer of raw-material for the development of products |

Platform project New product family |

4 |

Q (2,1) |

29 |

Partnership with equipment manufacturer for process development |

Breakthrough project |

3 |

Q (3,1) |

30 |

Partnerships with University in biopolymers and nanocomposites |

Basic (science) R&D project |

1 |

Q (3,2) |

Based on the underlying logic of the matrix (bigger risk in areas of lower familiarity), and analyzing the episodes the 27, 28, 29 and 30 relative to different types of technological partnerships raised in the study, it is possible to make some considerations.

One aspect that becomes clear through the analyses of partnerships episodes is the distinction between the types of projects: while a commercial partnership of low complexity and short term duration, as episode 27, is characterized for some attractiveness in situation of high familiarity (Q1,1), on the other hand, the activities of partnership in basic R&D, with long maturation and high degree of uncertainty, thus falling into a region of low familiarity (Q3,2), should receive the same treatment as the unrelated diversification, that is, preferentially carried through externally and with lower amount of the resources of the complete portfolio. The lower degree of performance attributed to this episode in comparison to the others, refers to the perception of the non attainment of expressive results so far, what was expected, due to the uncertainty of the practical results given the long term maturation condition of basic R&D. However the company clearly notices the strategic value of this type of activity for the survival.

Finally, the projects of medium complexity, as new generations of products, are located in the region of medium familiarity and seem to be sufficiently stimulated by partnerships with suppliers, customers and manufacturers of equipments.

In this way, it is formulated a new matrix, assigned as Matrix for helping the partner selection, as in Figure 3, as a new proposal to be verified in subsequent researches with a wider research coverage of partnerships’ episodes, as much in terms of number of episodes, as well as in types and complexity.

It is suggested that basic R&D or radical innovations, involving higher risk, uncertainty and time of maturation, must at the beginning be dealt as a minority strategy, if possible externally and gathering the lowest level of resources from the portfolio - depending naturally on the maturity and degree on technological innovation of the industry to which the company belongs and its technological strategy (leader, fast follower, follower, licenser or imitator). On the other hand, the partnerships with chain players, when related to the incremental innovations or to new generation products, can also harvest better results when treated in the zone of bigger familiarity with bigger level of resource allocation.

Figure 3: Proposition of the Matrix for helping the partner selection

As limitations of the whole study, we can mention the characteristics of the incorporated single case qualitative study, not enabling generalizations for other contexts. Future researches could address companies from different sectors or even quantitative cross-sectional studies, enabling interesting comparisons.

As one limitation of the alliances” context model replication, it must be considered the so few episodes analyzed at this time, only four, only enabling the explorative comprehension of the phenomena. The model advocated in the figure 3 is being tested in a current study focusing on technological alliances. In this on-going study, twenty alliance-based projects are being qualitatively analyzed and preliminary results point to different patterns, depending on the nature of the project. This on-going research can enable the inductive building of hypothesis, to be tested deductively in another quantitative research, scheduled to be done after the completion of the qualitative investigation.

References

Berger, P. G.; Ofek, E. (1995), “Diversification’s Effect on Firm Value”. Journal of Financial Economics, vol. 37, 39-65.

Berry, C. A. “New Business Development in a Diversified Technological Corporation” (1983), MIT Sloan School of Management-Engineering School Master of Science Thesis.

Block, Z.; McMillan, I.C. (1995), Corporate Venturing; Creating New Business within the Firm, Harvard Business School Press, 1995.

Burgelman, R.A. (1984), “Managing the internal corporate venturing process”. Sloan Management Review, vol.25 (2), winter, 33-48.

Clark, K. B. ; Wheelwright, S. C. (1993), Managing new product and process development: text and cases. Maxwell Macmillan International, New York, 233-289.

Dussauge, P.; Hart, S.; Ramanantsoa, B. (1992), Strategic Technology Management, John Wiley and Sons.

Hunger, J. D.; Wheelen, T. L. (1995), Strategic Management and Business Policy, 5 ed. Addison-Wesley, Massachussets.

Keil, T. (2000), “External Corporate Venturing: Cognition, Speed and Capability Development”. Doctoral Thesis. Helsinky University of Technology. Espoo-Finland, available at http://www.tuta.hut.fi/isib

Liebeskind, J.; Opler, T. C. (1993) “The Causes of Corporate Refocusing”, working paper, Southern Metodist University, Dallas, TX. USA,1993.

Maula, V.J.M. “Corporate Venture Capital and the Value-Added for Technology-Based New Firms”(2001). Doctoral Thesis. Helsinky University of Technology.Espoo-Finland, available at http://www.tuta.hut.fi/isib

Odebrecht (2008), “Annual Report2008”, available at: http://www.odebrechtonline.com.br/relatorioanual/2008/.

Peters, T. (1980) “Putting Excellence into Management”. Business Week, 21.07.1980, 196-205.

Revista Isto é Dinheiro (2003), “Perfil das grandes empresas – Braskem”. April 30th 2003, No. 296, Grupo de Comunicação Três S/A., São Paulo.

Roberts, E.B. (1988) “New Ventures for Corporate Growth”, in Burgelman, R. A. and Maidique, M.A. (Ed.), Strategic Management of Technology and Innovation, Irwin, 488-498.

Roberts, E.B.; Berry, C.A. (1985) “Entering New Businesses – Selecting Strategies for Success”. Sloan Management Review, Cambridge, MA, spring, 3-17.

Rumelt, R. P. (1974), Strategy, Structure and Economic Performance. Division of Research, Harvard Business School, Boston.

______________(1982) “Diversification Strategy and Profitability”. Strategic Management Journal, vol. 3, 359-369.

Yin, R. K. (1994), Case Study Research: Design and Methods. Sage, Thousand Oakes, CA.