Felipe Mendes Borini* y Moacir de Miranda Oliveira Junior**

Recibido: 16-03-2010 - Aprobado: 15-06-2010

|

ABSTRACT: |

|

RESUMEN: |

Firms from large developing economies like China, India, Mexico and Brazil should play a more important role in global competition in coming years. These firms include subsidiaries of multinational corporations with investments in these large developing economies. This paper deals with subsidiaries of multinationals corporations working in Brazil. There is a growing interest in the area, and there are already some studies analyzing aspects or sectors related specifically to foreign direct investment in Brazil (Consoni and Quadros, 2003; Franco and Quadros, 2003; Quadros et.al.2001). The purpose of this paper is to study the strategic relevance of the largest foreign subsidiaries located in Brazil, under the emerging economies´ viewpoint, in order to find out the most influencing factors in the dynamics of the subsidiaries roles in the multinational corporation. By strategic relevance we understand the relative capacity of the subsidiary to develop innovations that can be transferred and used by other corporative units, so that they become a corporate competitive advantage. In this sense Strategically Relevant Subsidiaries (SRS) are responsible for corporate value creation, do own global competitiveness, when compared with other subsidiaries, and have her competences recognized by the corporation. Based on the theory about subsidiaries strategies, and the concept of strategic relevance, a typology of the multinational corporation’s subsidiaries in emerging economies was developed in order to:

1. Be able to classify the subsidiaries from the point of view of strategic relevance. The fact is that, for emerging economies, attracting and keeping subsidiaries with strategic relevance is a very important task. The use of advanced technologies and knowledge tend to extend far beyond the borders of the firm, reaching suppliers, distribution channels, research centers in the emerging economy, therefore improving the international competitiveness of the country in the specific industry;

2. Be able to understand the factors that determine the dynamics of the subsidiaries’ roles in emerging economies. Subsidiaries have roles in the global corporative network that can change with time. The dynamics of these roles depends on internal factors of the subsidiary, as well as factors related to external environment;

3. Be able to help in strategic decision-making regarding the subsidiaries’ roles. A better understanding of the different subsidiaries’ roles in emerging economies, represent executive support for multinationals corporations (in the headquarters and in the subsidiaries), as well as for government’s technicians in emerging economies.

It’s known that there are three main perspectives to explain the role performed by the subsidiaries (Birkinshaw, 2001; Peterson and Brock, 2002): the perspective of environmental determinism, the perspective of the headquarters policies regarding the subsidiaries, and the perspective of the subsidiaries strategies. The first perspective of environmental determinism is due to the fact that multinationals companies operate in different strategic environments and, as the characteristics of location varies, subsidiaries may have different strategic roles (Bartlett and Ghoshal, 1992). It is clear that the more dynamic the local competition is, the more demanding the buyers and the more qualified are the suppliers; therefore, higher the chances for the subsidiary to play a role of strategic importance (Porter, 1990). Similarly, the higher is the global competitiveness of the subsidiary, the higher are the chances of the subsidiary to become strategically relevant for the corporation (Birkinshaw, 1996). The subsidiaries are becoming more dependent and engaged with the productive chains located abroad, also in activities of innovation and value creation (Frost and Zhou, 2000).

The second perspective considers that subsidiaries roles are determined by headquarters. Headquarters determines structure, control, communication and autonomy, thus defining the relative importance of the subsidiary (Roth and Morrisson, 1992). The larger the integration between headquarters and subsidiary, in terms of communication, knowledge and socialization, the larger the strategic importance of the subsidiary (Nohria and Ghoshal, 1997; Frost, Birkinshaw and Ensign, 2002).

In fact, the autonomy of the subsidiary, when it does not valorize the integration with the other units of the corporative network (headquarters and subsidiaries), complicates the alignment of the corporative strategies and may be considered a negative point. A high autonomy, when unrelated to the non-local competences of the multinational, may be harmful (Moore, 2001). The excessive power of the subsidiary may cause several agency problems because a very autonomous subsidiary may tend to develop projects that are not integrated to the goal of the multinational corporation (Birkinshaw and Hood, 1998).

Finally, the third perspective proposes that the role is a consequence of the subsidiary’s active interest in improving it within the corporate network. Resources and capacities of the subsidiary, aspirations of their executives, and their own initiative determine the subsidiary role (Roth and Morrisson, 1992). This is not an easy task, because there are several barriers that prevent subsidiary autonomy, such as the dependence of the headquarters, the lack of resources and corporative recognition.

In any one of the three perspectives only non-local competences developed by the subsidiary may be transferred to other units of the corporate network (Rugman and Verbeke, 2001). This competence may be represented as specific knowledge, managerial techniques or processes. The strategic relevance of the subsidiaries depends essentially on the non-local competences development, mostly in R&D and manufacture (Birkinshaw, 1996; Birkinshaw and Morrinson, 1995; Birkinshaw, Hood and Jonsson, 1998).

An entrepreneurial orientation of the subsidiary is in the base of the new business opportunities creation that may be led by the subsidiary. Therefore, entrepreneurial orientation is essential for the development of the non-local competences (Birkinshaw, 1997; Birkinshaw, Hood and Jonsson, 1998). Without proper initiative to make decisions and take risks, the processes of developing strategic relevance can hardly be started (Birkinshaw, 1996; Birkinshaw and Hood, 1998).

Again, creation and development of competences, as well as entrepreneurial orientation, are strictly linked to the innovations in the subsidiaries (Bartlett and Ghoshal, 1992; Birkinshaw, Hood and Jonsson, 1998). However, although the initiatives of the subsidiaries can induce and increase strategic relevance, it will take an extra effort to keep up with demands of new competences along the trajectory of the subsidiary; and this means a continuous effort of the subsidiary in seeking, building and developing new business opportunities and getting the necessary support from headquarters (Birkinshaw, 1997). In other words, the subsidiary needs credibility and recognition regarding its strategic relevance from the headquarters.

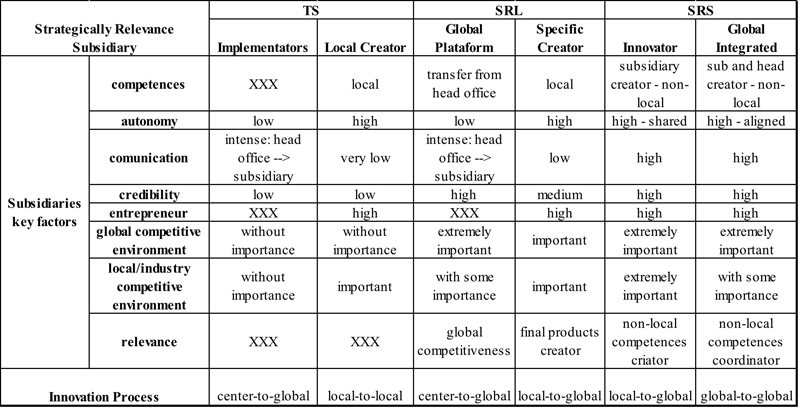

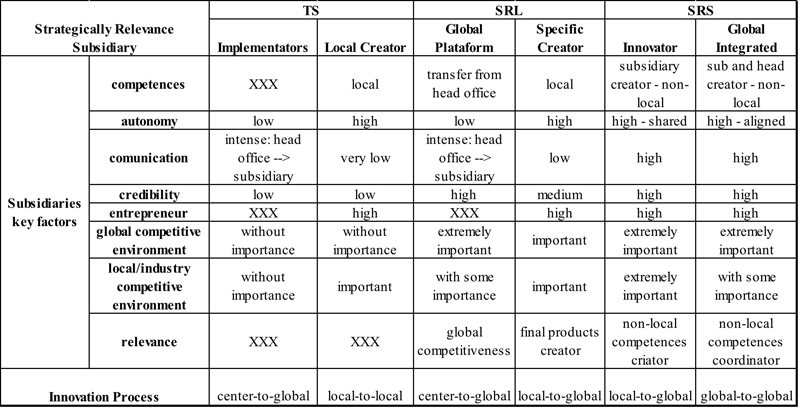

Therefore, the three perspectives point out a series of certain factors of the subsidiaries roles, namely: a) the competences allocation; b) the communication and autonomy regarding the head office; c) the subsidiary entrepreneurial orientation; d) the subsidiary credibility; e) the global competitive context; f) the national and industry competitive context; and g) key factors related to strategic relevance (value creation, global competitiveness and recognition of the subsidiaries by the headquarters).

As the conditions of these factors change so do the different roles and degrees of strategic relevance among subsidiaries, what configures the differentiated network (Bartlett and Ghoshal, 1992; Nohria and Ghoshal, 1997), and as consequence these subsidiaries may show different strategic behaviors and innovation processes (Nohria and Ghoshal, 1997), as well as different situations regarding the evolution of their strategies (Birkinshaw and Hood, 1998).

Innovation processes in multinationals, for example, differ according to the location of the several competences of the company and of the nature of the interlinking among its different units (Nohria and Ghoshal, 1997). In the center-to-global innovation process, the center – the headquarters or a centralized structure as R&D laboratory – creates a new product, processes or systems for global use, mostly technological; usually, local subsidiaries were not involved except for routine tasks as marketing or support during the implementation process.

In the local-to-local process innovations are mostly created and implemented entirely by a national subsidiary for local level uses, and they don’t involve technology; except for small modifications to adapt a technology, product or already existing system. Later on these local innovations, developed for a specific country, may be used in other units of the corporation abroad that may get involved in implementation processes.

The local-to-global innovation process happens by seizing the different resources and competences of the network, seeking to integrate local solutions and global opportunities, representing an excellent example of the application of the combinative capabilities concept in multinationals companies (Kogut and Zander, 1992); and involves collaborative work from the corporate network in solving problems rather than just sharing answers coming from a sole unit (Nohria and Ghoshal, 1997).

These last processes are the most common regarding strategic relevance of the subsidiaries, but this does not mean that all the subsidiaries should perform processes of local-to-global and global-to-global innovation, since in this case managing a multinational would be too complex and strategic goals would hardly be accomplished. Although the functions related to center-to-local and local-to-local innovations are of smaller strategic relevance, and more susceptible to internal competition (Birkinshaw and Hood, 1998), they also have some strategic implications in the sense that: a) means application of technology and competences ‘overtaken’ in other countries, thus recreating and extending life cycle of the products and corporative profits; b) increases economies of scale by mass production in countries where conditions may be more advantageous; c) attends specific market needs exploring the volume of potential sales.

Table 1 shows the different degrees of strategic relevance of the subsidiaries as related to innovation processes (Nohria and Ghoshal, 1997) helping to determine key factors for relevance, as argued above. This panoramic view may help the reader in the discussion that follows, trying to find out the key factors for each type of subsidiary. In the table, SRS refers to Strategically Relevant Subsidiaries, while TS and SRL means respectively, Traditional Subsidiaries in Emerging Economies and Subsidiaries of Limited Relevance. SRS creates and transfer competences and innovations. TS just implement and adapt innovations generally coming from the head office for the local market or create innovations only for local purposes. SRL implement competences coming from head quarters and help linking the net to increase corporative value; and when they develop innovations, they are more specific recovering a product or competence that is of no use anymore elsewhere. Next section will be dealing with these categories.

Table 1: Strategically Relevance of Subsidiaries in Emerging Economies

Source: Authors

Vol. 31 (4) 2010

[Índice]